Lagos is on the list of the most expensive cities to live in Nigeria. However, by many accounts, the quality of life in the city is not the best. I spoke to a few Nigerian living in Lagos about how they get by and the financial cost of living in the city.

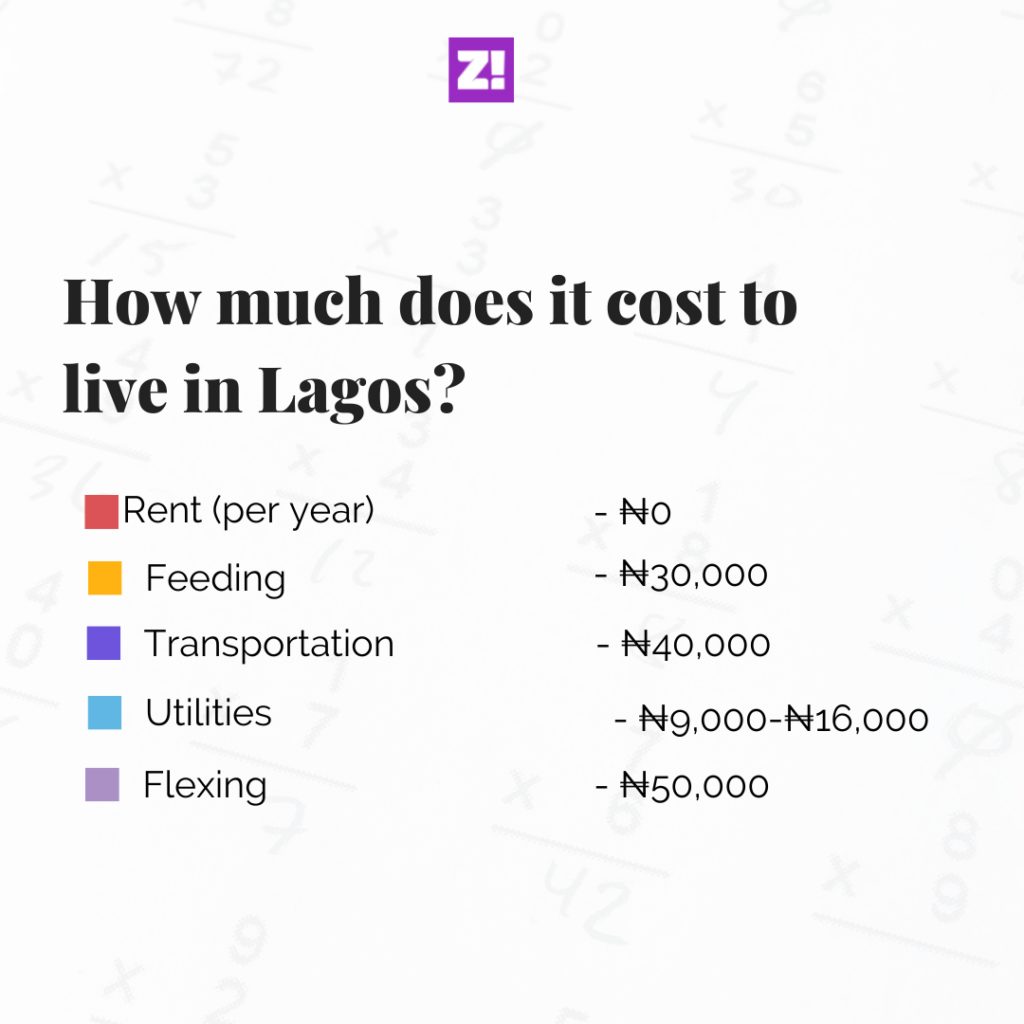

1. Amanda, 26

“Living in Lagos is ridiculously expensive and the quality of life is poor. I’m aware of my privilege and I think my cost of living would be exponentially more expensive if I wasn’t living with my parents. We’re not spending too much or saving too much, we just don’t have money. The jobs don’t pay enough. However, the chaos in the city keeps me grounded, so I’ll take what I can. “

Occupation: Management consultant.

