Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Over 5 million people trust Carbon to reach their goals without drowning in debt. Transparent terms, fast approval, and full control. Turns out, loans don’t have to come with pain. Click here to start.

When did you first realise the importance of money?

In uni. I had a relatively easy childhood, and although we experienced financial difficulties from time to time, my parents provided me with everything I needed. At the very least, I ate three meals daily.

However, things changed when I started university in 2020. My dad said, “You’re on your own now. Don’t ask me for money.”

Omo, I suffered. Scarcity taught me the importance of money.

No allowance?

There was, but ₦10k/month was never enough. There was one day I drank garri throughout the day. After I drank garri again in the night, I just started crying and asking God why I was in that situation. It was terrible.

Phew. Was there a reason your dad wasn’t open to billing?

My parents are pastors, and the pandemic grounded a lot of things financially. We couldn’t hold regular church meetings, and even after lockdown, we found it difficult to restart service due to several factors.

My parents tried a few businesses to supplement our income, but things weren’t going great. We had to manage, and that affected what they could afford to give me for school. After the garri incident, I resolved to find alternative ways to make money.

What did you do?

The first thing I tried to do was sell clothes when I was in 200 level. I didn’t exactly have a passion for it; I didn’t even believe I was a businessperson. However, the popular stereotype about my tribe is that we should all know how to buy and sell. So, I thought it was a good idea. Also, I was desperate.

So, I borrowed ₦20k from my elder brother and bought clothes from someone who imported them from China. The business didn’t last up to a month, and I barely sold anything due to my lack of interest in the whole thing. I didn’t know how to sell, nor did I have the energy to convince people to buy. I ended up giving most of the clothes away.

Did you try another business venture after that?

I didn’t. Instead, I turned to social media. It was initially an escape for me. I was bored and getting depressed because of my financial situation, so I became active on social media to take my mind off things.

Then, I started to read about opportunities such as writing, freelancing, and social media management. As I learned more about them, I felt they were things I could actually do. I’ve always known how to write, and I could easily learn the others.

In fact, I already had some community management experience from managing Christian Facebook communities. I had created those communities to make friends, and grew membership to hundreds of thousands. Facebook was hot in that 2020/2021 period, and the communities were very active.

My work with the communities and my writing skills pushed me to explore these new opportunities. Plus, if I couldn’t make money in the traditional way of buying and selling, I could acquire skills and earn money from the comfort of my house.

How did you go about acquiring these skills?

I took free courses in Search Engine Optimisation (SEO) and digital marketing on SEMrush and HubSpot. Then, I started building in public. I actively posted on Facebook, sharing my skills and my work experience. I also joined freelance platforms like Upwork and Fiverr and sent proposals back-to-back. My social media audience grew steadily, and clients began to come in.

I landed my first gig — $15 to write an SEO blog article — in 2022, about six months after I started taking those courses. That gig made me feel complete, and the whole freelancing experiment felt real. Like, finally, I’m earning my own money, and I could earn more with even more effort.

