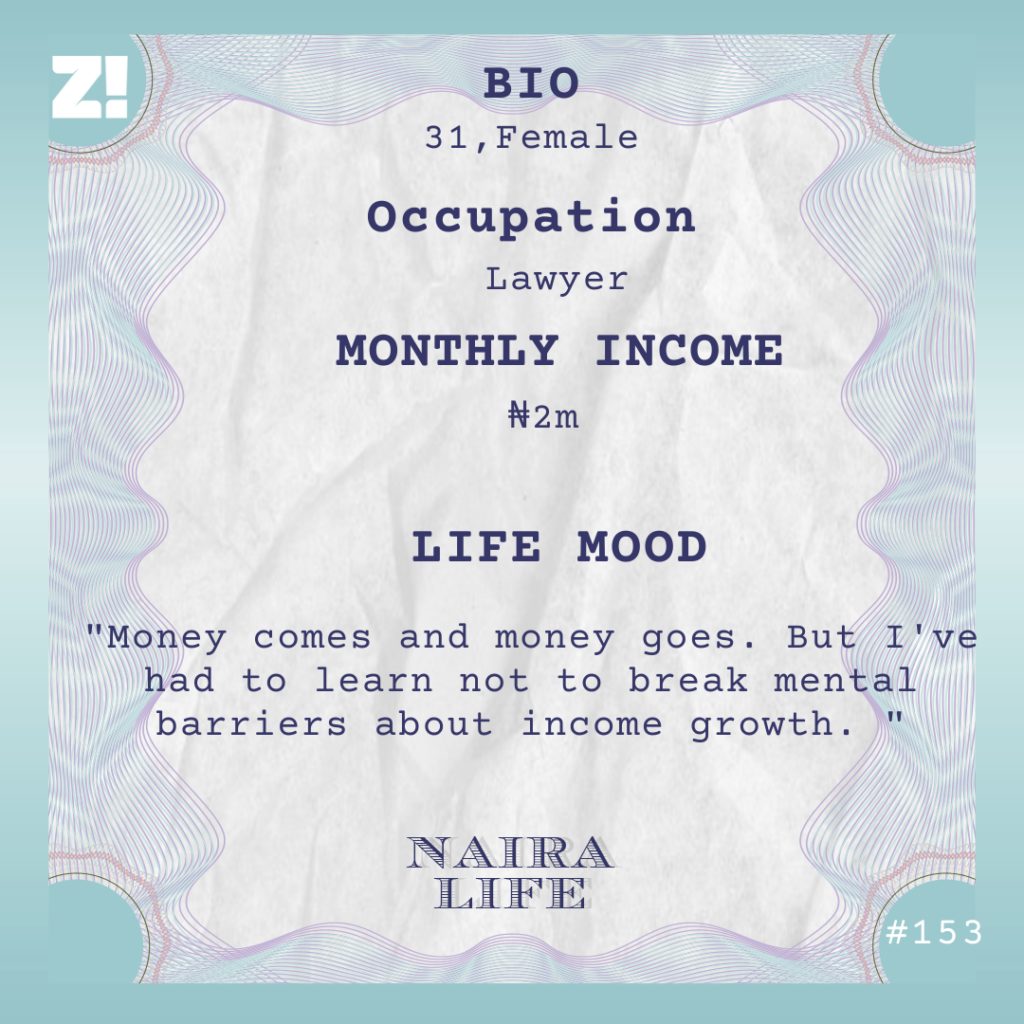

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Today’s #NairaLife subject got tired of the slow income increase at the law firm where she’d worked for four years and decided to leave in 2020 at ₦386k/month. Two years later, she’s at ₦2m and hoping to increase her earnings even further.

Let’s start with your earliest memory of money.

I was 9, and my dad used to give my siblings and me ₦20 every day to school in addition to the lunch we took in our food flasks. In 2000, ₦20 was enough to get a drink and some snacks, so we always brought our lunch back home untouched, and my grandma who lived with us didn’t like that, so she complained to our parents, and they reduced our pocket money to ₦10. It hurt like hell because I now had to manage half of what I used to, and I didn’t have any money saved.

Did you start saving after that?

I didn’t start saving until secondary school. This time, my allowance had gone up to ₦200 a week. My dad would give me money on Monday and ask for a report on how I’d spent it by the end of the week. If I didn’t have any money saved, I got scolded. I lived on allowances until I decided to try out business for the first time.

When was this?