Monthly income: My salary is ₦100k a month. I get an additional ₦90k from my parents. Also, I get dividends from stocks. While they don’t come in every month, they run into ₦1m every year.

Feeding: ₦30k. I live with my parents and my feeding budget would have been nothing if I don’t eat out. I go to the office three times a week and I spend about ₦1k on lunch. Also, I spend ₦5k on Tacos every other Tuesday.

Accommodation: I don’t pay rent. My parents live in a 3-bedroom apartment on the Island. I think a 3-bedroom apartment in the area costs about ₦2.2m.

Transportation: ₦40k. I have a car and my dad gives me ₦10k every week for fuel. I don’t go out unless it’s a work thing so that does it for me. However, there are times I spend an additional ₦2k-₦4k on fuel.

Utilities: I don’t pay the power bill. Occasionally, I offer to buy diesel for the generator and this is between ₦9k and ₦16k. However, this is far and in-between and I don’t consider it a major expense.

Flex: I don’t have a flex budget. Anything I don’t save goes into this. But I’ll put the figure at ₦50k. The money mostly goes into buying my skincare products and investing in my wardrobe.

Savings: I save ₦40k from my salary and ₦40k from what I get from my parents. I still think I’m living above my means though.

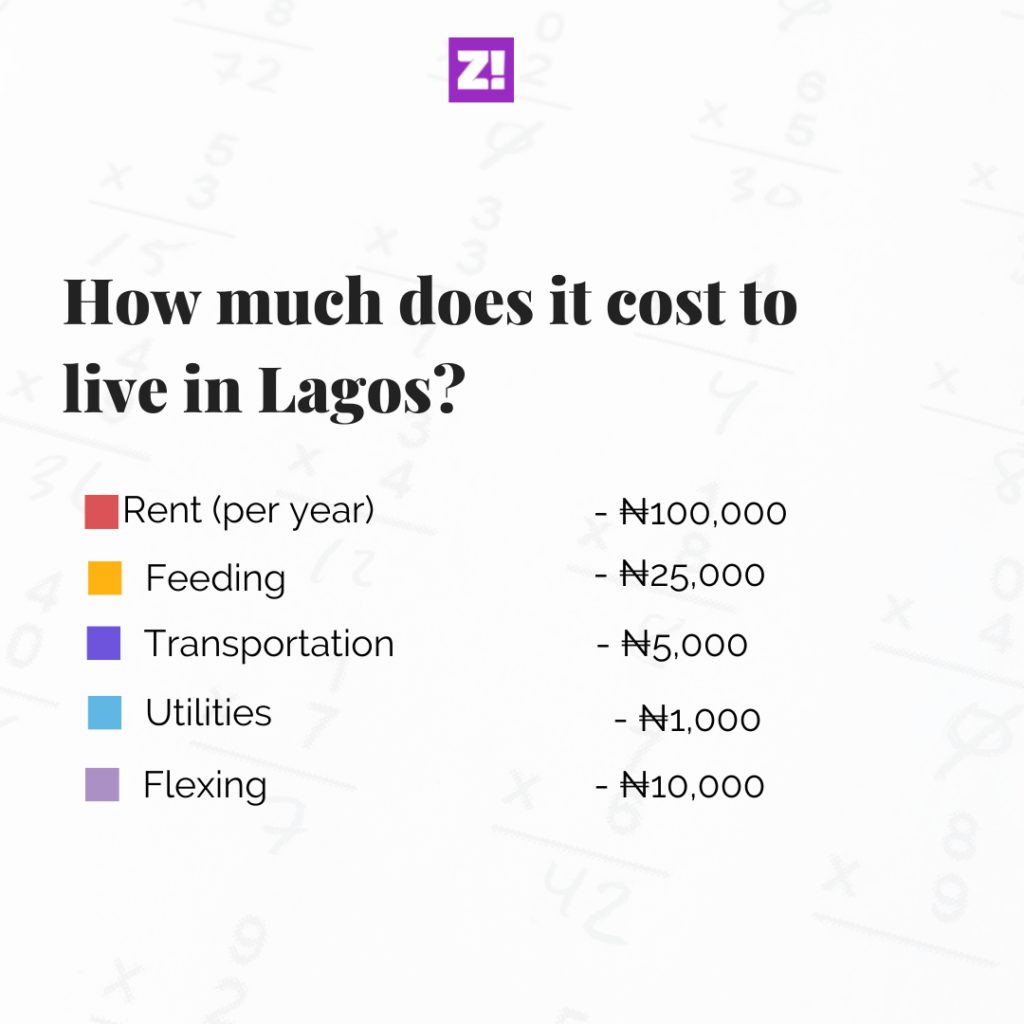

2. Ronke, 27

“Lagos is all hype.It’s like everyone is surviving but not thriving. I’m praying for a breakthrough that will up my lifestyle and an opportunity to change location. “

Occupation: Teacher

Monthly income: ₦70k

Feeding: ₦25k. I cook all the food I eat and take lunch to work. I don’t eat out at all and I don’t spend a lot of money on groceries because I don’t eat a lot.

Accommodation: ₦100k for a room self-contained apartment in Berger. The average cost of self-contained apartments where I live is between ₦150k and ₦200k.

Transportation: ₦5k. I live very close to work and I rarely go out.

Utilities: My neighbours and I split the power bill with my neighbours, and my share is ₦1k. I don’t spend money on laundry — I wash my clothes myself.

Flex: I set aside ₦10k every month to buy something nice for myself. The bills are rarely on me when I hang out with my male friends because they take care of it.

