Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Kwakol Markets is a global broker that lets you trade multi-asset financial markets with ease. They aim to provide transparent and innovative technology that gives you a simple, secure and superior experience. Start trading with Kwakol Markets today and create the future you deserve.

Tell me about your earliest memory of money

My uncle gave me ₦100 when I was 11 years old. It was the biggest money anyone had ever given me besides the usual ₦10 I got annually from neighbours and family during Christmas and New Year. Of course, my mum took the money to “keep it for me”.

And you never saw it again

I never did o. But sometime later, when I was in JSS two, I also started making my own money.

How?

A street friend introduced me to a man who made bulk dusters and chalks for blackboards. He provided the wood and rug materials for the duster’s surface, and our job was just to assemble the materials to produce a ready-to-use duster.

We worked after school, and he paid ₦1 for every duster. My friend and I each typically made an average of 50 dusters in the few hours we spent there every day.

Were your parents aware of this?

They were aware, but they didn’t know the exact amount I earned. They just knew I used it to supplement the ₦20 they gave me for snacks. The duster money helped because the ₦20 I got was only enough for a meat-pie, or at best, a plain plate of rice. With the money from my job, I could afford meat and the occasional FanYogo or Tasty Time drink.

I stopped working with the man after a year — he started owing and defaulting even after several promises to pay. Imagine owing ₦1.

Anyway, I had to go back to managing the ₦20 from my parents.

Omo. What did your parents do for money?

My mum sold cement, and my dad was a police officer until he got wrongfully dismissed from the force in 2007.

What happened?

The Inspector General of Police at the time, Sunday Ehindero, had set up a task force to prevent police officers from collecting bribes. They’d randomly stop officers and search them. They even stipulated a particular amount of money expected to be the highest amount found on a police officer at any given time.

While this was happening, my dad was assigned on special duty to guard a bank along with some other colleagues. The bank typically paid the officers a bonus for the protection. One day after my dad and his colleagues got a bonus payment, the IGP’s task force accosted and found the money on them. All efforts to explain the source of the money fell on deaf ears. It wasn’t the first special duty he’d done, and even the bank manager testified to making the payment.

My dad and his colleagues were imprisoned for about three months before they were released and dismissed from the force.

Wow. What was this period like at home?

It was tough. My mum became the breadwinner, but she also lost her shop to a road expansion project. Although she moved her shop to a new location, sales weren’t great at the new place.

This happened after my dad’s dismissal, so things got tougher. We only had two meals a day and couldn’t afford new clothes or shoes. I’m the last born of five children, and I was still in secondary school. I remember always complaining about my tattered uniform and threatening not to go to school until she got me another uniform. I was 15 years old.

Did your dad try finding work again?

He tried his hands at other things. After the dismissal, he started buying multiple kegs of palm oil from our village and reselling them in Lagos. He did that for about three years, including some other side hustles. He also got rent from our tenants, and that was his primary income source around the time I finished secondary school in 2008, and WAEC became my stumbling block.

How so?

I wrote WAEC three times. The first one was a complete write-off. I decided to be serious the second time, but I didn’t make all my papers. The third time was the charm. That was in 2012.

I wrote JAMB the following year, passed and got admitted to study banking and finance at a Polytechnic. Then ASUP decided to go on strike for a year, and I didn’t resume school till late 2014.

So it took you six years in total. What were you doing while you waited?

Between 2008 and 2012, I sold newspapers. Every morning at 5 a.m., I’d leave my house at Ipaja and go to Oshodi to pick up the newspapers. By 7 a.m., I’d be back at my sales stand at Ipaja where I’d stay till I sold all the newspapers. This brought in ₦2,500/week.

When I left in 2012, I went to work at a Coca-cola depot where I offloaded crates of drinks from the truck and occasionally attended to customers. I did this from 8 a.m. to 6 p.m. daily except Sunday — my day off.

