Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Kwakol Markets is a global broker that lets you trade multi-asset financial markets with ease. They aim to provide transparent and innovative technology that gives you a simple, secure and superior experience. Start trading with Kwakol Markets today and create the future you deserve.

Let’s talk about your earliest memory of money

I counted ₦5k for the first time in my life in JSS 1. My dad gave it to me to give my mum. This was around 2005 when the ₦1k notes were newly introduced. He had access to it because he worked in a bank. I remember that the notes were in mint condition. He gave my mum ₦5k a couple more times, and he always passed the money through me or an uncle who lived with us at the time.

Was there a reason for that?

My parents weren’t on good terms, and they hardly talked to each other. We grew up in Bodija, Ibadan, but around the time I got into primary school, his bank transferred him out of Ibadan, so he was hardly around. He typically only visited twice a month, and it was only when he was around that he gave us money.

What did this mean for the family’s finances?

My mum took on most of the household expenses with her teaching salary. She didn’t earn much, and we were three boys. We ate beans a lot. Drinking a bottle of Coke meant you’d done something right; it was a privilege.

I used to win many prizes in school, which helped my mum because the principal allowed us to delay school fees payment. In secondary school, she had to take loans to pay my school fees. I think my dad only contributed twice during my entire time there.

For the rest of secondary school, I relied on whatever my mum could give for allowance. My dad lost his job in 2009, when I was in SS 2. That’s when he just stopped coming home. We haven’t spoken since then.

That’s tough. What happened after secondary school?

I went for a pre-degree program in 2010. It cost my mum ₦135,600. My mum was so upset when I eventually failed and had to come back home. But it was during my pre-degree that I met the person who introduced me to a business opportunity.

I’m listening

He was my pre-degree classmate, and I don’t know why, but he took a liking to me. He sold movies and games, and he decided to make me his partner. We sold the films by transferring them from hard drives to fellow students’ devices.

One episode of a series was around ₦50, 12-episode series were ₦600, and 24-episode series cost ₦1,200. The games were anything from ₦500 to ₦2k. He used to give me a 10-15% commission on every sale. We later progressed to splitting the sales 50-50.

Sounds like an interesting business model

We kept a massive database of movies in three 1-terabyte drives. Those sizes weren’t common then. He bought the first for ₦32k and the others, when the drives became more common, for ₦17k each. Before I started working with him, I didn’t even know words like “torrent” or “gigabytes” existed.

How much were you making?

Typically, we made ₦5k/month each, but we often made more. We made ₦15k once, but then, I spent almost all of it on a girl.

Your girlfriend?

We weren’t even dating at the time. I just liked her, and we were quite close during the pre-degree programme. I wanted to do something nice for her, so I got a card and a bouquet of terrible-looking flowers. Then I took her to get food. It all cost about ₦10k, and she loved it. When I realised the money was remaining ₦5k, I sent it to my younger brother. I couldn’t send it to my mum because she’d warned me to focus on my studies and leave business alone.

Maybe she knew what she was saying?

You could say so. I felt remorseful about failing to secure the admission, but when I returned home, I got a couple of jobs to keep busy. I taught in a private school for ₦7,500/month. I was in charge of three junior secondary classes, and I taught maths, agriculture and integrated science.

On the weekends, I did ushering gigs for ₦1k per day. I got introduced to them by a friend’s mum, who was a caterer. Some gigs required us to spend two-three days at an event to help with cooking and clean-up after. I looked forward to the three-day gigs because it meant I made more money. So, after I finished teaching in the school by 1 p.m. on Friday, I’d resume at one ushering gig or the other.

How long did that last?

The entire year I was home. I was also still making some money with my movie business partner. He still sent me commissions when the people on my referral list made a purchase, but he was just being nice because he was the one selling the movies. He sent around 10 – 20% of whatever he sold monthly.

What were you spending on?

My family. I’m the firstborn, and without a dad, I became the father figure. So, if they needed anything, my mum would be like, “How much are you bringing as the father of the house?” I was 18 then.

I later did JAMB in 2012 and got admitted to study architecture at the same university as my movie business partner, who’d gained admission earlier.

So you went back to selling movies

I continued till my second year, when I felt the money was too small. I became an executive in my department and, somehow, got into a shirt printing business.

How did that happen?

My department was to play a football game, and I was in charge of getting jerseys for the team. I made findings, and the prices were exorbitant. I kept thinking, “What’s hard about printing these things?”

I walked into one of the jersey print stores and pitched to the owner to do it for free. He refused and offered us a discount instead. We agreed, and I left his office thinking of how much money he would’ve made from us, so I went there the next day and said I wanted to learn. He agreed, showed me the ropes, and I started printing shirts.

Did any capital go into setting up?

No. He allowed me to work out of his shop for a small cut of each contract I got. I told my folks at school about my new business so they could patronise me. I was in my third year when I started.

All they had to do was pay me, and I’d get the shirts and print them. Profit was around ₦700 per shirt. One time, I made 50 shirts for another department’s freshers’ week and got ₦25k in profits. On average, the business brought me around ₦30k/month.

So it was going well

Until I ran into debt in my final year.

One department wanted to make about 1000 sweatshirts. Production was to cost me ₦2k, and I gave them a ₦2,200 estimate per shirt. It was a large number to supply, so my markup would’ve been high regardless.

I was supposed to produce the shirts in three batches, but by the time they approved and I went to the market, the cost of producing each shirt had increased to ₦2,500. I went back to inform them, but they’d already approved the initial price with their executives, so I decided to continue.

By the time I produced the second batch, I didn’t have any money left to produce.

I saw that coming

I told them they should get someone else to continue, but they got a lawyer and threatened to sue me. To save my reputation, I borrowed ₦200k from the man whose printing shop I worked in and produced the rest.

Did you pay back?

I did, but it took me about a year. Six months after graduation, I had to return to school to continue the business so I could pay back the debt. He was really patient with me and just took any amount I had to spare at the end of the month till I finished the repayment.

What happened next?

I went for NYSC in 2019 and decided to intern at a radio station. I’d had a brief stint with my school’s radio station in my undergraduate days for free. I’d also worked at an external station for ₦400 in airtime per show.

I landed a radio job for NYSC, where I did sports news and beat writing. They paid me ₦30k/month, in addition to NYSC’s ₦19,800 — which got increased to ₦33k about six months in.

After NYSC, I got retained, and they increased my salary to ₦100k/month.

That’s a nice jump. How did it feel?

My radio journey had gone from working for free to getting paid in airtime to finally getting good money for it. I was excited. Immediately I saw the first alert, I went to Shoprite and bought food.

I’m curious. Did your financial responsibilities increase?

Black tax definitely increased. I started sending about ₦30k/month. My mum didn’t put pressure on me, but it felt good to send money home.

I was staying with a friend at the time, so I didn’t have to spend on rent or data because he had a MiFi from his office that I also used. But I used to pitch in with food and other utility bills. I also make money via commissions from work. If I market my radio shows and get someone to sponsor them, I get 15% of the income. This helped after my roommate japa in 2021, and I had to leave his place to rent my own apartment.

How much did that cost?

₦1.1m. I had just made ₦500k in commissions from work, and I didn’t have any other savings, so I borrowed ₦400k from my mum, and ₦200k from my former roommate, to get the place.

My roommate had just travelled, and he needed money to settle into his new country, so he was the priority for repayment. In a bid to meet up, I had the not-so-bright idea to join a ₦100k monthly ajo.

But you were earning ₦100k/month?

In fact, the ₦100k was gross. The net salary was 90-something thousand. We were six in the ajo, and I was the first to collect the ₦600k. I paid off ₦400k from my debts and had ₦200k left. A smart person would’ve saved the money, right? Not me.

Please, don’t tell me you spent it

I started buying food every other day. There was also this babe I liked. I sent her ₦50k. By the time I’d spent about ₦100k, I had to ask myself, “Are you okay? How do you intend to survive for the next five months?”

Skrimming

I got a few beat writing gigs from someone who wanted content for their sports website, and that paid ₦25k/month — I still do that fairly regularly now.

Then I got another commission from work in 2021, about three months after I started the ajo. I’d gotten a brand to sponsor our weekend show for a year, and my 15% cut was ₦1.4m.

Millionaire doings. What did you do with it?

I spent almost all of it on a woman in one week.

How?

I met her online in 2020, and we became fast friends. She was in a relationship, so we were just friends. Then her boyfriend broke up with her, and I tried to comfort her with, “I’ll be your assistant boyfriend till you find someone else.”

We got even closer, and I got to learn about her family. In my mind, we were unofficially together. Then I started spending money on her. Even before I got the commission, I’d borrowed money to pay her ₦100k school fees, and another ₦50k for her sister’s school fees.

By the time the commission came in, it was her birthday, so I organised a surprise party with her best friend. I also paid her flight fees from Port Harcourt to Lagos so she could attend the party. That cost ₦50k. Then I gave her ₦250k as a gift. I sent ₦50k to her younger sister who just gained admission, and another ₦50k to her mum because she wanted to travel. I really lost count at a point, but it was about a million in total.

All this was within a week?

Yes. I used some of the money to get a gift for the person who signed off on the sponsorship, and settled a few people at work. By the time I noticed the money was almost gone, I remembered I hadn’t sent anything to my family.

I sent my younger brother ₦50k to get a phone and ₦50k each to our youngest and to my mum. Then I bought a pair of shoes for ₦25k. I still have the shoes today.

How would you describe your relationship with money?

It’s a rollercoaster.

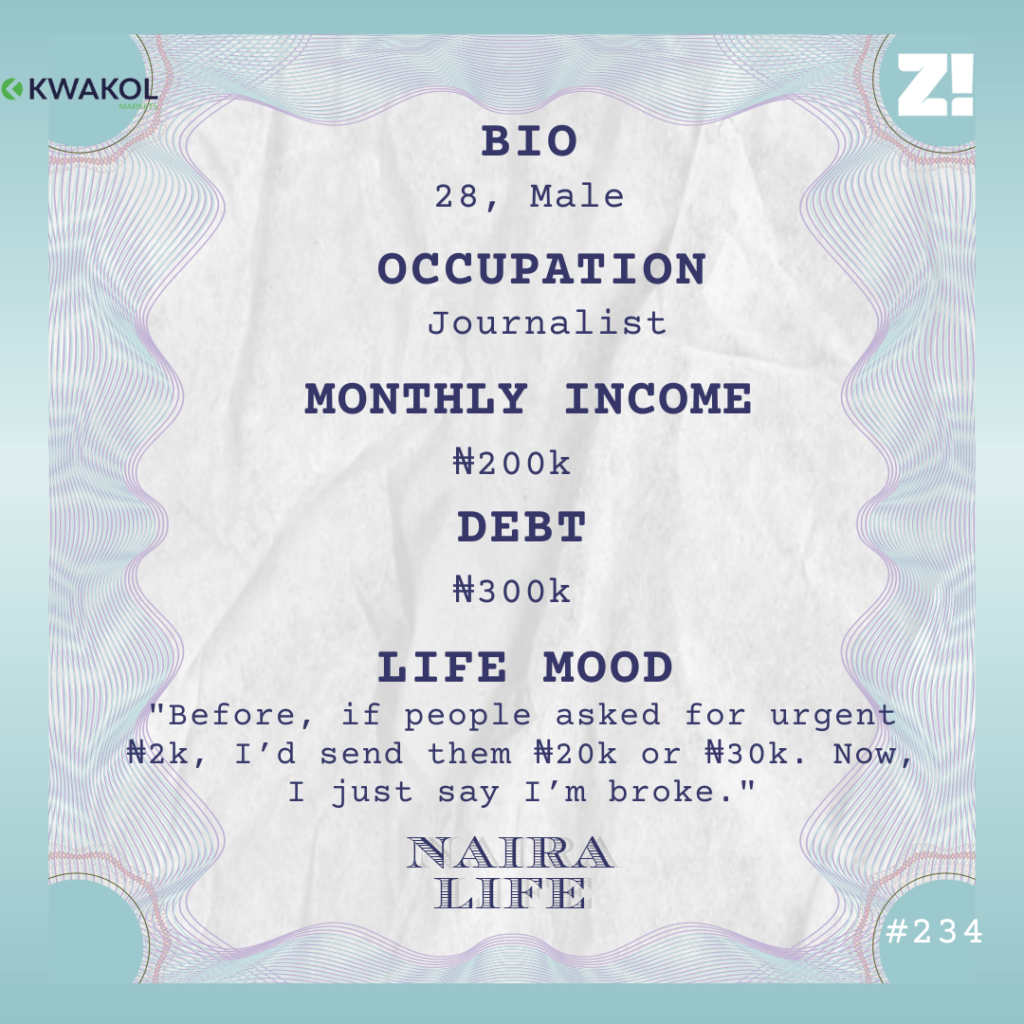

I got another salary raise in 2022. I earn ₦200k/month now, but I have no savings. I just run on vibes. I didn’t even know how I’d pay my last rent till I made ₦300k from another commission at work. I had to borrow more money to settle my part of a ₦1.6m bill we got at my house because someone bypassed electricity illegally. So, more debt. I’m still trying to recover from that.

I’m now making an effort to be less of an impulsive spender, especially considering the person I spent ₦1m on eventually returned to her ex-boyfriend.

Wiun

It was brutal, but it was then I thought about how I could’ve done so much with the money if only I’d properly planned it out or even told my mum so she’d make sure I put it to good use.

