Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

Making ₦200 – ₦300 from braiding hair when I was 15. I was in secondary school, and I taught myself how to make hair by plaiting the grass stalks in my boarding school’s compound. I also practised on a senior student’s hair. Then I started making simple braid hairstyles for people in my area whenever I was home from school.

I also tried my hand at making braided wigs and sold a few to neighbours at ₦1k – ₦1,500. I remember feeling so excited that I was making my own money. It’s funny because it’s not like I didn’t have parents to give me money, I just wanted to make mine.

Why do you think that was? This desire to make your own money?

I’m the first child of a large polygamous home. My dad had a cocoa farm that wasn’t doing great, and we had several members of our extended family living with us at different points. So even though my dad did his best, many people depended on him for money.

I grew up knowing I couldn’t always wait for my dad. I had to work for whatever money I wanted.

Where was your mum in all of this?

I was the only child on my mum’s side, and she mostly depended on my dad too. He once gave my mum money to start a provisions business, but she was forced to close it after a few months. My dad would take money from the business to help these same family members, and my mum also had to feed them with the business proceeds. At one point, my mum opened another shop in a different location without my dad’s financial input so she could have a say in how the finances were managed.

Back to hairdressing. Did it help you become somewhat independent?

The jobs weren’t consistent, so I just did it to get the usual ₦1k every other week. I took a break in 2015 when I got admitted into a polytechnic.

I didn’t make hair or do anything for money because I was focused on leaving the school.

Why?

I decided I didn’t like the school from the first day I stepped foot there. You won’t believe they welcomed me to school with a cult fight.

I spent all my time there writing JAMB and applying to other schools. I finally got admitted into a university and started classes in 2017.

I had a sister in the same uni too, and she told me the students loved to look fashionable. So, I decided I could make a fortune by offering them nail services.

What did this involve?

I took some money from my ₦10k monthly allowance and went to the market to get the materials. A bottle of nail polish cost ₦100, and I got nine colours and a hardener for ₦1k. I also bought nail polish remover for ₦150 and a couple of nail files, buffers and artificial nails. I put all my tools in a basket and started moving from room to room in the hostel, looking for clients.

I charged ₦500 for both hands (with artificial nails) and ₦200 if it was just normal painting. I charged an additional ₦200 to paint both sets of toes.

Sounds affordable

It was, and it made the business an instant hit. The students in my uni typically held many events, and when these happened, I’d have as many as six clients and make about ₦3k daily.

By 200 level, I had to move off-campus — only first-year and final-year students were guaranteed hostel space. Staying in an off-campus apartment with my sister was a big blow to my nail business. I could no longer move from room to room to find clients. It was time to find something else.

What did you find?

Makeup. Just before the end of the session, an entrepreneurship class in school tasked us with learning a skill during the three-month break so we could present what we learned when we returned to school. I’ve been interested in makeup since childhood, so I decided to learn it.

What was learning it like?

I found a professional at home and paid ₦30k for a one-month class. I’d drag a friend along to practise on her face. I also regularly followed YouTube tutorials. When school resumed in 2019, I began telling everyone I was now a makeup artist.

At first, I charged ₦2k for a face beat, but when the cost of products started to choke me the following semester, I increased my price to ₦3,500. I usually had three to four clients daily across different hostels.

In final year, I moved back to the school hostel and restarted my nail business. This time, I charged between ₦1k – ₦1,500 to fix nails. I also increased my makeup rates to ₦5k – ₦6k. I was constantly booked and made about ₦20k weekly from both businesses.

The money was good, but my partner introduced me to UI/UX design in 2020. I saw yet another opportunity to make money.

Let me guess, you grabbed it

I procrastinated for a bit sha. My partner was in the Google Developer Students Club, and I joined in 2021. The training was free, but omo, it was hard.

My beauty industry experience helped me quickly understand the user interface bit because I was already dealing with colours every day. However, it took me about three months to get a hang of the user experience part.

Did you get any UI/UX gigs while in school?

I didn’t prioritise getting any. I was already making money with makeup, so I decided to focus on learning and mastering my UI/UX skills.