My starting salary was ₦8k/month; then it increased to ₦9k after a month because they noticed I was hardworking. Funny enough, they hired someone almost immediately after and paid him ₦10k. I felt cheated and let them know. They tried to match the ₦10k, but I insisted on ₦12k, and they agreed. I worked there till I had to leave for school in 2014.

A negotiation masterclass. What were you spending on?

Mostly on feeding and clothes. I also paid my last two WAEC fees myself —about ₦6k each. My dad paid for the JAMB exam.

Coincidentally, my dad and his colleagues got reinstated into the police force the same year I resumed school at the polytechnic. They’d been appealing the wrongful dismissal since 2007, but our judiciary system kept dragging it. They weren’t financially compensated, as far as I know, but my dad was able to take some exams two years after the reinstatement and got promoted to sergeant from his corporal cadre.

Interesting. Did you do anything else for money in school?

Not at first. My sister was also in my school, so I relied on her and the monthly ₦4k my dad sent me. It was just enough for feeding and nothing else. Sometimes I inflated my school fee figures, so I’d get extra money to buy textbooks.

I was supposed to go for a one-year industrial training placement after I finished my National Diploma in 2017, but it didn’t work out.

What happened?

I heard a bank was paying trainees ₦40k, and I wanted that too, so I went to their Victoria Island headquarters to apply. They told me I needed a guarantor who was a senior staff at the bank. Because I didn’t know anyone, I went to the bank’s branch in my area and started begging the staff to stand in for me.

Let me guess, they said no

Of course. They didn’t know me from anywhere, and my promises to be a good boy didn’t work.

After trying and failing to get another job at a tomato paste-producing company, I abandoned IT and just resumed school for HND in 2018.

What happened next?

I started helping people to make school payments — school fees and acceptance fees — with my phone for a fee. When I was done with the payments, I’d print the receipts at a cafe, and hand them over to my client.

I charged around ₦2,500 per person and had an average of 15 students at the beginning of each session. I did this until I left school.

I also started getting paid to write during my HND.

How did that happen?

I often wrote for fun, and many of my friends knew this. One day, a friend reached out to me and told me I could make money from writing.

