Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

This is #NairaLife, episode 96.

What’s your oldest memory of money?

I’d say not having a lot of it. My dad had money, but it did not seem that way. I felt we were poor. I remember back in secondary school, I had to wear worn-out shoes and bags, my uniforms were not anything to speak about, and while my friends were going on trips out of the country, that was not the reality for me.

We had this policy in my house where you didn’t get an allowance until SS 1. So until SS 1, I couldn’t buy anything during break period.

In JSS 1, I had this friend in JSS 2 who always seemed to have a lot of money. At break time, he’d buy me a barbecue, which was a big deal then. After a few months, we found out that he was actually stealing the money. His parents beat him for it.

I’d say that was my first memory of “if you want to have friends or be cool or be popular, you need to have money”.

What was it like growing up generally?

The first time we travelled out of the country, my dad said, “This is the amount that you will have for the trip.” I took the money — I didn’t spend it on food or rides or any of those things that people spend money on to have fun when they travel — I spent it on clothes and shoes and a bag because I wanted to look nice at school.

My understanding of money was utilitarian: “There isn’t a lot of this thing, so when you get it, put it to good use.”

My first university allowance was ₦30k, and I went to one of these private universities where you only had to spend on food. I knew how to save towards my goals, and I liked to look good. I learnt to take that money, spend a little of it on food and essentials, then save towards the things that would make me happy: nice shirts.

So as early as my first year in university, I used to buy one shirt for like ₦5,500.

Ah, the TMs and H&Cs.

Exactly! That’s all I had money for. I never went to parties, bought phones or anything.

I bought my first smartphone in 2014, almost one year after I’d graduated. HTC. I loved that phone.

Interes–

I’ll add that before I left uni, things got significantly harder for us as a family. My dad disappeared. My allowance went from ₦40k a month to ₦5k when my mum could afford it.

Thankfully, my girlfriend at the time was an amazing person, the original glucose guardian, until she cheated and left me.

I –

About my dad, I can’t properly explain it because I don’t understand it myself. He was well-off, worked in an oil company. I think I noticed that things started to get bad just after he retired.

He was always complaining about money, even though I literally never asked for anything. One day he packed his things and left.

He came to school and told my brother and me that he would no longer be paying our fees or supporting us.

“Aired dfkm.”

Bruh.

My mum saw me through the rest of uni.

What did she do for a living?

She was a civil servant, so she was earning peanuts. But she’s an amazing person who’d done a lot of good in her life, so she called in a lot of favours.

In my final year, God blessed her with a well-paying job, and our story changed.

After uni, I was adamant about serving in Lagos, so I begged her help make sure I served in Lagos. My reason: I had to get a job and start working sharp, sharp so I could marry my wonderful girlfriend. My mum helped me get a job.

How did she get you your job?

She was walking down the street where she worked and saw this company She didn’t even know what they did. She just started talking with one of the people who she assumed was working there and told him about me. Anyway, he ended up asking for my CV. Turns out we went to the same uni, and that’s how I got in the door.

The pay was ₦35k. Working there throughout NYSC, ₦35k + ₦19,800, wasn’t bad at all at the time.

Anyway, I was able to save up enough to buy my first car. This was including all the money I’d saved up from uni.

Wollop. You bought a car?

The car plus shipping was like ₦700k. The good old days. The dollar was ₦150.

Fun fact, I still have the car, and it’s worth more now than when I bought it. Time to throw Nigeria away.

Hahaha. Okay. So after NYSC?