2010. I was 19 and in university, and I saw that Valentine’s was a big thing, so whenever my sister and I went to the UK, I would buy cheap perfumes and other tiny gifts university students could afford and sell them during Valentine’s period. My goal was to double whatever my capital was so it didn’t feel like I was wasting my efforts. if I spent £500, I’d make £1000 back. I did this until I left university in 2013.

Before I started NYSC in 2013, I went to the UK again and bought white shirts, white shorts and white shoes for people who didn’t want to go to the market. This time, I broke even — I didn’t make any profits or losses. That was the last time I ever did business.

Why?

I realised that business wasn’t for me. I wasn’t doing it to make money, I was doing it just because I saw an opportunity and a market. It didn’t really excite me. Immediately after NYSC, I went to the UK for my master’s.

How did that go?

It was very stress-free. My fees and accommodation were paid for and I lived on campus, very close to my classes. The savings culture I’d developed in secondary school was already a big part of my life. My dad gave me £800 every month, and I got a job that paid £600. Sometimes, my uncle in the UK gave me money when I went to visit him, and other times, my mum just randomly sent me money. I bought foodstuff and cooked, and only really spent money when I occasionally went to visit my boyfriend in Manchester.

When did you return to Nigeria?

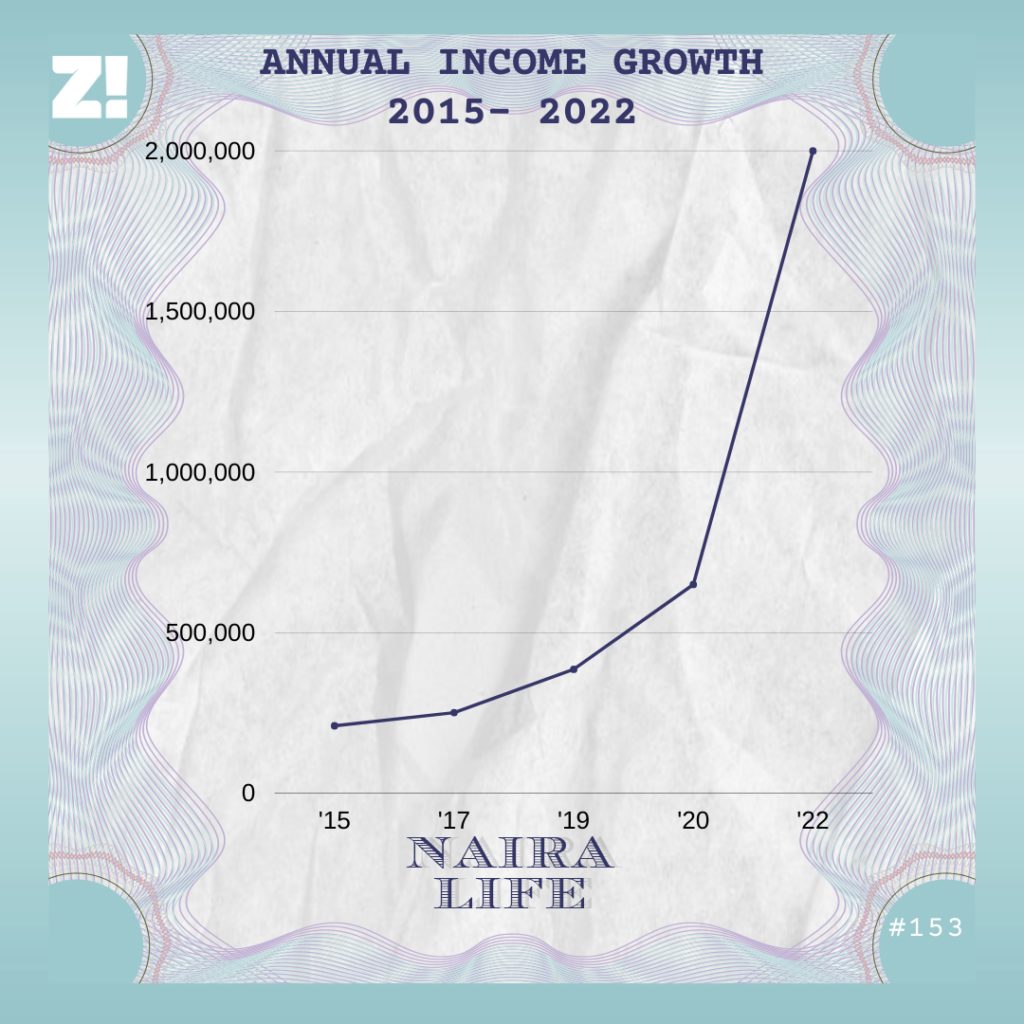

Immediately after my master’s in 2015. I had about £8,000 saved, but I started looking for jobs immediately. When I found one, it was at a top law firm in Lagos. Because it was my first job, I expected to be offered between ₦100k and ₦120k, so you can imagine my shock when I got the offer letter and saw ₦210k.

