Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

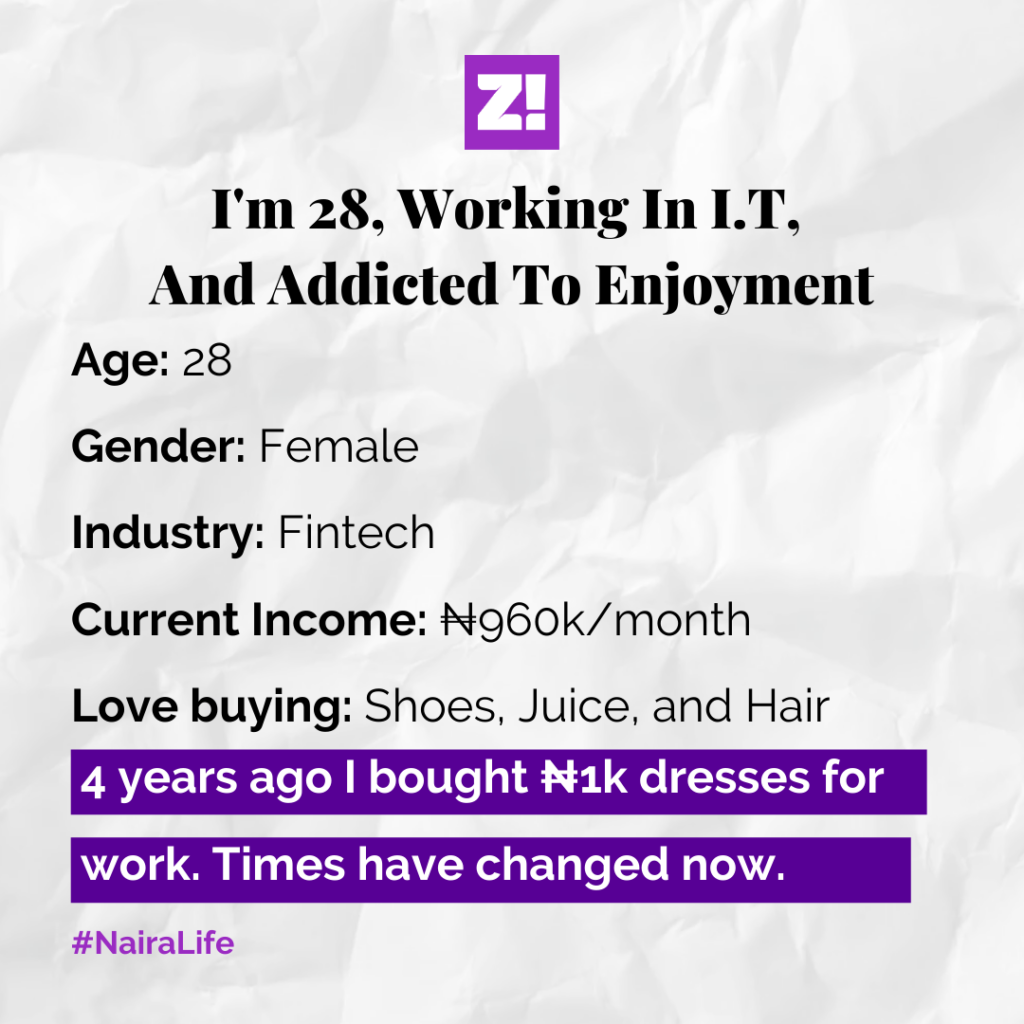

The subject of today’s story is an IT expert with a special focus on the financial sector.

What was it like growing up?

Someone once said this about me while I was in school: “Is it not that girl that used to act as if her father has all the money in the world?”

Sounds silly, but this is how I can describe my dad while I was growing up; he always provided everything we needed.

One day, I overheard a neighbour arguing with his wife and he said, “Where was your father when I was sending you to school?” And I just knew that I never wanted to be in that place that she was. I’d rather just stay in my lane, and not collect insults.

You know, my dad has one of those large families where you’re responsible for your siblings, nephews and nieces. But still, whenever we needed something, he always came through.

What was the first thing you ever did for money?

I dunno if this counts, but I was one of those people that their state governments sent on a scholarship to go to school abroad. I also got a stipend of a few hundred dollars per month – can’t remember the exact number now. My dad also sent some money every other month.

But what I’d consider my first real income was my NYSC allowee in late 2013, ₦19,800. My dad also cut me off from pocket money from his end. But my mum started giving me ₦5,000 monthly from her tiny salary – she was a teacher.

