Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

My family had an open approach to money; we all knew when there was money and when there wasn’t. My dad always said, “If you return from school and there’s no food to eat, go to the bedroom. There’s probably money on the table”. If there was no money there, I’d check other places he kept money. If I checked everywhere and there was no money, it meant we had no money.

There was no such thing as “stealing” your parents’ money because you knew if you took the money for no good reason, it’d affect you since there was no other source. It also helped manage expectations. I’m the firstborn, and when my siblings whined about wanting sweets, it was easy for me to go, “Can’t you see there’s no money in the drawer?”

What did your parents do for money?

My dad’s a pastor, and our finances had a lot of no-money and faith moments. My mum’s a lawyer, but she was also a jack of all trades. She sold chin-chin, beads, hats, clothes, and even ran her own practice at some point. Another time, she was legal counsel at a microfinance bank.

It was a two-income household, but we mostly lived on my mum’s income because my dad wasn’t the rich-pastor type. He was more of the pastor-struggling-to-make-ends-meet type, and my mum held the family’s finances down.

Do you remember the first time you made your own money?

I first made money in junior secondary school by drawing maps of Nigeria and selling them to my classmates. For some reason, I was good at drawing them, so whenever we were given class assignments, they’d pay me ₦20 to draw for them.

It later progressed to drawing and labelling skeletons for biology class and selling them to my classmates for biscuits. Slowly, my customer base expanded to students from other classes. While I did this till senior secondary school, I didn’t have a standard price. My friends typically paid with snacks, and I’d charge others depending on how much I liked them.

Here for the nepotism. What about after secondary school?

In 2014, I got into university in Benin Republic to study law, but I didn’t do anything for money till my second year.

My parents moved to the US because my dad was transferred to a church there, and I realised I’d need to make money to support myself. This was because my dad was still getting paid in naira, which wasn’t much after the conversion to dollars. I knew they didn’t have much. So, when my parents sent my ₦15k – ₦20k monthly allowance, which was about CFA 30k – 34k, I’d lend it to people short-term for 10% – 20% interest.

What were you surviving on while you loaned people money?

My aunty usually sent me groceries, so I had minimal day-to-day spending needs.

The loan business worked until one guy refused to pay me back my money. He’d borrowed ₦30k and was supposed to pay me ₦35k after a month. I didn’t trust him from the beginning, so I had him sign a contract and use his laptop as collateral.

Month end came, and he didn’t pay. I told him I’d sell his laptop, but he thought I was joking. After the second-month grace elapsed and he still didn’t pay, I sold the laptop for ₦40k and told him I was keeping the ₦5k change. He couldn’t say anything because it was better than calling the Beninoise police, who didn’t even like Nigerians. He’d have slept in prison. That was the last time I gave out loans. I can do hard guy, but only so much.

I graduated in 2017 and relocated with my siblings to join my parents in the US. That’s when I got my first official job.

Tell me how that happened

Since my dad’s visa only allowed my parents to work, I could only get a job that paid me in cash. Our senior pastor introduced me to a lawyer who needed a paralegal and agreed to pay in cash. The pay was $10/hour, and I worked six hours thrice a week.

Someone else also offered me another job on the side. It was called medical coding, and my job was to change medical diagnoses to alphanumeric codes — like record keeping, but in codes. So, when he got the medical coding jobs, he’d outsource them to me and pay me around 30% of what he was actually getting paid. Payment was $1 per chart, but I was coding as many as 100 charts daily and 1000 charts weekly, and making $1k weekly.

I was 19, earning $1,200 a week from two jobs

That’s not bad at all

It was good money, and I hardly spent it. I was incredibly frugal and was only interested in saving. My sister was in high school, and I knew university would be expensive as an international student, so I was saving towards that. I was also saving towards a car and the medical coding exam to qualify as a professional because I expected we’d get the green card soon.

So after I got paid, I’d remove my tithe, set aside $100 for pizzas and McDonald’s — which was essentially my fuel for the long work days — and save the rest. The other bills that took my money were the few times my parents needed help with rent or groceries and my brother, who would randomly ask me to pay for sneakers, food and just random things.

Not spending enough of my money on myself is one of my biggest regrets today. I thought I’d finally start enjoying my money after I took the medical coding exam. The next step would have been an income boost since I’d be able to get the jobs myself. None of it happened because we had to leave the US in 2019.

What happened?

My dad was on an L-1 visa, which is mostly for executives. There’s a separate visa category for pastors, but my dad didn’t come in through that because it’s very difficult to get a green card with that visa category. So, his official job title was something like a financial advisor for the church, so he could apply for a green card after two years.