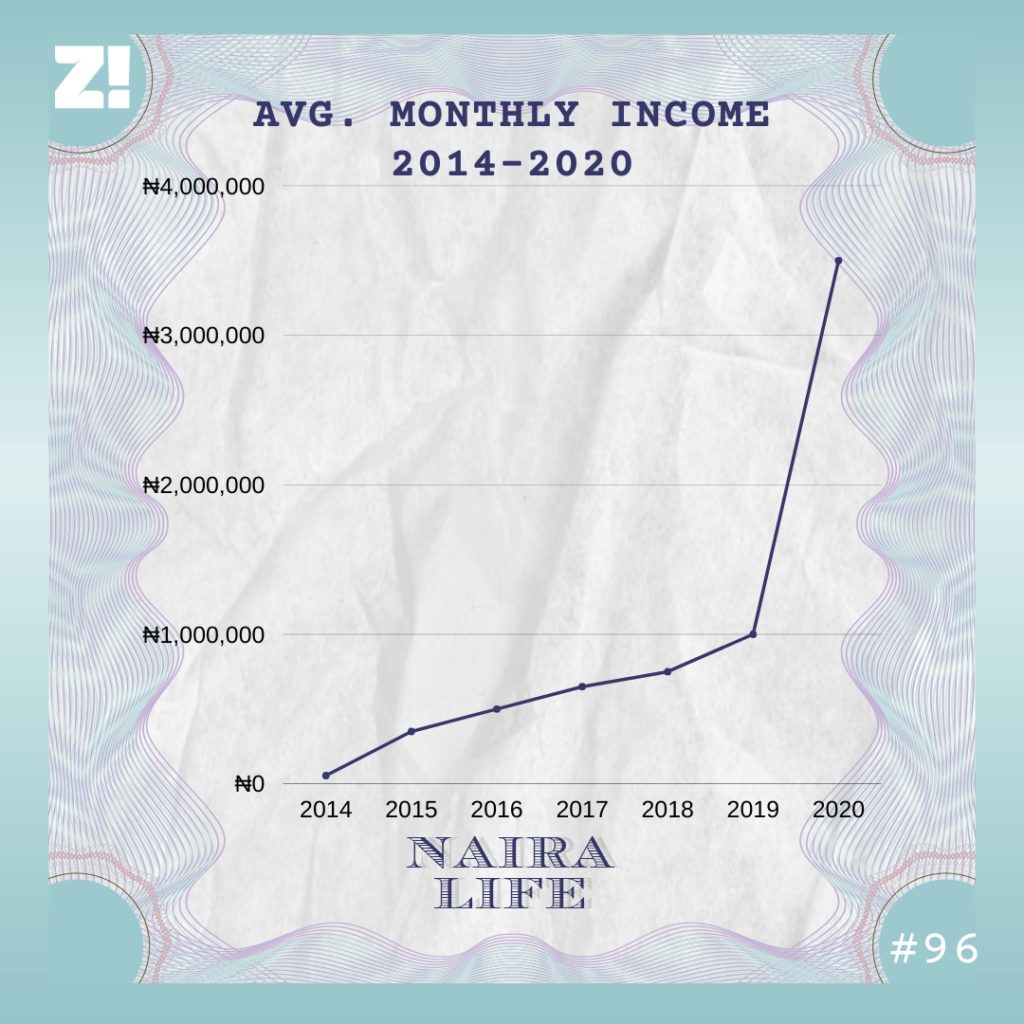

Immediately after NYSC, I got a job at an oil company. The starting pay was ₦350k/month. For the first time, I had more money than I knew how to spend. Anyway, I earned this for about 10 months before I moved jobs, another oil company, this time the pay was ₦500k.

I got a few promotions, and by the time I was leaving the company in 2019, I was earning roughly ₦1 million a month, excluding bonuses. I left to a bigger oil company and currently earn about ₦4 million/month.

You can’t be calling money like this and be rushing. Oya, break it down for me.

Hahaha.

In 2020, I landed a side hustle that generates up to 600k a month for me.

Wait, how does one add a side hustle in the middle of a pandemic that generates this much?

Well, it’s very capital intensive. I lend money to people who then lend money to folks that take high-interest short term loans. So if they’re lending out that money at 10% interest per month, they borrow from me at 4% per month.

Hmm. Is there like an app for this?

Well, none that I know of. I know someone who has a company that does this. He came to me about a year after he’d started looking for funding. It was high-risk, but it’s also high reward.

