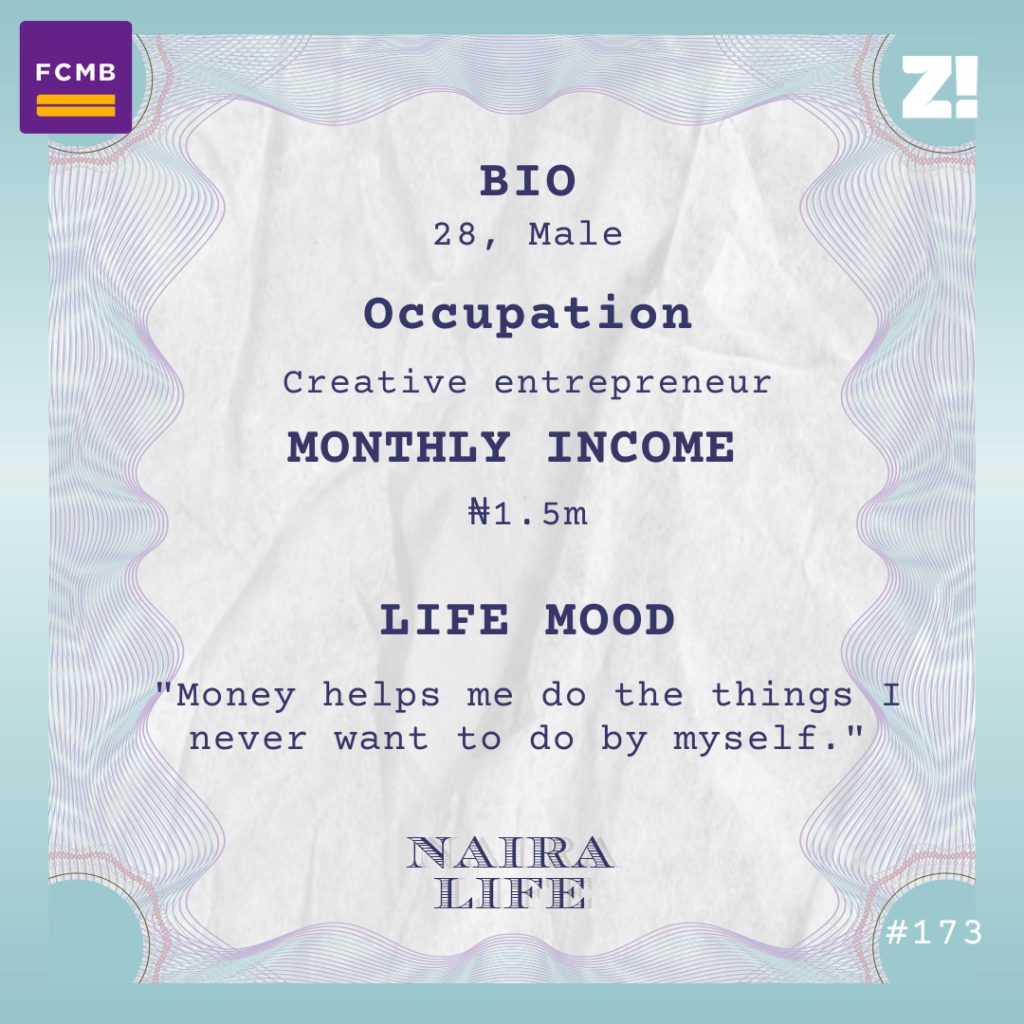

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Get an auto loan of up to N30 million to buy your dream car, at a reduced interest rate. Get started.

When this week’s subject on Naira Life was 12, an uncle advised him to never do anything for free. Less than 10 years later, he made his first million. How did this creative build a stable business from scratch?

Tell me about your earliest memory of money.

My dad ensured my siblings and I learned about computers because he knew the future was tech. He got us a computer when I was 7, and hired a computer teacher for home lessons. By the time I turned 12 in 2007, I was already helping adults set up emails and search for stuff on the internet.

One day, an uncle asked me to help him do something on his phone and asked how much I was charging. It was a strange question. Of course, I wasn’t going to charge him. When I told him this, he looked at me and said, “Is that how you’re going to become a millionaire?”

That moment defined the way I saw work, and I’m grateful to him.

Did he pay you?

₦1,000. First money I ever made.

From then, any time someone needed me to do anything on their computers, I charged them between ₦1k and ₦2k, and surprisingly, they paid. This continued for a couple of years until I got to senior secondary school. In SS 1, I was part of a dance group, and I made the music mixes we danced to myself. Whenever we went for a competition, people wanted to know where we got the music, and soon enough, I began charging ₦5k to make mixes for people. Again, because I was using my computer a lot, I’d learnt how to design. Whenever there were parties, I designed invitation cards and printed them with my dad’s printer.

