If you read this article where I shared some tips about saving in Tinubu’s Nigeria, you’ll know I stressed the importance of financial literacy. I’ve taken one for the team and compiled the savings apps in Nigeria that’ll put you on track to doubling your coins.

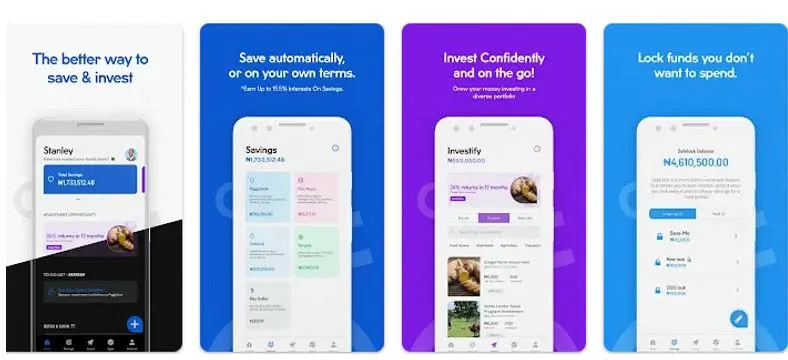

Piggyvest

Source: Piggyvest

There’s a standing joke about Nigerian women and how they don’t joke with their Piggyvest accounts. It’s a popular savings app in Nigeria that offers customers different savings options. The app has a flexible savings plan that allows users instant access to funds and a target savings plan that lets users save for personal or business projects.

Piggyvest also has a safe-lock plan that allows users to lock away funds they don’t have an immediate need for while accruing interest.

Interest rates:

SafeLock offers 12.5% interest annually, target savings offers 8% interest annually, and the flexible savings plan provides 8% interest annually.

Piggyvest is available for download on Apple and Android phones.

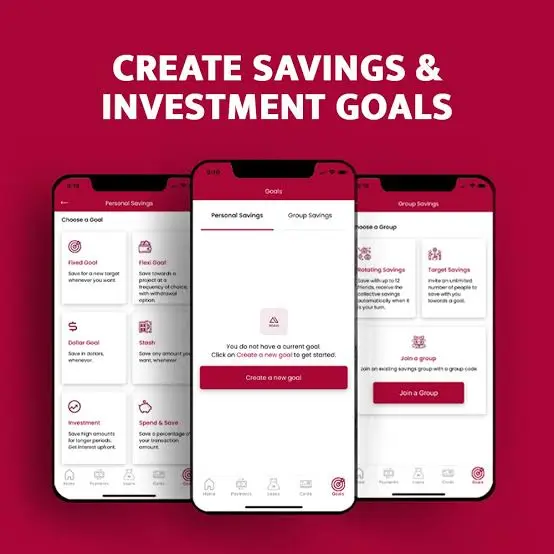

Alat by Wema

Source: AlatbyWema

It’s Wema’s fully digital bank, which offers several savings options for users. The stash savings option lets users save and withdraw money at will. The fixed goal savings option is preferable for users saving towards a personal or business project. Flexi goal allows users to save at a frequency of choice.

Interest rates:

All saving options on Alat offer a minimum of 6.5% interest rate per annum and a maximum of 10.5% interest rate per annum.

Alat by Wema is available for Apple and Android phone users.

Kuda Bank

Source: Kuda Bank

Kuda is a Nigerian digital bank that offers customers a range of savings options via its mobile app. The bank has a fixed savings plan that allows users to save a lump sum and earn annual interest. However, withdrawal before maturity means users will lose accrued interest.

The Spend and Save plan is an exclusive feature that automatically saves (a pre-specified amount of) money every time users spend from their Kuda account. Kuda’s Flexible savings plans let users save money at will daily, weekly or monthly.

Interest:

The fixed savings plan offers up to 15% interest per annum, while the flexible savings plan offers up to 10% interest annually.

Kuda Bank app is available for Apple and Android phone users.

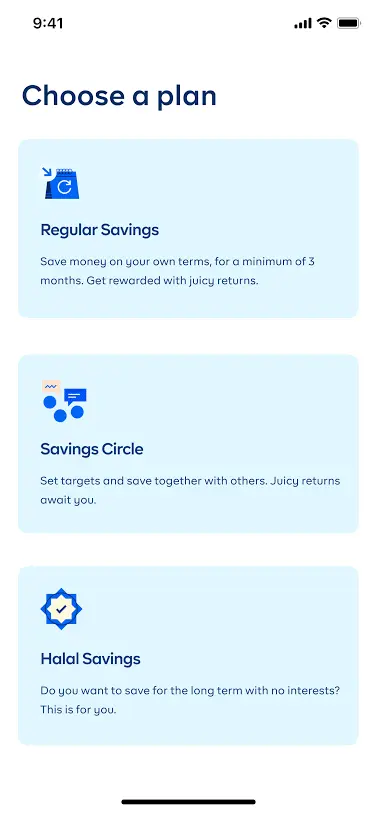

Cowrywise

Source: Cowrywise

Like other savings apps, , Cowrywise offers a range of savings options to suit individual needs. The regular savings plan lets users save for a minimum of three months. Money Duo is a special plan for couples looking to save for long periods. Halal savings plan caters to Muslim faithfuls who do not want interest, and the Savings Circles plan allows for joint savings by a group.

Interest rates: Cowrywise offers a minimum of 5.50% per annum and offers as high as 8.5% per annum.

The Cowrywise app is available for download on Google Play Store and App Store.

Moni

Source: Moni

It’s a savings app that also offers loans to users. With the Moni app, users can save money through two different plans: Safebox and Reserve. With Safebox, users can be flexible with savings and save daily, weekly, bi-weekly, or monthly. Users can also set a target savings goal that lets the app make automatic transfers to help hit set savings goals. Reserve is Moni’s fixed deposit savings plan that allows users to lock away lump sums for long periods.

Interest rates:

Moni promises up to 21% interest rate per annum on the reserve savings plans.

Moni app is available for download on Google Play Store and App Store.

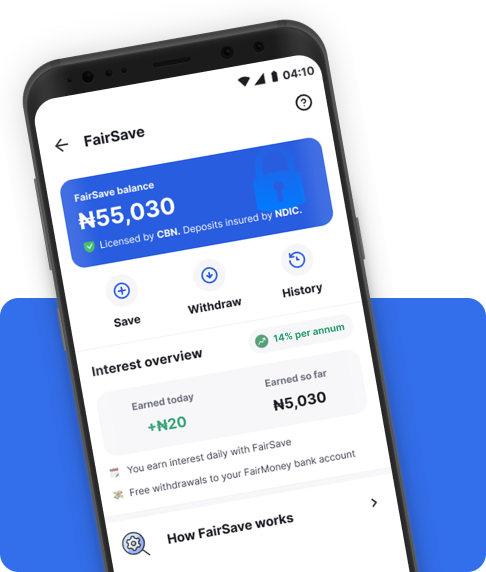

Fairmoney

Source: Fairmoney

FairMoney is a digital bank in Nigeria that also offers users the option to save via a mobile app. Fairmoney has two savings plans: FairSave and FairLock.

With FairSave, users can access funds at will without getting charged for withdrawals. It also gives daily interest alerts on your savings.

FairLock is Fairmoney’s fixed deposit savings plan option. Users lock a lump sum for a specified period and only get access to it when the tenure expires. Withdrawal before maturity will attract charges.

Interest rates:

FairMoney’s FairSave savings option offers as high as 10% interest per annum, while FairLock offers up to 18% interest rates per annum.

FairMoney app is available for download on the Google Play Store and App Store.

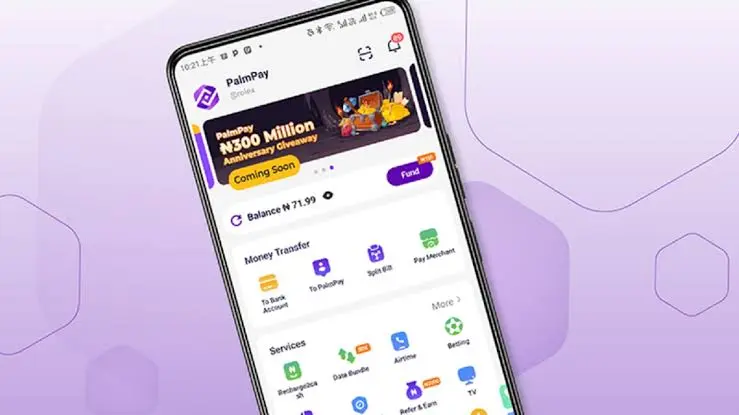

Palmpay

Source: Palmpay

It’s one of Nigeria’s best money-saving apps that you shouldn’t sleep on because it also offers loans. The Palmpay app has two savings plans that cater to long and short-term goals.

