Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your oldest memory of money?

I remember my aunt coming to our house on weekends and bringing gifts with her every time. She was a badass tailor, and everyone said she was rich. Her frequent visits to the house meant I could ask her for anything and she’d get it done. My most expensive request was a bicycle. I was about six years old.

I’d asked my parents for the bicycle, but they dribbled their way out of it. They were raising four children on their civil service salaries, so they didn’t prioritise things like that. However, we were very comfortable.

Growing up, everyone in my family — from my parents to my aunt — was some of the most hardworking people I knew. And from watching them, I knew that if you worked hard, you’d make money and live a soft life. Also, my older sister became a millionaire at 19. All of this exposed me to the concept of money relatively young.

Did this push you to go look for money yourself?

All I did was face my book. The thought of making money didn’t kick in until university. My allowance was ₦20k/month, which was great. But everyone in my family was fiercely independent, so I started thinking about things I could do to make money. Between my second year and third year, I started three businesses in school.

Tell me about them

At first, I was making hair for students, charging between ₦1500 and ₦2000 per job. In a good month, I could make up to ₦15k. I stopped this in the second semester because it was so much effort for little pay. I wanted to raise my prices and nobody wanted to pay.

Then I started making Ankara journals and selling them for ₦1k. Again, people complained about prices, and I wasn’t going to bring the price down. I shut that down too.

When I got into 300 level in 2017, I settled on soap making. I’d learned saponification in secondary school chemistry class and knew what to do. I worked on a formula during the session break before returning to school.

Interesting. How did this work out?

A bottle cost ₦300, and I was selling an average of two bottles per day. Then a cousin advised me to pitch my services to hotels in town. I didn’t think anyone would take me seriously because I was 17 years old. But I landed two hotels and the deal was to supply each hotel with 50 litres of soap every month.

A 25-litre jerrycan was ₦10k and I was making ₦20k from each hotel. That’s ₦40k a month from soap making, and I still had my ₦20k monthly allowance.

Sweet.

This lasted for a few months before both hotels ghosted me — I think they found a cheaper option. None of them even bothered to send me a breakup text. I was back to living on my monthly allowance. I didn’t bother to start anything else though. My attention had drifted to something else.

RELATED: NairaLife: The Photographer Who Went From ₦50K To At Least ₦800K/Month

What was that?

An internship at a radio station. I was studying zoology at the university, but I loved the arts. Also, I’ve always loved doing accents, and everyone said I had a nice voice. When the opportunity to intern at the radio station came, I took it. This led me to my next job.

How?

In 2017, another radio station was working on a jingle and wanted a fresh voice for the voiceover. A friend recommended me for the job because he thought I had a way with words. I went in and did what they needed me to. They paid me ₦7k for it. Thing is, I would have done it for free.

Haha

They also thought I was a natural at it. Subsequently, they called me back for other projects. These were mostly unpaid, save for the “transport money” — ₦500 here, ₦1k there. But when they paid me, I’d go home with ₦5k.

Years later, I’d find out that the going rate for what I was doing for them was ₦20k. I don’t feel like they exploited me; I learned a lot about voice acting working with them. Besides, I was doing it mostly for fun.

What happened after?

In my final year, I decided that voice acting was an option I’d like to explore. But I put everything on the back seat to face my books again. I graduated from uni in 2019 and applied to serve in a media house for my NYSC. My primary job role was as a front-desk representative, but I was also an audio intern. This meant jumping at voice-over tasks whenever the opportunity came.

Were you being paid at the job?

I was. My combined income during NYSC was ₦55,500 — my salary at the job was ₦22500 and the federal government paid ₦33k. Sometimes, I’d get occasional radio jingle voice-over work on the side and get paid ₦5k. But those weren’t consistent: I got about four of those the whole year.

How were you moving money out?

I was saving ₦20k/month in an ajo scheme of 10 people I was in. We took turns collecting ₦200k every month.

I’d been robbed on my way to a job interview and developed a fear of public transportation. So

I made an arrangement with a driver to pick me up from home and back every day and paid ₦20k/month.

Thankfully, I was living with my parents, so accommodation and feeding were sorted.

When Covid came in 2020, my place of work stopped paying my salary, reducing my monthly income to ₦33k. Once I took ₦20k out to save, I was left with ₦13k.

