Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish–others will be bougie. All the time, it’ll be revealing.

This week’s story was pulled off in collaboration with mycashestate.com–they’re making it ridiculously easy for everyone to grow money by investing. The lady in this story will do whatever it takes to make a living.

Age: 27

Occupation: Content Creator

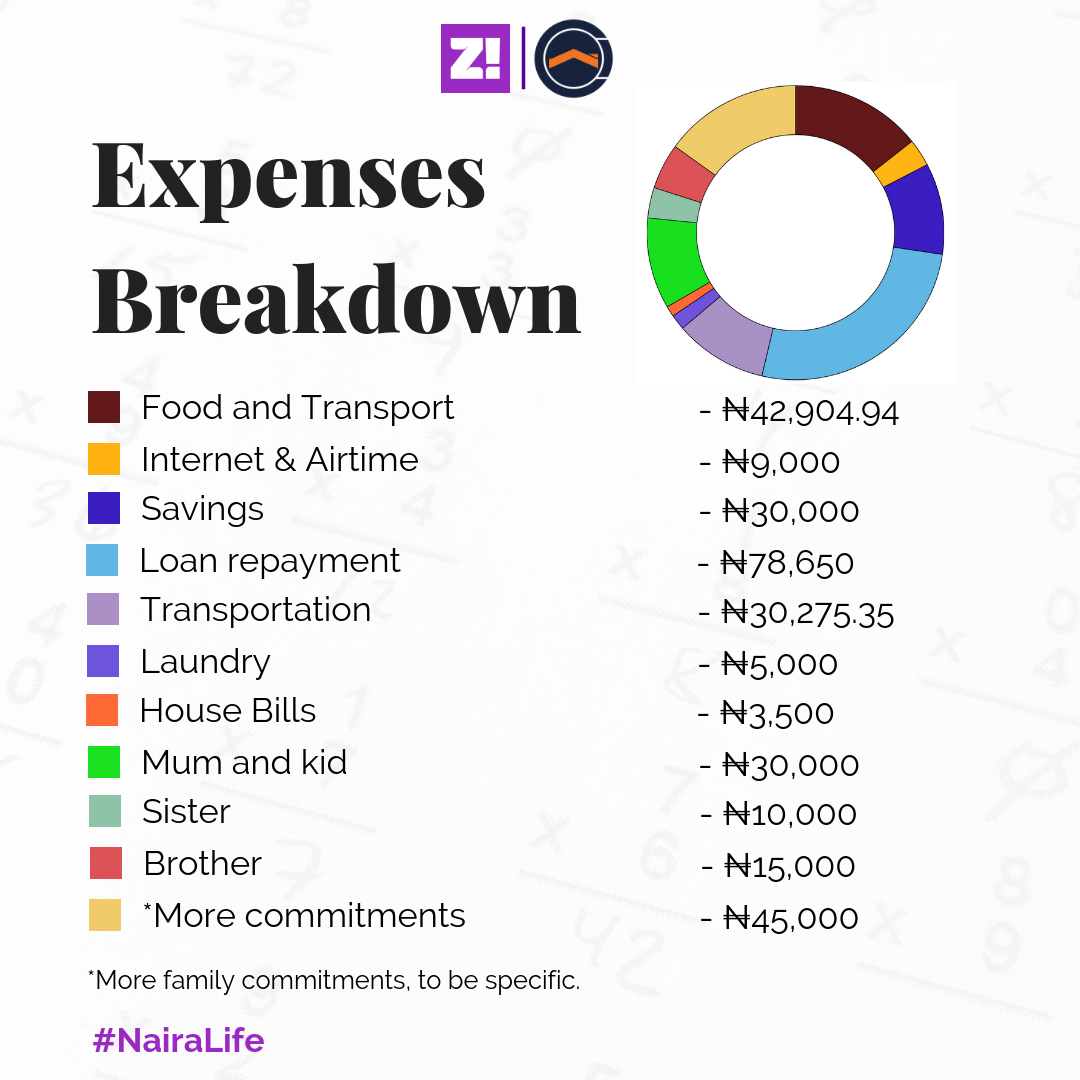

Net Income: ₦300,000/month

Rent: ₦250,000 (shared apartment)

What’s your oldest memory of money?

Not like I had physical cash to spend, but I knew we had money growing up. But I remember my mum worked a lot–she’d leave early and come back late. And even though we hardly saw her, we went shopping every other weekend.