Unfortunately, Donald Trump started fighting against immigrants. My sister was just finishing her first year of uni, and my brother had just graduated from high school. I was studying really hard for the exams myself, and we were all hopeful. But we got denied and had to return to Nigeria.

I’m so sorry

Thanks. I couldn’t do any medical coding jobs in Nigeria because it was sensitive information you couldn’t even move houses with. I also couldn’t do the paralegal job anymore. So, I had to start from scratch. I converted my $2k savings into naira, and I don’t remember how much it was now, but it was quite a lot.

I eventually lost the money sef. I naively put about ₦300k in a ponzi scheme that promised 40% interest after six months. I didn’t get anything, of course. Then I used about ₦750k to buy some plots of land somewhere I’ve never seen before. Honestly, I just bought it so it’d be like I owned something.

Then someone who knew my dad introduced me to a real estate company for a job. They didn’t have an opening, but they just wanted to help out, so they put me in customer service. When I met the HR, she asked about my salary expectations. I just laughed and told her to tell me what the role paid. She was still insisting, asking what I earned before. When I said, “$1k/week”, she sat up in her chair in shock.

LMAO

She finally said the role paid ₦50k and explained they couldn’t pay more because I hadn’t done NYSC. I wasn’t expecting much before, so I took it. I was in customer service, but I did everything. If the lawyers weren’t around, I’d draft contracts. If the accountant were unavailable, I’d print receipts. I also did admin work, visited sites, and took videos.

I registered for NYSC in 2020 and was at the orientation camp when COVID hit, and we had to go home. I did the rest of my service year with the same company, even though they didn’t pay me for the three months I was home because of the lockdown. They also tried to reduce my salary to ₦20k because I had NYSC’s monthly ₦33k stipend, but I reported them to the person who brought me there, and they fixed up.

I started looking for a job as I approached the end of my service year in 2021, but I didn’t know what I could do. The only job I was really good at — medical coding — didn’t exist in Nigeria. I also wasn’t planning on going to law school, so I couldn’t practise. Then, a friend told me about a social media management position in an EdTech company. I’d been posting videos on my personal social media for the longest time, and I thought I could try social media management. So, I applied for the role. Honestly, I don’t know how they hired me because I’m not sure what I did in that interview. But they did, and I got my first social media job.

How much did it pay?

₦100k/month. It was remote, and I also got side gigs once in a while from a lawyer in the US who needed me to speak to Nigerian clients and get documents. That paid $10 per hour worked, and I worked two to three hours per week, so that was an extra ₦10k/month.

I lived with my parents, had no expenses and even started saving again. I saved ₦20k monthly with my colleagues through an ajo contribution arrangement and another ₦10k on a savings app. I was in a relationship and thought I’d get married that year, so I was saving because everyone says you need to have money to do a wedding. But I later decided I was too young to get married, so I used my savings to buy my dad a new iPhone 11. It cost about ₦350k.

In December 2021, I had a severe mental breakdown and decided I couldn’t do the job anymore. My team lead and I were the only people in the marketing team. I was hired for social media, but I was drafting copy to drive “leads” and meet “OKRs”. I had no idea what I was doing.

So, I left and told my parents I wanted to pursue a postgraduate degree. Really, I just wanted to leave the job, but I needed to give them a plausible reason for quitting, so I chose academic advancement.

Did you have any source of income while in school?

I survived on the generosity of my parents and boyfriend for the entire year I spent in school. I lost the paralegal side gig because school wasn’t in the same state I lived in, and most of the errands I did for the lawyer were back home.

After graduation in November 2022, I landed two social media management jobs, one for a startup and the other for a homeware store. They paid ₦100k and ₦150k/month respectively, bringing my total income to ₦250k/month.

I also started planning for my wedding. So, some of my salary went into getting my clothes and jewellery. I think that cost about ₦300k. We also had to pay rent for our new place, which cost ₦700k, but my husband mostly handled that. The wedding itself was in February 2023 and was paid for by our parents. They wanted 500 guests, so they might as well pay for it. My husband and I just showed up.

Were you still working both jobs?

It’s funny you ask because I kinda lost both jobs at the same time in September. To be fair, I quit the ₦100k job because handling both full-time was too stressful, and it felt like I was no longer doing anything impactful there. The second job is a lot funnier. When I started, there was a whole content creation team, but then they sacked everyone one by one and left me to be the videographer, photographer, editor and social media manager all in one. Then a few weeks after I quit the other job, they sacked me and hired another team because they wanted “quality”.

