Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Kwakol Markets is a global broker that lets you trade multi-asset financial markets with ease. They aim to provide transparent and innovative technology that gives you a simple, secure and superior experience. Start trading with Kwakol Markets today and create the future you deserve.

Let’s start with your earliest memory of money

This story is funny now, but it wasn’t funny when it happened. A little backstory: My two siblings and I grew up very sheltered. We weren’t rich, but my parents were comfortable, so all we needed for school was available. We always took food to school, so we never got any money.

When I was in primary one and maybe five or six years old, another primary one class had to join mine (each class had two arms) because their pregnant teacher had an ante-natal appointment that day. When it was break time, I noticed a girl from the other class who’d sat beside me forgot ₦5 in my locker. I took the money and used it to buy puff-puff. I was eating it when I came face to face with other students who were looking for the money.

LOL. Caught in the act

They immediately knew I took the money because I never brought money to school. I didn’t even try to defend myself. I just promised to return the money the next day, even though I knew there was no way I’d get the money.

So what did you do?

For the rest of the week, the girl whose money I took made it a point to embarrass me every time she saw me. She’d hold me and be like, “Where’s my ₦5?”

It was crazy because the puff puff I got with the stolen money was long gone, but I was still suffering for it. I eventually took ₦5 from my mum’s purse without her knowledge to pay back my debt. I repaid that one in four folds with random money gifts I received when I was in primary three.

Two years later?

Yes. I’d read the Bible story of Zaccheus, how he paid back four times what he took from people. But my decision to return the money wasn’t only based on religion.

I’m talkative, and I’ve never liked being put in uncomfortable situations where I have to watch my words or actively prevent someone from knowing something. My mum didn’t notice the ₦5 that disappeared or the ₦20 that reappeared. But I felt free.

Tell me more about growing up with your parents

We lived in Abeokuta, which didn’t do much for my exposure. The first time I heard my mum speak English was when I visited the school she taught in. My dad was a police officer, but he’s retired now.

In 2013, when I was about to finish secondary school, my mum started a poultry farm with about a thousand chickens and paid me and my siblings ₦650 per month to clean the cages and feed the chickens.

Was that the first thing you did for money?

Yes. But she didn’t exactly give us the money. She kept it with her; the only way we got to spend it was if, for instance, we spoiled something. Like, “You broke the lantern; you’ll pay for it”. Then she’d subtract it from whatever amount we had with her.

Definitely a Nigerian mother

At some point, my siblings and I complained to relatives about it, and she gave us our money in cash. Mine was about ₦3k, but I thought better and asked her to keep it. I knew she’d definitely bring up how I collected the money and spent it, in the future, and it wasn’t worth it.

I stopped working on the farm when I got into the university to study law a few months later in 2014. The plan was to face my books; I wasn’t really entrepreneurial or money conscious, and my mum had specifically told me not to work in school. She said, “I worked in school, so you wouldn’t have to work.”

Aww. That’s sweet

I didn’t exactly follow the plan. At one point, I started helping my sister market a black soap she was producing. Each soap cost about ₦500, and she’d give me one for free from a pack of six. My mum had this ginger-honey drink she sold for ₦700/bottle, so I also marketed it for her in school. She didn’t pay me though, but if I wanted any for personal use, she’d give it to me.

My third year in school was when I actually made money. During the 2017 semester break, my uncle helped me get an internship at a law firm. They paid me a ₦10k stipend monthly, and I was there for two months.

Do you remember what you spent it on?

I took the first stipend to my parents because I heard that’s what people do with their first salary. They took ₦2k from it and gave me the rest.

The next job I got was in my final year. I was in church that day, dressed in a gown and heels, when a lady saw me and commented on how well I carried myself. She said she had a clothing line and asked if I could model for her. I agreed, and she paid me ₦10k per photoshoot. We had about 7-8 sessions that year. I stopped working with her when I went to law school in 2020.

I spent two years in law school because of the pandemic. We’d only spent about two months in school when we had to return home for the lockdown. It was during that period of uncertainty and plenty of free time that heartbreak led me to tech.

How so?

I still had feelings for my ex-boyfriend. Although we broke up in 2018, I hoped we’d get back together because we were still in touch. But around December 2020, I caught him in a web of unnecessary lies, and I asked myself, “Is this the person I’ve been wasting all my time on?”

