Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Let’s begin with a throwback. Do you remember your oldest memory of money?

I’d say it was the house-to-house visits during Christmas. I always looked forward to that every year, even though the money I got from them wasn’t a lot — about ₦800 at the end of the day. It was a big thing because every kid my age was doing it.

Apart from that, it was watching how my parents managed money. My dad was a frugal parent. He believed his core responsibility was taking care of our education, and nothing more. My mum was the one who took care of the extra things. Nothing luxurious, but just enough to get us by.

What did luxury mean for you at the time?

Let’s start with allowances. My friends in school were living large and bringing about ₦200 to school. I had ₦20 to spend. Also, video games. I wanted SEGA and PS1 at different points, but I didn’t get them. The only fancy things I remember us doing was going to restaurants, and those were far and in between.

This didn’t affect me in any major life-changing way — I always thought that I could do whatever I wanted when I started making my own money.

Speaking of money, do you remember the first time you made some?

My grandmother used to sell bread, and she bought it from a bakery close to the house. Sometimes, I put some of my money into it when I went to get a fresh batch. So, if I had ₦20 and invested it, I would make like ₦10 naira extra.

I also worked intermittently at the bakery from 2002 to 2005. The highest I made from the job was ₦500, but I ate a lot of free bread. I didn’t think the pay mattered because I was young and the job was fun.

That’s interesting. What happened after?

In 2005, I moved in with my aunt in Lagos to continue school. It wasn’t a major change because I’d always visited her. At her house, I had some of the things my parents couldn’t give me.

Oh? What sort of things?

A better allowance for starters. Also, my aunt worked at the port, so I got some of the things she brought in from the port. I even had a Gameboy at some point. You could say I was a little spoiled.

Lmao. What was that like?

It was definitely a step up. It was nice having some of the things I thought were out of reach. The people she worked with thought I was her son and that brought in some additional perks.

Like?

Making extra money. I always hung around the port every day after school and people started asking me to wash their cars and would give me about ₦500 when I was done. After a few times, I became more intentional about doing this and tried to wash as many as four cars in a day. On average, I made ₦10k every week.

Impressive. Do you remember what you did with the money?

I saved most of it with my aunt’s daughter. If I needed anything, she bought it for me. I didn’t need a lot because I got whatever I needed already, so most of the money was hers.

After secondary school, I taught at a private primary school for ₦6k per month. I quit and went to university when I got an admission offer later that year.

When was this?

2011. Another change happened here: my aunt retired from the ports authority around the time I got into uni. I slowly realised I had to sort myself out for the most part. My allowance used to be ₦10k per month at first and I got it on time. Then it reduced to ₦5k, then it went down to ₦3k. At some point, nothing came for months.

What did that do to you?

It spurred me to get a job. In my second year, I became a private tutor— six hours a week and I got ₦10k at the end of the month. In my final year, I did a bunch of things — typed projects for people or helped them with their research. The money I got wasn’t set in stone, but it was between ₦5k and ₦20k.

When did you leave uni?

2016. But before that, I did this internship that changed the course of my professional life.

Tell me about it.

I studied a science course and was supposed to intern at a research institute or something that had a lab in my third year. But a friend called me and asked me if I wanted to intern as HR admin at an insurance brokerage firm. I thought to give it a try and applied for the role. There were concerns about what I was studying but I convinced them to give me an interview. The interview went well, and I got the job. They paid me ₦25k every month, but I was living at Apapa at the time and going to work at CMS. The commute took most of my money. I didn’t mind, I thought the job was giving me more value than what I studied could ever do. My internship ended after six months, and I returned to school with the knowledge that I wasn’t cut out for lab life.

I wasn’t doing a lot of courses during the second semester of my final year, so I asked them if I could come back to intern with them. They agreed, and I combined the job with school until I graduated.

So, after uni?

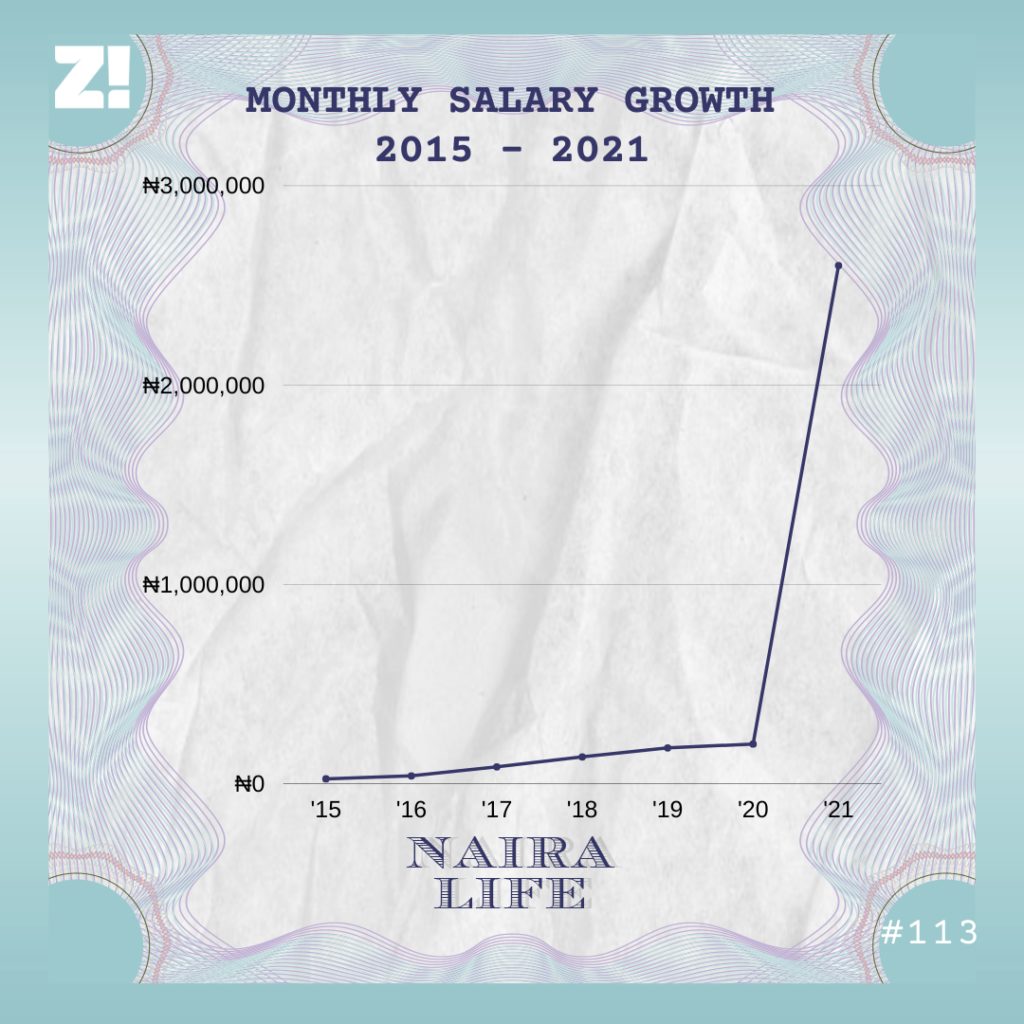

I got a job at another HR consulting company, which paid me ₦40k a month. I was there for a little over a year before I left in October 2017.

Why did you leave?

My boss was a pain in the ass. The company used a monthly performance review system to determine who got paid for a month. That wasn’t a problem, but my boss would delay the review until the 26th or 27th of each month. That meant we couldn’t get our salary until the first week of a new month. It wasn’t sustainable for me. So when I got a new offer, I left. The best thing about my time there was that I’d transitioned into sales too. I have the same boss to thank for that.

Inside life!

I got a job with a fintech company operating in the payment space. They hired me as a business development executive. My salary when I started was ₦85k. Since it was a sales job, I had targets and was expected to bring 15 agents to the business. On average, I brought in 13 agents, and each agent was doing ₦3m-₦4m in volume every month. I wasn’t doing badly. After six months, I was moved to operations and became a team lead. I left the field and started managing a team on the field. My salary was bumped up to ₦135k.

Nice.

The environment became somewhat hostile at some point though. Someone I used to report to on the team thought I was undermining them. Also, there was a problem with some transactions I was in charge of, and I got a series of queries for it. At the end, I left. This was December 2019.

Ouch.

Yup. I had been looking for a way out too. Shortly after I left, a friend reached out and asked if I would be interested in a Head of Sales role at a new Edutech company. I applied for it, and I got it. ₦180K per month.

