Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

I started getting pocket money in JSS 1. It was the early 90s, so I don’t remember the exact amount now. I always gave the money to my uncle — who was in SSS 3 — for safekeeping because the students in my boarding school were notorious for stealing.

But my uncle was the one I should’ve been careful of. He started spending my money and would lie to me that it had finished. Somehow, I believed I spent it all.

How did you find out?

My dad noticed I was constantly writing to him for more money every few days. He asked, “Why is your money always finishing?” And I responded, “My uncle said the money has finished.” My dad figured he was tampering with the money and asked him. My uncle was mad at me for not covering him.

I changed schools in JSS 2 when I kept getting bullied for my accent and started keeping my pocket money myself.

What accent?

I spent some of my early years in the UK with my parents, who were studying for postgraduate degrees. I was in primary two when they were done, and we moved back to Nigeria in 1991. I remember because my parents were really disturbed by the fact that a dollar exchanged at ₦14 on the black market.

If only they knew now

When we returned to Nigeria, my dad worked in agribusiness for a bit with the company that sent him to the UK while my mum found work as a teacher. There was a bit more money, and I was the boy with comic books in primary school. I had them all — Superman, Batman, Guardians of the Galaxy, you name it.

But my dad left his job to become a missionary around the time I entered secondary school, and we had to tighten our belts. No more comic books, and we moved to a smaller town.

What did your mum think about your dad’s decision?

If there was any pushback, my siblings and I weren’t aware. My parents always presented a united front, and they cushioned us from whatever our financial situation was as best as they could.

I entered university in 2001, and they placed me on a ₦20k/month allowance, which was a reasonably good amount. Unfortunately, I didn’t know how to handle money, so I spent it on music CDs and books and was always broke before the next allowance came in.

We’ve all been there. When was the first time you made your own money?

2002. I was studying engineering in school but didn’t like the course. So, I put my energy into learning programming. I found this book called “Teach Yourself C++ in 21 Days” and another called “Cryptonomicon” by Neal Stephenson and decided I wanted to be a cryptologist. But I started with programming. I spent hours in the library learning how to code on the computers.

My first gig was to build a website for a church, and they were supposed to pay me ₦10k, but I never got anything. In fact, I didn’t get paid for the first three gigs I did. One was even my dad’s friend who promised ₦50k for a website gig but never paid. Funny enough, he saw me regularly after that and always said, “I have a job for you to help me do.” Yeah, right.

LOL

I quit engineering and moved to Ghana in 2004 to start my first degree afresh. I had started getting depressed because I wasn’t doing great academically, and I desperately wanted to move to the US to study. However, my parents couldn’t afford the tuition, and scholarships didn’t work out, so I settled for Ghana to study mathematics because of my cryptologist goal.

Did you get more gigs while in Ghana?

Yes, but they were mostly from Nigeria. At one point, I worked with about four companies simultaneously, which meant I was in Nigeria almost every weekend. The clients paid for my flights to Nigeria on Friday and then back on Sunday. I had so many airline miles I was giving it out.

How much were you making from the gigs, though?

Anything between ₦100k to $5k per project, depending on what I was working on. Some clients — mostly the big ones — also didn’t complete payment. But I was making money. I also had a friend from a freelance agency who regularly threw work my way.

In my second year in Ghana, I became responsible for myself and stopped calling home for money. My parents had also gone full-time into the ministry, which affected the family’s finances, so I occasionally supported my siblings too. I didn’t really spend on anything else apart from books and music. By the time I finished school in 2009, I had saved about €20k.

That’s huge. Were you saving towards a particular goal?

Yes, a postgraduate degree. I got admitted to an English-speaking German university to study for a one-year Master’s degree in Computational Mathematics. About €15k from my savings went into covering my fees, rent and living expenses for the year.

After one year in Germany, I moved to India in 2010 for another Master’s degree in Computer Science. I chose India because it was cheaper. It only cost me $2k to cover fees and living expenses for the one-year program.

I’m curious. Why the double Master’s degrees?

I just wanted to expand my knowledge. I’ve wanted to get a PhD since I was seven; I consider it one of the highest intellectual awards one could get. It’s not even to become a professor; I’m not one to teach. But that PhD? I still plan to have it before I die. Even if it means doing it at 70 with my grandkids.

Did you do anything for money while in these countries?

