*Joseph (23) accidentally struck gold when he got a dollar-paying gig as a fresh uni student in 2023. Unfortunately, his new financial status triggered a wave of impulse spending and landed him in a ₦2m debt. It took him losing his job and fighting depression, but he’s finally on the road to recovery.

As told to Boluwatife

My first year in uni was the first time I made “serious money,” and it quickly got to my head.

Before entering university in 2023, I briefly looked for writing gigs on freelance sites. My family’s financial situation had changed for the worse after my parents fell ill and had to travel abroad for treatment, so I became very money-conscious. I needed to make money, and writing felt like a way to do that. But after slaving for hours and making $5 per gig, I decided it wasn’t worth the stress and abandoned the sites.

During the second semester, I decided to give writing another try. This time, I’d read that it was possible to cold-email online blogs and pitch my services to them. So, I started.

Anytime I found a blog, I looked for their email and shot my shot. I created a spreadsheet to track my cold emails, but stopped tracking after the first 100 applications. It was just too much to document.

Luck smiled on me in October 2023. I got a yes from a blog, and in the contract, they offered $600/month for three weekly articles. My initial thought was, “This is a scam.” I’d never received that kind of money before, and it felt too good to be true. When the first payment came in, I immediately converted it to naira — around ₦500k — because dollars didn’t feel like real money to my poor mind.

The first thing I did with my pay was get back at the girl I was dating. I knew she was seeing other guys, but I was broke and didn’t think I had the right to call her out. When people told me she was cheating, I ignored them. But when the money entered, I decided I couldn’t let myself be disrespected anymore.

So, I created the perfect plan. The same evening I got paid, I took her to a restaurant and spent the night at an impossibly expensive hotel. I spent ₦280k that night: ₦80k for the meal and ₦200k for the hotel. Then, I dumped her the following morning. She was so shocked.

In hindsight, it was a pretty dumb plan, but it was an ego trip for me. Also, I figured the rest of my salary wouldn’t finish that fast. Besides, I still had my job. ₦500k was big money, I’d be fine.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

I started walking around like a king. I knew my lecturers didn’t make close to what I earned, and there I was, a fresh student making so much money. I felt rich, and suddenly, I forgot what limits were.

My tastes went up immediately. I stopped eating at local spots because I didn’t like how the food looked. I once called an Uber, and when the ride came, I looked at the car, shook my head and walked away. I didn’t like how the car looked, so I didn’t ride in it.

Another time, my phone fell and the screen cracked. I didn’t pick it up again. I bought another one instead.

I became stupidly picky, and it wasn’t just food or cabs; it was everything. It was the clothes I wore, the people I talked to, and the sort of things I tolerated. I didn’t feel like I needed to respect anyone again.

I also started spending carelessly, mostly on girls. The funny thing was that I wasn’t really interested in sleeping with them. I’d just take them out and spend like crazy for the power trip. I wanted them to look at me differently and know I existed. God, I was so foolish.

My parents knew I was working, but didn’t know I earned that much. They just knew I had gradually stopped asking them for money. I even started sending money to my siblings for no reason.

My lifestyle eventually got me in trouble. I first realised how bad it had gotten in May 2024. I opened my bank app one day and saw I had zero naira. I was shocked, but I knew my salary was still coming. I just needed to find something to tide me over till then. That’s how my next problem began: loan apps.

I started with small ₦20k – ₦30k loans, but my lifestyle became more expensive, and those amounts finished in a week. So, I moved on to larger sums: ₦50k, ₦100k, even ₦200k. I tried to repay the loans, but it was a constant cycle of borrowing again when I settled one debt. By the end of August, my debt had reached ₦2m across seven loan apps. I got up to 20 calls daily from the apps asking for their money back.

The harassment was so much that I became scared to walk around school in fear of loan agents hanging around. I stopped going to class, and my state of mind also affected my work. I couldn’t concentrate, and my output at work reduced.

