Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

My dad started giving me a ₦1k monthly allowance when I got into secondary school. It was big money for a JSS 1 student, and I didn’t know how to handle it. So, I’d spend it all on snacks within three days. After I was down to zero, I’d beg my mum to give me ₦100 every other day for snacks.

My parents quickly realised I had a poor spending habit and tried to curtail it. My mum gave me a book about money to learn the importance of saving. There were also lessons about saving and how negative spending habits can affect one’s life. None of it worked, and I was still spending anyhow.

What was growing up like financially?

We were comfortably middle-class. My dad was a marketing manager and also owned a school my mum managed as the proprietress. We owned and lived in a duplex, which was the finest in our neighbourhood. I thought we were rich until my dad took me and my older siblings to a posh Lagos neighbourhood one Saturday, and I saw better-looking houses. I remember thinking, “It’s as if we’re not as rich as I thought.”

It became like a weekly tradition, where my dad would take us to Lagos to see impressive things, widen our perspective of the world, and aspire to greater things. I quickly understood that “money pass money.”

Fast forward to 2013, I moved to a different town for a ten-month-long Cambridge A’levels program. I was 15, and the A’levels was my dad’s idea. I had finished secondary school but was denied admission to the university because I wasn’t 16 yet, and my dad didn’t want me to just sit at home.

It was during this program I made money for the first time, but it was out of necessity.

How did it happen?

My parents regularly sent me more than enough money to provide for myself, but I always spent everything in five days. I knew I couldn’t call home for money barely a week in, so I started selling recharge cards. I’d ask friends to send me credit, and when they did, I’d sell it in the hostel at a cheaper rate. For instance, I sold ₦100 credit for ₦90.

I stopped this business when I got into uni the following year. But my terrible spending habits became worse.

Tell me about it

There was a classmate whom I admired. Her shoes, dressing and make-up were always on point, and I decided I wanted to look like that, too. Once I collected my ₦20k monthly allowance, I’d use all the money to buy beauty products and fashion accessories.

When I inevitably got broke, I’d resell everything I bought to other students. There was one time I was so hungry that I convinced someone that the rope of my bag was a belt and sold it for ₦1k.

When I had nothing to sell, I’d take on typing gigs. I’m a really fast typer because I had access to computers quite early due to my parents’ school. So, I put the word out, and people would come with their laptops so I could type assignments and projects for them. I didn’t have a standard price; I just found out whatever business centres in school charged, and charged a lower price.

How long did you do this for?

About a year. In 200 level, a friend who sold pastries in school was looking for someone to handle his social media. I had no clue about social media management, but I’m not one to say I can’t do something. I told him I could do it, and he employed me. He paid ₦6k/month, and as usual, I’d blow all the money once he paid.

Four months into the job, he delayed my salary by a week, and I was on his neck for my money every day. He got pissed and was like, “We’re also friends. Can’t you just give me some grace this one time?” But I had no grace to give because I was broke and hungry. He eventually paid me, but that event ended our work arrangement.

I wasn’t unemployed for long. I started pitching other brands, and through the help of some friends, I got another social media management gig for a yoghurt company. The job paid ₦10k/month. Between that time and when I graduated from uni in 2018, I did one social media gig or the other to augment the allowance I got from home.

What happened after graduation?

NYSC. My PPA, a government agency, paid ₦5k/month in addition to the ₦19,800 monthly stipend from NYSC. My parents’ house was only a few hours away from where I served, so I didn’t have to rent an apartment.

I’m the last-born, so I also got ₦2k here and there from my mum and siblings for transportation.

I had no responsibilities, so when allawee dropped, I’d take all my friends to chop life at malls and restaurants. I now realise they never spent their money on these outings. When I wasn’t spending on them, I’d take myself out to eat and have fun. I knew I’d be broke in a week anyway, so why not enjoy myself?

This continued until I finished my service year in 2019. Afterwards, I returned to school almost immediately for my Master’s degree. I didn’t have an allowance this time because my dad had retired, so what I got from home was usually a combination of whatever my siblings gathered for me.

Were you doing anything else for money?

I didn’t do anything till 2020, when we were sent home due to the COVID pandemic. I was supposed to graduate during that period, but the lockdown put a pause on things. While at home, I started taking surveys and tasks online so I wouldn’t have to ask my parents for money constantly. It was a waste of time.

Why?

I could take 30-50 surveys and only earn $1. Plus, the minimum withdrawable balance was $10. I also needed PayPal, which I couldn’t access, so I just dumped it. Then, a friend introduced me to a news hub where I could submit stories to a portal, and if they published it, I’d earn money per page view or click.

