Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Grow your wealth in both dollar and naira, earning up to 15% in USD and 25% in naira. With flexible rates that move with the market, you can switch between wallets anytime to match your financial goals. Start here.

What’s your earliest memory of money?

I heard the term “school fees” for the first time in primary one, and I had two distinct thoughts. The first was, “Why is anyone charging money for school?” School felt like an essential part of life, and I didn’t know people paid for it.

The second thought was, “Does my mother also pay school fees?” She was a teacher, so I assumed we both had to pay school fees. When I asked her, she laughed and explained that she worked to get money and then used the money to pay my fees. That’s the first time I realised things weren’t free.

What was money like growing up?

I spent most of my childhood unaware of whether we were rich or poor. My mum didn’t allow thoughts like that to fester. When I asked for something she couldn’t afford, she’d emphasise the importance of being content with what I had. There was no room for self-pity.

My mum also handled the money and was responsible for financial decisions at home. I can’t remember what my dad did for money. I just know he fixed or repaired things.

In JSS 3, I finally noticed we really didn’t have money like that. I kept missing school and almost didn’t write the junior WAEC due to payment delays.

One annoying boy in my class kept pointing out that it was because we were poor. I got my revenge on that boy by beating him to the first position. At least, academics vindicated poverty.

I’m screaming. When was the first time you worked for money?

2016. After graduating from uni — I went to a school in Kenya — I took an 8-month internship at a bank. My pay was KSh 10,000/month, which was about ₦25k. The money wasn’t even enough to cover a student, much less a working person.

Fortunately, I lived with someone, which cut down my food expenses. I only spent on transportation, data, and the occasional snack at lunch. It was still not much money to live on, but moving to Kenya for uni had taught me how to manage money. I’d learnt to channel the little I got from my mum and random donations from strangers to school fees and necessities, so adjusting to my pay wasn’t so difficult.

I’m curious. Why a Kenyan uni?

I finished secondary school at 14, and I think my mum was scared that Nigerian universities wouldn’t want to take me. So, she sent me there and we made it work.

Fast forward to my internship at the bank. It was finance-related, and I enjoyed it. But I wasn’t sure I wanted to make a career out of it. My interests veered towards development, governance, and public speaking because that was all I did in school. I participated in many extracurricular events in my undergraduate days: hosted events, participated in school council elections, and attended every campaign. I’d hear there was a “save the trees” campaign somewhere, and I’d go. Did I care about the trees? No, I just loved attending and participating in the campaigns.

It was pretty clear my passion was in the development sector. So, while I worked at the bank, I also applied for a master’s degree in development studies. Unfortunately, I didn’t get a scholarship. So, after my internship ended, I packed my bags and returned to Nigeria.

What was the plan?

I decided to do my NYSC. I returned in 2017, and it was a fantastic idea because I finally got to work with a development organisation. The NGO paid me ₦25k/month, and I got the ₦19800/month stipend from NYSC.

The highlight for me was how much I learned. I travelled to 13 states and multiple communities across Nigeria, doing important work. I hoped they’d retain me after NYSC, but I only did two extra months of consultancy with them. At least they paid me ₦120k/month for those two months, which I left in a savings account.

I’d also saved most of my salary throughout service year — I lived with people, so my expenses were minimal. So, after the consultancy, I carried all my savings and travelled to Rwanda for vacation. Now that I’m saying this, I realise I can have a sort of arrogant confidence about money and don’t mind spending it on things I want. I was jobless and had nothing to return to, but I still went ahead and travelled for a month.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

What did you do when you returned?

I was unemployed for five months, applying for several jobs. I survived that period by just staying indoors and avoiding billing. I also lived with a very chill person, and they allowed me to figure things out.

I finally landed a job in May 2019. It was another NGO role, but my salary this time was ₦88k. A month later, I left it for a communications intern role at an NGO that paid ₦80k.

Wait. Why?

It’s funny, but the ₦80k job had a better work environment. The office had natural light, and my colleagues were younger. It looked like a more challenging environment with better opportunities for me, so I took the pay cut.

It wasn’t great money, but I could finally move to my own apartment. About eight months into the internship, my salary was reviewed to ₦120k. A few months later, an older colleague sent me an opportunity to join the global arm of the NGO. I applied and got the job.

It was wild because I was just an intern, not an officer or advisor. It was practically unheard of for an intern to jump to the global branch. My salary jumped to ₦350k, and I mostly worked remotely since I worked with the international team. It was sweet. I only left the job in 2021 because I finally got a master’s scholarship after years of trying.

Love it! You had been trying while working?

I never stopped trying. I even furnished my apartment lightly because I kept waiting for an admission to click. The thing is, I was getting the admissions, but funding was the problem.

When funding finally came, I packed my bags and moved to the UK. I’d saved about ₦2m over the years, and everything went into visa fees (plus the crazily expensive £600 health surcharge), flights, and shopping.

The scholarship also came with a stipend, about £3k/quarter. It wasn’t enough to cover all my bills and £450/month rent, so I got two part-time hybrid jobs. It was basically the same job in two different places. My school had an online platform where students could access courses, and I helped two different departments optimise the digital learning experience for fellow students. The pay was £10/hour, and I split my 20 hours/week work limit between both jobs.

Was that good money?

It was. I worked both jobs until I finished my postgraduate program in 2022, saving £3k in the process. Foolishly, that money still went to the British government.

I couldn’t stay back in the UK without transitioning to a work visa, and I heard of an option where I could pay £2k for a post-study work visa. It’d allow me to stay in the UK for two years. It was enough time to hopefully find an employer willing to sponsor a longer-term skilled worker visa.

So, I used my savings to pay for that, but unfortunately, I didn’t get a sponsored job. Actually, I got a job with an NGO, but it was a £600/month internship that couldn’t sponsor my visa. I just took it because I’d finished my program, and there was no scholarship stipend anymore.

Less than a month later, I landed a remote senior advocacy role with another US-based NGO. This one paid $3500/month. It made escaping the UK much easier.

How did you go from wanting a visa to wanting to escape?

You know how I once left a job because another office had natural light? The whole UK doesn’t have natural light. The sky is always grey and drizzling, and the people never smile. I’m a very expressive person, and the place was too gloomy for me. It was borderline depressing.

Besides, the UK internship was just one year, and the US job paid six times what I earned. There was no point waiting for a visa when I didn’t like the country and was constantly fighting depression. So, I told my UK employer I wanted to return home for a short break. I returned to Nigeria and completed the rest of my internship remotely while working with the US people.

Was the plan to return to Nigeria permanently?

The plan was to come and decongest for about three months, soak up some sunshine, and eat amala. I even tried to rent an apartment for three months, but I saw a three-bedroom flat for ₦1.5m/year. That was equivalent to my one-month rent in the UK, where I shared a bathroom with five people.

I took the place thinking, “Well, if I leave before the rent expires, it won’t pain me because that’s what I’d have spent for one month.” It’s been two years, and I’m still here.

I faced a lot of backlash from people. The common consensus was: Why would you leave the abroad to come back here? But I told people, “Omo, you can pick the struggle you want.”

You can do well financially, have great pictures abroad, see snow, and be depressed. Or you can come back to Nigeria, be with your people and just be in community and content. My two-year UK visa has even expired, so I’m still here for the foreseeable future.

What’s your income like these days?

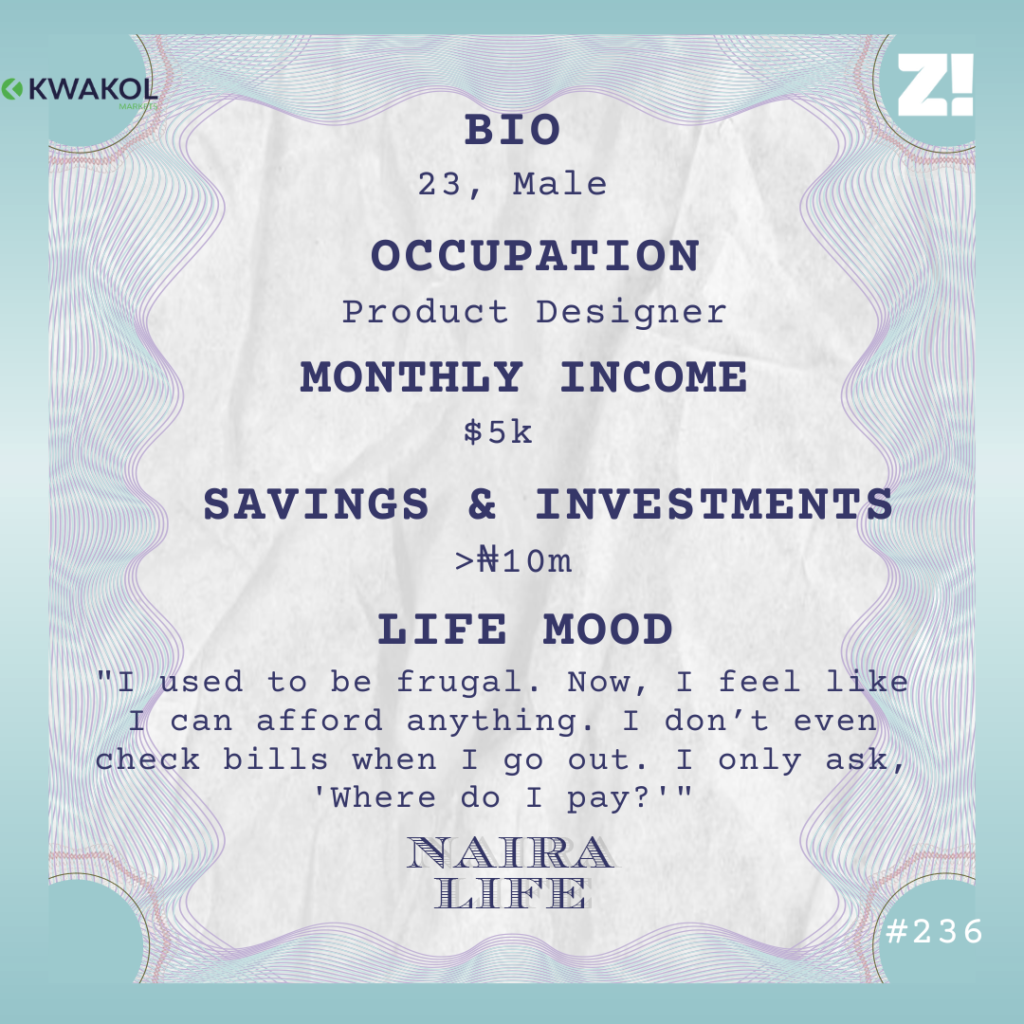

It’s actually zero. I just started a three-month sabbatical this July. But, up until June, I worked with the US-based NGO that paid me $3500. My salary increased to $4k/month after about a year.

Why are you on a sabbatical?

Burnout. I’d been tired for a while, and a few months ago, I had a terrible travel experience in an African country that led to a four-day detention. I think the trauma and general exhaustion from life just triggered a mental breakdown. I couldn’t concentrate at work and needed a break.

I wanted to take a year off, but my money will finish, and I was scared I’d completely lose the motivation to return to work. So, three months seemed safe. Right now, I plan to get back to myself first and hopefully get back in a mental space to think about work.

Fingers crossed. How did you financially prepare for a sabbatical, though?

I didn’t need to plan anything, so it wasn’t hard. I’ve automated my finances in a way that I think should sustain me even if I didn’t have to work for a year.

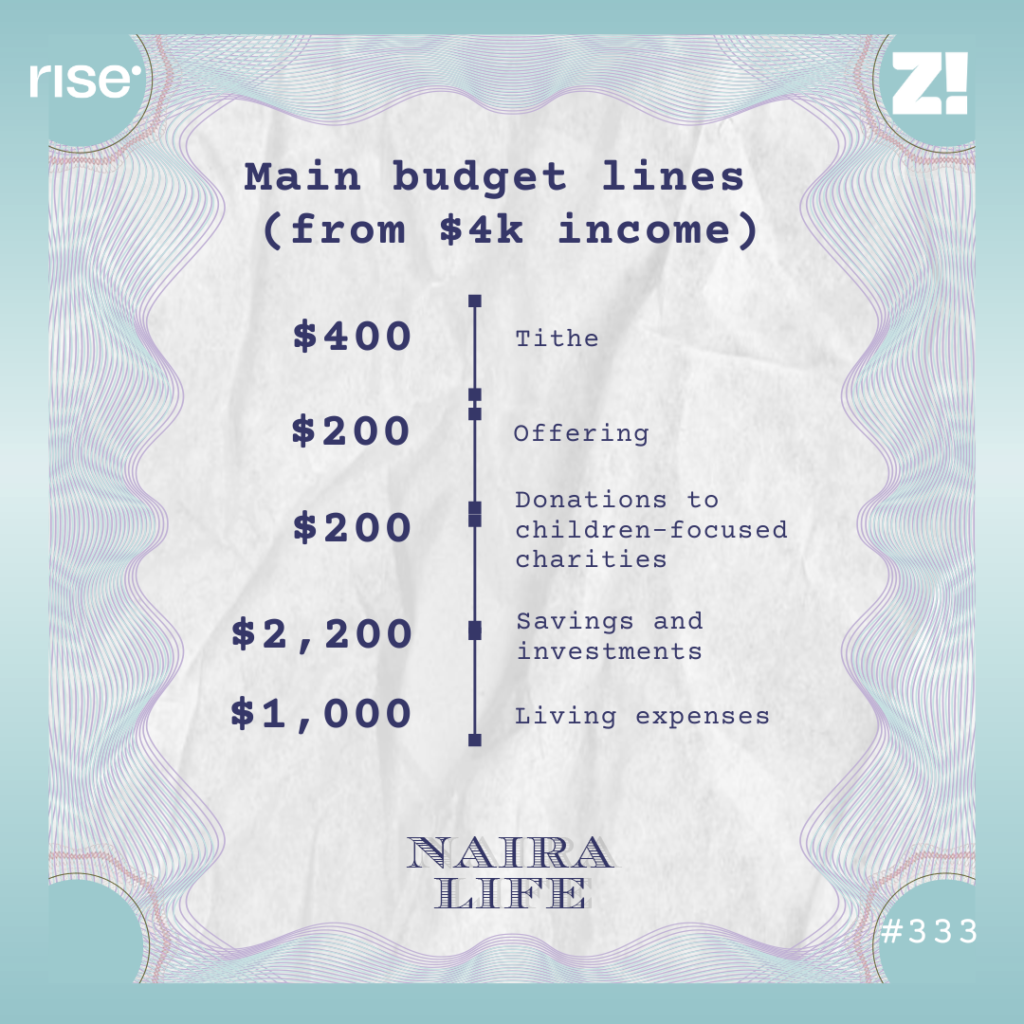

I typically live way below my means. I wouldn’t touch July’s salary on a normal day because I’m still living on January’s salary. Only 25% of my earnings go to day-to-day living expenses, 20% to tithe, offering, and children-based charities, and the rest to savings and investments.

For the latter, I have a high-yield savings account on a fintech app that also allows me to invest in stocks. My savings and investment budget is $2200/month, so I put $1200 in low-risk stocks on the app and $1k in the high-risk ones. My portfolio is currently $23k (about ₦35m).

I also have ₦5m in a fixed-deposit account because my brother got into uni last year, and I wanted some money aside from my main purse in case I needed to dip into it to sponsor him. I also have two plots of land I got for ₦15m early this year and ₦1m in Nigerian shares to diversify my investments.

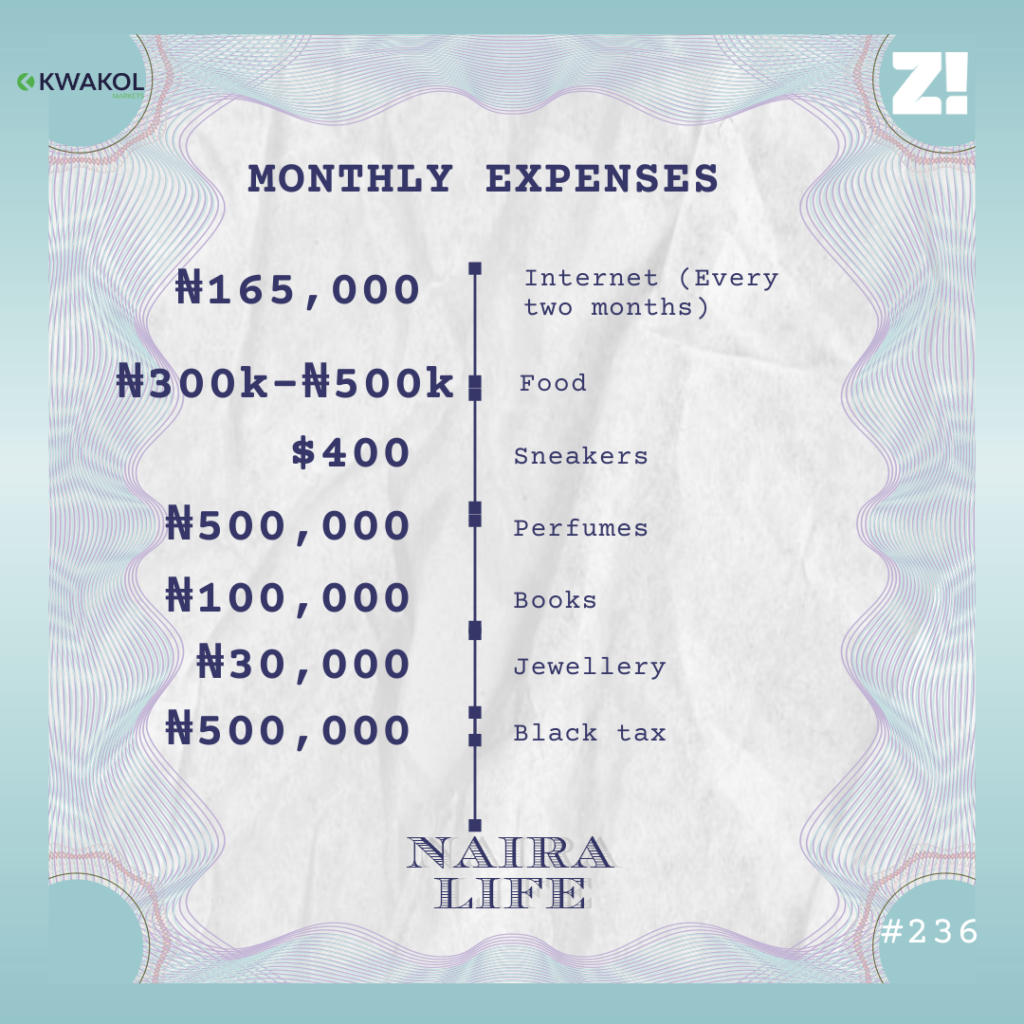

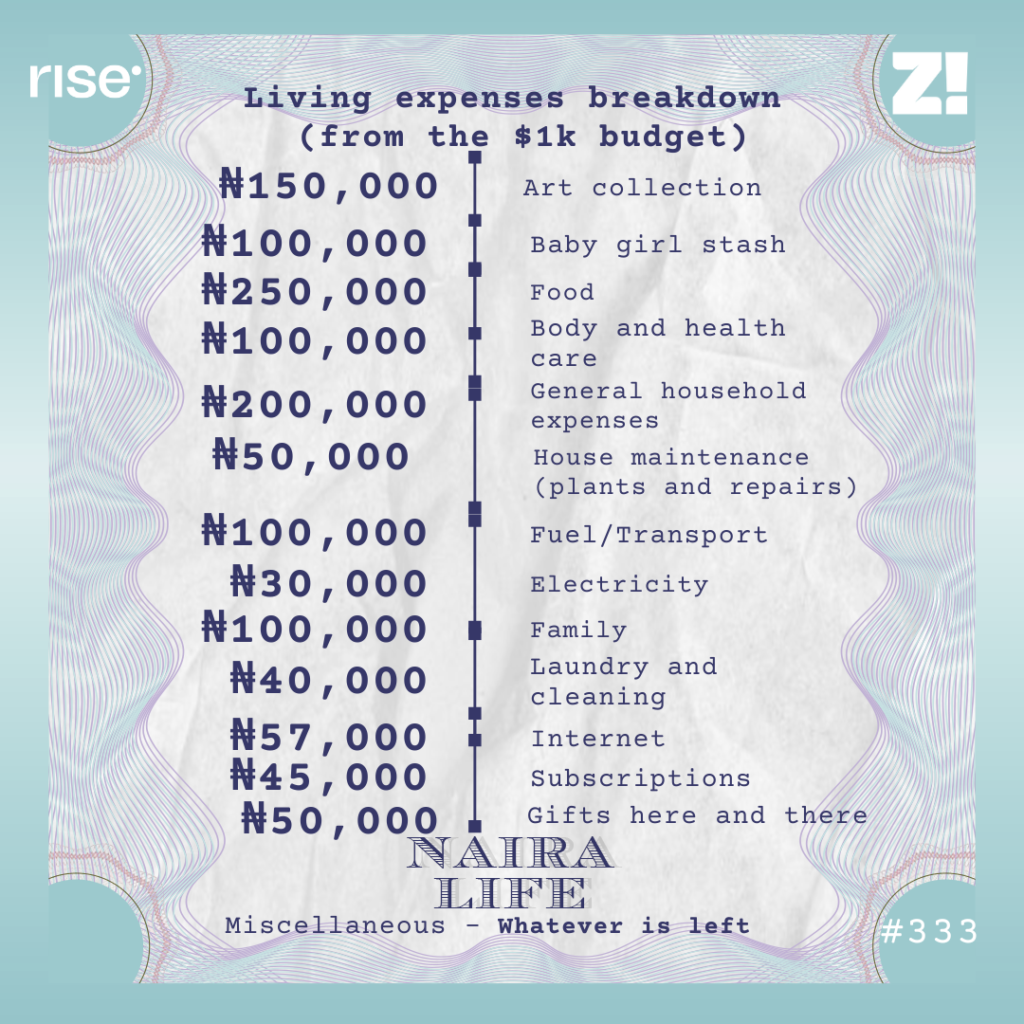

Can you break down the day-to-day living expenses bit for a typical month?

I’ve been collecting art since February because I dreamt that my artist friends will soon blow and I’m hoping their art will become millions in my house.

I rate it. Do you deliberately set out to live below your means?

It has much to do with how I grew up; the “be content with you have” mindset. I literally just started learning to buy new things for myself. My mum was the queen of thrift shopping and seeking out bargains. I can spend five years researching a product I want to buy to ensure I’m getting value for my money, no matter how negligible the amount.

The only thing I don’t have a budget for is travel. Once there’s a destination and I have the money for it, I’m gone. I’ve been to over 20 countries, and no one paid for any. I don’t even think twice about the money. I also spend money on friends and relatives.

But when I’m not travelling or giving people money, I’m keeping it. Sometimes I wonder what I’m keeping money for. The whole “Pay yourself first. Invest before you spend” rhetoric doesn’t apply to me because I don’t need discipline to save money.

Tell me more

Being prudent is the only way I know how to be. I’ve noticed there’s a bit of perfectionism in how I handle my finances. I believe God gives me everything I have to be a good steward of it. What will I have to show for the money if I’m just flinging it around, spending like crazy? Besides, how much is the money sef? If God can’t trust me with something small, how will he trust me with more?

So, I guess in my head, I’m just keeping money and waiting to discover what I’m supposed to use it for. One thing I really want to do, though, is to buy a three-bedroom apartment one day so I can give it to my granddaughter. It’s funny, but it has to be my granddaughter. It feels symbolic. Maybe that’s the thing I’m keeping money for.

Have you made any lifestyle changes since you’ve gone on sabbatical?

I was hoping to cut down my expenses, but I can’t lie; lifestyle inflation has entered. It’s not yet the end of the month, but I’ve already maxed out my baby girl stash by 300%. I just have more cravings these days. It’s like I just want to eat amala and buy two-piece outfits.

I’ve not gone beyond my total budget. Even if I continue like this for three months, I won’t eat up to one month’s salary. But I’m a little disappointed I haven’t been able to shrink my expenses since I’m not earning. I need to do better.

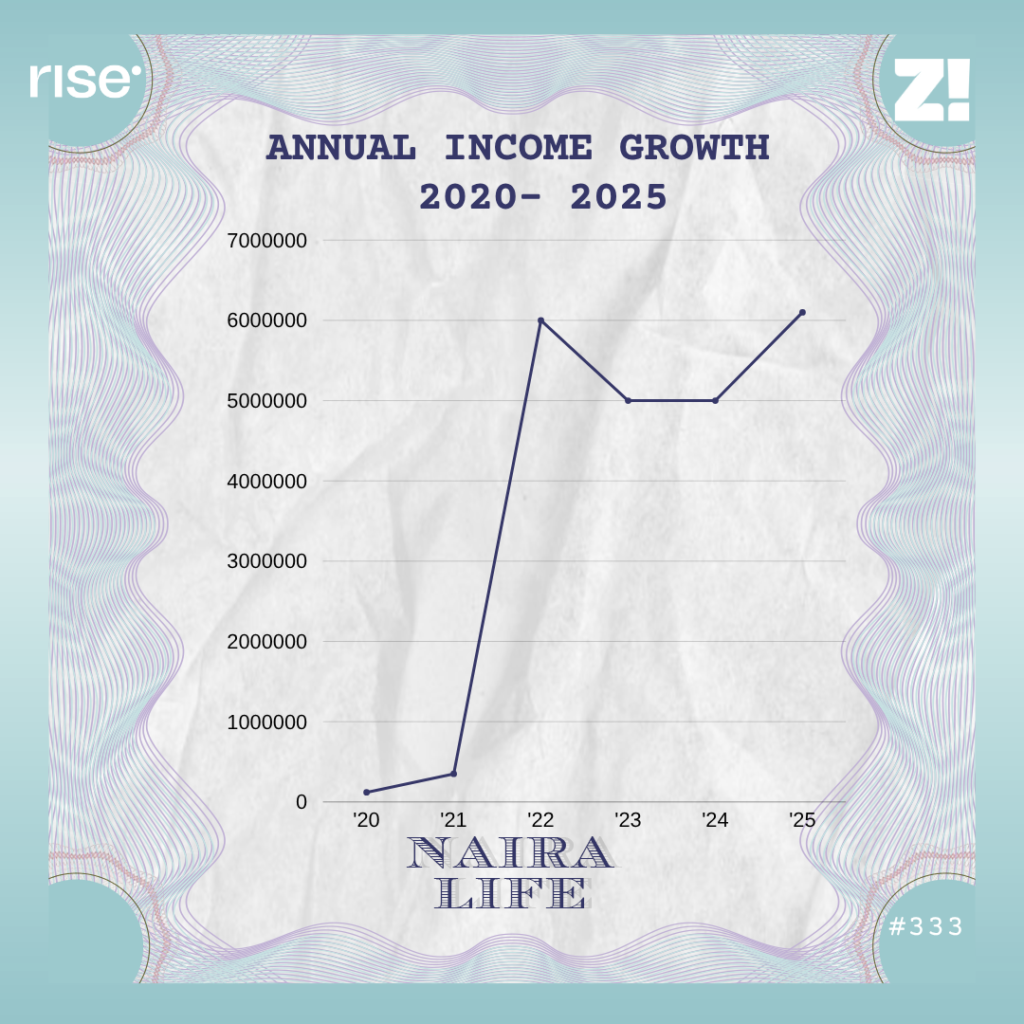

How has your income growth over the years impacted how you think about money?

I think it’s a full circle moment because I remember reading a Naira Life story in 2019, and there was a chart that showed how the guy’s income grew over the years. It was a straight upwards slant, like from zero to 100 real quick, and I remember showing my colleagues.

We also plotted our own graphs to look at our career trajectories and see how our growth could be just as slanted. It’s interesting because if I were to do that now, my upward growth would be just like that guy’s own.

I’m responsible for more now, but the principles have always remained the same. I’m content with what I have and diligent with managing and multiplying whatever comes into my hands when it eventually does. I live below my means, but I also believe in spoiling myself occasionally. That’s all there is to it.

Is there an ideal amount you think you should be earning right now?

I don’t know. I want money, but I don’t want to be the one earning it anymore. I’m very much romanticising the idea of being an “Iyawo oga” so I can use my money to buy a beach house in Epe.

Haha. What about something you want but can’t afford?

I want a Mercedes-Benz. I have the specific model and colour in mind, but while I can afford it, I can’t afford the mental gymnastics that come with owning a Mercedes right now. Maybe unless I also get a mechanic attached to it so they can handle all the wahala that comes with driving that car.

What was the last thing you bought that required serious planning?

A ₦12k wok. I went to like three different stores before I settled on one, but that thing is fantastic. There’s no stir-fry I can’t do in that thing, and it cleans easily.

If we were going for a more conventional answer, I’d say the last month-long slow travel I did across two countries. It cost me $6k, and I had to do some financial planning for that.

Do you have any financial regrets?

I lost about ₦700k in total to bogus farm investments during my NYSC period in 2018/2019, and I still feel foolish that I didn’t run when they said they’d give me 20% returns per month. Maybe I was just a thief.

Skrimm. How would you rate your financial happiness on a scale of 1-10?

In terms of how much I’m earning, I’d say 7. I believe I should be earning within the $8k – $10k range for my work. I’m probably not earning that yet because of where I am. But in terms of how I handle my finances, I’d say 8/10. I’m not doing badly, but I want to practice letting go of certain expenses and be better.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad]