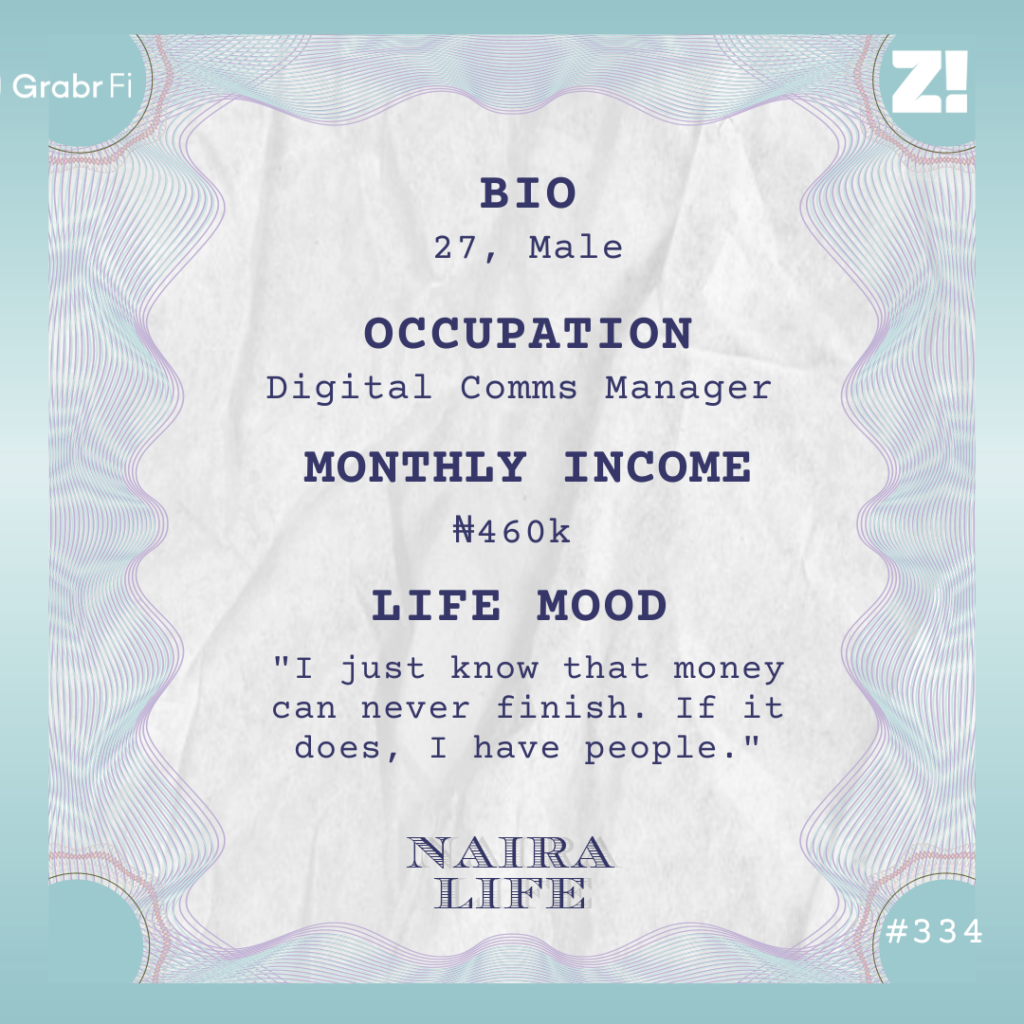

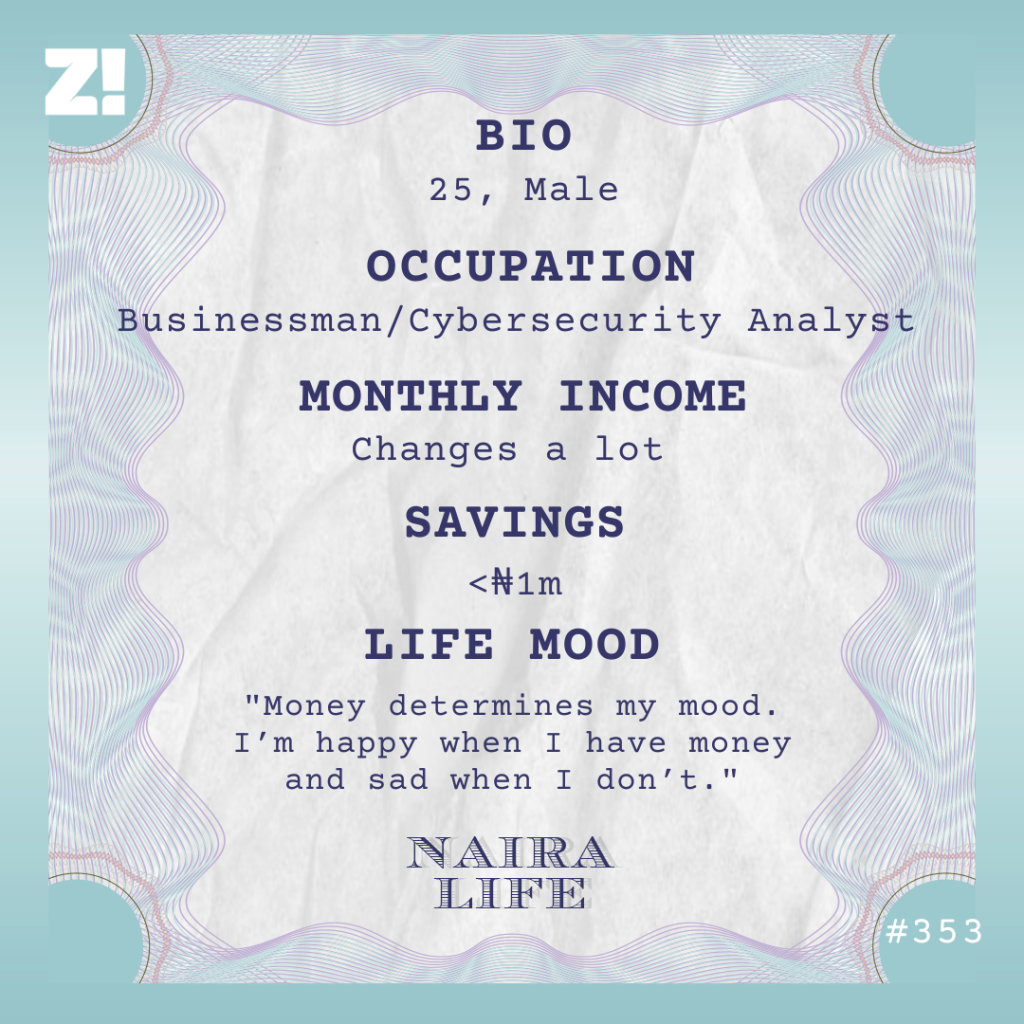

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

I began to have a strong desire to make money when I was 11 or 12 years old. It was largely due to my family’s financial situation. I didn’t know what having money meant, but I knew what poverty looked like, and I wanted better.

Tell me more about your family’s financial situation

I was raised by a single mother who didn’t make a lot of money as a civil servant, so things were difficult. While my friends attended private school and received toys, I attended public school and managed food.

I noticed this difference in our quality of life pretty early, so I often thought about making money. The first time I was able to do so was at 15 years old.

What did you do?

I taught primary school students. I was still in secondary school at the time — either SS1 or SS2 — but I’d work as a holiday lesson teacher for makeshift schools in the area for ₦4k/ month.

I also made money running errands for people, mostly in the ₦20 or ₦50 change they told me to keep. There was also an estate beside my street where I’d go to help rich people bathe and walk their dogs for little money here and there. When the dogs had puppies, I helped the owners market and sell them on an online marketplace and earn between ₦2k – ₦4k in commissions.

I finished secondary school in 2016 and returned to teaching at schools. The first job I got paid ₦8k/month, but I worked there for only two months. I was more of an errand boy and cleaner than a teacher. I moved on to another school that was supposed to pay me ₦12k/month. I didn’t last one month there because the middle-aged proprietor began to move funny.

