Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This week’s Naira Life is brought to you by Busha. Thinking of starting your crypto journey and trading the most secure way? Try Busha.

The lecturer in this Naira Life wanted to be a tech bro as early as 2002, but he watched a few marketing strategy sessions in 2005 and decided to follow a marketing career instead. Along the way, he also learnt photography. Now, he uses his media skills to support his family because his lecturing salary can’t cut it.

Tell me about your earliest memory of money.

The freshest memory I have of money was hearing that my mum had been scammed of millions and was in trouble.

Ah.

My mum was 17 when she had me. My dad was 23. They were not married. Her parents didn’t want them to get married after I was born, so she single-handedly raised me. She sold gold and jewellery for a living. We lived in western Nigeria, but she’d go to the north to buy gold, sell it in Niger and Burkina Faso, and then buy jewellery to sell at home.

We were pretty comfortable. I had all the toys I wanted, the latest shoes, and I went to a good school.

That was until the year I turned 9, in 1995.

One of her business partners who was supposed to collect money from customers, give her the money and then she’d deliver the goods collected the money and vanished. Nobody ever heard from him again. At the peak of the drama, my mum got arrested, taken to a police station and she came back with a swollen face. Things changed quickly for us.

From a private school, I was shipped to a public school. I didn’t get shoes and toys anymore, I saw my mum sell off her property one by one, and eventually, we had to move in with her parents.

Damn. What did this switch do to you?

It didn’t hit me at first. At my new public school, students had to wear brown sandals, but my mum couldn’t afford them. I kept wearing the fine shoes I had until the school seized them and had me walk home barefooted. Ah! It was only after then my mum struggled to get me the brown sandals.

The older I grew, the more the gravity of the situation dawned on me. Before the incident, my mum taught me to be generous at every chance I got, so if a friend came visiting and liked one of my toys or shoes, she encouraged me to give them. After the incident, someone came visiting and told me they liked my shoes and I gave them. If you see the scolding I got after.

It was also really hard watching her take on multiple odd jobs to make ends meet. She bought used jeans and dyed them blue to resell, she worked at a restaurant that barely paid so she could get food to bring home at night.

Did things get better?

Gradually, with my dad’s help and with all the work she was doing, she was able to pay off the debt. By the time I turned 14, she had started working as a hairdresser and had a business centre for people to make calls on the side.

Even though things were getting better, my requests for money were mostly met with rejection because we now had to be cautious about the way we lived. But I was a teenager and I had wants — the most pressing was the need to always be in cybercafés, around computers — so I found a way to start making money at 16.

My first job was helping people take their phones to Computer Village to fix them and helping other people browse and fill forms online. I helped one man fill his USA immigration visa lottery form and he won and moved to the US. These were people that lived around us, so I didn’t charge them. They gave me small ₦1k or ₦2k tokens, and I used the money to go to cybercafé.

A tech bro in 2002?

I was so amused by the concept of computers and how they worked. I even got a certificate in computer appreciation, where I learnt the fundamentals of computers and programmes like Word, Excel and PowerPoint. At that stage, what I wanted to do was be an IT guy. I finished secondary school in 2002, but I failed physics in WAEC, so I couldn’t get into uni. We couldn’t afford WAEC in 2003, so I stayed at home and kept doing what I was doing.

That year, my interest in computers grew and I got another certificate in information technology in 2004 instead of trying WAEC again. In late 2004, a church member who saw I was home and largely idle linked me with a job as an operations assistant at a haulage company. The pay was ₦12k and my job was to track inventory, ensure the trucks were well-serviced, confirm that the items the customers said they wanted to ship were actually there and take drivers’ complaints to the bosses.

I became an instant favourite at the job because I saved them a lot of costs. Mechanics were scamming them by double-charging on invoices. If they needed one thing, they’d write it in two different ways, so I pointed it out to the bosses. I wasn’t loved by the artisans, but the bosses loved me. There was no week I didn’t get a ₦2k or ₦3k tip, but not long after I started the job, they increased my pay to ₦15k. I was making no less than ₦20k monthly.