Then I had my ₦5,000 from the state government.

After NYSC?

Ah, I was waiting for my daddy’s connections to get a job. Well, I waited for four months.

Ouch.

Staying at home sucks. One time, I lied to my dad that I was travelling for a job interview, but I actually went to my sister’s school to stay in her hostel for a few days.

Then one day, someone asked for my CV.

Progress. Where?

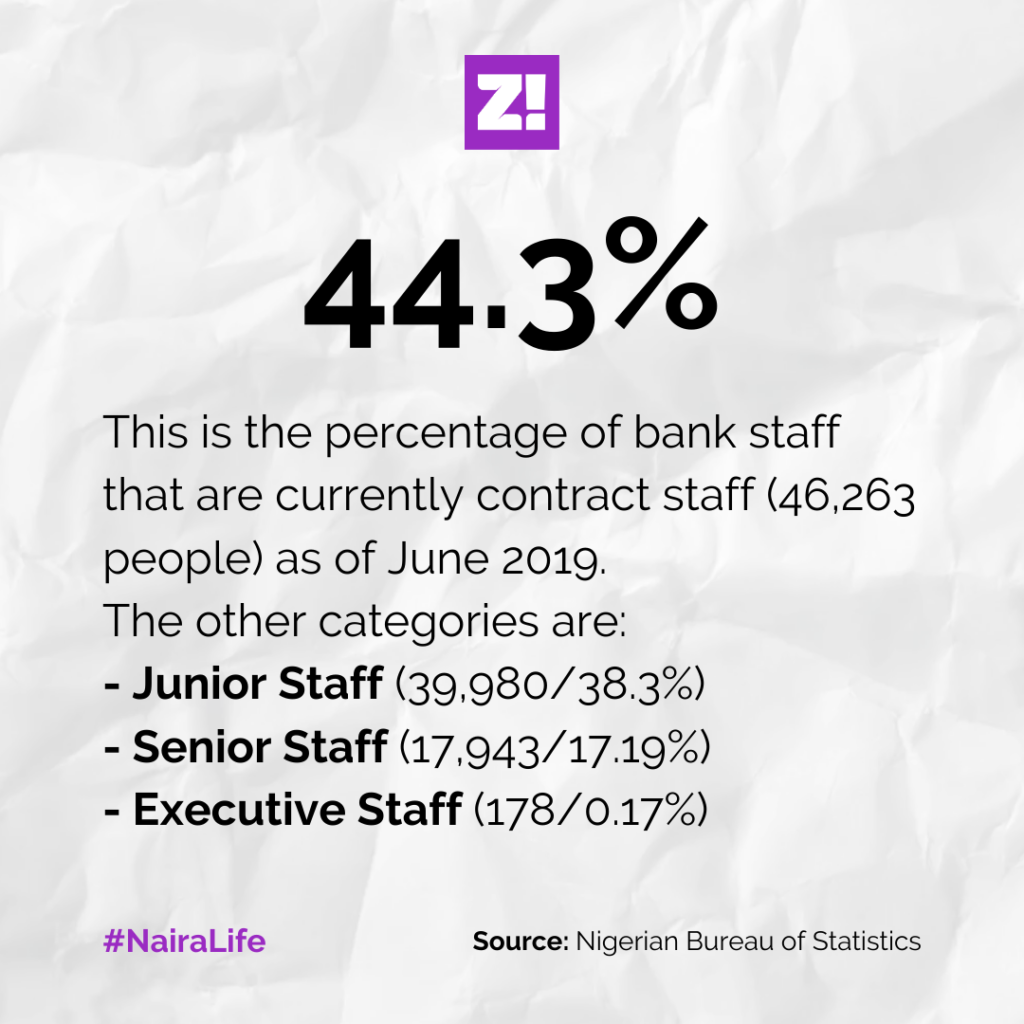

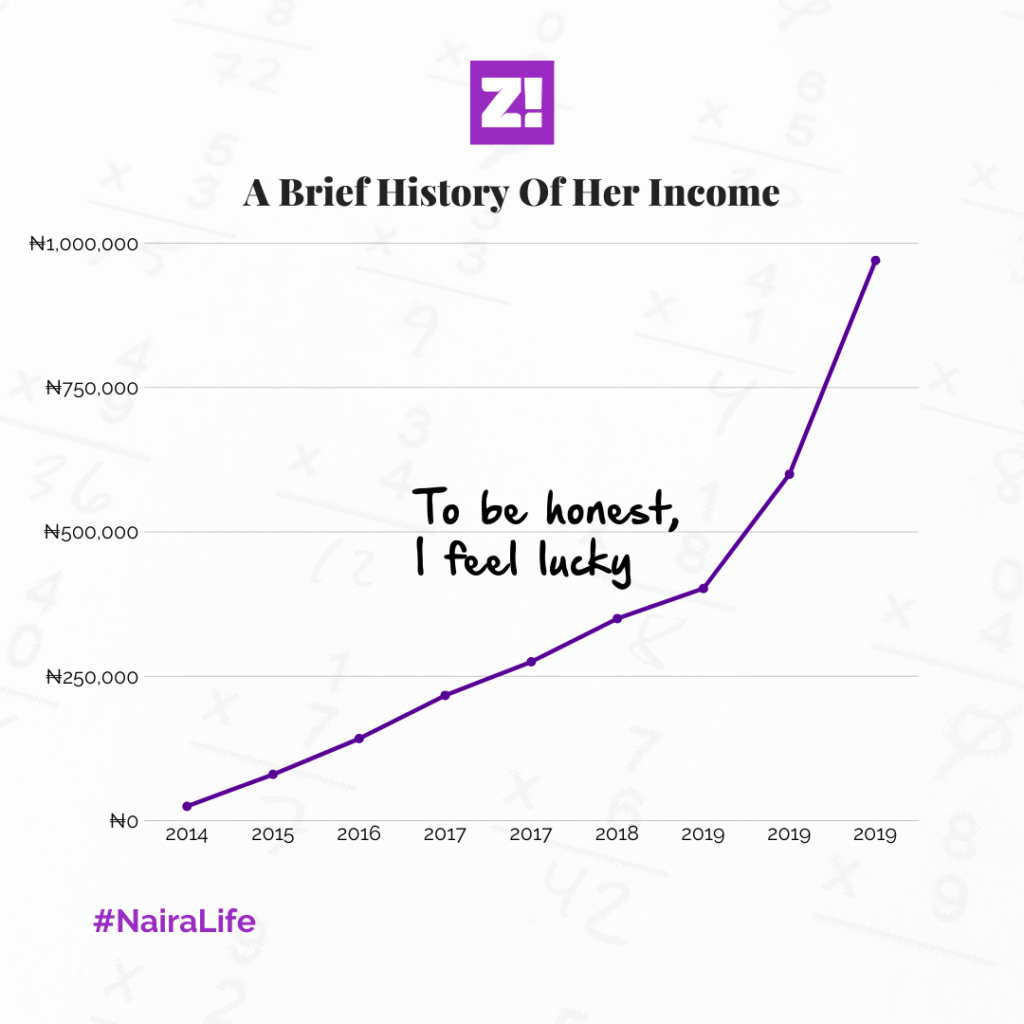

A bank. I got a call one day and fast forward to one month, I was starting as a contract staff. We got started on ₦80k/month, while a normal staff was earning ₦142k. I think contract staff are the banks’ way of saving costs.

You know what’s wild? I didn’t want to go for the interview. I thought I wasn’t good enough. It’s the same thing with the scholarship exam. I just felt I wasn’t good enough until my sister kicked me out of the house to go take the test.

At the end of the interview and training at the bank, I was the best in my batch, so I had the privilege to choose any department I liked.

I chose the IT department, of course.

So, you had to move to a new city to take this job?

Yes. I used to live outside Lagos. Moving to Lagos was hard, financially. But my dad took care of my first rent and I had my ₦80k to live with. You know, my glasses got bad in those days and I couldn’t afford to fix it. I couldn’t afford brand new clothes, so I’d go to the market to buy secondhand clothes and ₦1k dresses. I used to be scared of going to markets then, but I had no choice really.

I found solace in the promise that we were going to have our appraisals and salary reviews after one year. Over one year later, it didn’t happen.

Why?

By August, my dad said, “You are a first-class, international graduate and you shouldn’t be earning ₦80k.” He was hustling a lecturing job for me that would have paid more, and we actually fought about it, but I just knew I needed to be away from them.

We had a town hall at work, and when it was question time, I raised my hand to ask why our salary had not been reviewed months after it was supposed to. The whole discontent at the time forced me to start thinking about my options. I started studying the bank’s pay structure, and I realised that if I stuck to their growth patterns, it’d take me about a decade for me to get to about 300k+ per month.