How so?

The man was making some “funny” sexual advances. I ignored him until he started asking me to wait behind after others had left. Ah, I resigned immediately.

Next, I worked as a cleaner at a school for ₦15k/month. I worked there for three months before I got an admission offer to the university. This was still 2016.

Did you also try to make money in uni?

I had to. I didn’t have a specific allowance from home. Sometimes I’d get ₦2k per week, other times ₦5k or even ₦1k if I collected food stuff. Money wasn’t consistent, so I needed to find ways to support myself. I did that by rearing rabbits.

Rabbits?

Yes. I love animals. I bought one rabbit, which I reared at home before I got into uni. She gave birth to six kits. Three died, and I took the remaining three with me to school when I resumed. That drew attention to me, and I became the guy who bred rabbits.

Gradually, people started to find me whenever they wanted to buy rabbits. I’d help arrange the purchase from a farm and earn commission. Over time, I expanded my operations and used any extra money that came my way to buy a few more rabbits and build a cage. That way, I could breed my own rabbits, sell them, and make a higher profit. I was selling them as pets, not for meat, but I was still making good money.

“Good” might be a stretch because I’m talking like ₦3k/week, but for someone who often trekked an hour to school because of transport fare, it was good enough for me to survive.

You mentioned you were selling the rabbits as pets, not meat. Is there a difference?

Yes. To sell rabbits for human consumption, you need to sell in large quantities to be able to meet clients’ demands. That’s big man business, which I didn’t have the capacity for. I only had like 7 or 8 rabbit kits a month. So, selling them as pets was the way to go for me.

People hardly bought rabbits as pets, but I had a strategy that allowed me to sell them at a premium price. I’d create content about how rabbits were quieter, cheaper to feed and maintain than dogs. I also spread the word that my rabbits were trained. Rabbits aren’t easy to train, but since mine were often in my room, they got used to being around humans.

I’d make videos to show how I could call them to come to me. The rabbits came because they knew I probably had food, but to people, it showed that the rabbits were trained and could listen to commands. So, while others could sell a rabbit for ₦1500 or ₦2k, I could sell mine for as much as ₦5k or ₦8k. Guys even bought them to gift their girlfriends. Business was good.

However, as I was getting money, everything went back into the business. I had to expand and feed the rabbits, and it became difficult to maintain. Then, a bag of rabbit food was ₦3k. Imagine a struggling student buying bags of food every week for rabbits.

So, even though the business grew very fast in just a year, it fell off just as fast. The final blow came when I was in 200 level.

What happened?

There was an outbreak of the RHD virus that unfortunately affected my rabbits. I had 8 breeding does at the time and I lost them one by one. I tried different remedies, even asked the person I got them from, but nothing worked.

So, whenever I noticed one got sick, I’d ask my roommate to put it down, so at least we could eat. I eventually sold off the remaining three for about ₦26k and the cage for ₦1k. I was able to make that much from the rabbit sale because one of them was an imported Angora rabbit I’d bought for ₦30k. I eventually sold it off for ₦20k. That’s how I stopped the business.

Phew. Sorry about that. What did you do next?

I briefly worked as a hostel agent and reposted pictures and videos of available hostels from another agent.

The first day I went for a physical inspection myself, I realised there are some jobs that need you to be mentally and physically fit. I went down with malaria after one inspection waka and decided the business wasn’t for me. ₦4k in commission was the only money I made from that stint.

During this period, forex had started to gain ground in my city. Someone I knew from another hostel did a giveaway, which I participated in but didn’t win. Then I entered his DM and was like, “Omo, this giveaway you did. I’m broke o. I really needed the money.”

He asked me to come to his office to see him. I did, and he told me how I could start a forex business.

He explained that I could raise money from people, invest it on their behalf, and collect a percentage of the profit. He gave me ₦4k to start. With that ₦4k, I designed a flyer and started posting about the forex opportunity.

To be clear, were you trading forex?