Like, I remember I’d see a toy on TV and be like “mummy mummy! I want!” And I got it.

When do you feel like you earned your first money?

If we’re counting getting sprayed at a party, then it’s my 7th birthday. It was about 5 or 6 thousand. I kept all of it in that Danish Cookies tin. And my mum was like, oh you made money. Let me keep it for you. That was the end of it.

Also, there was this time in secondary school when I entered a writing competition. I was in SS1, and this was in like 2005. Anyway, I won 500 pounds. It met the same fate as my birthday money, but we move.

Ouch.

After I won that competition, I realised I could actually sell stories. So people would buy empty notes and I’d write stories for them. They paid with food. I think at every point, I’ve always done all kinds of things to raise money, like “oh I can help you do this if you pay me.”

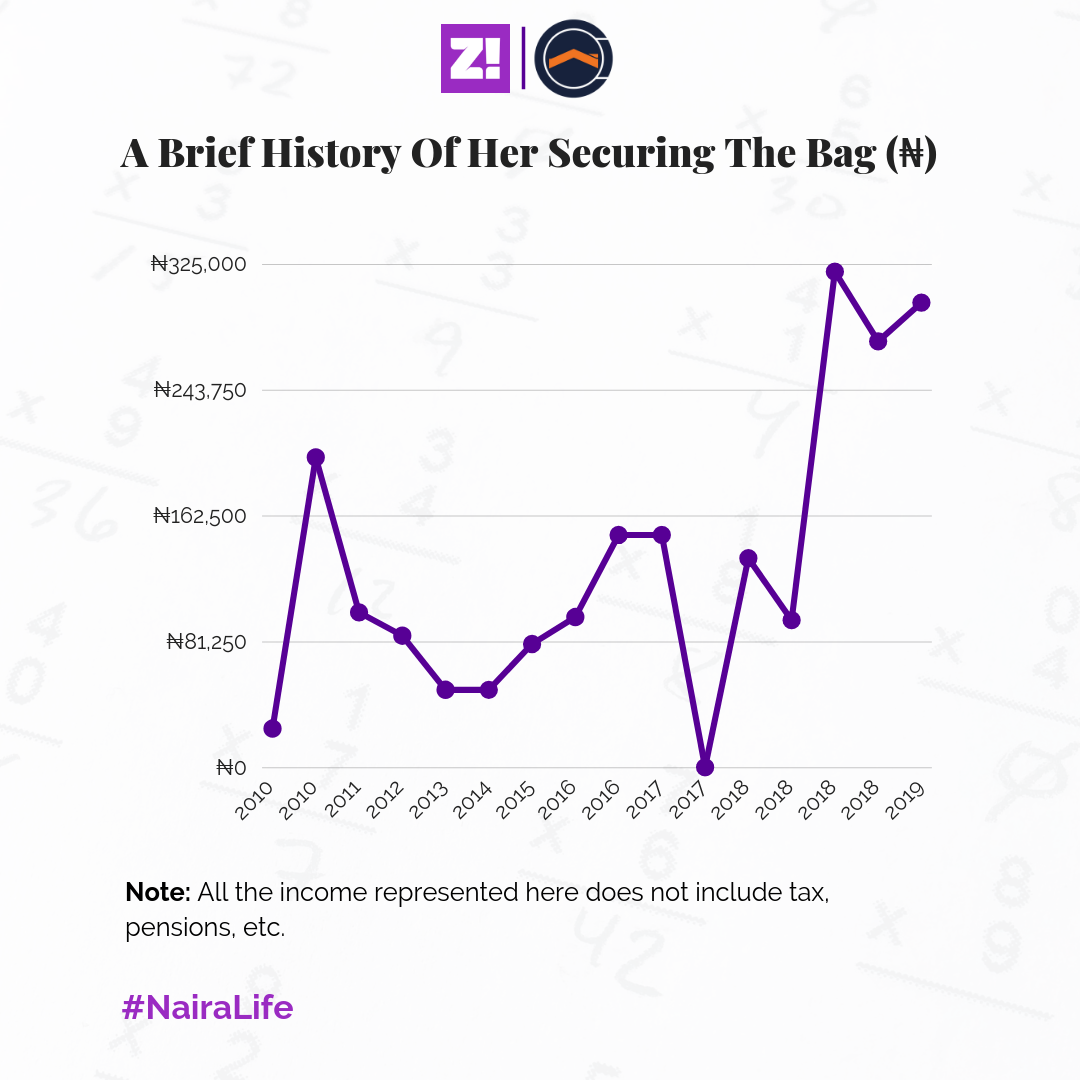

But my first proper paying job was in 2010. I’d just dropped out of school walked into a Broadcast station, and lied to them that I was a Youth Corper. So they hired me as a news correspondent and paid me 25k. Shortly after I started, I met this man who told me “leave this job, come and work for me.”

