Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This week’s Naira Life is brought to you by QuickCredit. With QuickCredit, you not only get the funds you need instantly, but you also get to pay back at the lowest interest rate in Nigeria.

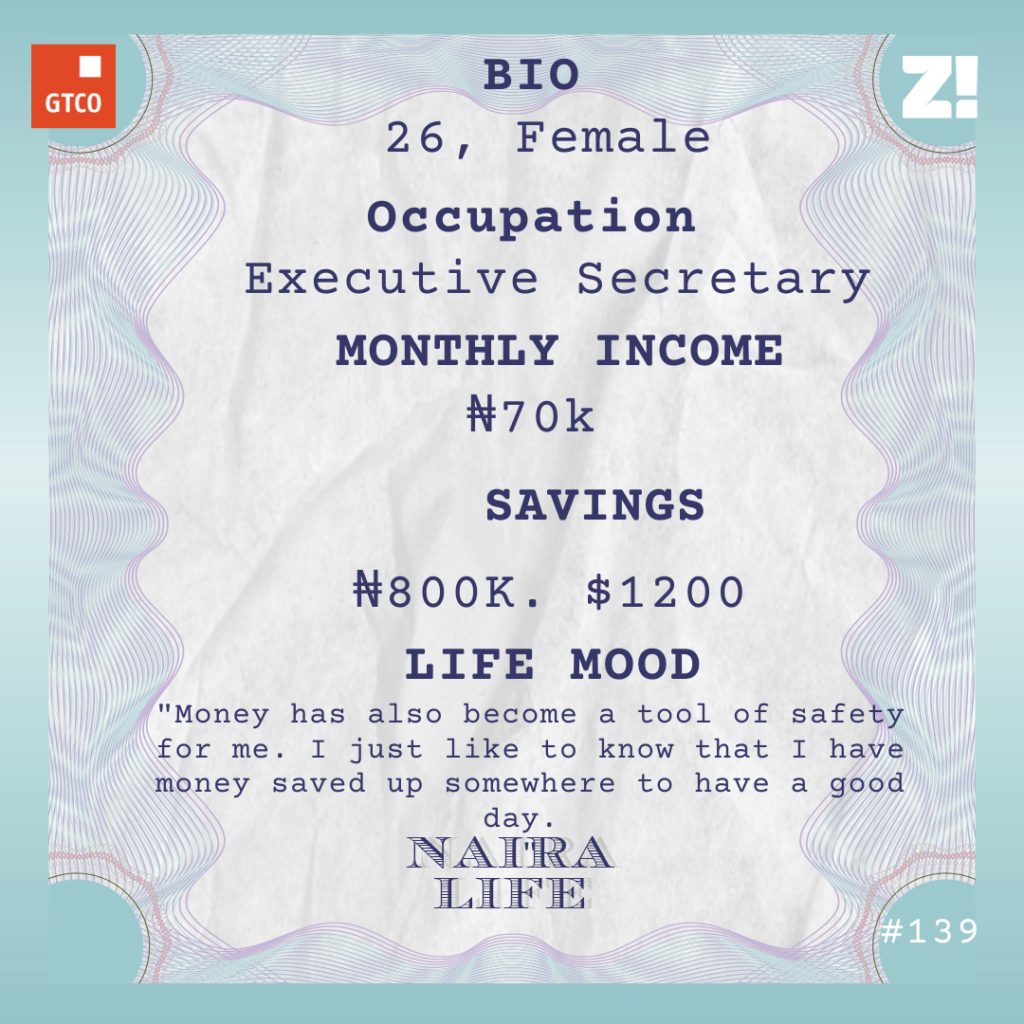

The 26-year-old in this #NairaLife YOLO’ed her way through some years of her adult life until eight months of unemployment stopped her in her tracks. Now, she’s all about financial security. How does she navigate this when her 9-5 pays her ₦70k?

What’s your oldest memory of money?

This would be in the early 2000s. My dad used to give me and my siblings some money to take to school at the beginning of the week — I don’t remember how much, but we would end up not spending it. Whoever saved the most money scored some bragging rights. At the end of each week, we pooled our money together to make a big purchase.

My dad was an accountant, and I think his job influenced his relationship with money. He’d never give us the money he didn’t believe we needed. He always said children who were exposed to too much money had a tendency to steal. But as we grew older, he started giving us our allowances based on the classes we were in. In 2006, when I was in JSS 1, my allowance was ₦10. This increased to ₦20 when I got to JSS 3 three years later. The money was barely enough to do anything. Guess what I decided to do?