This is super interesting.

Nothing was making sense to me anymore. But a few weeks after that townhall, our salaries were reviewed and we were upgraded to full-time staff. I got upgraded to ₦142k. Then I went to buy something.

Ohooo.

I went to buy hair. That cost me ₦45k, but I paid in instalments. This was towards the end of 2016, by the way. In mid-2017, I got a message:

Person: Hey you, are you interested in moving?

Me: But of course!

I got called for an interview. They liked my CV, and I got offered a job. I suck at negotiating, so they offered me ₦217k. Also, at the time, that felt like a lot of money.

How did that go?

It didn’t feel like a good call, but I think leaving the bank had to happen, because it pushed me to grow, and in a way, leave my place of safety. But you see that place? It was shitty and toxic.

Also, every month, they’d split the salary into two. Then pay you the other half as a lump sum at the end of the quarter – I think it was to beat tax. So while I was earning more than I was at the bank, it felt more difficult. I stayed there for three months.

Where did you go?

So, while I was working at the bank, I had someone who I might call a work big sister. She just hit me up one day, while I was still at the bank:

Big sis: How much do you earn now?

Me:

142kBig sis: I’ll be in touch.

So, while I was at this place, she reached out and did the interview and bam. I got the job. That bam was months of uncertainties and “we’ll be in touch” etc.

Awesome. Awesome.

HR offered me ₦250k. I asked for a review, and eventually, it went up to ₦275k. I took the offer mostly because someone I respected and learned a lot from was going to be my boss again.

Was there a probation period?

Yes yes. And six months later, I got a message saying my performance had been reviewed, and now my salary was increased to ₦350k. By the end of 2018, up again to ₦402k. And then a shocker: towards the end of the 2019, I got a raise to ₦600k.

I heard the sound of sirens in my head now.

Hahaha. But as my money increased, I felt more responsible with family and stepped up. I got a loan from work to get a place in Lagos. So even though my salary was increased, part of it had to go to repaying the loan. A few months into living at the house I got, I was going crazy.

Why?

Traffic. It was killing me so much that I literally abandoned the house. I took another loan, this time outside work, and rented another place. By the end of 2018, I took another loan. Also, I feel like I was living from paycheck to paycheck, and saving was just hard.

Then a friend of mine linked me up to a gig where they needed an I.T. person. It was abroad, and that paid $250 weekly.

Weekly money is good.

This one started in July 2019. This reduced a lot of my loan burdens. By December of 2019, I became debt-free.

It’s crazy, because in 2015, just about four years ago, you were on ₦1k dresses. How you see life?

Ahhh, I’ve grown. The day I knew I’ve grown was one time when I went out for dinner, and when my bill came, it was slightly over 10k. I just pulled out my card and paid.

And I realised oh shit, I couldn’t have done this in 2015. But, I can do that now! I just got a hold of my finances, and I don’t know how my dad managed to have all that responsibility with how much he earned. He used to earn about 600k, but that dropped to about 300k, and somehow he still manages to have all the responsibilities that he currently has.

