Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

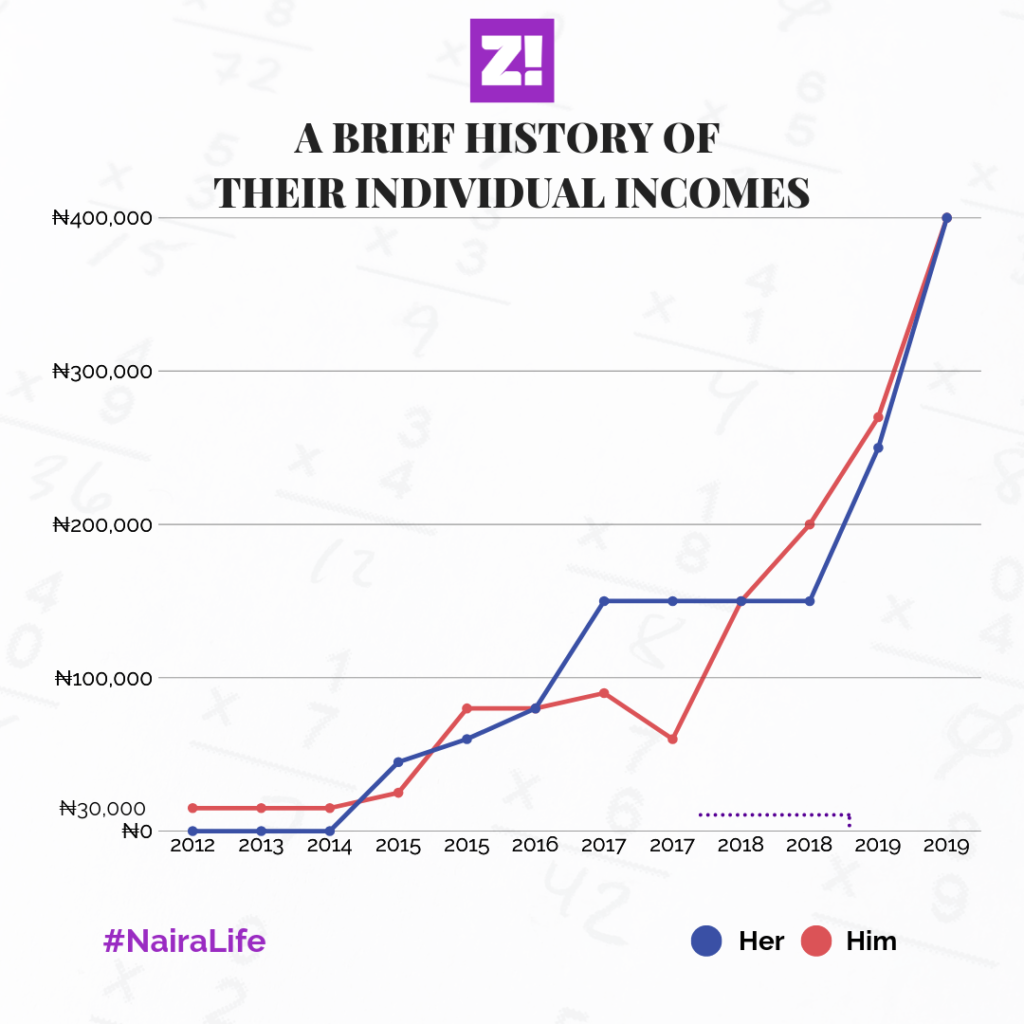

This week, it’s the first couple ever – they’ve been dating for about a year, and they’ll be letting us peek into their lives. They’re both 28 and currently earn ₦400k – cute coincidences.

Both of you are my first couple ever.

Them: Litttt!

Her: Let’s go!

Him: Oya oya.

When did you first clock that money is important?

Her: I think I was about 10. My father was the richest in the family. He was put on a kind of pedestal because of this. He wasn’t the firstborn or anything, but because he had money –

– He was the senior.

Her: Exactly.

Him: Mine didn’t start at home. I think mine was in noticing the differences between our family’s lifestyle and my friends in school. On holidays spent with my cousins, it seemed like they had everything! Why would a parent just take their kids to Mr Bigg’s randomly? Mr Bigg’s was an event in my own family. Is it your birthday?

Hahaha.

Him: My cousins were staying in duplexes, while we were living in a block of flats. They had their own bicycles and actual balls, instead of the usual roll-on balls that I played with.

Ahh, that.

Him: That’s when I started looking at it like hmmm, something is not balancing here.

Have both of you ever had this conversation?

Them: Nope.

Her: I’m just finding this out.

Him: I mean, I knew your father was rich, but I dunno how you turned out this way.

Them: Hahaha.

Her: We thought the money was going to be there forever.

About that forever part, what changed?

Her: My dad retired. When you retire from the civil service as a senior, you get a huge sum of money. I can’t say how much he got, but you start to get a sense when you think of the things he spent it on.

How old was he at retirement?

Her: 60. He decided to start a business, so he opened a cold room, bought himself a car, bought another one for my mum. An extended family member got ₦5 million, another got like ₦3 million – he was just distributing the money. He thought that money would come in from the cold room business.

Her: Meanwhile, I still had like 2 younger siblings in school. He didn’t think about that – this was 2015.

When did you know things weren’t great anymore?

Her: It was when my sister needed to go back to school, and there was no money to pay her fees. Things were already bad because he used to borrow money to restock. But this was when I knew “there’s no money in this house o. Everybody figure your shit out.” Then one day, he closed the cold room.

From cold cash to cold room, to… cold turkey?

Them: Hahaha. Wow.

Him: Next time your dad vexes you, say, “That’s how you went from cold cash, to cold room, to cold turkey!”

Her: Hahaha. You’re so rude.

I have a sense that you reached this realisation earlier.

Him: What happened in my case was a little different. I was still able to go to school. In fact, there was a time I used to go on the school bus. At this point, I didn’t know my mum was the one giving my dad rent. Unfortunately, my dad chopped the rent this particular year, hahaha.

Her: Hahaha. Chisos.

Him: The landlord evicted us. My mum didn’t have the money to get another place, obviously. We had to split up. She and my younger sibling had to go live with a pastor. Then I was living with her relatives, hopping from family to family.

Him: I went from “mummy I want to buy sweet” to an aunty saying, “oya stay in that shop and sell.” You learn very quickly after all this, that money is the key.

Where was your dad?

Him: He was all over the place o. My dad used to be much more stable. He reached a senior role in a financial institution – a good paying job for a man his age at the time. A true high flyer. But he was also really ambitious. So he resigned. He believed that there were even bigger opportunities for him in other places.

Him: The mistake he made was that he didn’t secure a job before leaving his current job. All of that was made worse by the instability of the early 90s, so getting a job was so difficult. By the time the job openings started popping up again, he started to get the “you’re too old for this role” feedback.

How old was he when he quit?

Him: He was 34 in 1992, and it was at that point my mum took over family responsibilities. She paid the rent, put food on the table, etc. He sold his car. My mum says that his jaiye-jaiye lifestyle made everything worse. There was no stability in all those years, and he was mostly absent. So by the time we were evicted in 1998, he was nowhere to be found.

I feel like you must have realised that she was running this race of responsibility and that the baton was eventually going to be passed to you.

Him: Yeah. That baton first touched my hand in university, when she couldn’t pay fees. My mum actually paid the first semester fees. But the second semester was a struggle. So we split it.

What does she do for a living?

Him: She’s a civil servant. The money wasn’t a lot, but civil servants always tend to have cooperatives or colleagues they can borrow from. It got to a point that she started getting bank loans, loans she’s still paying back till this day. These loans were supposed to help pay our school fees and deal with other responsibilities.

She opened a shop, even opened a second. But she’s not exactly great at business, so those didn’t work out.

But what changed the game for her was getting a degree – she entered the civil service with a secondary school certificate. But that degree changed a lot for her and for us because she got promoted.

Awesome.

Him: Back to the second semester, before the promotion. I started selling stuff in school and helping people sell stuff, anything to make some money. It got to a point where we had to start splitting my school fees.

Where was your dad at this time?

Him: Nowhere. It’s like all the men in that their generation were just missing.

Her: Oh, my dad was different!

Him: Was he there?

Her: Yes, he was. The nature of his job saw him get transferred from place to place, but he was always committed to family.

Have you ever had a conversation with your dad about a possibly different 2015?

Her: No. That’d be like talking to a wall. He made so many bad calls. In fact, he literally just showed up without telling anyone previously, “I’ve bought land and built this cold room”.

Anyway, I’m not the oldest sibling, but I started working first. My first salary was ₦45k in 2015, so when my salary entered, my mum would ask that I chip in. After about three months, I just chipped in without her asking. It just felt like the right thing to do.

Let’s talk about both of you. Where were you financially when both of you started dating?

Her: Oh, I was Gucci, hahaha. This was about a year ago. I was earning 150k

Him: Omo, I wasn’t Gucci o, but I was earning 200k.

How are you earning more and struggling? Make it make mathematical sense.

Him: I’d taken a loan to rent an apartment- the apartment cost ₦450k. Then I took another loan to buy a computer. That set me back ₦90k every month. Both loans almost totalled ₦800k.

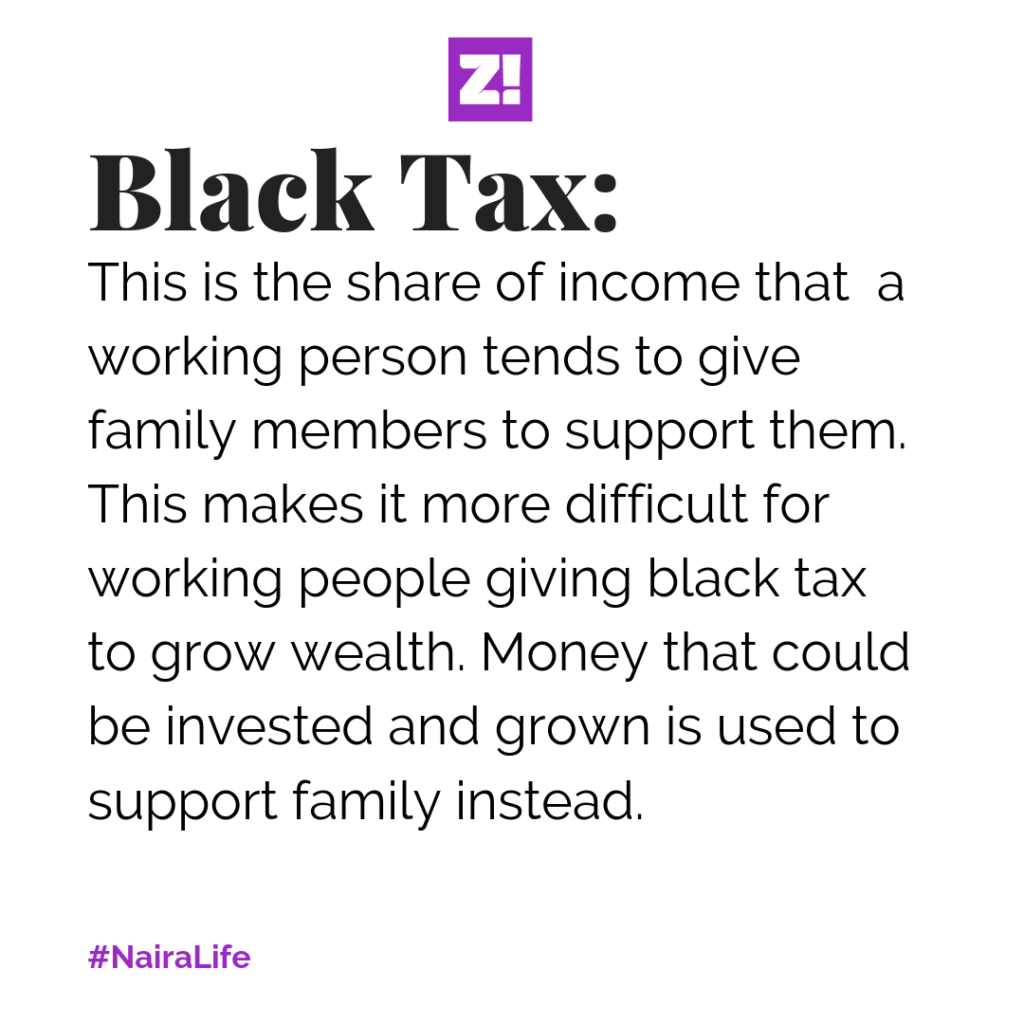

Him: Then there was the black tax part – ₦25k was the non-negotiable black tax, but a lot of the time, it was more. The only reason it wasn’t more than 25k was that I simply couldn’t afford it because of the loan.

Her: My own black tax was ₦45k a year ago. I’m giving the entire family money – dad, mum and two younger siblings. Currently, that tax has climbed to ₦60k. It climbed as my income as climbed.

What’s the highest you’ve ever spent on black tax in a month?

Her: ₦100k.

Him: ₦140k. I was earning ₦80k, and my mum had fallen sick. So I poured all my savings into that.

It’s interesting, but despite all of this chaos, you people still had time to fall in love. How far na?

Her: Abeg na hahaha.

Him: For me, I got to a point in my life where I just wanted to take things seriously. It started in the DMs then went to Whatsapp, then next thing you know, we’re going on a first date. On that first date, my account wept.

At the time, I’d just paid for my house, and here I was, paying for a date. It was mad. A leap of faith.

Hahaha. How much was it?

Him: ₦11k – I still have the receipt. Thank God it worked out because that’s the riskiest ₦11k I’ve ever spent. I’m going to laminate that bloody receipt. Interestingly, most of our dates after tended to be cheaper. Did we even go to a restaurant after that period? Not for a while, at least till we started the new budget thing. So concerts, drinks and all that.

Budget thing?

Him: Yes o. No relationship without money. I was asking her yesterday about what she’d change about our relationship, and she said more money.

Her: Hahaha.

Him: Now we keep ₦20k aside every month for date night – ₦10k from each of us.

Her: That’s just date night because there’s other stuff like Friday wine or food.

Him: Date night is its own thing – a restaurant, phones turned off, just the two of us.

The thing with money is, a lot of the time, you can do anything with the money you have. You just have to want it enough. We realised that we weren’t keeping that money aside, we weren’t doing it. But keeping it aside meant we had to do it.

What other money ties you together?

Her: A lot now, household stuff. I mean, I still have my house, I’m just at his a lot more.

Him: It could have been her house, but she stays with people.

What do you currently earn?

Them: We’re both currently at ₦400k.

Do you see your money as a unit, or separately?

Him: Both.

Her: Separately when there are personal obligations, like family. And together with most of the rest of our money.

It looks like both of you are in this for the long-term. Where do you see this in 5 years?

Her: Outside of this country for starters hahaha. We’re probably working remotely, earning more, living in a two-bedroom apartment, raising one kid –

Him: Definitely one kid.

Recommended Reading: Lagos to Amsterdam – Fifi’s #AbroadLife

Do you have an active plan for this future?

Him: If you mean active as in, putting the money aside for that, nope.

Her: There’s a framework though.

Him: What just needs to align is the finances to make that happen. We’ve only just reached a place of stability, income-wise, that we can begin to think beyond our family obligations.

How do you manage bad financial periods? It looks like he does most of the running in your direction.

Her: Oh yes!

Him: She’s my glucose guardian. Most of the time, we can already tell at the beginning of the month, we can almost always tell who’ll be broke first. So subconsciously know who’s going to be supporting who before the end of the month.

What’s something you want but can’t afford?

Him: A phone, I swear. It’s not like I can’t afford it, but –

Her: He wants a Pixel 3a and the iPhone X.

Him: I’ll probably just buy the Pixel 3a, because it’s cheaper.

Her: I just want a holiday, a vacation. Like to Dubai.

What do you wish you could get better at?

Her: I think I could get better at not living my life like the weight of the entire family has to rest on my shoulders. I wish I could be a little more selfish.

Him: Erm, for me –

Her: Better say saving! Because you can’t save for shit.

Him: I think it’s saving, and then investing the savings. I’m just glad that the loan is now about to be over.

To be honest, she’s the financial manager of this relationship.

Any financial regrets?

Her: I bought a bottle of water for ₦1k.

Him: Hahaha, you actually bought two. I still can’t believe you did that shit. Something I think I really regret is that all my salary negotiations earlier used to be nonsense. For two years, I earned 80k, despite the fact that people employed after me were earning more.

Do you ever worry about ending up with your parents’ outcomes?

Him: I constantly worry about this, but I also think that my dad’s outcome is motivation for me – it’s a lot of what I shouldn’t be. I’m constantly thinking of how to make sure, at every point, that we’re financially secure.

My mum’s experience with loans is why I spent so much time researching options when I took my loan. My mum’s own experience was different because those banks will just come to the offices, make promises, and they end up brutal.

Her: I just generally think that their generation was different. So if my partner retires and gets a lump sum, we’re going to sit down and plan that money. But my dad was ‘the man’, so he could do whatever he wanted.

Him: My mum has this belief: “if you have money, spend it” and I used to hold that view before. But that’s changed. I now try to curb my spending urges.

Let’s talk about happiness, over 10.

Him: I always wonder how people think about their happiness levels. I feel like people have different exposures to the Nigerian element. So in the broader context of Nigeria today, I feel like a solid 7. I’m doing okay.

Her: Not bad at all. I feel the same way too.

Do you think about your pension?

Them: Yes oh.

Him: when I saw how much money was in my mum’s pension account, I started taking mine seriously. Last year, it was about 14-point-something million naira, and she’s done 20-something years in service.

Her: Senior civil servants actually get serious money when they retire.

What’s something you think I should have asked that I didn’t?

Her: Perhaps, what I want to do with my life? I worry about the next point in my career. I just know I want to retire when I’m 45, and by retire I mean become a lecturer.

Him: I think you should have asked about how I view my economic status in the Nigerian context.

Tell me.

Him: I realised that only a tiny fraction of people actually earn more than 80k. I don’t think you can be financially satisfied if you can’t see the through-line between what you’re responsible for, and what you’re not responsible for.

You can’t control the economy, for example, but you can control your investments and your salary negotiations perhaps. In that context, I’m doing great. Maybe if I change my salary to dollars, I can start weeping.

Don’t.

Him: I think a question everyone should ask themselves – and I’m throwing this to everyone reading this – how do you think of your economic standing in the broader Nigerian context?

This conversation has been condensed and edited for clarity.