Energy

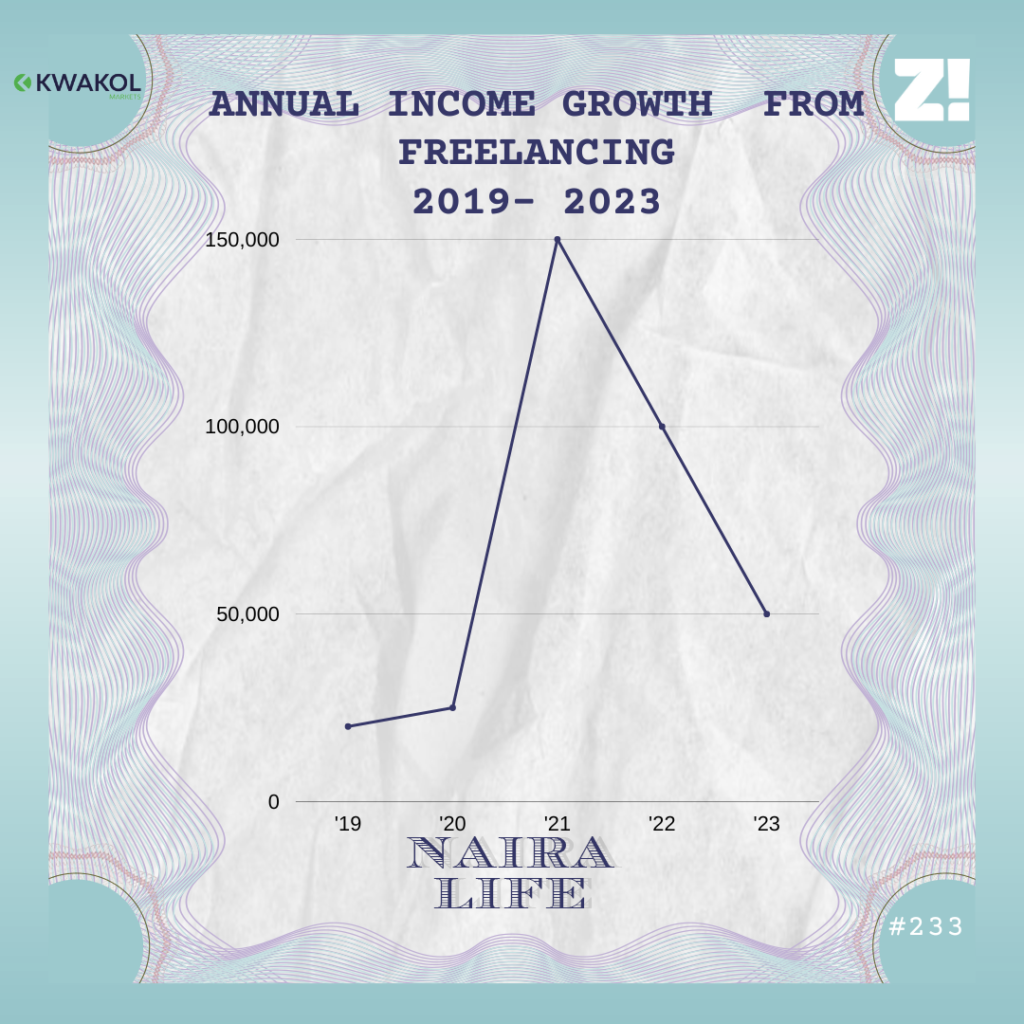

Subsequent gigs mostly came from Facebook and my school network. I had an audience on Facebook, and since I was steadily posting write-ups, clients came with their writing needs. I earned the odd ₦5k or ₦10k here and there.

The school clients were classmates who were too busy trying to make money to take school seriously. I told them I could write, and they paid me to handle their assignments and seminar papers. I charged anything between ₦5k and ₦15k, depending on the level of work to be done. Fortunately for me, the pandemic and multiple strikes had affected our school calendar, so we were constantly rushing.

The school authorities would condense a six-month semester into two months, and we always had a lot of assignments. So, I constantly made money from that. I even started a referral program, offering a 20% to 30% discount to people who brought friends and clients from other departments.

What was your average monthly income from these gigs like?

Initially, my income was quite irregular. However, as I became more consistent around 300 level, I built a solid reputation in school, and more people came to me. Between Upwork, Facebook and school gigs, I made an average of ₦100k monthly.

My income peaked during my final year. I started writing final year projects for clients and charging up to ₦90k per project. I also got the opportunity to write for UK clients —people who had used my services in school referred me to their siblings studying in the UK.

These international students rarely had time for assignments and theses because they juggled school and work, so I did them on their behalf and charged well for it. In my final year, I comfortably made up to ₦400k monthly.

Not bad money for a student

It was more than enough to cover my needs. I’m an introvert who hardly went out, so my money usually went to books and food.

When I graduated in 2024, I basically continued where I left off. However, I decided to pay more attention to SEO and social media marketing because the international student gigs were seasonal. They could go on holiday for like three months, and I wouldn’t make any income from that source.

Currently, I primarily freelance as an SEO writer and social media marketer. I still receive academic writing gigs from international students, but it’s not my sole source of income.

How do you get clients as a freelancer?