A few months into the job, Covid happened. The company was building solutions for schools, and when the pandemic hit, schools stopped coming. The homeschooling product we tried to ship didn’t scale as much either because parents weren’t willing to pay. We got a 15% pay cut. Then salaries started coming late. Later, we were hearing talks about the founders shutting down the business and moving into something else. Nobody’s job was certain.

I was working a HR gig on the side while all of this was happening, and it was paying me ₦200k, so I didn’t feel the heat as much as I would have.

When did you finally leave the Edutech company?

July 2020. I was home for a month before I got a new job as an e-commerce manager at a renewable energy company. They offered me ₦200k, but what did it for me was that they promised me up to ₦500k in commissions after my first six months on the job.

Did it happen?

I didn’t spend up to six months. The system was flawed. First, the salary came on the last day of the month, which I wasn’t comfortable with. But that wasn’t the deal-breaker — they weren’t completely honest with where their products came from, and I was at the forefront of managing their displeased customers because I was the salesperson. To be fair, I always knew I wouldn’t stay there for long before I ran — there weren’t many chances of growth..

When did this happen?

January 2021. I had a defining moment when I was planning my exit. A friend I used to work with moved to Europe and started a YouTube channel. In her videos, she talked about the process of relocating and applying for remote jobs. That spurred me, and I was like, “Okay, I need to go all out about this remote job thing.” At the end of January, I had three remote sales jobs.

Wait. How do you go from being out of a job to landing three remote jobs?

Information. My friend talked about Linkedin and one other site, which I didn’t find very useful. I started with Linkedin and followed the steps she talked about. It was as simple as typing “worldwide sales manager jobs” in search, and I got a list of options. I got my first remote job within a week of applying, but it didn’t work out.

Someone I follow on Twitter tweeted about another platform — angel.co. I signed up to the website and started seeing roles that were specific to my needs. I applied to a bunch of jobs, got matched with prospective employers, and interviewed with them. These three jobs came from that.

Omo. Tell me about the jobs.

Two of them are contract jobs, and they offered me 10% and 15% of my monthly turnover. The third one is a full-time job and I’m a country partner managing their markets in Africa and Europe. My gross salary is $8k per month.

FROM ₦200K.

Yup, it’s a massive difference. I started full operations in February, but I got $7k at the end of the month. Something about taxes. They are working on that since I’m not a tax resident in the country they work out of. But yeah, I’m currently earning about ₦2.6m from that job.

Mad. And the other two?

I’ve not made anything from those ones. As I said, they are contract jobs and I’m only getting a percentage of whatever we sell. One of them is actually on hold right now because the company we were contracted to work for had some technical issues.

Omo. This is the part where we break down your monthly running costs.

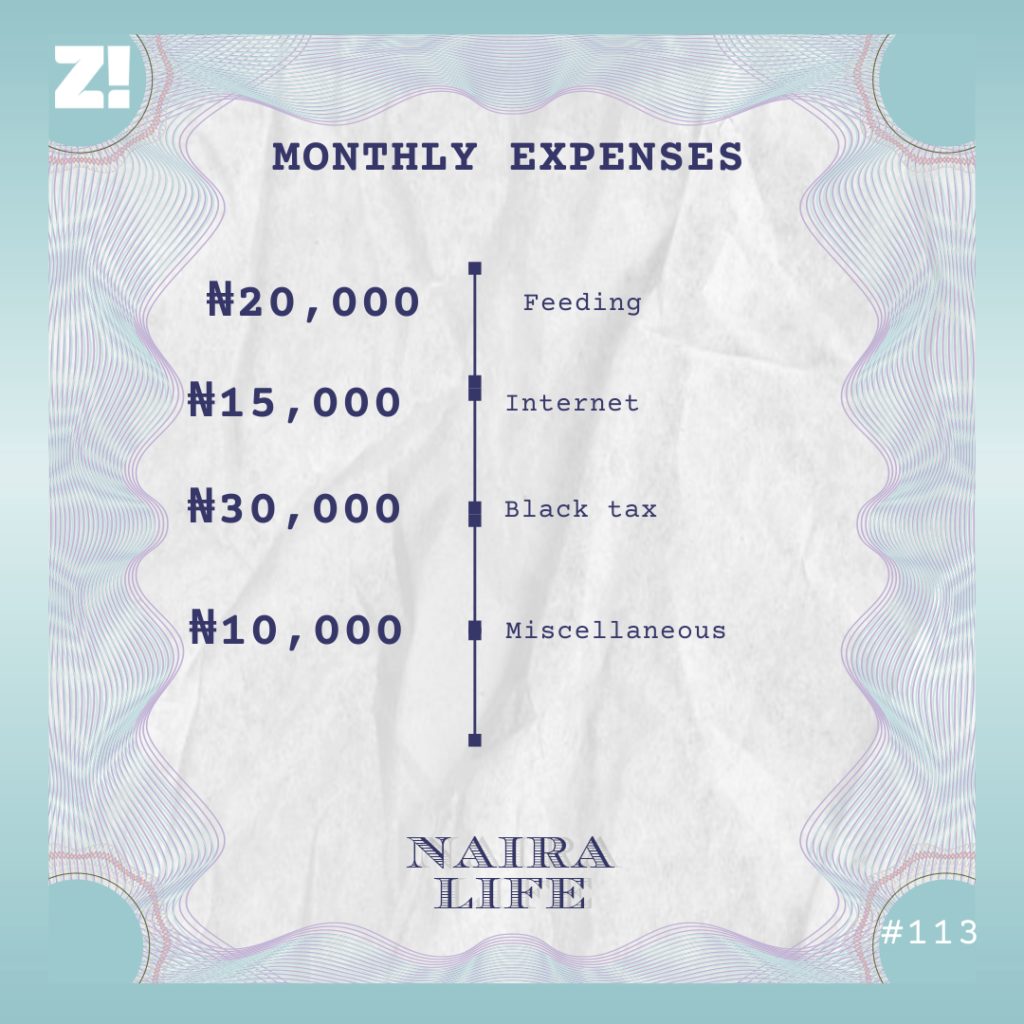

I’m still living on my old salary. However, there are so many other bills to pay.

I’m listening.

Most of it revolves around family. There are projects that I’m expected to chest. And there are the additional emergencies that come out of the blue. My sister needed money for something recently, and I had to cough up ₦400k. I’ve never been able to save because of these things. When I was still earning my old salary, I used to save half of it at the bank and before the end of the month, I would have touched it. As a matter of fact, I only had ₦60k in my account a week before I got paid.

The first thing I did when I received my first paycheck at this new job was to clear all my debts, which was about ₦300k. Also, I spent ₦600k to take care of my traditional wedding expenses.

At least I’m debt-free now. One job took care of all that.

That’s lit. Going forward, how do you imagine your personal finances will look?

I have $3k left in my savings now. The plan now is putting 50% of my monthly earnings into that account and letting the money breathe. The other 50% will go into my monthly running costs and other projects. This means I can’t be chesting every little bill for my family anymore. I’m also starting my own family, and I have to think about that too.

Looking at your career now, how much do you think you should be earning?

$15k. I’ve realised that I can’t take a job that pays in naira anymore. I expect to hit that figure soon because I’m currently in talks with other companies. The plan is to get about two full-time roles and some contract gigs on the side.

That sounds like a plan. What do you think has made all the difference between the time you left your job and now?

The quality of work I do. I’m all about the value I provide. Most of the jobs I got were through referrals. Also — and this is very important — the quality of information I had access to. I probably wouldn’t have thought of finding remote jobs that pay forex if I didn’t hear about them or the process involved from someone I knew and trusted.

That makes sense. What’s something you bought recently that changed the quality of your life?

I spent ₦350k on a laptop and upgraded my iphone. Working has been a much smoother experience.

Haha. Anything you want but can’t afford right now?

A car. My budget is ₦3.5m but I should raise that within three months.

Do you have any financial regret?

Maybe not saving as much as I should have tried to all these years. But I have an opportunity to remedy that now, and I will.

Rooting for you. On a scale of 1-10, how will you rate your financial happiness?

At the beginning of the year, I was at a 2. I had more expenses than my salary could cater to, and it wasn’t healthy. But with everything that’s happened since that time and my new earnings, I can say I’m at a 9 ½ at the moment, and it’s the best feeling ever. Now we move to $15k per month.