Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This week’s Naira Life is brought to you by QuickCredit. With QuickCredit, you not only get the funds you need instantly, but you also get to pay back at the lowest interest rate in Nigeria.

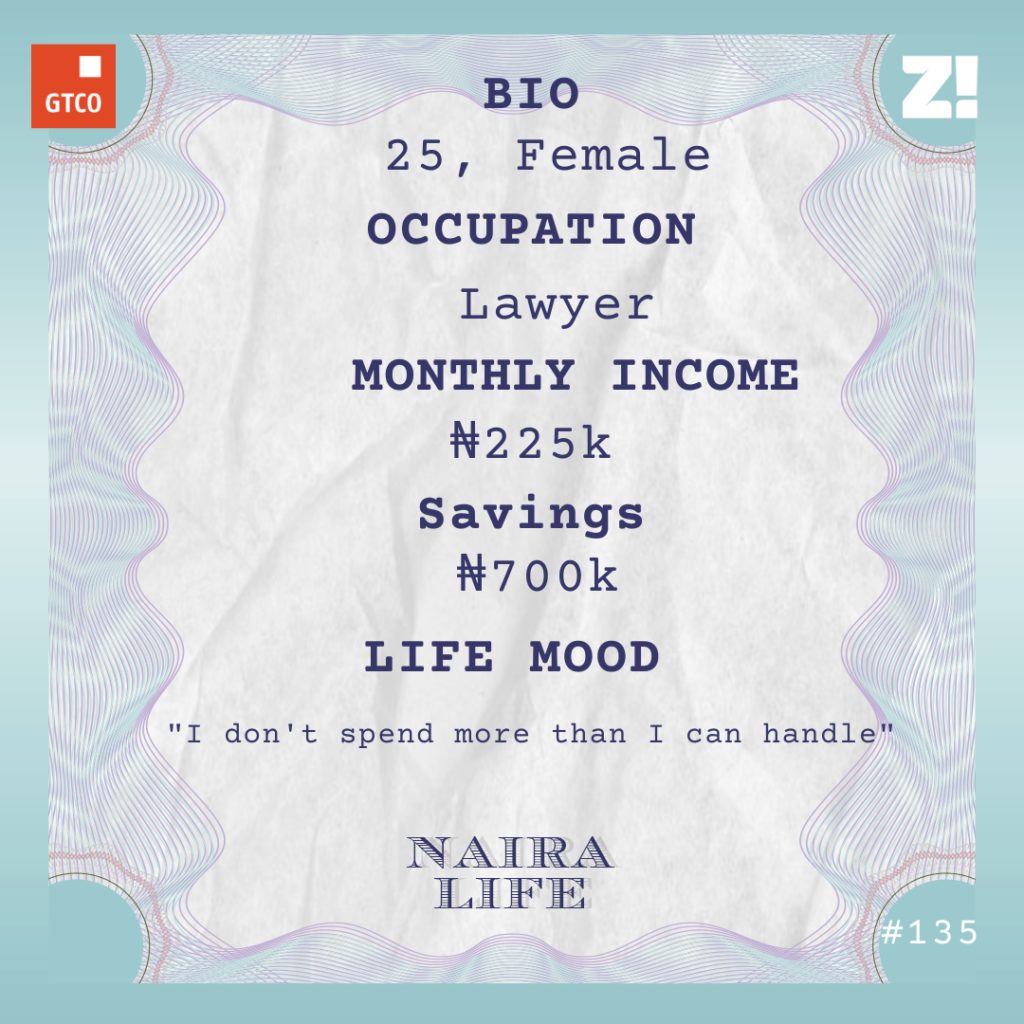

A consistent pattern in this #NairaLife is how this 25-year-old lawyer’s black tax increases as her income increases. But she doesn’t mind a lot. So how does she balance her black tax obligations with her hopes and aspirations?

What’s your oldest memory of money?

Primary school. Besides my allowance, my parents used to pay my siblings and me anything from ₦5 to ₦10 to wash plates, usually when there was a big pile in the kitchen. My parents also had an ice block business run by my mum. Whenever we helped out, they’d pay us between ₦30 and ₦50 naira. This was in the late 90s through the early 2000s, and my relationship with money then was “earn and spend”.

