Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This week’s Naira Life is brought to you by Quick credit. With Quick credit, you not only get the funds you need instantly, but you also get to pay back at the lowest interest rate in Nigeria.

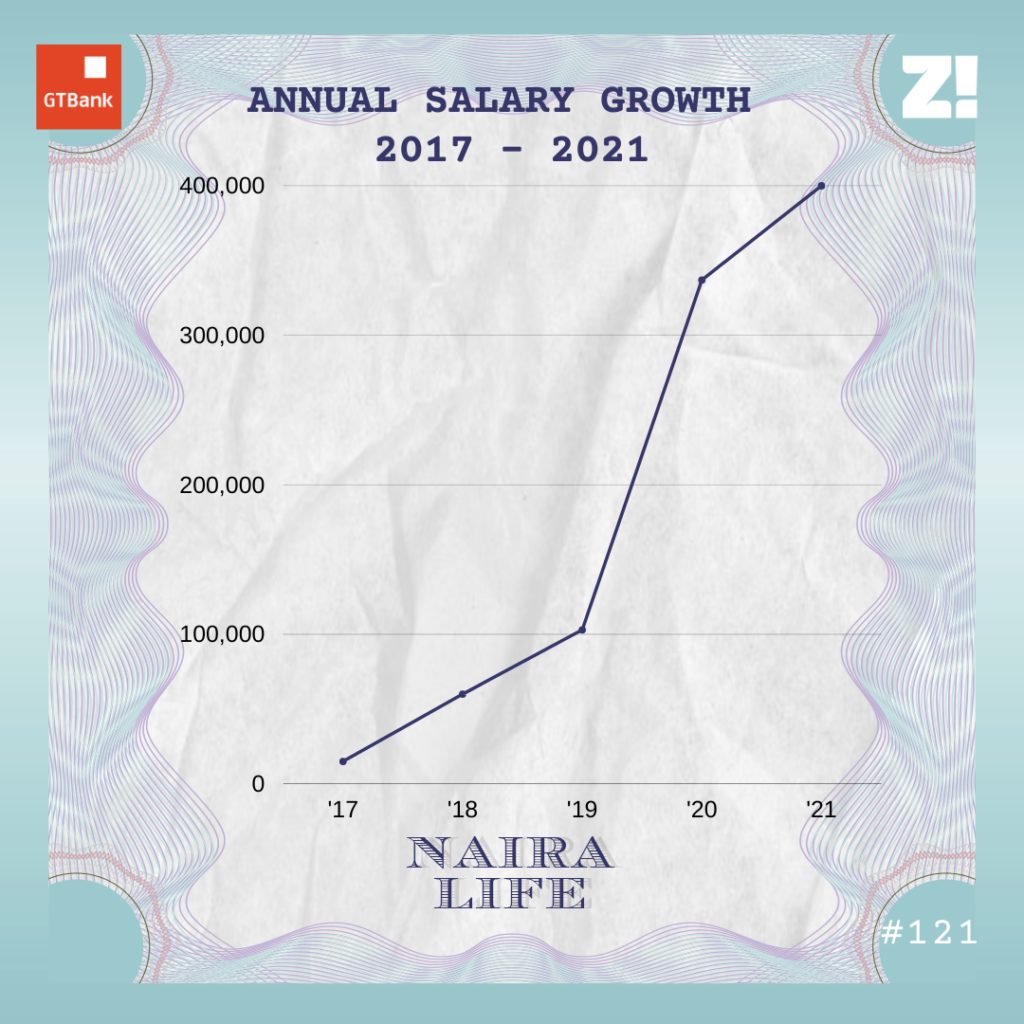

Between 2019 and 2021, this 22-year-old investment analyst grew her income by almost 400%. What’s her trick? Going after the right internships, building important relationships and leveraging her network.

What’s your oldest memory of money?

It was my primary school allowance for me. I started getting pocket money for school in 2005. I was six years old at the time. The money was a nice touch because I took lunch and was driven to school. It started with ₦30 and increased in the subsequent years. When I left secondary school, I was getting ₦250 to school every day. My friends thought I was rich because I always had money in my pocket. But I didn’t understand what they meant for the longest time.

Baller. Why didn’t you think you were rich though?

I grew up in a small town and went to a cheap school. I thought if my parents were rich, I would go to a more expensive school. I started to understand why they thought I was the rich girl as I grew older. A car dropped me at school while others took the school bus. In comparison to most of my classmates, I had money.

To be honest, I never lacked anything growing up even though my family is a large one — my parents have five children. The first time I got familiar with lack was after I finished secondary school and found out that I couldn’t go to my dream school because we couldn’t afford it.

