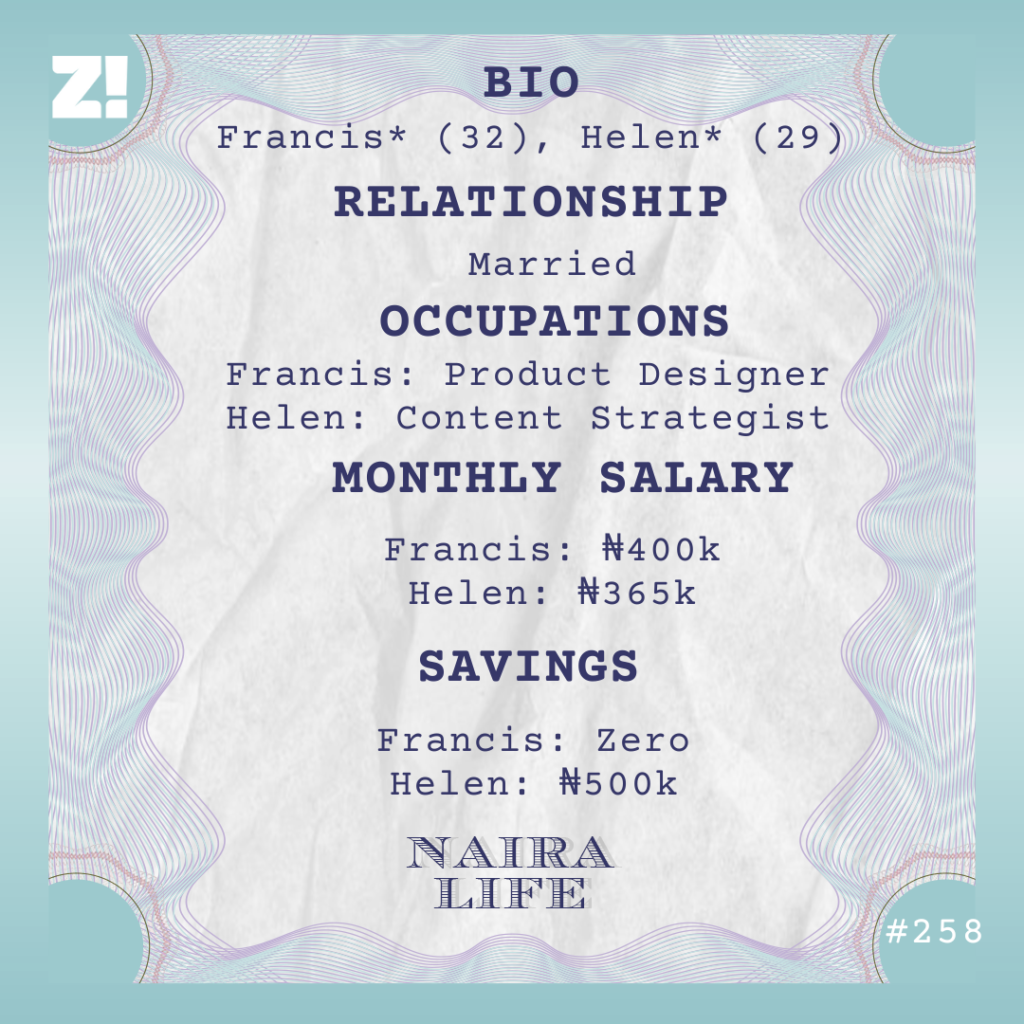

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What are your earliest memories of money?

Francis: I visited my cousin when I was around seven and was shocked to see he had money saved in a kolo. The money must’ve been like ₦50, but it was a huge discovery because it just clicked in my head that children could have money.

Helen: It’s funny how kolo is my earliest money memory, too. I was about nine years old when I watched my mum break her kolo after I complained about my teacher flogging me for not paying school fees. She gathered the money and dragged me to school to cuss out the teacher.

You didn’t know children could have money?

Francis: It wasn’t a thing in my house. My siblings and I were never given money for snacks in primary and secondary school because there was always home-cooked food. My mum was something of a “money police.” If any of us were found with money, we’d have to explain where it came from. So, anytime relatives dashed us money, we immediately gave it to our mum out of habit.

On the other hand, my dad didn’t take things seriously like that. When I entered secondary school, he let me keep the small change from the errands I ran for him.

I’m now curious about what money was like growing up

Helen: There wasn’t a lot. I lost my dad at 6. My mum said he was a banker, and we were ballers when he was alive. But I have no memory of this.

When he died, his siblings grabbed his properties and pushed my mum aside because she “only had one girl”.

My mum — who was previously a stay-at-home mum — had to start selling clothes to survive. I remember she fasted a lot, but I realised later that it may have been because there wasn’t enough food for us. She was the OG independent babe, though: I never saw her ask for help or handouts from anyone. She taught me how to hustle and not wait for no man to use ₦2k to shakara me.

Preach it

Francis: Things were different for me. Both parents worked in the civil service, so we didn’t struggle. My mum was just stingy. You had to present a dissertation to convince her that you needed to buy a bicycle.

Screaming

Francis: My dad was the lau lau spender, and this caused clashes between him and my mum. He once bought two of those big DSTV satellite dishes for the two TVs in the house without telling anyone and paid for the premium subscription. These things just came out and were crazy expensive.

My mum felt vindicated when he had issues at work in 2006 and was transferred out of spite to another department where he wasn’t getting as much money.

Wait. Tell me about that

Francis: There’s a lot of “chop, make I chop” in civil service, and everyone is involved in it somehow. My dad worked in procurement and handled contractor bids. He didn’t have the authority to accept or reject a bid — that came from the higher-ups. But it was obvious the contractors either “settled” the bosses or inflated the cost so they could use the excess to “show appreciation”.

No one will come and tell you directly, but you can hear that Oga is sharing ₦10k with everyone in the department for the weekend. So, he always had extra money apart from his salary.

Interesting

Francis: I think my dad started discussing with his colleagues how one contractor was doing rubbish but kept getting renewed. I don’t have the full story, but his comments may have rubbed some people off the wrong way. He got transferred, and the cash flow stopped. We didn’t go broke, but there was no more calling Daddy to buy ice cream when returning from work.

I think I got the lau lau spending from him, though. In 2009, I started writing notes and doing assignments for people in uni for random ₦1ks and ₦2ks just because I’d finish my ₦10k monthly allowance in a week buying suya for babes or buying them food, as per baba for the girls.

Helen: Wow. But me I didn’t see your money to chop o.

Wait. You both met in university?

Helen: Yes. In 2013. He was a final-year student, and I was a hustling second-year student. I’d just started selling chiffon shirts in the hostel to supplement my ₦5k allowance. We met through a mutual friend and started dating soon after.

Where were you both financially at this time? How come you didn’t see his money to chop?

Helen: I was making approximately ₦10k monthly from my business. I sold far more than that every month, but the profits weren’t all mine because I bought the shirts from an okrika vendor and added a small amount of money on top, so it’d still be affordable.

About not seeing his money to chop, I wasn’t looking for his money, TBH.

Francis: She’s the one Neyo talked about in ‘Miss Independent’. I was broke then, though. My dad had just retired, so money from home wasn’t regular. Any money I made from doing assignments or billing any of my older siblings went into my project and trying to stay afloat.

But you had time to get into a relationship. Love it

Francis: Wetin man go do? Looking back, I realise it wasn’t a great time to start a relationship. In 2014, I went for NYSC in a different state, and my income was ₦24,800 — NYSC allowance + a ₦5k stipend from my PPA. We had to navigate long-distance, which was hard. And then she lost her mum and decided she didn’t want to be in the relationship anymore.

Helen: Ah ah. It wasn’t like that.

So sorry about your loss. What was it like, though?

Helen: It was tough because I had to become solely responsible for myself. My aunt from my mum’s side who could help was also struggling, so I was basically on my own. I remember looking for ₦50k to sort out something at school, which seriously bothered me.

Whenever we talked on the phone, he’d ask several times what was wrong with me, but I couldn’t tell him. I didn’t want it to look like I expected him to start giving me money. So, I just told him we needed to take a break.

Why did you think sharing your problems meant you were asking for money?

Helen: It was something I subconsciously picked up from my mum. Growing up, she was very particular about me not depending on guys. We could be watching movies together, and she’d point out how the actress felt indebted to the guy because he helped her. Or how the guy thought the babe was billing him simply because she was sharing her issues.

I had a similar experience with a previous “toaster”. We were talking on the phone, and I randomly mentioned that I needed to end the call because my charger had issues; I couldn’t charge the phone and stay on the call. He said something like, “We haven’t even started dating, and you’re already telling me your problems.”

Ah.

So, it was like a reflex reaction to lock up and solve my problems myself. I wanted to be in a better place financially before focusing on relationships. It was time to double my hustle.

How did that go?

Helen: I did all sorts. I sold perfume oils, plantain chips and chin-chin at different points until my final year in 2016. Then, a friend introduced me to social media management, and it was like my big break. My first job paid ₦60k/month. When NYSC came around in 2017, my monthly income had grown to ₦90k.

Coincidentally, NYSC posted me to the state he lived and worked in, and we picked up the relationship again.

Who made the first move to pick things back up?

Helen: I did. It wasn’t like we broke up and became enemies; we were still in touch. He was hurt, but we still talked, and I knew he wasn’t seeing anyone. So, I told him we needed to see, and we just talked it through.