Sweet.

The money wasn’t going to change my life significantly, I was just shocked I was getting that much. I wasn’t spending so much money. My dad had gotten me a car that I drove to work and I stayed with my sister, so I was only spending money on fuel and saving the rest.

My salary didn’t increase until 2017 when the company reviewed salaries and increased my pay to ₦251k. It was also in 2017 I got married to my Manchester boyfriend, got pregnant, and by January 2018, I had pregnancy complications that kept me out of work for 10 months. In May 2018, I travelled to the US and had my baby there in June, and by August, I was back in Nigeria, and I resumed work in October.

I’m curious, was your salary paid for the months you were away?

I was paid for the first two months, and then I requested that they stop because I knew I wasn’t returning to work soon. When I had my baby and officially got on maternity leave, they started paying again.

Do you remember how much it cost to have your baby in the US?

If we’re talking about flight costs, accommodation, hospital bills and buying things for the baby, we spent roughly $35,000. A lot of it came from my savings and my husband’s money, but we also got $10,000 from my parents.

That’s a lot of money.

Yes, it was, but we didn’t have to spend much money going forward because we already bought clothes, diapers and all of that. My total savings when we got back to Nigeria was ₦1 million and about £5,000.

What was happening on the work end of things?

I was due for a promotion, but the time away from work delayed it. In 2019 however, I got my promotion, and my pay went up to ₦386k. A few weeks after I got the promotion, I stumbled on my first ever Zikoko Naira Life story, and that’s when my view on money changed completely. Before, I used to think you had to work hard for a long time before you could make the type of money you wanted. The more I read Naira Life, the more I realised that I needed to have more ambitious goals for my finances. I saw stories of people who had crazy salary jumps and thought, “Why can’t this be me?”

Instead of feeling happy about the raise, I felt even more dissatisfied because I thought, after working for the firm for four years, I deserved more than ₦386k. I decided I was going to leave, and after that decision, I started seeing things I didn’t see before. For example, it was only then I realised that out of the 13 people that were hired at the same time as me, I was the only one still working at the firm. I also looked at the top people at the firm whose positions I aimed to get to one day — senior associates and partners — and realised they weren’t happy. They were just people that were stuck at the job doing the same thing for years. I didn’t want to end up unfulfilled with my job like that.

Did you leave immediately?

Nope. Because I fell pregnant. A month after I got the promotion, I found out I was pregnant again. I didn’t want to start a new job while pregnant or soon after I had a baby, so I stayed at the firm, learning and putting myself on more projects and deals so I could increase my value. The US denied my visa application to have my second baby there, so I had my second child in the UK in January 2020. I stayed there until April because of the pandemic lock down, but when I got back, I started actively searching for jobs.

I found one that was going to pay ₦500k monthly, but I felt like I deserved more, and they didn’t offer more. When I considered that the law firm I was leaving paid bonuses at the end of every year that could be as high as ₦1.2 million, it meant my average monthly salary was ₦486k, and ₦500k wasn’t a big jump.

What happened next?

I finally answered a friend that had been trying to poach me for months. He wanted me as head legal counsel at his tech start-up. For some reason, I just didn’t consider interviewing for the role. He first texted me when I was in the UK to have my baby, but I told him I wasn’t interested. From time to time, he’d text me stuff like, “So when are you coming to work for us?”

So why did you finally answer?

One day, I was praying about getting a new job and God told me to consider the person that had been disturbing me for months. I spoke with my husband, and he agreed that I should give it a shot, so I did.

I asked for ₦1.2m monthly based on what I heard the market was paying for that position, but we ended up negotiating ₦650k and I took the job.

That’s almost half of what you asked for.

You know how these tech people can sell you dreams about huge salary increases when funding comes. As the head of my department, I’d also get the opportunity to make my own decisions and mistakes. Immediately I joined, my first major task was to be the legal personnel in charge of closing out the funding deal we were chasing. It was exciting because I got to be in meetings negotiating huge sums of money with people I could only dream of meeting.

Did you eventually close the deal?

We closed it in December 2021, and it was finally time to do a salary re-negotiation.

Should I drum roll?

Haha. We started at ₦1.5 million, but I wasn’t accepting that, so after some back and forth, we ended at ₦2 million monthly.

