Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This week’s Naira Life is brought to you by Busha. Thinking of starting your crypto journey and trading the most secure way? Try Busha.

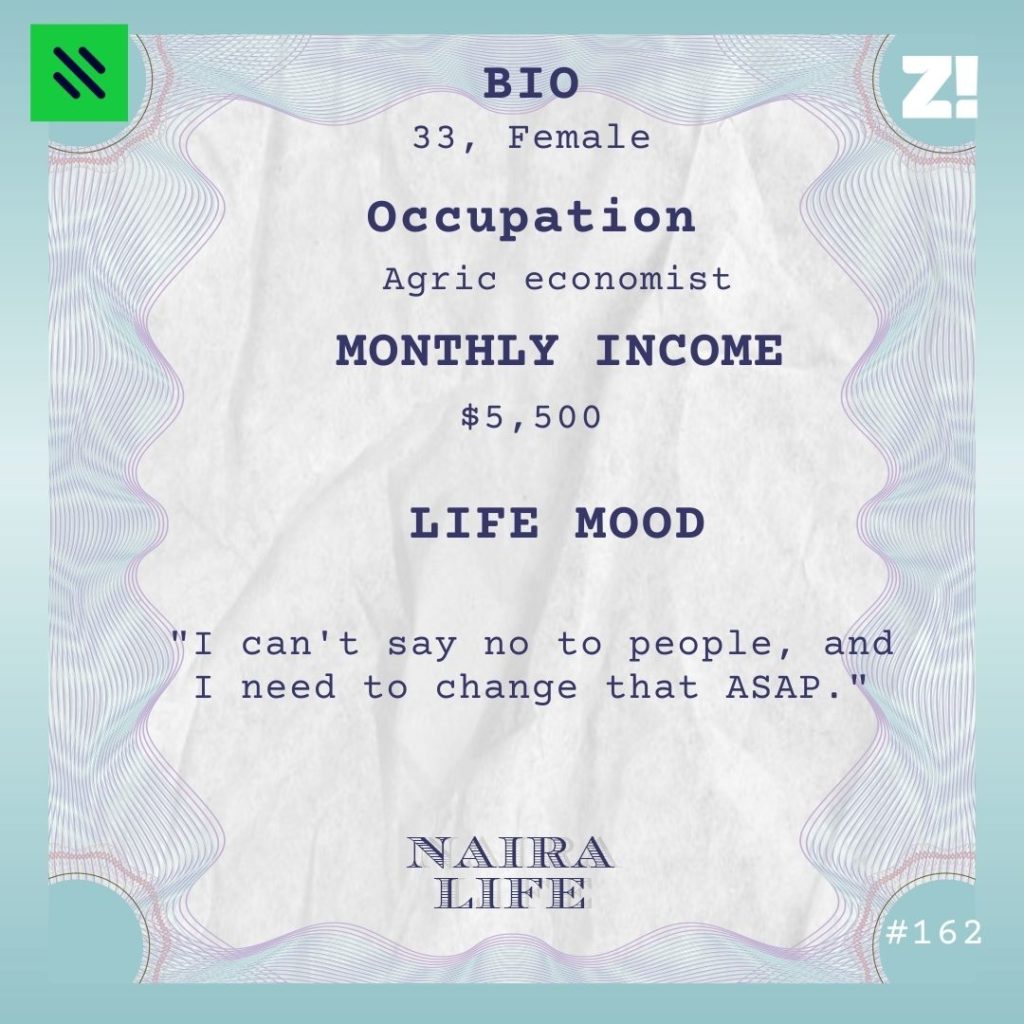

Today’s subject on #NairaLife wanted to be a pilot until she had to study agric economics in university. Now, the seemingly unpopular career has taken her around Europe and Africa, and pays her much more than she imagined she’d be earning at 33.

Let’s start with your earliest memory of money.

It’s closely tied to my dad’s accident in 1998. I was 9. He was coming back to Lagos after dropping my older brother in boarding school and a truck climbed over his car. There were broken ribs and damaged lungs. It was horrific.

Before the accident, my dad was the breadwinner in the family. He first worked as an economist in a big food conglomerate and then left to start his own business branding and printing gift items for any company he could get contracts from. My mum’s role was to support him at his printing place whenever she could, but the accident changed things. She took full charge of his company for the year he took to recover just so we didn’t suffer too much financially.

That didn’t mean we didn’t suffer though. We went from being an upper-middle-class family who could afford all their needs to a family that just managed to get by.

That must have been difficult for you.

It was, but an advantage I had was that I was emotionally mature pretty early in life. I’m the second child out of five children and the only girl, so my parents did that African parent thing where they made me more involved in house affairs than my brothers.

About two years after the accident, things started picking up again. My dad was back in full control of his business and my mum had started her own business buying huge bulks of crops and vegetables from the north and selling them to restaurants. I’d even say things got much better than they were before the accident because of my mum’s business.