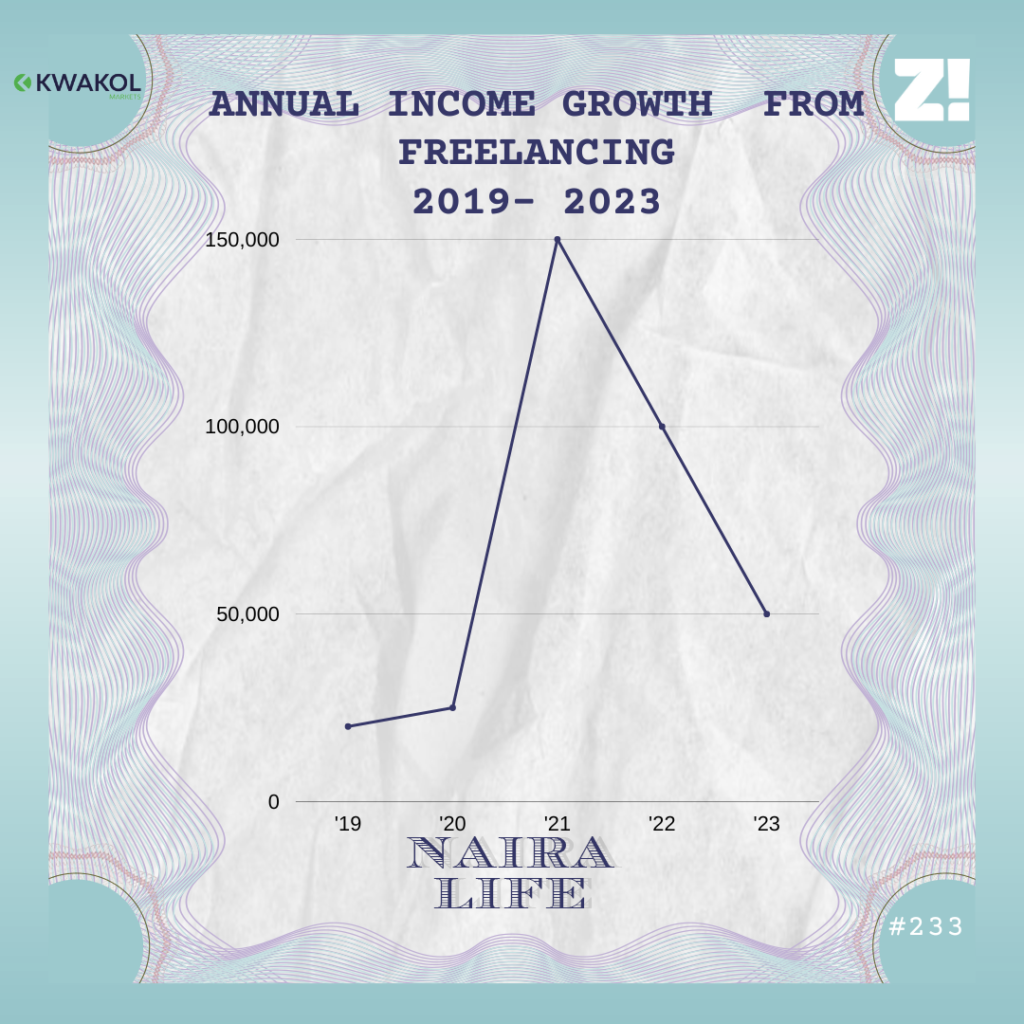

Subsequently, he introduced me to someone who paid me ₦10k to edit a 50,000-word novel. When I received the money, I was like, “Ah. This thing that I’ve been doing for fun all this while?”

I didn’t know it was possible. It opened me up to the potential of freelancing. Thankfully, I had a laptop, which my uncle had gifted me, so it made it easier. I started getting more regular gigs. One of them even paid ₦50k, and I used it to buy a new phone.

Sweet

I went for NYSC in 2020 and was part of the set that did most of our service at home due to COVID. So, there was more than enough time to focus on my writing gigs. The well-paying gigs worth ₦50k to ₦60k only came like once in two months during this time, but the small ₦5k 1000-word article gigs came more frequently.

Where were the gigs coming from?

I discovered that my main contact had a Fiverr and Upwork account. So, he was getting the jobs from clients and outsourcing them to me. Many of my other contacts also did the same thing.

What kind of writing were you doing?

All kinds. Even if I didn’t know something, I never said no. One time a client asked if I could write a movie script. I’d never even seen what a script looked like before then, but I said yes and got the gig.

I did my research, and downloaded movie script samples online to study before I even started the job. I delivered it and got paid ₦15k.

How much were you making on average?

₦25k/month from writing, and ₦33k from NYSC, making around ₦58k monthly. Most of what I earned went into paying my portion of the rent for the apartment I shared with a friend, which was ₦100k. The rest went into buying a bed and other kitchen essentials in the house.

But I had about ₦300k saved up until I lost it all to a Ponzi scheme.

Ah

This was in February 2021. It’s not like I was greedy or looking for quick money. I just thought it was a legit investment scheme. Up until that point, I’d never invested in anything before. So when my girlfriend at the time introduced me to it, it looked promising.

Unfortunately, it crashed soon after, and all the money I had saved up from my gigs, including my NYSC allowance for the previous three or four months, vanished. I almost got depressed, but fortunately, the gigs got frequent right after NYSC, and I didn’t have to mourn my losses for long.

How often did you get gigs?

I had about seven steady contacts, and I started charging around ₦4 per word, which brought about ₦150k/month. At that point, I decided I didn’t need to apply for jobs anywhere. I knew many of my coursemates earning ₦80k at bank jobs, and I was earning much more working from home.

Freelancing was treating you well

It was. In 2022, I published my own fiction novel, but it didn’t turn out as well as I’d hoped.

What happened?

