Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

I grew up believing we had money— I never lacked anything — so it was quite shocking for me when, in 300 level, I asked my parents for ₦50k for textbooks and some personal effects, and they said they didn’t have money.

They’d never turned down a request for money before?

Nope. It made me realise that money wasn’t something that was just there. It actually took my parents working hard and pulling resources together to cover any financial gaps.

My dad was an accountant, and my mum was a lecturer. So, combining their resources meant my siblings and I were well provided for. But at the time of the textbook incident, two of my younger siblings were also at university, so our finances weren’t what they used to be. I’d make a list of school supplies, and my parents would slash the amount by more than half. I understood why that had to happen, but I also realised I couldn’t rely on my parents for all my needs. I had to make my own money.

What was the first thing you did that fetched you money?

Dancing. I danced a lot in school, so I started taking occasional gigs with a dance ministry. I made ₦3k – ₦5k per gig. This was in 2013.

I also had a friend in final year who sold jewellery, so we started a reselling arrangement where I marketed her jewellery in my hostel and added between ₦300 – ₦700 to the cost price. The additional cost was my profit after selling.

I did that until 400 level when I decided to sell shawarma in school.

Why shawarma?

I like cooking for people, and I like to think I have an eye for business opportunities. Shawarma was newly popular in my school in 2014. Every other shawarma stand sold one for ₦500 – ₦1k, and I thought I could make a profit if I took advantage of the demand and sold mine cheaper.

So, I started learning how to make shawarmas. I watched videos and reached out to a friend who used to sell shawarma before he came to school. I went to his lodge every day for a week, and he taught me what I needed to know.

The next thing I needed was money. I reached out to a cousin, who used to live with my family, with the business idea, and he agreed to invest. I got a space in my school’s market area, and my cousin paid for the container we used as the kiosk, a fridge and some other equipment. The whole setup cost him about ₦300k. I also had about ₦70k, which I’d saved from an unpaid six-month internship I did just before 400 level.

How were you able to save from an unpaid internship?

My internship was at a lab popular among politicians and big men. They’d dash the lab staff money when they came with their girlfriends to run tests before “the show”. The free money came regularly. I lived with a relative during the internship, so I didn’t need money for anything. I just kept depositing my windfall in the bank.

I eventually used the money to buy two shawarma machines and contributed the rest to set up the space. I wanted my money in the business so we’d be like partners rather than have him pay for everything.

Did you start making a profit soon like you imagined?

I can’t say for sure because while the business was immediately lucrative, most of what I made either went to my cousin or back into the business. So, I made between ₦8k – ₦25k in sales every day — The highest amount I ever sold in a day was ₦55k because I sold at one of my school’s all-night events.

I sent ₦10k to my cousin weekly as his returns on the business. I was supposed to pay him ₦500k in total for his ₦300k investment. I wasn’t paying myself anything.

At one point, I spent ₦60k trying to add ice cream to my list of products, but after I bought them, we didn’t have light for the next couple of days and the whole thing spoiled. That’s how that money went.

Damn. Sorry about that

Thanks. I graduated in 2015 and had to shut down the business because there was no one else to manage it. I had only paid my cousin about ₦350k out of ₦500k, so he kept the fridge and sold the container for ₦70k. I kept the equipment I bought.

What did you do next?

I waited a year before going for service. I lost my dad in 2015 too, so it was a tough time for me. I was hoping to get dance contracts to make money in the meantime, but I stumbled on detergent distribution.

Stumbled?

A relative visited our house and came with a very nice-smelling detergent. I asked where he got it from, and he said his brother was a distributor. My mum and I were interested, so I went to the detergent factory in a different town to make enquiries. I got in touch with the CEO and pitched my idea of becoming a distributor in my state. He liked my energy and allowed me to buy a few bags to start. That initial purchase cost around ₦150k.

My mum was also part of the business, and we went from carrying a few bags per time to filling 14-seater buses with bags of soap — We did at least one bus-filled consignment monthly. We made payments to the factory only after selling the product. We’d sell to supermarkets and retailers for three weeks, then make payment by the fourth week. We made between ₦150k – ₦200k profit on each bus trip.