I recently started cold outreaches using LinkedIn. I’d find the contact details of decision-makers in companies I believe need my services and pitch them. That works half of the time. The rest of the time, my clients come from word-of-mouth referrals and freelance platforms. The academic writing gigs are solely referrals; I don’t need to pitch for those.

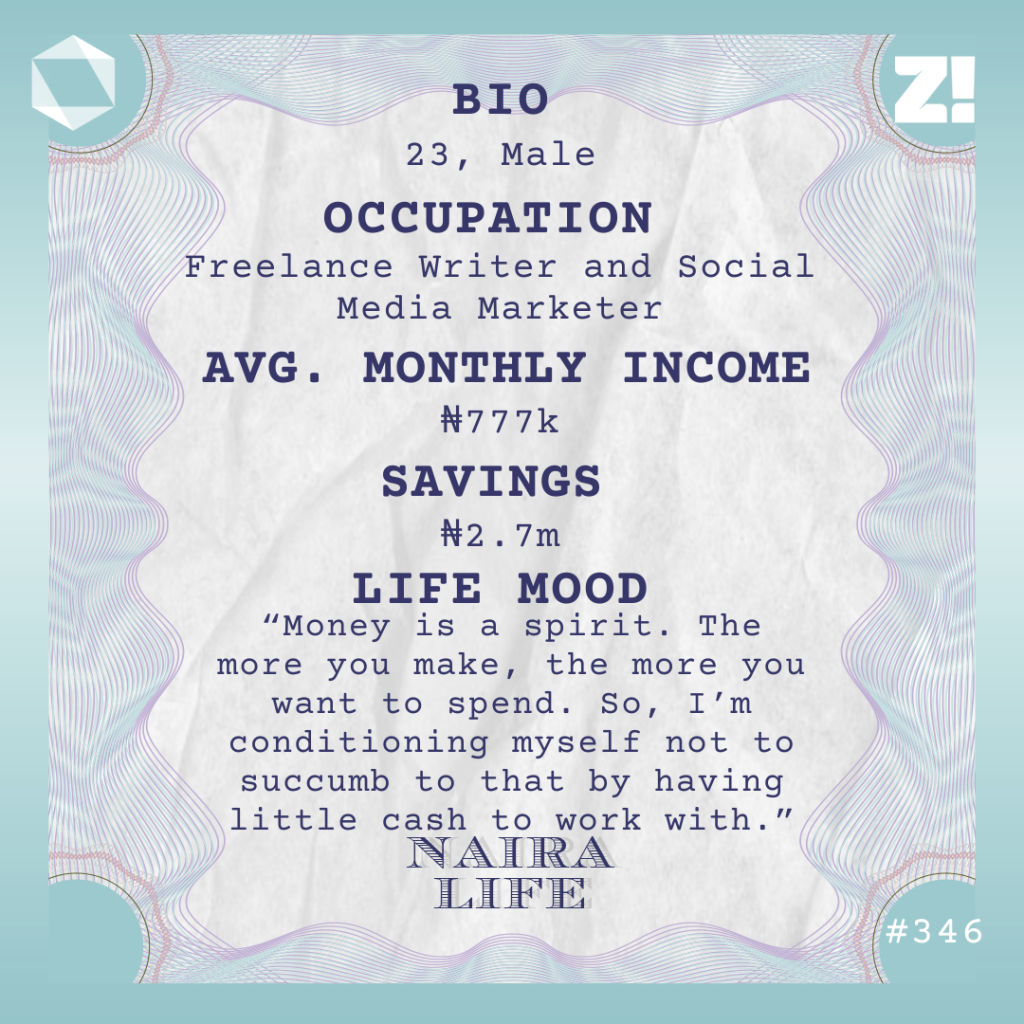

I average ₦500k/month when my academic writing clients aren’t in session. When they are, my income can get up to ₦800k or ₦900k. Now, that’s just from freelancing. I also have a 9-to-5 job that pays me ₦200k/month, and I receive ₦77k allawee as a corps member.

I feel like we’ve jumped a few chapters. When did the 9-5 happen?

