Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This week’s Naira Life is brought to you by QuickCredit. With QuickCredit, you not only get the funds you need instantly, but you also get to pay back at the lowest interest rate in Nigeria.

What’s your oldest memory of money

It was realising that not having a lot of money didn’t mean I couldn’t be comfortable. I grew up with my mum and my grandparents in a state in the east. My mum was a teacher employed by the government and my grandfather was a worker at the Anglican church — they weren’t earning much, however, they provided everything we needed.

Do you have an idea what your grandfather and your mum earned at the time?

My grandfather retired from the mission in 1987, and his pension was ₦47. Before his retirement, his salary was about ₦44 per month. My mum joined the civil service in 1981, but I didn’t know how much she earned until the late 80s or early 90s. She got into the university and couldn’t always make it to work on salary day. Whenever I was at home, she’d inform her boss, the headmaster, that I was coming to get it on her behalf. I found out her salary was a little over ₦1000.

Around this time, I was also in secondary school and lived in an Anglican boarding school. My pocket money was ₦2 per term. The school provided feeding and almost everything else, so there wasn’t a lot of reason to spend money.

What could the money get you though?

Mostly snacks, especially 10 kobo worth of buns or groundnuts at a time. There was barely enough money left to save when the school closed for the term.

I left secondary school in 1992.

What happened after?

My mum wanted me to go to the Teacher’s Training College. I bluntly refused.

Why?

I didn’t want to become a teacher. I wanted to go to university and try something else. I wrote JAMB once or twice and didn’t get into any, so I started looking for a job.

When did you find a job?

1993. I worked as a salesgirl in a shop at a filling station, and it paid ₦80/month. There was no need to keep the money because I still lived with my family, so I always handed my salary to my grandmother the moment I got it. I was at the job for about 11 or 12 months. My uncles and aunts asked me to quit.

Did they give you a reason?

A lot of it was because we were active members of our church community They said I couldn’t be serving people who were not one of us. It wasn’t a big deal.

I applied for more jobs and got a few interviews. I wasn’t earning, but money wasn’t a problem. There was always food on the table. There was still a plan to return to school, but that didn’t happen immediately. At least, not until after I got married and had a child in 1996.

I was married to my ex-husband for about a year before we dissolved the marriage for reasons I don’t want to share. By 1997, I was out with my one-year-old daughter. Thankfully, I got a job in the civil service with my SSCE certificate less than a year later. I was hired as a forest attendant in the agriculture unit in a local government.

Yay! How did it happen?