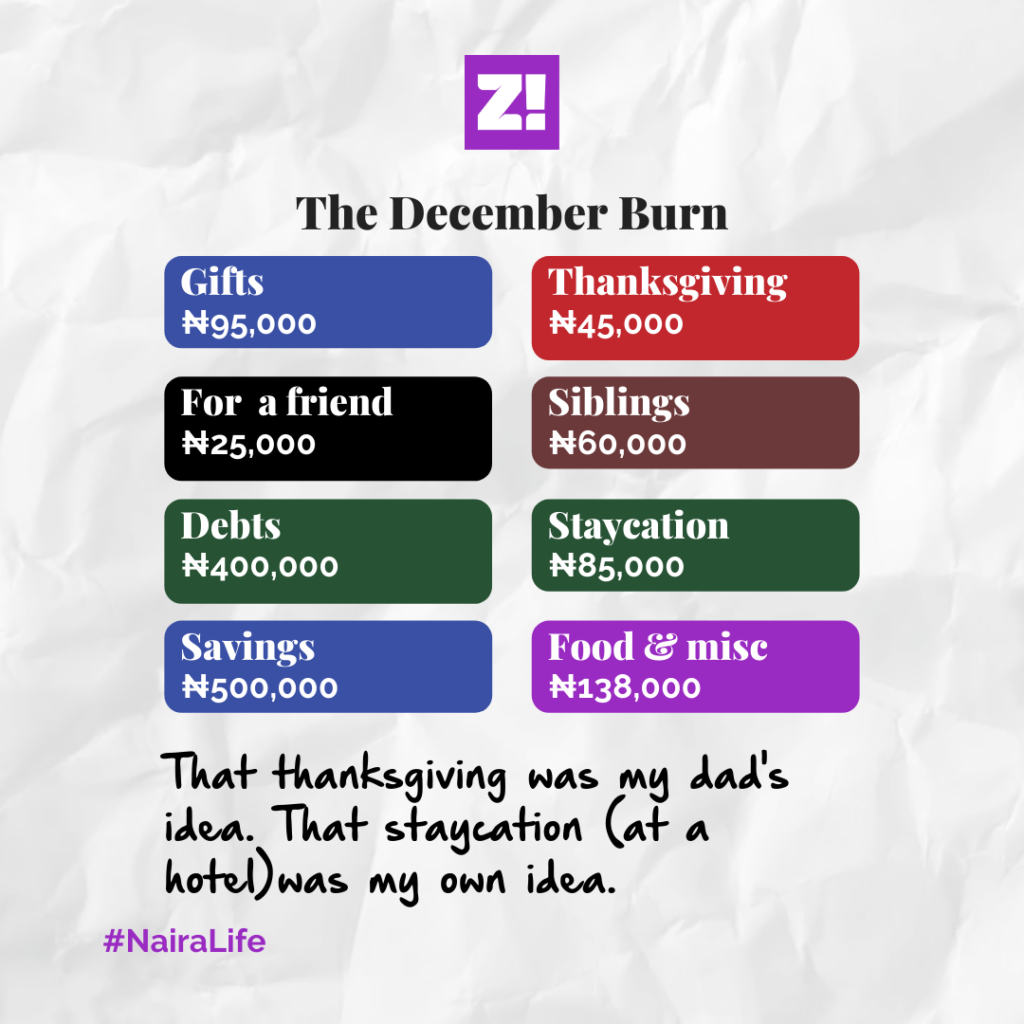

I stan. Let’s look at everything you netted in December 2019.

First, there’s my ₦600k salary. Then my 13th month; 650k. Then my $250 per week, which brought everything to about ₦1.6 million.

Now that we’ve established that, let us talk about your Detty December.

Hahaha. First of all, I cleared all my debts. All my outstanding debts were almost ₦400k. Then I did a two-night staycation; ₦80-something-k. I moved 500k to my savings. Send ₦60k to my siblings in total, as per December.

Then I kept ₦262k aside to survive the 100 days of January.

That’s almost 1.5 million.

I’ve just been buying food anyhow. Today now, I just branched somewhere and ended up buying food and juice and all that for 15k. Don’t ask me about the rest.

What’s something you want but can’t afford?

A holiday to say, Bali. I feel like I can’t afford it because I always have to go back to my savings to make big expenses like this.

What’s the last thing you paid for that required serious planning?

It was a work trip that I didn’t have to pay for. But something else happened; I dipped into all my savings and spent everything buying gifts for my family, nuclear and extended.

You can tell me how much it is now. I’m holding on tightly so I don’t fall down.

Hahaha. About a million. The first child of a Nigerian family for me means buying gifts for everybody when you travel. So shoes, bags, clothes. Add my excess luggage money to that money.

Talking about buying things, what about yourself?

Ohhh, I’m a big spender on gadgets. I must – must use the latest iPhone at every point in time. Also, I like shoes a lot.

And hair.

What’s your biggest financial regret of 2019?

I couldn’t save more. And that’s mostly because I bought a lot of shoes, and then I added weight. That meant that I had to buy new clothes. A lot of new clothes. And of course, I was no longer buying the ₦1k dresses, so that means I spent more. My average dress now costs ₦7k or so. The other time, I went to a store and bought a dress for ₦25k.

Let’s attempt to rate your financial happiness on a scale of 1-10.

I’m a 7. For someone who coasts through life, I feel extremely lucky and it just feels like God’s grace. I can’t discount the fact that I’m a hard worker though.

Despite the fact that I feel lucky, I need to get to a point where my money starts to work for me. Can’t be dipping into savings every time I want to buy basic things.

Check back every Monday at 9 am (WAT) for a peek into the Naira Life of everyday people.

But, if you want to get the next story before everyone else, with extra sauce and ‘deleted scenes’, subscribe below. It only takes a minute.

Every story in this series can be found here.