Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What was your first introduction to money?

Getting into university at 16 was my introduction to financial responsibility — or my lack of it. I started receiving a ₦15k monthly allowance and finishing it on food before the 19th of the month. Then I realised money wasn’t just there. I had to use it wisely if I didn’t want to go broke before I got my next allowance. Before that time, I never thought about money because my parents shielded me from it.

What do you mean by “shielded”?

I attended schools that were above my parents’ means. They’re civil servants, but my dad happily took loans to send me to expensive schools. Of course, I didn’t know this, so I had this illusion that we had all we needed.

It started to show we didn’t have much money when my dad would wait until the last minute to pay my tuition. One minute, he’s like I don’t know if I’ll be able to pay tuition. The next minute, he’d bring the money. It was obvious he had to take loans.

Interesting. When did you first make money for yourself?

My second year in uni. I helped a student faculty union political aspirant write campaign speeches for ₦2k. The thing is, there was no structure to the payment arrangement. He could just remember me randomly and send me ₦2k today and another ₦2k three weeks later. That lasted for only one semester. The guy lost the election; the last thing I wrote for him was an appreciation announcement.

But the experience taught me that I could get paid for writing. I’d been writing for fun since primary school, and I didn’t imagine I could get paid for it. So, I decided to pursue it further.

How did you get the next gig?

In 2019, a friend introduced me to some people who needed a writer to work on a white paper for a crypto token. I had no idea what a white paper was, and I went ahead to overpromise and undercharge. I charged them ₦50k and said it’d be ready in two days. Something that should’ve been around $500 – $1k.

I got it done though, but it has to be the worst piece of writing I’ve ever done. I downloaded several other white papers and just combined them. Thankfully, my employers didn’t know what a standard white paper looked like, and they thought it was acceptable. They put me on a retainer and paid me ₦30k – ₦40k/monthly to write promotional articles and employee agreement forms. The internet helped me a lot here. I just needed to search for templates and tweak for what I needed.

By the way, they gave me three million crypto tokens as a founding member— I still have them even though they’re practically worth $0 now. I stopped working with them after four months. The project wasn’t really taking off and there wasn’t much for me to do.

What did you do next?

I got a few opportunities to write for crypto companies. I also dabbled into trading crypto, and it was a lot of trial and error: I’d compete for airdrops and trade the token I got.

A few friends also introduced me to forex trading. The first day I tried it, I traded $10 on synthetic indices and turned it into $700. I guess it was beginner’s luck, but I was sold. I immediately called a friend and asked him to bring money so I could trade for him. He gave me $100, but I lost it. Thankfully I was able to pay back with the money I’d won.

That was a close one

Heh. It wasn’t the last time I lost someone’s money while trading. Towards the end of 2021, I lost $8k of my and other people’s money. I’d gained some trading experience and my portfolio was worth $5k, so I was comfortable trading with more money. I didn’t expect the loss.

How did it happen?

So, about $3k of that money was for me and a friend. We were collaboratively trading, so our money was together. The remaining $5k belonged to three lecturers and another friend.

How my lecturers got involved was so random. One day, I was on my phone in class, and the lecturer seized my phone. He saw I was on a trading platform and asked me about it when I went to pick up my phone. Apparently, he’d heard about the platform and wanted me to teach him. I convinced him to give me his money instead because my friend and I had a strategy to make about $100k from $8k. He brought in two more lecturer friends and they raised about $4k between themselves. The plan was to trade for three months and pay them back with 300% interest.

Why were you sure you’d make $100k?

My friend and I constantly explored ways to game the system and we came up with an arbitrage strategy for futures trading. It required us to trade simultaneously on two devices. We’d open a “buy position” on one device and a “sell position” on the other. If the market went up, we’d close the sell position and wait for it to balance out. It felt like a safe gamble since we were trying both ways.

When we were successful, we could make $10 every five minutes. So we thought — rather foolishly — that if we did that 100 times, we could make $10k daily. It didn’t happen like that; we made $300 on the first day.

Then a few days later, I left my room to watch a football game and dropped my tablet with my friend so he could trade with two devices as usual. When the match was over, I saw that my friend had called me several times. I called back and he said he’d lost the money. His phone had gone off before he could close a position and the only thing left of the $8k was $500.

Ah

I didn’t understand it. But I was very audacious and arrogant about my skills. I believed I’d trade the remaining $500 and make the money we lost back. I don’t need to tell you I failed miserably.

