Every week, we ask anonymous people to give us a window into their relationship with the Naira.

In this story, the woman talks about her choices, like not getting a job and choosing to raise her kid.

Age: 25

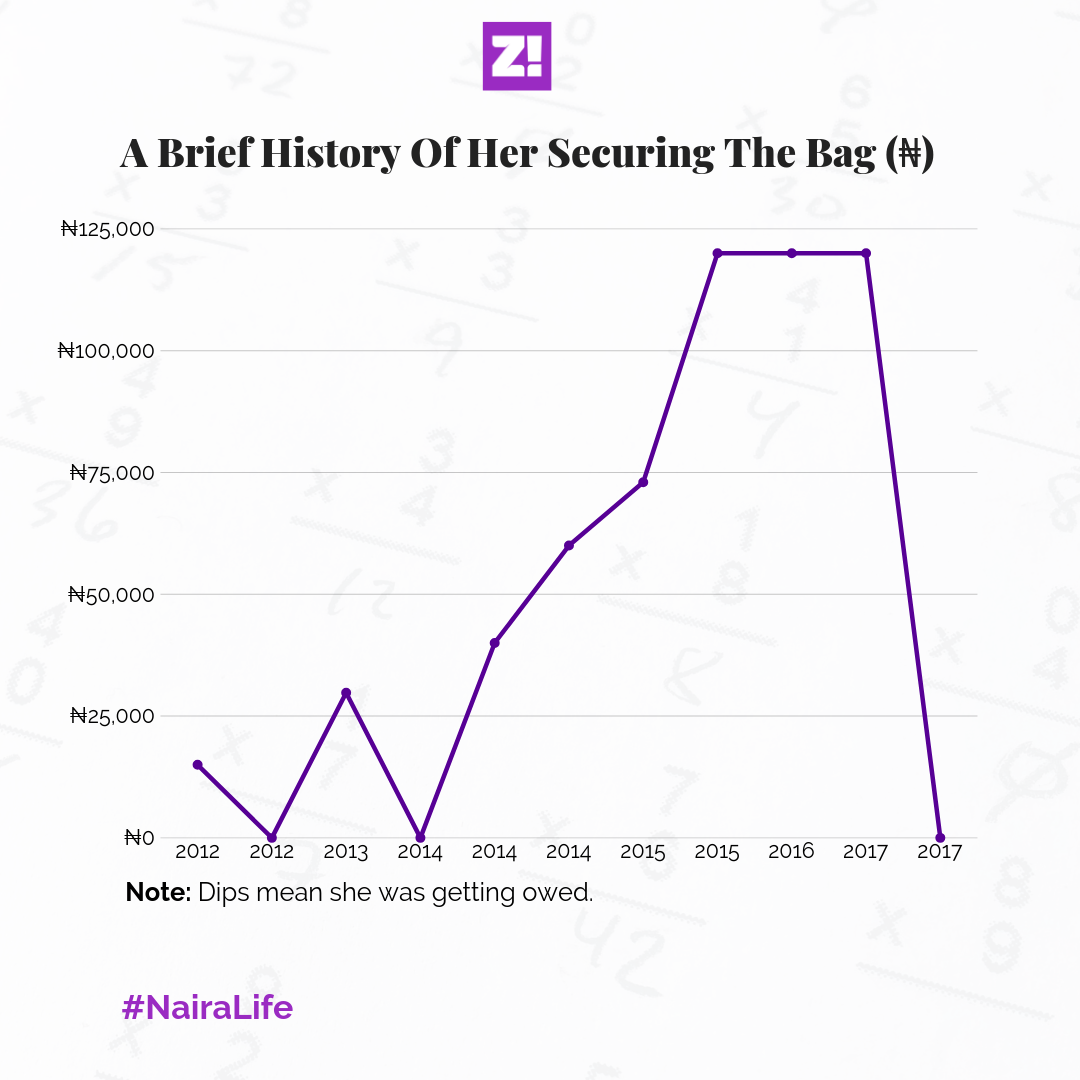

Tell me about the first time you made money

The first time I probably made money for myself was after school. It was a small newspaper and they only paid my first month. It was something I was doing to pass time while I waited for NYSC.

Bear in mind that this was a 15k job, and they still owe me 2 months till this day.

By February 2013–

–NYSC?

Yes. NYSC. Back to that job thing–my parents didn’t want us to work at all, so we won’t get “distracted from school work”.