March 2025. I moved to a different state for NYSC, and my cost of living skyrocketed. It honestly came as a culture shock. As a student, I paid only ₦150k for a decent self-contained apartment. But moving here, the same apartment costs ₦600k. Transportation and feeding are also more expensive.

To make it worse, my income wasn’t stable when I first moved here. My international students were on holiday, and money wasn’t coming in frequently. That was when I even decided to focus on my other skills to fill the gap from academic writing. I also decided to take a 9-to-5 job to keep me grounded during periods when freelancing didn’t bring in as much money.

I got a social media marketing job with a manufacturing company. They pay me ₦180k as salary and an extra ₦20k for data. The job is primarily for stability, and thankfully, it’s remote. At least I know, whether it rains or the sun shines, I’m getting ₦200k from somewhere every month.

So, it’s like your NYSC Place of Primary Assignment (PPA)?

Actually, no. My PPA is at an NGO where I work in communications, but they don’t pay me. So, I told them they shouldn’t expect me to come to work every day. Instead, I work like a consultant for them. I help them with newspaper and magazine contacts when they need to publish press releases and offer communication advice, but that’s it.

Interesting. What kind of life does your income afford you?

I live a comfortable life. I eat well, and I can afford data, good clothes, and live in a decent place. That said, I don’t think I live luxuriously. I have plans for my future, so I don’t overspend. In fact, 60% -70% of my income goes into my savings. 10% goes to tithe, and I live on whatever’s left to cover my cost of living.

Tell me more about how you break down your savings

This is how it works: I allocate 60% – 70% of my monthly income to two savings accounts. One is an emergency savings account that I can easily access if I’m stranded, and the second is under a lock feature in my savings app that doesn’t allow me to touch the money for at least a year. I put most of my savings into this feature. Sometimes, I also direct some of my savings to crypto and stocks, but that’s not regular.

Right now, I have around ₦700k in my emergency savings and ₦2m in the locked account. I started this approach in 2024.

Is there a reason why you lock your savings for a year?

Two reasons: The interest rate and financial discipline. I’m very liberal with giving, and it’s a way for me to caution myself. I intentionally make myself poor because if I earn ₦700k this month and keep the whole thing in my account, I’ll spend it when someone asks. So, I’d rather hold ₦100k so when they come, I can say, “I only have ₦100k. Take part of it.”