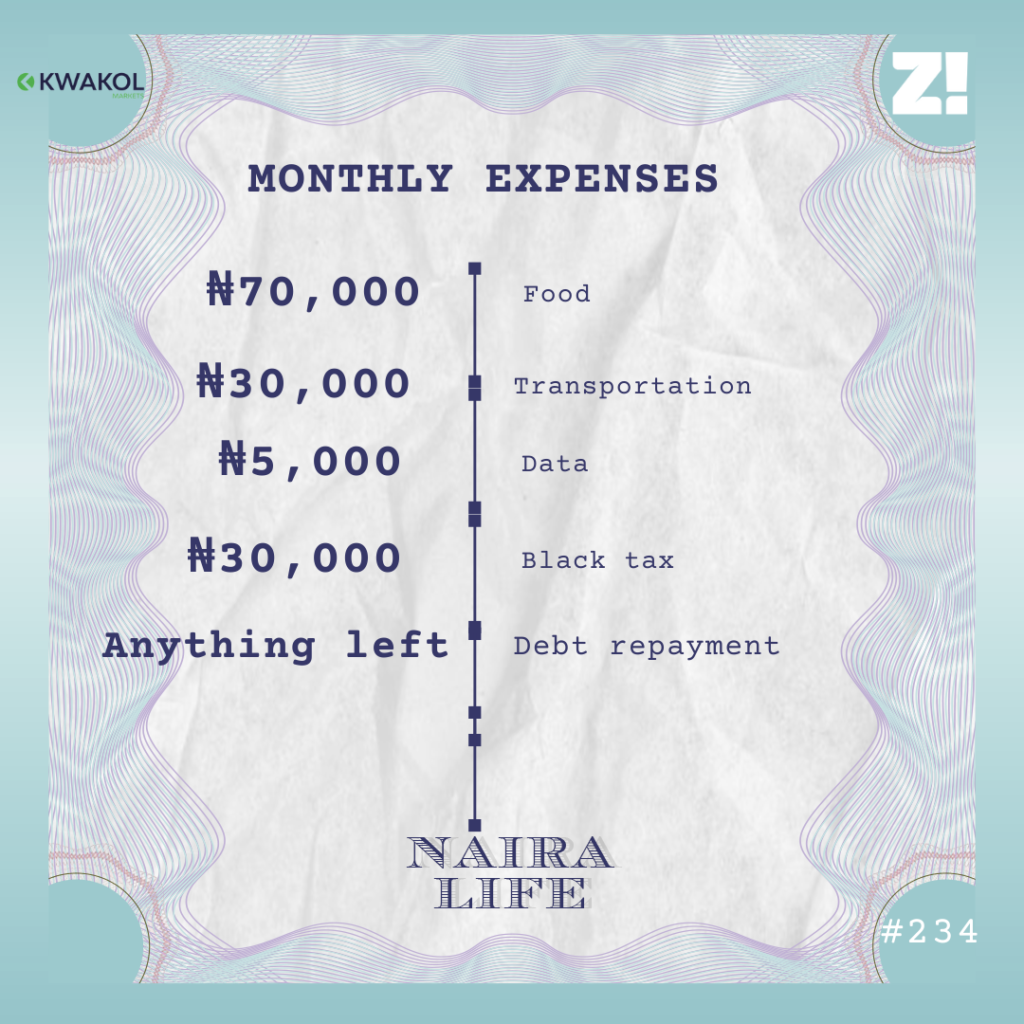

Then the worst happened. In September, my employer did some restructuring, and I was the first to be laid off. It shocked me like mad. I had exactly ₦300k in my account, over ₦2m in debt, and the salary I banked on suddenly disappeared.

It was the wake-up call I needed.

I blocked all the friends and people I hung out with so I wouldn’t have to spend money. I also changed my number to get the loan guys off my back for a while. My focus then wasn’t repaying them, it was finding a way to survive and get my life back on track.

Interestingly, readjusting my taste back to factory settings was more difficult than trying not to spend money. I went days without eating because I couldn’t stand the sight and taste of street food. When I eventually ate something, I’d buy from a restaurant and convince myself I earned it because I’d gone days without food.

By November, I’d exhausted the last ₦300k in my bank account. I knew it was only a matter of time before I’d be homeless because I couldn’t afford to renew my hostel rent.

So, I packed my load and went to live with my aunt while I looked for another job. I didn’t feel comfortable returning to my parents for money, so I tried to fix things on my own.

For the rest of 2024 and the first few months of 2025, I survived by writing assignments for fellow students and doing odd hustles for money. It’s a miracle I didn’t get carryovers because I totally abandoned school. I just needed money.

March came with a ray of hope. One of the blogs I cold-emailed liked my pitch and gave me a job for $200/month. No one needed to tell me to make better financial decisions this time. My first expense was a pair of boxers, because I couldn’t remember the last time I bought something for myself.

Then, I used the remaining salary to pay for a $120 copywriting course to upskill. I never want to be in a situation where I’m the easiest person to lay off because of skills or performance again.

As for my debt, I’m trying to pay it gradually. The loan agents somehow found my new number and are still calling me. One of them reached out on WhatsApp a few months ago and offered me a discount on my repayment. Instead of nearly ₦400k, they allowed me to repay only ₦150k so that they could clear the debt. I also paid a few others as I was getting money.

Right now, I owe about ₦1.5m, and I want to save enough money to pay them all off at once. I still live with my aunt, so I only take out $20 – $30 out of my pay every month for data and a few toiletries and save the rest. My savings is currently around $300, and when it grows to $700, I’ll clear my debt.

I often think about my financial situation and get depressed all over again. I constantly check my account balance to keep myself in check, and I remember when I earned really well. At some point, due to the exchange rate, my salary was close to ₦900k. Now, it’s barely ₦400k.

While I regret my choices, I don’t think the lifestyle was the problem. It was fun not worrying about money; it just wasn’t a $600 lifestyle. I wasn’t earning enough to be doing all that. I hope to grow to the point where I can comfortably have that kind of lifestyle again.

The goal is to eventually earn so much that I can upgrade my lifestyle without guilt. But for now, I’ll focus on saving my way out of debt and making better choices.

*Name has been changed for the sake of anonymity.

NEXT READ: I Took a ₦2.7m Loan to Buy a Car. Then I Lost My Job

[ad]