When I graduated in 2021, I got two small UI design gigs on Twitter. I got these gigs because I was already vocal about my skills on the app, and someone reached out to me to redesign a website for ₦20k. The second gig was a simple landing page website design that paid ₦40k.

When NYSC came in 2022, I was posted to a school, but I paid someone ₦25k to change my PPA to a fintech startup because I wanted to do more UI design. I don’t even know if he worked with NYSC; someone just introduced me to him. Thank God they didn’t scam me.

LOL. Tell me about the job

I was supporting a UI/UX designer on the team. For some reason, I didn’t ask if they’d pay a stipend in addition to NYSC’s ₦33k monthly allowance. But the job came with a free room in the office, so my accommodation was sorted.

The designer I was supporting was redesigning a product, but she was preparing to leave the team and was distracted. So, I decided to do the work myself and did three different redesign variations within a week. I later learned they planned to pay me ₦10k/month, but the MD was impressed with my work and decided to give me a ₦20k bonus that month.

I got ₦30k in my first month and expected only ₦10k the next month. But I got ₦30k again. I asked HR, and they said the increase was because I was the only designer they had at the time, and they hoped to retain me after my service year. In my head, I was like, “Wow, nice one.”

Were you still offering makeup services on the side?

Not really. NYSC was in a different state where I didn’t know anyone. Two months into the job, I got a part-time design job on Twitter. It paid ₦50k, and only required me to work on the product for two hours every weekday.

The project ended five months later, but then they asked if I could manage social media for their sister company as they didn’t have a manager. By now, you should know I can say yes to anything as long as there’s money in it.

Screaming. So you took the job?

The job was onsite in a different state, as I’d need to take videos and create content. I told them I’d take the job if they gave me accommodation. They agreed, and I moved to the state in December 2022. The pay was ₦150k/month.

But you weren’t done with NYSC

I was going to round up NYSC in February 2023, but my PPA was already having money issues. They’d offered to retain me at ₦70k/month (including the free accommodation). But they started laying people off in December. We even closed for the year in the second week of December because of the money issues. I couldn’t wait around to find out, so I told them I was leaving and would return for my final clearance. They were okay with it.

So, I moved states for the second job. It was an event video coverage company, and I had to follow them to events to create content. It was crazy stressful. I’d never experienced something like that in my life. We could go out all day, return at 6 a.m. the next day and still go out again in the afternoon. I suffered.

Did the pay help the suffering, at least?

If anything, it allowed me to save more. During my service year, I regularly saved the ₦30k from my PPA and lived on the ₦33k allowance from NYSC. When I got the ₦50k side gig, I also saved part of it and spent the rest on random shopping or sending money home to my mum.

I had about ₦200k in savings when I started the social media job and saved an additional ₦100k from my first salary. Subsequently, I tried to save at least half of my salary monthly.

But I wasn’t enjoying the job at all. In January 2023, I got another UI/UX design side gig at ₦50k/month. Then I was referred for and landed another ₦50k/month social media management gig for a US client the following month.

You were juggling three jobs?

Yes, and it triggered a mental breakdown. My primary 9-5 was stressful and extremely toxic. Our MD used most of the company’s funds to relocate, and we were left with the HR officer who was a bully. I was planning to resign in June when they called me in March 2023 to tell me they no longer needed my services.

The crazy thing is, I resigned from the US job only two weeks earlier because my head wasn’t in the right place, and I needed to reduce my workload. I had no idea I’d lose my 9-5 so soon. I was left with only the ₦50k/month UI/UX job.

But I’d saved up ₦600k from my earnings, and I used it to buy a MacBook so I could focus on design. I didn’t want to do anything social media-related again.

How were you surviving on ₦50k/month?

I told my employer I could now work full-time with them, and they increased the salary to ₦70k. I also moved in with a family member to reduce my running costs. I tried getting side gigs again, but nothing came.