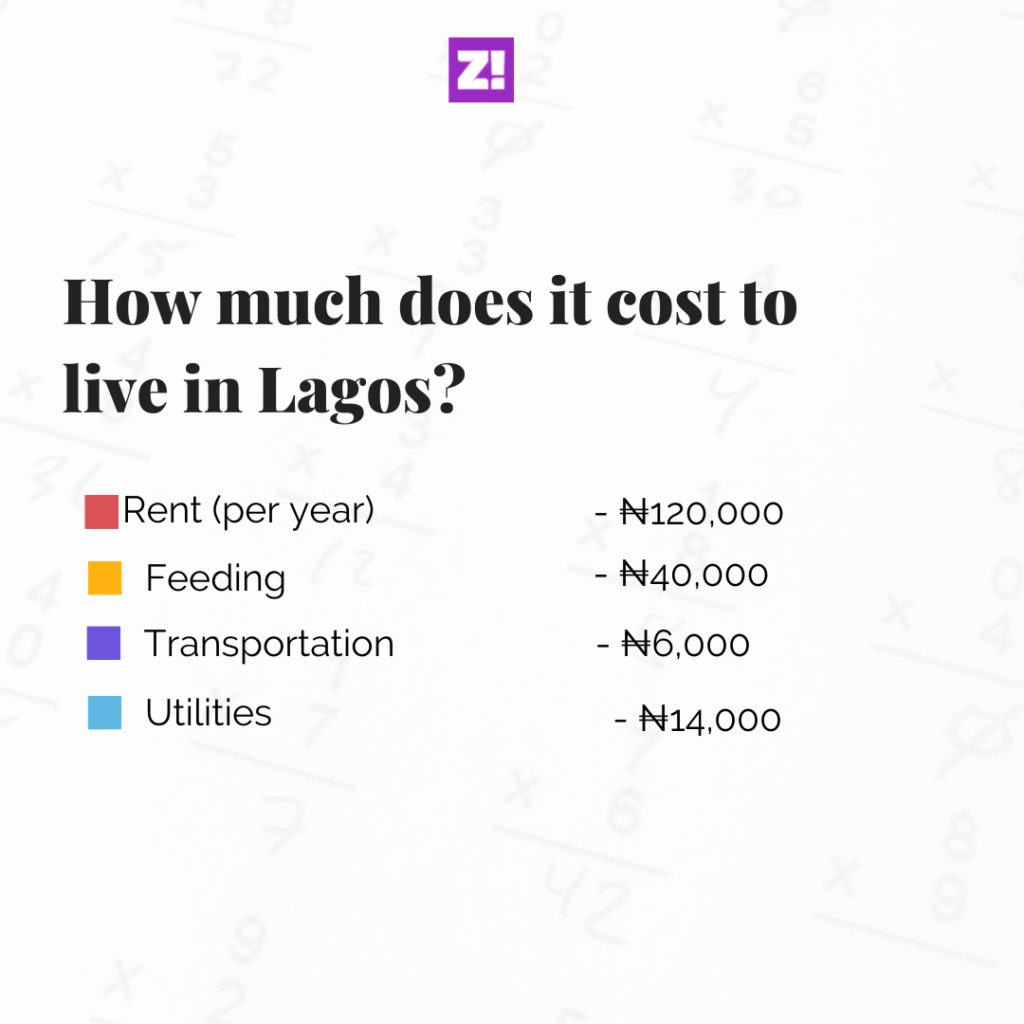

3. Keji, 26

“I’m not exactly happy living in Lagos. This place is not good for my health and personality. I’m here because I don’t have another choice. The crime rate has also increased, which means I’m not safe. Going out requires a lot of planning to evade traffic and crime hotspots.”

Occupation: Graphics Designer and Content Writer

Monthly Income: My 9-5 pays me ₦132k. Side gigs bring in between 0-₦100k

Feeding: ₦40k. My younger siblings live with me and we cook a lot. However, I’m looking at ways to cut the feeding budget because there’s an increase in the price of food every time I visit the market.

Accommodation: ₦120k for a studio apartment in Alimosho LGA. I don’t consider rent a monthly expense because my 13th-month salary can take care of it. My landlord has been moving mad lately and has stopped maintaining the property. I may have to move out soon.

The average cost of studio apartments in the area is between ₦150k – ₦300k depending on the quality of the apartment.

Transportation: ₦6k. I go to work once in a week, so I don’t spend a lot on transport. I rarely go anywhere else. For the occasional outings, I rely on Bolt and Uber rides.

Utilities: ₦14k. Power is relatively stable where I live so I don’t use my generator often. I think the power bill is reasonable.

Flex: I don’t have a budget for this. If I feel like going out, I consider the impact it will have on my finances for the week or month before I make a decision.

Savings:

