Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

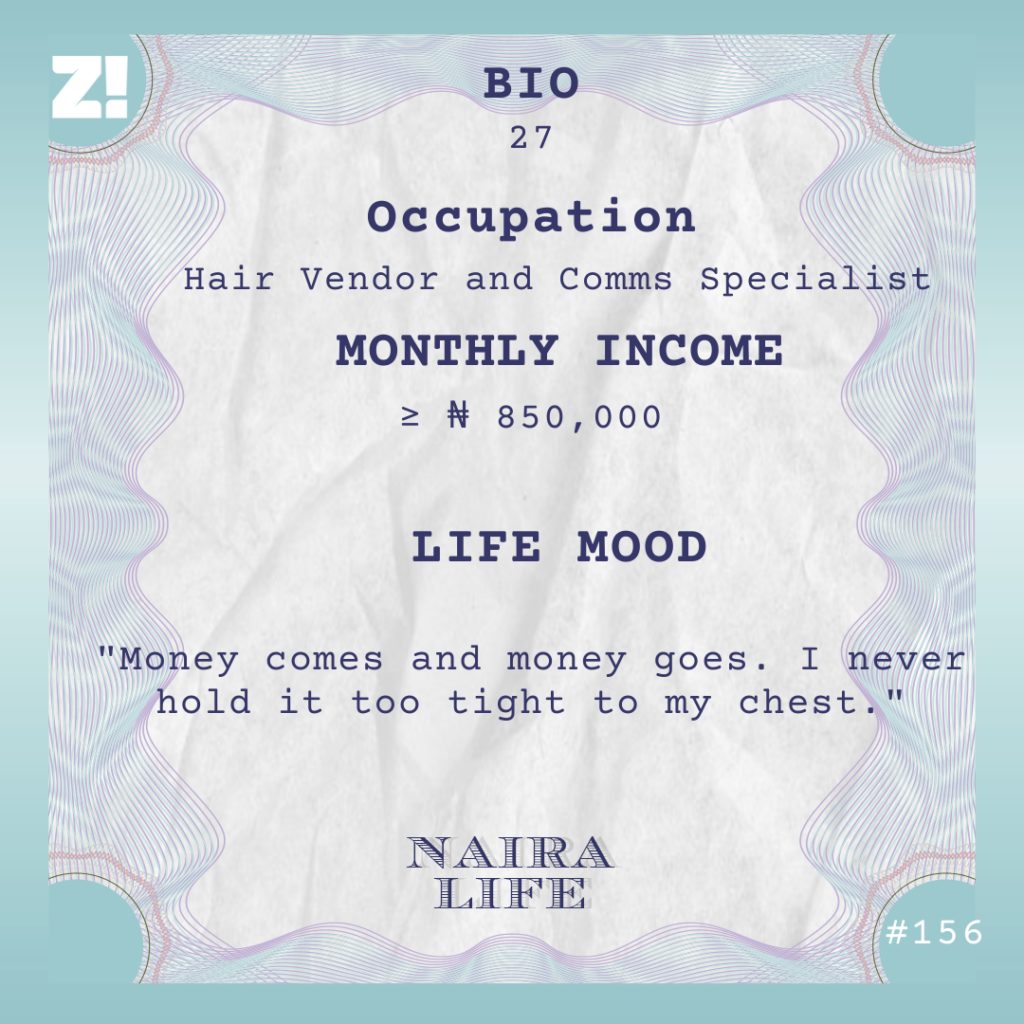

Today’s subject on #NairaLife grew up seeing her parents struggle and borrow to keep up in the wealthy society they lived in. At 22, she decided to start her own business. Now at 27, she makes millions selling hair and doing comms side jobs. You want to know her biggest fear? Losing it all.

Let’s start with your first memory of money.

I remember overhearing my parents complain about not having a lot of it. We weren’t broke, but we lived above our means in a few ways. The school we went to was the most expensive in the area, but they sent us there just because they wanted us to get a good education. They did it even at the risk of embarrassment for themselves because when they couldn’t afford the fees, we got sent out of school. They had to resort to borrowing.

