Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing

What’s your earliest memory of money?

When I was eight, I was involved with my mum’s soft drink business. I was always in the shop with a salesgirl, so I knew how the business worked. It was also my first significant introduction to money — I learned how to count money and balance the books.

I liked the control handling money gave me, so it wasn’t a surprise that I started exploring ways to make money for myself, too.

Do you remember the first thing you did for money?

In JSS one, I mended shoes for my classmates. I was a very curious kid, and every time a shoemaker mended my shoes, I paid attention to how they did it. One day, I went to the market, bought the needle and thread and started practising on my own. That was it.

I charged my classmates ₦50 for every shoe I worked on, and it happened until I got bored after a few months. This was 2006.

Fascinating

The next thing that caught my attention was computers and the internet. When I was 14 years old and was in SS two. My mum gave me a phone that had internet access. Somehow, I stumbled on how to build basic websites with HTML and XML. I’d pay people to build a demo website, study the code and try to implement it myself.

There wasn’t a plan to make money from this at the time, but I knew it could be a source of income later.

It appears you started thinking about money early

My parents drove that awareness. For example, my dad’s parents didn’t leave anything for him, and he had to find his way as a mechanical engineer. My mum’s father was better off, but she didn’t bring any of his wealth into our home. She was raised as a Muslim, and when she decided to marry my Christian dad, she had to forfeit almost everything and start over.

It’s probably why my mum made sure that I was involved in her business for as long as I could.

By the time I finished secondary school in 2012, my mum’s business had grown into a food canteen. I was awaiting admission, so I managed the business. I wasn’t being paid, but I could take money out of the business if I needed anything. On the side, I was also learning how to build websites.

The good thing about this was that, when I got into the university in 2013, I knew how businesses worked, and I also had some tech skills. I leveraged this to make some money for myself in my first year.

Tell me about this

I studied my university community and found out that there were lots of Christian fellowships that needed bulk SMS services. I got to work and built a bulk SMS website and put the word out. I was buying an SMS unit for 90 kobo and selling it for ₦1.50. From this, I was making an average of ₦3k/week.

I wasn’t even doing this full-time — I had a weekly allowance of ₦5k, even though I went home every weekend. Selling SMS was just a side hustle, so it was easy to leave it altogether when it got frustrating.

What happened?

The service provider I bought the unit from increased the unit price from ₦0.90k to ₦1.20. It made sense to raise my prices, but I didn’t think my customers would appreciate it. Ultimately, I decided to end the business. It was the end of my first year and school was closing for the session anyway.

What happened after?

My immediate elder sister was studying for her Master’s Degree at a university in the southwest, and I spent the session break with her. While I was with her, she randomly asked me if I was interested in learning about photography. When I told her I was, she took me to a photography studio at her uni and paid the owner ₦10k to teach me the basics.

I hardly learned anything about photography the whole time I was there.

Haha. Why not?

The guy who owned the studio was busy, and the boys who worked for him weren’t the best teachers. Luckily, the studio also had a cyber cafe, and my computer skills were useful there, so I paid more attention to that part of the business. I was helping people do stuff there and making some small changes — about ₦1k – ₦2k/day. I thought that was a fair trade-off since I always had money in my wallet.

Fair enough

After about three months, I returned to school for the new session. My allowance was now ₦10k/week, and I didn’t do anything else for money during the year. I just focused on school and website development.

But my interest in photography was growing, and I was looking for opportunities to learn. This came when I was in 2015 when I was 300 level.

How?

I found a guy — a studio and wedding photographer — on Instagram and liked his work. He worked in the town, so I approached him and offered to work for him for free. That’s how I started interning with him.

Man, he used me, but I learned everything I know about photography during the year I worked for him.

Were you being paid, though?

₦1k transport stipend every time I went out to work for him. It didn’t matter if he wasn’t even at the job, I didn’t get paid beyond that. I was pretty much paid in “experience”.

Haha. We’ve all been there

After working with him for a year, I had enough confidence in my skills to start looking for my gigs, so I left him. But we were still in contact and occasionally worked together. Now he was paying me between ₦5k-10k every time I worked with him.

The first job I got for myself was to shoot a wedding. I was paid ₦3k.

Sir?

Haha. I rented the camera I used from a classmate, and I gave him ₦1500. So really, I got ₦1500 from the job.

Subsequently, I got jobs that paid me between ₦5k and ₦10k. But the downside was that I didn’t have my camera, and I’d usually part with half of my earnings to rent a camera. I didn’t mind this very much because I still had my allowance. That said, I started thinking about getting my camera. It was the only sustainable way.

I agree. What was the plan?

The camera I wanted cost $2k, and a dollar was trading for ₦300 at the time.

You needed to raise ₦600k

Yes. I turned to my family for help. My mum gave me ₦300k and two of my siblings gave me ₦100k. Luckily, I got a big wedding gig that paid me ₦200k, and my profit from the whole thing was about ₦150k. I had the money I needed.