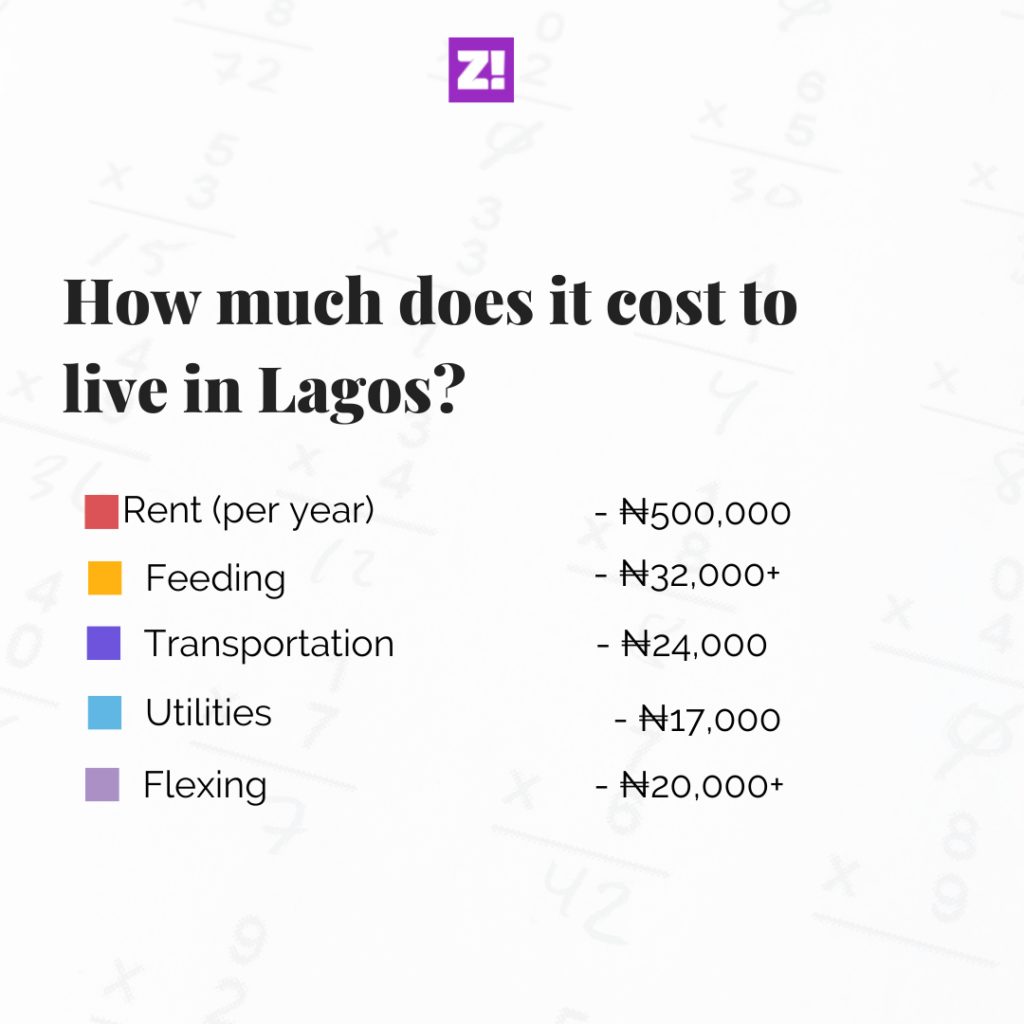

4. Dammy, 23

“There’s no such thing as too much money in Lagos. Just cut your coat according to your size.”

Occupation: Designer

Monthly income: ₦300k+

Feeding: >₦32k. On average, I spend ₦6k on groceries and other foodstuffs every week. On days I order food, I spend about ₦3500 per meal.

Accommodation: ₦500k. I have only had my place for less than a year. It’s a 2-bedroom apartment I share with a flatmate.

Transportation: ₦24k. I don’t have a car, so I use Bolt and Uber to move around. I spend an average of ₦6k per week on transport.

Utilities: ₦17k. Light and cleaning expenses are about ₦N12k monthly. I spend about ₦5k on laundry every month.

Flex: I don’t particularly have a budget for this. I put aside ₦10k every month for books though. I don’t have a budget when I go out but I can spend up to ₦10k or more on one occasion.

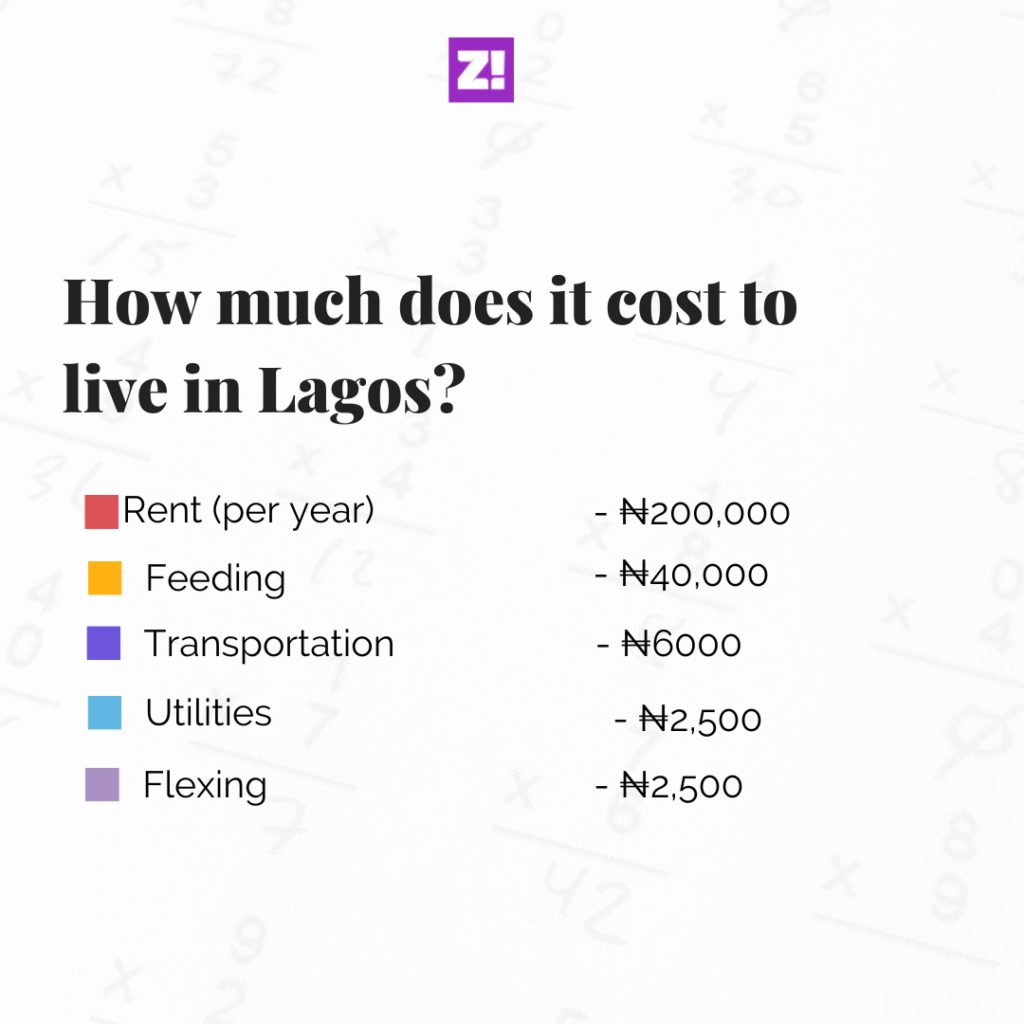

5. Olufunmi, 25

Occupation: Software Tester

Monthly income: ₦130k

“Living in Lagos is about survival. My quality of life is 4/10.”

Accommodation: ₦200k. I live in a very tiny self-contained room in Yaba. The bathroom is ensuite but the kitchen is not, and I share it with three other neighbours. Now my landlady wants to increase the rent to ₦250k. I’ve managed to convince her not to increase the rent this year but now, I have to fix the roof of my apartment myself. That will cost ₦25k

Feeding: ₦40k. I buy food in bulk at the beginning of the month. My basic foodstuff runs into ₦25k. The other groceries cost ₦15k. However, the price of food has increased. A litre of vegetable oil has jumped from ₦700 to ₦1700. A crate of eggs is now ₦1500 from ₦850.

Transportation: >₦6k. I only go out for work and church. I spend an average of ₦300 on my daily commute. My church is in Ikeja and I spend about ₦1k on a round trip when I take public transport. On days when I want to flex, I order a bolt ride — a trip is about ₦1300.

Utilities: ₦2500. My power bill is ₦2k and waste management is ₦500.

Flexing: The only thing I flex on is my GoTV subscription and it costs ₦2500. I don’t go out.

Savings: I try to save ₦60k a month to make rent. When that’s settled, I use what I have left to change my daughter’s wardrobe and splurge on things we’ve both wanted for some time.

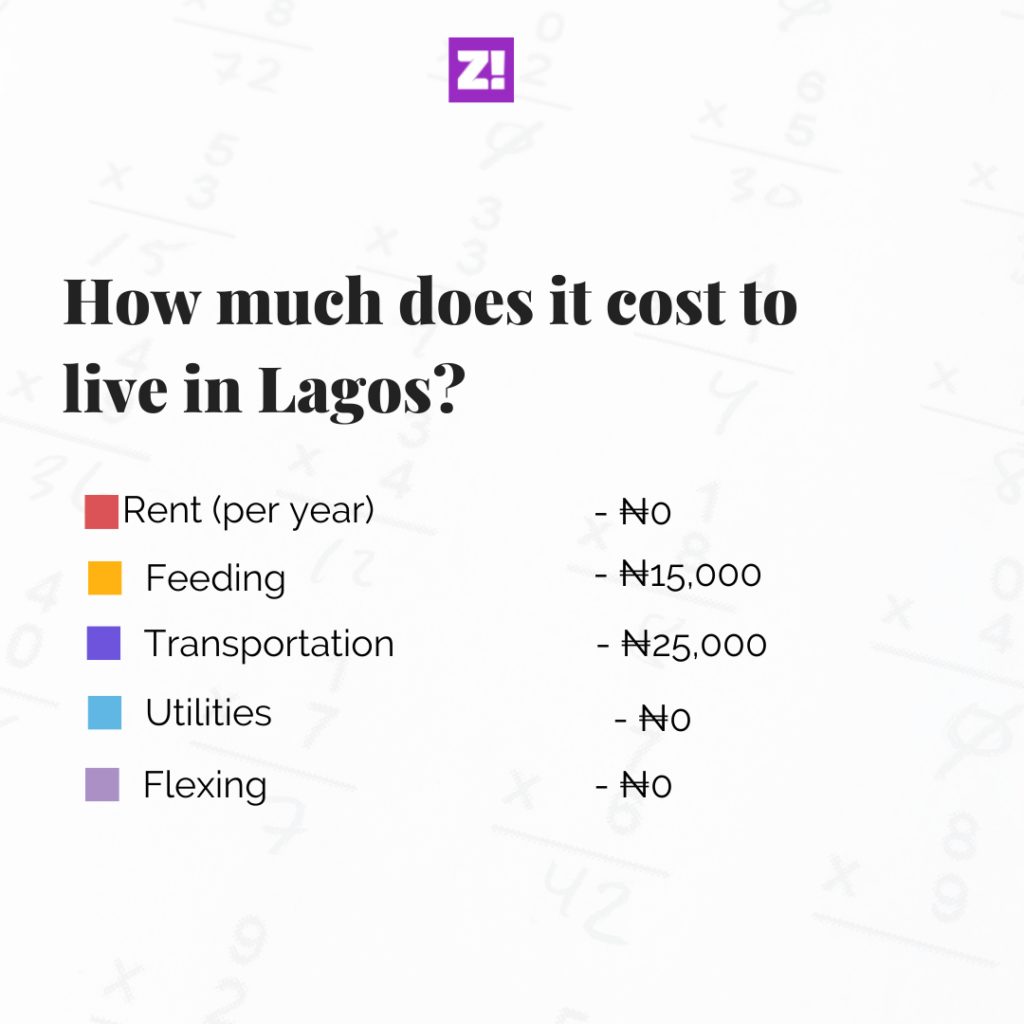

6. Oluwadamilola, 21

“Living in Lagos is not easy. It’s the survival of the richest. I constantly have to remind myself that I’m just 21. While the quality of my life is good, I think it can be better.”

Occupation: Call centre representative (NYSC)

Monthly income: ₦58k. 9-5: ₦25k. Allawee: 3₦3k

Feeding: ₦15k. I live with my parents and they take care of that. But on days I don’t eat at home, I buy food and this costs between ₦500 and ₦1000 per meal. My favourite places to go to are the mama-put restaurants and chicken republic.

Accommodation: Haha, I live with my folk in a 4-bedroom apartment at Ogba. The average cost of rent for similar apartments in my estates ranges from ₦1.3m to ₦1.5.

If I was living alone, I imagine I’d be somewhere at Yaba and paying ₦300k for a studio apartment.

Transportation: ₦25k. I rely on the public buses on most days and spend between ₦700 and ₦800 daily.

Utilities: I don’t worry about those thanks to my parents.

Flex: I don’t have a budget anymore. I haven’t gone out in about three months because I can’t afford it.

Savings: I have a friend abroad who sends me ₦20k every month. That goes straight to my savings.