Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What was the first money conversation you both had?

Michelle: Shortly after we started dating in October 2021, I took ₦14k out of the ₦60k I had saved up to replace my phone to buy him a surprise gift for his coming birthday. He knew I was saving for a phone and would have objected to my plan. Honestly, it wasn’t exactly a conversation. I used my strong head to decide on my own.

LOL. What was the surprise?

Michelle: I wanted to send him a pair of sneakers since we’re quite a distance apart. He lives in Aba, while I live in Keffi. But I had issues finding vendors, so I told him to find me one.

JC: I found a vendor, and she paid for it. That was the first birthday gift I ever received from anyone.

That’s sweet. You guys were long-distance right from the start?

Michelle: Yes. We met on a mutual friend’s Facebook group. JC and I were both admins of the group, and we progressed from exchanging banter on the timeline to talking every day. We’ve been talking every day since.

What’s navigating a long-distance relationship like?

JC: To anyone reading this: Don’t do it. Sometimes you just want to be with your person, but they’re several miles away. We have to rely on video calls, emails and virtual dates to keep the romance going. It’s tough.

Michelle: We’ve only seen each other physically twice since we started dating. The last time was in 2023. I visited, and we stayed together for about two months before I returned home to Nasarawa.

Who pays for these trips?

JC: We both do. When she visited for the first time in 2022, I was running a part-time university program which was taking the little money I had. We were both terribly broke, but she insisted on coming. She’s really the type to sacrifice everything she has — or doesn’t have — for me. So, we just ended up gathering what we had to cover the roughly ₦30k travel cost.

What about dates during these physical visits? Do you both pay for it too?

Michelle: We always have big plans about where to go when I visit. But we’re both introverted, so we end up not going anywhere. Plus, we hardly see each other, so spending all the available time together makes sense.

JC: Most of the time, we cook and have indoor dates. I’m the host, so I take up the cost for those. But we make up for our few dates by celebrating our anniversary every month.

How does that work?

Michelle: Sometimes, we exchange love letters and emails. At other times, we do virtual dates. We choose a meal and cook it on both our ends. Then we do a video call and chat about the past month. He once published a chapbook of 30 poems and dedicated it to me. It was so romantic. We’re just spontaneous like that.

I’m curious. Is it work keeping you both in your respective cities?

JC: Kinda. I moved here in 2017 to work as a graphic designer at a pharmaceutical company, but I quit in September 2023 because I kept getting owed salaries — which was just ₦50k/month. When they didn’t owe me, they’d deduct up to half of it for flimsy reasons.

I now offer freelance graphic and web design plus writing services. I have two consistent clients and a few occasional ones, bringing an average of ₦180k – ₦350k in a good month.

It’s not my first time in Aba, though. I first moved here when I was 10 years old. My family was forced to leave Kano in 2001— run is the correct word here — because of increased religious violence that became widespread following the infamous Reinhard Bonnke-Kano crisis of 1991. I’d experienced violent riots before and even lost friends to them, but I think another one happened in 2001, and my pastor dad decided enough was enough.

Oh my. What was it like starting afresh?

JC: Quite traumatic. We left with no properties and stayed in our family house in the village for seven months to figure things out. Fortunately, my mum worked in NIPOST, so she resumed work after her formal transfer request to a city nearby was approved. My dad also got transferred to a branch of the church there. We soon became financially stable and got our own place.

I’m glad there was a happy ending. How about you, Michelle?

Michelle: I’m a freelance writer, but I’ve been living in Nasarawa since 2016. Actually, let me start from the top. I lost my dad at five years old, and this affected the family’s finances. My mum was going to hold it down, though. She was a big-time seamstress in Lagos and had a huge foodstuff store, but she died nine months after my dad.

I’m terribly sorry to hear that

Michelle: Thank you. After her death, my siblings and I were passed around different relatives’ homes till I travelled to Zaria to write post-UTME in 2016.

It turned out that I had the wrong information and had travelled far ahead of the exam. So, I decided to stay with my elder brother who lived in Nasarawa with a relative in the meantime.

My brother had a sickle cell crisis shortly after I arrived, and I picked up a ₦6k/month restaurant waitressing job so I could care for him. I didn’t even write the post-UTME because the university eventually used JAMB and WAEC grades to decide the cut-off aggregate.

When I got the admission, I couldn’t go because I’d used all my money to take care of my brother. I tried JAMB again a couple of times, but my brother’s health problems always came up, and I’d have to pause the process. He eventually passed away in 2018.

Damn. I’m so sorry

Michelle: I should’ve given an “emotional story ahead” warning. After his death, I did several things for money. I was once a sales girl for ₦5k/month, then I worked at a cyber cafe serving chicken and chips. I learnt how to use a computer there. Then I had stints as a receptionist, admin officer and front desk officer. My town is pretty underdeveloped, so there’s nothing here.

I got my first real job in 2019. I started working as a secretary/paralegal in a law firm for ₦10k/month. In 2021, I moved to another law firm in Abuja for ₦30k/month in the same role. It was the same year I discovered I could get paid to write, and I started getting small gigs writing guides for a software product blog. That brought in an average of ₦100k extra monthly.

In December 2022, I took a risk and quit my law firm job to start my freelance business when the stress of moving from Nasarawa to Abuja every week became too much. I’ve worked freelance since.

How has that been?

Michelle: Really tough. I feel like I should’ve found my footing in the freelancing world before I left my 9-5. Right now, I’d say my income is zero. I haven’t had a constant gig in about seven months.

You’re both freelancers with somewhat unstable incomes. How do you manage bad financial periods?

Michelle: We don’t have bad financial periods at the same time, so we come through for each other. There’s no month that goes by that we don’t send each other money. I haven’t had a steady income in a while, but whenever I get anything from favours or random gigs, I send a token with a narration like, “I’m grateful that I’m able to love you with my money”. I get a sense of fulfilment from it.

Is there an average amount for this per month?

JC: No month is the same, really. It depends on how the month goes. I don’t even keep records. However, our bank did something like a 2023 summary of who you send money to the most, and we were each other’s.

Love to see it

Michelle: JC, I’ve been thinking we need to budget an amount every month for each other. Of course, we can go higher or lower depending on how much money comes in that month. But it’d also help us keep our expenses in check.

JC: Sounds good to me.

What does the future look like for you both? Say, the next five years?

Michelle & JC: Oh, we’ll definitely be married.

Michelle: I feel like our financial future is bright. I want to get into data analysis, and I’m currently taking Udemy courses. So, in the next five years, I should be working remotely full-time and contributing more to our finances. We’d have upped our game financially by that time.

Have you both thought about how money will work in your home? How will the bills be managed?

JC: We haven’t discussed this, but sharing responsibilities, depending on who has money at the time, has always worked for us, so we may continue that way.

Michelle: There will definitely be more structure to how we plan our expenses. Like if we’ll need to save for our kids, or how much goes into taking care of the home. I think the major change will be creating a joint account. I’m the lavish spender in the relationship — I mostly spend on gifts — and a joint account will help keep my spending in check. We actually tried to open a joint account in 2023, but it didn’t work because JC had BVN issues.

Psst! Have you seen our Valentine Special yet? We brought back three couples – one now with kids, one now married and the last, still best friends – to share how their relationships have evolved in the last five years. Watch the first episode below:

How was the joint account supposed to work?

Michelle: The plan was to send whatever we made there, and the goal was to use it to monitor our spending. He was still working his 9-5, and transportation was taking a huge chunk of his money, which bothered him. He wanted to clearly track how the money was spent. Plus, I mentioned I tend to overspend, so we thought it’d be better if he was the only signatory to the account. That way, I’d think twice before asking for money to buy something unimportant.

JC: So before anyone withdrew money, we’d have to discuss and agree on why that particular expense is necessary. Unfortunately, it didn’t work, but it’s still something we intend to do when we get married so we can use it to handle bills together.

When you eventually do, would it still be a “send everything to the account” arrangement?

Michelle: I think it’ll depend ultimately on our earning power. For instance, if this person earns more, they contribute more and vice versa.

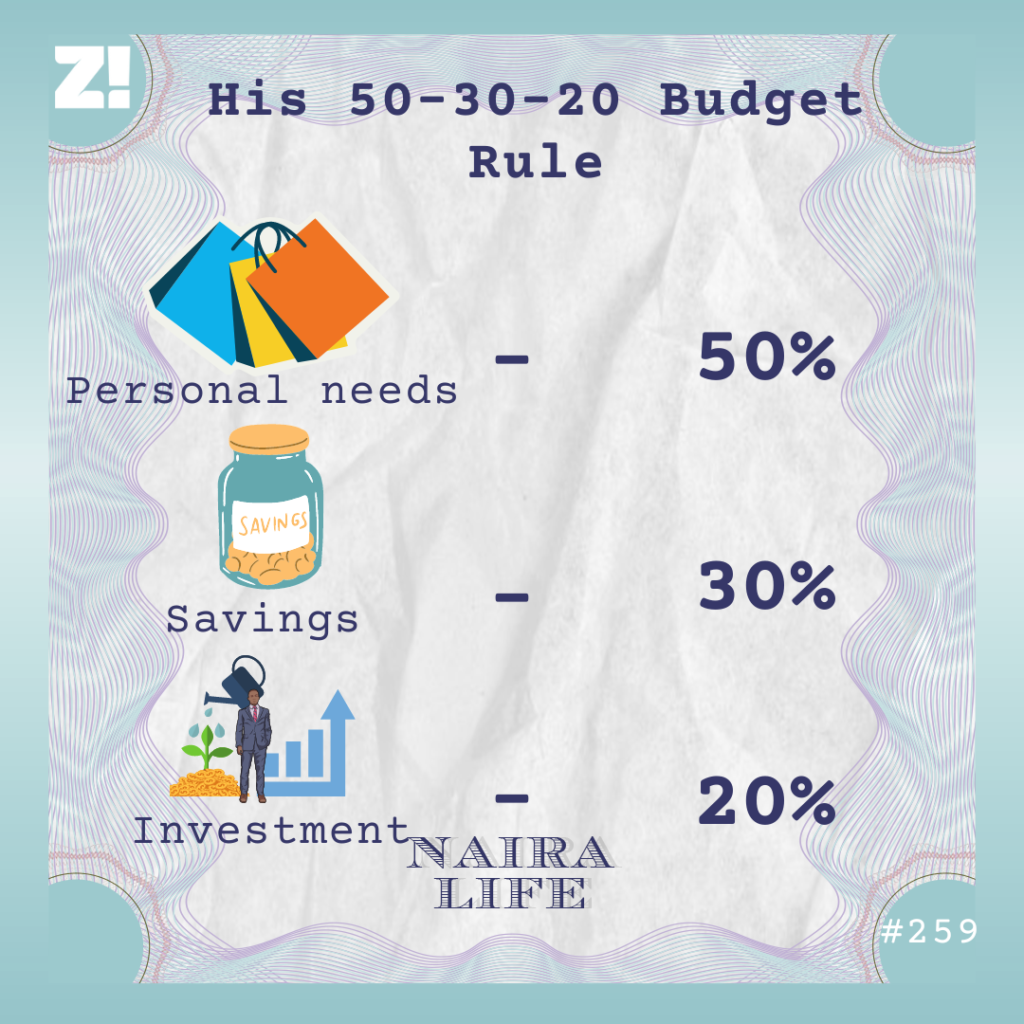

JC: Also, I started learning about finance intelligence in September 2023 from one of the companies I freelance for. It’s the 50-30-20 method, where you spend 50% of your income on personal needs, 30% on savings and 20% on investment. I’ve been trying the savings and investment bit with a savings app, and I think it’s a good blueprint for how we’ll likely plan our joint expenses when the time comes.

How would you describe each other’s relationship with money?

JC: She already confessed hers. She’s a lavish spender. It’s not that she spends on herself; she’s just generous to a fault. She always goes out of her way to do things for people who don’t even value her.

Michelle: Because the Scriptures say don’t pay evil for evil!

I’m dying

JC: She’s very accountable, though. She keeps track of every expense and shares them, no matter how excessive it is. I struggle with that degree of attention to detail, and I really admire that in her.

Michelle: JC thinks twice before spending money. He evaluates everything; Is this important right now? Can we get a cheaper alternative? I’m not like that. Once a need arises and there’s money, I spend it on the spot before thinking of how I could have gone at it in a better way.

Have these differences ever caused a fight, though?

Michelle: Ironically, we had a slight disagreement about money earlier today.

Do share

Michelle: You know how I mentioned I haven’t really had an income for a while? Well, I still get random money from my friends and siblings occasionally. As a Christian, I’m quite big on tithing. I’ve tithed since I was a child.

So, recently someone sent me ₦20k, and JC knew about it. The plan was for me to take some time away from home and travel to spend some time with my big sister in Abuja. But this past Sunday, I used most of it to pay tithe — I accumulate my tithe and pay when it’s gotten to a tangible amount — and announced to him today that I no longer had money to travel. He was like, “I thought it’s money you earn you pay tithe with, and not money you’re given?”

Haha. I see his point

Michelle: It wasn’t a big issue, though. We talked through it, and he understood why I did it. I’ve tithed for years. It’s not just something I can just stop.

We’re gradually embracing the fact that we’re different people. So even though we don’t always have the same attitudes to money, we know to talk through the faults we notice and accept that our differences complement us.

Do you both plan to shorten the distance between you soon?

JC: We plan to move together to a new state in the second half of 2024.

Have you thought about how much it’d cost?

JC: With how the Nigerian economy is going, it’s difficult to be decisive on a budget. But we started a joint savings plan on a savings app this January so we can have something saved up when we’re ready. We didn’t set a specific amount to save monthly, though.

Michelle: He has a more stable income and will probably move first to prepare for me to join him at the end of the year. Hopefully, my income will be better by then too. But we have to bridge the gap somehow this year. We both can’t deal with the distance again. This year is our year.

Amen to that. How would you rate your financial happiness on a scale of 1-10?

Michelle: 2. And that is me being kind to myself. It should be below zero. Not having an income in this economy is crazy.

JC: 5. My finances improved this year, which I’m grateful for. I’m looking to lock in two more consistent clients soon, and that could increase my income significantly. The future is bright.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.