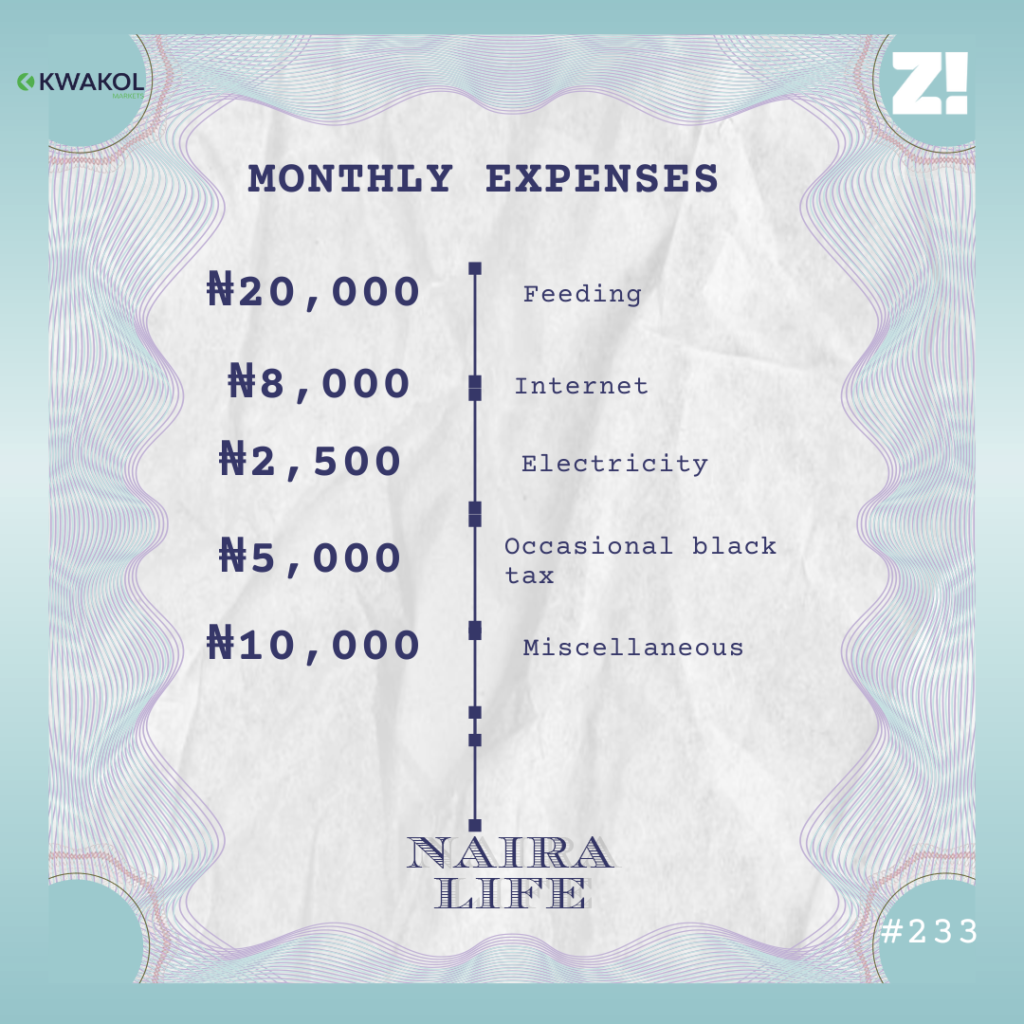

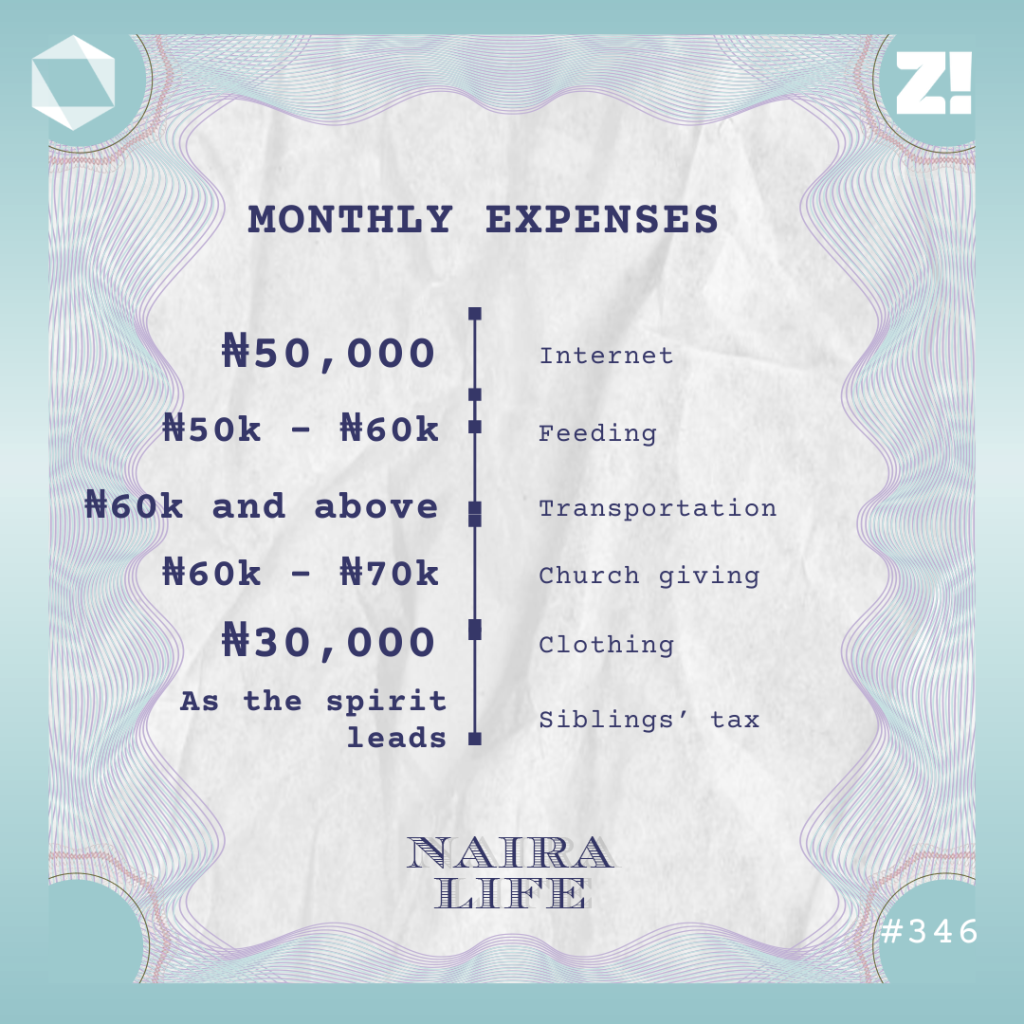

So, you live on about 20% of your income. Let’s break that down into monthly expenses

My feeding budget is that low because I’m a minister in my church, and we fast a lot. My church giving is exclusive of my tithe and offering, also because I’m a minister. I teach an age group in church, and I like to give them monetary gifts.

I should also mention that I recently started channelling some of my savings into a real estate investment program. The program allows people to pay a deposit for land and complete payment in instalments. The land I bought costs ₦3m, and I initially deposited ₦700k. I’m supposed to complete the payment by the end of December. I’ve already paid around 70% of the money; what’s left is ₦1m, and I know I can complete it by then.

The person who introduced me to the program is a trusted church member. He’s already given me the papers and necessary documentation for the land. So, I’m already technically the owner.

How would you describe your relationship with money?

“Interesting” is the only word I can think of. My mum says I behave like someone who hates money because I’m almost always broke, even though I earn a lot of money.

It’s a paradox: earning so much and still being broke, only that mine is induced poverty. Once I get paid, I channel my money into savings and make myself broke because I don’t want to be extravagant. I’ve also learned that money is a spirit. The more you make, the more you want to spend.

So, I’m conditioning myself not to succumb to that by having little cash to work with. I was recently stranded and had to ask my sister to loan me ₦4k because some bank issues prevented me from sending money from my savings account to my regular account. And that’s normal for me. It may not be ideal, but that’s how I condition my life.

I’m curious. Do you have a particular savings or investment goal?