Firstly, it cost so much to publish. I’d initially tried to publish in 2019, but the publisher gave me a ₦300k estimate to print a thousand copies. I didn’t have the money, so I postponed it.

When I returned to the project in 2022, I found out I now needed ₦750k to publish the same number of copies. At the end of the day, I published only 100 copies at ₦220,000 — the way publishing works, it costs more to print a lesser number of copies.

Secondly, I didn’t get as much support as I expected. I expected sales to come from family and friends who had been pestering me to publish a book, but support was minimal. I even had a deal with my alma mater to help sell the book to students in the general studies department. They saw the draft, agreed and promised to support, but in the end, it was just “aspire to Maguire”. When I didn’t have money to publish the 1000 copies, they said they needed at least 500 copies for a start, which I couldn’t afford.

So the school was out of it

I had to take my books home to sell. Maybe I should have done more marketing, but that would have also cost money I didn’t have. So, I relied on my social media to market. I sold them at ₦3k each, sometimes ₦2,500. The cost of publishing each one was ₦2,200, so I made ₦300 to ₦800 as profit. So far, I’ve only sold about thirty copies. The rest are still in my house looking at me.

Did you only publish physical copies?

I also published on Amazon and OkadaBooks, but sales have been very poor. My marketing efforts could have been better, but I’ve also realised that Nigerians hardly read. My money is still in OkadaBooks because they don’t allow you to withdraw until you make ₦10k in profits after their cut. I’ve only made ₦2k. I have other books there as well, but sales have been skeletal. I’m yet to make any profit from Amazon.

What does your finances look like these days?

Honestly, not great. I started noticing a dip in my writing gigs in August 2022. My dad was hospitalised, and I had to stay with him in the hospital for two months. I hardly worked during that period. My dad later passed, and it was a tough period for me.

I’m really sorry

Thank you. By the time I came back to focus on work in October, the gigs stopped. I reached out to my most consistent contact, and he explained that his Fiverr and Upwork accounts had been closed.

Why?

Anyone familiar with these freelance platforms knows how difficult it is to get jobs if your profile has “Nigeria” on it. So, most people use fake foreign accounts to get gigs. But the platforms started clamping down on fake accounts and anyone they found operating in a country different from what their profile stated. Once the account was closed, any money that was still there was confiscated as well. This affected most of my contacts, and many of them are yet to recover.

Damn

It made me decide to open my own Upwork account, but since November 2022 till now, I’ve only got one $25 writing gig. The competition on the platform has become so intense now.

You have to use “connects” to apply for gigs. But people also bid to get their applications seen. So you can use 50 connects to bid for a job now, and someone will bid 100 connects to get to the top of the list. Even that isn’t sure because yet another person can come and bid 200 connects to take first place. It’s like using money to look for money, but not even seeing the money.

Wiun. Are you still getting any referrals from contacts, though?