Interesting. So how does he find people in need of loans?

They find him. A lot of people live above their means, so he only loans money to salary earners who are in steady employment. Think of someone who’s been working at a bank for over 5 years.

This is fascinating.

Yup. Nigerians are amazing.

Back to the bag. What type of oil and gas worker do I have to be for my income to grow like this?

It has to be exploration, development and production; The guys who actually produce oil and gas, not servicing companies. That one na scam. Also, you’d have to get a job at one of the international oil companies. Some smaller indigenous ones pay well too sha.

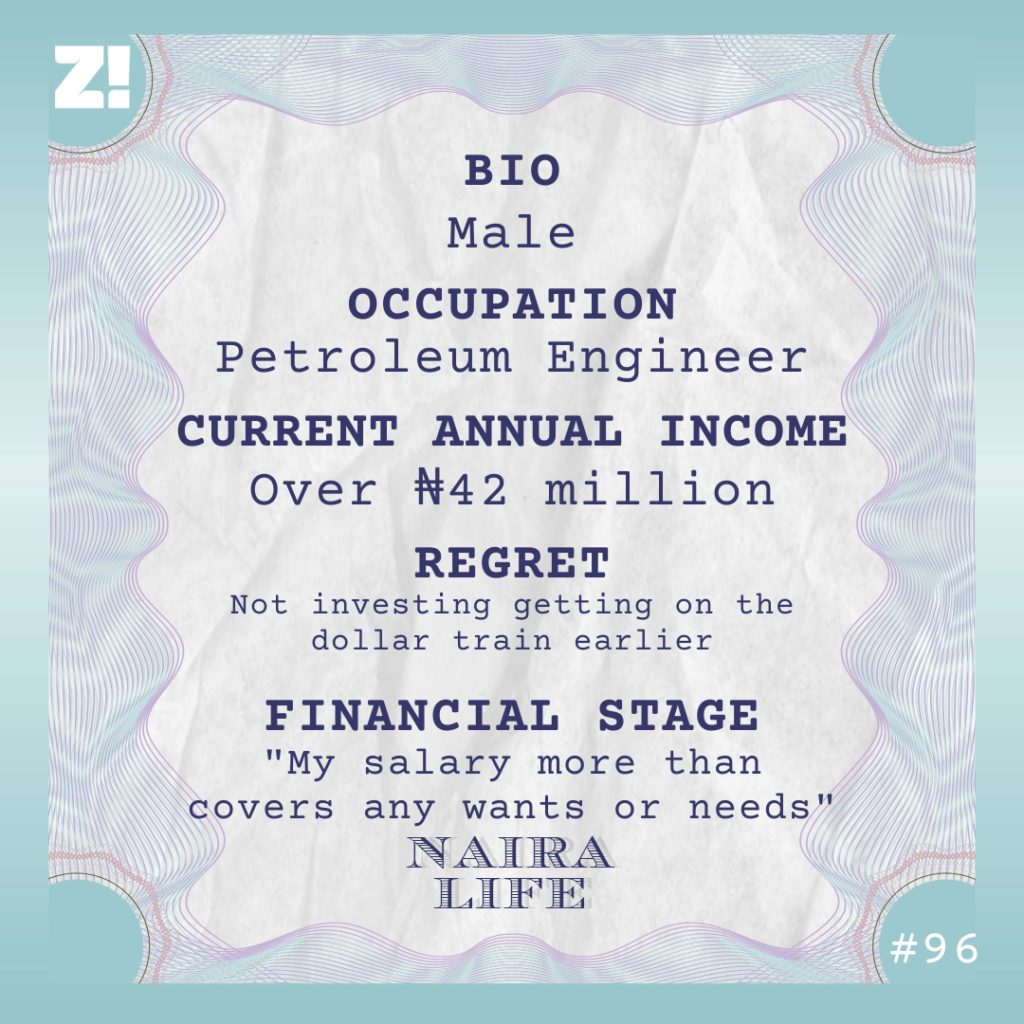

Engineers and geologists typically earn the most, but everyone gets paid quite well. I’m a petroleum engineer, and I do production and completions engineering.