What?

I went to a boarding school for my senior secondary education to force my dad to give me a lump sum amount every term. My allowance at the beginning of the term was ₦1k. My dad would also keep ₦500 with one of my teachers. I would live on ₦1k for the whole term and at the end of the term, I’d collect the extra ₦500 to take home.

Interesting.

When I got to SS 2, my parents separated and that translated into more money for me.

How?

My dad got custody of us. My mum was no longer physically present and she tried as much as possible to make up for it with money gifts. Whenever she visited me at school, I got ₦10k. When I graduated from secondary school and got into university in 2011, the ₦10k became my monthly allowance.

But that stopped in my second year — my mum was relocating, so she resigned from her job and didn’t have as much money anymore. I wasn’t getting any allowance from my dad because the university was a short distance from my house, so I didn’t live in a hostel. Once my mum moved, I knew I had to figure out what to do to make money.

What was the first thing you did for money?

Does working on my dad’s fish farm count? My dad ran into problems at work in 2012 and quit his job. Subsequently, he started a fish farm and put us four kids to work. When we made big sales, he paid us about ₦2k at least once a month.

Simultaneously, I was working with a friend’s dad. He owned a lottery kiosk and he hired me to work on Saturdays. Typically, I worked from 9 a.m. to 4 p.m. and got paid between ₦1500 and ₦2k. Later in 2012, I started ushering and making between ₦5k and ₦10k every two months.

The biggest lumpsum amount I’d make in uni came in 2014.

Tell me about it.

It was the buildup to the 2015 general elections. Some campaign organiser hired me and some other girls to work on their campaign train. The job paid ₦10k per week, and I got ₦40k in the first month. In the second month, I got ₦70k — I worked an extra three weeks before the project was cancelled. bought a second-hand Samsung phone for ₦35k. I’m not sure what I did with the rest.

How was your relationship with money at this point?

I wasn’t big on saving anymore because there were things to use money for this time. I struggled to find a balance between earning and managing money and thought I could always make more.

So what happened after?

I wrote my final exams in December 2014 but didn’t graduate until a year later. ASUU strike happened. During the time I was at home, I worked on my dad’s fish farm. In 2016, I was finally mobilised and moved to Abuja to serve. My PPA paid me ₦7500/month and the federal government paid ₦19,800. I had a constant source of income now. But I made a money decision that could have gone wrong.

What was it?

MMM. Some of my co-workers introduced me to it. I put ₦15k in the first time and got ₦33k. Afterwards, I invested ₦10k. The thing casted on my third try, but I got my capital back. However, I’d introduced my mum and my brother to the scheme and they lost their investments. It was my first reality check about putting money into things I didn’t understand.

Anyway, my service year ended in May 2017. Hello, unemployment. This was when it first struck me that I could have done better with my finances.

Omo. How long were you unemployed?

Eight months. Those months were horrible. My mum came through whenever she could, but the frequency was far and in between. I was living with my brother and living off him. He didn’t mind that I couldn’t pull any weight, but the guilt ate at me. It’s one thing to be broke, but it’s another to be broke and knowing that your choices got you there.

I got my first job post-NYSC in January 2018 as a content developer. ₦40k a month. But I only got paid ₦10k once.

Ah.

All I heard was “Sorry.” or “Don’t worry, take this small change for transport.” Nobody could have prepared me for the helplessness I felt. After three months, I quit the job. I didn’t even turn in a resignation letter — I just stopped going to work.

Phew.

Two weeks after I quit the job, I had to travel home. My dad had fallen ill. Cancer.

Oh wow. I’m so sorry.

I won’t lie, it was one of the toughest periods I’ve had to deal with. My eldest brother wasn’t making a lot of money. My younger sister had just finished her youth service. My youngest brother was still in school. And there was me, unemployed as well. The family had only one source of income, and we were dealing with a terminal illness.

What was it like navigating that?

Tough. I stayed home from March until September 2018 to work on my dad’s fish farm, so we could get money to buy his drugs. There’s no nice way to say it; we were at ground zero.

Thankfully, a graduate trainee job I had applied for at a bank came through in September, and I started making money again.

How much did the job pay?

₦100k and I worked as a bank teller. For the first three months, more than 80% of my salary went into my monthly running costs, including the money I sent home for my dad’s medication. But I was making sure I saved ₦10k every month. Things got a little better in December because I started making more money at the bank, but it wasn’t from a raise.

What was it?

Tips from the bank customers I had built a relationship with. On average, I was getting between ₦1k and ₦3k daily in tips from people who had business to do in the bank. This took care of my feeding and transportation expenses for the day.

I had more money to save now, so I joined a contribution scheme with nine other people, and we saved ₦50k every month and took turns to cart away the money.

I also had my personal savings — ₦10k per month. I’d seen what not having money could do and saving money seemed like the best way to avoid it.

For the first time in forever, things were looking up. Then my dad passed away in December 2019. Cancer finally got him.

I’m so sorry.

Thank you. Funerals are expensive. The whole thing cost me about ₦800k, and I think the whole family spent up to ₦5m. We were broke oh.

How did you raise the money?

A lot of it was cash gifts. I had to take a break from work for a few days when he passed, and the bank customers with whom I had a rapport noticed. They found out the reason I wasn’t at work and started sending me money. ₦20k here. ₦50k there. Also, I got my ₦500k from the contribution scheme. It was in January 2020, in time for his funeral.

After the funeral rites had been completed, I had about ₦250k left. More money gifts came in when I returned to work, which shot my savings to ₦450k. The contribution scheme cycle had passed, so I was back to earning my full salary. But I was still channelling most of it into my savings.

Fast forward to March 2021, I lost ₦250k in some investment scheme.

What happened?

My contract with the bank was going to expire in September 2020, and I knew I didn’t want a promotion to full staff. I wanted a stronger safety net. Someone told me about the investment opportunity and I went in. The term was that I’d get 10% of my investment in the first month and subsequently receive 20% for six months. The first payment came through right before the lockdown. Then the whole thing came crashing down. That was the last payment I got.

Omo.

I was in worse shape than before, and I had only a few months to spend at work. I doubled down on my savings and made it ₦20k/month. When my contract with the bank expired in September, I had ₦300k in savings.

But you were out of a job again. What was that like?

It wasn’t as scary as I thought it would be. I got a gig as a freelance content writer with someone I know. Then I got similar jobs with two other people. The rates were ₦1.20k per word. On average, I was making between ₦10k and ₦18k per week from each person I was working with. But it was also a lot of work for little reward. I did this for two months, then I got another job.

I was hired as an executive secretary at a forex management company for ₦50k/month. It wasn’t a hectic job, so I had time to continue freelance writing and making money on the side.

What has happened between then and now?

I got tired of writing for people and earning so little money in return. In February this year, I turned my sights to Fiverr. Later that month, I got a job on the platform, which paid me $20. Subsequently, the client put me on a retainer — $100 per month to create content for their Instagram page.

By this time, I had spent up to six months at my job, and they reviewed my salary to ₦70k. In May 2021, another client put me on a retainer, paying me $5 per hour. I was making $80 per week.

And how has your relationship with money evolved?

I’ve been saving most of what I got from my 9-5 and my side gigs. It’s been easier to do this because I always get money gifts from men these days. It’s hard to put a number to it but a ballpark amount would be ₦50k – ₦60k, and I put most of it into my savings.

I’m open to taking more risks too. In April this year, I took ₦300k out and put in an investment opportunity at my place of work. The terms are that I’ll get 15% of my investment every month, so it’s been bringing in an extra ₦45k/month.

Hmm. What does your savings chest look like at the moment?

₦800k sitting in my PiggyVest and $1200 in my dollar account. My goal was to have ₦1m savings goal by the end of the year, and it looks like I’ve surpassed it already.

Yay. This sounds like a good place to talk about your monthly running expenses.