I paid for the camera in July 2018 and got it in August.

Here’s where it got interesting.

I’m listening

I grew up in a state in the north-central. It so happens that the governor of my state in 2018 used to be our neighbour. His wife — the first lady — was my Sunday School teacher at one point. On a whim, I contacted her on Facebook and offered to photograph her. Two weeks later, she replied with a number to call. I called the number and her P. A invited me to the governor’s office.

Coincidentally, the first lady and her photographer had just stopped working together, so the role was open. The first time we worked together, we went out for an event. I didn’t get paid for that event, but she promised to call me back.

Did she?

She did. That’s how I became her photographer.

Sweet

At first, our arrangement wasn’t concrete. We’d go to an event, and she’d pay me ₦20k to use for transportation. After working for three months, she asked me to come on full-time and name a number I wanted to earn every month.

I told her to pay me whatever she wanted.

Why do I feel like you fumbled a bag there?

I probably did. Chances are that she’d have paid me whatever I asked for, but I didn’t have a framework for how much my services were worth. Anyway, she put me on ₦50k/month.

Oof

I also wasn’t on the state payroll, so she paid me from her pocket

This was also a campaign period — the 2019 general elections were close — so I was going to work every day. That said, I was making an extra ₦5k – ₦10k every day. We could be at an event and one politician would dash everyone who worked the event money. In a month, I was making about ₦300k. But ₦50k, which was my salary, was the only lump sum payment. Essentially, I was spending the money as I got it, such that at the end of the month, I didn’t have up to ₦100k in my account.

Rough. How did you navigate this?

I figured I wasn’t very accountable with money because I was still living with my parents. When the governor won his second term bid, and it was confirmed that I’d be working with the first lady for another four years, I started making plans to get my apartment.

In 2020, I moved into my place; rent was ₦200k.

The next step was figuring out a savings plan. I devised a rule to save half of what I made every month.

So ₦25k?

My salary was ₦50k, but I typically made more than that every month. Most of the extra money came from planning and producing photo books for the governor’s office. I was making one of these once every two months, which brought in an additional ₦200k – ₦300k.

Ah, I see

In 2020, I had about ₦2m in savings. I thought it was best to put it in something and let the money compound. But I went the wrong route.

What happened?

Forex trading and crypto. I was trading via a proxy, and I lost all my capital and profit in a few months. This was about ₦3m.

But I wasn’t going out without a fight — I got in contact with another trader and convinced him to let me copy his trades. I started the account with $500 and grew it to $2k in six months. After that, I dumped my position and took the money out. It wasn’t what I lost, but it was something. I used the money to buy my first car, which cost ₦1.2m.

But you had to rebuild your savings, didn’t you?

I did. By the end of 2021, I had rebuilt my savings to ₦1.5m. Then I was in an accident and crashed my car. This happened in November 2021.

Ah. I’m sorry, man

It’s all right. But I didn’t work for five months after that. And I wasn’t paid either. That’s when I knew I couldn’t depend on a single source of income.

Where did you go from there?

I thought of a business idea and asked a guy to build a mobile app for me. When he charged me ₦800k for it, I had the biggest “But I should be able to do this myself” moment. That’s how I returned to learning programming languages. While recovering from my accident, I started learning Javascript, then React and CSS. I already knew about web design, so the existing knowledge fastened the learning curve.

Was the plan to make money from it this time?

Not at the time. In April 2022, I returned to work at the governor’s office. I’m not sure why, but I finally got an official appointment and was put on the government’s payroll. My salary level was grade level 13, and I was paid ₦120k/month. Then I’d make an extra ₦200k/month from photo books and other extra tasks.

But I understood that I had less than a year left at the job since their tenure was about to end again, so I focused on learning about these programming languages as much as I could.

My last salary was in May when the governor and his wife got out of office. I’ve been on my own since.

Tell me you’ve started making money from software development

Of course. I’ve returned to it full-time. I feel like I’ve been out of the photography game for a bit, so it’s probably time to focus on tech — it’s my first love anyway. I worked on one or two projects last year and made ₦500k.