The Flexible plan allows users to save and withdraw at will, while Palmpay’s Fixed-term savings plan suits customers looking to save for longer periods. Both plans have no minimum amount to participate, thus making it suitable for anyone.

Interest rates: The flexible savings plan offers as high as 16% interest rate per annum, while the fixed-term savings plan offers as high as 20% per annum.

Palmpay app is available for download on the Google Play Store and App Store.

Disclaimer: This is not a sponsored post. Thus, it should not be taken as financial advice. Please do your research before you use any of these platforms.

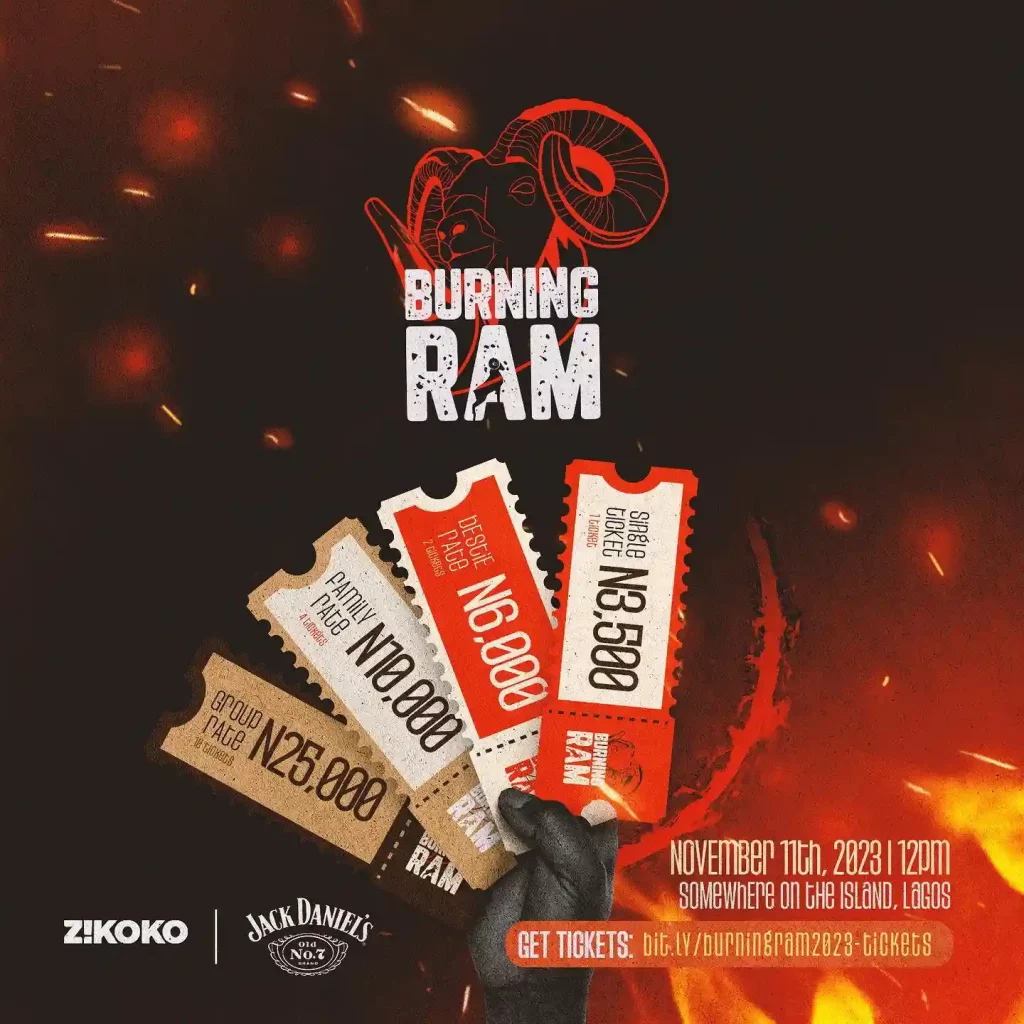

You’ll have your fill of grilled, peppered or fried meat and many more at Zikoko’s meat festival on November 11. Have you bought your Burning Ram ticket? You can do that real quick here.