Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your earliest memory of money?

My dad left our family — my mum and younger sibling — when I was 11, and I remember a lot of anger on my mum’s part. Figuring out how to provide for us on her civil servant’s salary was a lot for her. Even when my dad was around, he wasn’t the provider. So, there was no love and money at home, and she took the frustrations out on me and my sibling. There was one time she just came home and slapped me for no reason after I opened the door for her.

Ah

It was a toxic environment. There was a period where she called me an idiot almost every day without cause. Whenever a visitor was around, she’d make sure to publicly humiliate and insult me or find something to accuse me of. She barely talked to me unless she wanted to give me a chore.

Escaping her became part of my prayer points. It’s why I started hustling for money the moment I entered the university in 2008. My allowance was ₦2,500/week, but I wanted to reduce my dependence on my mum, so I set up a phone call business.

How does one set up a phone call business?

I just needed my phone and airtime. I charged ₦20 for calls between one second and one minute. The price doubled based on how long the call went, and I used what I made to buy airtime. Combining business with school was tough for profitability because I only had time to work in the evenings. I realised I wasn’t making anything after some weeks, so I stopped.

Between 2008 and 2011, I did a few other things for money. My major gig was writing exams for GCE and WAEC students.

Tell me more

Tutorial centres wanted their students to pass, so they’d arrange with the parents and invigilators to get people like me to impersonate the student in the exam hall. I was usually paid ₦30k for four major subjects. I regularly got those gigs during exam season.

When I wasn’t writing exams, I was gambling with the little money I had. The only thing on my mind was making money, and sports betting brought me hope that I could make it big one day. I didn’t make it big; in fact, I lost more money than I won. I eventually made my first million, but it wasn’t from gambling.

How did it happen?

I was a fan of “Who Wants to Be a Millionaire” and tried to get on the show three times before I got in. There was a code you had to send to a number in order to get invited, and they invited me after I did it the third time. This was in 2011, and I was in my final year.

I went on the show and walked away with ₦1m, though I didn’t get the money till 2012. They taped the shows months in advance, and winners got paid only after the show aired. I got ₦900k because there was a 10% tax deduction.

When I got the money, I stopped going home and cut off my mum. I was finally independent and didn’t need to endure the toxicity. Plus, she saw me on the show and started billing me. I didn’t want that.

What did you spend the money on then?

I decided to set up a business centre on campus. But first, I wanted to multiply the money. So, I turned to sports betting again. In my mind, I only needed to reduce the risk by reducing the number of bets I made on a single ticket.

This is how sports betting works: You can have several bets on a single ticket to increase the value of your possible winnings. But the challenge with that is, you have a lesser chance of winning. For example, if you predict 10 games, all have to be correct before you win. You can win 9, but one wrong prediction will “cut” the ticket.

Knowing that, I decided I’d have better chances of winning if I reduced the number of games I staked on a ticket and placed bigger bets. I made bets worth ₦30k – ₦50k per ticket. I lost more than I won. But I kept playing, hoping to recover what I’d lost. But every gambler knows that hardly works out.

Oh no. Did you gamble away all the money?

I lost about ₦600k. I did manage to set up a business centre, but it was smaller than I planned. I also couldn’t afford a prime business location.

It cost ₦300k to set up and buy equipment — a computer, printer, photocopier and laminating machine. After that, I had ₦100k left, and then I fell sick. The rest of the money went into treatment.

Sadly, the business centre packed up after three months. The location affected business since it was far from where students frequented, and I was forced to close shop and sell off the equipment. I used the ₦80k I made after selling to just hold body.

I still feel terrible that I gambled away that opportunity, but it helped curb my gambling addiction. You can call me a casual gambler now: I still bet once in a while but with smaller amounts — the highest I go is ₦2k/month, and I only bet during game weekends. I can’t go back to losing more than half a million.

Got it. What did you do after the business packed up?

