Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Luno is a great way to get into cryptocurrency Download and start trading today.

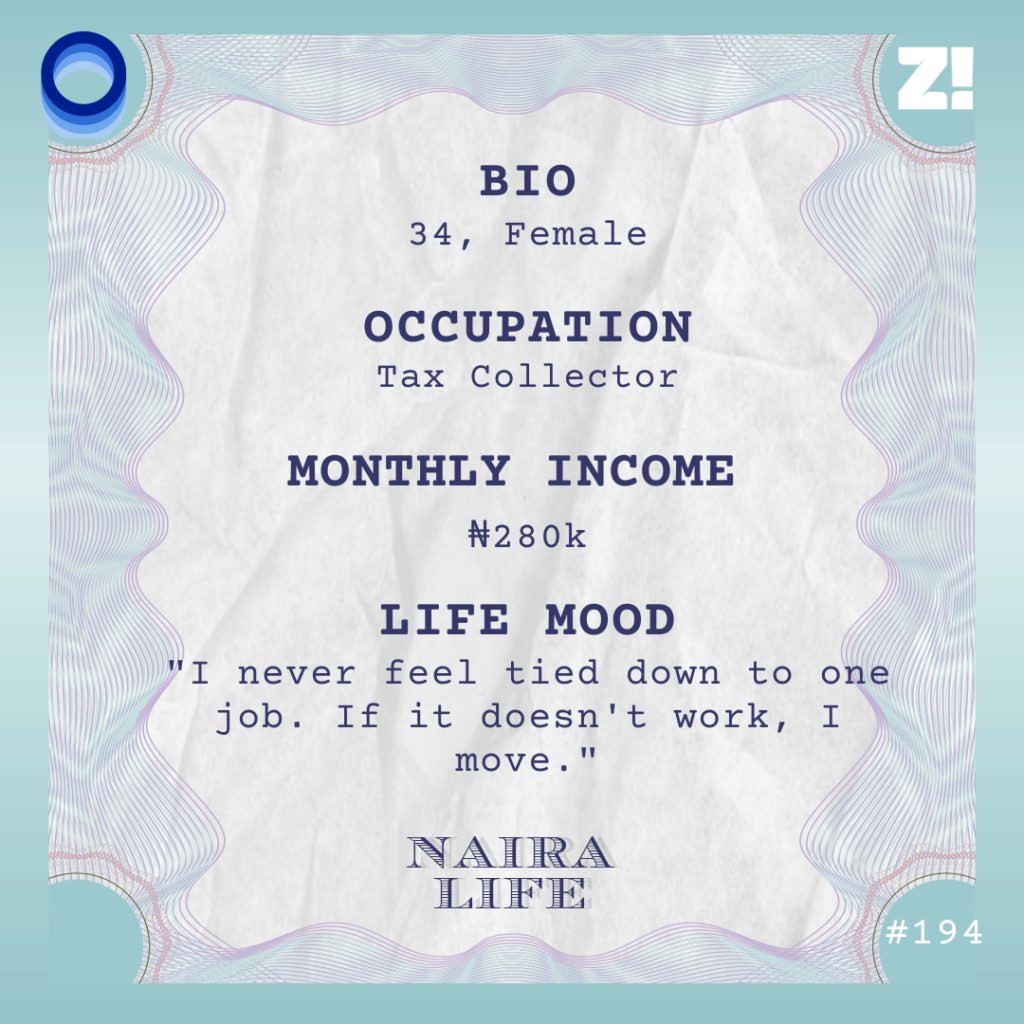

If the 34-year-old in this #NairaLife stopped working, she’d be fine. But even with free ₦4.3m yearly and wealthy parents, she enjoys being independent while catching business owners who try to evade taxes.

What’s your earliest memory of money?

My grandma worked at CBN and used to bring home mint notes from work for me and my siblings. I was about five or six when this started, and it was so cool just holding new money, no matter how many times I got it.

When you say “bring home”… You lived with her?

We lived in the family house owned by my paternal grandpa, which was a mansion. My nuclear family — dad, mum, me and three siblings — and two maids lived upstairs, and my grandma lived downstairs.

What did your parents do for a living?

My dad was a banker and my mum was an accountant.

Sounds like money all around

I didn’t notice how privileged I was until I got into boarding school when I was 10. In retrospect, I think my parents sent me there to see that there was another side to life. In primary school, my classmates were children of ministers and even governors, I had a driver, and I travelled during the summers.

In boarding school, I waited a whole week and ran out of clean clothes before I found out there was nobody coming to do my laundry. I had to learn to wash my own clothes. I had classmates whose parents were drivers and who lived in face-me-I face-yous.