I decided I needed something to get him out of my head, so I reached out to a friend and explained that I needed a hobby. They linked me to an online coding resource, and another friend added me to their YouTube family subscription so I could learn for free. That’s how I started learning front-end development.

What happened next?

In 2021, law school resumed, so I had to abandon it for a while because of exams. By the time graduation came, I had started applying to law firms for NYSC placements so I’d have a PPA by the time I was called up for service. I applied to several places, but most firms were maxed out on NYSC associates.

I started having some second thoughts about practising law. My university degree wasn’t efiko level, and I’d heard how difficult it was to get into top firms without good grades or nepotism. I eventually turned to my uncle, who referred me to a lawyer.

Finally

I wish. I got there to discover it wasn’t a law firm. While the person was a lawyer, the vacancy wasn’t at his law firm but a tech company he managed. I quickly improvised and told them I’m into tech as well and wouldn’t mind an internship with them. So they took me in.

The job involved implementing web pages and minor developer duties. I also got to practise the skills I learnt from code camp and participated in a Google mobile web developer program.

The internship was supposed to pay me ₦50k per month.

Supposed to?

They didn’t pay me one naira, and to think I signed an employment contract. I know better now, but at the time, I didn’t know how to speak up. I also felt they were doing me a favour by helping to build my skills. Plus, my parents were my safety net, and I stayed with an uncle at the time, so the only thing I had to worry about was the food I’d eat.

I did this for about four months till I went to NYSC orientation camp in September 2021. By the time I returned in October, they’d decided to put their tech operations to sleep. Since I was still technically tied to them for my NYSC year, they moved me to the law firm.

Back to lawyer things

First, I had a car accident in November that kept me away from work until January 2022. When I resumed, my stipend was reduced to ₦30k monthly because I now had NYSC’s ₦33k stipend. Even with the reduction, I didn’t see anything.

Did you ask this time?

My sister was on my case, so I summoned the courage to ask my boss one day. He brushed me off with a promise to pay. He eventually moved from not paying at all to paying once in two or three months. I was still recovering from my accident, so I couldn’t go through the stress of looking for another PPA.

Sounds tough

It was. I still had to do the typical stressful legal work: client interviews, court appearances and correspondence. I found it quite boring, so I continued with tech on the side. I heard about product management from a friend, and it made me realise I enjoyed reading about tech more than writing code. I applied to Side Hustle to get skills as a Product Manager and spent all my free time studying. I also applied and got into the Women Techsters Fellowship.

I was nearing the end of the fellowship in August 2022 when someone I’d worked with at the tech company reached out and offered me a Junior DevOps engineer role. I was also supposed to be his executive assistant, and he assured me I’d learn DevOps on the job. The pay was ₦100k per month.

Sweet

It was tempting, considering I was coming from a place where I got paid on and off. But I was also looking forward to a three-month product management internship slot from the Techsters fellowship. Slots were reserved for best-performing students, and I took it seriously because I knew it’d help me kickstart my product management career. I was also a bit sceptical about taking a full-on engineering position when I didn’t like coding.

I completed my NYSC year within the next few weeks and accepted the offer. But I explained to them that I was in a product management fellowship and hoped to combine my role with the internship when the time came. They accepted.

What was it like going from almost no income to ₦100k per month?

I was on the road when I received the first alert, and it felt good to not have anxiety about whether I’d get a salary. My spending habits didn’t change much — my dad still supported me from time to time, especially when I had to get an apartment closer to work.

But the wahala started when the fellowship offered me an internship in March 2023. My bosses started having issues with the idea of me doing the internship at the same time. They were also about to increase my salary to ₦200k because my work had extended to operations and administration. They’d even sent me a salary review confirmation letter. But I really wanted product management, so I left for the internship.

How did it go?

It turned out to be a mistake. I was entitled to about $500 monthly, but we never got paid for the almost three months we spent there.

Again?

At the end of the first month, they claimed that the delay would only last two weeks. Later, it turned into months. By the time the third month came, the other interns and I realised nothing was coming, so we seized the NFT projects we were working on for a hackathon and didn’t come back. This was in June 2023.

Here for the violence. So what did you do next?

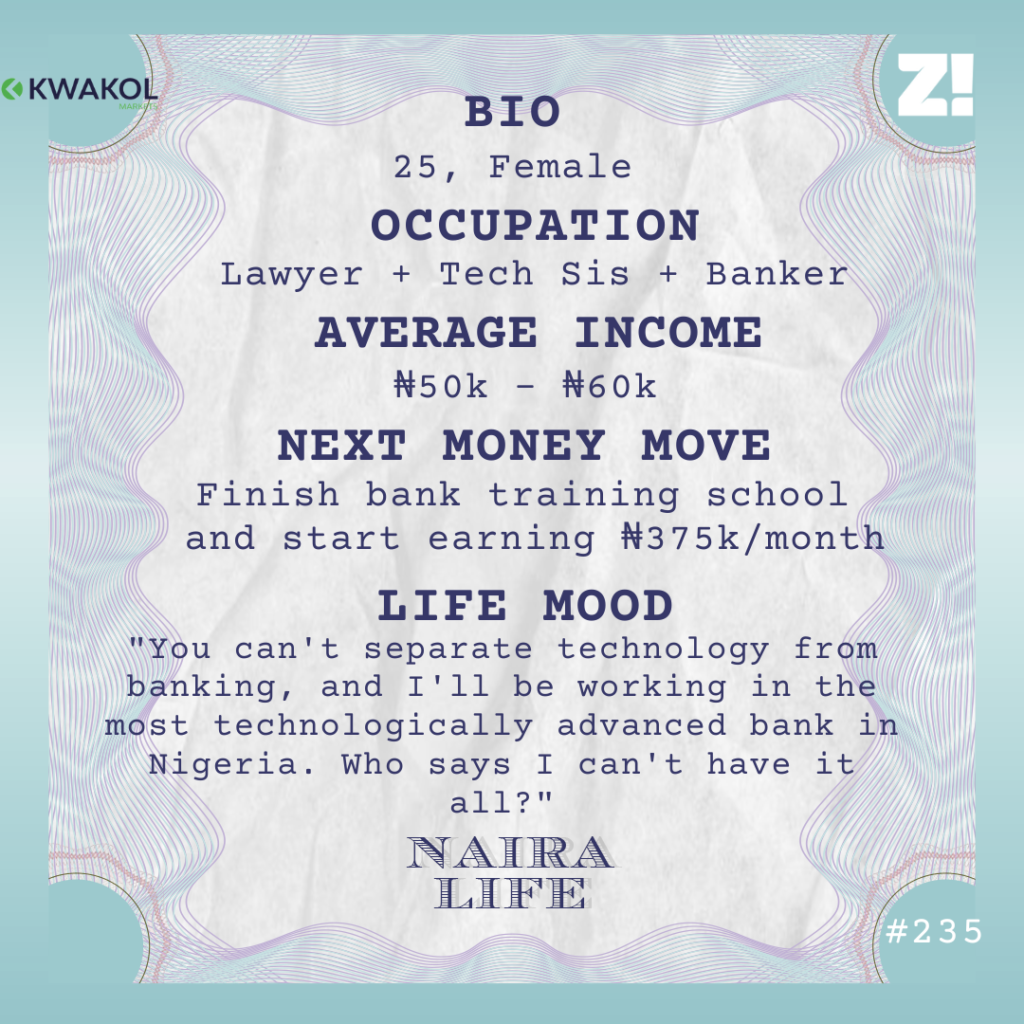

I’ve been a registered Corporate Affairs Commission (CAC) agent since 2021, so I make some money helping people with corporation filings and things like that. That fetches me about ₦50-60k, but it only comes once in a month or two.

Just recently, I briefly took up a sales job because I needed money. That didn’t last because they paid ₦40k and expected me to convert 200 vendors weekly. I only survived a month.

What’s next for your career?

I got an executive trainee job at a bank a few days ago.

I applied in March and didn’t think anything would come out of it. But they invited me for a series of tests and interviews, which I passed. I applied for a product management role, so I guess we’ll see what happens after bank training school.

What’s the intended pay?

₦375k monthly. I can’t wait.

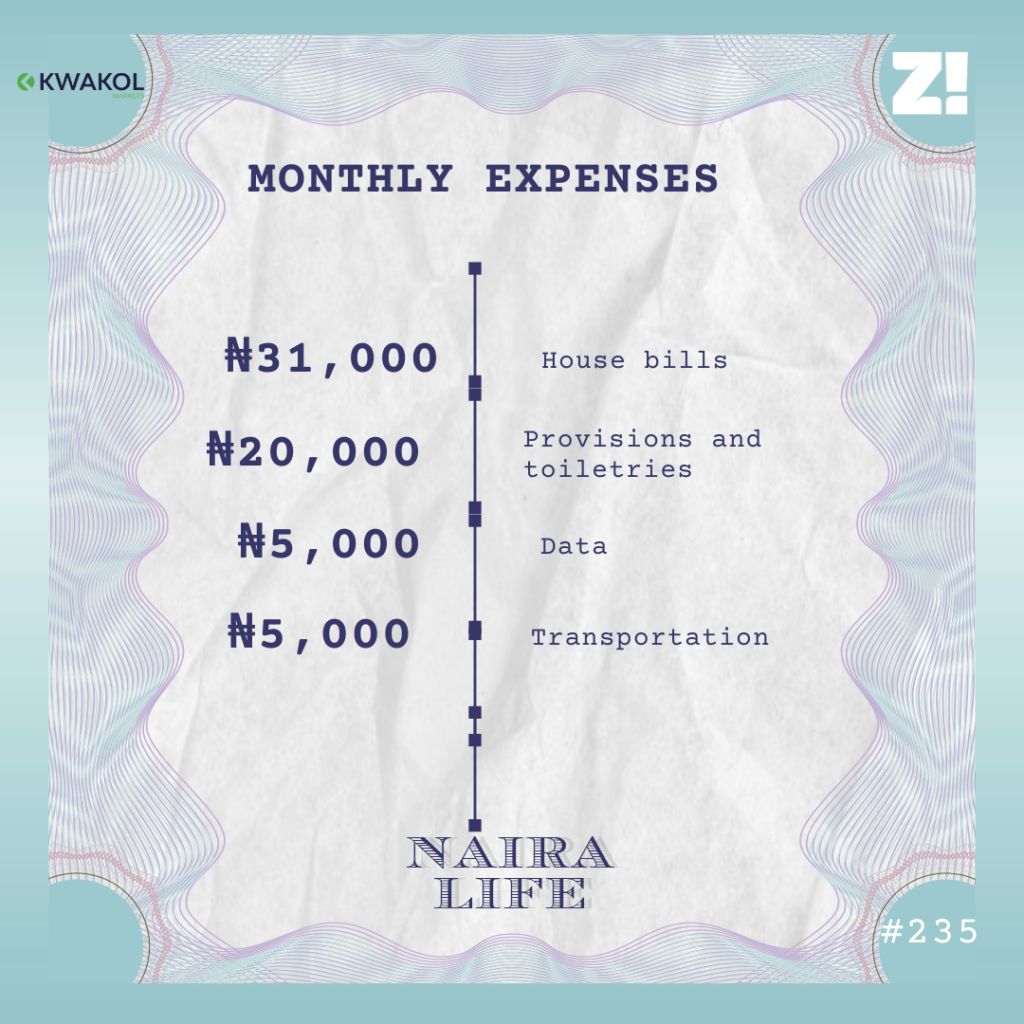

Exciting. But how much do you typically spend in a month now?

My transport costs will likely increase to about ₦20k when I start this new job. It’s quite far from my apartment. My dad is also retired now, so I plan to budget ₦25k monthly for black tax (my parents and younger brother).

Do you think you’ll return to tech proper?

Right now, I just want an opportunity to really learn how things are done at structured organisations, build my career, grow my network and upscale, even if it’s in banking. You can’t separate technology from banking, and I’ll be working in the most technologically advanced bank in Nigeria. Who says I can’t have it all?

Is there something you want right now but can’t afford?

I have a couple of certifications on my wishlist, which will cost around $600 in total. I also want a bigger apartment because whenever I have friends, they have to sit on my bed. I’m not a big fan of it.

What’s something you bought recently that you didn’t plan for?

Omo, I entered the market yesterday and got a couple of stuff for my siblings and some work outfits too. It wasn’t until I got home that I realised I’d spent roughly ₦50k at a go. My account balance reads ₦6k at the moment.

Where would you put your financial happiness on a scale of 1-10?

Ask me when I receive my new salary next month because right now, it’s at zero.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.