It was all going well until I introduced the person I was dating at the time to the business.

What happened?

He lived in another state where the detergent wasn’t being sold. I thought it’d be a way to help him get extra money, so I gave him goods worth ₦150k with the promise that he’d pay back the capital after he sold the goods. I even paid for the bus delivery of the detergents to his state.

That’s how this guy started telling me story when it was time to pay. I had to scrap my savings together to pay back the debt to the company. I couldn’t even tell my mum because it was so embarrassing after what happened the last time.

What do you mean?

I’d loaned him ₦300k a year before — basically an investment. He was into movie production and said he needed it for a movie. I borrowed the money through an ajo contribution I was doing with my friends.

When he defaulted, my friends started disturbing me about it, and I had to involve my mum. She was the one who helped me settle the money. So, I couldn’t even tell her when he did the same thing again.

Yikes. Did he ever repay any of the debts?

Never. The relationship ended shortly after — not because of the money; I just realised he was malicious. He’s tried to beg me from afar, but anytime I see him, he’ll enter prison until he pays me back every kobo.

The soap debt affected the business because it took a while for me to pay the company back, and it almost became an issue. Fortunately, NYSC came right after, and I left my state for service in 2016.

What was your service year like?

I was posted to a rural area, but the main town had a dance studio. I worked at the studio during the weekends, teaching dance workout classes. I was paid on a commission basis — ₦5k per every person who signed up for my class at the end of the month.

I still continued taking the classes after my service year ended. I also had a stint managing the studio’s social media and organising dance festivals. I loved the work and dancing, but I couldn’t live on commissions for the rest of my life. Plus, my mum didn’t think dancing was a real job. You know how Nigerian mums are.

Oh. I do. So, what did you do?

In 2018, I got a brand activation gig — Those ones where you follow the truck around and try to get stores to buy — with a noodle brand. It paid ₦17k/month, which wasn’t much of an upgrade. I also did small social media management for them.

I stopped after four months because the job stressed me out. Imagine jumping up and down from trucks all day. The constant body pain was terrible. I returned to dancing for a bit till a friend helped me land a ₦150k/month business development job at a company in Lagos in 2019. It was even the same friend who sent me the ₦15k I used as transport fare to relocate to Lagos.

I squatted with some people for a month until I rented a room and parlour apartment for ₦350k/year. The full rent package was around ₦550k, and I took a salary advance from work to settle it.

Sounds like things were looking up

I wish. The job was on the Island, and I lived on the mainland. I woke up at 4 a.m. and returned at 11 p.m every weekday. There was a time when I got home at 12.30 a.m. because of terrible traffic, slept for three hours and went right back to the road. I was so frustrated. I’d get to work most mornings, enter the toilet and cry.

I didn’t stay at the job for longer than six months. I couldn’t deal. Within that time, I entered one-chance buses twice and had my office laptop stolen. I had to pay ₦190k for that laptop from my salary.

Fortunately, I got another business development role at an agricultural firm almost immediately. The salary here was also ₦150k. But six months later, COVID hit, and I was laid off. They didn’t mind that I’d raised ₦10m for the company in that short time.

Damn

I was also in another relationship then, and my partner had moved in with me. We were living on the little savings I had left. I’d gotten experience working at the agric firm, and decided I could focus on building my own.

My plan was to deal with grains. So, I’d work with farmers and northern traders to grow and supply corn, rice, beans, soya beans and millet to production companies. I made my partner a co-owner even though she brought in zero capital and wasn’t business-inclined. She handled the admin front, though.

Did you bring in all the capital? How much was it?

I needed ₦10m to start, which I didn’t have. So, I pitched to five investors and raised the money through them. We started in late 2020, and that period was crazy. I did 90% of the heavy lifting and interfaced with the farmers and clients.

I made a mistake, though. I agreed to pay the investors 70% of the monthly profit for six months. Looking back now, that was too much to promise for a new business. My partner and I shared 10% and put the remaining 20% back into the business. In a good month, I made between ₦70k – ₦100k.

Why was the 70% plan a mistake?

It should have been spread over a year, rather than monthly. I could only afford to pay them for four months. The business started to fall apart; the 20% we were putting back in wasn’t enough to cover the logistics cost. So, I paused the investor payments and started brainstorming ways to revive a dying business.

Around the same time, my partner began complaining that she didn’t feel like a part of the business, that sharing 10% was nothing, and that she only held a ceremonial position. I was baffled, but I briefly increased her percentage to 40% to satisfy them.

How did the investors react to the suspended payments?

I tried to explain the situation, but it definitely caused a strain. Some of them were known people, and there was just a period of long silence. I was still trying to make small payments here and there, but it wasn’t regular. My focus was on making the business work. I also stopped paying me and my partner a salary.

I was able to stretch the business till 2022 by getting grains on credit and paying later, but the economy became too unfavourable. The grain merchants refused to sell on credit, and it just wasn’t working anymore. By then, the investors had gotten back their capital, and it was just about ₦13m in profits and ROI left.

But some of them grew tired of waiting and arrested me. I slept in the cell for a day before my family came to release me. They had to pay ₦1m to one investor so they’d let me go. My partner didn’t contribute anything financially. I felt bad, but she said her family asked her not to get involved.