I had two months to pay back $5k and I couldn’t tell the people involved what had happened to their money. When the time elapsed, I called one of the lecturers and asked for three more weeks because the money was locked up in a trade. He called me a scammer and said I had used their money to buy clothes. The lecturer I discussed the opportunity with initially was more cool-headed.

But then the three weeks came, and still no money. I had to come clean. The cool-headed lecturer — who was a senior lecturer — told me I wouldn’t graduate if I didn’t pay him his money.

Damn

It was a chaotic situation. They were all on my neck and it seemed like the two other lecturers were willing to harm me physically. Thankfully, ASUU went on strike in February 2022, which gave me some breathing space. I stopped taking most of their calls so I could think about how to make money. I didn’t know how long the strike would last, and I needed to make the most of it.

I decided to go back to the basics: writing. I got ₦6k from my dad and paid for a “How to use Upwork” course. I was added to a group with the other course participants.

Within a week, someone in the group got a gig. I’m very competitive, and suddenly I didn’t just want any gig, I wanted to catch up with that person. So, I started studying like my life depended on it.

I believe that helped

It did. But I had to send proposals every day for a month before I landed a video transcription gig that paid me $15. I got another writing gig that was supposed to pay $1k, but after they made the first milestone payment of $10, they never got back to me again. After that, I regularly got random $20 gigs here and there.

I got my big break a few weeks after. I landed a $25 gig to write an edition of a daily crypto newsletter. They liked my work and paid me $125 weekly to write the newsletter daily. I did that for three weeks before they offered to take the gigs off Upwork so I’d join the team full-time.

On the same pay?

Somewhat. They offered $500/month. I took the meeting in my dad’s room, and after the call, I told him I’d turn down the offer. He thought I was mad, but I felt I could get more. I was basically keeping the newsletter running.

So, I made a list of the things I’d do on the job, requested another meeting with my employer, and successfully negotiated an increase to $750. My dad was shocked. Honestly, I wasn’t completely sure it’d work, but I had to try. This was in July 2022.

In September, I got another Upwork gig to create a tutorial for an edtech company. I had to walk a friend through the process over the phone so he’d do it for me on his laptop — I didn’t have one, and it was necessary for the tutorial. The employer liked the work and I became a regular tutorial content creator for them. The hourly pay usually came to $1,500/month.