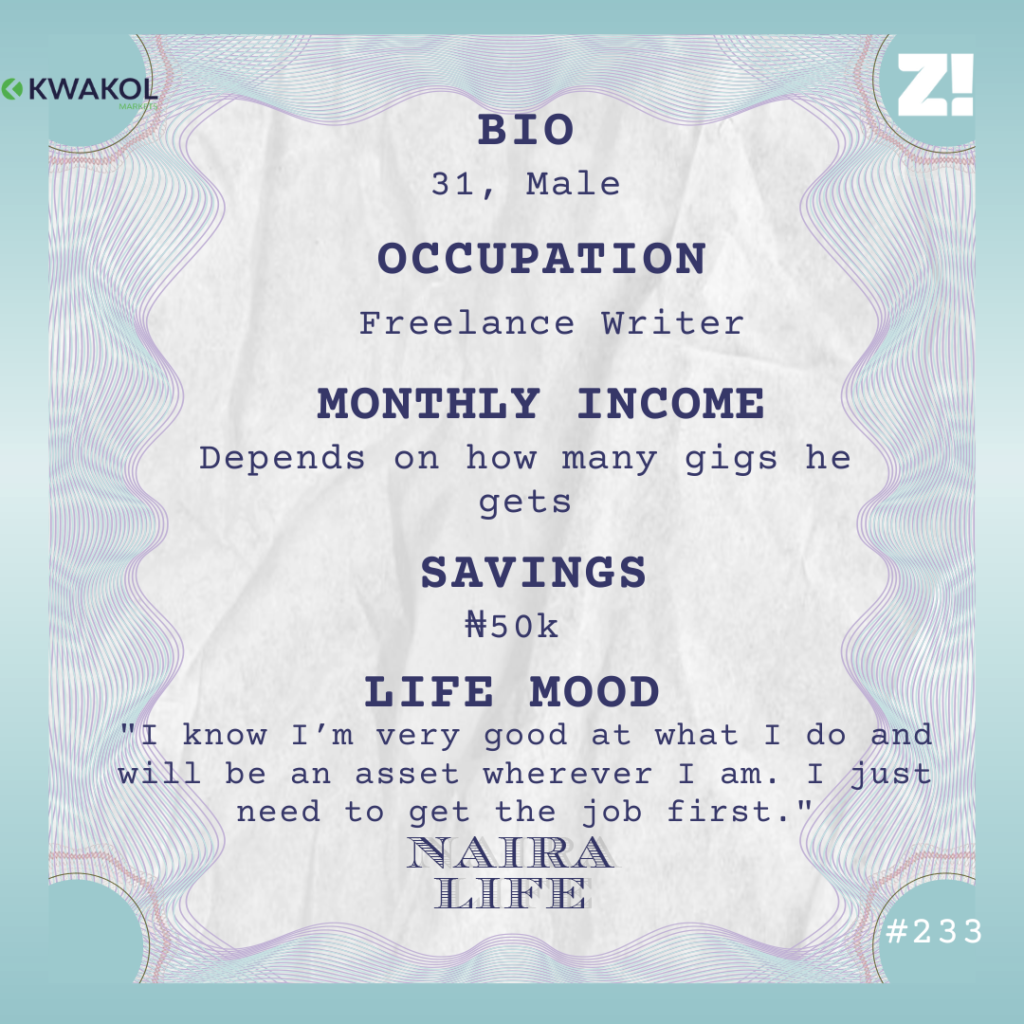

Yes, but it’s far below 2021 levels. Now, I get about one or two gigs a month. I don’t think I’ve made up to ₦50k all year from freelancing.

How are you surviving?

I started writing final-year projects for students, charging about ₦25k to ₦30k per student. The last session just ended in April, and I wrote projects for about seven students in total.

How are you thinking about long-term career plans?

I’m ready to leave the freelance life behind and work in a structured environment, at least for now. The gigs are no longer frequent, and I want to take a break from working from home. I’m looking for copywriting or content writing positions, and I’ve been applying everywhere. I’ll still take on writing gigs if they come, but I need the security and consistent income a salaried job will provide. On average, I put out at least 10 applications a week.

Any luck?

I’ve only had about three interviews so far, but no job offer. I’m still holding out, though.