I lived on my savings for the most part. My student visa didn’t allow me to work in India. The only job I managed to do in Germany was to assist at a local food mart, where I sat behind a register. This paid like €10 or €15 per hour. It was good money for almost no work, but it wasn’t my thing.

I also did a website for one hair salon lady for €100. I also tried bartending, but I was more interested in drinking than actually serving the drinks.

I left India after my Master’s and returned to Nigeria. Then, I tried to go to Poland for my PhD, but it didn’t work out. So, I decided to stay back and work for a year before returning to school. It wasn’t that easy.

What happened?

Applying to jobs in Nigeria with two Master’s degrees on my CV was destroying my chances. Recruiters said they couldn’t afford to pay me. So, I drafted two CVs: one with all my degrees for foreign jobs and the other without them for local jobs.

Did that help?

It did. I got a ₦150k/month job at a web development studio, but I only stayed for seven months because my boss was more interested in politics than paying us for our work. At the point I left, I was being owed two months’ salary.

After that, I worked freelance between 2012 and 2013. I didn’t get as many exciting gigs as I did in university, but it paid the bills. That said, the thing about freelancing is that you can make ₦3 million today and make nothing for the next couple of months. It wasn’t sustainable.

Plus, my tastes had changed. As a uni student, I didn’t need to spend much. But as an upwardly mobile tech bro, I started hanging out with other tech bros, and my expenses increased. At some point, I reduced how frequently I hung out because I couldn’t always afford the drinks. When your friend buys you drinks twice, by the third time, it’s already looking awkward.

Real. Did you try applying for 9-5 jobs again?

Yes. Fortunately, I landed a ₦200k/month job towards the end of 2013. I stayed there for only a few months before moving to another role that paid three times more. After nine months, I also left the new job because I got bored and returned to freelancing. Nine months is the longest I’ve spent at a job.

In 2017, I returned to 9-5 for ₦450k/month and quit after four months — the boss was terrible. Shortly after, I took up another ₦300k/month job with one of the early Nigerian blockchain companies, but they crashed around March or April 2018.

I then moved to Maiduguri to work with an NGO. It was almost like I did it for charity because the job was below my skills and only paid ₦130k. But after two or three incidents where I ran from Boko Haram attacks, I decided I was done. ₦130k wasn’t enough for that.

What did you do next?

I did another four-month stint at a company I later discovered scammed its customers. They paid their developers, though, and my $500/month salary was never delayed. I left the job for another that paid me $1k/month. I was just moving like that and increasing my income.

My savings increased with my salary too. By the time I started earning $3k/month in 2020, I was saving and investing 80% of it. Mostly because I was living with my parents and had side gigs that brought money in occasionally.

What were some of the things you invested in?

Stocks: tech, pharmaceutical, and metals through foreign investment platforms. I invested in Tesla when it was $30 per stock. When I sold most of it in 2022, it had grown to $290.

I also had 50 Bitcoins, which I got as a gift in 2012 when it was still around $12. I tried to access them in 2018 and realised I’d forgotten my private key to the wallet.

Excuse me. WHAT?

Yeah. I haven’t been able to crack it since, even though I’ve been doing blockchain bounty hunting since 2021.

What does that mean?

I go around different blockchain projects to find security bugs or build something for them. Bounty hunting is all in — you either make so much money or nothing at all. I once lost an $80k reward because I stepped out in the middle of solving the problem to grab drinks with a friend. By the time I returned, someone else had submitted a solution.

Damn.

I landed a more stable job to handle a project’s developer relations shortly after, though. It paid $7k/month with bonuses up to $5k. I did that for about four months. During that time, I took a small break from working on multiple blockchain projects to focus on the job.

I saved and invested aggressively, living only on $1k/month. This time, my savings goal was to get a Golden Visa.

Why did you want a golden visa?

I want to travel the world, which isn’t the easiest thing to do with a Nigerian passport. I wanted a passport that’d give me access to pretty much everywhere. So, I learned about the golden visa, and the most affordable option I found was the Portugal Golden Visa. It cost €350k and involved buying property, which would give me a five-year residency. Last last, I could rent out the property and make money from it. I only needed to visit Portugal for one week every year for those five years, after which I’d get citizenship.

Plus, they don’t pay tax on crypto-based earnings in Portugal, they speak a lot of English, and there’s a relatively big Black community there. It was the perfect option, and I was going to get it. But then I lost all my savings — over $500k in total.