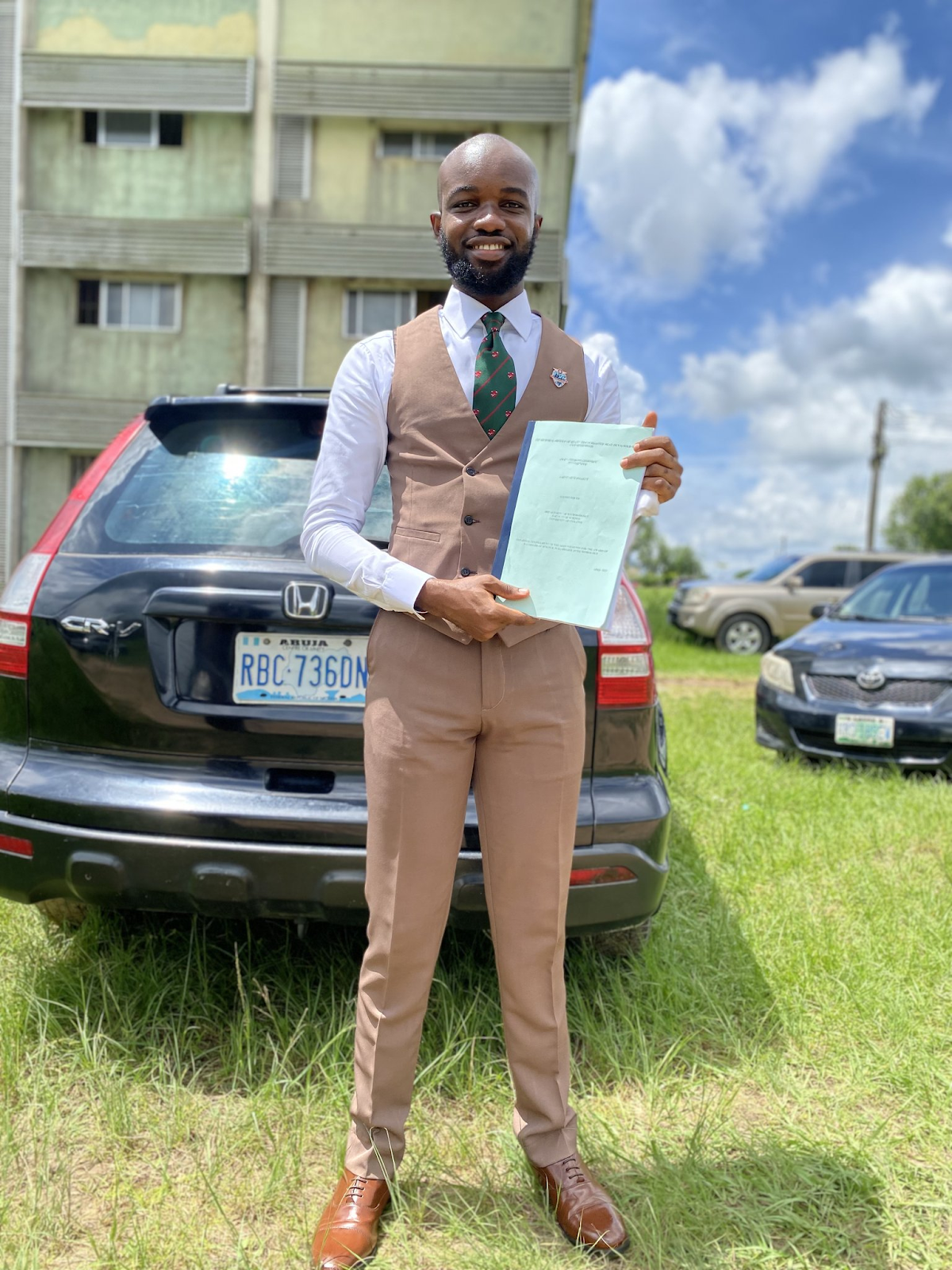

By the time ASUU called off the strike in October, I had enough to pay everyone with interest as agreed. I even had to beg one of the lecturers with extra $200 because he was really pissed and insisted I wouldn’t graduate. I paid back $8,100 in total.

Phew

I kept working like crazy after school resumed. My boss at the edtech company was pleased and gave me $1k for a new laptop after I complained about the one I was managing. The money was enough to get me a laptop, a headset, keyboard, and a mouse.

Two months later, I got laid off from the newsletter job because of funding issues. I had the edtech job, so I wasn’t bothered. I’d also somehow transitioned into their marketing guy, so I was doing more strategy than creating.

My salary increased to $2500 in 2023. On average, I was spending ₦200k/month. I wanted something stable to put my money in, so I started thinking of starting a business.

What kind of business were you considering?

A lot. At first, I thought about building a restaurant. Later, I considered a gym. But in 2023, I finally settled on a co-working space after my friends and I visited one during a trip. I had $4k — about ₦2m — in savings which was nowhere near the ₦8 million I projected I’d need to start. I got two more friends who also earned quite well on board and we got started.

We leased land somewhere and worked on the building project for six months. All our savings and salaries went into it, and we eventually spent about ₦50m on that project. We’ve been in business for about three months and have made about ₦8m in revenue. Most of the money still goes back into the business because our dream now is to build co-working spaces in multiple locations.

That’s audacious

It is, but we have a roadmap for how we hope to achieve that. It’s transformed from just a means for me to invest and make passive income. It’s now the crux of my life’s work.

I should add that I also formed a digital services agency with two other friends in 2023. They’re badass designers and software developers. We pitched handling marketing and product development to a startup, and they accepted.

So, we gave ourselves a name, pitched more people and kept a portfolio of clients. We’re now a 10-person team and currently have one retainer that pays us ₦900k/month. We also get other bigger clients from time to time. I get about 40% – 50% of whatever we make monthly because I fund the upfront costs of running the projects. However, profit sharing is dependent on the project and terms. The highest payout I’ve gotten is ₦5m. There’s no standard amount, but it’s naira income and I like that it helps me save my dollar earnings.