My investment goal is real estate. I want to buy multiple lands in developing areas and wait for them to become prime locations. I’m also looking to japa through the student route, and I imagine I’ll need to have sufficient proof of income. I don’t know how much I’ll need yet, but I’m saving with that in mind.

Is there an ideal amount you think you should be making?

At least ₦1.5m/month. I want to get a bigger apartment closer to town, but I can’t do that on my current income. I also have a relationship and marriage in mind within the next two to three years, so I need to increase my earnings.

What do future plans look like? Do you intend to continue freelancing?

Definitely. It’s working for me, so I’ll keep at it. I also want to go into thought leadership and content creation. I recently started posting videos on my TikTok, and I’ve been getting decent views. I know I’m a skilled communicator who knows how to deliver speeches and offer advice, so I’m confident my content will resonate well. I just need to get content creation equipment because I mostly do selfie videos for now.

Besides thought leadership, I also plan to produce content focused on career tips and organise classes for people who want to transition into the digital space. I’ll probably start all these by the end of the year.

Interesting. Is there anything you want right now but can’t afford?

A car. I spend too much on transportation, and it’s a major hassle in my city. I might need about ₦20m for the car I want.

How about the last thing you bought that made you happy?

I bought a tie for ₦1500 a few weeks ago, and it’s gotten me so many compliments. In fact, I was so happy the day I bought it that I placed it on my bed, snapped it, and posted it. That tie makes me so happy.

Love it for you. How would you rate your financial happiness on a scale of 1-10?

6.5. I’m happy with where I am presently, but looking at my goals, I feel like I should be earning more. I can’t japa or start a family with my current financial status.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad]