Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

I always had home-cooked food for lunch throughout primary and secondary school, while my friends would get money to buy snacks or whatever they wanted. I grew up in a middle-class family, but I didn’t have direct access to money. It was like something only the adults in my family could have.

How “middle-class” was your family?

My dad worked in a bank, and my mum worked in an airline company, so the money was good. My mum had access to discounted tickets, so we flew for international holidays at least once yearly. We had three cars and lived in a ₦1m/month rented apartment. Our neighbourhood in Lagos Mainland was quite mixed; there were really comfortable people and people struggling to make ends meet. I think this mixed upbringing is why I don’t want obscene wealth today. I just want to be comfortable.

My dad operated on the same values. He was an auditor, so he constantly drilled the “never steal money” lesson in me and my siblings’ heads. Even at work, he was a very “play by the rules” kind of person, which earned him some enemies. He lost his job to rightsizing in 2011 when I was in SS 2. My mum had quit her job a year earlier to focus on becoming an entrepreneur, so my dad losing his job changed some things at home.

What were some of these changes?

My dad’s work at the bank gave my mum access to loans for her business. She imported clothes from Turkey to sell at a mark-up. The loans allowed her to go on the trips and stock her three shops. Without his job, there were no more loans, so she had to downscale the business.

Our international holiday trips stopped, and there were no more random Chinese restaurant trips. We also never renewed our Ikoyi Club membership. Thankfully, my dad used the settlement he got from the bank to purchase a house in 2012, so we didn’t have to bother about rent. At some point, my dad did some consulting, but nothing steady.

Do you remember the first thing you did to earn money?

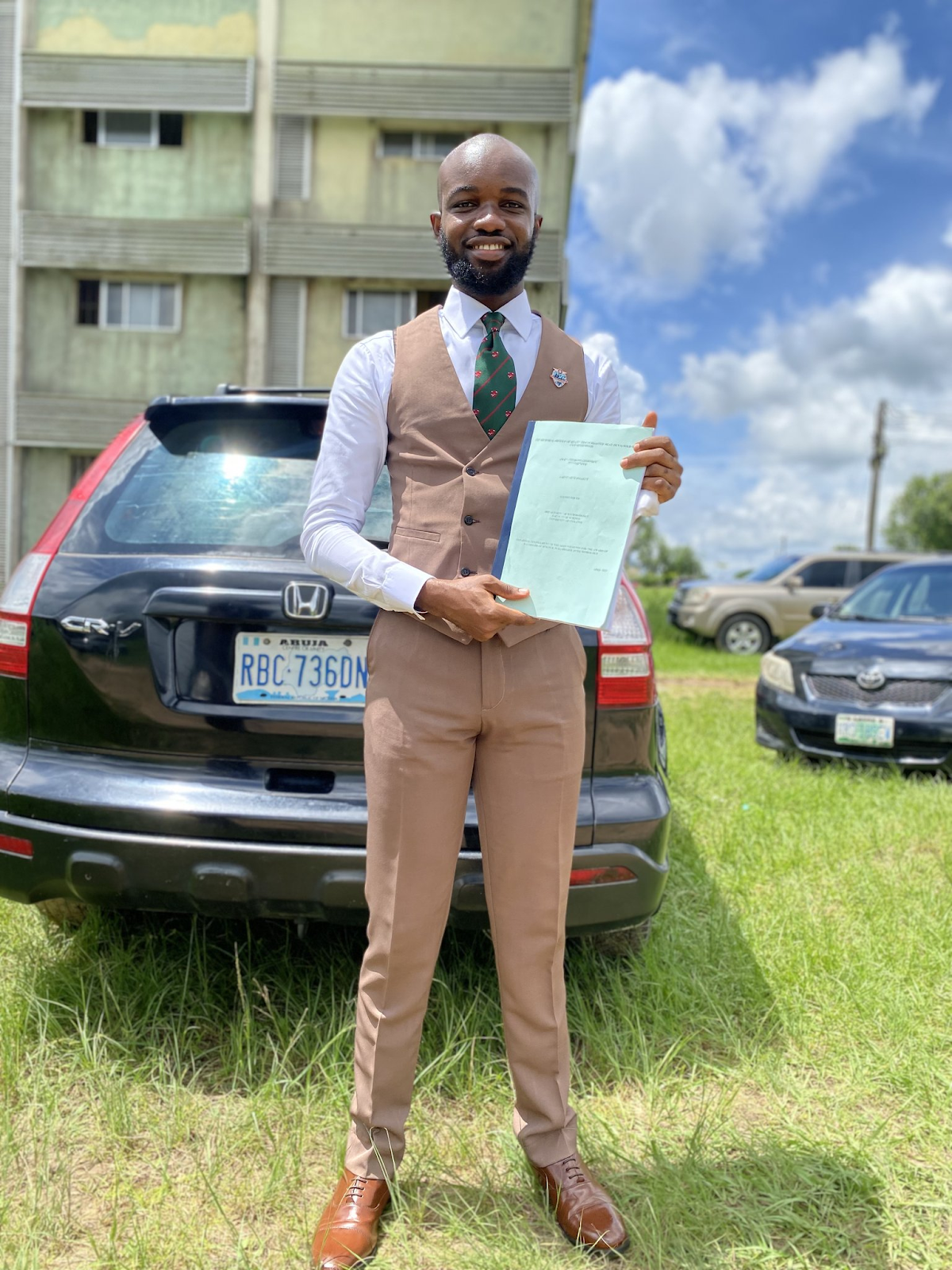

I got into the university to study pharmacy in 2013, and in my five years there, the only time I ever worked for money was during industrial training in my third year. The company paid me ₦15k after working for six weeks. I also got a ₦50k endowment allowance — given to first-class students — from school in my third and fourth years.

I just wasn’t someone to carry work on my head. It helped that I schooled in Lagos, so I could always go home when I exhausted the ₦4k – ₦5k weekly allowance my parents gave me. It was around this time I realised that money can control you. I couldn’t break away from my parents because they were my primary source of money.

After my project defence in December 2018, I started seeking to earn my own money. A school strike delayed my graduation and induction, but I eventually got a locum pharmacist job in March 2019 for ₦50k/month — ₦47k after deductions.

What were your expenses like?

Transportation and food took all the money. I also occasionally contributed to expenses at home.

I was still at the job when the induction ceremony for graduating pharmacy students finally happened in May 2019. The compulsory one-year internship for pharmacists came after. At first, I didn’t want to intern at a community pharmacy because they don’t pay well, so I targeted a hospital or government agency.

However, my search was unsuccessful, so I settled for a ₦90k/month internship at a community pharmacy in December 2019. After a month, a teaching hospital finally reached out to me, and I jumped at the ₦126k/month offer.

A significant increase

COVID made it even more significant. I don’t want the pandemic to return o, but I wouldn’t mind if we had something lockdown-ish again. It came with an increased hazard allowance for health workers, so I got an extra ₦30k for two months, and ₦50k in the third month.

Although I didn’t get paid in the first month due to the normal government bureaucracy, I was paid two months’ salary in March.

So you were balling?

I was, but I also spent most of what I earned paying back loans.

What loans?

I first discovered mobile loan apps on social media while doing the ₦50k locum job. It started with just needing small change to sort something out before my salary dropped, but the interest rates are crazy, and you find that you’re paying back up to ₦12k on a ₦7k loan. When salary drops, you realise you need to top up because the repayment has eaten into your budget. It’s a vicious cycle that followed me into the internship.

When the double alert came, I paid off outstanding loans and took another one with a phone retailer that allows you to buy in installments. I got a Samsung phone that cost ₦160k and paid ₦80k outright. The balance summed up to ₦120k, including interest, which I paid off over a couple of months. At that point, I was using a third of my salary to service the loans.

Some of my money also went to my dad. He occasionally took ₦20k or ₦50k loans from me but never paid back. I also saved a bit, and by the end of 2020, I had close to ₦200k in savings.

What happened after the internship ended?

NYSC. Most medical professionals can relate to it being a period of uncertainty because you go from earning a good salary to a mere ₦33k/month stipend. I decided to use my savings to get a laptop, learn some tech skills to increase my earning potential and possibly get a side gig.

I went to Ikeja to purchase said laptop, but then, I got robbed of my phone on the way. Thankfully, the thieves couldn’t access the account that had my savings. But the experience scattered my plans. I had to spend two weeks navigating the NIN process to retrieve my sim, abandoning the side gig plans.

NYSC posted me to a state in southern Nigeria in 2021, where I moved in with a fellow corps member. My half of the rent and other bills was about ₦110k for the year. My PPA was a general hospital that didn’t pay anything extra, so I hardly showed up. I relied on NYSC’s stipend and the occasional allowance from home.

I also continued taking loans — I must’ve taken up to ₦100k in loans during my service year.

Did you try to do anything else for money?

I got another locum pharmacist job two months into my service year in June 2021. Someone I met at CDS introduced me to this community pharmacy that paid ₦57k/month. It’s still one of my favourite locum experiences so far. My boss had no issues and even increased my salary in November to ₦76k/month. He also gave me an extra ₦70k Christmas bonus.

I’m not sure how I managed it, but even with the added income, I wasn’t free from the loan cycle. I hardly went out and didn’t spend so much on transportation or clothes. I randomly shopped online and had some black tax expenses, but it shouldn’t have been enough to keep me in my constant borrowing cycle.

But I was still in the vicious cycle set in motion from my very first loan.

I finished NYSC in February 2022 and considered staying back in the state I served. The original plan was to request to be converted into a full-time staff at the pharmacy, but then, I landed a temporary position at a public health organisation in the state. Temporary because they worked with donor funds and could only guarantee me a job while they still had funds.

How much did the job pay?

₦209k/month. It was also a break from working long hours almost every day at the community pharmacy. My major expense was black tax from my younger sister. I got into a relationship too, but I only spent on my girlfriend when we went out on dates at least once a month or when I more frequently stopped by her workplace with food.

In March, I moved out of my NYSC apartment into a two-bedroom with a roommate. My half of the rent was ₦275k, which I didn’t have at the time, so I took a ₦100k loan from a loan app and another ₦101k loan from my roommate.

The donor funds at my job expired in July. I was unemployed until September when I got a one-week gig at an NGO that paid ₦209k — the standard pay for my role in the NGO industry. In November 2022, the public health organisation that ran on donor funds (my former job) called me back, and I resumed my ₦209k/month role. During the months of unemployment, I took on academic writing gigs for UK master’s students who were doing work-study programs. I had a friend who hooked me up, and I’d get ₦15k or ₦20k gigs once in a while.

I also took occasional loans from my roommate and girlfriend. She didn’t know about my loan apps problem, though.

Were you ashamed of it?

I definitely wasn’t proud of it.

Before I got my job back in November, a loan company called my dad after I defaulted on a payment. I’m still grateful he didn’t tell anyone else, or it’d have been a whole family meeting. He called me to ask what was happening, and I lied that I took the loan when I lost my phone, and that I’d settle it. That call was the drive I needed to sit up and stop the loan cycle once and for all. I couldn’t be in debt forever. I wasn’t saving, investing or doing anything worthwhile, and that wasn’t the life I wanted.

I decided to focus on taking my job even more seriously. I knew unemployment could take me back down the loan route, so I wanted to be indispensable at work, donor funds or not. I also continued taking the freelancing gigs, and in a good month, it brought an additional ₦50k.

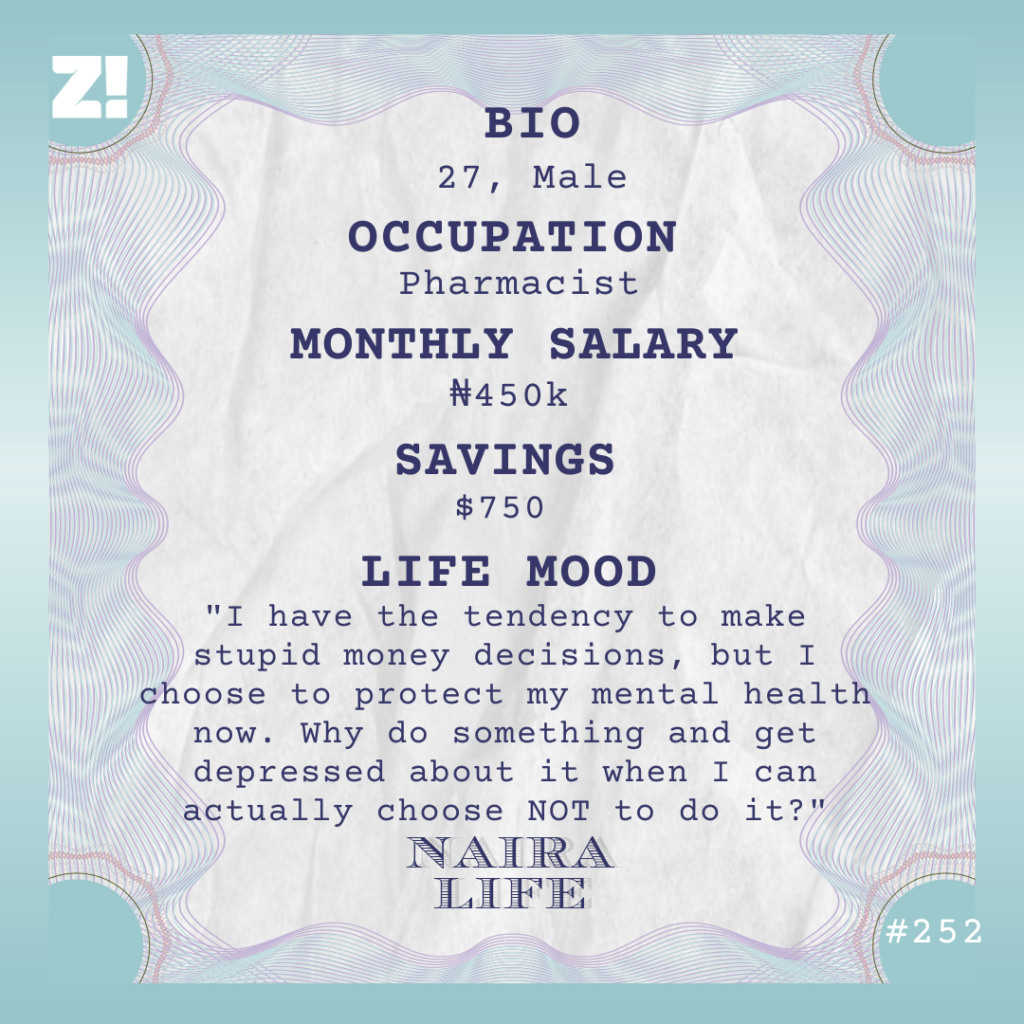

In March 2023, I finally landed my first permanent public health pharmacist role at an NGO. It paid ₦500k/month during the six-month confirmation period. They now pay me ₦450k/month.

The pay reduced?

Confirmation meant they had to start removing tax and other compulsory stuff. I’m terrible at keeping track of deductions. I just know the company pays for my pension and health insurance charges.

The job was also in a different state, so I had to move and get a new laptop. I took a final ₦400k loan from an app to do this, and I just finished repaying it in November. I was comfortable taking this loan because I knew my salary could cover it.

My salary is also not the only way to make money at my job.

Tell me more

Work trips are where the money is at. They assign you to a secondary location for a couple of days and pay a per diem — an allowance for the trip. This blew my mind. You mean, you’ll foot transportation costs, lodge me in a hotel with complimentary breakfast AND still pay me daily because of the stress of the trip? Wonderful. The trips never go beyond a week, but it adds an extra ₦20k – ₦180k to my income at the end of the month.

What do you spend this money on?

I live in a dead town, which says a lot coming from an introverted person. So, I like to pop into Lagos once in a while, like an IJGB, to have a good time. I’ve been to Lagos thrice this year, and I spent around ₦30k – ₦70k on each trip. I also send around ₦60k monthly to my parents to help out with my dad’s medication and support the income. Then there’s the random money I send to my siblings.

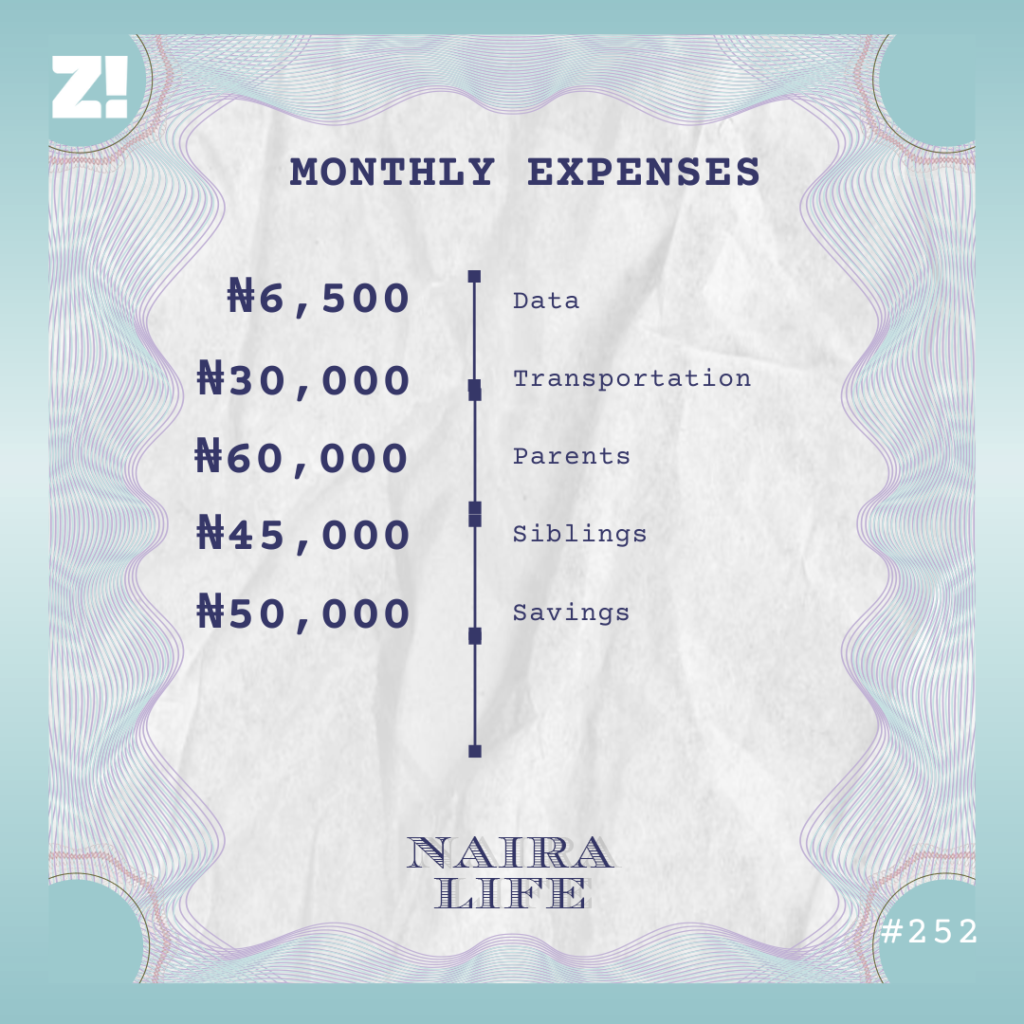

What do these expenses look like in a good month?

I mentioned I just finished repaying a ₦400k loan. That took ₦120k out of my income every month, but that’s done now. I don’t put an amount to feeding because I just feed myself based on what I have left. My rent is ₦250k yearly, which is half my monthly income, so I figure I don’t have to actively save monthly for it.

Sometimes, I save more when I get more money from work trips. I currently have $750 saved in a fintech app, and I hope to cross the $1k threshold by January 2024. I’m worried my parents could have a hospital emergency at any time, and I want to be ready. I also want to japa one day, but I don’t have a particular route yet, so I want to have the money down first.

What’s your relationship with money like now?

I used to be quite impulsive with spending because my mentality was, “Another one will come eventually”. But that’s how the loan addiction started. Now, I make sure to save something immediately my salary comes in. Since I was repaying a loan up until November 2023, I’ve only saved ₦50k constantly monthly since I got my job in March. I hope to increase that now that I’m debt-free.

Do you ever feel tempted to take another loan?

I literally just opened a microfinance bank app today, and they offered me a ₦1.4m loan. I considered taking it and investing in a business until my brain told me to calm the hell down. The fact that I can take the loan doesn’t mean I should do it.

I think I understand I have the tendency to make stupid money decisions, but I choose to protect my mental health now. Why do something and get depressed about it when I can actually choose NOT to do it?

That’s fair. Do you have an ideal monthly salary?

I just want to earn at least ₦1m/month. I don’t have any entrepreneurial blood in me, and I think that’s a decent amount to suffice for me waking up every day to do a 9-5. I’m trying to psych myself up to get public health, logistics and supply chain certifications in 2024 to help my future japa plans and increase my earning potential.

I don’t want to be obscenely rich, though. People with crazy amounts of money have to do unethical things to get there, and I can’t do that. I’d rather take a smaller payday.

Have you considered what these certifications would cost?

I have, and they’re quite expensive. One costs as much as $2k. I’m hoping to get grants from my job, but before then, I’ll probably take advantage of as many free and less expensive courses as I can to gather knowledge. I just need guidance and strength to push through with these plans and not get discouraged along the way.

How would you rate your financial happiness on a scale of 1 – 10?

This is one of my favourite Naira Life questions. I’ll rate it a 7.5. I could be better, but I’m happy, and I can deal with what I have now.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.