When I was 13, we moved back to the UK.

Back?

I was born and spent my first five years there. We returned because that’s what my dad wanted.

So why did you go back at 13?

My mum ran away from my dad’s domestic violence. We waited for him to go to work one day and japa-d. Extended family tried to mediate, but they never got back together. We, his children, never stopped talking to him, and he came to stay with us in London a few times in a year. He also still sent money for school and upkeep throughout, so we were never in need of anything.

What was moving like?

I had to quickly learn independence. There was nothing like having a driver or being sheltered. I bused to school and had to run errands for my mum. I even got my first job as a sales assistant at 15. Not because we needed the money as a family. It’s just something many 15 and 16-year-olds in the UK do as their first job. I used my money to go out to the movies with my friends.

How long did you stay in the UK?

12 years. I returned to Nigeria in 2013, three years after university.

What was that like?

I came back for a wedding, and family members and friends kept telling me to move back, so I thought, “Okay”. When I got back to the UK, I told my mum, and she thought it was fine. My dad was excited I was coming to Nigeria to stay with him. So I quit my job and returned to Nigeria. The plan was to do NYSC first and decide what to do afterwards.

I’m so confused. First, you quit your job for Nigeria?

LOL. First of all, I was confused after uni. Then I saw a master’s in human resources programme and thought, “Let me try this”. When I told my dad, he said, “HR? what do you want to use HR for?” And that’s how I decided not to do a master’s anymore.

Instead, I got a job on the marketing team of an advertising agency. My job was to help them ensure their campaigns were seen by as many people as possible. It’s not what I studied in uni, but I learnt on the job and did well at it.

I see. So, NYSC camp…

I just wanted to do it. And camp was so much fun. I’d go again if I had the chance.

After camp, Nigeria itself wasn’t so fun. It was frustrating. Like I moved from sanity to chaos. I had to learn to be sharp. People were scamming me because I seemed soft and new.

Welcome. Where did you work for NYSC?

They posted me to a school that would pay me ₦8k a month, but my dad wasn’t having it, so he got me a job at Lagos State Internal Revenue Service (LIRS) instead. This one paid ₦25k monthly, and that was enough to see me through a month. I only needed the money to fuel my car. I lived with my dad, there was food at home, and I only went to work.

What did you do there?

Nothing. Corp members weren’t allowed to know too much about the operations because a lot of it is sensitive, so I just sat all day. They tried to retain me at the end of my one year there, but I rejected their offer. I was tired of Nigeria.

So you left again?

Yep. I moved back to London and got another marketing job almost immediately. After two months, I realised I actually preferred living in Nigeria. London was boring. The only thing it was offering was a structured society, nothing else. So I moved back to Lagos to look for work.

What did you find?

I met an NGO founder through a friend, and he hired me. His NGO helped small business owners get grants and funding, and I worked as his assistant. It was a lot of work for ₦80k, but I did it to engage my brain. Again, I didn’t need money for survival. I had everything I needed at home. If I needed extra money for anything like flight tickets or car problems, I saved towards it.

Have you ever had to work for money to survive?

Not yet, no.

What’s that like?

It means I never have to feel tied down to a job. If I ever feel like something is not right for me, I’ll leave. I know I’ll be fine.

After about a year at the NGO, I quit.

Why?

I had to do some travelling with my mum and siblings. Just to unwind.

When I returned to Nigeria, I started thinking about getting a long-term job so I could be a bit more settled. From the conversations I had with friends, the two major jobs that stood out were banking and federal parastatal jobs. Top of that list was Federal Inland Revenue Service (FIRS).

Banking was a no-no for me. It just seemed like slavery having to do so much high-intensity work and be under pressure all my life. And I also heard banks sometimes hired people based on their looks. I didn’t want to be a professional call girl.

What of FIRS?

It seemed much better. I heard people got promoted when they were meant to, without politics, and the working environment was welcoming. So I decided to apply to work there. In the months before I got the job, I interned at an accounting firm for ₦35k a month. Sometime in 2018, I started work there, and that’s where I’ve been since.

What do you do?

I’m a tax collector. There are different ways the government collects taxes from companies that don’t want to pay. I don’t look at companies’ tax records and reach out to them directly. My job is to look for loopholes and make business owners pay their taxes. For example, when business owners want to get visas, they have to submit their business accounts to show proof of funds. If they don’t pay tax, we’ll know and reach out to them. It’s really interesting work because I get to see people try their best to try and outsmart the law.

How much do you earn?

I earn the same thing I’ve earned since I joined — ₦280k. I also get some bonuses, but as part of company policy, I’m not allowed to talk about them. I’m due for a promotion soon. Fingers crossed.

Would you say you’re financially independent?

I’ve not had to ask for money for many years. Apart from living with my dad, I’ve handled every other aspect of my finances since I began working. I’ve thought about moving out, but my very Nigerian father has many issues with it, and I don’t want wahala, so I guess I’m not moving out yet. For car issues, travel or whatever other trouble, I handle them all myself.

Is your job your only source of income?

Up until two years ago, yes. After that, my siblings and I started receiving rent from properties my dad and grandma own. My dad has two apartments that bring ₦2m each, and my grandma’s apartment brings ₦300k. So that’s ₦4.3m at the end of every year for the past two years.

Do you do any investments?

A few months ago, if you mentioned investments around me, we would’ve fought. I lost ₦6m to agro partnerships last year. That’s the end of any investments for the foreseeable future for me. Now, I just save in dollars.

Is there anything you want but can’t currently afford?

Nah. I don’t desire a lot of things. If I want something, I plan and save towards buying it.

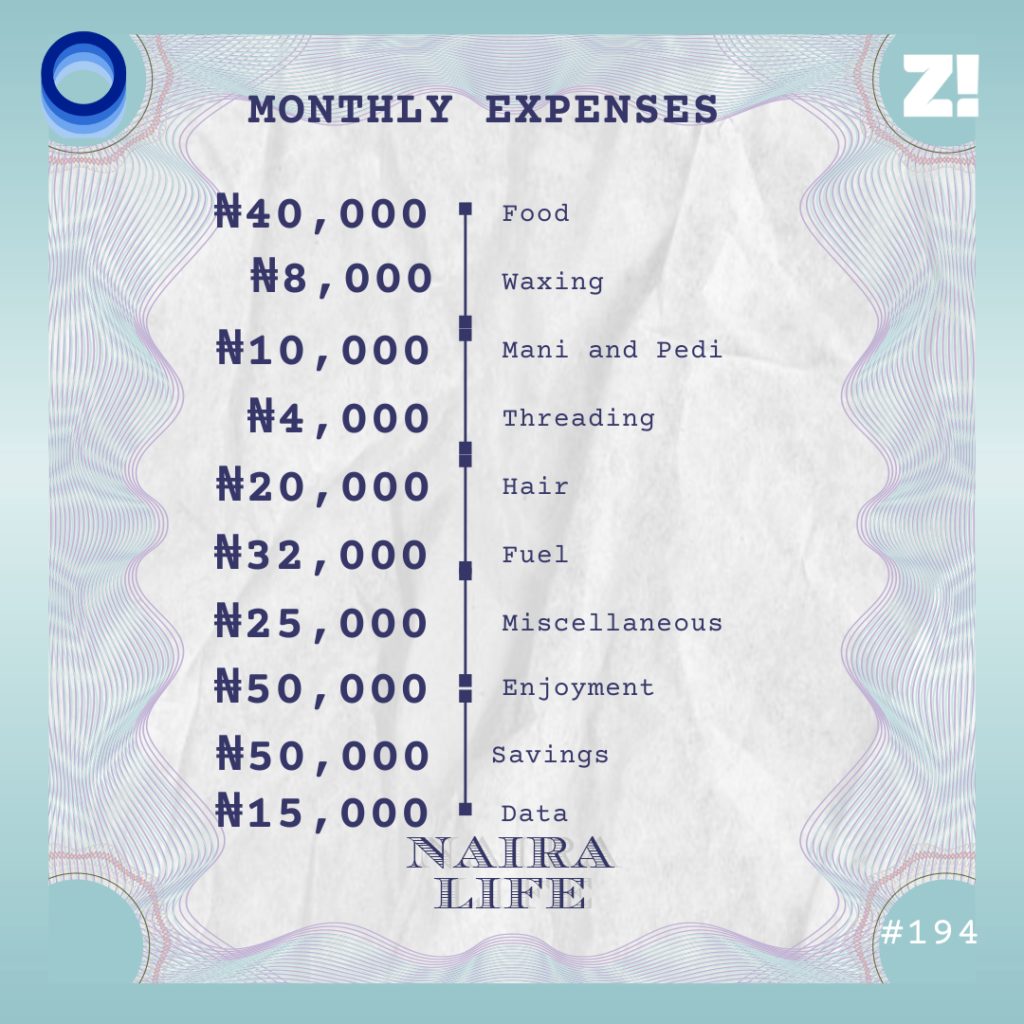

I’d love to see what you spend money on

How financially happy are you on a scale of 1-10?

5. If I could get the ₦6m I lost, I’d probably be at a 10. Other than that, I’m pretty grateful to have the family and privileges I do.

Luno is a great way to get into cryptocurrency Download and start trading today.