Phew

In April or May 2020, it was my turn to collect ₦200k from the ajo. The first thing I did was to take ₦150k out to buy a 2012 Macbook Pro. It was a necessary purchase because I wasn’t going to work anymore. Yet I needed to practice my audio production and record my voiceovers. In addition, someone gifted me a microphone and a sound card.

I spent the rest of the lockdown and 2020 practising and learning everything I could. I was constantly broke because there was always something voice-acting related I needed to spend on, mostly self-development.

But I came out of the learning phase sharpened and confident in my skills. So I started putting myself out there and got my first regular gig in October 2020.

How did that happen?

I opened an Upwork account when I was at uni in 2017. I even did two $5 jobs before I abandoned it. When I returned to it in 2020, I was vigorously sending proposals and pitches. Then I landed the first client who wanted a voice actor for their audiobook projects. The pay was $50 per finished hour.

What’s a finished hour?

It’s how payments are decided in the voice-acting industry. Typically, you’re paid for each hour of the actual recording output.

Gotcha

This was a recurring gig, and I was making $500/month: each book I narrated was about five hours long, and I’d do two books in a month. It gave me a sense of stability and a bit of financial wiggle room. For example, my earnings from this gig were the reason I could attend a voiceover course I’d always wanted to take in February 2021. The fee was ₦100k.

How did that go?

It was great. I came back with so much ginger, equipped with how to navigate the business parts of voice acting.

I also realised that I wasn’t cut out for radio jingles and commercials. I wanted to do animation voiceovers and audiobook narrations. There weren’t a lot of local opportunities for these, so I set my sights on foreign audio production companies.

I’d go on Instagram, find audiobook publishing companies, find the email addresses of whoever was in charge of recruiting talent and send them an email introducing myself and attaching demos of my work.

Did it work?

I got tons of rejections, man. I call that period a dry season, and it lasted for the first half of 2021. I lived on my savings from previous projects and whatever I made from the local projects that occasionally came in. For those, I was now charging ₦15k-20k for a minute ad.

When did your pitches start yielding leads?

I landed my first project in June 2021; an audio drama series. I was supplying them with five to eight hours of audio every month.

How much were you charging per finished hour?

$100. This project brought in between $500 and $800 every month for the three months it ran for. After that, I got another audiobook project that paid me $1300. For the rest of the year, I got a few more gigs here and there. I was a little busy.

Do you know how much you made in the second half of 2021?

Over ₦1m. But I was also in debt. ₦800k. Most of what I made in the year went into paying it off.

That came out of nowhere

Living in Nigeria showed me a lot and affected my productivity in 2021. Power shortages and noise pollution were my biggest opps. So I needed to set up a studio to improve the quality of my work. My mum borrowed me ₦300k at first, which went into acoustically treating my room to block out noise. Then ₦500k later to buy an inverter and an air conditioning unit. Productivity boost.

2022?

I increased my rates to $125/finished hour. However, there was another bit of a dry spell in the first half of the year where I didn’t have regular gigs. But things opened up again in the second half. From June 2021, I was making about $1k/month from two major clients plus $500 extra from one-off gigs.

At the same time, I took local gigs when they came, even though I didn’t depend on them. These brought in ₦50k – ₦100k for a minute voiceover. They weren’t consistent because I wasn’t looking for work in the Nigerian market – I wasn’t interested in doing commercials.

By the end of 2022, I’d increased my rates a few times and it was now $225/hour. I’d also built my emergency savings up to $2k.

Well done. What’s happened between then and now?