Then I thought, if a job won’t work, why not school? So, in July, I told my parents I wanted to apply for a master’s abroad. They agreed, and I began the process of getting my transcript from uni for the application process. I took permission from work for this, but one day, they felt I was asking for too much permission and asked me to leave the company.

Just like that?

Just like that. They also complained that I was delaying tasks, but I was severely burnt out. It felt like I was just learning how to work afresh. That’s how I sha became jobless.

For the next two weeks, I cried daily. I lost my confidence and questioned my abilities. Like, wasn’t it this same me that was hyped at my PPA then? Had I gotten so bad?

When I was finally done crying, I told my parents I was now unemployed, and my dad demanded I start a business. I considered my options and told him I wanted to sell thrift clothes. He gave me ₦500k. I used half of that to buy stock and launched the business online in August. Within a month, I had 30 orders and made ₦36k in profit.

Not a bad start

However, I was still interested in UI/UX design, so I decided to start afresh. I paid ₦40k for an online three-month design course to rebuild my confidence. I’d create content for my business in the mornings and then study after.

In October 2023, I thought about returning to makeup but going at it differently. I opened a YouTube channel and started doing makeup looks and sharing via YouTube Shorts.

Why YouTube Shorts?

I noticed people preferred short-form content. My first video had 10k views because I used a trending sound. It motivated me, and I thought, “Maybe I can blow on YouTube”.

Remember the master’s admission I was pursuing? I got admission in October 2023 at a UK university. The deposit was about ₦4m after conversion. My dad sent it, but before I could make the payment, the exchange rate increased from ₦1k to a pound to ₦1,300, and the deposit was now about ₦5m.

Damn

My dad couldn’t afford it. Even the ₦4m was everything he’d made from selling a cocoa harvest. He hadn’t even paid his farm staff. So, we agreed to defer the admission to 2024, and I returned the money to him.

Since school was off the table, I focused my attention on YouTube, my design classes and business. By December 2023, I’d grown my subscribers to almost 200, using only YouTube Shorts. I intend to start vlogging properly in 2024 to cross the 1000 subscribers and 4000 watch hours threshold to get monetised.

What about your thrift business?

The business is no longer doing as well; I make an average of ₦50k/month from it. But it’s business money, so it goes back into the business. I still have about ₦200k left from the initial business capital saved up, and I might restock in a couple of weeks.