That’s a lot. Sorry you went through that

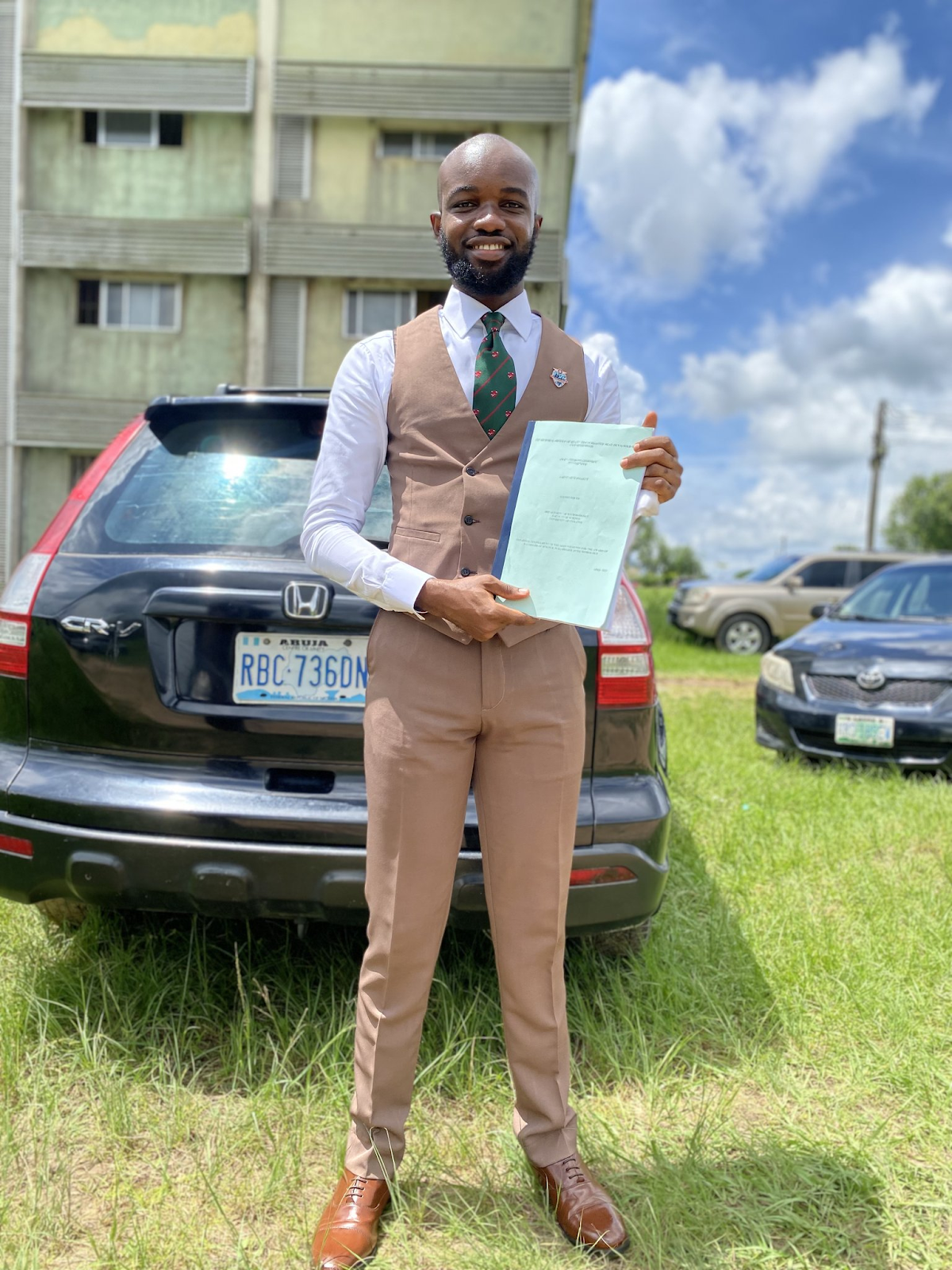

Thank you. I had to pause the business and take up random dancing and script-writing gigs to make money so I could repay the debt. So far, I’ve settled about ₦7m out of the ₦13m. That also included support from my family.

Around this time, my partner started making plans to japa. To support her, I gave her ₦90k to add to what was needed for a passport.

Were you bothered that she wasn’t there for you during the arrest, though?

I was bothered, but I believed that she did everything she could at the time. I didn’t use that as a yardstick to withdraw support for her travel plans. But then she relocated in 2023 and broke up with me after a few months, leaving me to handle the debt.

Omo…

I should mention that I couldn’t renew my house rent when the debt and arrest issue happened in 2022. My landlord was kind and allowed me to stay for free for a whole year. After my partner left in 2023, the landlord asked me to leave. He actually tried for me, waiting that long. That’s how I became homeless in 2023.

Damn. That’s a string of bad things happening all at once

It was a lot. I sold most of my properties and for five months, I was moving between the houses of multiple friends. I held onto my sanity by attending dance workshops.

In October 2023, I eventually got a job as a personal assistant. My salary was ₦120k/month.

Phew. How did that feel?

It felt like a lifeline. Landing that job after an uncertain five months was a relief. Though I wanted ₦250k because of the workload, I had to take what I was offered.

By November, I’d moved into my own apartment. I unexpectedly got ₦500k as a birthday gift from a friend, and it went into getting a place. Things were starting to take shape again. But I left the job in February 2024.

Why?

The work environment became toxic, and my workload was what four people should ideally have to share. It wasn’t worth it, so I left.

Before I left, I’d already begun to take my art seriously and had started to paint commercially.

Wait, when did art come into the picture?

I was introduced to painting in secondary school, but then I stopped to face adulting. I took it up again briefly during the pandemic. I’m mostly self-taught, really.