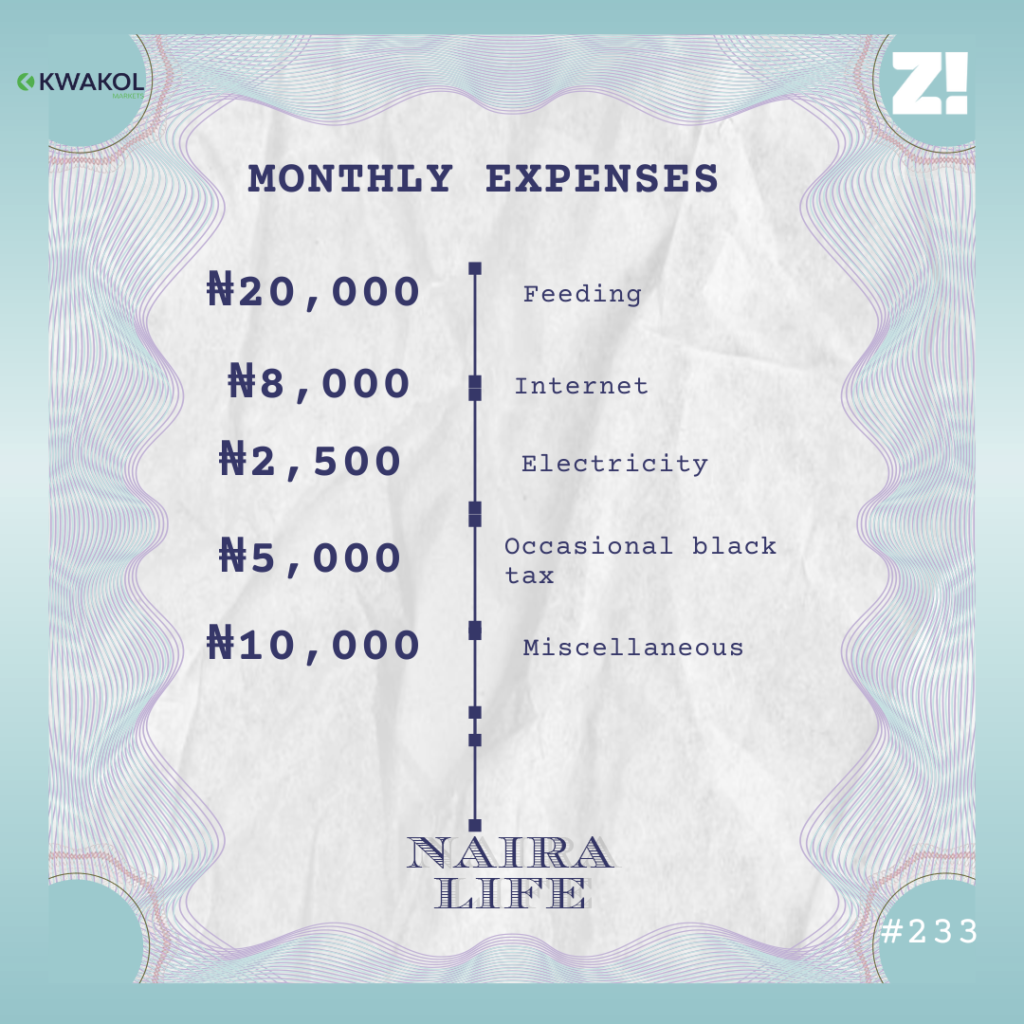

What do your monthly expenses look like?

The miscellaneous expenses include church offering, transport fare, and haircuts. I usually stock groceries that can last 2-3 months at a time, so the ₦20k for feeding goes to buying ingredients for soups/stews, bread and other perishable items that can’t be stocked. When I’m out of food items, restocking costs around ₦50k.

What was the last unplanned expense you made?

This question triggered me because I just fixed my phone’s screen last week for the second time this year. It cost me ₦20k to fix it. Imagine that kind of money going down the drain in this economy.

I feel your pain. Do you have any savings?

I have ₦50k locked up till next month in an online bank, and I’m too sure it’s what will save me by the time next month comes.

How much do you think you should be earning right now?

Anywhere between ₦150k and ₦200k, depending on if I get a job in Ibadan or Lagos, factoring in the cost of living, rent and transportation in both cities. I can even take any amount if it’s a remote job. I know I’m very good at what I do and will be an asset wherever I am. I just need to get the job first.

Is there anything you want right now but can’t afford?

A new laptop and phone. Both would cost about ₦400k — ₦250k budget for the laptop and ₦150k for the phone.

On a scale of 1-10, how would you rate your financial happiness?

3. There’s food on my table twice a day, and my laptop and phone are still manageable, so I can’t complain. But things can get so much better. I hope to get married in the next one or two years, but I’ll need my earnings to improve for that to happen.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.