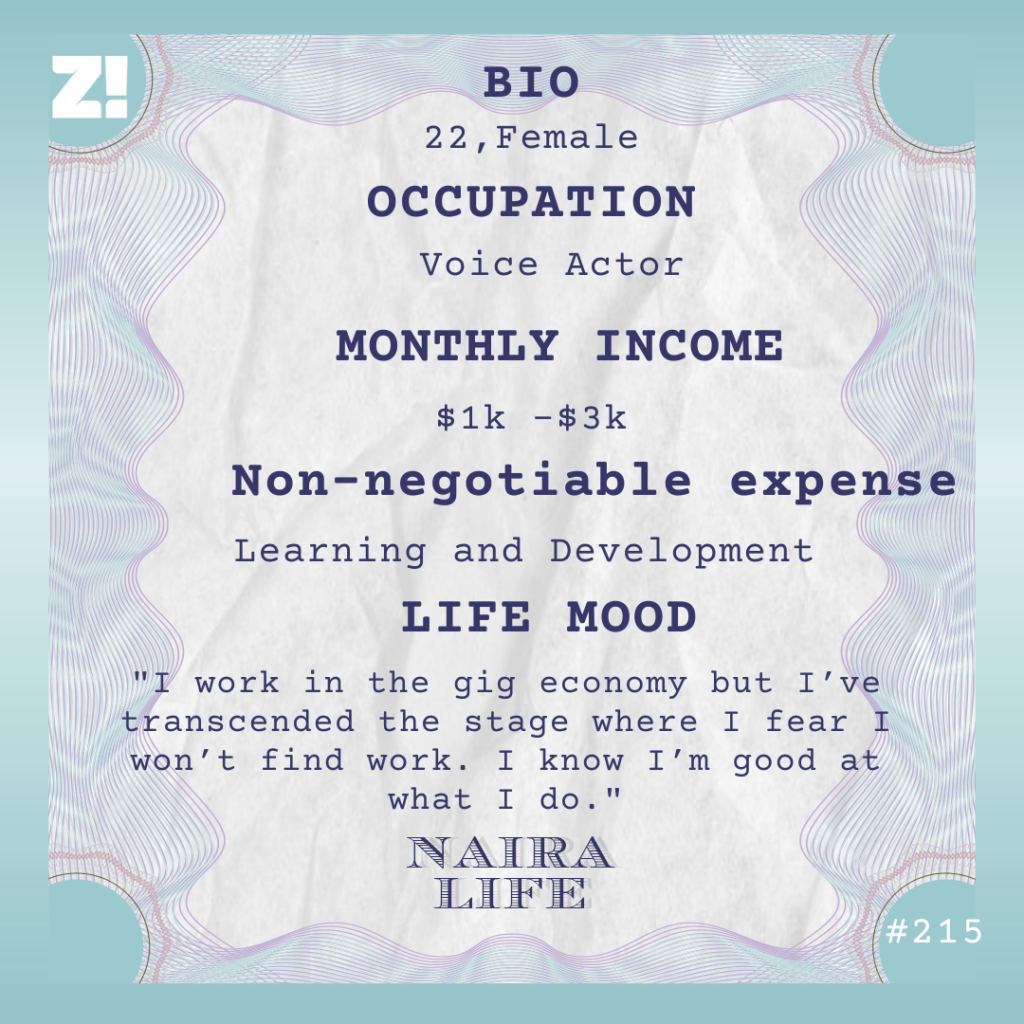

I increased my rates again to $250/hour, which means working on fewer projects and having more freedom to choose the projects I want. I now make about $3k in a good month and $1k in a bad month.

I’ve also landed a big project with a studio for a 13-episode project.

How much?

About ₦7m – ₦10m per season. I’m currently working on that now and the other side projects.

Phew. I think you’ve come a long way in the past five years

The major driver has been my insatiable thirst for growth. I’ve realised that learning how to put myself out there while learning the work to be better at what I do has a direct influence on how much I get paid. It’s why I’ve been so big on self-development. I spent about $3k on a couple of voiceover courses in January, and they were worth it. The more I put in, the more I can take out.

By the way, remember the voiceover course I took in 2021? I work with the organisers as an instructor now. I’m not being paid a lot but it’s just proof of growth. A few years ago, I was dying to go there.

Love it for you

I work in the gig economy but I’ve transcended the stage where I fear I won’t find work. I know I’m good at what I do. That said, I make sure my emergency savings is always there. And before I finish off a job, I’m already pitching for a new one.