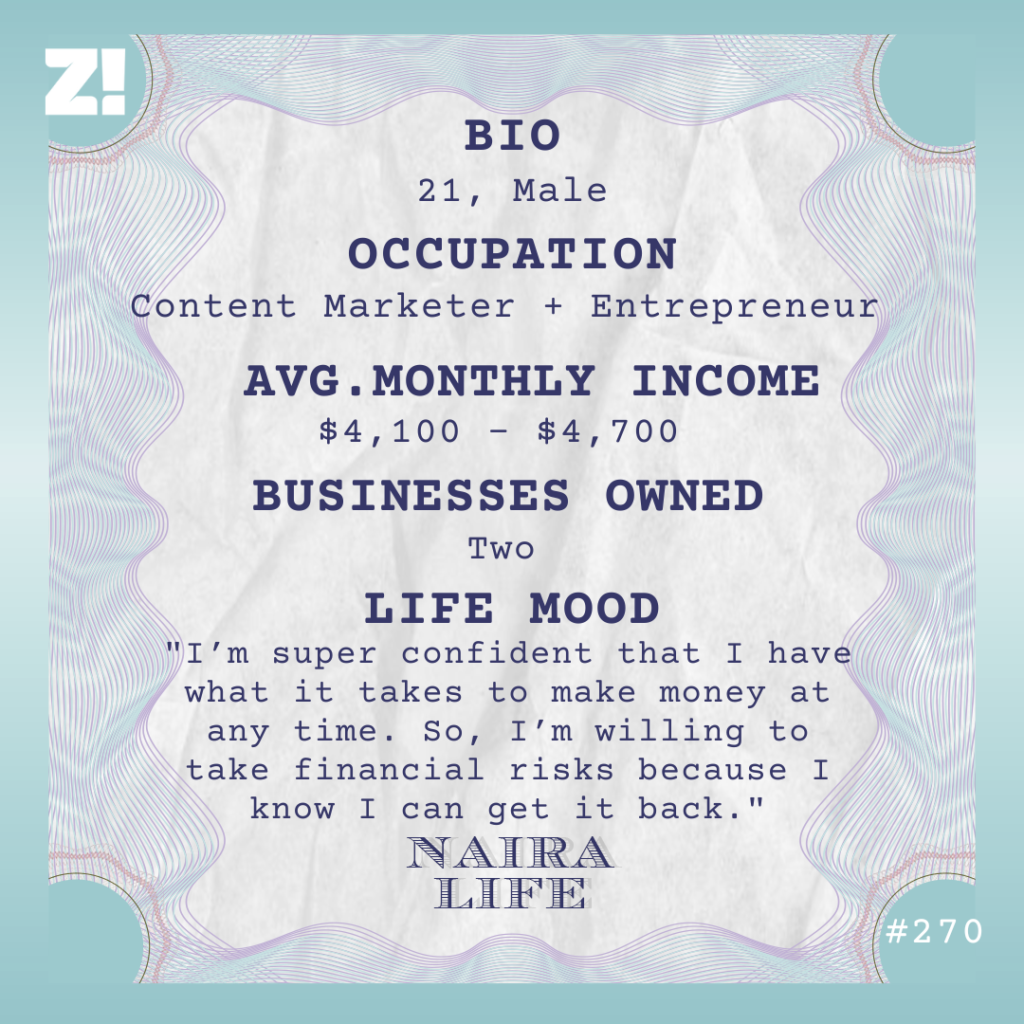

What’s your monthly income like right now?

My 9-5 pays me around $3,500 these days. It slightly differs sometimes based on the number of hours I work. I make an additional average of $600 – $1200 from the agency. I earned more here in 2023, but I’ve not been as active this year because of school work.

Wait. Are you still in school?

I wrote my final exams a few weeks ago, so I like to say I’m done with school. But there’s still clearance and a few more steps before I’m officially done.

How would you describe your relationship with money?

I’m not shy about spending money. I don’t necessarily live above my means— my quality of life is pretty modest — but I spend aggressively on things that can improve the quality of my life, like my businesses.

Right now, I’m super confident that I have what it takes to make money at any time. So, I’m willing to take more risks and put my money into possible income opportunities because I know I can get it back.