I mean, I thought it was an actual job. But, na Glucose Guardian.

He put me on a 20k per week stipend. To be honest, it was actually more, because every time we’d see, he’d give me money. At the beginning of every week though, I’d still get 20k.

So what I’d do was leave home and resume in his house every other day. What’s interesting is that most of the time we didn’t even have sex or anything–just gisting.

Aaaannnd then I got pregnant.

Interesting

After that? Uhm, nothing changed much to be honest. Money was still coming in even though I wasn’t working. I also had two more Glucose Guardians.

After your baby daddy?

Before actually–one was super busy while the other was Abroad.

How much was coming in at this point?

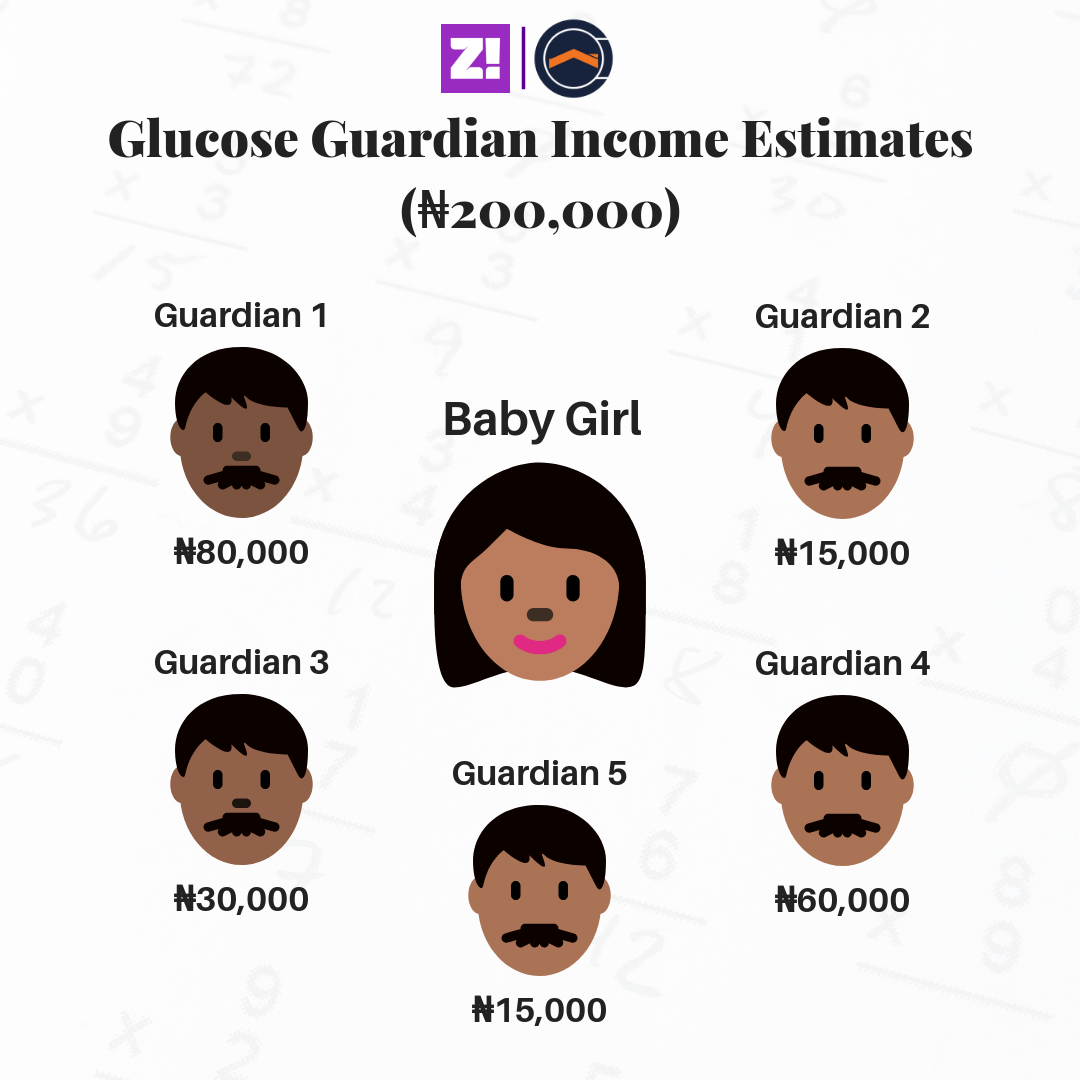

There was $100 every month. Plus another 20k every week. Plus the one guy that’d just point me to his money and say “take whatever you need”, but I never really took more than 30k. Then another guy who’d give me money. I think I was grossing at least 200k a month.

How many Glucose Guardians did you have at peak?

5–that I took seriously. The others were just guys I hit up for money.

How did you find them?

They always found me. Always. One day I was leaving this place where I used to go buy cakes, and I was waiting for a taxi. And then this guy walks up to me and drops the “you look like someone I know” line. And we get talking and he goes, here’s my number. Call me, I’d love to eat cake with you. One of them I met at the same place on a different day. Others were people I met at a club or at a party.

Okay, So I–

Oh, I forgot this guy. He wasn’t really a Glucose Guardian. But he just liked me, and always loved clubbing. Also, he almost got duped by waiters once while he was drunk, but I didn’t let that happen. And since then, every night he wanted to go clubbing, he’d just call me up, and by the time we were done clubbing, he’d give me 200 or 300 dollars.

2010 was a busy year.

Pretty much.

2011?

Glucose Guardians dropped to two–one of them was my baby daddy. And I just thought to “calm down”. So I stopped smoking, I stopped drinking as much. But they still kept sending money every other week. But I think my general money coming in per week dropped to like 100k.

Then the baby came.

By then, it was still the same. Simple stream. 100k. 2012 was when I went back to school.

Why did you drop out of school the first time?

I felt like I was under serious pressure. I just felt this need to be good at everything and make my mum proud.

“You’re the genius in the family. You’re the one who will take this family higher.”