Wait. How did that happen?

I’d invested about $80k in Terra in 2021. By April 2022, it had grown to $150k. Then the Luna/Terra coin crash happened, and took my money with it. Honestly, I should’ve known the returns were too good to be true, but shit happens. It was painful, but I still had about $400k in other savings and investments. So, it was like, “Damn, I lost money. Well, I still have money.”

I just fell to my knees

The plan was to finalise my Golden Visa in November 2022. So, I liquidated the rest of my crypto and stocks in late October and put it all — about $380k — in a crypto exchange, FTX. I didn’t put the money in the bank because I didn’t want anyone asking too many questions or forcing me to fill out forms.

It was supposed to be there for a week. Unfortunately, FTX crashed on November 2. I didn’t even know until November 9 because I was busy with work and was ignoring my emails. By the time I found out, my money was gone. If I had heard the news earlier, I could’ve withdrawn some of it.

Oh my God. I’m so sorry

I was devastated. I couldn’t take a bath, eat or step outside for a whole week. My security guard even came into the house to make sure I wasn’t dead. I usually struggle with depressive episodes. I’m very sure that if I’d been in one of my low periods when this happened, I’d have killed myself.

It wasn’t exactly the money I lost that bothered me; it was the freedom it was supposed to bring.

Ironically, I’d quit my job earlier that year to start my own software development company in February 2022. I was supposed to get a $200k investment grant but got $50k in funding. I also only got 30% of the $50k upfront. The rest was going to come only after we delivered a particular project, so I had to put much of my money into the startup. We had more than 20 staff, and I had to pay almost ₦10m in salaries and other expenditure every month.

By the time I lost my savings, we’d already depleted our initial funds, and I had to take a ₦20m loan to pay salaries in November and December. We finished the funding-backed project in December, and I had to tell my staff we were taking an indefinite break till we got back on our feet.

Phew. That’s a lot. How did you pay back the loan?

The 70% balance came in, and fortunately for me, the naira had fallen against the dollar. It was now about ₦700 to $1 from about ₦300 at the beginning of the year. It meant the naira value I got was far more than when we got the first 30%. I was able to use the money to settle the loans I took and still had about ₦26m.

I still have a few freelance developers on the payroll for another major project we’re working on, but progress is slow — we haven’t gotten to the point where we have paying customers. Maybe if the investment grant had come in and I hadn’t lost my money, we’d have a working product in the market now.

What are you up to now?

I’m definitely more broke than I was in 2022, and I pay more attention to how I spend money. After moping around for months, I went back to bounty hunting for a bit in 2023. Another way I make money now is by participating in crypto communities on Discord.

How does that work?

Once you show you’re active by helping to solve problems in the group, the owners reach out and offer you a stipend to continue giving value.

One group pays me $1k/month. Another group gave me some Joystream coins because I was an early member, and I can always sell them if I absolutely need money. I explore communities to see where I can pitch in and make random $2k occasionally.

