Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This week’s Naira Life is brought to you by QuickCredit. With QuickCredit, you not only get the funds you need instantly, but you also get to pay back at the lowest interest rate in Nigeria.

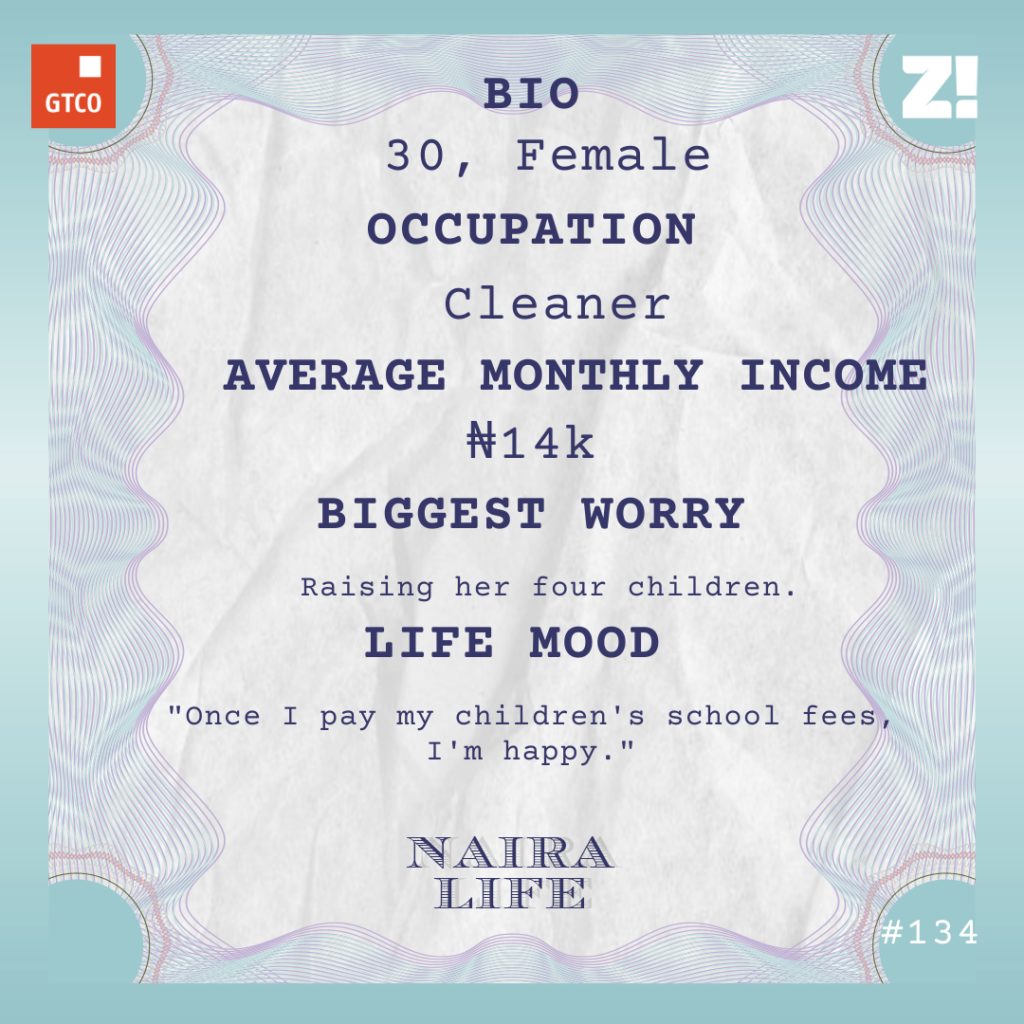

On this week’s #NairaLife, this 30-year-old lady’s quality of life nosedived after the death of her husband in 2020. Her current biggest worry? Raising her four kids on an average monthly income of ₦14k.

When did you first realise the importance of money?

That would be after my father died in 2003. We lived in a village in Ankpa in Kogi state and didn’t have much. But we didn’t suffer because my father took care of us. He made furniture and was also a farmer.

When he died, my mother had to mourn him for two years. This meant she had to stay at home, so someone had to take care of our family.

And that person was you?

Yes. I was 12 years old and the eldest of five children. The first thing I sold was oranges. A basin of oranges cost ₦700, and I made a profit of ₦800 after each sale. Any money I brought home was what we used to buy food.

After a while, I started going into the bush to gather firewood to sell. One bundle went for ₦300, and that paid for my school fees.

How much was your school fees?

₦1200.

How long did you do this for?

About two years. In 2005, one of my aunts who live in Lagos came to the village and asked me to come with her. She said we were suffering too much, and she wanted to help us. My mother’s mourning period had ended, so I didn’t have to stay in the village if I didn’t want to. I agreed and followed my aunt to Lagos.

What did you do when you got to Lagos?

I helped my aunt with her soft drinks business. She showed me how it worked, and I started selling on the streets. At the end of every month, she paid me ₦5k. She also put me in a tutorial centre. I sold drinks during the day and went to my classes in the evening.

It didn’t reach two years after I came to Lagos when I got married.

Tell me about how it happened.

A soldier took an interest in me. Whenever he bought drinks from me, he gave me something extra. That was all at first. Later, he said he wanted to marry me. I looked at him, and I looked at myself. I thought if someone like me could marry a soldier, maybe our suffering would be reduced. So I agreed to marry him.

I introduced him to my aunt and her husband. From there, we went home to my village to meet the rest of my family. We got married later in 2006. I think the whole thing cost him like ₦50k. My people don’t collect a bride price, but my uncle took ₦50 and my mother took ₦20 out of the money to show that they supported the marriage. The remaining money was used to entertain our guests.

Ah, I see.

He was a lance-corporal in the army and his salary was about ₦48k when we got married. We gave birth to our first child — a daughter — in 2007.

Things were good: I won’t lie. He took good care of me. From his salary, he’d give me ₦10k to send home to my mother and give me extra money to buy food in the house and take care of myself.

In 2009, we gave birth to our second child. That was also when I decided to start making some money on my own. I started selling fruits — oranges, pineapples and watermelons. For every ₦5k market I bought, I made ₦7500.

I did this until 2011 before my husband asked me to stop. The market wasn’t selling very well anymore, and I was also pregnant with our third child.

What made me stop was what he promised me.

What did he promise you?

A shop where I could start a better business. At some point, he wanted to take a loan to start me up, but I told him not to — I fear loans.

Now that I wasn’t working or selling anything, my children and I relied on him, and he didn’t fail. Not even when our last child came in 2015. He had started earning ₦60k and was close to being promoted to a corporal.

Every month, he sent us ₦20k for our feeding. It was enough because things were still cheap at the time. I’d spend ₦5k on baby food and diapers, ₦10k for foodstuff and save the remaining ₦5k so we could have something to spend before the month was over.

My husband also took care of the children’s school fees. When it was time to pay, he’d send his whole salary for that month. That’s how our family worked — I stayed home to take care of the children and he did the rest.

Then in 2017, they said he should go to Maiduguri to fight Boko Haram. My last child wasn’t even up to two years at the time. Nothing much happened until March last year.

What happened?

One night, I got a call around 9:30 p.m. The person introduced himself as a major and said that he was sorry, but they lost my husband in combat. I wanted to run mad. We had spoken the previous day, and he talked about coming back home in three months.

Oh my God. I’m so sorry.

Thank you. They buried him there and sent his things home. I couldn’t even go for his burial because it was during the lockdown, and they said everybody should stay at home.

I’m very sorry. He passed on active duty. Did you get any of his benefits?

That’s where the problem is. His brother was his next of kin, so his name was on paper. After they got the money, his family turned their back on me. Now they don’t even remember me or the children. I don’t know how much they gave them, but nothing got to me or the children.

Ah!

That wasn’t all. We were living in the barracks before my husband passed. After the army paid my husband’s people, they asked us to leave the barracks. I moved in with one of my cousins and that’s where I’m squatting now.

What are you doing these days?

Since June, I’ve worked at the barracks. I sweep two blocks in the barracks every morning for ₦14k at the end of the month. I have no money in my bank account or my savings. I use everything to buy food and take care of my children.

How do you manage it?

The first thing I do is to take ₦4k out every month. From that, I give my children ₦50 each every morning when they go to school so they won’t be looking at other children. The rest of what I make is for food. Thank God for the neighbours that bring something from time to time. My aunt sends me money when she can and my younger ones send foodstuffs.

My biggest headache is their school fees.

How much is their school fees?

My first child is 14 years old and is in JSS 2. I withdrew her from the private school after my husband died and took her to a government school. They don’t collect school fees there even though I pay ₦5k for PTA and other things. The second child is 12 years old and in Primary 5, and the school fees is about ₦25k. I also pay about that amount for the third child who is 10 years old and in Primary 3. My last born is six years old and in primary one. His own school fee is ₦20k.

How do you raise the money?

Ah, when it’s time to pay their school fees, I start to disturb my people. Some of my husband’s friends also send me money for this. I gather the money from everywhere I can find. I fear that people will stop helping me soon. That’s why I want to start my own business.

What business do you have in mind?

I want to get a shop and start selling provisions and drinks. I don’t even know how much I need because I’ve not started asking around. I want to have some money in my hand first.

But I know it’s the next thing for me. It’s my prayer request every day. I even drop something when I go to church — even if it’s ₦100. I just want to have enough money to take care of my children.

As you are now, how do you see life and money?

If you’re alive and you don’t have money, you’re nothing and nobody. But if you have money, you will be okay and happy. The people around you will also be happy and proud of you because they know you can help them.

Hmm. What was the last thing that made you happy?

When my husband was alive, he would send us extra money during holidays so I could take the children out. That used to make me happy. Now, it’s their school fees. Once I pay it like this, I’m happy.

It’s been a difficult year, but how would you rate your financial happiness on a scale of 0-10?

2. But I know that nothing is hard for God. I’ll be happy very soon, and people will know that I’m happy.

Update: Upon request from readers, we added a payment link for people to donate to the subject of this story. Find it here.

Great! You got to the end of this article. Know what’s even better? You can get QuickCredit faster than the time it took you to read this article. With Quickcredit, GTBank customers can get N2million in less than 2 minutes and pay back over 12 months at an interest rate of 1.5%. No forms. No collateral. No hidden charges. Get Your Quick Credit on GTWorld