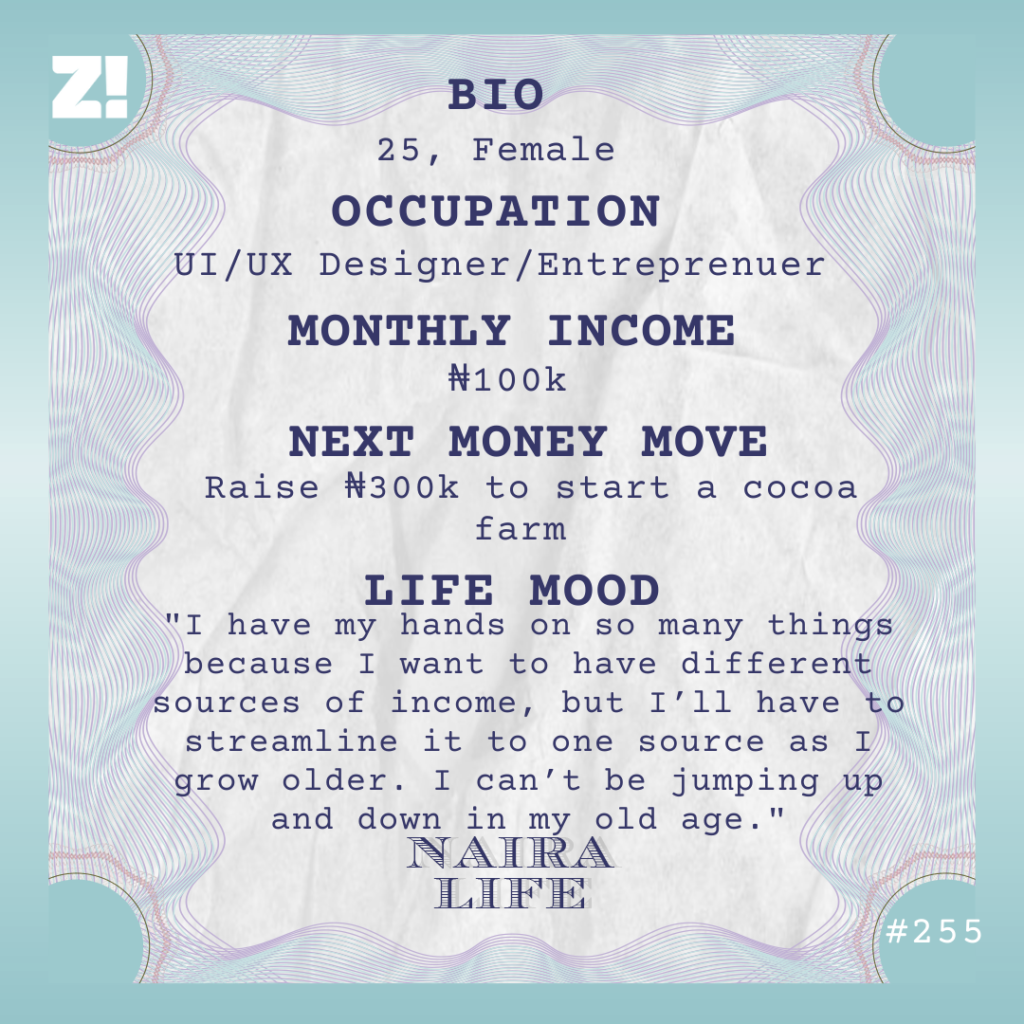

These days, I survive on the occasional design gigs I get through my partner, and that brings in an average of ₦100k in a good month.