By the time I was going to university, I’d made enough money to buy a ₦60k iPod Touch for myself.

Had you always been interested in doing business?

My parents were business people, but they wanted us to have traditional jobs for stability. Me, I just wanted to do the things I enjoyed. It wasn’t really about business or money.

The major factor that guided my choice of university was that I wanted it to be a place where I could be by myself and improve on my skills without stress. So my parents put me in a private school.

What skills were you looking to build?

I liked films, so video editing was the next thing I thought to learn. By my second semester, I made a short film that went viral on campus, and I became popular. Next thing, people started reaching out to me to make videos for them. My first gig was to produce a game show for some campus organisation. It paid ₦35k. After that, I never stopped getting gigs. ₦100k here, ₦20k there, ₦50k here. School became secondary and my grades dipped terribly, but I didn’t care.

By my second year, my parents were so worried I wasn’t asking them for money anymore, that they told my cousins to start sending me money.

You didn’t tell them you were a business mogul?

I didn’t want them to lecture me and say stuff like, “Face your studies for now. You can do business later”. I just kept it to myself.

Occasionally, companies outside school would notice me and reach out, and I’d make some nice ₦250k or ₦300k.

Were you doing all this on your own?

Because I was making good money and getting more work, I decided to hire people outside school and put them on salaries. We’d find early-stage tech startups and reach out to them to make videos for them. Surprisingly, a lot of them agreed.

In my fourth year, we got a big client that paid ₦1m in cash. I remember just sitting and looking at the money, thinking, “Man, I’ve made it.”

LMAO. What were you using the money you were making for?

Apart from paying salaries, I bought gadgets like new phones and computers to help me work better. Also, my biggest motivation for making money is that money helps you do things you don’t want to do. For example, I hate cooking, so when I started making money, I bought food. Other things like paying for laundry also made my life easier.

I was having a conversation with someone recently who correctly said that when I was in school, I didn’t have to start a company. I could have been making good money as a freelancer without the stress of paying salaries and running a company. Now though, I don’t regret starting the company. It’s a legacy for me, and that legacy keeps growing bigger.

What happened after uni?

I graduated in 2014. My convocation was on a Friday. By Monday, we’d found an office space, paid rent and resumed full-time by 9 a.m. That year was for a lot of learning. For example, we spent so much money trying to set the office up, we started going broke. So yeah, it’s never a good idea to spend everything your company has on office aesthetics. We also learnt that in the creative industry, invoicing a client doesn’t mean you have the money. Some big companies take months to pay and that can leave you in a bad place if you were relying on their money to pay salaries and survive. Thankfully, because we had a lot of clients, we were getting a good in-flow of money, so the worst thing that happened was a one-week salary delay.

For the first year, my salary was ₦500k once every three months and increased it to ₦1m every three months the next year.

I lived in the office space and didn’t go out a lot. However, based on how well the business did, I took bonuses at the end of each year. My first bonus was enough to buy me my first car, and that’s when my parents realised that they didn’t have to worry about me anymore.

They were still worried at this time?

Oh yeah. They kept sending me job opportunities and asking questions like, “Are you sure you can make a living out of this?”

By the end of the second year, we moved to a more strategic location where we had to pay rent that was 5x what we were paying before.

When did you start getting a monthly salary?

After the second year when I started dating and having boyfriend responsibilities. The business was also doing much better and I needed a stable income, so I started earning a monthly income.

Is that what you earn right now?

Nah, I earn ₦1.5m a month, and my average end of year bonus is about ₦4m.

Omo.

I’m looking at more bigger picture stuff now. For example, I don’t want to collect a monthly salary from my company anymore. I just want to collect a lump sum at the end of each year, after we analyse our profits. The more money we make in a year, the more I’ll earn.

Also, my goals for this year are to learn and invest in real estate. I know there’s money in it.

In a month, what do you spend your money on?

Tell me one thing you want but can’t afford.

If I say I want a brand new car, it might sound greedy because I already have a car. So I’m just going to say a nice house in one of the wealthy parts of my state.

Do you ever get asked to do stuff for free?

Nobody asks us to do stuff for free, but there are people that expect us to deliver much more than they paid for. Early on, it was fine because we just wanted the big clients, but as time went on, we learned that not billing people properly can lead to see-finish.

Rate your financial happiness on a scale of 1-10.

I’d put it at a 7. Like I said, money does things I wouldn’t necessarily do myself. Now, I have a chef and live a pretty comfortable life. I don’t even have to work so much anymore. I can walk into the office and find out we’ve been paid for a job I didn’t even know about. That’s pretty dope. Also, I can travel. I love travelling.

Get an auto loan of up to N30 million to buy your dream car, at a reduced interest rate. Get started.