Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

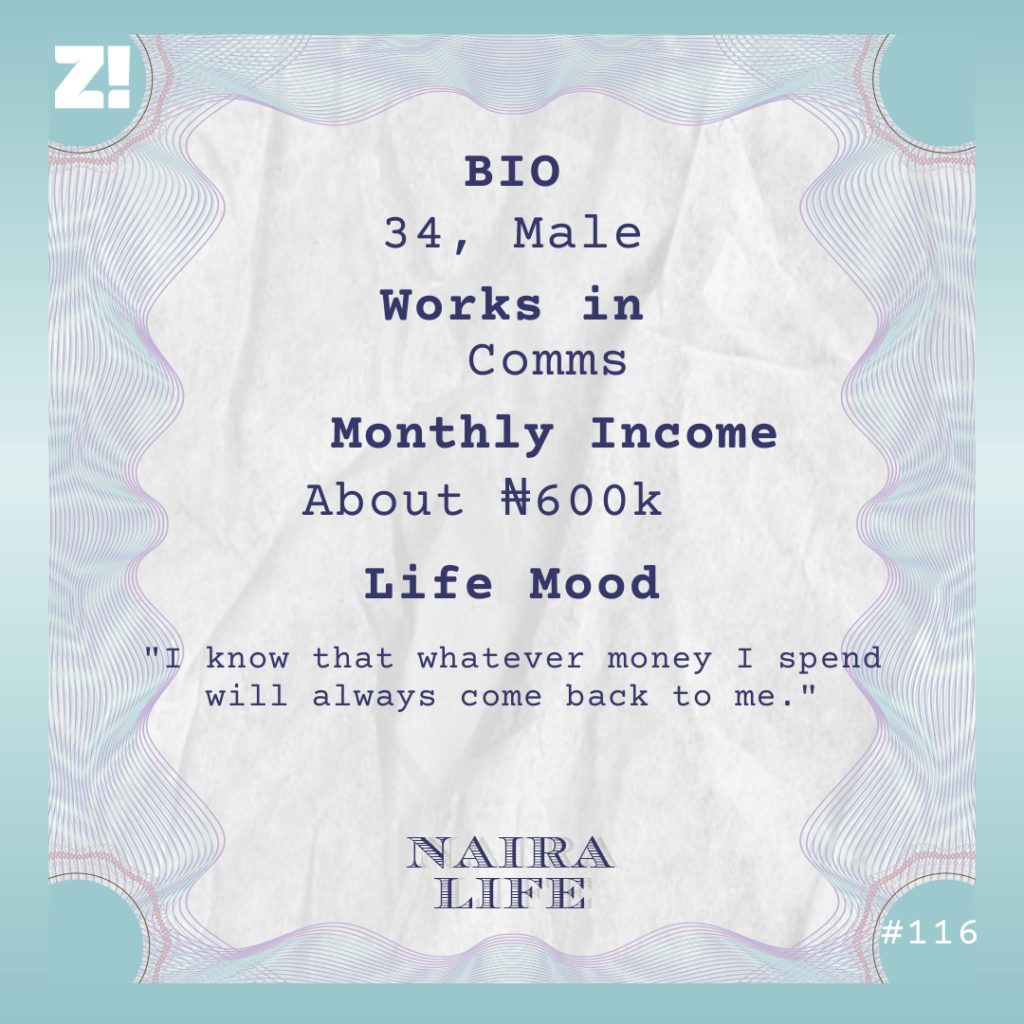

A couple of things to know about the guy in this week’s story: He’s 34. Spent 13 years in university. Has done a couple of stuff but currently works in comms. He’s found a way to balance a full-time job with three side gigs. This is his #NairaLife.

Do you remember your oldest memory of money?

My mum worked in the civil service but she always dabbled in one thing or the other. When I was 12, she did a bit of GNLD and built a community where we lived. I was involved in the business and got a few orders for her. The first and most memorable moment was when I pitched some supplements to a classmate who had a bad case of acne. She told her mum about it, and her mum signed off on the purchase. It was about ₦10k, and I made ₦2k from it. It wasn’t about the money, but the thrill of making it.

Nice. What happened after that?

By 2002-2003, the GNLD thing had gotten saturated and there were competitors springing up everywhere, so we moved on. I finished secondary school in 2002, took a gap year and got admitted into university in 2004. I should lead with this: I spent 13 years in university.

Wait, what?

My university was a special breed. We took at least two months break between semesters, and there were also long school closures and strikes. Also, I wasn’t passionate about the course I was studying, so I struggled with it. I eventually switched departments in my fourth year and started all over again.

That sounds intense.

It was. By the time I switched courses in 2011, it’d become easier because I was doing a couple of things on the side and making money. I was pretty much a non-academic student.

Haha. Let’s talk about that.

I partnered up with a friend and we started consulting for people who wanted to start their businesses. Our services mostly revolved around strategy and marketing. The only problem was that our potential clients either had a limited understanding of how branding works or didn’t have the budget. It took a while but we eventually landed a client who wanted to start a school and we did a feasibility study for her. We got ₦25k from that job. Other jobs came too, but they were far and in between so the business wasn’t the core money earner for me.

Oh. So how were you earning?

It started in 2010 when I was in a government-funded TV show where I was paid ₦300k. I remember I bought a laptop and a Blackberry phone with the money. The following year, I deferred a semester from school as part of the process for changing departments. I opened a blog and started writing about government policies in the North since I was born and was living there. At the end of the year, a blog reached out and asked me to be a contributor. The deal was that I’d write four articles a month and get ₦10k. I was like “Great! Now I have BIS money.” This gig ran for 3-4 months. As it was ending, I got another contract with a different blog and it paid me the same amount.

Interesting.

Writing gave me a lot of visibility, and it helped build my clout. A lot of people weren’t writing about the kind of topics I was interested in. The clout brought better opportunities. Once in a while, I would get invitations to be a resource person on a project or get invited to a conference and get per diem allowances — this was anything between ₦60k-₦300k. This continued until 2014.

In the months leading to the 2015 elections, I got a lot more writing contracts, especially from foreign publications, and of course, the pay was much better. I was averaging at least ₦50k per article.

Baller.

It didn’t feel like I was making a lot of money, although it did increase my standard of living in school. I’d also become totally independent and wasn’t living on an allowance from my parents. Life was sort of soft.

Of course. 2015?

I worked at an NGO for my I.T for ₦100k monthly. I had two side hustles at the time too — a writing gig that paid ₦20k monthly and a social media job that paid ₦30k monthly. Now, my income was steady and I knew how much to expect at the end of each month.

What was that like?

This is very embarrassing for me to say. I lived with a family friend during my IT, so I wasn’t spending money on accommodation or feeding. But there was a lot of lau-lau spending on hangouts and women. I saved some money too, but what I saved was not a reflection of what I earned.

IT ended in 2016 and I returned to school. I eventually graduated from uni in 2017 and moved out of town to a city in the North-Central.

Man, 13 years though. What was your post-uni plan?

The initial plan was to pick up the consulting business with my partner from where we left off and focus on it, but it didn’t work out as quickly as I hoped — the jobs weren’t coming in. My parents also gave me two choices: find a job or move back home. I found a job.

Lmao. When was this?

May 2017. It was at the Nigerian division of a non-profit focused on renewable energy. I was hired on a six-month contract to handle comms which kept getting extended, and my salary was ₦400k per month. But there was a challenge.

What was it?

Salary never came on time, and nobody explained why this happened. We could go three months without a salary and it made it very hard to make plans. My boss in the Nigerian office also had her own NGO, and she started giving it more attention. In December 2018, she brought most of us in on her project. That meant a contract revision and a pay cut.

How much?

₦200k

Oop.

Well, we were being paid on time. A while after I started the new job, I got a side job with another NGO, and they offered me ₦150k per month. That brought my monthly earnings to ₦350k

Lit.

I was with my boss until the end of 2019. There were lots of departures that year, so I took on a lot more roles and my workload increased. My health suffered for it in the third quarter. I was physically and mentally exhausted. I’d wanted to quit earlier, but I was involved with a family project with my brothers and needed to keep earning.

Anyway, a media company reached out to me towards the end of the year and gave me an out. But I knew the arrangement wasn’t going to last because of their model. They were very particular about recruiting people who had large social media followings, even if they couldn’t write. We agreed to a ₦30k per article deal. It lasted for about three months, but I made at least ₦380k every month from them alone.

…

It ended in January 2020, and I had also quit my job. I took the whole month off from work. Money was already running out in February, so I found a job at another non-profit. My salary this time was ₦250k. Everything went sideways the following month.

Covid?

Yeah. There was no money coming in and everything came to a standstill, including our salaries. I was meh from April to June. My income dropped massively. Fortunately, I had a small gig with a media company that was paying ₦20k, and it became what I relied on to get me through each month. My brothers also stepped in from time to time to help because I was the hardest hit.

Damn. What was navigating that period like?

It made me realise the difference between needs and wants. It also made me cut down on my spendings. I wouldn’t have thought that I could live on ₦5k per week.

Things started opening up in July and I got hired to work on three projects back to back. An energy consulting company I’d reached out to months earlier finally got back to me and wanted to see if I was available to work on a part-time project. I signed on to it. Also, I reached out to a UK risk analysis firm and was brought on one of their projects. Not long after, the last NGO I worked with came back to engage me on something else. I worked long hours in August and September. At the end of it, I think I got about ₦800k from all of these projects.

Wild! Can we break it down?

- Energy consulting: ₦570k

2. The UK risk analysis firm: ₦140k

3. NGO: ₦100K

Must have been a huge relief.

It was like a swing from one extreme to the other. I started deliberately reaching out to more folks for job opportunities and attending job interviews. In January 2021, I got another full-time job at a non-profit I applied to in August last year. I’m currently leading their communications team and getting paid ₦320k per month. The good thing is that I’m still working with the energy consulting company and the UK risk analyst firm. Also, there’s another writing contract with a media company. At the moment, I have a full-time job and three side gigs.

How much do you make from all of them?

About ₦600k. My full-time job pays ₦320k. The UK risk analysis firm and energy consulting company pay me ₦160k and ₦100k respectively. I also work with a media company, and it brings in ₦20k per month.

How do you balance all of this?

Time management. I decide on the numbers of hours I need to spend on each job per day and stick to it. However, I don’t work on all of them every day. Besides, there are deadlines and that helps too.

Ah, I see. How much do you think you should be earning now?

My earnings are fair. I can live comfortably without even touching my core salary. However, I’m still trying to find my footing with my new earnings because of how life has changed.

What do you mean?

My biggest worry at first was balancing my side gigs with my full-time job, but I’ve been doing that well. I got married in January, and now, there is a kid on the way. Kids aren’t cheap, so there will be a lot more expenses. Also, I moved into a new apartment recently and well, my account took a hit.

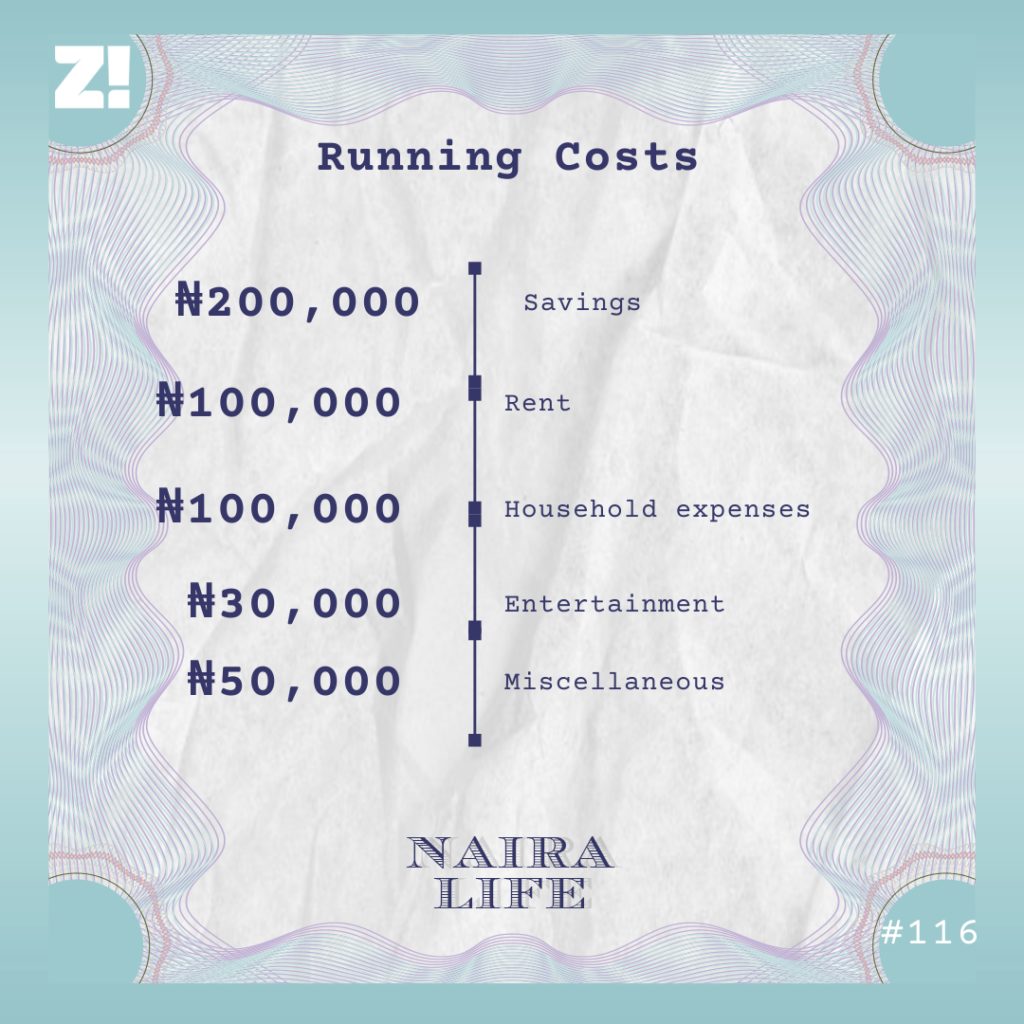

I’m curious about what your running costs look like each month now.

This is more of a projection because everything is currently changing so fast. I expect these numbers to change in the coming months.

Let’s talk a bit about your savings

I have about 200k in my savings account now. I’m just coming out of a wedding and have just moved into a new apartment, so that’s a factor. However, this doesn’t include all the money I have outside — I always have money outside from jobs that haven’t paid.

Do you have investments?

I talk with friends and I follow conversations about investments on social media. There’s also a lot of reading and research on my own part. I started a portfolio with Risevest last year but I couldn’t consistently fund it because of the pandemic. My investment portfolio is about 100k at the moment. The plan is to be more consistent this year.

What do you think you need to unlock your next level of income?

Working on more side gigs. I want to get to a point where the money I make from these projects is at least twice my monthly income. That should do it.

How have all of your experiences shaped your perspective about money?

I’ve realised that people will always pay for value, so I know that whatever money I spend will always come back. At the same time, savings and long term investment plans are important. I’m afraid that the quality of my life will drop if my salary stops coming through — I’ve seen it happen to a lot of folks. That may be why I’m so committed to having multiple streams of income.

Fair enough. What’s something you want but can’t afford?

I’d like to furnish my new apartment to taste, but that will run into 500k-600k. I can close my eyes and do it, but it will affect a couple of things.

Interesting. What’s something you got recently that improved the quality of your life?

My car. It was a gift from my parents. I thought I was doing fine without one, but my life has been immensely better since I got it.

Nice. On a scale of 1-10, how would you rate your financial happiness?

I’ll give it a 7. I’m not there yet but I’m in a place where I can conveniently take care of my basic needs and some of my wants. The way I see it, it can only get better from here.