No, I was just the middleman. I worked with a trader who traded the money for about two weeks before paying out the profit. The profit margin on investments was around 20% – 30% bi-weekly, and my cut was typically 5% or 10% of the total investment + profit, depending on my agreement with the investor (the person whose money I was taking).

For instance, if someone invested ₦1m and we earned ₦1.4m after two weeks, I’d only return ₦1.2m or ₦1.3m and keep the balance. Fortunately for me, people trusted me, and it was easy to convince them to give me their money.

In the first month, I rallied five people who invested between ₦400k and ₦3m. By the end of that month, I had earned ₦1m in commissions. To give you a full picture of how crazy that was, I’d never had up to ₦80k cash at once at that time in my life.

When I saw that ₦1m, I went to the bank and withdrew ₦200k. Then, I took it home, poured the money on my bed and slept on it. I had never seen that amount in cash before. The next day, I packed the money again and deposited it back into my account.

That’s wild. How did this sudden windfall impact your lifestyle?

Omo, I didn’t handle money well, and I think that was natural. I mean, I went from struggling to survive to making my first million. It was a big change.

Some people say that money can’t change them, but I believe it’s because they haven’t seen the amount that’ll change them. Money changed me, and I didn’t quickly realise that I was losing my head.

I started making money from forex, and suddenly I couldn’t cook again. Me, who used to cook palm oil rice and slice onions inside tomato paste to make stew, suddenly realised I wasn’t eating healthy. So, I started ordering food.

I went from eating chicken once in a blue moon to three times a day. Now, I can’t bring myself to eat chicken anymore because that’s all I ate when I started making money, and I’m tired of it.

My lifestyle completely changed. I bought my first iPhone, an 11 Pro Max. Also, I started going to the club, buying expensive stuff and hanging out with friends.

You were balling

I was. People kept investing in the forex business, and I continued to make money. This was around 2019. I even registered my brand as a proper business, employed a graphic designer and social media manager to create content for me. I think I paid the designer ₦15k/month.

It was a structured setup, and I made money. At some point, I had up to ₦9m and was even considering buying a car. Then, you could get a small Toyota car for like ₦1.5m. I didn’t go through with the purchase because I couldn’t drive and didn’t really need a car.

Interestingly, the period when I finally attempted to get a car was when the business came crashing down. This was in January 2021.

It turned out that the people trading the money weren’t legitimate forex traders. It was a Ponzi scheme, and they ran away with ₦6 billion of people’s money, including mine and my investors.

Damn. I imagine your investors tried to recover their money from you

Of course. I nearly died during that period. Interestingly, I had just returned from a vacation and only had ₦32k in my account when everything went to shit. Investors wanted to kill me with calls. Some turned to the police.

One time, I had just returned home from settling police officers after one arrest when a police van from a different station came to pick me up. I became a celebrity; the police were just looking for me. I couldn’t stay at my hostel either because of the guys who wanted to beat the hell out of me and burgle my apartment. I had to stay at a friend’s place.

How did you get out of that situation?

My saving grace was that I’d made my investors sign an MOU. In the document, I’d set up the contract so that they were essentially agreeing to recover only 5% of their initial investment in the event of a crash. I’d done that after a smaller crash had happened to limit my exposure and how much I had to pay back. Many people didn’t read the fine print of the MOU and simply signed it.

So, when that wahala started, I created a group with all 19 investors affected and showed them evidence of what had happened. I’d been clear from day one that I wasn’t the trader; just a middleman. Fortunately for me, most of the people who invested heavy amounts of money chose to let it go. It was the ones who invested little money that wanted to take my life. One of the guys who arrested me invested ₦10k. I eventually returned his 5% as ₦500 data.

I sha found a way to return most people’s 5%. Some of them argued that the agreement wasn’t legal because there was no lawyer present when they signed it. It was a lot of back and forth, but that’s how that era ended.

I lost everything and went right back to being completely broke.

Phew. Out of curiosity, did you invest in any safety net when you were making money?

Hmm. I invested in myself alone. I consider that period the biggest mistake I’ve made, but also not exactly a mistake. There is some money you make in life that only comes with lessons. People say, “opportunity comes but once,” but that’s only helpful when the opportunity comes to someone prepared and mature.

Imagine that kind of opportunity coming when I was barely 19 and with the limited exposure I had. I was bound to make mistakes, and I don’t regret it. I’d make the same mistakes again if the situation repeated itself with the same level of knowledge I had then.

Omo, I lived the life then. Land of ₦1k, I didn’t buy. Instead, I invested in myself aggressively. I went on multiple vacations, started looking good, and bought whatever I wanted. I even bought diamond earrings for the girl I was dating at the time. On her birthday, I used a car to deliver gifts to her. Me too, I know I made mad idan moves. Giveaway dey cry.

I’m screaming. How did you cope with the lifestyle changes that came with losing everything?

It was tough. A few weeks after the forex incident, I travelled out of my school area to stay with a family friend for about a week. I just needed a place to survive. That visit unexpectedly provided me with a lifeline.

When I had money, I’d developed an interest in drones and had bought one for ₦40k just to practice with. When I visited the family friend, I decided to do what I knew how to do: be a middleman. But this time, for drones. So, I got prices from a vendor and began posting drones for sale.

My first sale came with a ₦35k profit. When I closed that deal, I said to myself, “Okay. Maybe there’s something here.” That’s how I started selling drones. I also took on a few drone event coverage gigs and got someone to operate the drone while we shared the ₦15k – ₦30k coverage cost.

Over time, I made enough money to upgrade my drone, which cost approximately ₦500k, then later to a more expensive one. In 2022, I upgraded my business registration to include my drone sales and event coverage business. It’s still my primary source of income today.

I also earn random money from real estate commissions on the side, as I served my NYSC year with a real estate company between June 2024 and 2025. However, it’s not consistent. I don’t market it a lot because I don’t want to take attention away from my major hustle, which is selling drones.

What’s your income like these days?

My income is wildly unpredictable. I run a business, and can’t determine when people will buy. I can make ₦300k this month, ₦1m the next and absolutely nothing for the next couple of months.

In March 2023, I made ₦2m in one month. The next time I made money from drones that year was in December, and I made only ₦40k. That’s how it is. I’m not selling fish. Drones are expensive, and I tend to only make a good profit when people buy expensive ones. I might only make ₦20k on a ₦200k drone, but I can make over ₦200k from a ₦3m drone. Unfortunately, those deals only come occasionally.

Besides the drones, I take on various random jobs to earn money. I can take on a video editing gig today and help someone buy a pet tomorrow for little money here and there. Even if it’s ₦10k or ₦15k, just bring.

I get it

I’m also on the lookout for remote cybersecurity internships. I studied a professional diploma course in cybersecurity during my NYSC year after a Twitter contact told me about a scholarship opportunity. The scholarship allowed me to pay $15/month instead of $30 for the one-year program. I was interested in tech and mostly curious about the field, so I joined.

The only problem now is that landing my internship might mean rearranging my life. I’m not based in Lagos, and most of the opportunities I’ve found require moving there. It’s crazy because these internships don’t want to pay more than ₦50k/month.

Even crazier, I’m seeing jobs requiring three years of experience offering ₦250k – ₦300k. That’s not nearly enough to justify a move to Lagos. So, my goal is foreign remote jobs that pay in dollars.

How would you describe your relationship with money now?

I’ve seen money, so it doesn’t freak me out anymore. It’s safe to say I can’t make the mistake I made when I was touching forex money. However, money determines my mood. I’m happy when I have money and sad when I don’t.

That said, I think I’m in a better place. I’m not where I want to be, but I can manage my life with what I earn. I may not like chicken anymore, but I can afford it. I don’t spend carelessly, but I still make sure to buy things that make me happy.

I also try to save in a way that my savings can “save” me when I’m not making sales. I don’t have a specific figure I save each month, nor do I lock away money. What’s the point of locking it just to enter debt when I urgently need it? So, I just do what I can.

What do your savings look like now?