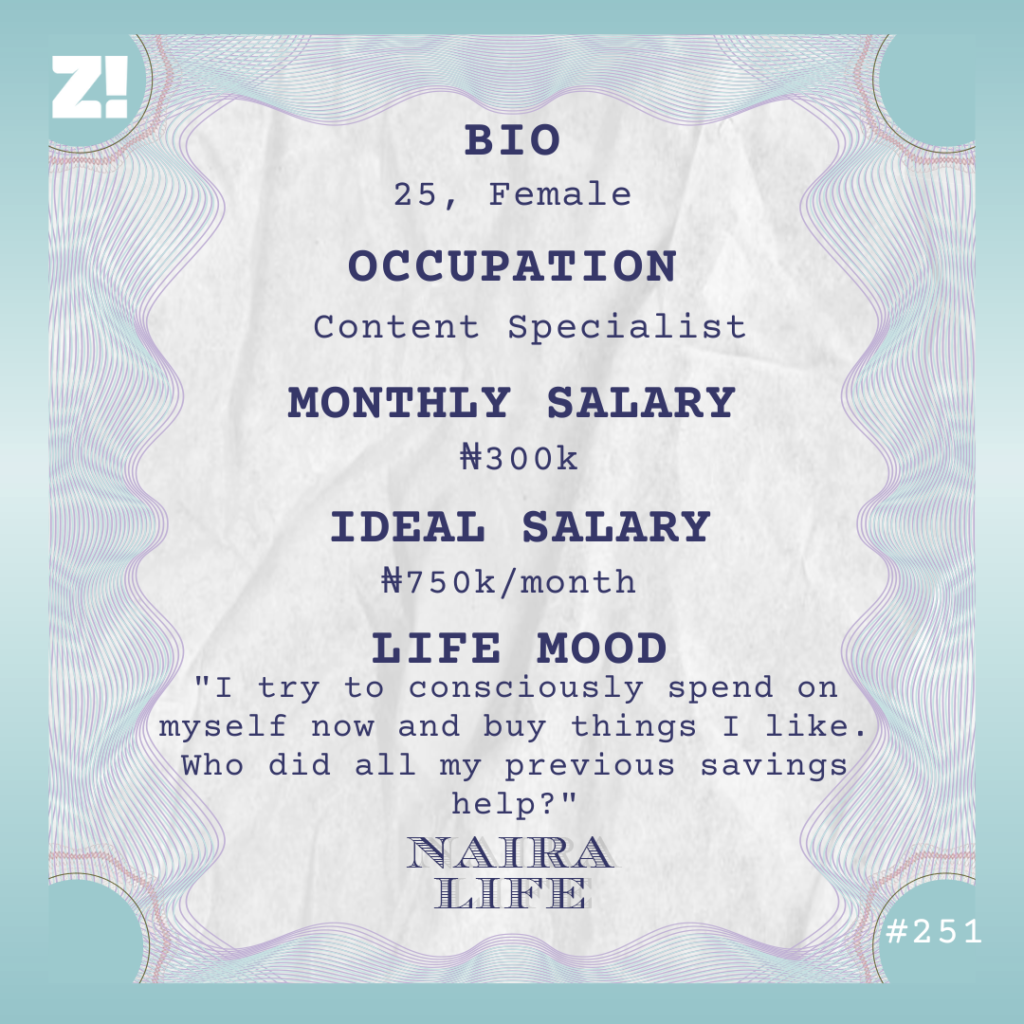

Thankfully, I applied and got my current job as a content specialist with a startup in October. This one pays ₦300k/month, better than my two previous jobs combined. However, it feels like I’m still struggling. If I earned this kind of money two years ago, I’d have felt incredibly happy. But with how the economy is, and the fact that my husband had to drop a job recently and is down to a ₦180k/month income, it doesn’t feel like much.

What are your expenses like?

