Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

The 28-year-old lawyer on this #NairaLife has over $150k in savings but put her financial happiness at 5/10. Why? Because the money is for her future, and she needs money for now.

Tell me about your earliest memory of money

My two siblings and I needed money to buy a cake for our mum’s birthday. Our dad had travelled, so we couldn’t ask him for money. We tried to find out how much big cakes cost, and knew we couldn’t afford it even if we saved our daily ₦100 pocket money for months, so we got creative.

We bought one small cupcake each for ₦100, and before she got home from work, decorated them with everything we could find in the fridge — chocolate syrup, candy, everything.

Aww. How did she react?

She didn’t eat the cakes, but she was grateful. When we talk about it now, she mentions how emotional she was because it was a financially difficult time for the family.

How?

Me o, I can’t remember any difficulty, but apparently, we were managing.

We grew up eating a lot of dried catfish and thought she gave us because we liked it. Nope. It’s because it was the cheapest fish she could find. Even the ₦100 she gave us to school was just because she didn’t want us to feel left out when other children were buying stuff — even though we got food packed. The fancy soups I thought she made were attempts at throwing whatever she could find into a pot and giving us what came out. Even the pizza we ate was homemade because we couldn’t afford to buy. But again, I can’t remember life being difficult one bit. I enjoyed my childhood. My mum is always thanking God we don’t remember.

What did your parents do?

My dad did cocoa importing and exporting, and my mum was a lawyer — and I wanted to be just like her. Apart from being a mummy’s girl, a few incidents also made me develop a strong sense of justice.

Do you remember them?

We had a driver that just stopped showing up. My parents thought he’d quit until weeks after we stopped seeing him, his wife called us crying that she also hadn’t seen him. My parents somehow found him at a police station, detained for nothing. My mum helped get him out. Another time, a police officer stopped my mum’s colleague’s son and after pocketing his driver’s license, claimed he was driving without a license. He was also detained, and had to beg someone that came into the station to help call his mother. Again, my mum helped him out.

So you studied law

Nope. Economics and Business Administration. I went to the US for school, and you can’t study law as your first degree. I was really good at math and loved economics in secondary school, so I thought this was a good first degree.

Things had gotten better for your family financially

Yes, but my parents still couldn’t afford to pay full tuition for three children. We got scholarships and they made us promise to keep the good grades so the scholarships would continue. We all did. I even graduated summa cum laude.

I also didn’t collect pocket money from my parents. I found jobs on campus that paid me $400 a week, so I could afford to fuel my car, feed myself and pay my speeding tickets, but no more. For example, I couldn’t afford the school’s annual ball because I couldn’t afford a dress.

Wait…Speeding tickets?

I got them all the time. I don’t know where I was always rushing to.

Vin Diesel, please

LMAO.

What happened after?

I graduated from university in 2015 and then went to law school between then and 2018.

I worked at law school too and even though I made less money than when I was in university, my parents still didn’t have to bother about giving me money for sustenance. After law school, I got a corporate law job at a firm.

Not criminal law?

I’d found out I could tie law and economics with things like antitrust law, tax law and project financing law, and I didn’t want to give up my love for numbers. So I went that route.

How did that go?

Great! My job paid $180k for the year I was there. I lived with a family member and didn’t have to pay rent or utilities, and I’ve never been a big spender, so by the time I was leaving, I had about $100k in savings. I did have to pay about $2k in speeding tickets that year though.

LMAO. Why were you there for only a year?

I didn’t have a work authorisation to stay in the US for more than a year after graduation. I was already thinking of planning a fake wedding with a friend for a green card, but God told me not to do it. So I returned to Nigeria in 2019 and went for NYSC.

What did that feel like?

I knew my family was comfortable, so I wouldn’t suffer. But I also knew I’d have to start all over. I even did law school again after NYSC.

But at least, you had $100k

$100k that I didn’t touch. Even until now, I’ve barely touched it. I’ve just kept it as emergency funds. I started NYSC as a regular corp member, collecting allawee and pocket money from my parents. Then my PPA, a federal law parastatal, paid me ₦92k per month.

What could ₦92k get you?

Data, fuel, and some food. From the first month, I knew it wasn’t going to be enough if I wanted to do any other thing like go out and buy stuff. So my mum gave me ₦300k “pocket money” the next month. After that month, I started touching my savings small small. I realised I didn’t want to do that, so I started doing side gigs.

What kind?

I reached out to people I’d schooled and worked with in the US and asked for quick jobs like writing business plans, growth strategy, market and product expansion plans, contract writing and reviewing, and negotiations. I was getting an average of $2,200 on months when I got jobs. Some months could go up to $5,300.

Fundsss

I had to stop when it was time for law school in January 2022 because law school students in Nigeria aren’t allowed to work. Thankfully, I’ve never been a big spender, so I had savings to fall back on. And when I finished law school in September, I started again.