So, I registered on the hub and started writing. It was self-paced; I could write as many articles as I wanted daily. The first payment I got after the first couple of weeks was ₦800, but I was excited. I was doing something that was bringing money. The following month, I got ₦6k. Subsequently, some of my articles went viral, and I got special recognition and an additional ₦20k. On average, I was making ₦20k/month from writing.

After about four months, I started having issues with the news hub. The process was entirely computer-based since we had to submit the articles via a portal. Sometimes, the system would malfunction and say your article isn’t original, then reject it.

It was really annoying because I put a lot of effort into my pieces. So, I stopped the gigs and decided to take LinkedIn seriously. I started reaching out to several people to position myself as someone who had something to offer them.

How did this go?

I became friends with a tech CEO, and we started talking about managing products. I didn’t have the experience, but I approached the conversation like someone who already had an interest and was learning about the field. That’s how I got a job at his startup as a product manager and social media manager in August 2020. My salary was ₦70k/month, an impressive jump from my previous income.

I worked at the startup for a year until I had issues with my boss. I forgot to complete a task, and she kept berating me, so I changed it for her. I shouldn’t have done that, and I apologised, but she also used the opportunity to express her annoyance at the fact that I called her by name. Mind you, everyone at the office called each other by name. It was messy, and I lost the job.

That’s tough. What did you do next?

That was my official entry into freelancing. I started pitching myself to brands and got social media management gigs. The first one was a ₦50k/month social media gig. Then, I got another ₦40k/month gig after a while.

In 2021, a virtual assistant friend opened my eyes to foreign currency-paying gigs. She sent me a screenshot of her payment partner app, which had $300 in it. I was shocked. I tried to get her to share her pitch template, but most people want to keep their secrets. She told me to just keep pitching people, and I could get lucky.

And did you get lucky?

Not at first. I was determined to also make foreign currency, so I went on Facebook and started messaging foreigners. That’s how I fell into the hands of scammers. They did a proper interview with me via Discord and said they’d pay me $1k/month. I was so happy. I even knelt to thank God that my life had changed. Only for us to do a video call, and I saw a shirtless Nigerian man on the street laughing at me. I feel like he didn’t even try to take money from me because I wasn’t his target audience, so I was just a comedy relief. Omo, I was frustrated.

But I didn’t stop pitching people. It was tough because when most of them heard “Nigerian”, they weren’t interested anymore. I moved to Instagram and started targetting businesses until I finally landed a social media management/virtual assistant gig with a UK business at the end of 2021.

How much did it pay?

$10 per hour — they paid in dollars, even though they were in the UK. At first, there wasn’t much for me to do, and I averaged $18/month in the first two months. I was quite fast with tasks and didn’t even know some people deliberately delayed tasks to get more hourly pay. I couldn’t even do that. It’s not me.

But I wanted to make more money, so I kept pitching my social media skills to my boss. I noticed she also did email marketing, and even though I wasn’t skilled in it, I kept telling her I could do it. In the end, she gradually gave me more tasks, and my income increased to $200/month.

The increase gave me the confidence to pitch to other prospective clients, and I got another virtual assistant gig with a US company. This one paid $500/month, and after converting to naira, my income was about ₦600k/month from the two gigs. I also had other on-and-off gigs. I made over ₦5m in total in 2022.

What did this mean for your financial habits?

I was still living from hand to mouth. Once I got paid, I’d take myself to Chinese restaurants or whatever tickled my fancy that month and eat all the food I could. My parents knew how much I was earning and were rightfully worried that I had nothing to show for it.

My parents tried to counsel me several times, but nothing changed. It’s not like I didn’t want to change; I even prayed for God to help me make better money decisions, but it was like immediately I saw money, I wouldn’t have peace until I spent it all.

In mid-2022, my uni called us back, and I did my master’s exams and finally graduated the following year. I also got married in 2022, and my husband noticed my terrible spending habits too. He also tried to encourage me to save and be better, but nothing he said moved me until February 2023, when he finally got through to me.

How did he get through to you?

He drew lines on our house’s wall and said, “This is where you are. When you make money, you go to this upper level, but when you blow it all, you come back to this lower level”. It was a simple diagram, but it was such a clear description of retrogression — something that most Africans reject strongly, and it struck me deeply.

It’s like I fully realised that I’ve been living a life without progress, and it scared me. This fear has helped to change my habits. My savings culture is even extreme now. I save 80% of my income. Sometimes, I only remove ₦5k and 20% tithe from whatever I make monthly and save the rest.