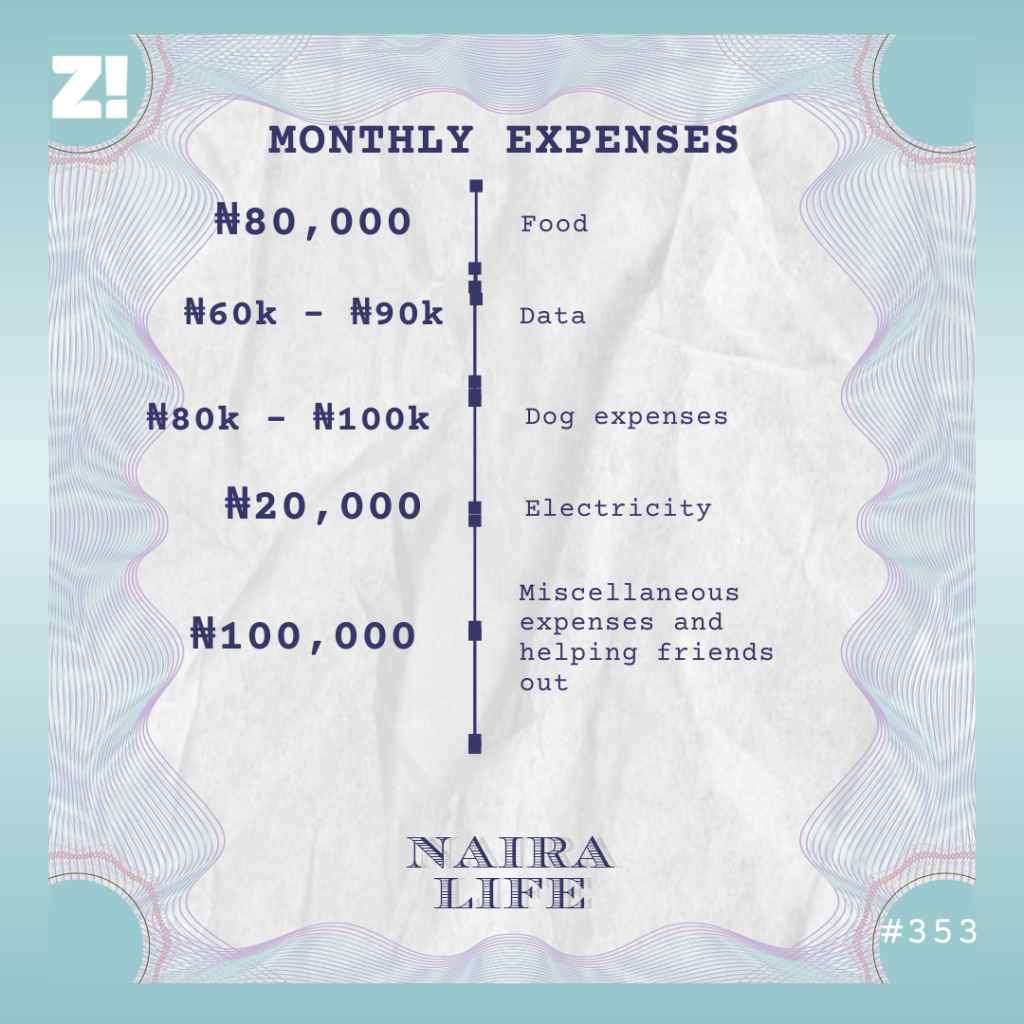

I don’t think it’s up to ₦1m. My dog has been ill for a few weeks, and I’ve been spending a lot of money on his health. I also recently got some perfumes and am preparing for December oblee and expenses. So, that’ll most likely eat into my savings.