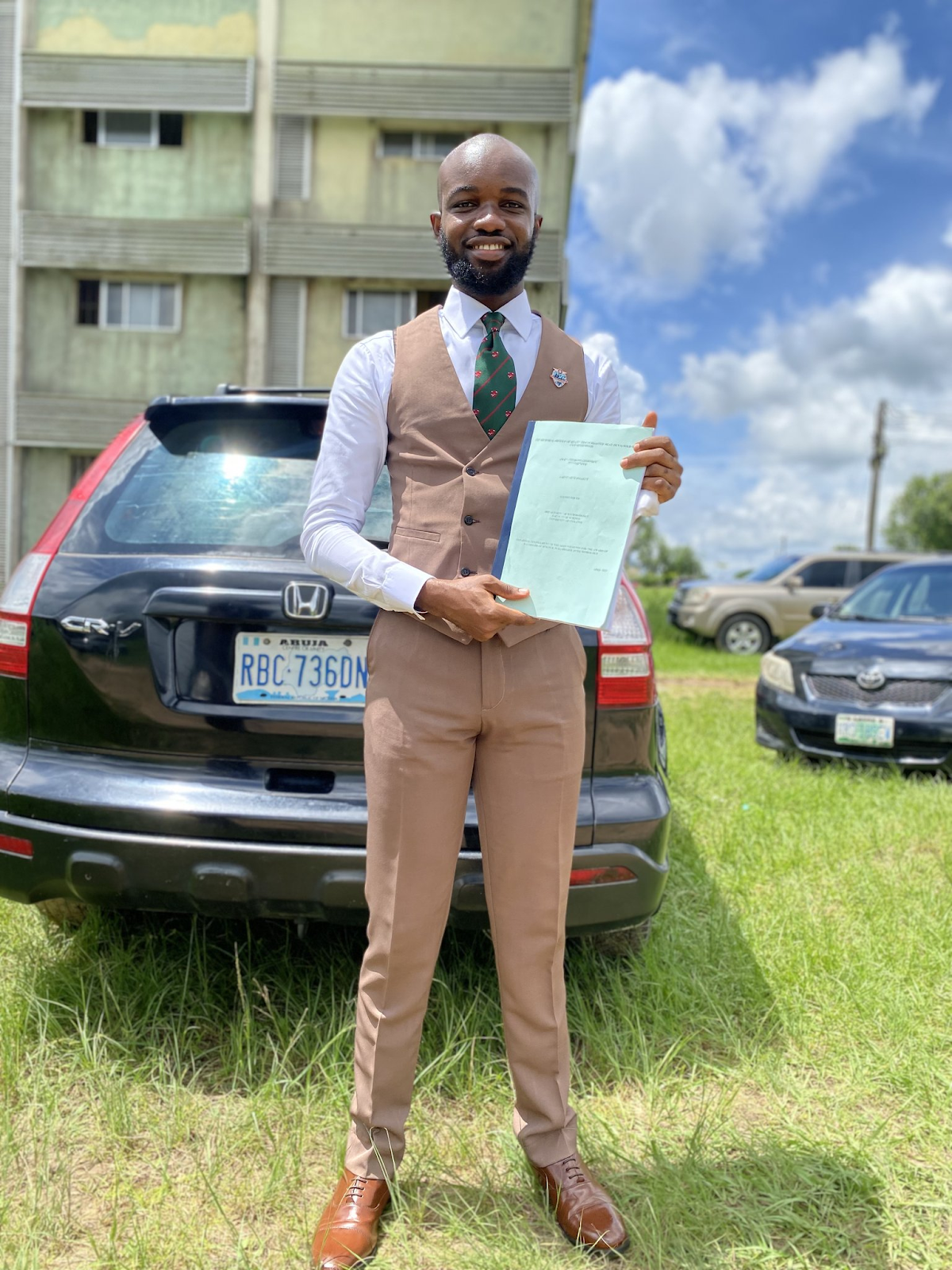

After I graduated from the university in 2012, I started writing projects for undergraduate and postgraduate students. I charged between ₦30k – ₦50k per project. The business took off quickly, and I regularly got referrals. I was even able to rent a ₦150k/year one-room apartment.

I still do this today, but my services now include conducting academic research and, sometimes, data analysis for my student client base. I started having foreign clients (mostly Nigerians abroad) in 2020 when some of my clients travelled abroad for school and began to call and refer me for their coursework and assignments.