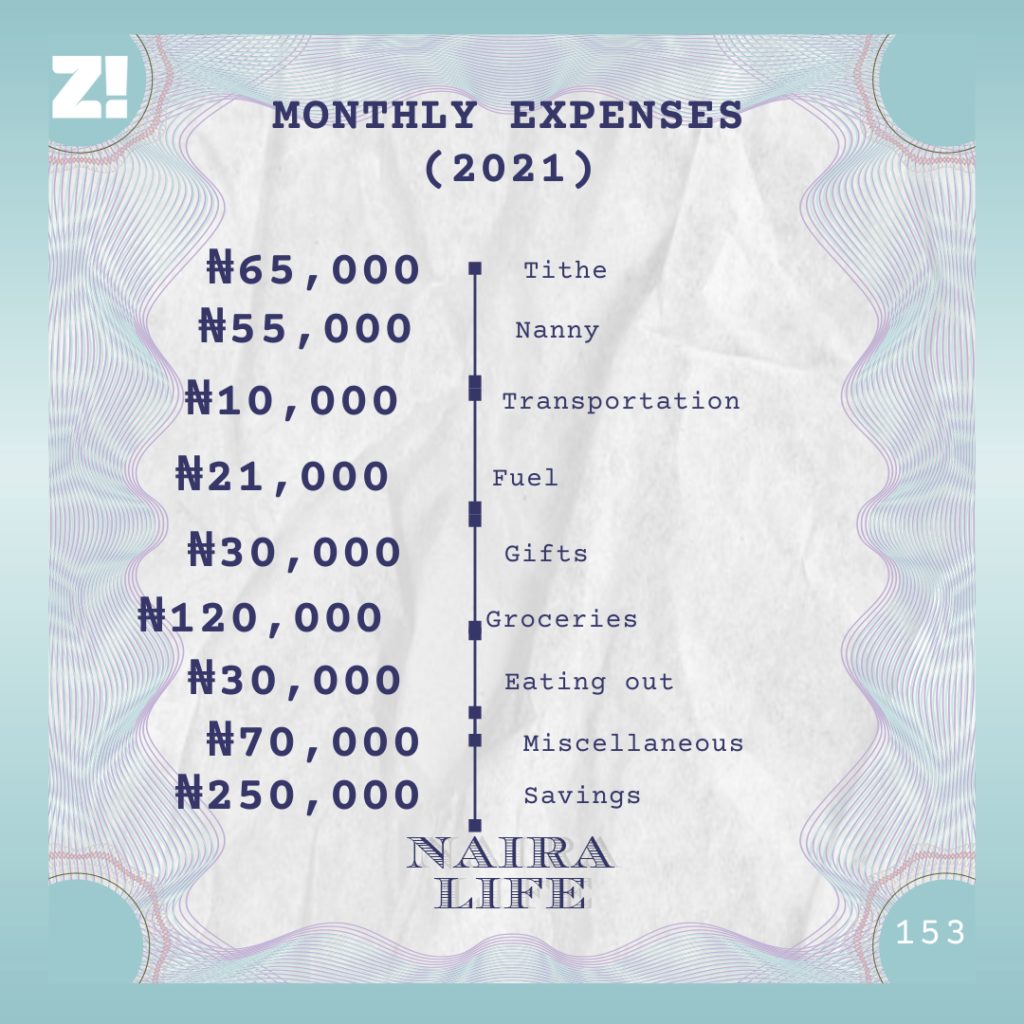

A baller. Let’s break down your current monthly expenses.

Is there something you want but can’t afford right now?

A new car. The car I currently drive is the one my dad got for me in 2015 and I would like to get a new one, but my total life savings is currently at $3,000.

How did that happen?

My family needed a new house because we’re getting bigger, so my husband and I sold our former house and got a new one last year.

Tell me about the finances of this deal.

Shortly before we got married in 2017, we bought a house for ₦30 million. My husband paid most of the money. I only contributed a little. We decided to sell the house last year to get a bigger one, so we sold it for ₦50 million and because my husband is a real estate broker, we found a good one for ₦77 million. Buying the house and furnishing it took a huge toll on our finances, but it was for an important cause, and money always comes back.

How will your new pay change the way you approach money?

I’ve decided that apart from my tithe, I’m going to keep living on ₦650k monthly. I’m also going to continue my habit of giving money to people and to God a lot. People have told me that the church abuses the money people give to them, but I don’t care. I’m giving the money to God, and it’s been working for me so far. The rest of the money is going into investments and savings.

What would you rate your financial happiness on a scale of 1-10?

9, because there’s always room for more. My friend recently told me that with my skills and experience, I should be earning about $100k yearly. That’s my next financial goal.