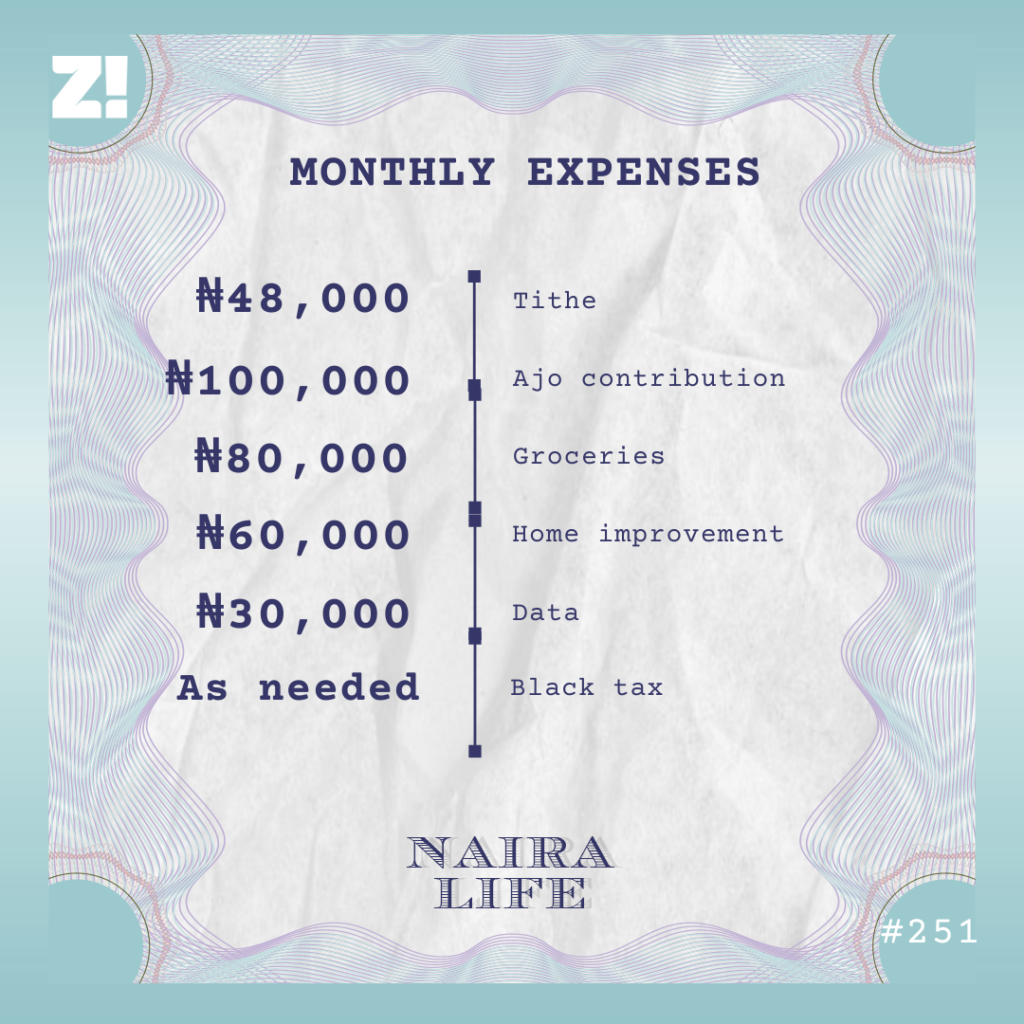

My husband and I operate a joint money system, so our expenses are made together based on our joint ₦480k monthly income. To break it down:

The ajo contribution is towards the rent when it expires. Black tax isn’t regular because our parents don’t really disturb us, we just send money randomly. My brother, on the other hand, calls regularly to ask for one thing or the other

Your income has gone from a sharp drop to a gradual increase. How has this impacted your perspective on money?

When you start a career with that much money, you don’t really think of it going away. I always thought it was just going to get better. It’s why I hardly spent on myself. I thought I was sacrificing my right now for a better tomorrow. But it didn’t turn out like that. Honestly, it was so depressing.

Now, I try to consciously spend on myself and buy things I like. Because who did all that saving help? I don’t have anything to show for all my hard work. On top of that, I had to start my career again, pretending like I hadn’t made good money before. It is what it is. I just have to keep moving forward and keep finding better opportunities.

Is there something you wish you could be better at financially?

Balancing side gigs. I’ve realised that I’m not very good with splitting my focus, but that’s what most people are doing to augment their incomes. On the other hand, maybe I just need to get my money up by finding a job that pays really well. Business isn’t an option, because I’m not good at it. I just need to find better opportunities; I can’t do anything else for money.

What’s an ideal figure you think you should be earning?

₦750k/month. I want my one-month salary to comfortably pay my rent without thinking about what’s happening next, or how to plan to make it happen.

Is there anything you want right now but can’t afford?

Definitely a car. I’m a soft babe, and jumping buses make my life miserable. If I take public transport two days in a row, I’ll fall ill. When I first started considering it last year, it was around ₦1.8m for a simple Corolla. Obviously, ₦1.8m can’t buy anything now, so let me just focus on getting my money up.

What’s one thing you bought recently that’s improved the quality of your life?

We got an inverter as a wedding gift and paid ₦20k for installations a few months after we got married, and it’s made our lives easier. We hardly spend on fuel.

How would you rate your financial happiness on a scale of 1-10?

2. I’m not happy. I think about all the things I want to do, but I can’t afford them. If I wasn’t thinking about them, it’d probably be a 6. My day-to-day life is pretty good, and I have the essentials. But there’s still a lot I need to make my life easier. If I want to leave the country now, ₦300k salary can’t do that, so I don’t even think about it.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.