Would you say you were rich?

I won’t say we were rich, but we were comfortable. We had a grass to grace story. When my dad first started working in the civil service, things were a little hard at home. By the time I was born, he had gotten a few promotions and a flat.

The ice block business was the first side business my parents started. When I was in JSS 1 or JSS 2, my mum opened a bookshop. So we had multiple income streams. The only tricky thing was that a lot of people in our extended family depended on my dad, and navigating that was a bit of a challenge.

Tell me about how it worked.

A lot of people on my dad’s side of the family saw him as a big man. That meant paying school fees for their kids. During the holidays, about three or four cousins would come to our place, and he’d pay for their summer lessons. Asides from that, when someone wanted to start a business, my dad was the first person they’d call. Every month, he always had a new list of family expenses to worry about. At one point, his black tax was even larger than our home’s expenses. My mum wasn’t a fan of that.

How did she handle it?

My mum understood that my dad was generous to a fault, so she advised him to do something for himself and his kids.

It’s funny but my dad didn’t have a lot of assets to his name, and it was because of all the money he was giving out. Even the house we lived in was owned by the government. Eventually, my mum convinced him to buy land and build a house in our village and another land on the outskirts of the city we lived in.

They still had constant arguments about how much money he was giving out. Since this caused friction between them, my mum was particular about managing the ice block and bookshop businesses by herself, so she could have her own security. If she had left the businesses to my dad, I’m not sure we would have seen one profit from them.

I should add that I was still young when this started and wasn’t always at home because I went to boarding school. The only thing I knew was that they paid my school fees and gave us an allowance. It wasn’t until SSS 1 or SSS 2 that I started knowing the true affairs of things.

Got it. Enough about your parents, what was boarding school like for you?

I went to a state school, so there were people from different walks of life. At the start of secondary school, my monthly allowance was ₦1k or ₦1500. It increased over time to ₦2500.

Boarding school taught me how to save. It was there I realised that I didn’t like not having the safety of money, so I took saving seriously in JSS 3.

During the holidays after I wrote my Junior WAEC, an opportunity to make more money presented itself.

What was it?

My mum had my younger sister, so she was at home for a while. She put me and my older sister in charge of the bookshop, and she gave us ₦1k – ₦2k when she could. But we figured out that we could make more if we added a markup on some products. For example, if the selling price of a book was ₦200, we would add ₦50 naira to it. By the time school resumed, I had made about ₦10k from the shop. It opened my eyes, and I was like “Wow. So this is how people make money.”

Do you remember what you spent the money on?

I spent the money on myself to the fullest. I got a wristwatch, a pair of slippers and other things I had always wanted to buy. When I returned to school, I felt like a big girl.

Lmao. I guess you continued helping out at the shop during the holidays.

Yes. This continued even after I left secondary school in 2011. The shop really came through for me and my siblings. We even started stocking the shop with books my mum didn’t sell, especially Harlequin books.

I got into the university in 2011 to study law. My allowance was ₦5k per month, which was hardly enough for a uni student. I augmented my allowance with whatever I made at the shop during the semester and session breaks — I was always back at the shop during the holidays. On average, I was making ₦20k every month from the markup and sales of books I bought and put on the shelves.

I lived within my means while in school — I cooked my meals and rarely ate outside and bought thrift clothes. So the money I made at the shop during the previous semester and my allowance were always enough for me to live on until the next semester break when I’d return to the bookshop. While my classmates were going for internships, I was at the shop trying to make as much as I could. That place really saved my life.

I bet.

Things changed a bit during the session break in 2017. I was going into my final year in school at the time.

What happened?

I had an accident, which caused some damage to one of my legs.

I’m so sorry.

Thank you. My dad was retiring, and my eldest sister was going to a school abroad. He also had to figure out how to settle my medical bills. Both expenses ran into millions of naira. That was a lot of money for a civil servant.

Do you have an idea how he raised this?

His savings. He had money in his domiciliary account, but the events wiped most of it. When he retired the following year, he used his severance pay to complete building a house on the land my mum convinced him to buy a couple of years back. Now, we were essentially surviving on my mum’s bookshop, which wasn’t as profitable as it used to be. The economy was hard, and that impacted everything.