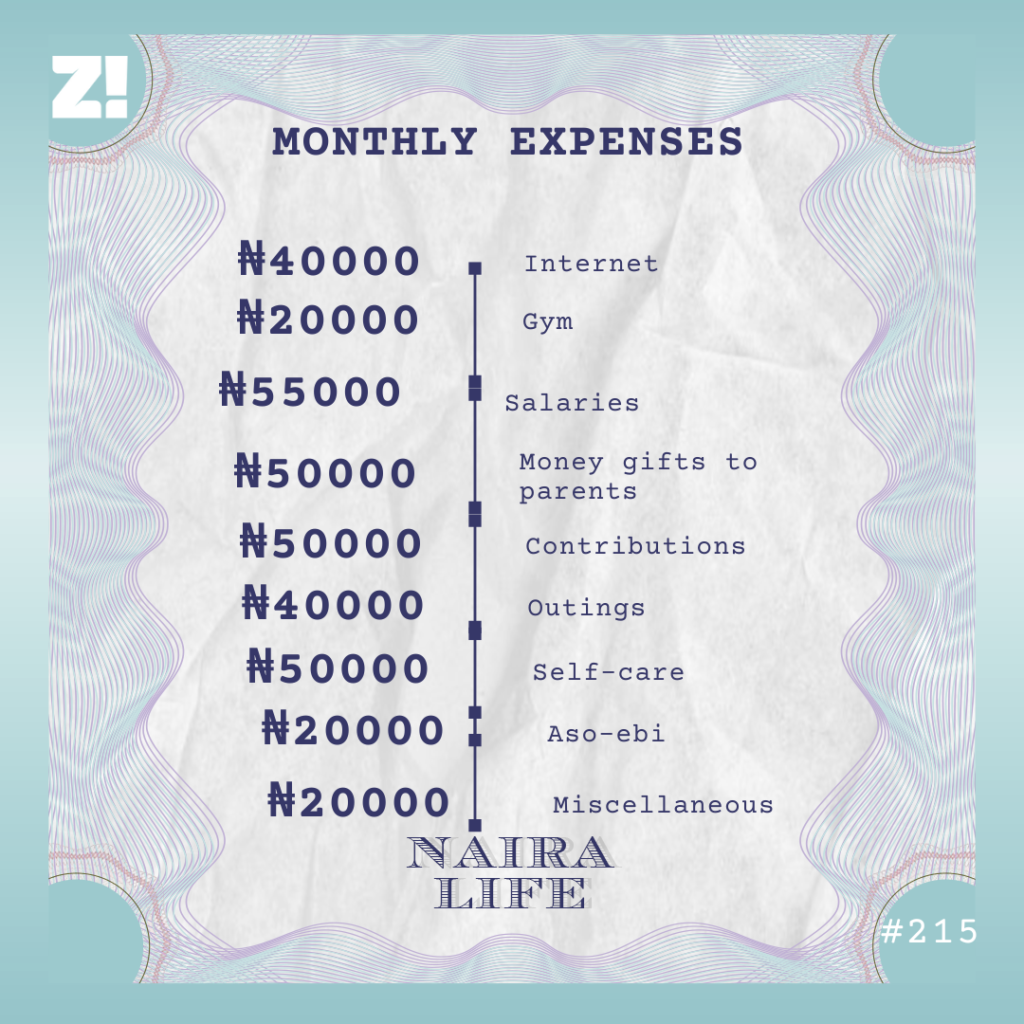

That’s probably smart. Let’s take a look at your monthly running costs.

I live on a monthly budget of ₦350k

I have an audio editor who works for me, and I pay them monthly. They save my time and help me increase my output. I budget for Aso-ebi and wedding gifts because a lot of my close friends have started getting married. If there’s no wedding in a month, I save the money somewhere.

Interesting. What about your core savings?

I have $2k in emergency savings. That’s my safety net and I don’t touch it for anything.

Beyond my emergency savings, I also save 40% of my income every month. At the moment, I’ve built this up to about $5k. The next step for me is learning more about what to do with my savings and not just leaving them in the bank.

Do you have any investments?

I invest $100 in stocks monthly. I’ve done some research and the one thing that keeps coming up is that it’s best to invest in companies that I like and believe in. That’s my strategy. My stock investment is a combination of S&P 500s, Apple, Disney, Netflix and Starbucks. I’ve done this consecutively for a few months now and have invested about $700 – $1k.

How much do you think you should be earning now?

Anything between $5k – $7k. Investing in tools and resources that will help my output and productivity is a direct line to hitting this number. At the moment, I still live with my parents but am looking to set up a better studio outside of the house.

Is there anything you want right now but can’t afford?

I’ve been thinking about a trip to Paris recently. But I’d need $5k for the kind of trip I want. I can’t shell that out right now. Looking to save for it for the next few months.

What’s your financial happiness on a scale of 1-10?

It’s a 7 seven right now. I might hit an 8 or a 9 when I start making $5k – $7k/month. But I’m still 22 years old — it will come. The millions will also come.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.