Let’s break down your typical monthly expenses

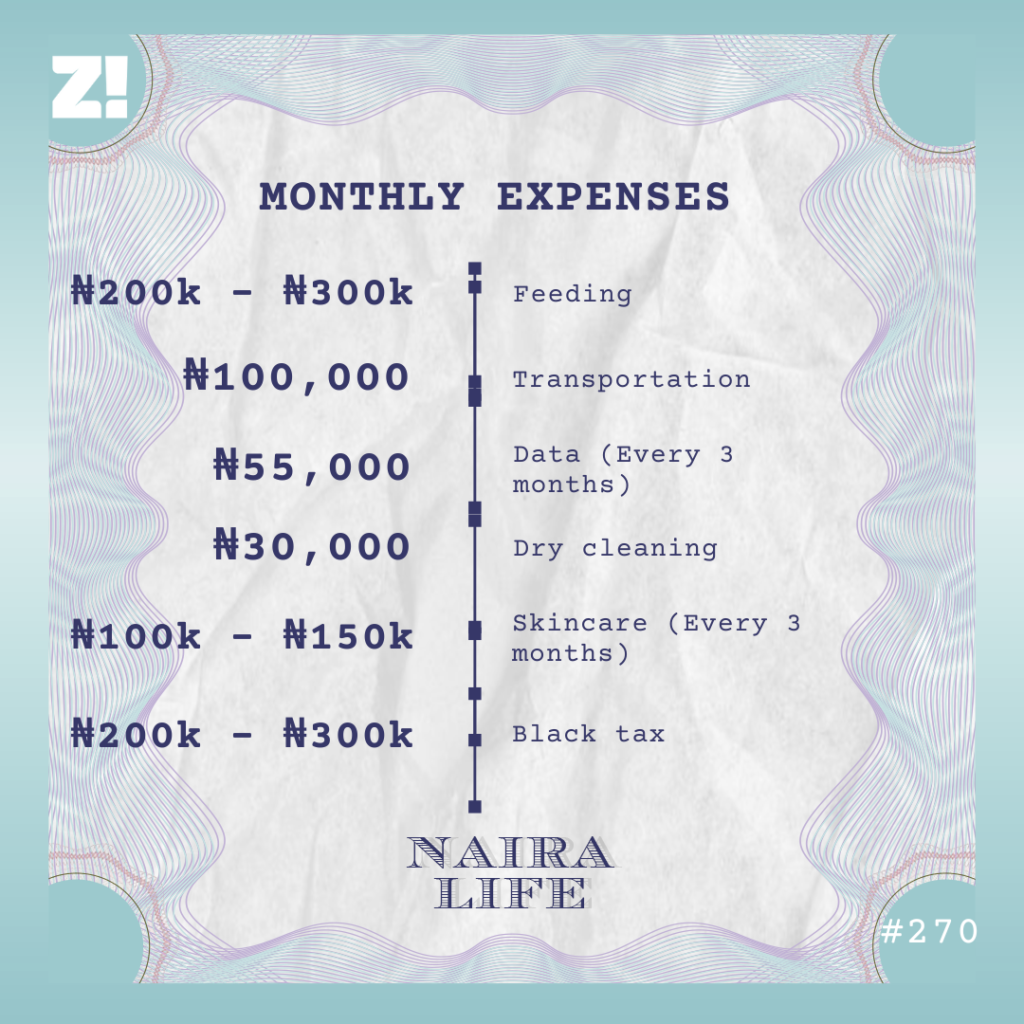

Black tax is mostly self-imposed. I just send money to my parents and siblings because I want to. I live in a two-bedroom apartment that I share with a flatmate, and that sets me back about ₦300k in rent yearly.

What are your savings like right now?

Absolutely non-existent. I mentioned my partners and I are pursuing the expansion of our co-working facility, and most of my money goes into that. I recently made an additional ₦750k investment a few weeks ago.

What might the next few years look like?

I think I want a PhD, which is ironic because I didn’t take my undergraduate years seriously. However, working on my final year project resurrected an interest in school. But I’ll focus on my 9-5 and business for the next two to three years because I need to leave Nigeria before 2027.

Why 2027?

I feel like our president will contest for a second term, and it’s my personal responsibility to be out of here before he wins.

Haha. What would that mean for your businesses, though?

I’ll spend the next few years building them to become self-sufficient. The goal is to build systems and structures that move them from mere businesses to proper organisations.

What’s a recent unplanned expense you made?

I bought two phones in the last three months for frivolous reasons. I replaced my iPhone 13 with the same model in January because it had a scratch. That cost ₦800k. In March, I decided I needed a new phone for another sim and spontaneously bought a ₦500k Google Pixel. I only needed the phone to make calls. Thinking about it now, those weren’t smart decisions.

How would you rate your financial happiness on a scale of 1 – 10?

6.5. I’m earning reasonably well, but I think I’m still leaving money on the table. I’m not earning as much as I should because being in school hasn’t helped me explore all the opportunities available to me. Now that I’m nearing graduation, I intend to fix that.

What’s an ideal amount you think you should be earning?

At least $10k/month. It’s audacious, but I have a mental picture of how to get there. I’ll definitely need to pursue entrepreneurship on a larger scale. I have ideas for businesses I can start, as well as how I can increase cash flow to my digital services agency. I’ll also need to find a way to reduce time spent at my 9-5 to give more time to these ideas.

I’m curious. Have you ever thought about when you’d like to retire?

I think about that every day. I want at least a million dollars in liquidity so I can retire at 30 — even if it’s pseudo-retirement. I may not stop working totally, but it should be reduced to the barest minimum so I can pursue fun projects. I’ll be 22 in a few weeks, so I have eight years to achieve that goal.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.