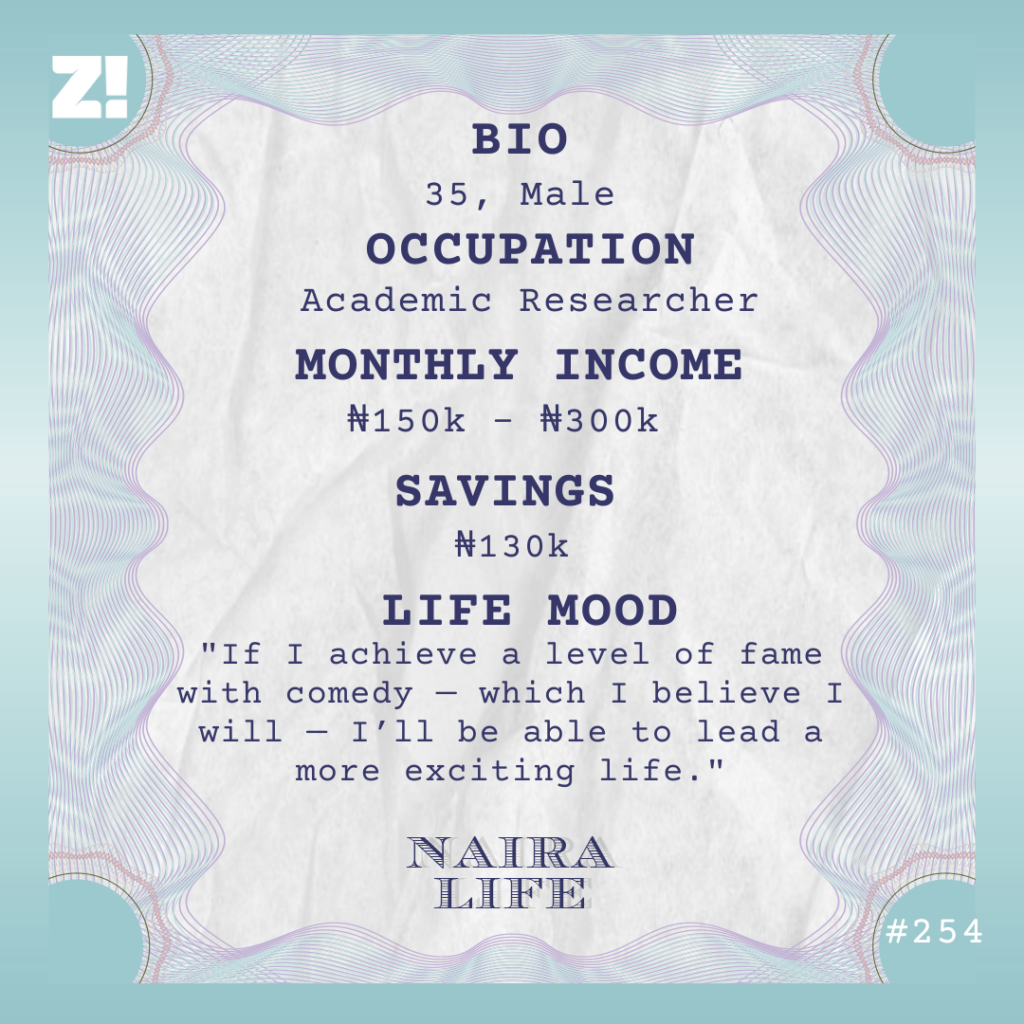

How much do you currently make in an average month?

Between ₦150k – ₦300k/month. However, work is slower at the beginning of the semester. The middle to end of the semester is when things get busy. This only applies to my foreign clients with stable academic calendars, though. Nigeria is a different ball game. ASUU can strike at any time and resume when they want.

So, I depend more on my foreign clients. At least, with them, you’re sure of at least six assignments in a month.

What’s the most difficult thing about your job?

Nigerian lecturers. Too many of them make ridiculous corrections on projects, and there’s no consistency in the quality of work they accept. You can write a project, and one supervisor loves it, but take it to another supervisor, and he says you’ve done rubbish. It’s exhausting. Some of them are just wicked.

Back to your finances. What’s your relationship with money like?

I try to live reasonably within my means and save, but unexpected expenses consistently scatter my plans. Top of that list is hospital bills. I’m a regular customer of malaria and typhoid. I think I just have a poor immune system.

I reconciled with my mum in 2015 — I got tired of staying away — so black tax regularly takes my money too.

I’m also looking to increase my income. I can’t continue with this one source. I recently started taking data science and analysis courses on Udemy, and I hope to land tech opportunities soon.