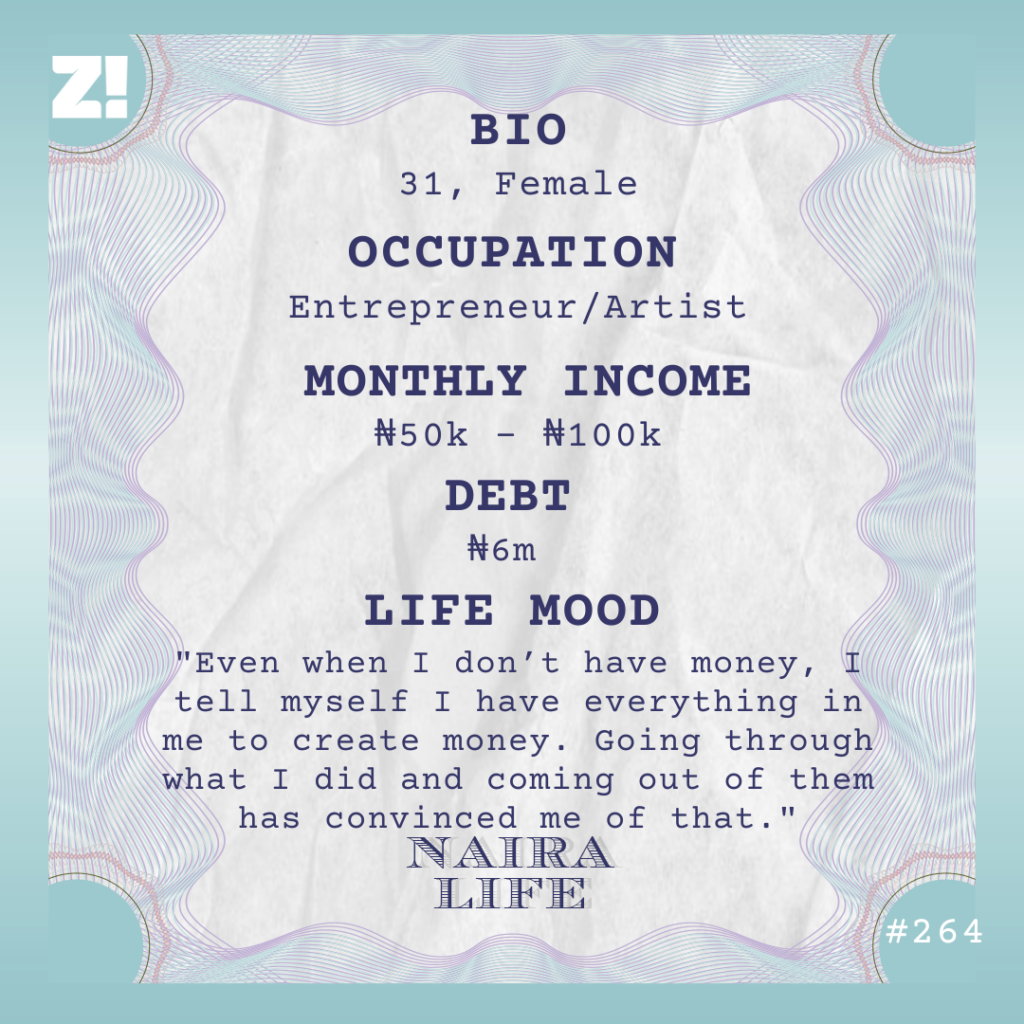

How do you make money as an artist?

Mostly through commissions. People reach out to me to paint them something. Other times, I paint and sell. I’m somewhat active on social media, and there’s also word-of-mouth marketing. In a really good month, I can make between ₦50k – ₦100k, but clients’ budgets aren’t fixed, so that figure changes a lot. If I can get more people to commission me for paintings, I’ll honestly have nothing to worry about again.

Fingers crossed. How have your experiences impacted your perspective of money?

Money comes and goes. Even when I don’t have physical cash, I tell myself I have everything in me to create cash. Going through what I did and coming out of them has convinced me of that.

I also think saving is crucial. My savings have helped me out a good number of times, and if I weren’t trying to set up a home studio, I’d be setting aside 30% of whatever I make into a savings account.

You’re setting up a studio?

Yes, for my painting. I deliberately rented an apartment with space for a future studio, so I’m working on that now. I’ve spent about ₦250k designing murals, painting and construction work. I do most of the manual labour myself.

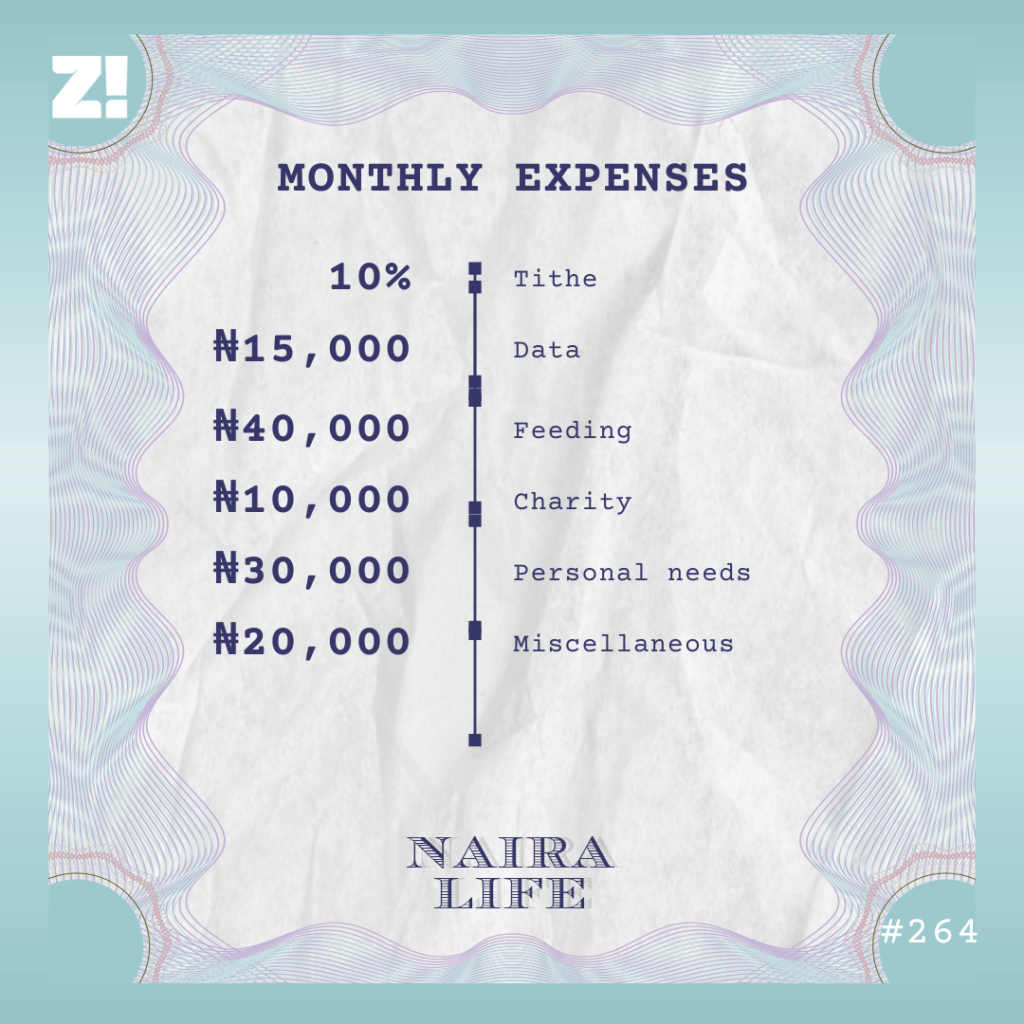

Let’s break down your typical monthly expenses

What’s the last thing you bought that significantly improved your quality of life

₦40k worth of art materials. That’s how I stay away from depression. If I can find Arolake’s money bag now, the quality of my life will skyrocket sharp-sharp.

How are you thinking of future plans?

I hope to own a creative haven for artists one day; where they can stay away from the hustle and bustle of the city and just create. I also hope to raise capital to revive my agric business. With the state of the economy now, I’ll probably need like ₦50m – ₦100m to even consider rice, but it’s a lucrative business. I believe I’ve gotten the business experience I need to not repeat the mistakes I made again.

How would you rate your financial happiness on a scale of 1-10?

4. I’m literally rebuilding from scratch, but I know it will get better. If I hadn’t experienced all I have, I wouldn’t have the confidence and tenacity I have now to try new things and just keep going even when they don’t work out.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.