What did they do for a living?

My dad had his own practice as a medical lab scientist, and my mum worked in the medical field for an oil company. She brought more money into the family, and she was in charge of making sure we had money saved. If it was up to my dad, we wouldn’t have the life we did. He was a spender. He’d get money and think of all the ways to spend it immediately.

So you were living among people that were much richer than you.

Yes, and as a child, stuff like that messed with my head. I constantly daydreamed about being rich like my school friends and getting picked up by drivers after school. Even now, I can’t bring myself to owe anybody money. The fact that my parents owed and struggled to pay makes me scared the same thing might happen to me.

How long did they have to borrow for?

By the time my siblings and I were going into secondary school, they couldn’t keep up with the finances anymore, so they decided to send us to public school. Public school wasn’t terrible. I made friends and had fun. I had a best friend whose dad sold electronics, and somehow I partnered with her to sell phone chargers and make small money to buy boli and okrika clothes.

After secondary school, I tried to get into a federal university to study medicine and failed on my first try. The next year, I got in, but somehow, they cancelled my results. I was home crying and miserable when my dad came to me and said, “Do you really want to study medicine?” My answer was yes, and two days later, I was off to study medicine in a private school in Edo.

At private schools in Nigeria, once you have money, you can get in, and that’s what my dad did for me.

Interesting.

I met more people from wealthier homes in that school. People who travelled abroad for holidays and lived more luxurious lifestyles than I’d ever seen before.

In my first year, my mum called me one day and told me to write JAMB again and POST UTME to a federal university, just to have as a backup. I had made friends and was enjoying my life, so I didn’t understand why she was telling me to do that, but because I had no choice, I did and got admitted to study plant biology and biotechnology in UNIBEN.

In my second year, I woke up one day and found out that the school didn’t have the accreditation to teach medicine, so there was a notice board with our names assigning us to other departments. They moved me to physiology.

Whoa.

There was no point staying in the expensive school anymore because the reason I was there was to study medicine, so we decided that at the end of the semester, I would go to UNIBEN. In the final semester before I left, I baked a cake for my roommates, and they loved it so much they swore I had to start selling it, so that’s what I did. Ingredients worth ₦1,200 were enough to make a few cakes that I sold in slices of 10 each. Each slice was ₦100, so I was making good profit. I partnered with a friend who knew how to decorate cakes and we split the profit 50/50 when I left the school.

What was UNIBEN like?

I lived a soft life. My parents didn’t have to spend so much money to send me to school anymore, so they could afford to increase my monthly allowance from ₦25,000 to ₦30,000 and eventually ₦35,000. The only attempt I made at saving was doing ajo with my boyfriend and his friends. We contributed ₦5,000 each month and whoever’s turn it was took ₦25,000. We were only able to do it for one round because it lacked structure.

I got a place and spent all my money on whatever I wanted — hair especially. Whenever I got a new wig or hair done, I would get endless comments about how I had great taste. People asked me where I got my hair from, and I told them the particular shop in Ring Road Market.

Now the thing is, the shop was popular for not having great hair, so people always wondered how I was able to get good stuff from them. The more I got compliments, the more it dawned on me that I could be making money from my ability to find good stuff. Around this period too, I overheard my parents talking about how immediately I graduated, they would stop sending me money. So I decided to start selling hair.

How did you go about it?

In 2016, my third year in university, I found about MMM through a friend and put ₦25,000 in it. After a few months, I had gotten ₦125,000 as interest.

I got an extra ₦40,000 from my boyfriend who was doing IT, got on a bus to Lagos, stayed in a hotel and went to Eko Market the next day. The cost for transportation, feeding and accommodation in Lagos took the ₦190,000 I had to ₦160,000, and that’s how much I started my business with.

In one day, I went to multiple shops until I found a vendor and bought hair from them. When I took my stock back to Edo, the first place I thought of going to was the university I’d left because I knew the people there could afford wigs worth ₦10,000 to ₦20,000. In two weeks, I sold off my stock and made an extra ₦50,000. I was speechless. I didn’t expect business to move that fast.