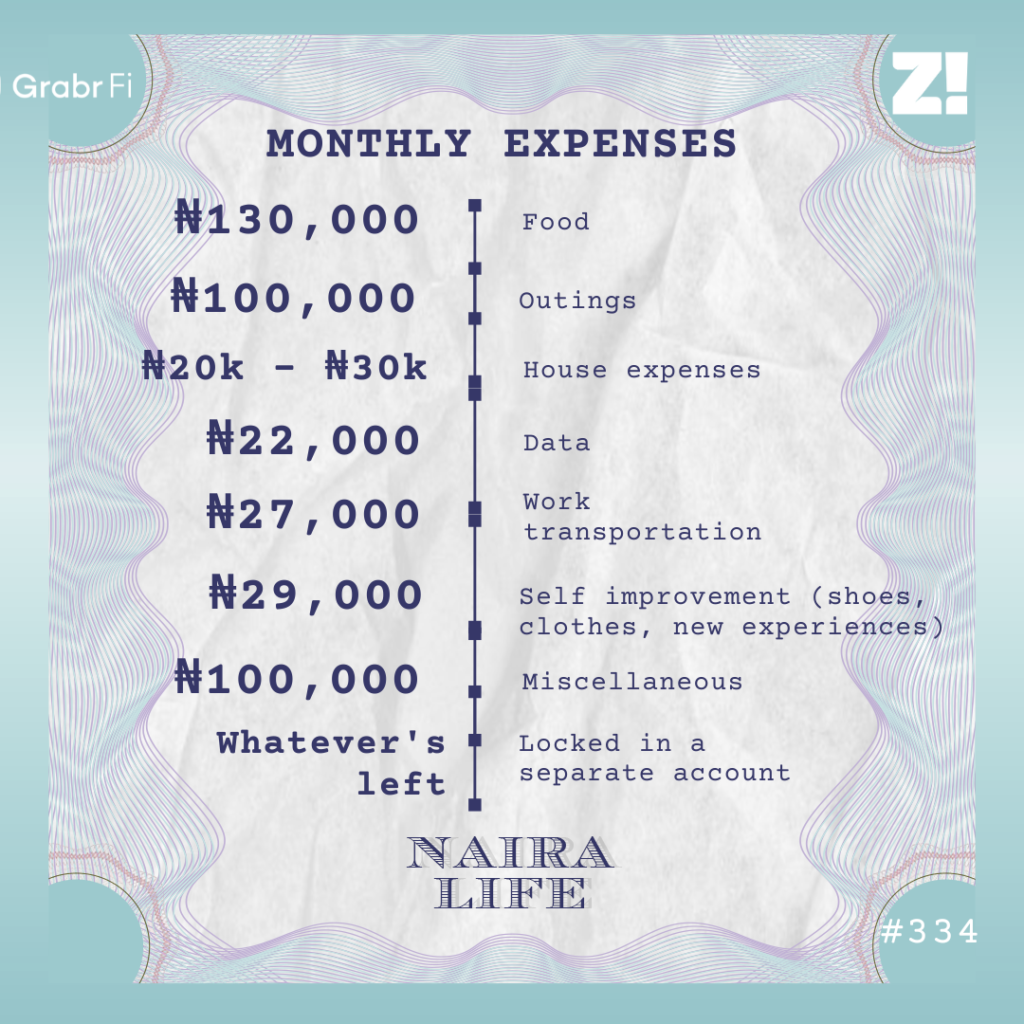

Let’s break down your typical monthly expenses

This depends largely on how much money I make each month. I can spend carelessly when I have money, and be extremely prudent when I’m broke. But here’s a decent average:

What do future plans look like for you?

I hope to have a strong and steady business. I would hate to be working a nine-to-five job. If I have to, it has to be remote work. I just want a stable life with a supportive partner and to be able to afford the basic good things of life. Yearly vacations wouldn’t be bad, either.

Is there anything you want right now but can’t afford?

A power bike. I ride my friend’s own and would really love to own mine soon. I might need around ₦3.5m to ₦4m for that. I can’t even save towards it because expenses keep coming to take away whatever money I manage to keep aside.

I can relate. How about the last thing you bought that made you happy?

I bought my perfume collection a few weeks ago, and my total spend was slightly above ₦200k. I liked that I was able to afford what I wanted.

How would you rate your financial happiness on a scale of 1-10?

5. I’m grateful that I can live a good life to a certain extent. However, I don’t have a stable income, and I’m unable to make long-term plans as a result.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad]