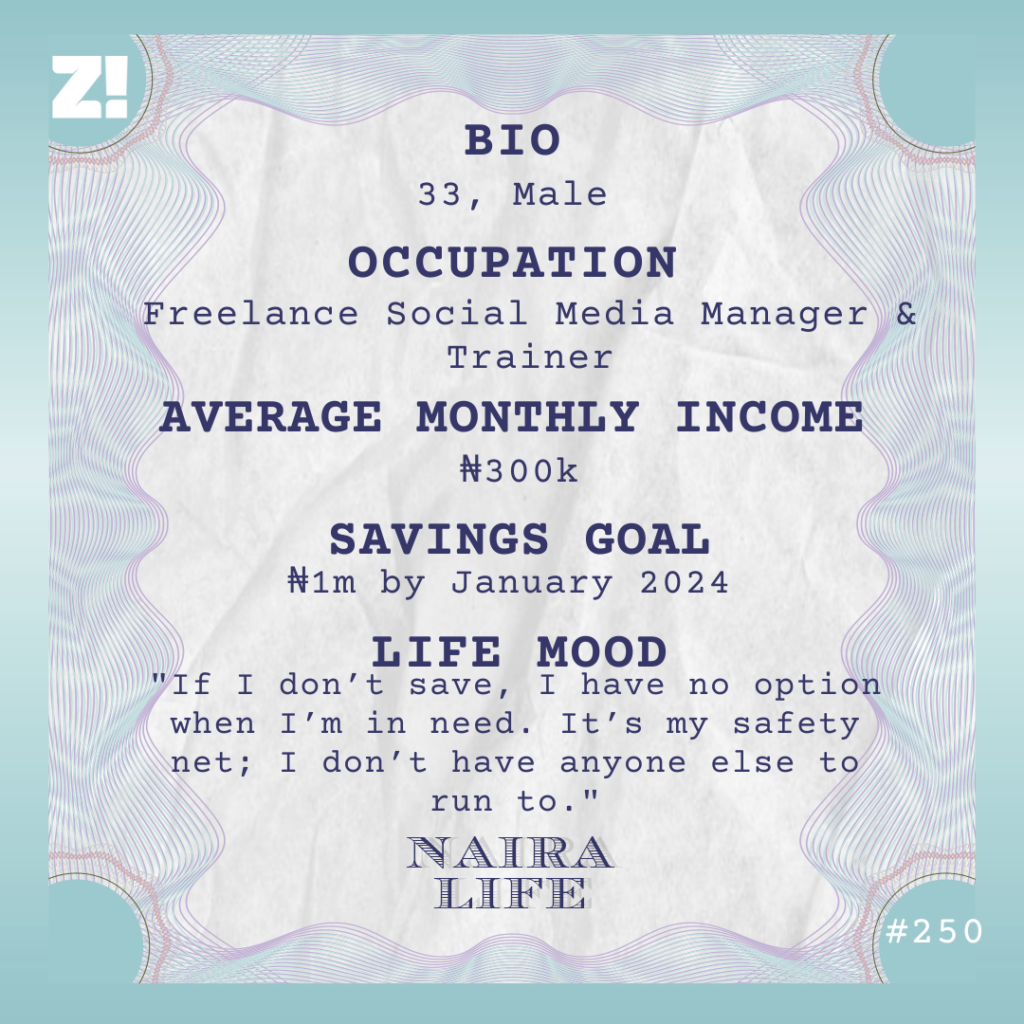

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Tired of the stress of moving money across borders? With Juicyway, you can seamlessly send, receive, and convert fiat or stablecoins like USD, CAD, USDT, and USDC in Nigeria—at great rates. Free multi-currency accounts, instant transfers, and top-tier security? Say no more. Click here to get started!

What’s your earliest memory of money?

I don’t have any deep story about money as a child. I just know my parents provided all I needed. I got the usual Christmas money from relatives, and I vaguely remember my mum giving me some cash in primary 5 to buy whatever I wanted at the supermarket. That’s about it.

Tell me more about your parents. What did they do for money?

My dad’s a veterinary doctor, and my mum consults for NGOs. We weren’t rich like that; just middle-class. However, my parents ensured that my siblings and I didn’t lack any necessities.

For instance, my dad doesn’t believe in allowances. I attended a private university that didn’t allow students to cook — we only bought food — so my dad was worried that if I had to manage money, I wouldn’t eat and risk losing the barely-there weight I had.

It was my mum who insisted on an allowance. She said I needed to be responsible with spending money. So, from when I entered uni in 2018, I received a ₦30k allowance. If the money finished before the end of the month, I could call home for the extra ₦5k or ₦10k.

I survived on my allowance until the second semester of my final year in 2022, when I realised I could get paid for writing.

How did writing come into the picture?

I’ve written all my life. At 15, I was writing Wattpad-ish stories for the sake of it.

Writing for money happened because some of my elder sister’s classmates relocated to study abroad. Their assessments primarily consisted of essays and articles, and they frequently sought my sister’s help. She decided to monetise it, and she recruited me to join. We had about 10 clients, so whenever it was school season abroad, we made money.

How much money are we talking?

We used to charge based on the length of the essay: ₦10k for an essay of 1k words, and ₦20k if it was up to 2000 or 2500 words. My sister gave me the liberty to decide how much I wanted to charge. So I charged more for topics I didn’t like or those that required a lot of research.

Even though the clients were abroad, the negotiations and payments were made in naira. I’m not sure which channel they used to send money, but they often sent it to my sister, who then forwarded it to me. One of the clients had a family member in Nigeria, so that person handled the payment for them, as it was more straightforward.

During the school season, I wrote an average of two articles per week and earned between ₦20k and ₦25k. The money was bonus income. I used it for things like makeup and final-year week activities.

Must be nice

In 2023, the high dollar exchange rate became a thing. Maybe it was just me, but before then, the exchange rate wasn’t something people talked about often.

But that year, I began to hear that the dollar exchange rate was going up, so we adjusted our pricing. My lowest charge for an article increased from ₦10k to ₦15k. Unfortunately, the gigs ended in 2023. Our clients graduated, and we didn’t get anyone else.

By this time, I had been mobilised for NYSC. I graduated from uni towards the end of 2022 and went for NYSC almost immediately. My Place of Primary Assignment (PPA) was at a federal polytechnic, and I didn’t do anything meaningful there.

I sat in an office collecting files and documenting registrations for ₦6k/month. They often owed, so sometimes I’d go three months without pay, then receive the whole ₦18k in one go. At least the ₦33k NYSC stipend came regularly. The only good thing about the entire year was that I lived at home and went to work from there.

What happened after NYSC?

I landed my current virtual assistant job two weeks before I finished NYSC in October 2023. The way the job came was a miracle, actually. It was my first stab at virtual assistance.

My sister worked with the company, which is a US-based company, and she was planning to relocate. Since I was almost done with my NYSC, she recommended me for the role.

The HR was like, “If it’s this person who recommended you, then no problem.” I interviewed on a Thursday and got the offer the following Tuesday.

Nice. What’s the pay like?

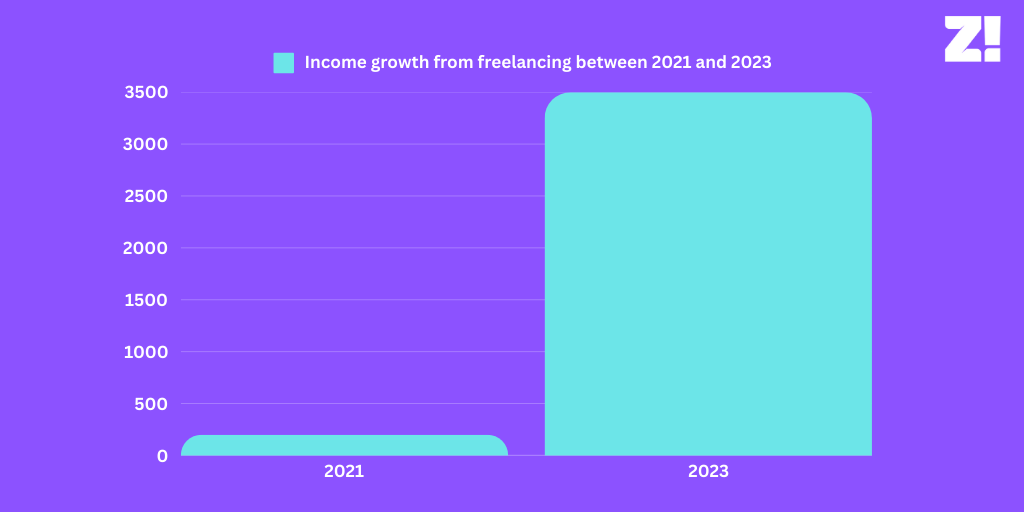

It’s an hourly payment schedule. When I first joined, I worked only 20 hours per week at $2/hour. Then it increased to 40 hours at $4/hour after a month.

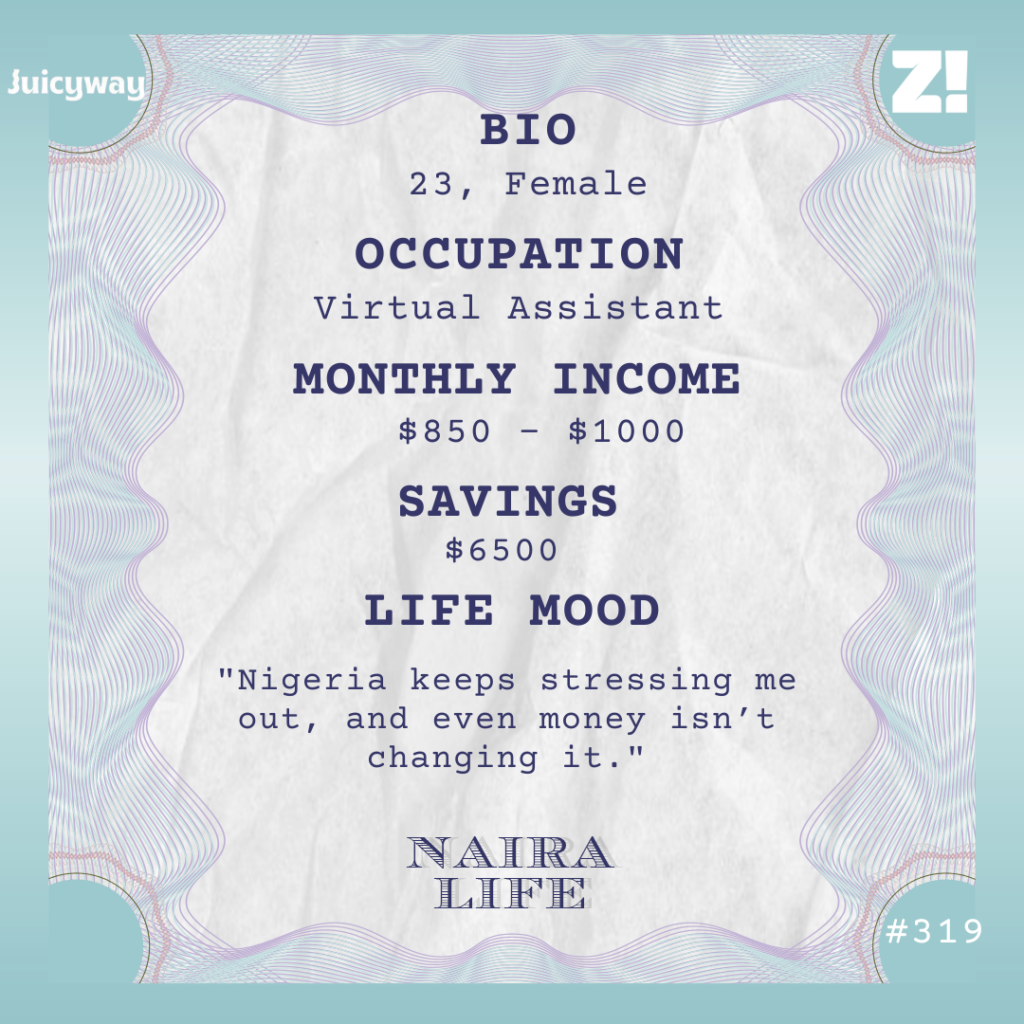

Then, in 2024, I moved to 50 hours a week at $4 per hour, sometimes $4.25, depending on whether I do extra work. That’s my current pay structure, and my monthly income ranges between $850 – $1k. My last payment was $917.

But receiving the payment is another thing. The company has an account officer in Nigeria who calculates my salary and sends it to my traditional bank’s domiciliary account. Then, when I need money, I have to go to the bank to withdraw dollars and exchange them at the black market.

I do that once a month to avoid the stress of changing multiple times. I used to change $200 – $250 to get me through the month, but with inflation, I now convert $300, which was ₦474k this month. I leave the rest in the bank.

It feels like a very manual process

Well, I can’t legally transact with dollars in Nigeria. I am unable to transfer the money due to government restrictions. One disadvantage of this process is the frequent fluctuation of the exchange rate. I can go today to convert dollars and hear two days later that the dollar is now more expensive, so it feels like I’ve wasted money. I can’t say for sure when the best time to convert my money is.

Also, I have a challenge with investing. Earlier this year, some of my colleagues and I talked about investments, so I decided to look into it. I thought it was just a matter of putting money in one investment application and coming out. But I saw an investment platform that promised 7% yearly interest on dollar savings. So, if I save $100, I only get $107 at the end of the year. It didn’t make sense to me.

Other platforms required me to convert to naira first to use their dollar savings and investment options. Like, they have dollar options, but I can’t send dollars to them. I have to change to naira, buy dollars at their rate on their platform, get interest, and then convert again to naira at whatever rate they give if I want to withdraw.

It’s a whole lot for a constantly changing conversion rate, and I’ll inevitably end up being the loser. So, right now, I’m just looking at my money in the bank.

Phew. That’s a lot to take in. Let’s go back to how it feels to have gone through such a significant income jump

It didn’t even initially click that I’d moved from earning ₦33k to earning in dollars. I think it was a delayed reaction because it wasn’t until three months into the job that I realised, “This thing is real.”

Maybe if I’d been praying for it, I’d have rehearsed how I’d react in my head when it finally came. But I just found myself in a new financial situation. I was very surprised, but also really happy.

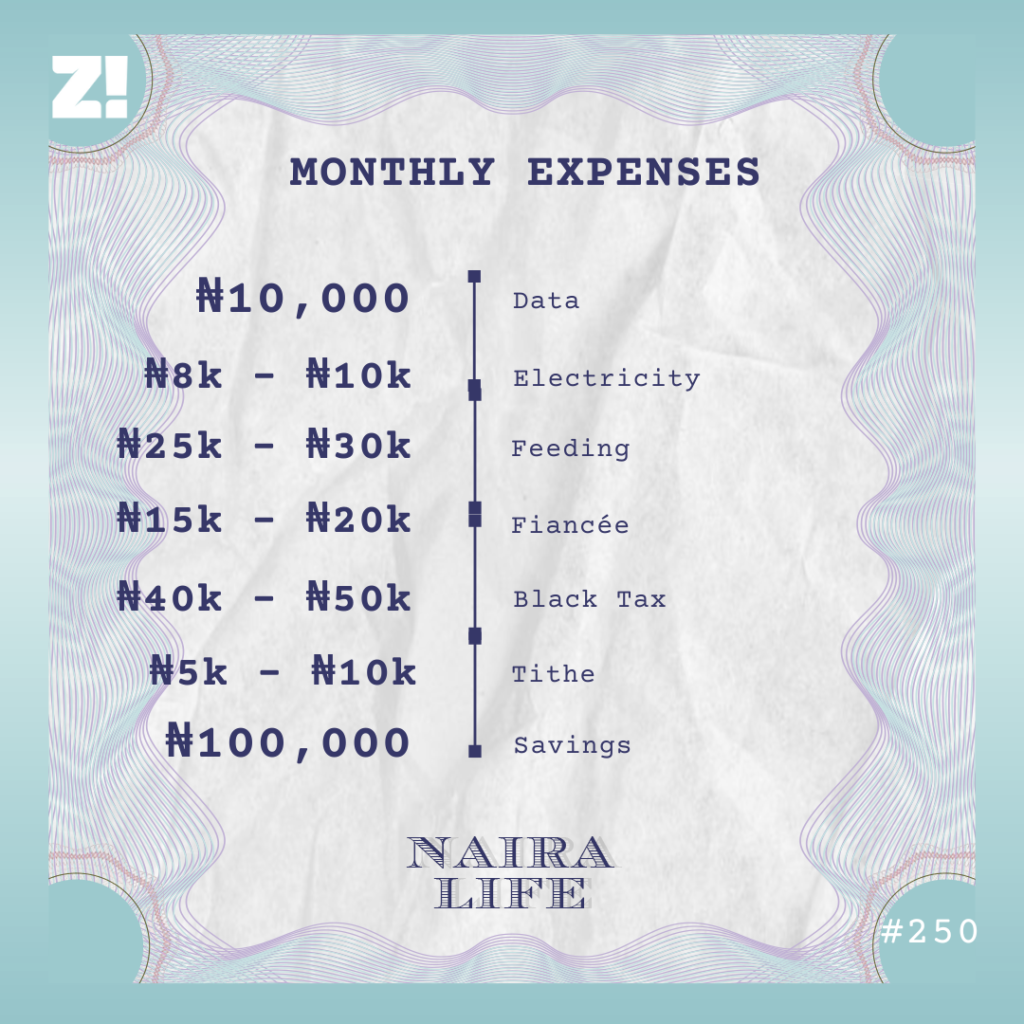

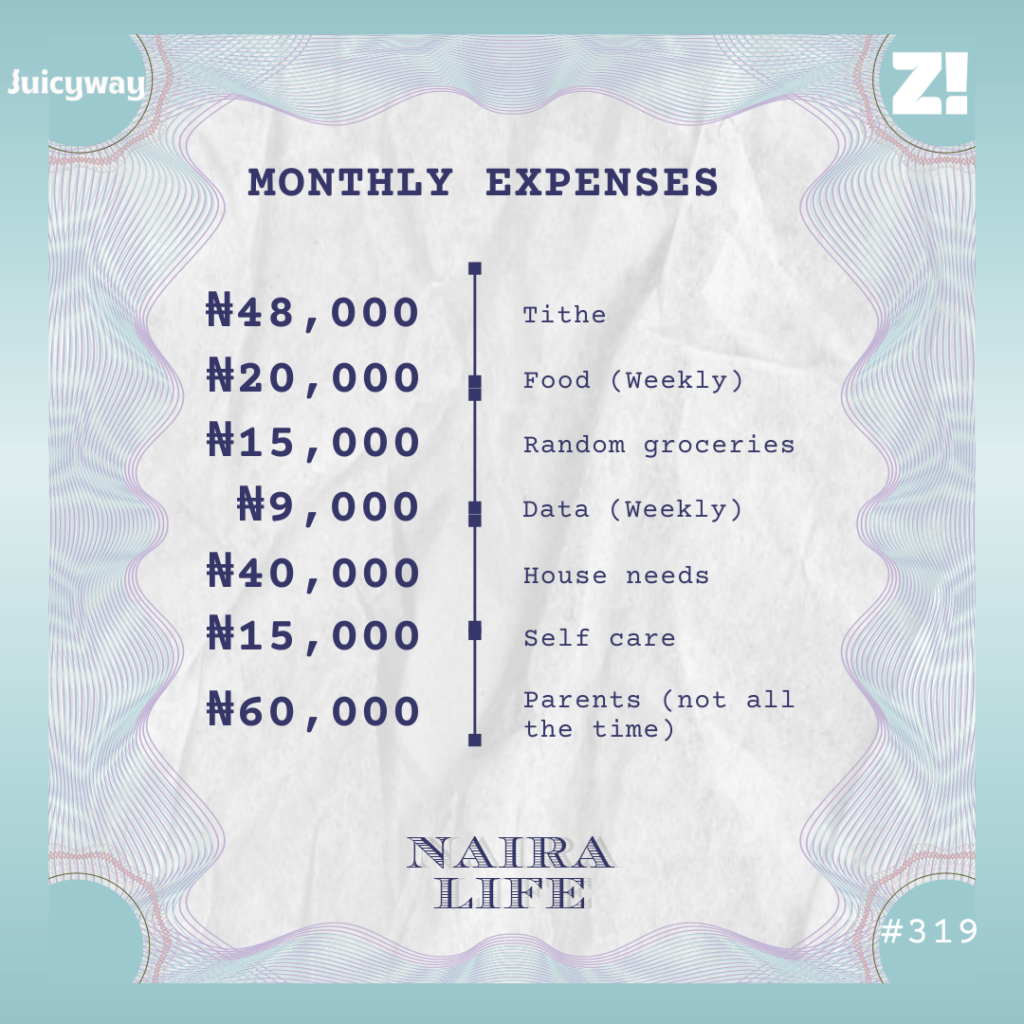

My income affords me a good life. I don’t live extravagantly, so I can buy whatever I need or want. That’s usually just food, skincare, church offerings, and rent. I moved into my own apartment in August 2024, and my rent is ₦500,000 per year. I also occasionally send money to my parents, but I don’t do it on a monthly basis because then it feels like I’m paying a bill.

Could you break down these expenses for a typical month?

I usually send my sister money, but it’s not constant as it depends on what she asks for. The rest of my money goes to food and data.

You mentioned not converting all your salary and leaving the rest in the bank

Yes. The $300 is just for monthly expenses; the remaining is set aside as savings. Currently, I have $6500 in my savings account. It would have been more, but I started my master’s degree last year and had to pay for school fees and other expenses. So far, I’ve spent ₦700k on the degree, which included school fees and rent.

Do you have plans for your savings?

Most likely japa for my PhD. My sister had saved money when she was relocating, and my parents didn’t have to chip in. That’s my plan too, but I’m sceptical about using all my savings to relocate. Let’s see how it goes, though. I just want to leave this country.

I feel like I shouldn’t ask why, but I’ll ask anyway. Why?

I’m not living the best quality of life possible in this country. I know people go, “If you have money, you can still live in this country,” but I don’t think that’s always true. It’s the little things that keep decreasing one’s quality of life.

For example, I was debited twice for a ₦100k transaction last month, and I’ve dragged the issue since then with no resolution. I said, okay, let me leave these people for God and open a new bank account. The last time I opened an account was in 100 level, I didn’t know it would be this difficult in 2025.

I gathered all the required documentation and visited the bank on two separate occasions, only to be told that there was no network available to process anything. When I returned the following day, they said the NEPA bill was old and I would need to come back with a different one, after more than three days of back and forth.

There are too many examples to give, but the summary is that Nigeria keeps stressing me out, and even money isn’t changing it.

What was the last thing you bought that made you happy?

My air fryer. I received a $50 bonus at work early this year, and I used part of it to purchase the air fryer for ₦53k.

How about the last purchase that required serious planning?

I changed my and my sister’s phones in December, and I started planning for it in October. Paying for the phones and receiving them was a very stressful experience. They cost $600, and I had to send the naira equivalent to my sister’s friend’s sister.

She bought the phones from a website and then sent them through a family friend who was returning to Nigeria for Christmas.

Out of curiosity. What do you think the next five years look like for you?

I think it’s going to be more work and school for me. I want to earn a PhD within the next four years while also working and making a lot of money. I hope to one day earn enough money to start my own company, allowing me to plan for an early retirement, likely around 50.

What qualifies as “enough money”?

Hundreds of millions of dollars. I don’t have long-term plans, so I don’t have a clear path to achieving that right now. It’s not exactly a specific, measurable goal; it’s just a dream, and I think I can afford to dream.

How have your experiences shaped your perspective on money?

I believe there’s nothing free in this life. If you work hard, you’ll have money. This doesn’t mean people who don’t have money aren’t working hard, but I believe it’s a principle that works. If you work hard enough, you will earn money within a specified period of time.

I also want to learn to handle my finances better. It’s not enough to sit at my laptop and work and work all day long, and spend money as it comes. I’ve come to realise I need to learn how to take calculated risks and explore beneficial investment opportunities. I believe the first step is to seek out educational resources and update my knowledge, so I know how to manage my finances effectively. That’s one thing I need to fix.

How would you rate your financial happiness on a scale of 1-10?

8. I can buy anything I want, and I’m happy enough. It’d have been a 10, but I don’t have money to japa yet.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad]