Nigerian women may have had a long history of suffering, but they’ve also had a longer history of resilience. There are many stories of the heroic struggles of women against colonialism.

Today’s story, however, takes us back to the late 1940s, when a women-led resistance movement fought against the British colonial system of multiple taxation on women and led to the dethronement of a king.

This is the story of the Egba Women’s Tax Revolt.

Egba women were indelible forces of anti-colonial resistance [UNESCO/The Republic]

In Colonial Nigeria, government revenue (in the Southern Provinces) came from two sources—import duties (a tax collected on imports and some exports by a country’s customs authorities) and railway freights.

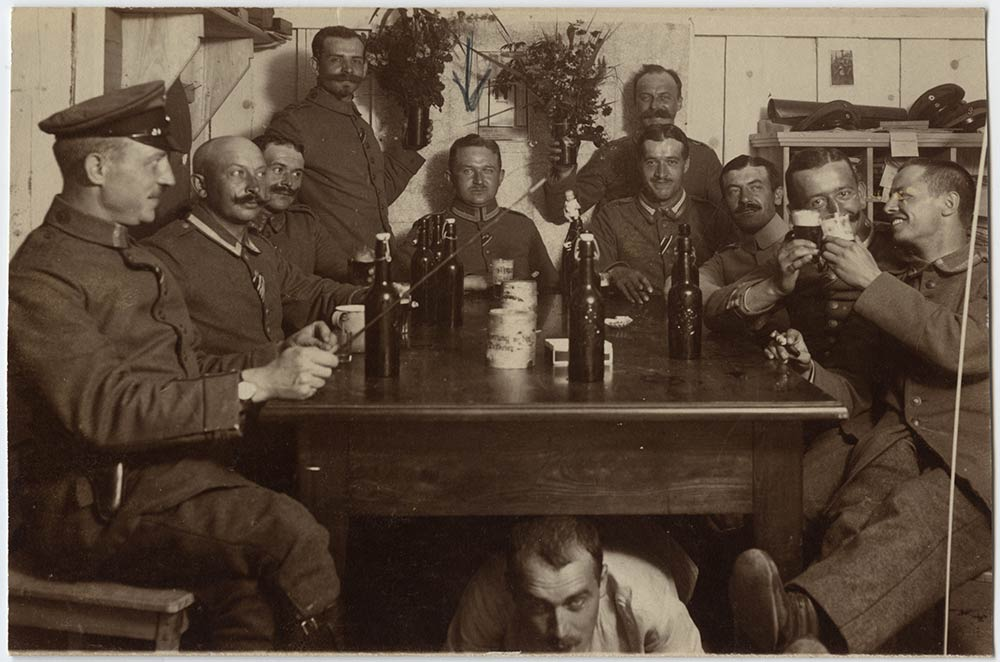

Under import duties, the real “moneymaker” for the British was trading German liquor and spirits, and Germany was the epicentre of World War I (1914-1918). Before 1901, liquor duties were three shillings, but by 1901, it increased to as much as six shillings! This resulted in liquor being a scarce commodity during the war.

The high liquor import duties and shipping difficulties caused revenue from that sector to drop drastically. Which ultimately affected the government’s pockets.

Undated photograph of German soldiers posing for a picture while drinking beer [Beer and World War 1]

This is where the Abeokuta people come in. Before amalgamation in 1914, they were known as successful producers and traders of palm kernel, palm oil, and cocoa. The British tried to put export duties on cocoa and palm kernels, but they couldn’t generate as much as liquor import duties once did.

At this point, Lord Lugard was extremely desperate to get the nation’s finances in order. He had to plead with the British colonial office formally to impose direct taxation on the Yorubas, but the British government took its time to give any kind of approval.

Even though there was no word from the British, the native rulers felt pressure from the colonial government to generate revenue no matter what. This led to indirect taxation known as the ‘sanitation fines’ in April 1917.

The “Sanitation Fines” and How This Affected Egba Women

As the name implies, sanitation fines were monetary penalties one had to pay for not keeping their environment neat and tidy. To make up for the government’s lack of revenue, they needed to catch offenders, summon them to court, and make them pay fines—and market women or rural women were always the easy targets.

These women had to pay fines of up to five shillings, with an additional eight shillings for court summons, making it thirteen shillings. Sometimes the courts could even decide to inflate prices by close to thirty shillings.

The “offences committed” were usually very mundane, like not sweeping the front of their compounds or setting up water pots outside the house with no covers (which could cause mosquito breeding).

The sanitation fines turned out to be a successful revenue scheme for the British. In the Native Courts alone, they made up to £1.6 million from 1.9 million sanitary case offences. It encouraged British colonial officials to further impose stricter taxes on women.

The “Independent Woman” Mode of Taxation

After much deliberation, the British Colonial Office introduced the official method of taxation for Abeokuta on January 1, 1918. This was with the approval of the Secretary of the Native Authority, Adegboyega Edun. But right from the start, there was something not quite right with this new tax.

Adegboyega Edun [Nairaland]

The model was for every adult to pay an average of 5 shillings per head. Based on the number of adults in a household, the head of the compound was given an amount that the family must pay. This happened to exclude women, as they had to pay a totally different amount of tax altogether.

This was entirely different from the model of taxation in other parts of the country, which didn’t recognise women as different from men. In that model, “tax for every household will be £1, including the wife, and £10 per annum for additional wives.”

Despite several complaints, the British Resident bluntly refused to change the system. Women were more prevalent than men in the population, which made the taxation spread wider, and he knew that if he increased the men’s taxes, they may cause ‘wahala’ and riots.

Ironically, despite his efforts to reduce mayhem, the people were not at all pleased with the taxation system. The income of the people was not considered. They still had to pay customs dues and shop licences, and forced labour was still in practice. This led to the Adubi War of 1918.

How the Adubi War Solved Tax Problems for Men But Not Women

On June 13, 1918, 30,000 Abeokuta residents protested their displeasure by destroying railway and telegraph lines south of Abeokuta. Neighbouring Yorubas from the French colony of Dahomey also joined the fight, as they also protested against forced army recruitment for World War I.

Three thousand British soldiers were used to suppress the revolt, after which 1,000 Egba civilians and 100 soldiers were killed.

Despite the bloodshed, the tax scheme was modified. Men who earned less than £40 per year were now required to pay five shillings a year, with women paying two shillings and six pence. Those above £40 paid 1% of their income in taxes, while landlords were taxed 5% of their rental income.

However, this modification did not favour women. Women expected the government to make the market favourable for them as traders so that they could also profit, but there were no gains whatsoever.

Market women were charged as much as £3 for sheds. Those who couldn’t afford it and made use of ‘illegal’ spaces had to pay fines. The industries they could profit from were also limited, as they included only trading foodstuffs, imported goods, and local textiles. And these problems continued until World War II (1939–1945).

Egba women are unhappy over the multiple taxes [Getty Images]

In the words of the women’s representative to the Oba, Madam Jojolola, “The women all complained that they derive no benefit from the government. We make no profit on the goods we sell, and yet we have been called upon to pay taxes…”

The Rise of Women Through the Abeokuta Women’s Union (AWU)

The AWU – a combination of market women and the Christian Abeokuta Ladies Club (ALC) – emerged in 1945. Although initially a social club for middle-class women, it morphed to respond to the unending taxes on women and ultimately the brutality of colonial rule. They felt they could do this by uniting both working class market women and middle class women as one.

Funmilayo Ransome-Kuti was its first president, and the Alake (King) of Egba land in Abeokuta, Ademola, was its first patron. Grace Eniola Soyinka also joined Funmilayo’s leadership.

Portrait of 70 year-old Funmilayo Ransome-Kuti[Obioma Ofoego/UNESCO]

The Soyinka Family in 1938. Wole Soyinka’s mother and father, Grace Eniola Soyinka and Samuel Ayodele Soyinka, with Wole, Tinu, and Femi. [Wole Soyinka]

To end the taxation regime, they wrote proposals to the Alake of Egba for the following:

- Replacement of the flat rate tax on women with taxation on foreign companies;

- Investment in local initiatives and infrastructure, including transportation, sanitation and education;

- The abolition of the Sole Native Authority and its replacement with a representative form of government that would include women.

Alongside these proposals, they heavily fought the colonial government with different kinds of resistance tactics. Many women stopped paying their taxes altogether, and they either got fined or jailed. The AWU also wrote several petitions to the Alake between August 1946 and May 1947, but to no avail.

This eventually provoked the Egba Women’s Protests or Revolt.

The Egba Women’s Revolt

Egba women were indelible forces of anti-colonial resistance [UNESCO/The Republic]

From Mid-October 1946, Ransome-Kuti and women from the AWU started to hold mass protests outside the king’s palace to demand the removal of direct taxation. The response was brutal, with police deploying tear gas and beating up the women.

But despite the obstacles, these women didn’t relent. They released a document in 1947 called “AWU’s Grievances”, which contained all their accusations against Alake and the Secretary of Native Authority. Ten thousand women then held another demonstration outside Alake’s palace, which lasted two days, while insulting Alake with different songs.

Alake’s response was an empty promise on tax suspension. More women got arrested and assaulted, including Funmilayo.

On December 8, 1947, over ten thousand women camped outside Alake’s palace and refused to leave until every woman arrested was released. They stood resiliently and remained until December 10, when they released the women.

Thousands of women come to show support for Funmilayo Ransome Kuti and the detained women. [Ransome-Kuti Family Archives]

However, the women didn’t get their demands met until three years later, in January 1949.

The British removed the Alake from the throne, the tax was removed, and four women were established in seats of power.

It is worthy to note that both the tax and the Alake later returned, but for a while, the women won.

The Impact

It is sad to see that market women are still being taxed without inclusive consideration in 2023.

A Nigerian marketplace. [Google]

In an article by TechCabal, market women are revealed to make little profit on their income as a result of various taxes for the local government, Lagos State agency officials, Kick Against Indiscipline officers (KAI), etc.

In July, the Nigerian Federal Inland Revenue Service (FIRS) announced the Value Added Tax (VAT) Direct Initiative, a way for the federal government to collect Value Added Taxes (VAT) from market women and reduce multiple taxation.

Will the VAT be effective? Will it lead to another women’s revolt? We’ll see what becomes of this.