At 35, *Juliana earns close to ₦4.5m monthly working remotely for a US-based development finance organisation. But her career started far from global development or tech.

After graduating with an economics degree from UNILAG, she spent a decade climbing the corporate ladder in a Nigerian bank, rising from intern to managerial level and increasing her salary nearly 10x in the process.

Her edge? Building strategic relationships, taking challenging roles, and collaborating where possible. Here’s how she navigated banking, pivoted into product, and found her niche in development finance.

This is Juliana’s story as told to Aisha Bello.

I never planned to work in banking or finance; I studied economics as a means to an end. I had been in the technical sciences in secondary school and wanted to study chemical engineering.

But when I wrote WAEC, I realised I didn’t like chemistry. I enjoyed maths, though. So I needed something close enough, but I didn’t like commercial courses.

Economics felt like a middle ground: the right blend of logic and people.

In 2008, I got into the University of Lagos to study economics. During my third year, I interned at a Nigerian bank, and that experience changed everything. I was paid ₦22,500 monthly for my three-month internship in the strategy department.

I know this sounds odd, but I didn’t fall in love with just the work; I was also drawn to the female bankers’ looks: sharp suits, pointy heels and an aura of control. I wanted to work wherever people dressed like that.

Getting My First Bank Job Before NYSC Ended

I come from a middle-income family. My dad worked in marketing, and my mum ran a bank’s food canteen. She helped me land that internship in 2011. Interning at a bank was fairly common back then, and building a network came naturally because I had already been in the system.

I graduated in 2012 and secured a job at the same bank before my service year ended in October 2013. I resumed at the bank’s training school that November. I was 23 years old.

Join 1,000+ Nigerians, finance experts and industry leaders at The Naira Life Conference by Zikoko for a day of real, raw conversations about money and financial freedom. Click here to buy a ticket and secure your spot at the money event of the year, where you’ll get the practical tools to 10x your income, network with the biggest players in your industry, and level up in your career and business.

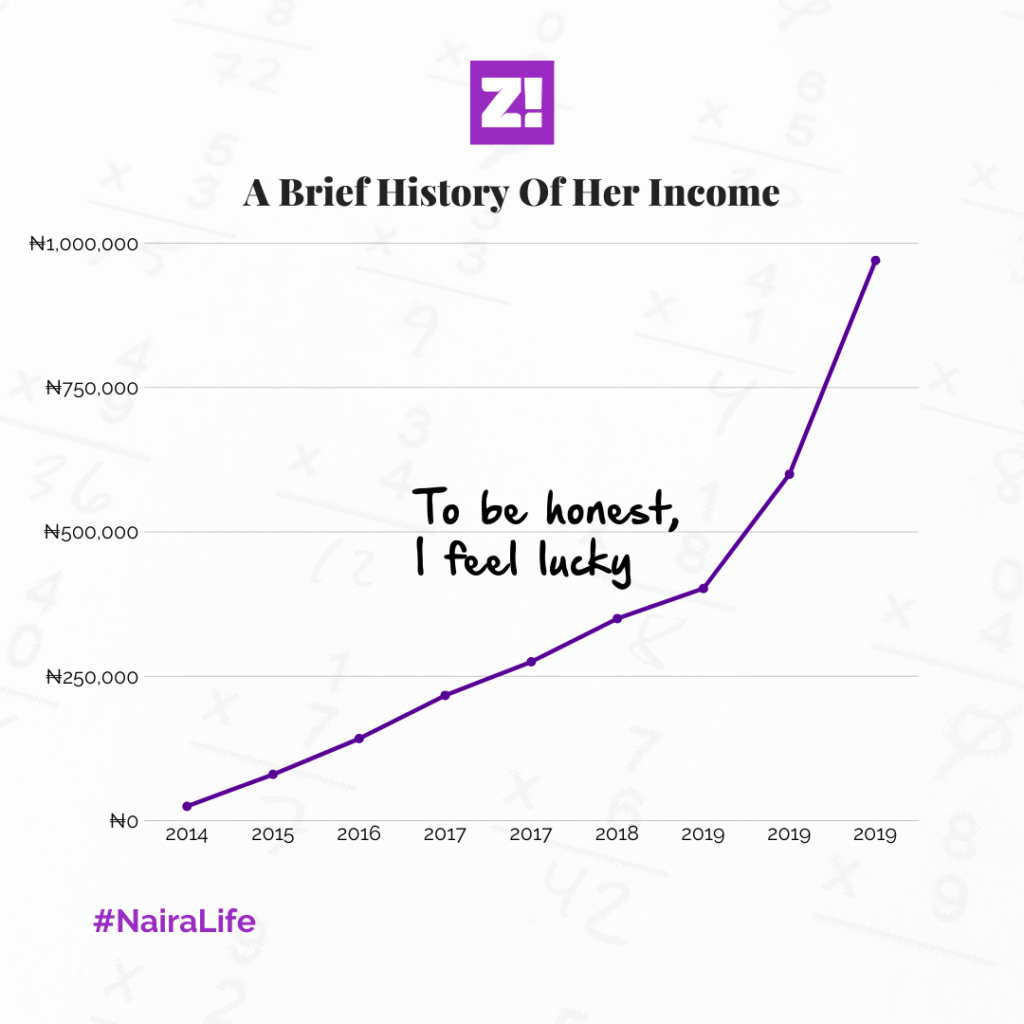

My Salary Progression in 10 Years

The training school lasted four months, and I was paid a ₦85k/month stipend. When I resumed as a full-time graduate trainee in 2014, my salary was bumped to ₦130k/month. Three months later, it was reviewed to ₦150k. I’d spend the next decade rotating departments at the same bank.

My first manager was very demanding. I thought she was too much, but in hindsight, she really shaped my work ethic. I always showed up prepared because I didn’t want to be called out, and that discipline stuck with me.

Because I was in the top 5 during training school, I was placed in an accelerated graduate associate program that allowed me to move from Level 1 to Level 3 in two years. I rotated across departments, gained broad exposure, and was promoted directly from graduate trainee to banking officer in 2016, skipping the Assistant Banking Officer level. My salary went from ₦150k to ₦250k. It was an intense two years, but it accelerated my career path.

In 2018, I was promoted to Senior Banking Officer and moved from retail to the corporate banking unit, where I earned ₦450k/month. I was in this role for four years, and my salary increased significantly.

In 2020, I was earning ₦600k. By 2021, it had climbed to ₦800k. When I got promoted to Assistant Manager in 2022, my salary jumped to ₦1.5m/month. Every promotion came with a salary bump. We also had regular salary reviews and year-end bonuses, depending on how well the department performed and met targets.

I moved units in 2022 and stayed in the last role for only five months before I left in 2023.

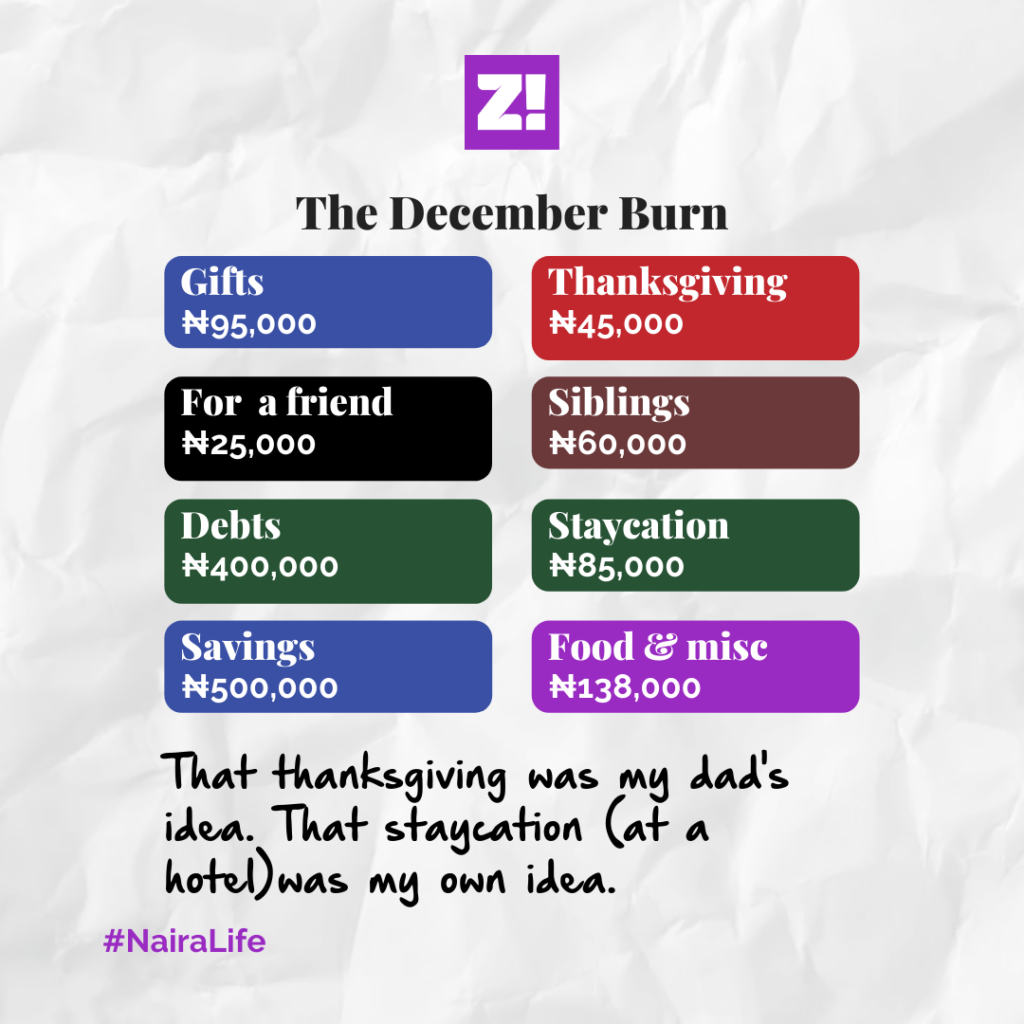

Here’s a Snapshot of My Salary Progression

How I Grew Fast in My Career

I earned four promotions in 10 years because my manager knew I always delivered. I consistently took on more responsibility, which got me advocates: people who spoke for me when I wasn’t in the room. In banking, that’s how you grow: results and the right people backing you. You need both to grow in the corporate world.

I also collaborated a lot. If I didn’t know something, I’d ask for help. As I got better, I also shared knowledge. That built credibility and trust, which, once established, opened doors.

What Kept Me in Banking for a Whole Decade

One of the reasons I stayed 10 years was how well compensated I was. One of the perks of being a banker is access to finance. We got credit facilities at favourable rates, so I got my first car in my second year and paid it off over time. With proper planning, I could also afford one international trip a year.

In 2014, I spent Christmas in East Africa, and in 2015, I spent it in Dubai. I remember I paid ₦150k for my round-trip ticket to Dubai.

I didn’t see any point in moving to another bank. Banking is banking. The primary reason to move was for growth, and I was growing just fine. But eventually, I grew weary of the routine, and the work started to feel monotonous.

Why I Left Banking in 2023

By 2021, I knew I was done with banking. I needed a new challenge and considered several tech-related jobs I could transition to. I listed my strengths and took a tech transition course, which helped me gain clarity on the next steps.

First, I transitioned within the bank, from corporate banking to the product unit, where I managed banking products for financial institutions.

I worked with the banking-as-a-service product team that partnered with fintechs and microfinance banks to leverage the bank’s infrastructure. Instead of building their systems from scratch, they used our APIs to create virtual accounts, move money, and offer financial services under their own brand. We managed the backend operations, and they focused on serving their customers.

I did that for five months.

I’d already been working remotely at the bank since COVID, so I focused on remote roles when I felt ready to make the leap.

I searched on LinkedIn and other remote job boards for over a year before landing a role as a project coordinator for a US-based development finance organisation working on different programs across Africa.

What I Do Now and How Much I Earn

I work with their implementation team, ensuring that every project is executed seamlessly, on time, and in line with agreed deliverables.

For over two years now, I’ve been working remotely for the development finance organisation. I earn in USD, but my net income is between ₦4 million and ₦4.5 million monthly, depending on the exchange rate.

I’m married, so I don’t handle all expenses alone, and I can afford to save up to 50% of my salary.

What’s Next for Me

The past few years have been my building years, and I finally feel like I’ve found my niche in development finance. It’s a vast and deeply impactful space, and I don’t see myself leaving anytime soon. The goal is simple: build expertise, earn trust, and carve a name for myself here.

Editor’s Note: Names have been changed for anonymity

[ad]