By the end of 2005, I had saved enough money to buy my mum a ₦70k generator. She loved it. The rest of the money was going to transportation and my own upkeep. The job was too far from my home, so I moved in with an uncle.

How long were you at the job for?

Just over two years. But in late 2005, I had an experience that changed me from a tech bro to a marketing bro. The haulage company I worked with had another company that created and marketed tech solutions. Someone in that company was on leave, so they called me to assist in whatever ways they needed me to for some time.

Cloud backups didn’t exist at the time, so they created a solution for people to backup their sim card contacts and retrieve them if they ever lost their phones. When I got there, they were at the stage where they were talking about marketing the product to their customers, and I found the thinking and process that went into getting a product in front of people extremely amusing. I even occasionally dropped some good ideas.

That experience made me want to go to school again, but this time, not to study anything computer-related. I was going to study mass communication and major in public relations and advertising.

Didn’t you go to science class?

I entered study mode to get a grasp of government, literature-in-English, and CRK so I could write a different WAEC that would qualify me to study mass communication. I wrote it in 2006. I failed ehn.

LMAO!

I studied hard again and wrote GCE exams later that year. This time,I passed, but school was already in session, so I opted to get in through diploma instead because I didn’t want to wait an extra year. I picked up the diploma form for ₦15k, wrote the exam and got in. Guess how much was the school fees?

₦365k.

I had only ₦200k in savings, so I told my mum I needed an extra ₦165k. She didn’t have it, but she went and asked her church if they could pay my fees, and they did. For free.

Mad, you finally got into school. How was your uni experience?

In my first semester as a diploma student, I got into a situation that got me expelled.

Don’t kill me, please.

One of the members of my four-man clique was running late for a test, so in my naivety, I collected an extra question paper, wrote his name on it and kept it for him. Right before the test started, I called him again and he said he couldn’t make it, so I called one of the test invigilators to return the question paper, and right there I got accused of writing a test for someone. My explanation fell on deaf ears.

The expulsion process took two semesters, so I kept going to classes and writing tests and exams, but at the end of the second semester, the panel decided I had committed malpractice and expelled me. I had a 4.8 CGPA.

That must have hurt.

I didn’t tell my mum. I just stayed in the school hostel studying for another JAMB and POST UTME. In that period, I started helping computer science final year students do their projects for ₦15k and assignments for ₦3k because I knew a lot about computer stuff and even some programming. That’s how I survived.

I also learnt photography. A friend who lived in a different state called me one day to say he wanted to stay with me for a night in the hostel because he had an event to shoot the next day. Because I had some free time, I told him to teach me photography so that whenever he had jobs, he wouldn’t have to travel. He’d just send me and give me a cut from the deal. He agreed.

After passing JAMB and POST UTME, I resumed 100 level in mass communication in 2009, aged 23. That’s when I told my mum about the expulsion incident. She was first angry, but she calmed down and appreciated me for trying again and getting back to school.

Because I’d been in the university environment since 2007, I became popular pretty quickly and got elected to be class rep. At this time, my mates who I started diploma with were already in their third year. But I pretty much studied with them since their first year, so I was acing all my courses and organising tutorials for people from year 1 to year 3.

Were you doing anything on the side?

I started doing photography professionally. I took matriculation pictures, got some wedding gigs.

In my second year, I had another business idea. It wasn’t new — people used to do it in 2007 when I was in diploma — but nobody was doing it on campus anymore. Basically, I reached out to cinemas around and got them to discount ticket prices for students once a month, and then got a university staff bus driver to pick the students from school and drop them off at the cinemas. After the movie, the bus took the students to nightclubs and then back to school. The entire thing cost each student ₦3k, but my profit was ₦700 on each student. From that money, I fuelled the buses, paid the driver and kept the rest.

Starting the cinema thing was my first major opportunity to use my marketing skills. I got babes from my department to wear branded t-shirts and carry banners to hostels to make noise about it. As it became more popular, so did I, and my popularity brought me more assignments, projects and photography jobs. I even got club photography gigs where I took pictures of people having fun in clubs for ₦5k a night.

Things you love to see.