So at some point, it’s like I snapped. I took my school fees for the semester, blew it travelling, and forged my result.

When my mum found out, and the “I’m very disappointed in you” was over, she asked me if I wanted to go back to school. I said no, I told her I’d work instead. That’s how I got the Broadcast station job.

Your mum seems to be the consistent parent figure.

She was my father figure too. I just knew my dad was somewhere in the world, but he never mattered.

Okay, back to 2012, you went back to school–

Aaand, that’s when my dad actually showed up. My dad was responsible for putting us back in school, but my mum still did the paying.

My mum gave him our money, and you know what he did? He blew it.

Ouch.

That was when I knew, “you know what, I need to make money again”. So I started working as a Social Media Manager for people. Keep in mind that the money from my Glucose Guardian days mostly went to taking care of my family too. But then that responsibility paused when my mum took financial control and wanted me to go back to school. But I was back at the helms after my dad blew the money.

So here I was, living in a short time hotel, living with a baby, and winging it because my dad blew our money–thanks, dad. He eventually paid the fees–but it wasn’t until it was time for exams that we found out it wasn’t even complete. We being me and my brother.

Okay, so the Social Media job?

I was handling social media for two accounts, and they were paying 20k a month each. And then I was writing for a couple of websites.

All of that brought my income to about 85k. This was 2012. I did this till 2013. I was also in school though.

And in 2013?

I dropped the old writing gigs, picked up some new ones but I was doing mostly the social media gigs. Mostly 50k a month though, in total. This was like the average till I graduated in 2015. I just always had to make sure I was earning money.

And post-graduation?

I started an Admin role in a school that same year. That was giving me 30k. But that was great, because my baby started school, and I only had to pay 60k tuition, as opposed to paying 100 and something. I did that job for about 5 months. Then I moved to Lagos.

Ah, Lagos.

I was in Abuja all this time. My starting salary was about 79,600 from October 2015 to April 2016, till the company folded up. Next job paid 97k. I was there till October 2016. Then the next job paid 150k. Because I wanted to go freelance, I renegotiated in 2017, and that money dropped to 100k.

How much were you earning from freelance gigs?