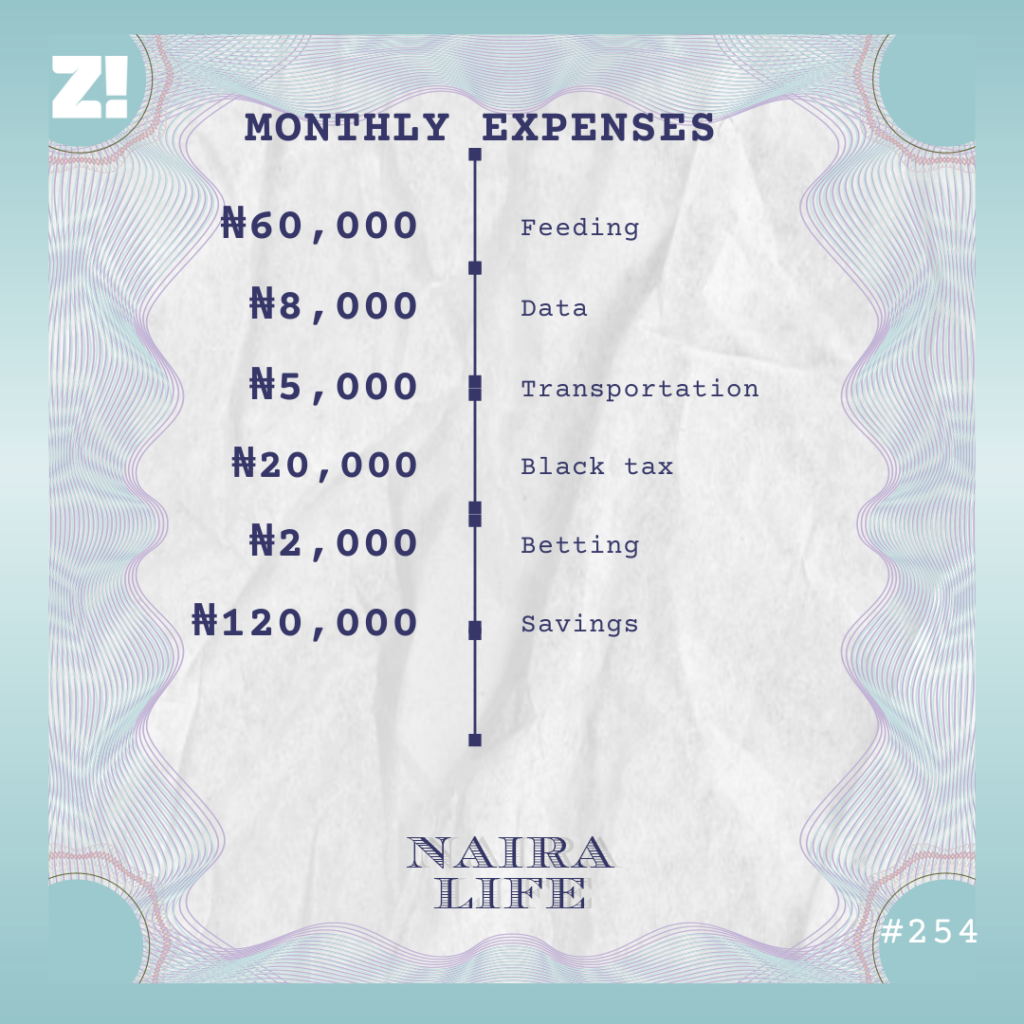

Let’s break down your monthly expenses

I hardly spend on transportation because I walk to the university, where I use a relaxation centre as a free makeshift office. There’s electricity and a place to sit, so I only need my laptop and data.

Savings only happen in good months when I’m not ill. Most times, I spend it on medication. I currently only have about ₦130k saved up.

Curious. Do you have other plans if a tech career doesn’t work out?

I’m currently doing some research on YouTube and following creators who share the different ways people make money online daily, and I’m honestly open to trying all the options available to me. I intend to diversify my income sources and start earning a significant dollar income. And I hope to do that with content creation. I’m actively planning to start a comedy skit-based YouTube channel in 2024.

Interesting. This came out of nowhere

I think it’ll be an opportunity for me to meet people. I’m not someone who makes friends easily. But if I achieve a level of fame with comedy — which I believe I will — I’ll be able to lead a more exciting life.

Plus, I’ve seen how these people who do skits live. They’re making serious money, and I know I have the right ideas that will get people to subscribe, engage and help me get to my earn-in-dollars goal. I’ve done my research on content distribution, too. I have a website, which I intend to sponsor with Google Ads to generate traffic. I’ll share some of my skit videos via the website and also direct visitors to my YouTube.

Have you considered what you need to start?

I’ll need some creator tools like a microphone and ring light, and I’ll also need to improve my video editing skills. With ₦40k, I should be able to buy the tools I need. I’ll start small and grow from there.

Rooting for you. Is there any other thing you want right now but can’t afford?

A car. ₦3m would get me a decent car, but I don’t have that right now.

Is there anything you wish you could be better at financially?

Knowing the right skills to invest my time in which would be financially beneficial to me in the long run. I think I’m already on the right path, but I want all the knowledge.

How would you rate your financial happiness on a scale of 1 – 10?

4. I can afford my basic needs, but I need to earn far more to improve my quality of life, and I’m not there yet.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.