Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Kwakol Markets is a global broker that lets you trade multi-asset financial markets with ease. They aim to provide transparent and innovative technology that gives you a simple, secure and superior experience. Start trading with Kwakol Markets today and create the future you deserve.

What’s your earliest memory of money?

My dad would bring bundles of cash home when I was around 7 or 8 years old.

He supplied construction materials to the military and got paid in bearer cheques. I’d find him removing money from brown envelopes and stashing them in his safe. My mum’s a nurse, so we were quite comfortable.

How comfortable?

My dad worked in the medical arm of the military, but we didn’t live in the barracks. We had our own place, and I attended an elite private secondary school. It wasn’t strange for students to bring ₦500 or ₦1k to school daily for lunch and end up unable to spend it all. My classmates even started a class savings bank of sorts where we all dropped money we weren’t using till whenever we wanted to take it out. I was one of the highest contributors.

What did you spend your savings on?

Random snacks and stuff. I even started a business selling stationery to my fellow students.

What inspired you to start?

My dad had a cool collection of ink calligraphy pens, and I regularly took them to school. My classmates loved them, and I started exchanging the pens for money.

My parents soon noticed the missing pens and encouraged me to start a business with them, rather than selling my dad’s pens. My mum bought the first set of supplies: a dozen 20-leave notes, a dozen HB pencils, a couple of lucky racer biros and six ink pens.

You were officially open for business

I was well-liked in school, so many students patronised me. My mum helped me restock during the weekends, but after the first set of materials she paid for, I gave her money for the rest from the sales I made during the week.

My profits were almost double the cost of the materials, and I spent it mostly on snacks.

The business only lasted two terms before the school management shut it down. They also got wind of the large sums in our savings bank and put a stop to that too.

Na wa

I didn’t try another business until I joined my department’s basketball team in uni.

Wait, let’s rewind. How did you start playing basketball?

I usually followed my dad to the gym at the national stadium in 2013. He encouraged me to play basketball instead of sitting and waiting for him to finish his sessions. The admission fee to the basketball court was ₦500, and I played and discovered I liked it.

My senior secondary school didn’t have a basketball program, so even though I was in SS 1 at the time, I went to play in the JSS 3 program of my old school. I did a few competitions with them for the one year I played with them — I stopped when I moved to SS 2.

But I missed competitive basketball. Fast forward to 2016 when I got into uni, the basketball community was the first thing I sought out. However, they didn’t let first-year students join the school’s team, so I couldn’t join until I moved from the main campus to the medical campus for my second year in medical radiography.

How did the business come in?

I schooled in the East, and we didn’t have access to basketball essentials like compression pants, shooting sleeves, and good basketballs. I decided to use my “living in Lagos” advantage, so whenever I went home on holiday, I’d purchase the materials with my pocket money (monthly allowance from my parents) and resell them in school.

I made a ton of profit, too. I could sell something I got for ₦1k at ₦4k or ₦3,500. I did that for almost two years while also playing competitive basketball. We typically played in school and inter-school events and won a couple of games too.

Did you ever get paid for winning games?

Never. We were even the ones spending our money. We got our own kits, painted the court and constructed our own hoops. There was someone from school management who was supposed to be in charge of those things, but this is Nigeria.

I stopped the business and active basketball after a freak injury in my third year. I slipped on spirogyra while walking out of my room and dislocated my ankle. I initially thought it was a minor injury and even played a couple more games. But when I started feeling throbbing pain in my leg, I decided to quit the game. I limped for a long time after that.

So sorry about that

Thank you. After dropping basketball, I started exploring other options to make money. One day, someone asked if I could crack Photoshop. I’d been something of a computer whiz since secondary school, thanks to the comprehensive practical lessons my school provided. I even became a certified network professional with Cisco in 2016.

So, I said yes to the Photoshop cracking request, and they offered me ₦5k. I was shocked because I was going to do it for free. That’s when I realised I could make money with tech.

Soon enough, word got around, and other students on our campus knew me as the guy to see if you needed help with your computer. It wasn’t very consistent, but I made the odd ₦5k to ₦10k fairly regularly. However, it wasn’t until my final year that my finances boomed.

What happened?

In 2019, my mum helped me land an academic writing gig with a friend of hers who was studying for a master’s degree in the US. She was also working and couldn’t keep up with the assignments and weekly projects. I got paid $10 – $15 per project. Then she introduced me to some fellow students to write for them as well, and I started earning $50 – $80 weekly.

Mad

I became confident in my writing skills. I mean, I was doing postgraduate-level work for international students as an undergraduate. So, I started actively searching for academic writing gigs. It paid off because I got clients from the UK and even started contracting out gigs to my friends and took a 50% cut of whatever we got paid.

I was still interested in tech, so on the side, I was also coding and designing websites as practice projects during a free three-month product design training/internship with a Fintech company.

During this time, I did about four freelance design gigs that paid an average of $150 each. There was still the monthly allowance I got from home — usually ₦50k.

To put it simply, you were balling

I was basically spending the money I made on food and enjoyment. I ventured into crypto trading too, but it didn’t end well. I bought $45 worth of Dogecoin in 2021, and it fell crazily. I think I eventually sold it for $5.

I also spent about $1k trading Bitcoin, Ethereum, ADA, and a few other coins, but I didn’t make any profit before I got tired of the whole thing.

The following year, I landed a product design job for a US company.

Tell me about it

I should mention that if it were up to my parents, I’d be a practising radiographer now. My family is very medically inclined, but I was never interested in it. I just did the course for them.

After graduation, I was expected to go on a one-year internship even before NYSC. But I told my parents to give me three months to do product design, and if nothing came out of it, I’d focus on medical radiography.

One day before the three months elapsed, my current employer announced some app updates on Twitter. I looked through their website and noticed a few problems, so I mentioned this to him in the thread. He reached out to me via DM and acknowledged that the data from their software backed up my analysis and wondered how I detected the issues so quickly. He asked if I had more insights, and I responded that I wouldn’t do that for free.

Next thing, he asked for my rates and portfolio, promising to send a contract across. This was around 12 a.m. I thought, “Is this one whining me? Who sends a contract without an interview?”

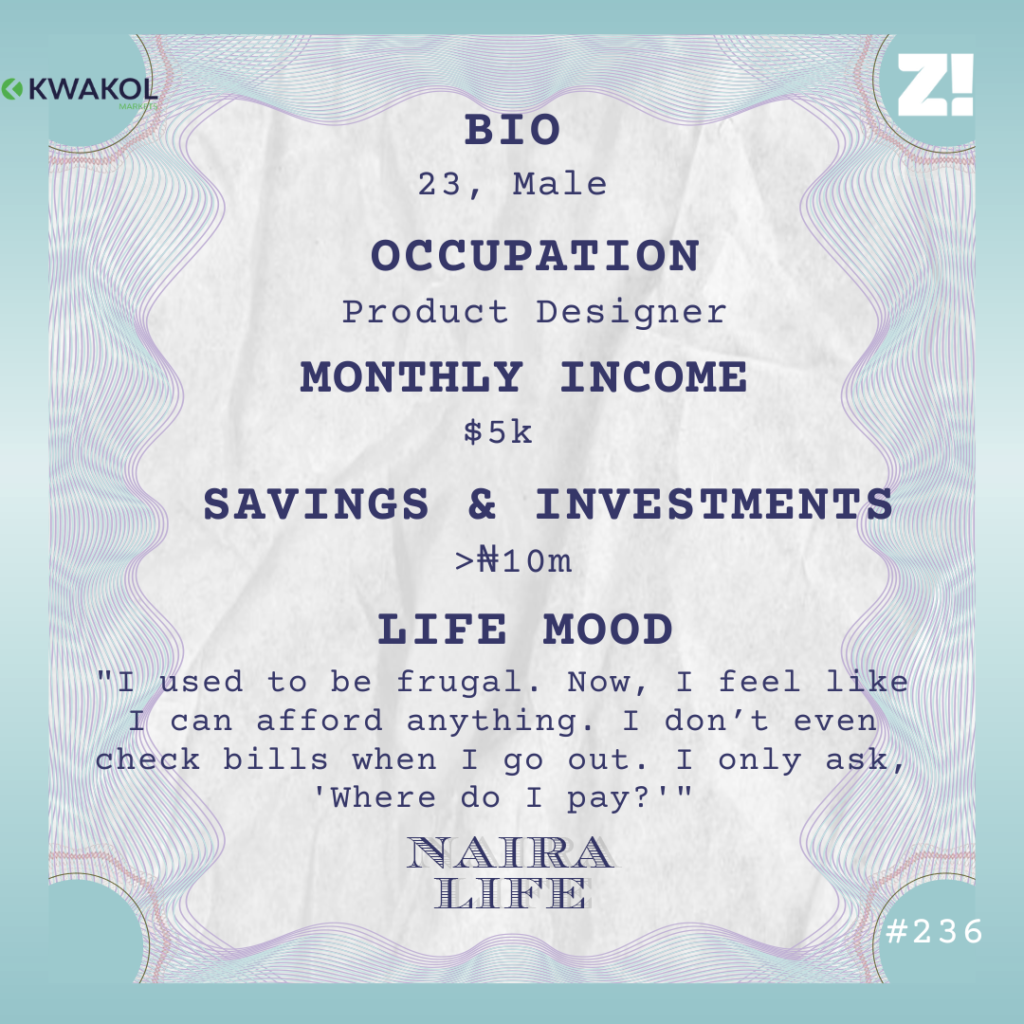

A few days later, I signed a 1099 contract for $5k/month.

Wow. How did that feel?

I kept thinking, “This thing can’t be this easy now,” until I got a cheque at month’s end for $3k as I didn’t work a complete month. The money was paid to my cousin’s US account because it was a hassle getting paid in Nigeria, and I was constantly asking her to check the money in her account to confirm it was real.

LOL

On July 25, 2022, I got ₦1.5m — the naira equivalent — in my account, and I started shouting, “I’m a millionaire!” I can’t forget that day.

I immediately sent my dad ₦300k and took my family out for a treat the next day. Over the next couple of weeks, I bought some tech gadgets. I got a new laptop for ₦600k, an iPhone 12 pro max for ₦600k, and a Series 7 Apple watch for about ₦200k.

What’s working for a US-based company like?

The different time zones mean I work between 8 p.m. to 6 a.m. They also pay by the hour, so when broken down, my pay is around $30/hour. I didn’t always make the full $5k; it was usually $4k.

However, I got promoted to design lead about six months later in January 2023 and took on more responsibilities, so I max out my hours and get the full $5k now. That’s about ₦3.5m/month, and it sometimes gets higher depending on the exchange rate.

How has this impacted your relationship with money?

My relationship with money has gotten very bad. I used to be a very frugal person — remember how I used to save in school? But now, the money just goes as it comes. I think this is what they call lifestyle inflation. I now feel like I can afford anything. I don’t even check bills when I go out. I only ask, “Where do I pay?”

It’s made me a bit out of touch about how much money is worth because if I hear someone complaining about needing money, it’s like, “Is it because of this amount you’re complaining like this?”

Last month, I visited a high-end restaurant with my cousin and just went straight to ordering. My cousin looked at me and said, “Are you seeing the prices of these things?” I wasn’t.

Looking back, I realise I probably spend someone’s monthly salary on food regularly, and I ask myself how I got here. With what I earn, I should have a few tens of millions in investments, but I don’t.

Do you have any investments at all?

Since the whole crypto brouhaha, I’ve tried to make safer investment choices. I currently have about $1k worth of Apple, Microsoft and Tesla stocks. I’m no longer trading crypto, but I’m currently holding about $6k in Bitcoin. Then there’s about ₦5m in a Nigerian account.