I’m curious about how much you have in savings

I have three savings buckets. The $90-something-k savings is for life-or-death situations for me or my family members. It’s absolutely untouchable except for health or maybe life-threatening situations. I try not to remember I have it.

From my side gigs from the past few years, I have two savings buckets. One has €40k in it. It’s for my future studies. I want to get an MBA. The other has about $25k in it. It’s my regular savings account. Apart from my entire year of NYSC allawee that I still haven’t touched, I don’t have any naira savings.

Where did you learn about saving?

From my mum. She’s always been averse to loans and stressed the importance of having rainy day funds. I’m also not a big spender on myself, so unless someone wants something, any extra goes into savings.

What are you up to these days?

I currently work in finance and economics consulting, but I’m applying for law-related jobs in Nigeria. I’m trying to build myself in both law and economics. My goal in life is to make enough money to become a venture capitalist — someone who finances businesses — and I want to understand every aspect of how businesses work. That’s also why I’m getting an MBA.

Do you have a business of your own?

I’m starting one this year. It’s beauty-related.

Tell me something you want but can’t afford right now

A new car, an apartment and three international trips annually lol.

What can you afford?

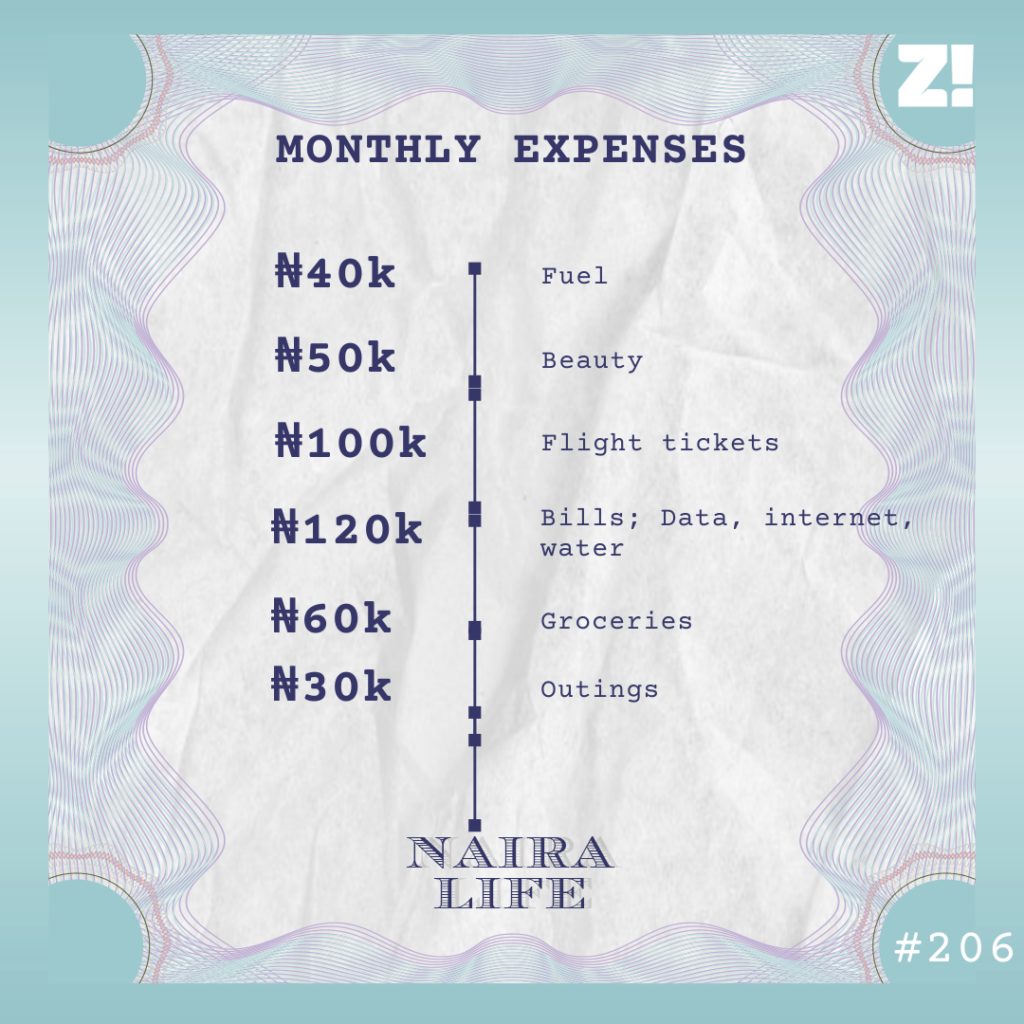

Petrol, food, a gym membership, car maintenance, beauty regimen — hair, nails and skincare.

And how do you break down your monthly expenses?

Final question: how financially happy are you? The scale is 1-10

5. I need more money. I want to be able to travel and do more for myself without having to touch any of my savings buckets.