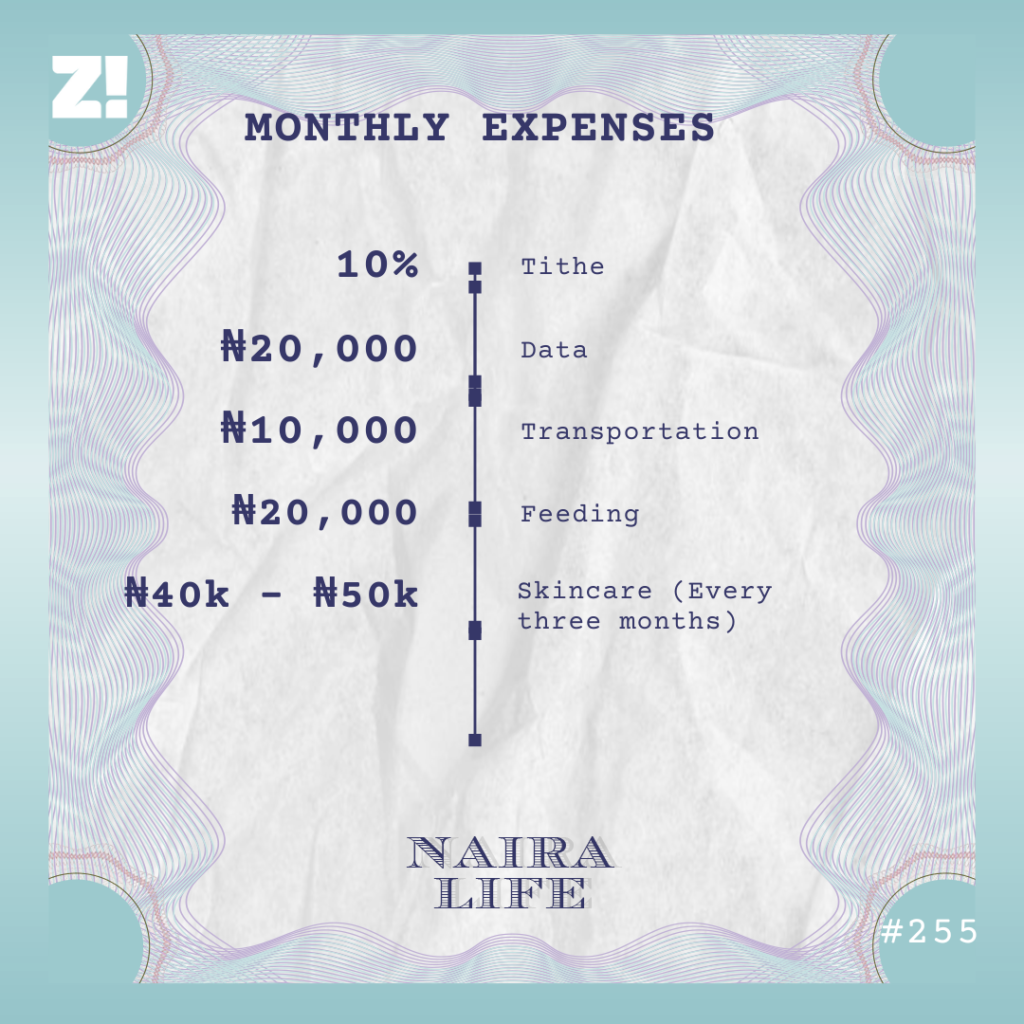

What do your expenses look like in a good month?

I’m trying to live on a ₦50k monthly budget, so I can save anything else that comes in. This is possible because my parents and partner support me financially when I have nothing — they’re essentially my safety nets. I just moved into my own apartment in January 2024, and it cost me ₦270k, with some financial help from my parents.

Before moving into my apartment, I hardly spent on data and food because my partner took care of it.

It’s interesting you lost jobs twice in a year but didn’t exactly go broke

For me, being broke means not having a job that constantly brings money at the end of the month. Though it wasn’t consistent, I was still getting money.

I was broke — I still am — but my safety nets and savings have helped me survive. I believe your savings can save you. Also, don’t just spend money the way you see it. You should always plan how you intend to spend. I usually weigh my options and decide the importance of things per time to determine what should take my money in one period of time.

What do you see when you think about your financial future?

Ah. I always hope for the best o. I have my hands on so many things because I want to have different sources of income, but I’ll eventually need to streamline it to one source as I grow older. I can’t be jumping up and down in my old age. I’m still looking for a good-paying job. I really want to do user experience research and product design. I might just put the business aside if I find a job now.

How much is a good-paying job for you right now?

That’s tricky. What if I say a figure now, and Jesus says, “That salary you mentioned is exactly what you’ll get?” What if He has a bigger plan for me? If I have to share sha, I’d say a minimum of ₦200k/monthly or $1k if it’s a foreign company.

Curious. Do you have a retirement plan?

I plan to invest in a cocoa farm like my dad once I have enough money. This is how cocoa farming works: You rent a farm that already has cocoa seedlings — so you don’t have to start planting all over again. Renting one can cost as much as ₦100k annually, depending on the farm size. Then you hire people to care for the farm and harvest the ripe cocoa in December.

Right now, a kilo of cocoa is about ₦5,200 and a bag contains 66 kilos. That’s ₦343,200 from one bag of cocoa. You can harvest up to 10 – 12 bags and sell them to those who export to other places. You can also decide to pay the person you hired to take care of the farm with one-third of the harvest.

I also plan to go into the palm oil business. That one just involves buying multiple kegs of palm oil in January and storing them to sell in December when they’ve doubled or tripled in price.

That’s interesting. How much do you think you’ll need to start cocoa farming?

I’ll need about ₦300k to rent a farm and start operations. I can actually start any time and make that amount back fully in a year because the dollar-to-naira rate influences the price of a cocoa bag, and since that’s consistently increasing, the profit would increase too.

However, I intend to build my business to a point where it’s profitable enough for me to be able to remove that kind of money to invest somewhere else. I’ll also have financial support from my dad when that time comes.

How would you rate your financial happiness on a scale of 1-10?

2. I still don’t have a job, so I’m not happy with my finances. I hope to get a job before March 2024 and possibly monetise my YouTube. Maybe by then, things will start looking up.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.