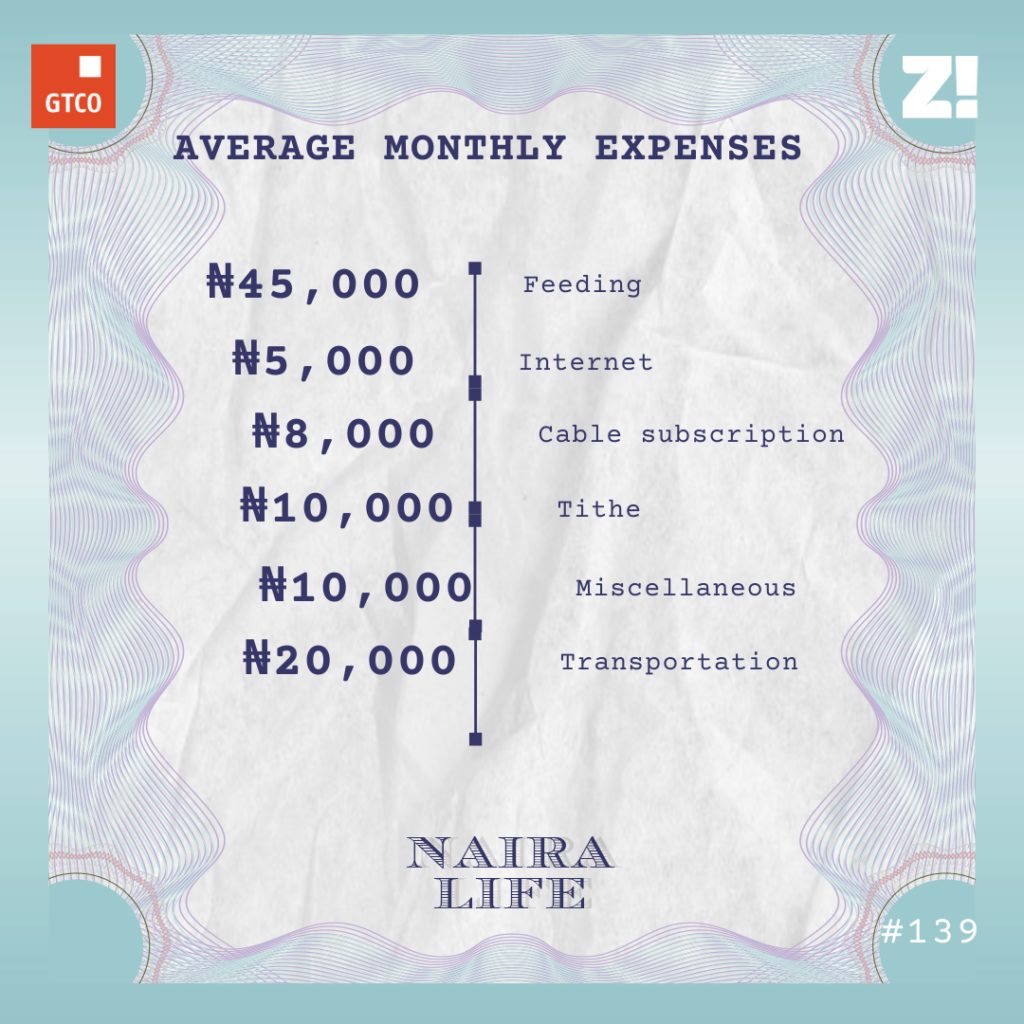

I get ₦115k from my salary and my investment. The first thing I do is to save ₦30k – ₦35k. The other running costs look something like this:

What have your experiences done to your perspective about money?

I’m a lot more responsible with money now. I know what it feels like to be stuck as an adult, and I know that a constant source of income brought me out of it. So it makes sense to respect money and be responsible with it. Money has also become a safety tool for me. Knowing that I have it saved up somewhere is enough for me to have a good day.

Fair enough. How much do you feel you should be earning right now?

From my 9-5? ₦180k seems like a fair amount, but I stand a higher chance of making that from freelancing than from my day job. And that’s how I plan to increase my income.

How?

The plan is to double down on freelancing and figure out how to get better-paying gigs. I recently paid $120 for a course that should help me leverage freelancing platforms. The plan is to make enough dollar earnings by January next year, so I can quit this job.

Rooting for you. I imagine there’s something you want right now but can’t afford.

I don’t know. Maybe a car. It would definitely make moving around easier, but I don’t have ₦1.8m – ₦2m to splash on that right now.

What about something you bought that significantly improved the quality of your life?

I recently splurged on some human hair, and it cost me ₦80k. Not sure if it improved the quality of my life, but it made me feel really good.

Fair enough. On a scale of 0-10, how would you rate your financial happiness?

6 ½. I’m not making enough and it makes me anxious. It’d be great to unlock more streams of income. That’s why I need this freelancing to work. My target is to make between $1k and $2k per month. When this happens, I can move up to an eight.

Great! You got to the end of this article. Know what’s even better? You can get QuickCredit faster than the time it took you to read this article. With Quickcredit, GTBank customers can get N2million in less than 2 minutes and pay back over 12 months at an interest rate of 1.5%. No forms. No collateral. No hidden charges. Get Your Quick Credit on GTWorld