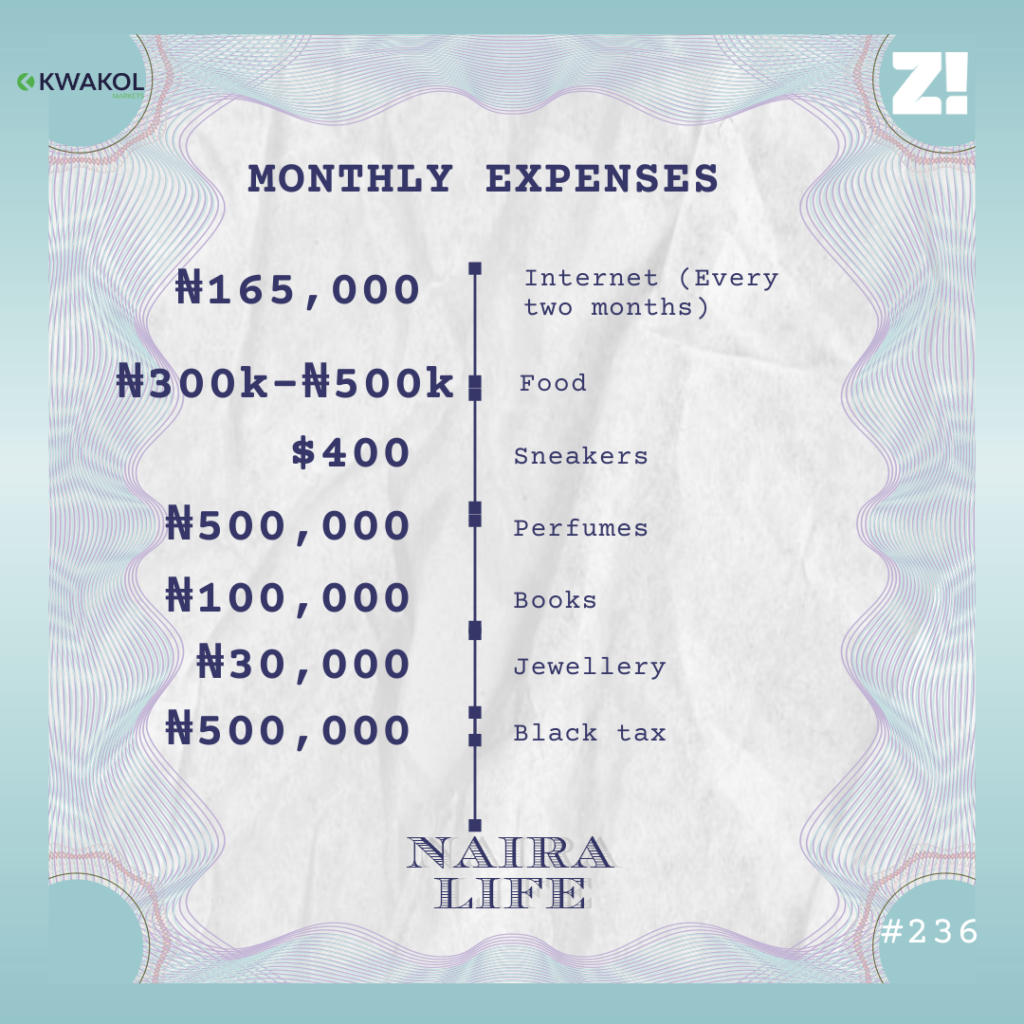

Can you break down your monthly expenses?

I spend so much on food because I eat out every day except Sunday, and sometimes I buy food for my youngest sister or my mum.

I live with my parents, so I don’t pay rent. My family knows how much I earn, which explains the black tax. Just a week ago, I gave my youngest sister ₦250k for her secondary school graduation. There’s also the odd flight ticket request, money for phone repairs, or school expenses for my younger sister who’s in university. I also collect things a lot; my recent obsession is perfume.

How are you thinking about long-term career plans?

Well, I have two companies, so I plan to be even more into tech.

That came out of nowhere

I hardly remember them because I don’t handle the day-to-day activities. The first one is an outsourcing company for tech talents in Africa. I started it with my best friend when I just got my job — my boss was always asking me to refer tech talents. That’s how the idea to match African talents to companies looking for cost-friendly alternatives to Silicon Valley guys came about. A week after launching, we got paid $5k to analyse data. It was more like an in-house contract, but it was still talent sourcing as we had to find and pay a team of data analysts to get the job done.

The second company is my private design studio which I started in the third quarter of 2022. Design requests go straight to my work email, and I take on contract projects from time to time if I feel it’ll be beneficial to my portfolio. If not, I refer someone else for it.

How do the companies run?

We acquire clients for the talent outsourcing company via cold emailing and running targeted ads on social media. Right now, everything is on hold till next month because we’re in the process of setting up properly and revamping our operations.

How much do you think you should be earning, with your skill level and businesses?

$10k – $12k/monthly.

Is there something you want but can’t afford right now?

I want to visit the UK, France and Spain, but with the current state of the economy, I can go and return to an empty account. Hopefully, it happens before the end of the year.

How would you rate your financial happiness?

In terms of financial liquidity, it’s definitely a 10. There’s really nothing I need that I can’t buy, maybe except a private jet.

But if you mean my relationship with money, it’s a 5. I feel like there are some things I should have that I don’t.

I recently had to pause my plan to purchase some plots of land in Lagos and Anambra at about ₦20m because I couldn’t afford it. But if I calculate what I’ve spent on frivolous items over the last six or seven months, it’ll very likely be more than ₦20m. I’m not happy with my financial decisions so far, and I know I can do better.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.