Was this because you were in a better place financially?

Helen: Exactly.

Francis: We didn’t get back together until we properly discussed what went wrong the first time. And that’s how I understood that she needed to do it for herself because of where she was coming from.

To be honest, a part of me initially thought she wanted to give us a try again because I’d become something of a big boy. I’d gotten into product design and had a ₦100k/month job. But if there’s anything she chases, it’s how to make her own money. We’ve been married for three years now, and she’s still the same independent, strong head.

What was dating like the second time? Were there other money clashes?

Helen: Oh, there were. We didn’t have money conversations the first time. Add that to the fact that we became long-distance shortly after we started dating; we didn’t navigate situations like who pays during the date or stuff like that.

But then we started dating again, and he’d take me for dates weekly and insist on paying. He’d also buy gifts when coming to visit me. I thought it was too much and told him so.

Francis: Me, I was confused. I thought I was doing what was expected, but she didn’t like it. It caused some arguments because I thought she wasn’t being appreciative. I told my friends, and some of them thought I was a lucky bastard. Others suggested she had someone else giving her more money.

How did you both navigate this?

Helen: It took a while, but I got better at letting him know that I appreciated him wanting to take care of me, but I didn’t want to feel too relaxed or dependent. More importantly, I wanted to chip in too.

Francis: So, we developed a turn-by-turn approach to our dates. I’d pay today, and she’d pay the next time we went out. I didn’t compromise on gifting, though. I still bought them as regularly as I wanted.

What’s the most expensive gift you ever got her?

Francis: A piece of land just before our wedding in 2020. I knew she wanted to own land one day and had saved up about ₦200k for it. A friend told me about a really good real estate deal, and I thought it was perfect for her. The cost was about ₦1m.

So I told her about it and said I’d pay the balance. The ₦800k was money I’d gathered from a work bonus and other monies towards the wedding. But it was COVID year, and no one was doing big parties anyway, so it all worked out.

Helen: It’ll always be the most thoughtful thing anyone has ever done for me.

That’s really sweet. How does money work in your home now?

Helen: We go 50/50 on everything. It sounds like we see finances as an individual thing, but it’s a joint feature in our lives.

Please explain

Helen: We have a joint account, and once we get our salaries, we send half of it to that account. We use the money in that account to settle our ₦650k/year rent, utility bills, food and other home expenses. The other half of our salaries is for each person to handle personal savings or other needs, including buying each other gifts.

Francis: Sometimes, if the joint expense is more than what we have in our joint account, we contribute equally from our savings to take care of it.

How did you decide this was what worked for you guys?

Helen: I’ve always struggled with depending totally on people. So, if he isn’t handling all the expenses, how do we decide who handles what? 50/50 seemed straightforward, and it’s worked well for us so far.

Does “so far” mean it could change in the future?

Helen: Maybe. Especially if we have kids. Right now, the plan is to get nannies so I can work. But if, for any reason, having kids reduces my earning power, we’ll have to revisit our 50/50 strategy to fit our new reality.

You mentioned personal savings. How much do you both have saved right now?

Francis: I don’t have savings. I still have a spending problem, and sometimes I run to my wife to borrow money till the month’s end. But to be fair, I mostly spend it buying gifts for her. She doesn’t ask, but gift-giving is what I do for people I care about.

There’s also black tax. I send ₦60k to my parents in a good month. Sometimes more. They’re old and always need one medicine or the other.

Helen: I have about ₦500k in my savings. It’d be more if this uncle regularly repays what he borrows with actual money rather than payments “in kind”.

I’m dying. It looks like saving comes easier to you

Helen: It does. Most of my interests aren’t capital-intensive. My idea of enjoyment is staying home alone and watching movies. Plus, there’s no black tax anywhere.

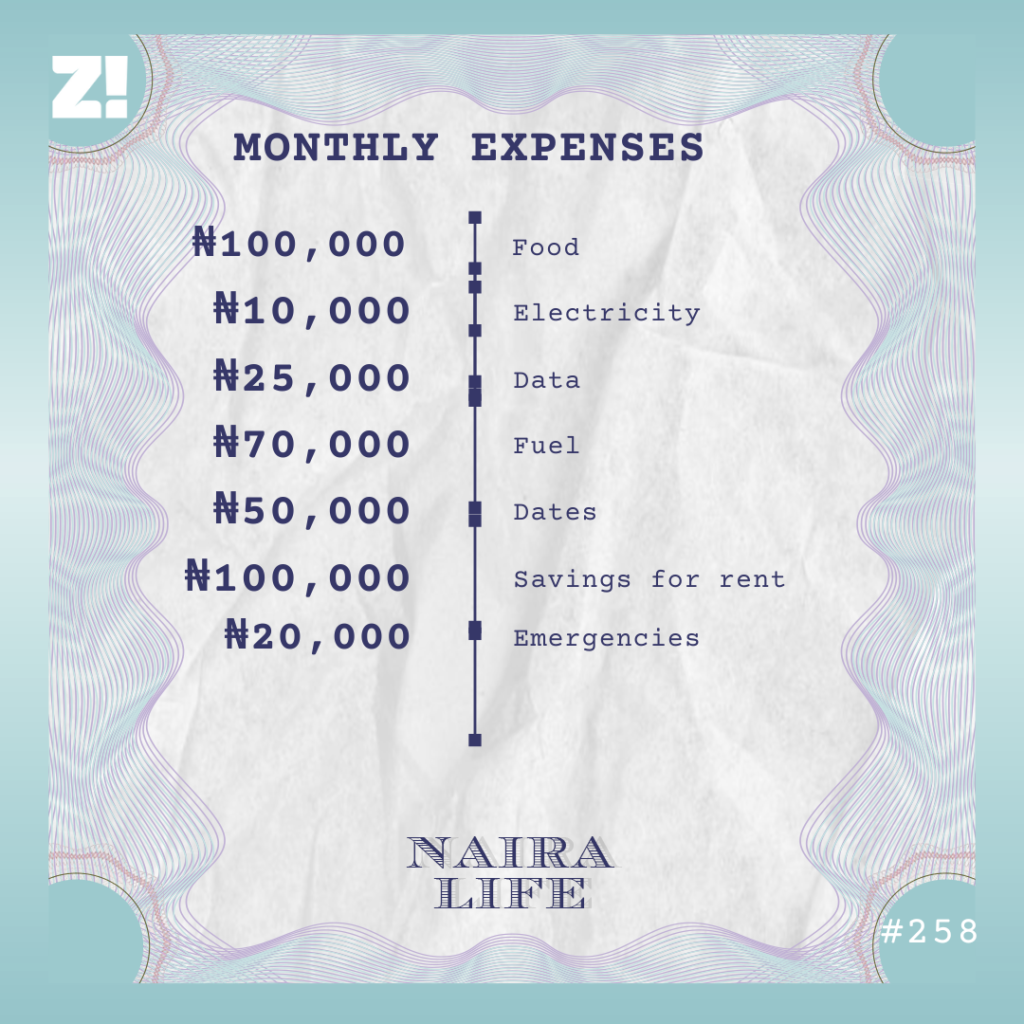

What do joint expenses in a typical month look like for you?

How would you describe each other’s relationship with money?

Helen: He has an “it’s for spending” mindset about money. I know it is for spending, but how you spend it also matters. I’ve tried to get him to use an expense tracker, but he says it’s too much work.

Francis: On the other hand, I think she needs to take money less seriously. Her scarcity mindset sometimes makes her forget that we aren’t doing too badly for ourselves.

How do you both reconcile these differences?

Helen: I went into our marriage expecting I’d be able to influence his spending behaviours directly. But that was a recipe for disaster. He thought I was nagging, and we had a bit of friction. But I’ve learned to leave him to it. He contributes his part to the home expenses, so I try not to overthink what he does with his money. I know his intentions are from a good place.

Francis: I jokingly call her the family accountant. I try to convince her to live a little, but her money habits don’t really hurt anyone, so we just take it a day at a time.

What’s something you wish you could be better at financially?

Francis: Investments. Saving doesn’t work for me because looking at the money is enough reason to spend it. But if it’s locked somewhere, I have no choice but to wait it out. I’m also wary of investments that will carry my money away, so I’m still carefully considering my options.

Helen: I’ll say investments too — specifically foreign investments. The way the naira is falling these days is enough to tell anyone that keeping money in naira won’t do any good.

Is there something you want, but can’t afford?

Helen: A house.

Francis: We have yet to make any concrete plans, but it’ll definitely be our next big project within the next five years.

How much do you think you should both be earning by then?

Helen: At least $1,500/month. I know several colleagues who work with international organisations, so that’s my next career goal. There’s a limit to how much a content strategist can make with Nigerian companies; I don’t want that to limit me. I’m focused on building a personal brand to pitch myself to my international startups.

Francis: Any amount in dollars is okay for me, really. The naira is terrible, and I feel like I could be earning ₦600k tomorrow, but my earning power would be the same as my current salary because of inflation. I plan to keep changing jobs till I get there.

How would you rate your financial happiness on a scale of 1-10?

Helen: 6. I’m doing okay, but I need to earn in dollars before I feel like I’m being adequately compensated for my work.

Francis: Also a 6. But my score is because I know I still have a long way to go to achieve financial discipline.

Editor’s note: Names have been changed for anonymity.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.