On the holidays, I helped my mum sort out vegetables and followed her to deliver orders, and she paid me ₦500 for every day I helped her. That was like twice a week.

Moving from poverty to comfort in a short time made me decide one thing: I never wanted to be poor in my life.

What was your plan?

I heard pilots made good money, and I wanted to see the world, so I wanted to become a pilot. My parents, scared of plane crashes, decided they wanted me to be a doctor instead. But I was terrible at chemistry and physics, and I knew I was scared of blood, so medicine was out of the door.

What I was good at, was economics, so I decided to go for it. My dad agreed, but on one condition — I had to go to the school he went to. University of Ibadan (UI).

I ended up not going to UI. I applied to UI in 2004, but they were delaying admissions. An inside source told my dad the delays would linger, so we picked up a change of school form. This time, I applied to Michael Okpara University of Agriculture. But they didn’t have economics as a course. The closest thing they had was agric economics, so I just decided to go with it.

Interesting. What was studying agric economics like?

I fell in love with agric economics pretty quickly. The course talked a lot about food insecurity in Africa and how to help developing countries avoid food shortages. That was really interesting for me.

I also learnt that although it wasn’t a popular course to study, there were a lot of opportunities on a global scale. After my first year, my dad wanted me to try to study economics again, but at that point, I was already too invested in agric economics to stop.

I pretty much focused on my education throughout university, except for the time I tried to do business — which was a disaster.

I finished university in early 2011 and was deployed to Ibadan for NYSC. For the entire year, I worked at the agric and economics department of a research institute. My supervisor was a professor who did a lot of research work so I spent the entire year doing heavy research and writing papers. The job paid ₦10k and NYSC paid ₦19k, but it was enough for me because I didn’t really have a social life outside of work.

At the time, what were the career opportunities for you?

I was aiming to work at places like Food and Agriculture Organisation, World Food Programme, World Bank, Nestle, and International Fund for Agricultural Development. Those organisations hire agric economists for their work.

After NYSC though, my dad insisted I did a master’s in agric economics in UI, so I picked up a form, wrote the exams and passed. Right when I was about to start, my older brother who had gone to the UK to study reached out to tell me I had to drop my UI admission to chase something bigger for my master’s. At first, I resisted, but he kept talking about how brilliant I was and how he was sure I was going to get in, so I just applied. It was the 2013 European Union Erasmus Mundus scholarship.

During my first semester exams in UI, I got a call from the programme director saying I had gotten in. Amidst all my screaming, he was able to tell me to send a mail saying I accepted the scholarship, and just like that, I was in.

UI in the mud once again. What’s this Erasmus stuff about?

LMAO. It was a two-year fully funded scholarship spread across four universities in four different countries. My first year was in Belgium, then I did summer school in Germany, my second year in Hungary, and summer school was in Spain.

At the beginning of each year, the scholarship paid €4,000 for us to settle in, and then €1,000 every month after for upkeep.

In my first year, we weren’t allowed to work while on the scholarship, but people complained, and they permitted us to work in the second year. I still couldn’t work sha, because I was now in Hungary and I couldn’t speak Hungarian.

From the €1,000 I received every month, I averaged €300 on rent and utilities, €100 on savings and €200 to send home. At home, things were getting bad again. My dad had gotten cancer and treatment was taking a lot of money.

On months when I didn’t send money home, I sent €200 to my brother in the UK. He was on a Nigerian government-funded scholarship that was supposed to pay him monthly, but they defaulted payments sometimes, so he needed money. With the rest of the money, I toured Europe because I had a Schengen Visa. Flights weren’t so expensive — I once took a €10 flight from Belgium to Hungary — but I was also staying in hostels and feeding myself.

So tell me, did you return to Nigeria after your master’s?

Yep. I applied and got in for an internship with an agricultural research organisation in Nairobi before my master’s ended, so I returned to Nigeria to stay for a few months before going there. In early 2016, I moved to Nairobi for the six-month internship. It paid $1,200 per month. After the first six months, they renewed the contract and hired me as a research assistant. The pay was $1,500.

For that 14-month period, I sent home $300, spent about $250 on rent, $100 on feeding, and saved whatever was left after miscellaneous spending. I also brought my mum to stay with me for a month so she could relax from the stress of taking care of my dad and holding down the fort at home.

By 2017, I was done with my contract, and the organisation told me we were going to do the same thing in Mali in three months. The plan was to go back to Nigeria and rest for two or three months, then travel to Mali. But on my layover at Addis Ababa, my hand luggage was stolen.

Damn. What was in it?

My passport, wallet, university certificate, master’s certificate, amongst other important documents.

Ehn?

The only thing I had with me was my phone. No money. I had to miss my flight, and then sleep at the airport for a night. The next day, after begging the airport officials for hours, they finally let me show them a scanned copy of my passport on my phone. After that, they called the Nigerian embassy to confirm I was in the system. I was, but that wasn’t enough for them to let me enter the country. They asked for my dad’s number and called him to wait to pick me up at the airport with documents that proved he was Nigerian and that he was my father. When they were able to reach my dad, they told the Addis airport to let me come home.

Chai. Did you get your stuff back?

Nope. Never. I reported to the Nigerian police and to Ethiopian Airlines, but nobody could help. Then I tried to get a new passport to at least make the Mali trip, but immigration said they ran out of passport paper. So I was just stuck at home, crying every day.

Thankfully, I had $3,000 saved from Nairobi, so that’s what I survived on. I kept applying for agric economist roles in Nigeria, but they were hard to come by. When I eventually found one, they made me go through hours of testing and multiple phases of interviews, only to offer me ₦120k…

First of all, the pay was small. Then the place was far from my house, so I was going to be spending no less than ₦30k a month on transportation. I accepted it and told them to increase the pay to ₦150k but they didn’t, so I dropped it. It wasn’t good enough for me.

After seven months at home, my savings had gone down to $1,000, and I was getting frustrated from being home and unemployed. My dad spoke with his friend who had an NGO, and she gave me a job. Guess how much it paid?

How much?

₦40k.

LMAO!

I took it o. I was tired of doing nothing. I was at the job until December 2017 when I got a new job in Abuja. I saw the ad online and applied for it: a programme officer for agriculture and rural development in a development organisation. They were working on a project to help rural farmers in five Nigerian states have better roads to transport their goods and to connect them with markets that would buy their goods.

The job paid ₦160k for the first six months and ₦185k after. Luckily for me, my younger brother worked in Abuja as well, so I just moved in with him. After a few months, his ₦400k rent expired, so we split it evenly. Every month, we contributed ₦15k each for food and paid utility bills together. I sent ₦30k home from the rest of my salary and saved the rest.

I was at the job until April 2019 when I got a similar job at another development agency.

How much did this one pay?

₦320k. My brother and I moved to a new apartment. This time, the rent was ₦600k. I paid ₦350k and he paid ₦250k. I also increased my monthly givings to my parents to ₦50k. By 2020, I’d saved up to ₦1.2 million and used it to buy a car. That one emptied my savings. After that, I started saving ₦50k monthly.

At this job, we worked in the same office complex with a big development organisation, and we even did some work for the agriculture division of the organisation.

In late 2020, some of the managers from the agricultural division of the organisation came from their head office in Abidjan to do some work and somehow I got in a conversation where I was aggressively pitching myself to them for a job. My boss was friends with one of them, so when he overheard me, he joined the conversation and told them I was great at my job and pleasant to work with. They seemed impressed, so they told me to apply for a consultant role. By January 2021, I got the job and moved to Abidjan. The pay was $5,500 monthly.

*faints*

LMAO! It’s good money, I can’t lie. I didn’t think my salary would jump that much in such a short time. I’ve worked there since then. We help African governments design agricultural projects, loan them money to do the projects and monitor the execution of the projects. The reason I’ve stuck with agric economics is that I enjoy working on projects like this. I enjoy knowing that I’m creating solutions so that Nigerians, Africans, can eat.

I love it. What did the huge raise change?

The major thing was that I was able to give my parents more money, save more and start investing in shares and crypto. It’s been over a year since my salary increased, so right now, I’m hoping for a raise and another big break in my career.

From time to time, I also get calls from other development agencies to help them work on agricultural projects. For those ones, I charge $250 a day for however long the project takes.

If you had to do life again, would you do agric economics?

I really wanted to become a pilot, so I think it would still be my first choice. But agric economics would be a very close second.

Let’s look at your monthly financial breakdown.

What are your savings and investments like?

I bought land in Abuja in 2021 for ₦1.5 million. Then I have about $3,000 in shares in Trove, $4,000 in crypto, ₦1.8 million in Piggyvest and about $9,000 in the bank.

What’s something you want but can’t afford right now?

It costs $150k to get a passport by investment in Grenada, and that’s what I want right now. My Nigerian passport doesn’t do me so many favours. I’ve been denied visas to multiple countries. I also want my children to have a better passport than the Nigeran one so they can have better life opportunities and travel more.

And your financial happiness on a scale of 1-10?

It’s a 7. I’m in a good place right now, but we both know humans are insatiable. I can’t afford my Grenada passport right now, so that’s a need. I also know there’s better opportunities for me in the future, so I’m excited.

Mad—

I forgot to add, I also have ₦4 million in credit from people owing me.

₦4 MILLION? Are you a loan shark?

LMAO! When people ask, I find it hard to say no, or “I don’t have”. The problem after is that I don’t know how to meet people to say I want to collect my money back. After I remind them once, it feels like harassment to remind them again, so most times, I just count it as a loss.

My brother says people know that it’s a weakness and are taking advantage of me. He might be on to something.

Now that you’ve made it to the end of the article, here’s exciting news: If you want to buy and sell Bitcoin, Ethereum, and more, deposit and withdraw instantly and securely, and manage your crypto portfolio, click here to download Busha.