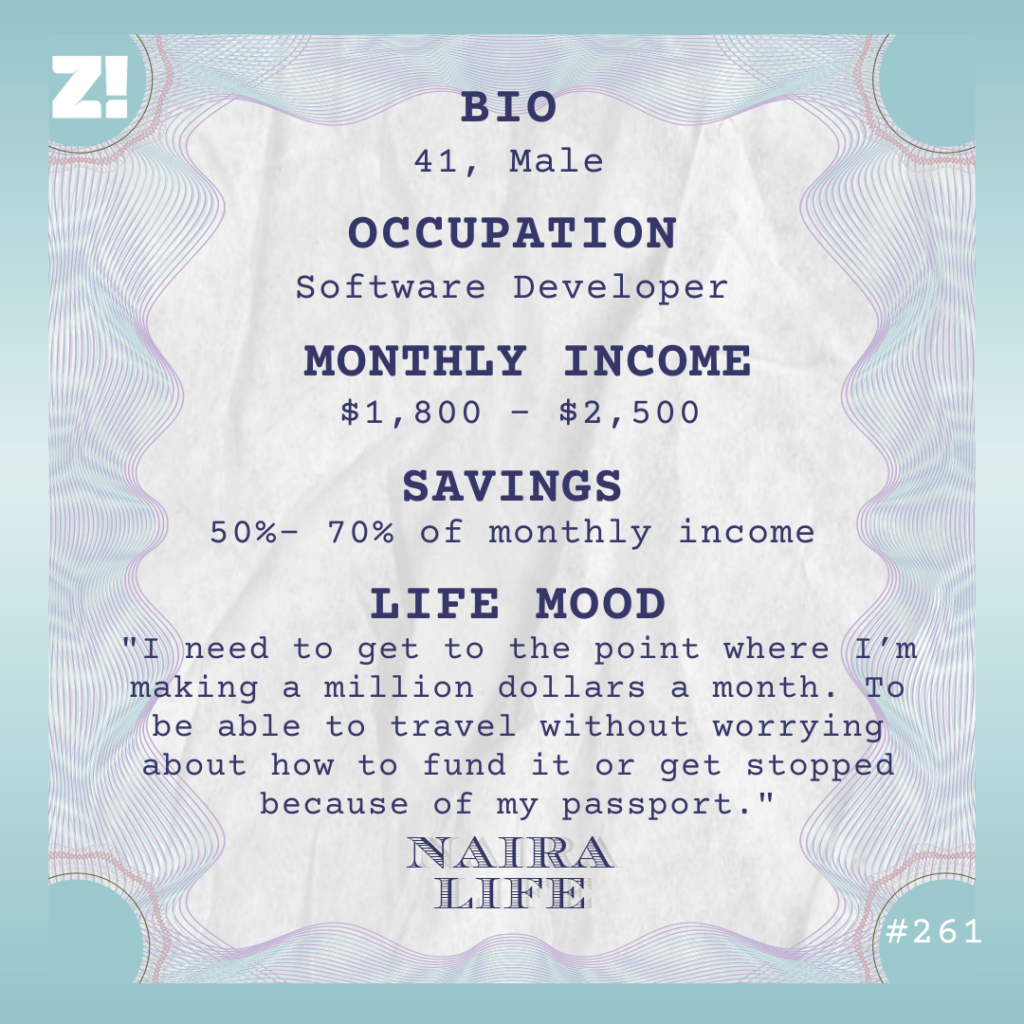

Usually, I’m sure of earning $1,800 – $2,500 monthly from bounty hunting and the crypto communities. It’s often higher. I’ve made about $8k once. The only downside is that if something goes wrong in the communities, you’re the first person people will yell at since you’re the one answering their questions.

Out of interest, did you tell friends and family about the money you lost?

I told my family and some close friends, but weirdly, it didn’t stop people from asking me for money. I’m usually the first person people think about when they need money, and it’s gotten worse since September 2023. Maybe I’ll blame Tinubu for it, but everyone suddenly became broke.

In a day, I’d get like 2-3 calls from people seeking financial assistance. It got so bad I had to change my number. I gave a few friends the new number, and now I’m even considering changing it again. Almost every day, someone asks for ₦20k or a ₦100k loan.

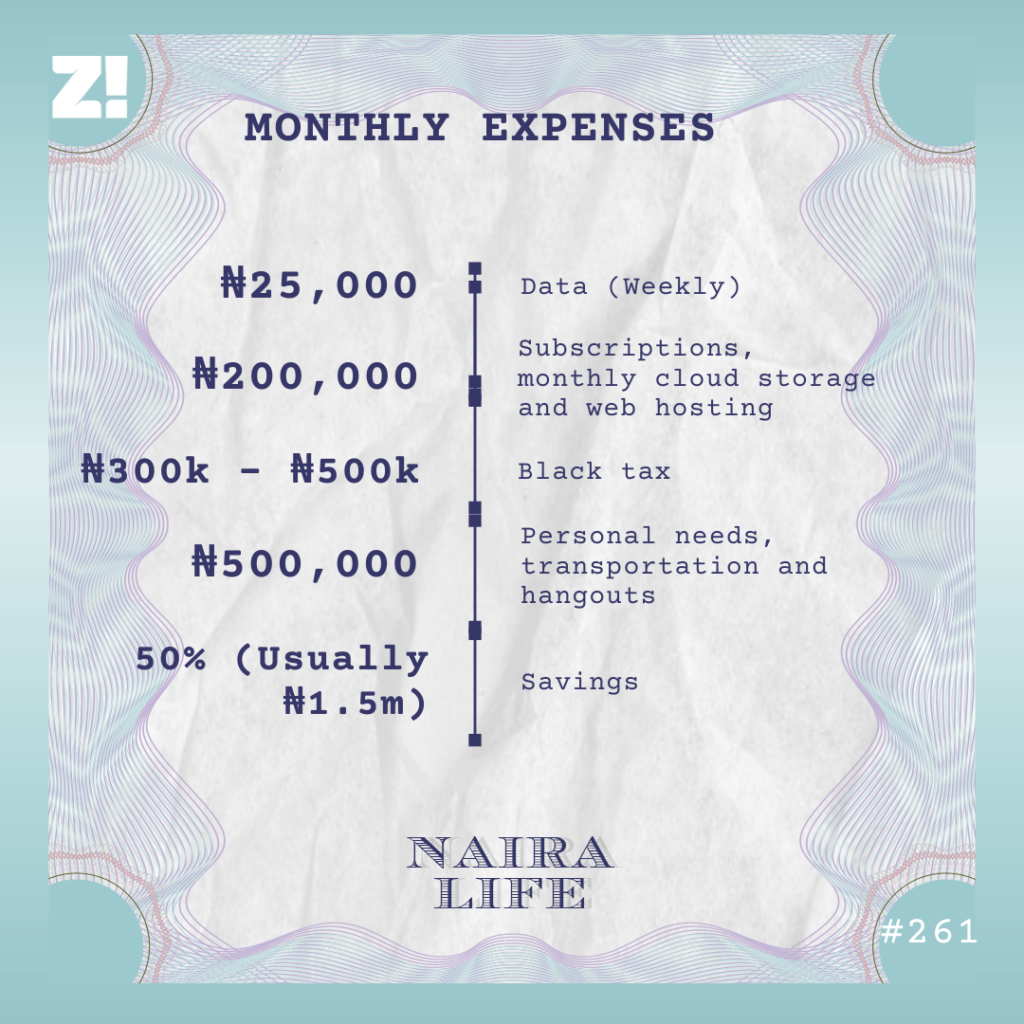

What are your monthly expenses like?

I still save 50% – 70% of my earnings monthly. Most of the crypto I got from the community is vested and worth about $40k today, but it’s imaginary money. I can’t access it yet, and crypto prices fluctuate wildly to say this is the definite amount I have. I should have access to it in 2025, and I plan to take 50% out to invest in stocks and metals. I’ll also probably invest in local property.

You’ve been on quite a financial journey. How have your experiences impacted your perspective on money?

It’s a two-way thing. On one hand, I’m trying to spend more conservatively. I haven’t changed my iPhone in almost two years, and I love having the latest gadgets.

On the other hand, I’m very aware of how fickle money is. It’s like, I better enjoy this money now because it may not be there tomorrow. I feel like I didn’t enjoy my money the first time around. So, I find myself constantly trying to strike a balance. I still intend to travel the world, so that’s still on my bucket list.

What do you imagine the next few years might look like for you?

My current target is a startup visa to Portugal, France or Denmark. People aren’t really going through the golden visa route anymore, and this is one of the best ways to get a stronger passport as an entrepreneur. It means I’ll need to pay more attention to building my startup. I plan to do that with the help of accelerator programs later this year, provided I remember to apply before the deadlines.

How would you rate your financial happiness on a scale of 1 – 10?

4. I need to get to the point where I’m making a million dollars a month. You know, to be able to buy things and travel without worrying about how to fund it or get stopped because of my passport. I’d also like to set up education trust funds for my nieces and nephews.

Have you considered where the $1 million/month would come from?

Income from work projects and investments, plus savings. I’m also talking to several business partners, and I’m hoping that the law of averages alone will ensure at least a few of the projects go my way.

I’ll be able to diversify my investments once my startup starts making money. I believe that’ll happen soon because I’m serving a growing market and offering solutions for a need that has been underutilised. I’m also looking to become an angel investor for startups or maybe even venture capital within the next three to five years.

Interesting

Earning $1 million isn’t just for spending sake, though. It’ll be a great financial security for me and my family, but I’m also looking to invest in lessening the effects of climate change and food and water insecurity.

I believe we’re on the brink of a major food and environmental problem in Africa. If Niger or Mali decide to block River Niger, our water supply is cut off. We must figure out ways to trap water from the environment, reforest our semi-arid areas and even consider renewable energy. I’m interested in these issues, and making that kind of money would mean I can contribute to solving them.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.