Absolutely. Doing things that made me money was a huge source of confidence in my ability to make money in the long run. In October 2012, in my third year, my friend and I went for a three-month internship in the media arm of a government parastatal. The pay was ₦15k, but then in December, they organised an event and told us to handle social media. A lot of the event’s huge success came from social media and the parastatal was happy with us, so they gave us ₦200k each. After the internship, they kept reaching out to give us work. For example, a few months later, we got a big contract to do the scripting and copywriting of an animated video and I made ₦500k from the gig. From these monies, I paid rent, got a laptop, a camera and settled my mum.

In 2013, I graduated as the best student in my department and got about ₦200k in prize money from school. When my boss from the government parastatal heard, he sent me $1,000. I bought a car. It cost over a million, but I paid only ₦600k. My dad, who I was reconnecting with, covered the rest.

Also, my mum got married when I was in university and her fashion business was much more stable, so things were going good for her.

Nice! What happened after university?

I went back to work at the parastatal doing comms and design work. They paid ₦30k for about five months, and then I had to go for NYSC camp. When I got back from camp, they increased my salary to ₦45k. I was on a steady ₦45k monthly with photography jobs here and there until 2015 when elections came, and through connections, I got copywriting jobs to work on politicians’ campaigns and made about ₦3 million.

In May 2015, I left the parastatal and got a job at a company that wanted to reach young entrepreneurs and help them get funding. They made me the project lead and paid me ₦70k in the first month, and ₦80k afterwards.

In August, through someone I’d worked for, I pitched to a top Nigerian bank to use WhatsApp as a channel for customer care, and they liked the pitch, so they took me on as a consultant on a three-month partnership that I made ₦1.8 million from. Most of this money was going into savings because I was planning to get married, but I was excited to be making so much money.

Fundssss.

In November 2015, I Ieft the job I started in May because my university poached me. They’d just started a thing where they hired the best graduating student from various departments to work as graduate assistants, and they wanted to start hiring from the 2013 set, so they reached out to me. The pay was ₦108k, and one of my lecturers gave me a long talk about how I’d find fulfilment in the job and still have plenty time to do other things on the side — the latter part has turned out to be not so true.

To be honest, since I started doing tutorials in school, I saw myself becoming a lecturer much later in life, but since the opportunity to start early came, I decided to take it.

I wasn’t happy with the pay because I’d just had a brilliant year financially, but I couldn’t do anything about it.

What happened next?

Life has moved fast since then. I started my job as a graduate assistant while I got my master’s in the same department. In 2016, I finished my master’s with a distinction, my role changed to assistant lecturer, and my salary changed to ₦166k gross monthly and about ₦140k after tax. My salary hasn’t changed since then.

On the side, I still do photography, but only for corporate events. When I see copywriting and advertising jobs I can handle, I take them on. Most times, I get them from friends, acquaintances and referrals. I also do content writing for websites, and at some point, I managed an influencer and got percentages when we got deals.

I also married in 2016, and all the money I’d saved over the years came handy when we had to rent an apartment and when our son came in 2017. In 2017, I also started my PhD in my department and had to go to the UK for six months for a semester.

Are you done with your PhD?

I’ll hopefully be done this year.

Let’s talk about your current finances.

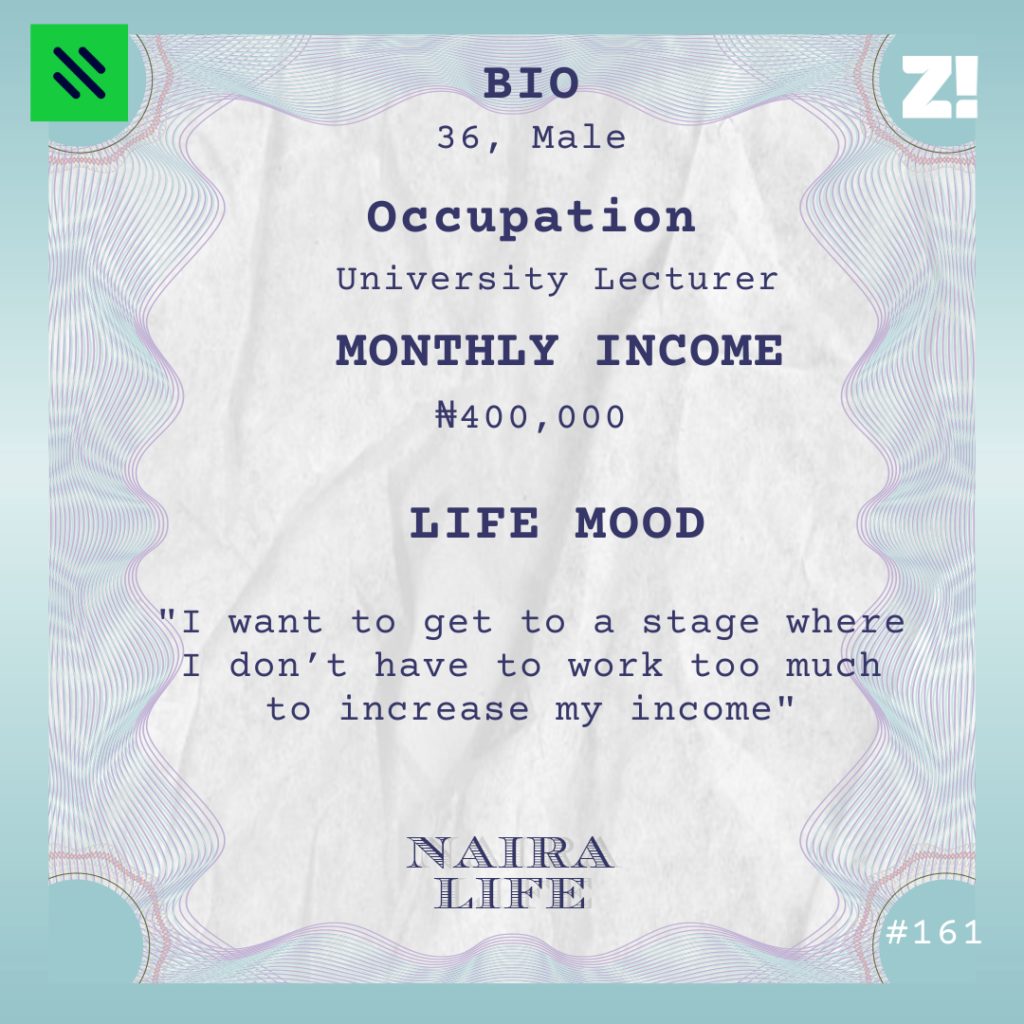

On an average month, I make about ₦400k in total. It can be much more in months when I get big deals, but it hardly goes below ₦350k.

What do you spend money on in an average month?

That’s more than you make in a month!

Yes o. I have to keep going into my savings every month. I have two savings accounts — one with a cooperative that takes ₦60k from my salary every month, and the other with a bank that I transfer to. I try to transfer at least ₦50k monthly to the account, but on months when I make big money, I save a lot. That’s how my family survives. Right now, I have about ₦500k saved. On some months, they can be as low as ₦10k, on others, they can be in millions.

My wife only just started her business as a fashion designer, so I’m looking forward to having support from her for the family when the business picks up.

Is there something you want right now but can’t afford?

My own house. I’m not a fan of building houses from scratch, so a 3-bedroom house would be great right now.

How happy are you financially on a scale of 1-10?

Let’s put it at a 4. When I was in the UK, I got a £1,200 monthly stipend from the school and made another £400 monthly from helping one of my lecturers do some graphic work. It was good money for almost nothing.

I want to get to a stage where I don’t have to work too much to increase my income. Right now, my plan is to finish my PhD first. That would move me from assistant lecturer to lecturer and add between ₦50k to ₦100k to my salary. Then I’ll have time to do more high-level media consulting, and more money to invest in my wife’s business so she can expand and be more profitable.

Now that you’ve made it to the end of the article, here’s exciting news: If you want to buy and sell Bitcoin, Ethereum, and more, deposit and withdraw instantly and securely, and manage your crypto portfolio, click here to download Busha.