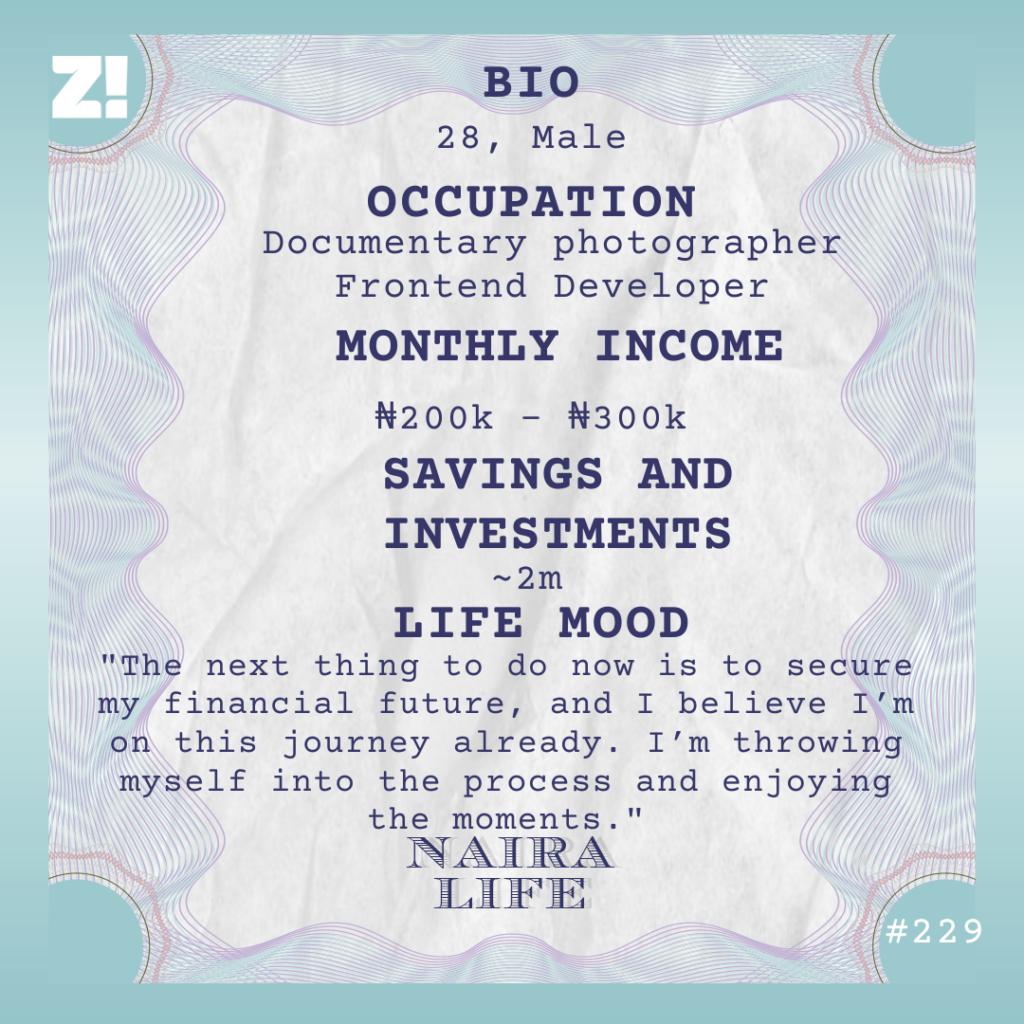

After my job at the government office ended in May, I moved to Abuja. At the moment, I work as a freelance frontend developer and make between ₦200k – ₦300k/month.

Do you know where this goes?

My expenses are very low.

Monthly contribution — ₦70k

Feeding — ₦40k

Data — ₦15k

I have two separate monthly contributions — ₦50k and ₦20k. Every month, someone in the group takes all the money. There are 11 other people in the group I pay ₦50k every month, and it was my turn to pack the money last month. So I got a bulk amount of ₦600k. Everything is going into a project I’m working on.

Do you want to talk about it?

My long-term plan now is to build tech businesses. At the moment, I’m working on a home service application. It won’t make me any money now, but I figured I might start building now. This is my focus for the next few years.

I have other ideas I’m working on, but those are still in early development.

In the next five years, I’m hoping to have developed these into companies valued at $1m. It seems like a lofty goal now, but I have the conviction. So I’m putting everything I have into it.

How much do you think you should be making now?

With everything I know about documentary photography, I should be making $2k/month. With software development, I think I’m at the stage where I should get a role that’ll pay me $40k/year. But everything comes in its own time. I’m more focused on building now.

Rooting for you. Do you have any savings or investments?

I have about ₦1m saved from my last job with the government, which is also my emergency fund. It would have been more, but I spent a lot of money recovering from my accident. Also, I have an investment in real estate — my sister convinced me to buy a piece of land in 2021. This cost me ₦1.2m.

What do you want right now but can’t afford?

A car, maybe. I sold my last car after my accident in 2021. It’d have cost me more to fix it. But this is a want — I’ve just moved to a new city and am navigating life there. This will have to wait.

On a scale of 1-10, how would you rate your financial happiness?

5. I don’t look for money to throw it around. I just want enough to keep body and soul together and afford basic stuff. I’m at this point right now. The next thing to do now is to secure my financial future, and I believe I’m on this journey already. I’m throwing myself into the process and enjoying the moments. The money may not be here now, but if I keep to the path, it’ll surely come. I believe that.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Yes, I want to do a Naira Life

Find all the past Naira Life stories here.