What happened next?

I went fully into business mode. I put my profits into MMM and used the returns to get more stock. Things kept going smoothly until MMM crashed with ₦250,000 of my money in December 2016.

Whoa.

It was devastating. I wasn’t saving, so that was all the money I had. By January 2017, I decided to take a break from doing business that way and instead started dropshipping. I received orders, got paid, sent the money to the vendors, the vendors sent the goods to the customer, and I kept my profit. I was in my final year and doing projects so I didn’t have time to make those frequent trips. By July 2017, I had made some profits, and had a bit more free time on my hands, so I started my business as usual again, but this time, I focused on selling online.

How did that affect your business?

It was amazing. All I had to do was post on Instagram, and I was sure to make sales. This continued into 2018 when I moved to Lagos for NYSC. I was making sales of at least ₦50,000 monthly in addition to the ₦20,000 I was making at my NYSC job and the ₦19,500 alawee.

By November 2018, I calculated my finances for the year and had a shocking revelation. I had made ₦1.2 million in profit from the business that year and only had ₦30,000 in total savings.

You’re killing me.

That’s when I decided to start saving. I saved the ₦20,000 I got from my PPA every month, used the ₦19,500 alawee to run my daily life and saved my business profits too. By the end of 2019, I had gotten a new job that paid ₦80,000 monthly, made ₦1.7 million in business profits and had about ₦900k in savings.

How did the pandemic year affect your business?

It started slow, then became the year that I made the most money in my life. Business went normally for the first few months until lockdown happened. In my head, there wasn’t going to be any business until lockdown was over, so I took three remote jobs. One paid ₦250,000 monthly as a corporate communications lead at a home automation company, the other paid ₦100,000 as a content and social media manager at a fintech company, and the last paid ₦150,000 as content and social media manager for a fashion brand. From time to time, I also got random graphic design gigs that paid the odd ₦10,000 or ₦20,000.

How did you get these skills?

I did social media work, graphic design and corporate communication every day in the running of my business, so I got really good at them.

How did you survive having three jobs?

I was on my phone every freaking time. Even when I was asleep, I was waking up at intervals to check my phone.

Sometime in the middle of the lockdown, I got a call. Someone wanted a wig for her birthday shoot. I was confused. People were still using beauty items in a lockdown? Quickly, I reached out to my vendor, got materials, made her wig and sent it to her. That’s how business started again. The orders were pouring in, and I didn’t have to do too much running around like going to the market to pick up stock. My dispatch rider did all of it for me.

2020 made me realise one thing: There will always be a market for beauty products. I can never run out of customers as long as I provide high-quality goods. To standardise the quality of my goods, I started ordering hair from Vietnam.

How did you balance business with three jobs?

As the year went on, I dropped the jobs one by one because I was getting overwhelmed. By October, I was doing only my hair business, but it was okay because business was booming. You know what made 2020 the perfect year?

Tell me.

The bone straight craze of December 2020. It was insane. Before then, I didn’t stock bone straight hair because people didn’t really like it. All of a sudden, people started ordering for bone straight wigs like that was the only hair available. I was making orders for hair that overwhelmed my vendors so badly, they started taking shortcuts to fulfil them faster. This led to people returning goods and some losses, so I found another vendor in Vietnam and ordered from them. Those ones did a better job.

The bone straight thing lasted only a few months, but it was the best run I’ve ever had in my business. By the end of 2020, I had about ₦2.7 million in savings.

Business continued as usual, and by the end of 2021, I was able to invest ₦4.8 million in buying stock in bulk. Although it hasn’t moved as fast as I expected it to I expect 2022 to be another great year.

What’s your average monthly income now?

I recently got a community manager job that pays ₦350,000 monthly. In addition to that, business brings ₦500,000 and other content jobs bring between ₦100,000 and ₦200,000

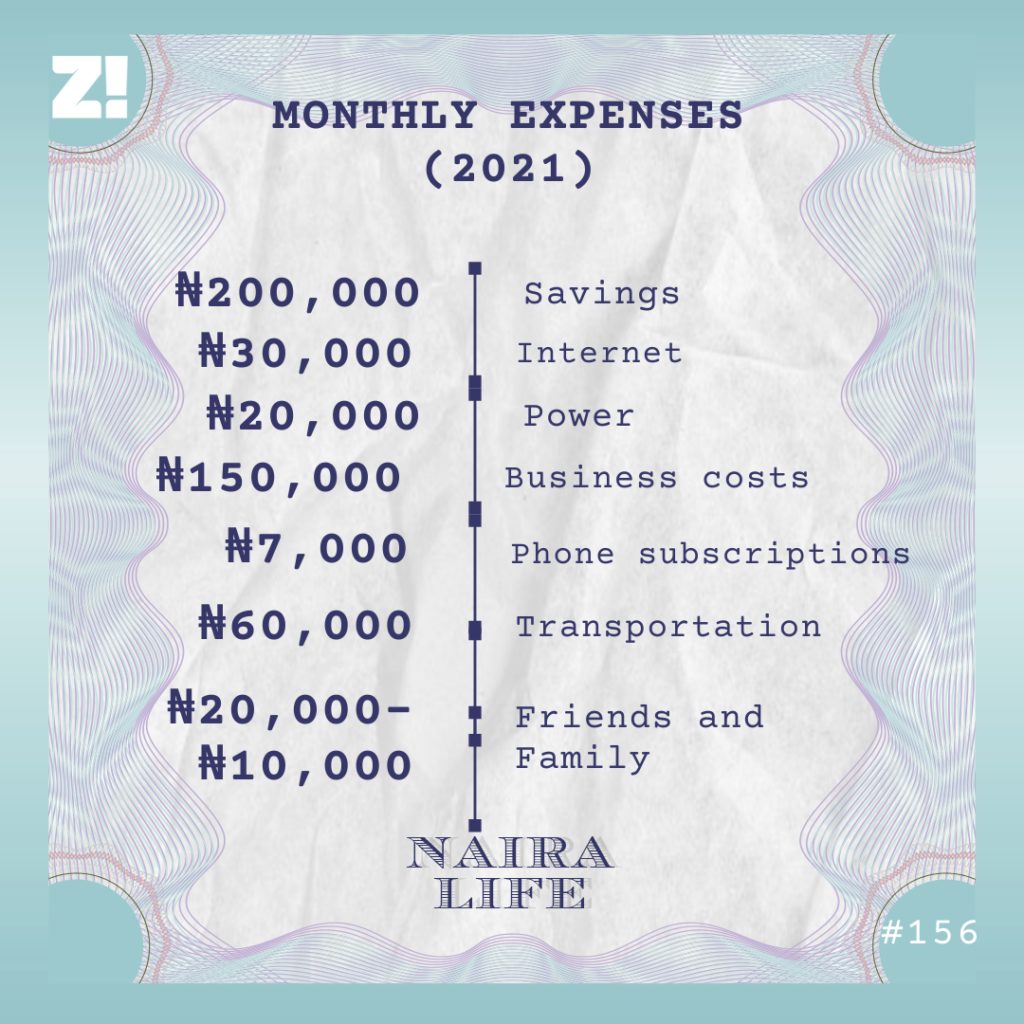

Let’s look at your average monthly expenditure.

Whatever’s left after saving and paying bills is for enjoyment.

How do festive periods affect your business?

They’re the absolute best times for business — Christmas and Valentine’s especially. I have to work double hard in this period because orders come in like no man’s business.

How has your money journey affected your view of money?

My view of money hasn’t changed a lot since I was child. I’m still very scared of poverty, but now I can let money go because I know I’ll always make it back.

What would you rate your financial happiness on a scale of 1-10?

7. I’m very content with my finances right now. There’s stuff I still want, like an apartment of my own, but I know those things will come with time.

What’s one thing you want but can’t afford?

I want to go to Europe for a month, just to live in and explore another country.