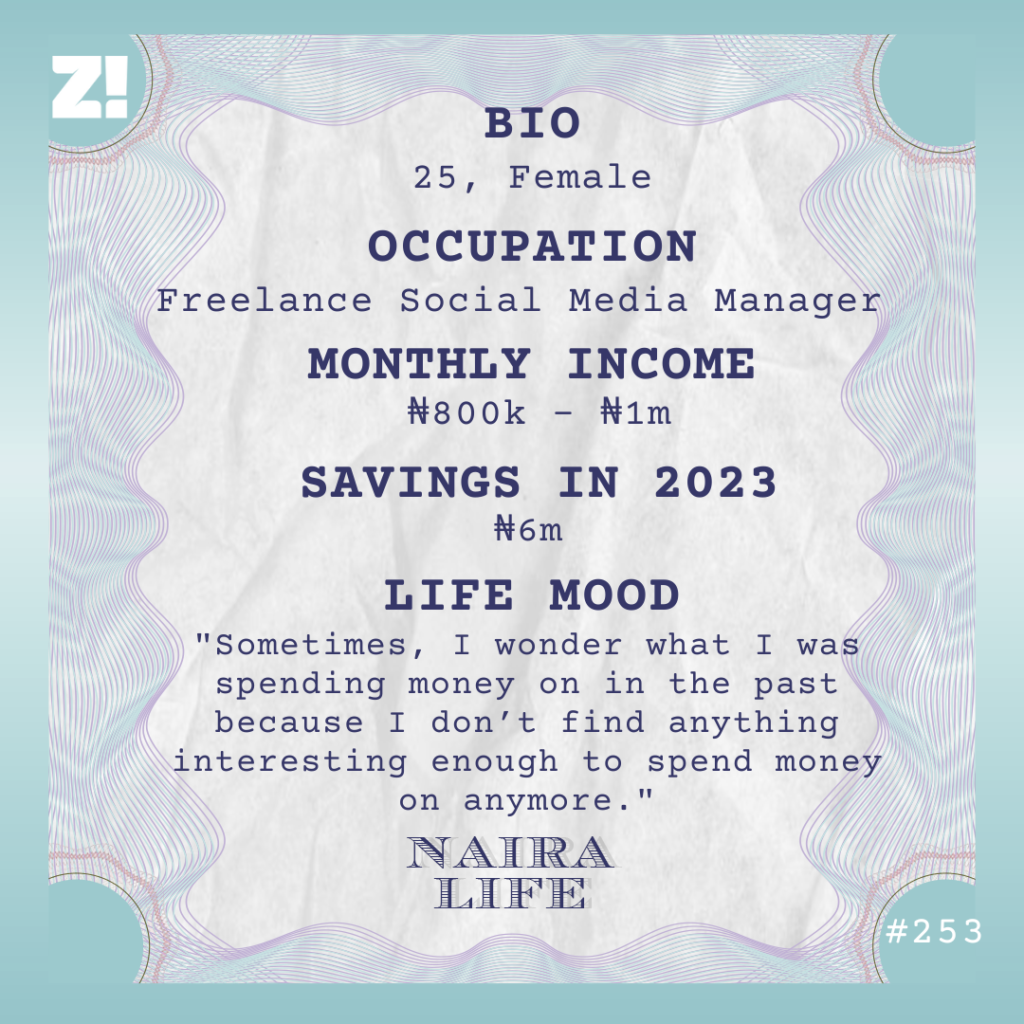

How much do you make in an average month now?

Between ₦800k – ₦1m from freelance social media marketing and web content management gigs with foreign companies. I currently have four retainer clients, and I’ve worked with three of them for over a year. Pitching is my major freelancing model, and it makes sure I’m never without at least one client.

When I take on too much work, I outsource social media management gigs to people with the client’s approval. So, most of the time, I still have a lot of free time because I’ve delegated certain tasks. I don’t hire on a retainer basis, and I typically pay ₦25k-₦50k per month depending on the length of the task, and how much work they need to do at the time.

What’s something that overcoming a spending problem has taught you?

Don’t waste your time trying to change people’s money habits. You don’t know exactly what’ll make them change. Maybe just pray for them from a distance. Looking back now, I feel bad that I caused my parents so much pain. They fasted and prayed, thinking it was a spiritual problem, but I just needed to be faced with the fear of retrogression to have a mindset change.

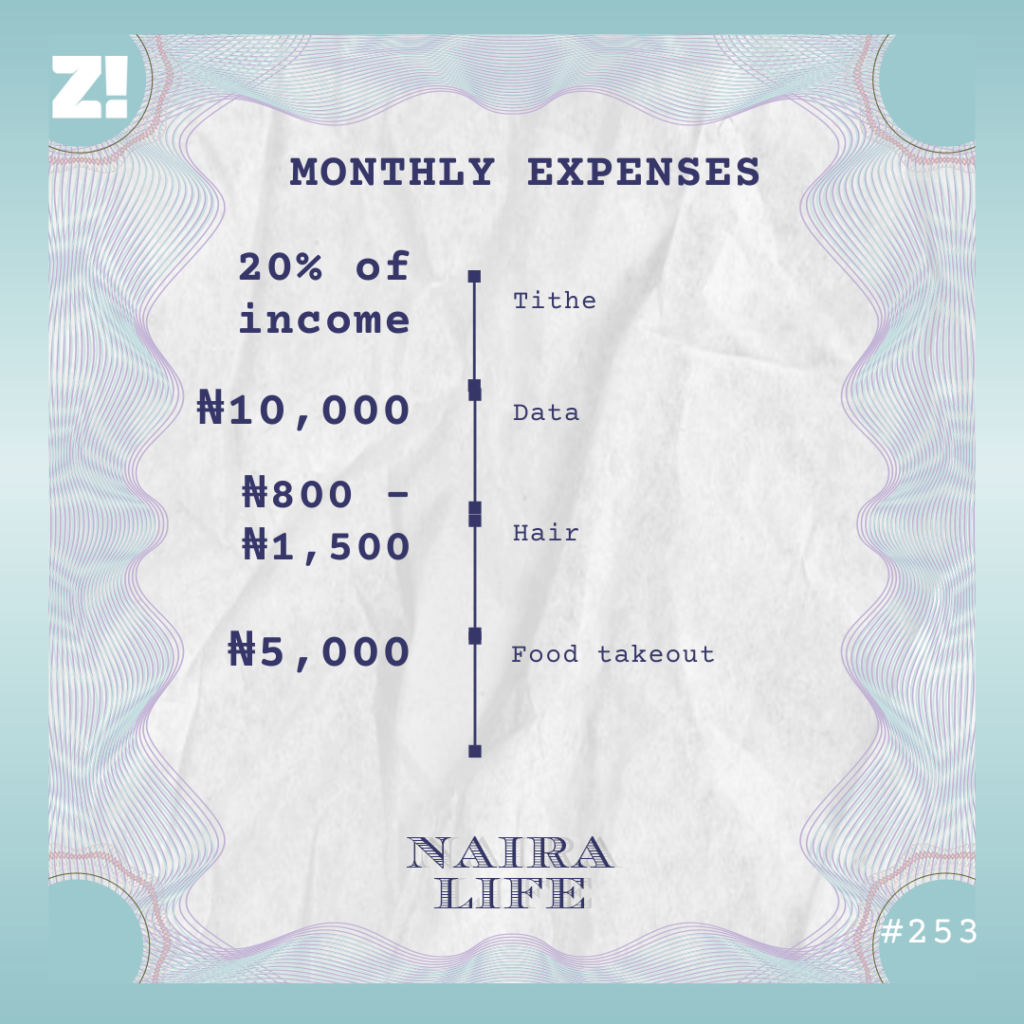

Let’s talk about your monthly expenses. How does that work?

I hardly spend money now. There’s no recurring personal expense except the ₦10k I spend on data, and it’s this low because I also use my husband’s data or the home MiFi. I’m on low-cut, so I only pay to trim my hair occasionally. The take-out expense is once in a blue moon. My parents are pastors too, so I pay my tithe to God through them or by helping someone in need.

Sometimes, I wonder what I was spending money on in the past because I don’t find anything interesting enough to spend money on anymore. I prefer to just save everything.

How much do you have saved up now?

I saved over ₦6m between February and December 2023. Past tense because something personal came up, and I just had to clear my savings to settle it. I’m back to saving from scratch, but I hope to take it a notch higher in 2024.

My short-term savings goal is japa. I finally have my Master’s degree, so I can start planning whenever I want.

Is there any other thing you wish you could be better at financially?

I’m already working on this, but I give too freely to people. Multiple times, I’ve given and loaned people money, but they either never paid back or ignored me when I was in need. I’ve encountered people who hid their own money but kept collecting from me. I need to be more disciplined — wicked even — so I know when to say no to certain people.

How would you rate your financial happiness on a scale of 1 – 10?

9. I’m happy with all God has helped me accomplish. I’m charging my worth and finally getting the hang of my finances. 2024 is looking very promising. God is good.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.