Omo. Tell me, what changed after the accident?

My life as I knew it. I couldn’t go to the shop for the longest time because I was recovering. Although, people gave me money gifts during this time — I got about ₦50k — I would have preferred to be able to make my own money. I needed some things when I was going back to school and that brought all the money I had down to ₦20k.

I resumed school a month before the first semester exams, so there was a lot to catch up on. After my father’s retirement, I got my first reality check about what it meant for us. He sent me ₦90k for my rent as opposed to the usual ₦120k. One of my sisters and I used our money to complete the rent.

My finances were non-existent at this point. I wasn’t doing anything for money and was pretty much depending on the goodwill of people. And I had to worry about my final year project too. Thankfully, my mum and my sister funded it but I had to do a lot of things I would ordinarily outsource myself to save money. Anyway, I graduated from university in 2017.

Well done. What came after uni?

Thank you. There was a short wait before I went to law school. I had recovered by then, so I returned to the shop. However, the economy was on a fast decline and customers weren’t coming as they used to. Whatever little money I made there, I used it to get things I needed for law school. I had ₦5k on me when I was going to school.

Law school wasn’t as difficult as I thought it would be. My family came through for me. I could go home during weekends if I wanted to get stuff. The shop was there for me to make urgent ₦2k too. Also, I had a boyfriend — we started dating right before law school and he was there for me all the way through.

Thank God for the best support systems.

Fast forward to post-law school. While I was waiting for my call to the bar, I was making some money from the shop. I also started giving legal advice to small businesses which fetched between ₦3k and ₦5k. I saved ₦50k doing these things from August to November 2018. I was called to the bar and mobilised for NYSC in October.

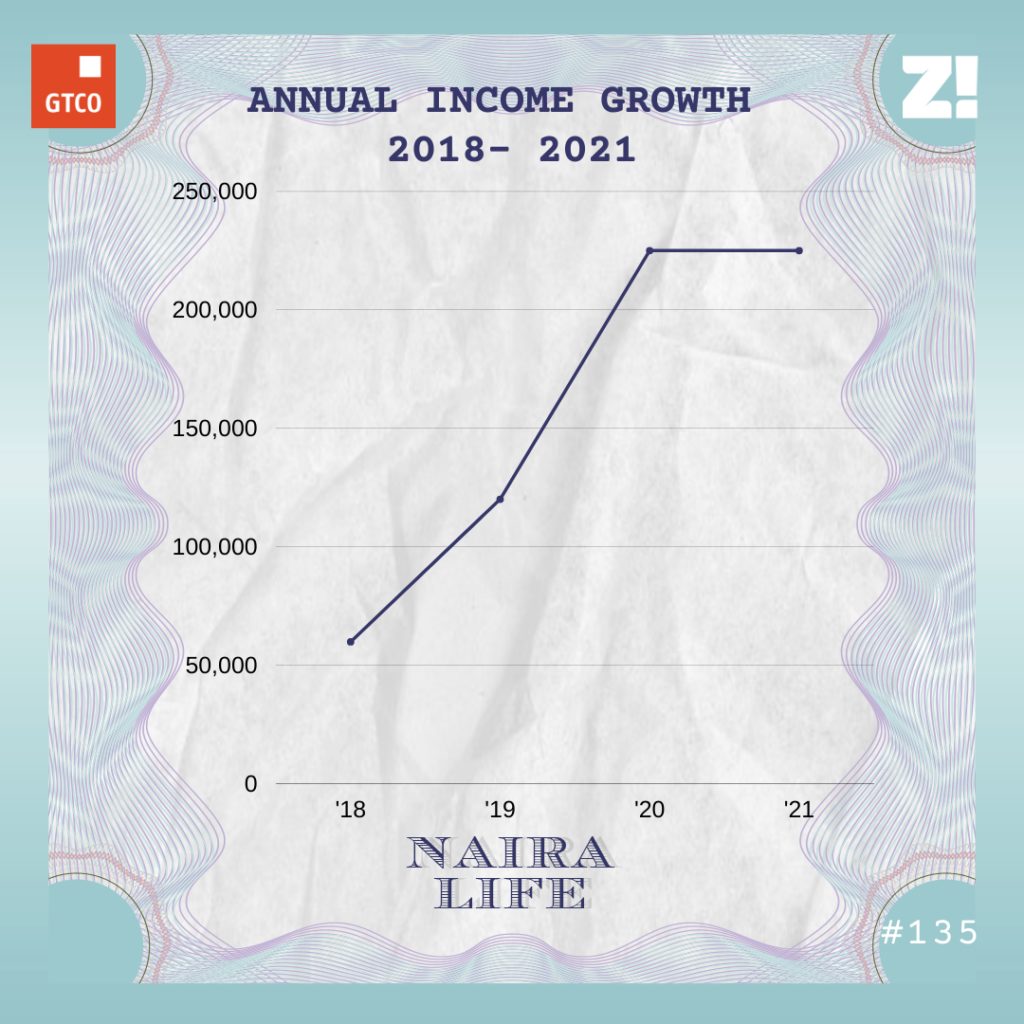

Where did you work during your service year?

I was posted to a law firm and the pay was ₦40k. The federal government was also paying ₦19800. The primary problem during my service year was the amount of money I spent on transportation. I was earning ₦59800 and spending up to ₦30k on transportation.

Why was that?

My parents lived on the outskirts of the city and my office was in the city centre. It was a struggle to move around on days my boyfriend didn’t call me a cab. Sometimes, I slept at a friend’s place. Despite this, I was always tired and frustrated, which makes sense — I was spending about half of my earnings on moving around and didn’t have enough money to save. My quality of life was pretty much non-existent.

The best thing I could do was to find a place closer to work.

That makes sense. Did it happen?

Yes. I got a one-room apartment in February or March 2018. The basic rent was ₦300k but the total package was ₦500k. My sister — the one studying abroad — had promised to support me with rent, but when I got a space, she was figuring out how to pay for her PhD. Thankfully, my boyfriend came through.

Nice.

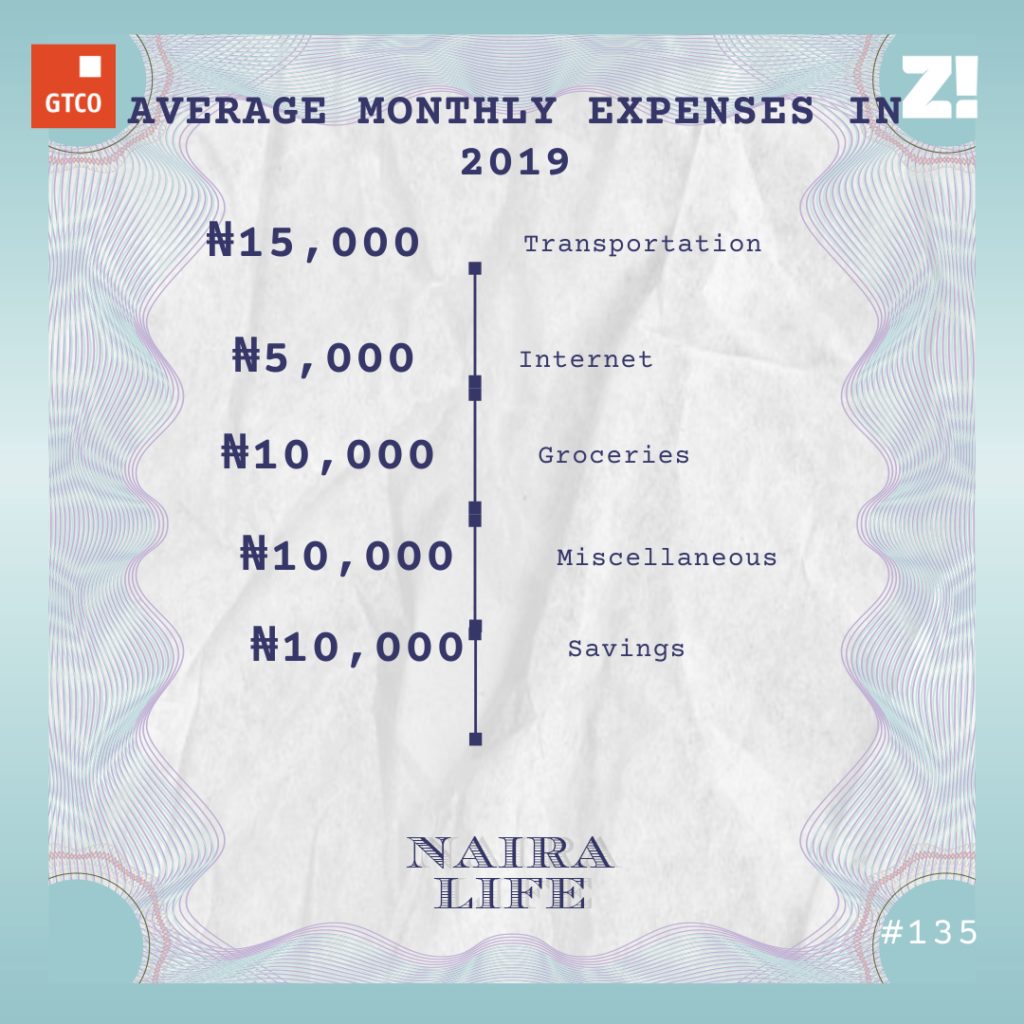

Although the space I got was small, it was worth it. I was now spending about 45 minutes to one hour on my commute and spending about ₦15k on transport in an average month. Let me even give a breakdown of my monthly expenses during my service year.

After the end of my service year, I quit the law firm. The pay was too little for the trouble. I had been applying for jobs and attending interviews before I finished NYSC. Shortly after my service year, I was hired at a law firm. My salary was ₦120k.

You went from earning ₦40k to ₦120k. How did that feel?

I was so excited. It seemed like I was earning a lot of money. But do you know what it means when they say someone earns their living? I earned that money. I worked long hours repeatedly. Sometimes I was at the office until 11 p.m.

It was while I was at this job that I started paying black tax. Omo, e choke. My parents didn’t ask but I knew things were not as good at home. Every month, I was saving between ₦20k and ₦25k. After paying other bills, I had enough left to send ₦20k home. I wouldn’t say it didn’t affect me because, by the middle of each month, I’d be down to ₦5k. Afterwards, I’d be forced to take out of my savings. The monthly cycle was to save money, take out of my savings, return whatever I took after I got paid, take out of the savings again.

Sounds hectic.

Oh, it was. I almost forgot about this. I started a legal business during NYSC, helping people establish businesses. I made ₦20k in profit from the first company I got as a client. A lot wasn’t coming in from it, so I dropped it.

While I was at my second job, I picked the business up again because a colleague was also doing it, and he was gracious enough to show me the ropes. This was in February 2020 and I started making ₦40k – ₦50k from each client I worked with. Before long, I had about ₦150k in my savings. It didn’t take long before I had to use it.

Why?

Something came up with my health, and it was related to the accident I had in 2017. The medical bill I incurred was ₦200k. My mum gave me ₦50k to complete the payment. A couple of weeks later, the pandemic hit and I had to deal with a 50% pay cut.

Ah, that breakfast.

Lmao. Nothing came from my side hustle either.

You were now earning ₦60k with no side hustle. What did that mean for you?

It was figuring out how to live on ₦40k after sending ₦20k home to my parents because my mum’s shop was locked up. It also meant that I couldn’t save. To be honest, I didn’t try to.

Fair enough. When did you return to receiving your full salary?

July 2020. My boss also paid me a ₦100k bonus in July 2020. I put ₦60k in my savings, sent ₦20k and used ₦20k to buy stuff for myself. Let’s be honest, I deserve it.

Haha. I mean, I agree.

After that, I was trying to rebuild my savings. I knew my salary at my job wasn’t going to do it for me, so I started looking for a new job. To be fair, they increased my salary to ₦140k in august, but I didn’t think it was enough to make me stay. I eventually quit the job in November and resumed my new job in December.

What’s the new job about?

I got an offer to work in the legal department of a financial services company. My salary? ₦200k. It was a major bump for me, even though my friends in other firms were earning between ₦350k and ₦400k. Sha, everybody dey run their race.

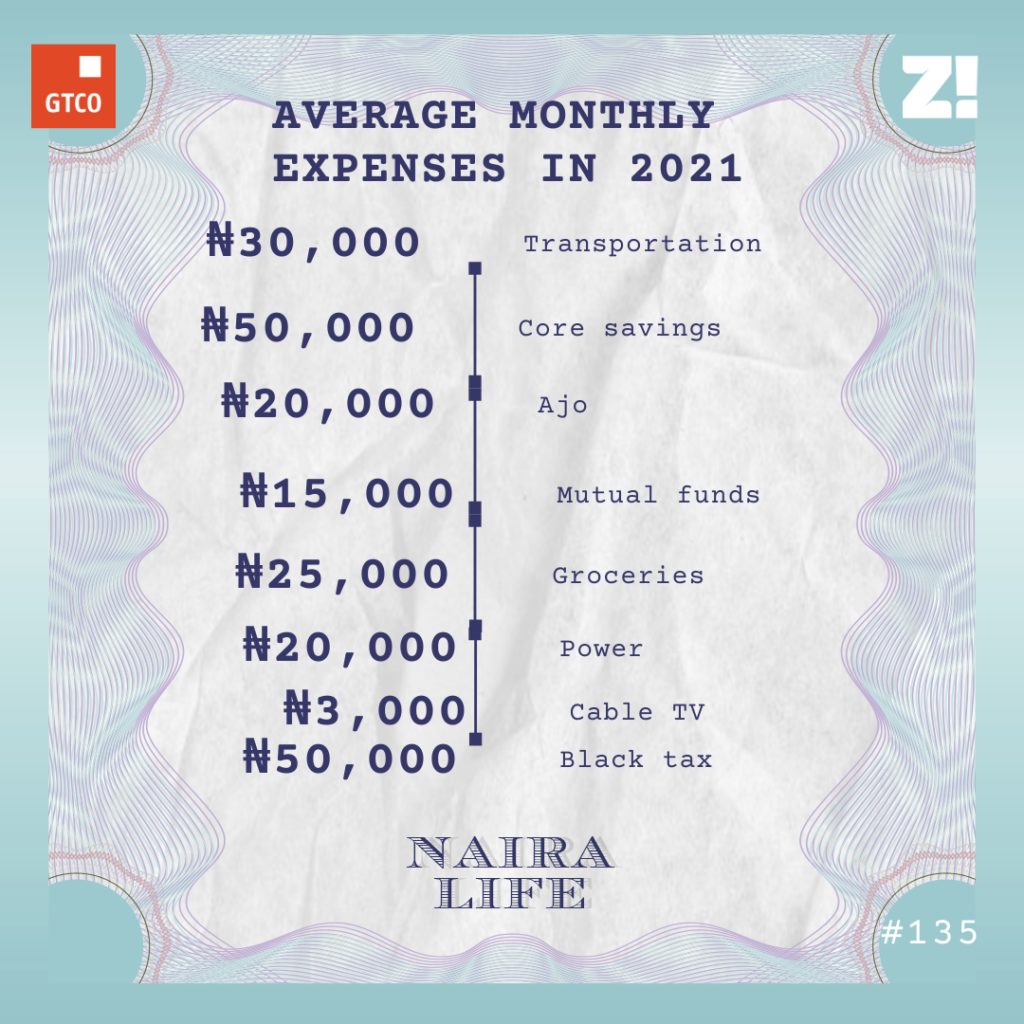

I’m still at the company and aside from my basic pay, they pay for my internet and give me another ₦25k stipend every month. So really, I’m earning ₦225k.

What’s happened between the time you got the job and now?

I got serious with my business establishment hustle in January 2021, so I set it up properly. I leveraged social media, and it’s been very helpful for referrals. Sometimes, I make up to ₦250k from my side hustle in a month.

That’s lit.

However, my black tax has also increased to about ₦50k per month. The major family expenses are sorted by me and my older sisters, then some by my mum. Nobody disturbs my dad for money now.

It’s not been that bad. My standard of living has also increased over time. Can I break down my monthly expenses now?

Yes, please.

My core savings goes into my PiggyVest account. My mum manages the ajo thing, so I send the money to her every month. Most of the money I use to manage myself during the month is from my side hustle.

I see you have money in mutual funds. What do you think about investments?

I only put money in it because my company offers a mutual funds service. I’m not interested in investments like that. I’ve realised that you need to invest a reasonable amount of money to get decent returns. I’m looking forward to getting my capital back by the end of the year.

Would you say you have a fear of investments?

I know that I have a low-risk appetite. My mum was always careful with money so I think that’s where the fear came from. I’m always thinking, what if something happens to the money. I like financial security and at the moment, my savings give me that. I know I have access to the money whenever I need it.

How much do you have in savings right now?

About ₦700k in my PiggyVest and ₦200k in my mutual funds.

What have your current earnings meant for your standard of living?

I moved into a bigger apartment recently. The rent is ₦1m but I’m sharing it with a roommate. My boyfriend paid my share of the rent, so I didn’t have to worry about it. I have stopped buying thrift clothes because I can now afford to buy new clothes every other month. Also, I spent ₦120k on a wig this year although I had to save for three months to afford it. I had been spending money on wigs that didn’t last long, so I wanted to invest in a good one.

My standard of living has improved but my parents’ haven’t. And since I centre my life around my family, I can’t enjoy myself too much without thinking about them.

I’m curious, do you have a plan for medical emergencies?

My sister pays for premium health insurance for my parents, and it puts me at ease. I don’t have up to ₦1m to my name, which isn’t enough for big emergencies. But I have HMO at work, which should cover a few things. For the most part, my boyfriend is my safety cushion. And maybe my sister who is abroad.

A segue. How much do you think you should be earning now?

Oh, I have been promoted at work and will start earning ₦250k at work from next month. People I went to law school with and got jobs in top law firms are earning about ₦400k – ₦500k. I think I should be earning within that range too, but things don’t work out that way in this country. I truly appreciate my salary. I’m content with this for now.

What will get you to your next level of income?

I don’t plan to leave my current job any time soon but I hope I get another promotion. Ultimately, the plan is to leave Nigeria for school next year, so I need to earn more to save more. I’ve been applying for scholarships and if one of them comes through, I want to have enough money to sort out the other bills that come with it. The only thing I can do is work hard and hope that promotion comes through.

I want to ask, is there anything you would like now but can’t afford?

A car! I really want one. However, I’m saving for school. At the moment, the option is choosing between a car and an education. I’m going with the obvious choice.

On the flip side, what was the last thing you spent money on that improved the quality of your life?

My AirPods. I got it for ₦75k, and it’s made my life so much better. Now, I can be in a meeting and doing chores at the same time. I love it so much.

What part of your finances do you think you could be better at?

I don’t want to say managing my black tax better, but that’s it. I’m always thinking about sending more money home. It’s not easy to navigate.

Going forward, what do you imagine your black tax will look like?

I don’t think it’s going to completely go away. As it stands, I have four siblings. Two of them are older than me, so I don’t have to worry about them. But the last two — a sister and a brother — are still in school, and they need us. The only option is for myself and my older sisters to get our money up and assist my mum. The black tax isn’t going anywhere.

How has your perspective about money evolved over time?

I’ve grown from earning money and spending it. I still think money is meant to be spent but I’m more responsible with money now. I do YOLO in a while because I believe there has to be a balance between making money and spending money. The point is, I don’t spend more than I can handle.

On a scale of 1-10, how would you rate your financial happiness?

6. I’m not earning as much as I want, and I can’t afford to spend money on a couple of important things. I shouldn’t have to choose between going to school and buying a car. I want to be able to spend money without looking at a list for too long. Also, the black tax is tiring — it worries me all the time.

What would get you to an 8, a 9 or maybe even a 10?

A significant salary raise and growing my side business to scale. For starters, I won’t feel the black tax a lot, and that’s half of my troubles solved already.

Great! You got to the end of this article. Know what’s even better? You can get QuickCredit faster than the time it took you to read this article. With Quickcredit, GTBank customers can get N2million in less than 2 minutes and pay back over 12 months at an interest rate of 1.5%. No forms. No collateral. No hidden charges. Get Your Quick Credit on GTWorld