Tell me more about that.

I wanted to go to uni abroad. I got an admission offer and a 70% scholarship. But my mum insisted that I wrote JAMB. Later, she sat me down and told me that I couldn’t go. I was like, “But I have a 70% scholarship.”

Wiun.

She said the best they could at the time was to send me to a private university in Nigeria. My father even kicked against that for a bit and told me to consider a federal university.

Why?

He was managing a family business and farming on the side. I grew up in a civil service state and the governor wasn’t paying salaries; that affected pretty much everybody in the state, so there was nobody to sell his farm produce to. There were also a series of unfortunate events — his farm flooded one time and he was dealing with family disputes as well.

My mother, on the other hand, was an administrator at a manufacturing company and she was still working and getting promoted. Anyway, we eventually decided that I would go to the private university.

So uni?

I got my allowance at the beginning of each semester, and when I broke it down, it was ₦15k a month. By the time I was in final year, it was ₦25k. There were other allowances too courtesy of my aunts and elder siblings.

I was careful with money in university. I only spent on essentials. For example, the cafeteria food was terrible, but I went there anyway because we had paid for it.

I got a scholarship in my second year that paid me ₦100k every session until I left uni. I also started going after internships in my second year.

Your first work experience?

Yes. I went for the first one in 2017. I wanted to intern with one of the “Big 4” but it didn’t work out. I found work in a family friend’s audit firm and spent the two-month session break there, earning ₦15k per month. I didn’t incur a lot of expenses because I took food to work and transportation in the town was cheap.

The second internship happened in my third year. This time, it was with an asset management firm in Lagos. They paid me ₦60k per month. Most of my earnings went into transportation, a little into flexing, and the rest went into my savings. I returned to school after the internship for my final year and got elected into the student council. This came with a ₦100k allowance every semester.

Your school paid you to be on the student council?

Yes.

Greatest Gba Gba is shaking. What did your finances look like when you left uni?

I had about ₦400k in savings. One of my sisters had warned me that my allowances would stop coming the moment I finished from uni and she was right. I hadn’t even gotten a job when my parents cut me off.

Lmao. When did you find a job post-uni?

June 2019 — about two months after I left uni. It was an internship at one of the Big 4s and it paid ₦60k. I was there for two months before I left for NYSC. And I’d gotten a job elsewhere before I left. This is how it happened: during my internship days at school, I networked a lot and maintained relationships with the people I worked with. Right as I was preparing for NYSC, one of those people texted me to inform me that she was leaving her job, and they were looking for someone to replace her. She wanted to know if I was interested in the role. The company was well-known in the finance industry and I was like, “Yeah, sure.” The interview was a breeze. My offer letter followed. ₦70k net.

Lit.

I earned ₦103k during NYSC — ₦70k from the company and ₦33k from the federal government. As my service year drew to a close, it started looking like I wasn’t going to get a full-time offer at the company. My boss was saying that he wanted me on the team but HR wasn’t saying anything. I started looking for a new job in June 2020 though my service year was going to end in October. I filled out tons of work applications, got a couple of interviews, but none of it came through. Companies were still trying to navigate Covid, so recruitment was weird. Anyway, I had no job when NYSC ended.

Wiun. How long were you unemployed for?

Three long weeks. I didn’t have a lot of money saved up anymore. I live with two of my siblings but I’d started contributing more towards housekeeping because their incomes were fluctuating. I had ₦300k saved up but during those weeks, the only thing I was thinking about was, “What will I do when this money finishes?”

Thankfully, that didn’t happen before I got my next job. I actually got two offers almost at the same time.

Again, my relationships with people helped me here. Someone else I knew was leaving a company and left my name as a possible replacement. I was still serving when I got a Linkedin request from someone at the company. The man who reached out said that they were looking for someone to fill the role and were wondering if I would be interested in having a chat with them. Of course, I was even though I didn’t think I qualified for the role. The first interview happened, then the second. But nothing happened after that, so I thought they went with another candidate.

A month after, they reached out and went, “You’re not who we were looking for but we like you. Do you want to join our team?”

My heart.

My God, I was so excited. I think I almost cried. The second offer came in the same week.

Let’s talk about benefits.

The first company isn’t Nigerian owned and they offered me a gross salary of ₦5m/annum. My take home every month would be ₦337k. The second company wanted to start with ₦2.5m per annum. That’s about ₦150k/month.

I decided to go with the first company. The money wasn’t the only factor that made me choose them though.

Fair enough.

Right before I resumed work at the company, I contributed ₦220k towards rent for 2021. I was at square 0 when I started work in December 2020. There was hardly anything in my savings.

What’s happened between then and now?

I was hired as an investment analyst and was on probation when I started. Then someone left the team and an opportunity to take some of her responsibilities presented itself. I wasn’t sure if I could do them, but I said yes when they asked me if I wanted to. They were impressed with my work and when it was time to confirm me, they increased my pay by 20%. My gross annual salary shot up to ₦6m. My current net is ₦400k per month.

Mad. You’ve come a long way in such a short time.

I’ve been fortunate. When I graduated from uni in 2019 and moved to Lagos, I carried one box of luggage because I wasn’t sure if I was going to stay but it’s been about two years and I’m still here. Also, I’m lucky I had siblings who could house me. I think I got a soft landing.

However, I won’t discount the work I’ve put in. I graduated from uni with a first class. When I was in uni, I sacrificed my session breaks from my second year up to my final year for internships. The work experience looks good on my CV. Also, I networked ridiculously. I’m here because people have reached out to me when they were leaving their roles or put my name on the potential candidate list when their company is hiring. Another good thing that has helped me is that people are comfortable telling me their salaries, so I know what to ask for during negotiations.

Oh, I also get ₦50k-₦150k from contract work from time to time. This mostly comes from the more experienced people I have worked with when they need an extra person on their projects.

Lit. What does ₦400k/month do for you?

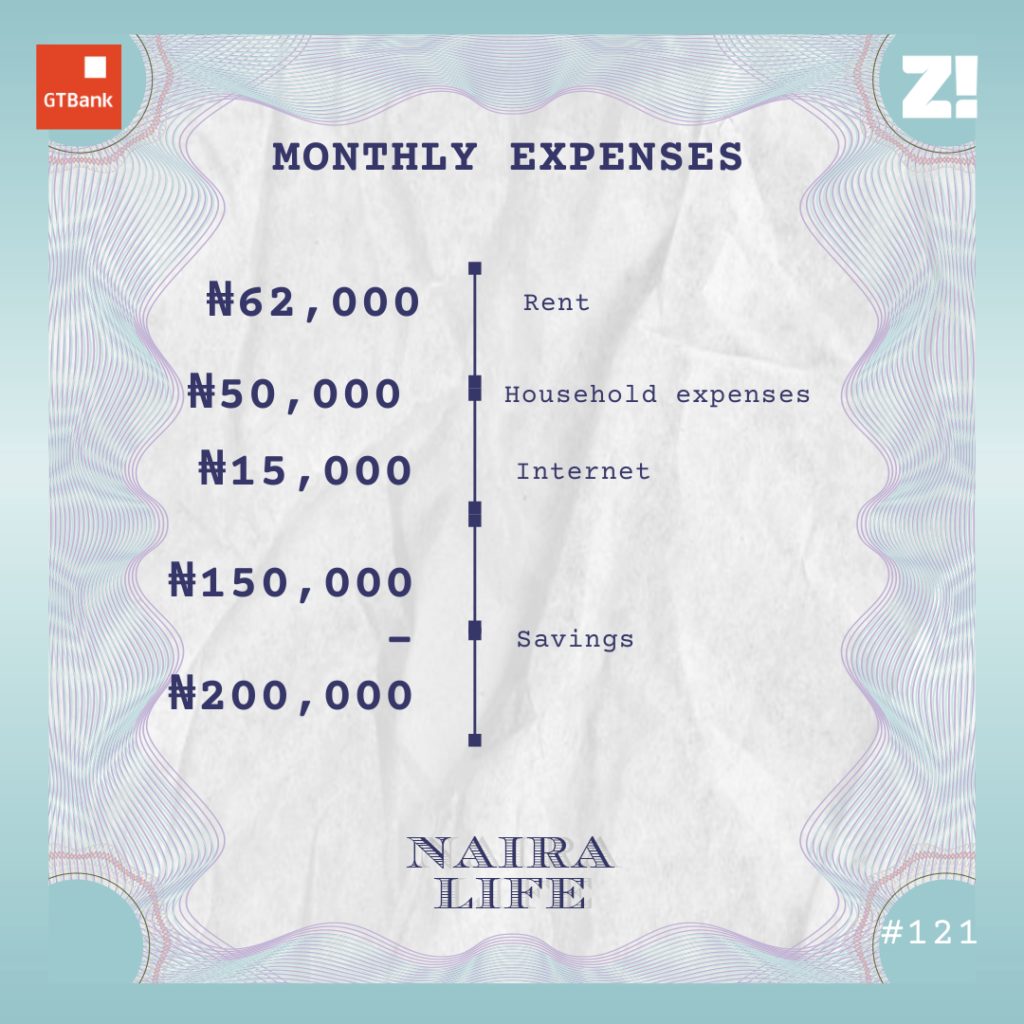

I put ₦62k aside for my accommodation expenses because my living arrangement will change next year. At the moment, I contribute ₦50k for things we need in the house. When I first started living with my siblings, I wasn’t contributing anything at all. Bit by bit, I started contributing some money because I realised that resentment can begin to set in if I wasn’t pulling my weight. As my income increased, my contributions increased.

There are skin care expenses, but it doesn’t happen every month. There are courses I pay for too. I spend money on food when people invite me out for stuff, so that’s also not fixed. I clear the basic bills first and whatever remains after this can go into whatever comes up.

How do you approach wealth-building tools, especially savings and investments?

My savings and investments are looking good right now. I have a target to build my wealth portfolio to ₦2m by the end of the year. So far so good, I have a little over $1000 in dollar savings, a few hundred dollars in crypto. There’s another ₦60k in cash and ₦100k in stocks — about ₦800k in total naira value. All of this is separate from my rent savings which is in mutual funds

I plan to save at least ₦150k every month and when I’m comfortable with my liquid cash position, I can expand my investment portfolio to dollar stock and maybe increase my crypto holdings.

How has your experience shaped your perspective about money?

I know that because of my background in finance, I don’t spend money anyhow. I want to buy things I like, but I can’t let go. Yes, I’m still very anxious about money. Like what would happen if I lost my job?

But I also know that I can be financially independent with a 9-5 though a lot of discipline will come into play. I believe money is a tool I can make work for me. Also because of my work in asset management, I’ve seen how rich people deploy their funds. I’ve heard an asset manager talk about portfolios worth over ₦500m, and I was like, “In this same Nigeria?”

Haha. How has your work in finance influenced the way you manage money?

I already have my personal stock portfolio, and I use the skills and knowledge I learn on the job to manage it. I’m wiser with the way I approach what I earn and what I spend. Now if I earmark an amount of money to something, it has to go into it. I trust my financial decisions because a lot of thought goes into them.

Interesting. How much do you think you should be earning now?

That’s tricky. I’m earning above ₦200k-₦250k, which is the industry average for my level of experience. There are companies that can pay me as high as ₦800k. The only problem is the options are limited to a few places and it’s hard to get into those companies. If I leave my current company now without a good exit strategy, I’d most likely get a pay cut. When I was looking for a job, I went to an interview and told them that my salary expectation was ₦200k, and the guy burst into laughter. I’m good right now but to put it out there to the universe, ₦800k-₦1m will be great.

Where do you see all of this in five years?

I hope I’m out of this country. I want to go for my MBA in 2023. I’ll spend two years in grad school, so in five years I should have gotten a better paying job and be earning about $150k/annum.

I’m saving hard right now so I can raise something for my MBA — at least for the application fees and initial deposit. Most of the rest will come from scholarships and loans. There are organisations that give international students loans and they start to get their money back when you get a job.

What part of your finances do you think you could be better at?

I’ve noticed a pattern in the last two years — I save a lot of money then something comes along and deflates my savings. It was my phone in 2019. It was the rent contribution in 2020. I think I should have a separate emergency fund, so I won’t have to touch my core and long term savings if something comes up. I need to build that armour tank.

What’s something you want right now but can’t afford?

I want a bone straight wig but my mind won’t let me rest if I take the money out of my account. I don’t think it’s a good use of my resources at the moment. I also need an AC for my room but I can’t buy it yet — maybe in a few months.

Hmm. Anything you bought recently that improved the quality of your life?

A headset. I’m in a lot of work meetings, and it’s made the experience much better. It’s only ₦10k but serves me well.

On a scale of 1-10, how will you rate your financial happiness?

5. I hate that I have to think and plan a lot before I spend money on things I want or even need. For example, my accommodation arrangement is going to change next year. Although I’ve set up a separate savings plan for it, it’s still a big expense and that makes me a bit uncomfortable. I’m not really sure if I will stop being anxious about money. My biggest fear is becoming a burden to the people that care about me.

But I think earning between ₦800k and ₦1m can improve my financial happiness and take the number to an 8. It’s very rare for people in my experience level to earn up to that, but it’s possible. I probably won’t leave my current employers if I get an offer like that. I’m careful about my career choices and I really like my job. But I can use an offer like that to negotiate a higher pay.

Great! You got to the end of this article. Know what’s even better? You can get QuickCredit faster than the time it took you to read this article. With Quickcredit, GTBank customers can get N2million in less than 2 minutes and pay back over 12 months at an interest rate of 1.5%. No forms. No collateral. No hidden charges. Get Your Quick Credit on GTWorld