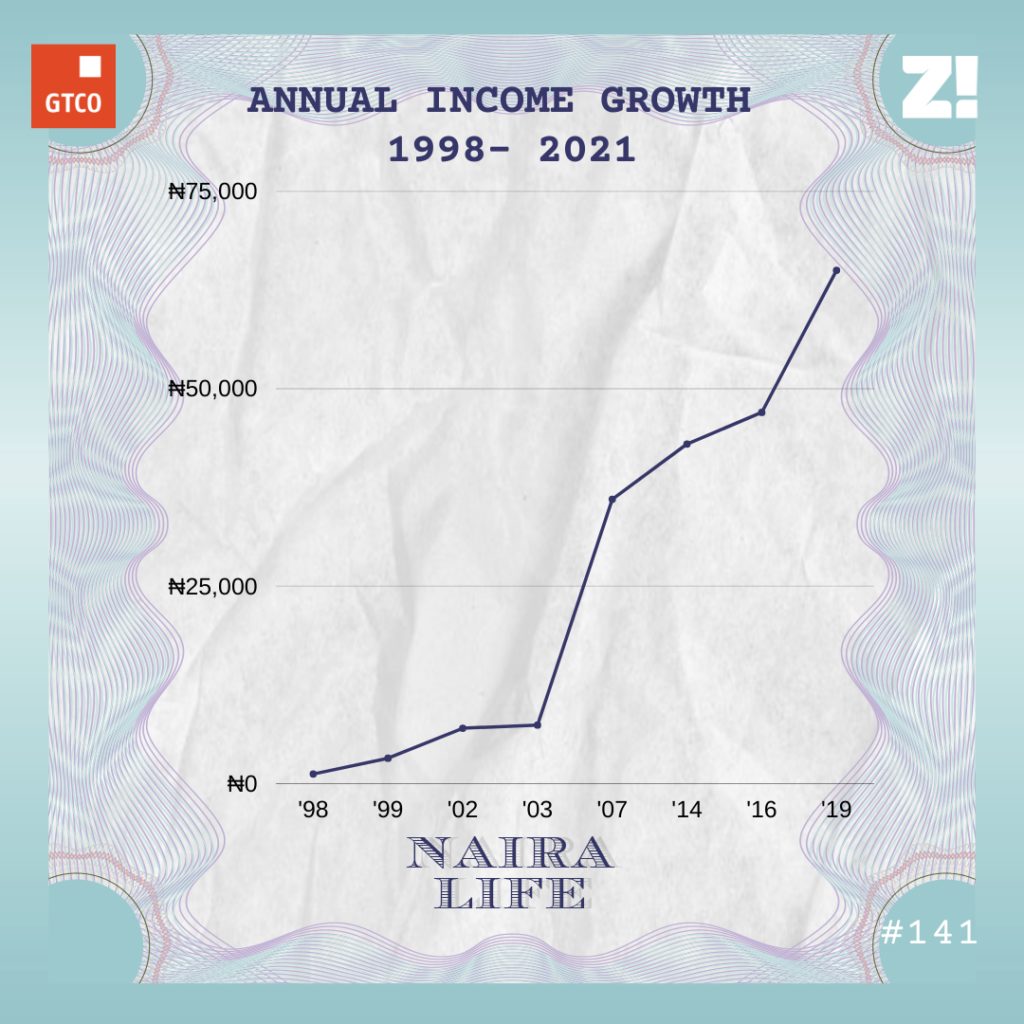

They put out a job advertisement and I applied. I was put on Grade Level two and my starting salary was ₦1200.

I don’t know what would have happened if I wasn’t earning something because my daughter was about to start pre-nursery school. My salary went into paying for rent, which was ₦500 per month and her school fees. Whatever remained went into feeding and transportation. There was nothing left by the end of the month.

Fortunately, an increment happened a year after I joined the civil service.

What happened?

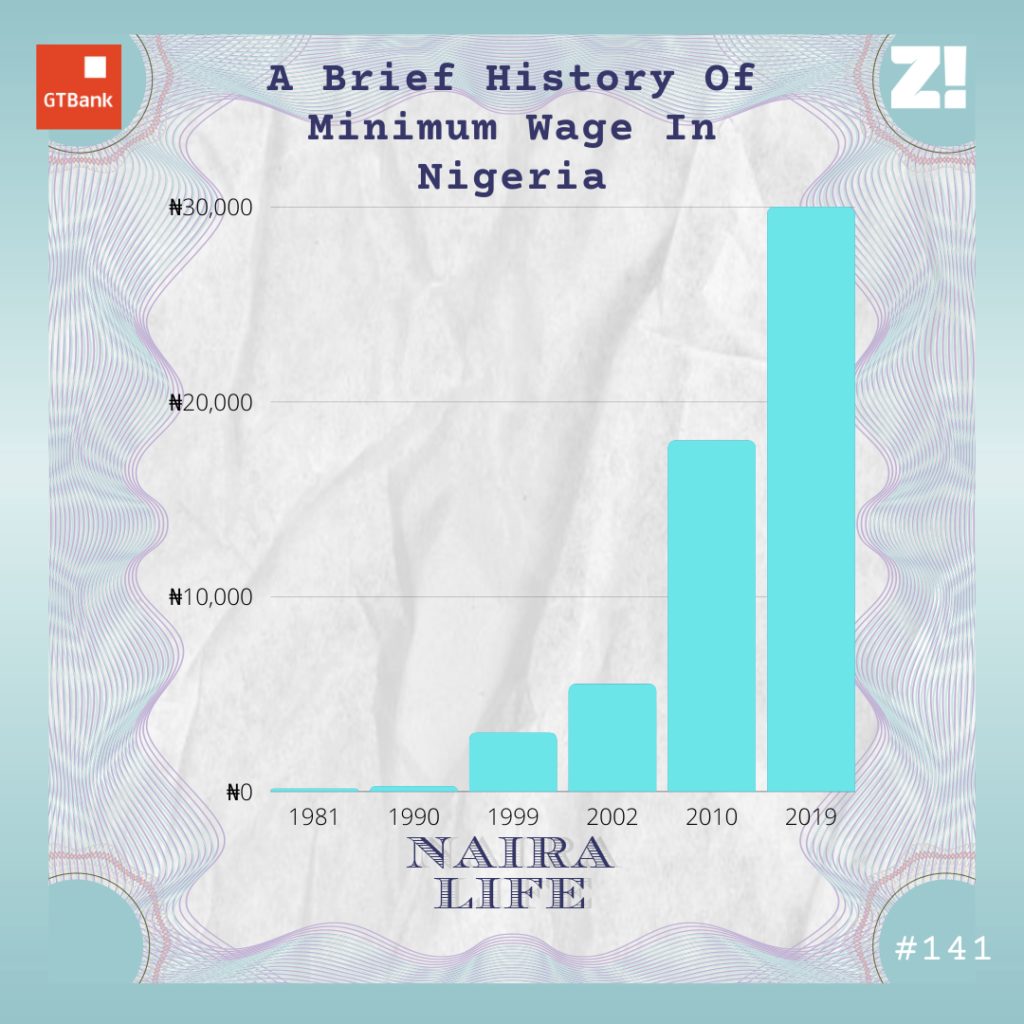

The government of General Abdulsalami Abubakar increased the minimum wage to ₦3k, and this brought my salary to ₦3200.

The year 2000 was tough though. The local government owed salaries for 13 months.

That’s a whole year. Did they explain why?

They said they were getting zero allocation from the state government. This is what they did: If they paid 50% of our salaries in one month, they wouldn’t pay anything for two or three months, then pay another 50%

That’s hectic. How did you survive this period?

My appointment at the local government had been confirmed, and that meant I was eligible for a state-government-sponsored diploma in public administration at a university in Enugu. The government was paying me a stipend every month, and the money was a bit higher than my salary.

My mum was also earning more than I did, and she was consistently supportive.

I finished the diploma in 2002. By this time, President Obasanjo had come into the office and increased the minimum wage to ₦5500, bringing my salary to ₦6500. I also got promoted that year. I moved from Grade Level Two to level four, and my salary was revised to ₦7k.

This was probably when I realised that a minimum wage review was the only way civil servants could get a significant increase in salary. Moving between grade levels only added some little change to what you were previously earning. Even though those little changes can do something.

What did these increments mean for your standard of living?

It was a big relief. It meant I could afford to pay for a better school for my daughter. Before this, she was in a school owned and managed by the church. Subsequently, I transferred her to another school. Although the school fees per term were close to ₦10k, it was totally worth it.

My next promotion happened in 2003, and my salary grew to ₦7400. By 2007, I was in Grade Level seven and earning ₦36k.

Were you still the only one raising your daughter?

I remarried in 2008. I met my husband in the local government where I worked, and he was earning a little less than I did. However, he had a couple of side hustle that brought in extra money for the family — at least enough to cater for my daughter who was now in secondary school and afford some other things.

Three years later, I gave birth to my youngest daughter. My husband passed a month after her birth.

I’m so sorry.

Thank you. He was ill for a while. At the time of his death, we had some debt, which I now had to figure how to sort out. I took a loan of ₦350k from the bank to repay the debt. I paid the bank back for three years.

I also had two daughters to take care of and was barely making enough. Thank God my mum was there to share some of the load with me. Her salary was ₦76k at the time, which was significantly more than what I was earning.

Ah, the support system.

On the work front, I couldn’t go higher than Grade Level seven if I didn’t get additional qualifications. Subsequently, I went for a six-month diploma, which cost me ₦50k. My next promotion came in 2013, and I moved to grade-level eight. But it didn’t go into effect until 2014. The minimum wage had also been increased to ₦18k. My salary was ₦43k.

I realised later that there had been a mistake. I was supposed to be promoted to Grade Level nine. It took a year before they corrected this and two years before it became official. Eventually, my salary grew to ₦47k in 2016.

Must have been a relief.

Oh, it was. However, my bills had also risen. My eldest daughter had just gotten into a polytechnic and my youngest had started primary school — their tuition was about ₦60k and ₦25k per semester/term.

How did you navigate this?

Hm. It wasn’t easy. Once I got my salary, I’d take out the rent first then pay part-payment fees of one of my daughters, depending on the one that’s more urgent. By the time I cleared everything, a new semester or term would have started. Rinse and repeat.

My eldest daughter took a lot of the load off me. During her IT at the end of her ND programme, she learned how to sew clothes, and that brought in money for her when she started her programme. The only thing I had to worry about was paying her tuition. She has since graduated from the polytechnic and gotten a job. That makes me happy.

That’s so great. What else has happened between 2016 and now?

I got my next promotion in 2019, which increased my salary to ₦65k. Although the new minimum wage is ₦30k, it hasn’t been implemented yet in the local government — only state government workers currently receive it in my state.

Also, I had enrolled in an ND programme in 2018 because I needed additional qualifications to move up from Grade Level nine. Once I finish this by the end of the year, I will get to at least grade level 14.

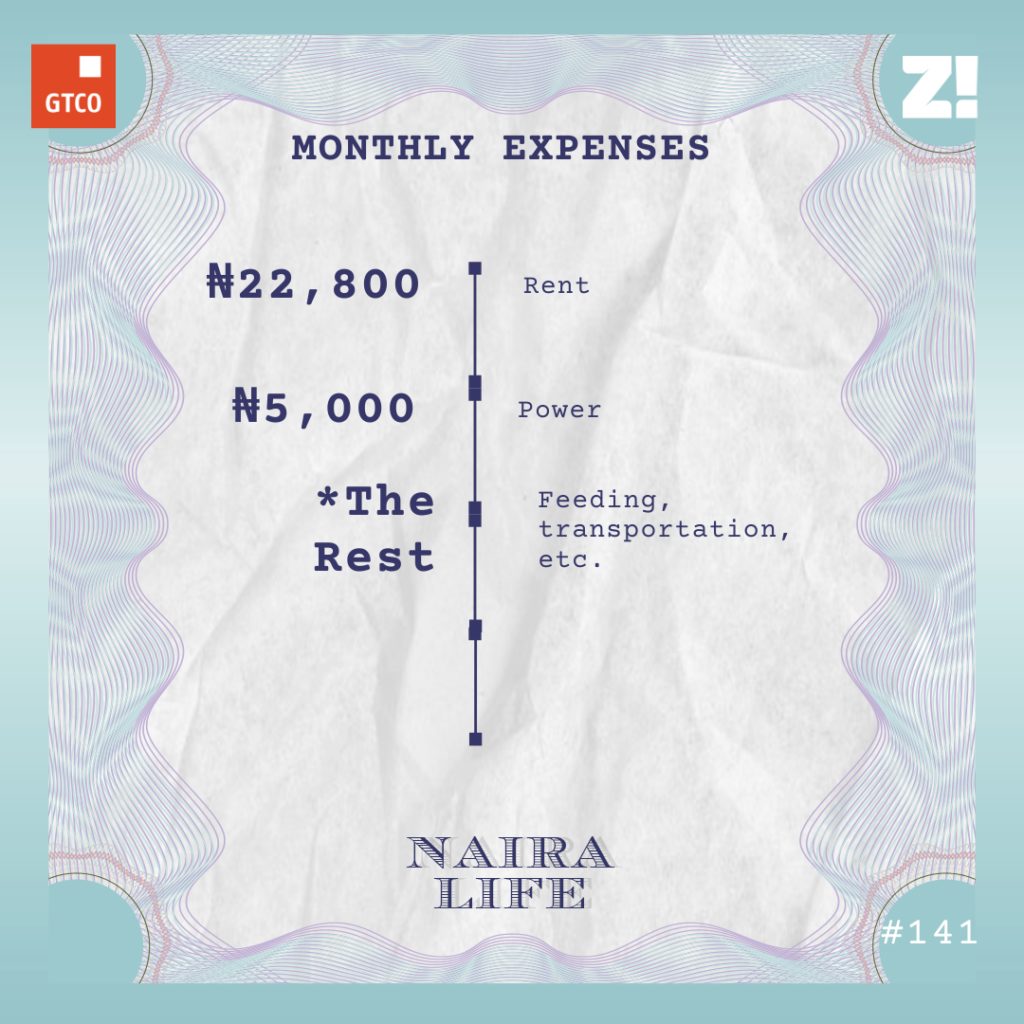

What do your monthly expenses currently look like then?

My eldest daughter also supports me a lot, especially with feeding and her sister’s school fees. It depends on which is more important at the moment.

Sweet. Do you have enough left to save after all of this?

Right now, what I have kept aside should be about ₦20k. I save whatever I can in the months I can. Typically, this is between ₦5k and ₦10k. However, I can’t help but touch my savings sometimes.

How much do you think would be great for you right now?

About ₦200k/month. I’ve been working in the civil service for more than 20 years. I don’t have a problem with the career path — it’s only that the money is not much. The local government is even owing us three months salary at the moment.

Wow. When did this start?

Last year. They didn’t pay in November and December. They resumed payments from January 2021 until July. August salaries came in September. Now, I’m looking forward to getting paid for September. Coping with this hasn’t been that bad though. My daughter makes sure of that.

You’ve spent more than two decades in the civil service now. Do you ever think about retirement?

Yes, I do. I’ll retire in 2033, and I’ve started thinking about what I could do after that. I think I may go down that academic route after all. I do some part-time teaching already, and I enjoy it. I could find work in a private school after I stop working for the government. Or if God permits, I can start my own school.

That sounds good. What about a retirement fund?

I have a retirement account with a bank, but I stopped putting money in it in 2016 — I changed my salary account. At the time, I had less than ₦200k in it.

It would be great to have about ₦4m or ₦5m in it before I retire. But with this inflation, that probably won’t be a lot of money in 2033.

Hmm. Is there anything you want right now but can’t afford?

I’m tired of paying rent. A piece of land where I can build a house and farm will be nice. But a plot of land in the township where I live in Abia state costs about ₦3m and is close to ₦2m in neighbouring villages.

Oof. I’m curious about how these years have shaped your perspective about money?

It’s important to know that you can’t kill yourself for what other people think. Not having enough money can make you look selfish, especially to people around you who think you have it. And it’s not even like you don’t want to help; you just can’t afford to.

I try as much as possible to be transparent. When the money comes, I extend a hand of fellowship to the people I can. It’s not how I’d have liked this to work, but it’s the best I can do.

I get that. How would you rate your financial happiness on a scale of 1-10?

It’s a 5. I’m really happy that I’ve raised my eldest daughter to this point where she has a job, can take care of herself and even offer help sometimes. This makes me happy so much.

Great! You got to the end of this article. Know what’s even better? You can get QuickCredit faster than the time it took you to read this article. With Quickcredit, GTBank customers can get N2million in less than 2 minutes and pay back over 12 months at an interest rate of 1.5%. No forms. No collateral. No hidden charges. Get Your Quick Credit on GTWorld