It wasn’t coming steady, but then there’d just be the random 50k for web copy, or 100k for proposals, etc. So I started a small business in 2017, that would give me 20k in the month that I was serious with it. Based on frequency, I’ll put the freelance average to 30k.

By October 2017, I decided to freelance full time.

How much did you earn in November?

Nothing. I earned nothing. I was basically living off of my savings. December, I went back home and seriously contemplated staying there. Because it was like yo, I hate where I’m living. I don’t have a job. I’m not making any money.

But you didn’t.

I entered 2018 wanting to take my business seriously. I saw that with little seriousness, I still managed to make 135k in cash. And it was with that I got a loan in 2018.

Where did you get the loan from?

A friend. About 380k. I’m paying back with interest–471,900. Last payment was last week.

So all of that money went into the business?

Nope. My sister’s school fees came up. Over half of it. The rest of the money went into the business. I used it to buy supplies and materials for the business. The money was supposed to be used for scaling the business and work on readymade stuff. While I just handle the bespoke requests. That didn’t happen.

I was living off the business at this time. The goal was to make at least 3k a day. But it didn’t come steadily. So on the average, it was an average of 1500 a day in profit. So put that to 45k a month. Plus 50k from a freelance job.

Did you get more freelancing jobs?

I was trying to get jobs, but jobs were not getting me. Everyone wanted full time, and I knew that wasn’t something I wanted to do anymore.

Thennn, one came, and it was paying 175k. And then another that paid 100k. And another one paying 50k. That 3rd one didn’t stick around for long though.

I stopped the business for a while, scaling down on orders to like, the barest minimum.

So currently, I’m at 275k per month. Add the random small gigs, and I do a little over 300k a month.

Looking at your career now, how much do you think you should be earning?

A lot more. At least 500k for less work. Nigeria is why I’m not earning this much.

How much do you imagine you’d be earning a year from now?

I have no idea. 500 hopefully. I’m working on my 500 game plan. I know what I want to do, I’m just working on doing it.

Something you want but can’t afford right now?

Travel. I want to go to Europe to see my favourite city.

Let’s talk about saving.

I tell myself I’m saving because of rent or my Eurotrip. But to be honest, I’m saving because I know there’ll always be an emergency. My mother is going to call about something for the house or my kid.

My brother is going to going to call about something.

Like, my mum might just call and say, “Ah, buy units for power for the house o.” And then I’ll go okay. And pay for it, while laughing in my head like, this woman doesn’t know I have only 2k left in my account sha. Maybe I’m just going to go to Cotonou.

But then again, I started this year with zero savings, and now I have 71k in my savings. You know, maybe I’m actually not doing badly.

Do you have a pension account?

I’m supposed to have had one at some point, in one of those jobs, not like I’ve paid attention. I’m going to pay attention to it eventually. I know how important pensions can be because I know what it means for my mum now. It’s not a lot but it comes–when someone hasn’t embezzled it.

What’s the last thing you paid for that required serious planning?

My laptop. I won’t say serious planning, I just kept waiting for the money to come so I could use it to buy the laptop. It cost 270k.

Do you have a health plan?

No. When I fall sick, I cry mostly. Then I go to the hospital and get drugs. Thankfully, I hardly fall sick.

What has changed the most about your perspective about money, 2011 and now.

Nothing, except now I know that I must always give my family the perception that I earn way less than I currently do. Doesn’t really change anything but it might just give me some comfort.

Do you have any investments?

I’m investing in my daughter’s future, plis dear.

How would you rate your happiness levels?

I’m content. I can afford to do things that make me a little more comfortable. This time last year, I couldn’t afford Ubers. I can eat when I want. Eating once a day is now a choice, not because I’m not sure when my next meal will come. I can afford to be a little reckless and buy clothes. I couldn’t do that before.

Tell me something you’d love me to ask you?

Please, what’s your account number? Lemme send you something for the weekend.

You miss your Glucose Guardian days eh?

I do. I honestly and truly do. I need a Glucose Guardian so I can afford to be more reckless without worrying about emergencies.

When everything is tough, a Glucose Guardian is a cushion.

Check back every Monday at 9 am (WAT) for a peek into the Naira Life of everyday people. If you’d love to share your Naira Life with us, tell us here. You’ll be anon of course

But, if you want to get the next story before everyone else, just subscribe here. It takes only one minute.