What are your finances like these days?

I’m currently in about ₦300k debt. The commission gigs are less frequent, so it’s just my salary. Transportation, food and literally everything is more expensive now. Staying home is one of the ways I curb my impulsive spending. I think it’s working.

Before, if people asked for urgent ₦2k, I’d send them ₦20k or ₦30k. Now, I just say I’m broke.

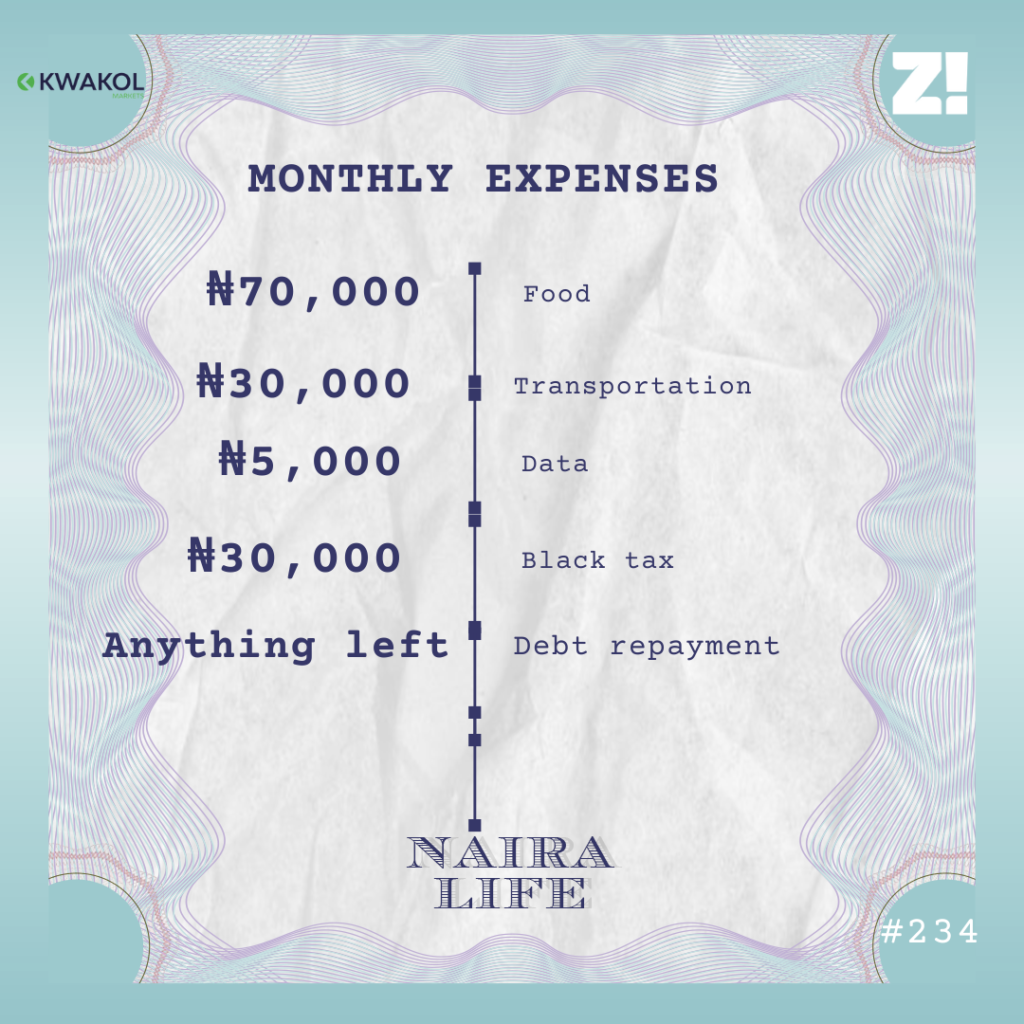

What does that look like in a month?

Have you made any unplanned expenses recently?

I spent about ₦15k on a friend for her birthday in July. I was even the one who told her to come so I could give her a treat.

Interesting. What about long-term career plans?

I’ve been considering practising the architecture I studied. I’m still in touch with the architect I interned with in school, and they want me to return, but I want to see if I can combine journalism with architecture.

Is there anything you want right now but can’t afford?

A high-end gaming laptop. One would cost approximately ₦800k. I also need a house. My rent is expiring in two months, and I currently have no money.

How happy are you financially? The scale is 1-10

2. I’ve messed up many of the financial opportunities I’ve gotten. Life hasn’t gone the way I envisioned it. I should be able to tell my mum to rest, or open a shop for her, but I can’t afford to do that.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.