Back to that NYSC part. I got posted to Bayelsa, and I remember crying so much. But you see, my NYSC was the most interesting of all NYSCs. I got posted to a riverine community in Bayelsa that can only be reached by boat.

We got free pots, kerosene, accommodation, mattresses, mosquito nets, and if you’re a super cool teacher, your students will bring you fish and periwinkles. There was also a community generator that meant power was out for only 6 hours every 3 days. We had a Common Room, so all we did was watch Game of Thrones and stuff.

Basically, all I had to bring was rice and myself. Jonathan was President at the time, so whenever the First Lady came to town, they still shared money. Corpers would get like 5k.

I was earning like 29,800 in allowances from NYSC, the state government, and even from the school where I was teaching. So 19,800 from NYSC, and 10k from all the other village hustle.

I barely spent any money. In fact, I only spent money on Suya and meat for when I was tired of fish. So by the time NYSC finished, I’d saved up 450k in the bank and another 20k in cash.

The first thing I did was buy a laptop–it still works. Then I bought a phone. Then I told my parents, “come, lemme pay part of the next rent.”

I was going on 21, and I’d never seen that type of money in my life, so I was just spending fala-folo.

So, post-NYSC?

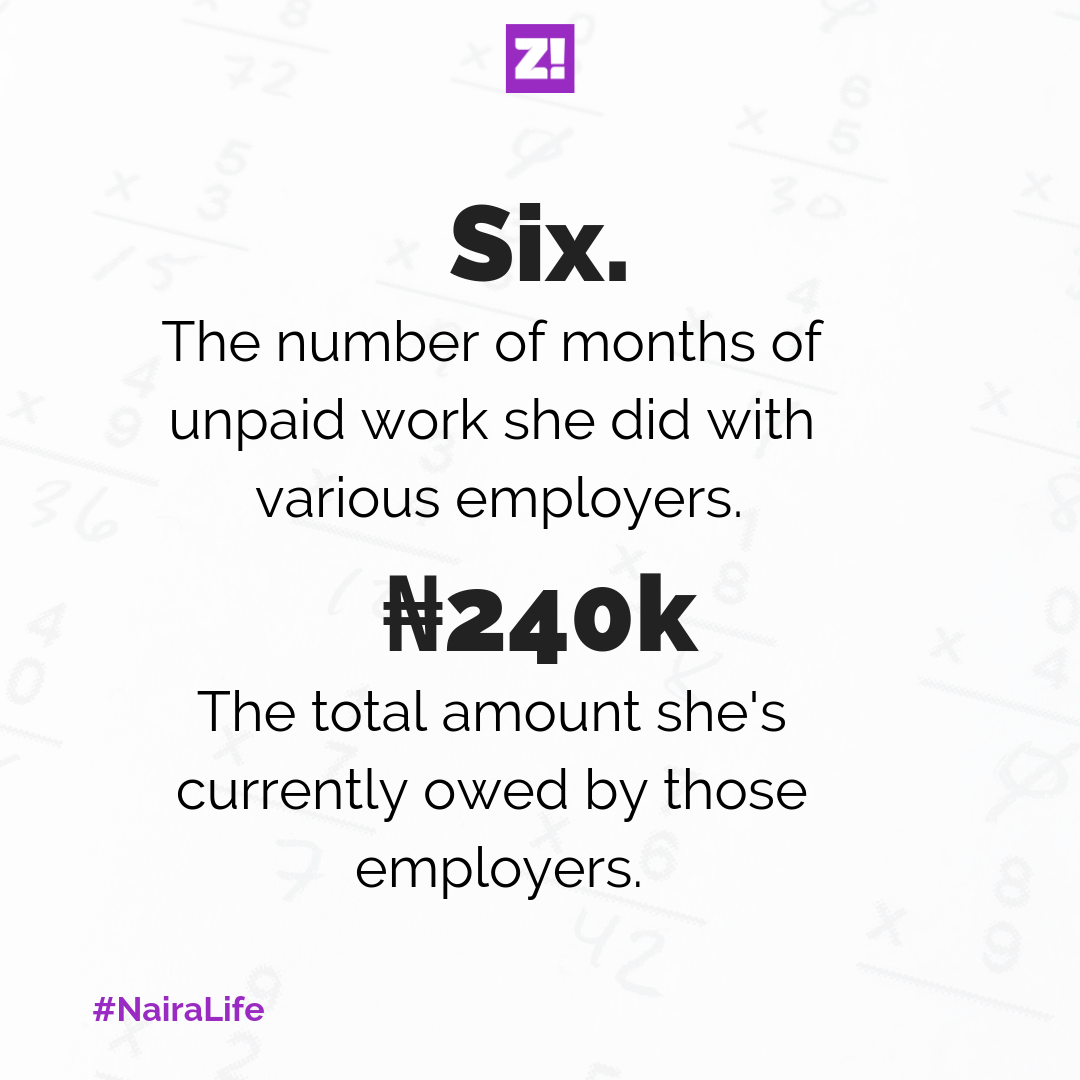

Aaahhh, that’s when my struggle started. I worked at a newspaper. They started with me at 40k, then it increased to 60k by the 3rd month because I started writing tech and religion. Buttttt, I never really got that 60k–they started owing again.

I was passionate about working for a newspaper, but I needed money. They still owe me 4 months salary by the way. I then hopped to another paper that was just getting off the ground, but never really took off.

Then in September 2014, I got a ₦60k gig. That’s where I was till March 2015 when I got another gig.

See this latest one? My parents were so proud because it was the first time I had a job with a welfare package–HMO and a pension plan. It was huge.

At first, my dad was like, let’s see how this goes. The first month, they paid. And the second. And the third. And so on. I got started at ₦70k net. 6 months later, I got a raise to ₦120k, because of my performance.

I had some dissatisfaction with the company at the time, especially with regards to some aspects of my personal growth, but I needed that consistent money.

Ah, that struggle.

Ah, let me tell you about this 2016 job interview experience–a TV station. I knew I wasn’t going to take that job for two reasons. First, they delayed me for two hours. Then the interviewer was using me to watch comedy on Youtube, while I was sitting there. When he starts asking questions, he goes “are you a moderate Muslim or an extremist Muslim?”

Like, seriously?

I told my dad when I got home, and the vibe I got from him was like, “why you dey vex, small play.”

My job at the time paid ₦120k net and the TV station was offering ₦150k. I didn’t take it, because it didn’t seem like they cared about my welfare.

My own workplace, on the other hand, I remember asking for a raise and someone in management saying, “oh the company doesn’t really have money. You know you don’t have that many needs. You still live with your parents blah blah.”

She was actually right in that I wasn’t spending money on anything but transport. Pretty much all my needs were met. So I just stuck with that plot.

Still, I was a dunce sha.

January 2017, I left. I’d saved like ₦600k at the time.

What came next?

With my savings, I was like “Oh, now’s the time to be an Entrepreneur. The spirit is calling me!”

Huhuhuhu.

I started selling stuff online, and that is when my wahala started. Ah, Nigerians are wicked. There are people still owing me till this day, and I suck at disturbing debtors.

I think I was a horrible businesswoman. I trusted people too easily and they just kept owing and telling stories. The stress was so much, I was struggling to sleep. My mum even said I was sleep talking about money.

I shut down that business.

Meanwhile, I met my husband while I’d started my hustle. And somehow, I told myself I wasn’t sure I wanted to live with hypertension over money, or work and not get paid. So I made up my mind that I was going to marry someone who’d earn for me and the kids.

So in November 2017, it was bye-bye entrepreneurship.

What was the weirdest reaction to you not wanting to take a job again?

Ah, my dad wasn’t having any of it. “Oh, after all the money I’ve spent,” he’d say, “how are you going to marry without having Dr. in front of your name?”

Then he’d send me articles of women pilots and high flyers, to ginger me, but to me, those were different. Those were foreign women in better societies.

I had a friend who used to work in the U.K. She was having the time of her life, and not only was her pay good, but she also got a lot of respect.

Not only am I likely to get underpaid or owed here, but you also go to work and still get snide comments like “you can’t hear me properly because your hijab is blocking your ears” and all that ridiculous stuff.

I used to be like “Ohh, you can be a superwoman.” But my stress levels are currently at “I can’t kill myself.” Since I left Lagos, moved to Abuja in 2018 and I had our baby, I haven’t entered a market since–that’s my husband’s job now.

I really don’t understand how women are expected to go to work and still come back to take care of a child. I’ve picked my own struggle, and it’s raising my child. Half the time, I’m already exhausted sef.

I respect people who are doing all of it, but it can’t be me.

Hypothetically, will you work if the conditions were better?

To be honest, my husband has good money. So unless he can no longer take care of all the responsibilities, I’m not working. Maybe my answer will be different when I’m faced with an actual scenario.

Let’s create a perfect scenario; what will make you become an entrepreneur again?

See ehn, I don’t even know if I want the money. The stress is just too much. I get frustrated easily, my BP rises over the littlest things, my asthma escalates. It’s not for me. I was suicidal when I was running a business, so I don’t understand why people glorify entrepreneurship. I think about those times and cry.

So, no income?

Well, I get allowances. There’s the ₦100k every month, and another specific ₦100k in savings every other month. That savings money is supposed to be an emergency fund. Just in case.

How much do you have saved up?

I have about 1.2 million saved up. Also, that money could go into my baby brother’s foreign degree. I tend to dip into the savings to help people and stuff. Can’t help it.

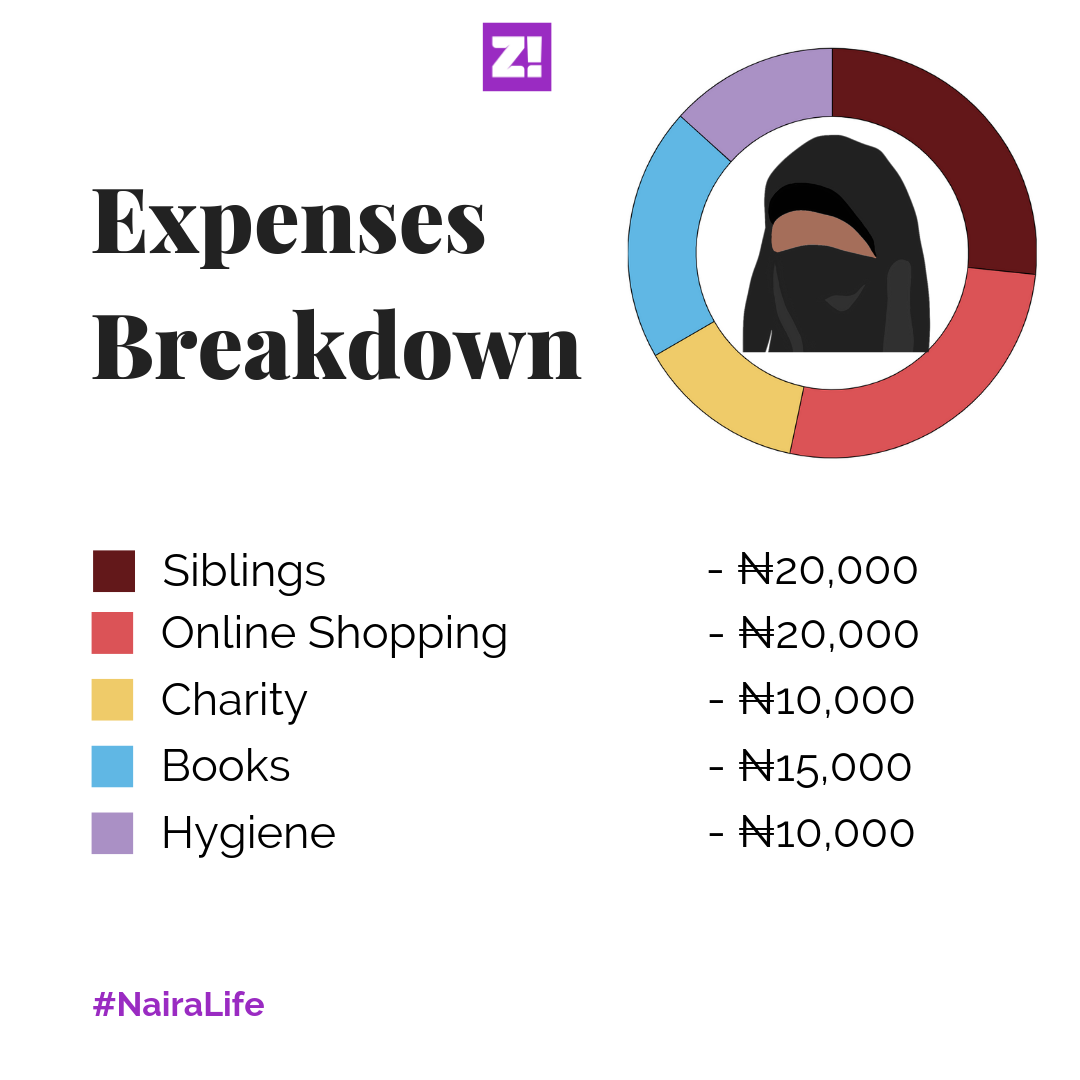

To be honest, I actually don’t need a lot of money. The 100k I get for allowance is to get a thing or two for myself or my baby.

Between 2012 and now, what has changed about your perspective about money?

‘Savings’ is hype. Nigerians talk about “oh save this and that.” You save for something and by the end of the savings cycle, you can’t afford the things you saved for. There’s inflation and all those things to worry about.

I think Nigerians like to save, but we don’t know how it works. It irks me a lot. We can’t save our way out of poverty, Now I’m more interested in using my money for experiences and intellectual capital.

Investing, on the other hand, I wanted to do that in my friends’ businesses, but they tend to reject it. I think many Nigerians treat investments like debt, and so they refuse it.

What’s chopping your money these days?

I’m addicted to weird things; like stickers, and pretty journals from AliExpress. Sometimes, it’s Alloy Cars. Or iPhone cases. Or water bottles. Ali Express and Amazon are my number one problem.

Argh, I need a support group.

Everyone thinks it’s an expensive habit, but these things are really cheap.. An iPhone case will go for as low as 0.98 cents.

There are also books–I have 364 of those. I know this because I counted yesterday.

A book I used to have but wish I still did? The Curious Incident Of The Dog In The Nighttime. It’s about this boy who was forming investigative journalist over who killed his neighbour’s dog.

Uhm, what else? I try to use as little single-use plastic as possible, so I buy reusable stuff. Also, being a hermit means I have few expenses and few friends.

Let’s talk about future plans.

My mum asked me this question and I’ll tell you what I told her;

“I don’t have one.”

I’d say travel and all that, but it’s hard to make travel plans when you have kids. So I really just want to read more books and learn new languages.

At my language peak, I could speak English, Spanish, Arabic, Bahasa, Hausa, a little French, and Yoruba.

I used to learn foreign languages on Livemocha–miss that thing so much. It was actual human interaction, instead of talking to some software.

Still on this future p, what about your old pension account?

I have about 700-and-something thousand naira sitting there. But if I’m going to cash out, I’m just going to calculate my actual money and leave their interest with them. Riba struggles.

Tell me something you want but can’t afford?

Huhuhuhu. A Tesla–self-driving. But I don’t even go anywhere. You know, the only time I prayed for a car was just so I could just race around with my friends. And I had a bike phase too where I just wanted to stunt on them. But I have a child now, huhuhu.

Let’s imagine being a stay-at-home was an actual job, how much will you charge?

250k. The money I’m collecting now is an “I love my husband” discount.

What do you do when you have free time?

I listen to a lot of podcasts. My favourite is Reply All. It’s made me superconscious. I don’t use Facebook or Whatsapp. I uninstall apps I’m not using. Can’t let anyone be playing with my data or security.

There’s this website you can go to check if your online accounts have compromised. I think Nigerians generally suck at Internet security.

There are other podcasts like This American Life, Serial, 99% Invisible. I like The Mad Mamluks, but they ramble a lot.

Do you have a healthcare plan?

Huhuhuhu. Am I too reliant on my husband? Medical bills are sorted. Look, I’m enjoying here.

On a scale of 1-10, what’s happiness looking like for you?

Seven. The remaining three is because I worry about illnesses where the money you earn is never going to be enough to sort it out. Also, I wish Abuja had more women-only places to just chill. That’s it.

Tell me something. Anything.

That breadwinner story, it terrifies me. I’ve never had people depend solely on me. I feel like if I ever become a breadwinner with all that burden, I’m just going to get depressed.

Also, when we started talking I was a little scared. Now, just thinking about it, I feel more confident about how I want to use money generally.

I feel a greater need to even begin to equip myself.

Update: Some parts of this story have been edited to further protect the identity of the subject. None of it removes from the core Naira Life story here.

Check back every Monday at 9 am (WAT) for a peek into the Naira Life of everyday people.

But, if you want to get the next story before everyone else, with extra sauce and ‘deleted scenes’ just subscribe here. It only takes a minute.