Nigerians treat money like knacks; they want a lot of it, but won’t be caught talking about it. Every week, we ask anonymous Nigerians to show us their Naira Life – some will be struggle-ish, others boujee–but all the time, it’ll be revealing.

(Shout out to Refinery29’s Money Diaries for the inspiration.)

First in line is a family man who believes he’s a diehard team player.

Age: 37

Occupation: Financial Analyst

Location: Lagos

Relationship Status: Married (with two kids)

Salary: ₦700,000 (net)

Household income: ₦700,000

Rent: ₦750,000/year

What was the first salary like?

I mostly spent on people; family for the most part. I was quite traditional about it. I remember sending all of it to my mum as a gesture, and her sending it back to me. My net income at the time was ₦182k, and my annual package was ₦2.8 million. That, of course, includes bonuses and all of that. Also, this was 2010.

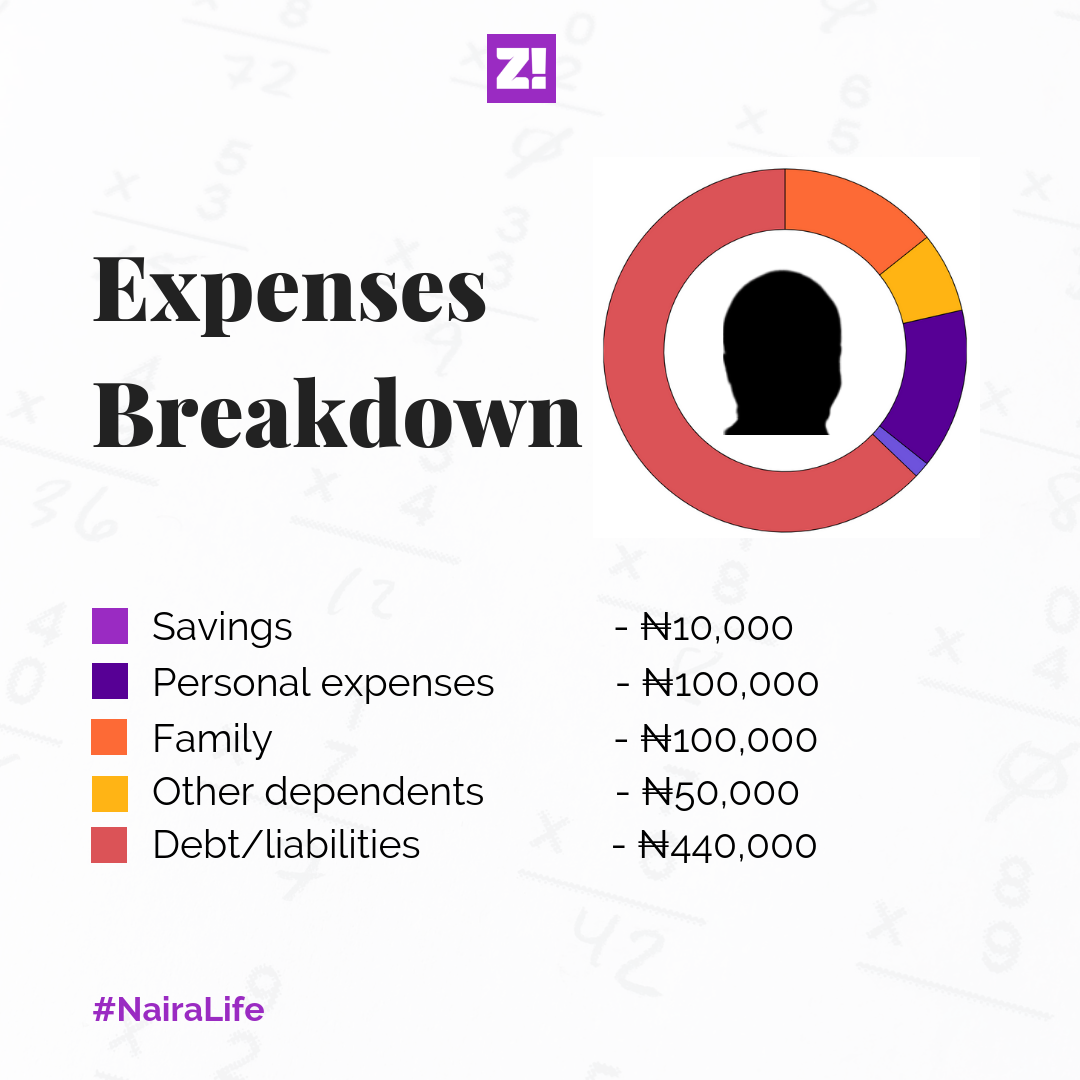

Less than 2% of your income goes into savings?

Yes, and that’s because the rest of my income goes into settling debts and other recurring commitments and liabilities. Also, I have this indiscipline of people asking for money and me not turning them down. Those 20 and 30k’s add up.

Investments?

None. I currently have no financial investments. I made some investments two years ago; they went bad, and I’m still paying for it. That’s where the debt came from. It’ll be completely paid in about six months though. For now, over 50% of my income goes into settling that debt.

What’s going to change about your spending when the debts are paid?

A lot more of it can now go to my family. Need to push up that family budget.

2019, almost 9 years since your first salary. What’s the annual package now?

My annual package is currently at ₦9.4 million.

How much do you feel like you should be earning now?

₦1 million. Net. I didn’t make some important switches in my career at the right time. Now, I believe you should move every 4 years max. I spent 7 years at my first job.

How much do you think you’d be earning in five years?

Using industry average, and where I currently am, I’d say somewhere between 1.5 and ₦1.8 million, net.

What do you feel like you should have had, but don’t have now?

Land. It’s just one type of investment I never really paid attention to. I just had a “never tie down capital” mentality. Most of my investments have actually brought me loss. Still, I’m not scared to take another risk.

Despite your bad investments, what are your best investments?

Definitely my certifications; the ICANs, ACAs, ACSes etc. When you work in an industry as structured as the financial industry, certifications help you stay competitive and valuable. Also, I’m kinda glad I got most of those certifications before I got married.

When do you want to retire?

You know, I used to think I’d retire at 45, but I realise now that I’m not a great businessman. It took a while to realise this, but I’m going to be working till the end, maybe 60. I’m the perfect company man; great energy, always representing, putting in the work for the team. I’m usually the person sharing impactful insights, and driving execution.

What’s your pension plan?

I don’t pay too much mind to it, but about 50-something-k goes into the pension account monthly. Currently, it holds no less than ₦4 million. It doesn’t make sense to me that I have that much somewhere–that is giving me about 7% annually but still–I can’t afford a house. I’ve done the math, and my pension is going to work best for me if I already own a house.

I imagine that the best use of my pension will be one where it helps me get a mortgage. I imagine a future where Pension Fund Managers in Nigeria create housing packages for consumers. If I have a ₦20 million pension and don’t own my house, I’m still screwed.

I inherited a mindset from my mum where I always imagined that I’d buy a house, instead of going through the trouble of building one. I was much younger, and that doesn’t seem so realistic now.

What are you long term plans at the moment?

I’ve been in debt for too long that it’s hard to see beyond it. At ₦700k, I can build a house in 3 years, because I really don’t have huge personal expenses. I’m just caught in the debt trap. At ₦700k, and with the responsibilities of family, I’d still be able to save ₦150k at least. In fact, 40% of my entire income can go into saving and investing.

What do you wish you paid attention to in 2010?

Discipline. I wish I’d began saving and investing early.

How would you rate your happiness on a scale of 0-10?

I’m really glad a lot of my happiness isn’t tied to my finances because I’d probably have high BP now. I’m totally fine. And while this might sound cliche, I have a family. I invest a lot of time in them, and it’s easy to underestimate how important this is for our future and mental wellbeing.

My head is still above water, and for that, I’m grateful.

Check back every Monday at 9 am for peeks into the Naira Life of everyday people.

If you’d love to share your Naira Life with us, tell us here. You’ll be anon, of course 🙂