You’ve come a long way, man. How has this shaped you?

My overarching view of money is that it’s a means to an end. And that end for me is making certain that life is soft for my wife and children in the future. I experienced not being able to pay school fees growing up, and that’s something I never want my family to go through.

I save/invest about 90% of my income. I think I live very modestly, but this may or may not be true. I think I’ve also gotten used to being able to afford anything I need. Recently, someone pointed out that I don’t know how much the individual items I purchase at supermarkets or restaurants cost because I never check price tags. The things I check price tags for are extremely expensive.

I think something that also influences my savings culture is that I don’t ever want to not have money. I’m certain that I wouldn’t be able to deal with it.

How do you decide what to save and what to invest?

Nigeria has made it easy right now. First thing I do is convert all the money I want to invest in dollars. In the beginning, I had a financial plan that I called “The Road To $1 Million”. I’d subscribed to a blog by a Nigerian entrepreneur, and he shared financial tips on investing.

This plan was basically geared towards leveraging the power of compound interest. So I set up a spreadsheet and determined what portion of my salary I needed to invest (and at what rate) to meet this goal.

I started off with fixed deposits. Again, these were the good days so it was 12.5% I think.

Anyway, I shifted to mutual funds, then got some great opportunities to buy land in Lekki from some folks who were relocating.

These days, I’m not looking to invest in anything Nigerian except actual Nigerians. I buy forex and split between Eurobonds, crypto and stock via a private equity fund that’s managed by folks who know this a lot more than I do.

Interesting.

Nothing is in naira except monthly expenses, an emergency fund that’s in a liquid mutual fund and my side hustle.

I used to be a dollar sceptic and touted all that talk about the naira being undervalued blah blah. Well, the best piece of investment advice I got this year was from my fund manager. The dollar had just risen to ₦390, and I wasn’t sure whether to buy.

His words: “I can’t tell you if the dollar will be higher or lower next week or in a month, but if you’re in this for the long run – 5 years and above – then whatever price you buy dollars at now is a bargain.” 23% since then.

You have a fund manager?

Haha, I just realised that that sounded super bougie. I use two private equity funds and the folks who do all the portfolio management are the fund managers. Because it’s private equity, I interact with them directly. So there’s a personal touch.

If you’re rich enough, even the very popular financial institutions offer private wealth management services.

What’s your portfolio looking like these days? Combined.

Total value? I’d need to crunch some numbers, but back of the envelope, maybe $250k.

This is a #NairaLife record.

Haha. Plus, I still stay with my mom. That’s sure to be an interesting fact. I’ve never had an apartment of my own.

WHICH BRINGS ME TO THE NEXT PART. WHAT ARE YOUR MONTHLY EXPENSES LIKE?

Barely 100k a month. I spend almost nothing fuelling my car because I’m currently working from home. Before, it used to be ₦30k. Utilities take about ₦50k. Then I give a percentage of my income to my local church. Food and stuff take another ₦50k.

This amount only rises due to miscellaneous girlfriend expenses, and to be honest, I see that as an investment. I need to chook this in and mention that my girlfriend is amazing. She’s also super independent so I basically have to beg her to accept any of this stuff. And I typically get a gift back in return. So I don’t even know if it counts as an expense.

How much are you going to have earned by the 30th of this month?

This month is a bonus month, so it’s not very representative, but the amount is about ₦20 million.

Please break this down for me. From where to where?

It’s the way employment contracts are set up. You have an amount that you earn annually but you’ll get paid bulk of that at certain times.

That means a better way to measure your income is per annum.

Yeah. Best way really. So it’s around ₦42 million. It’s difficult to say exactly until the year ends.

I find it interesting that you said “rich enough” earlier. You realise you’re rich, right?

Rich enough for me means ensuring that life is soft for my wife and kids forever. I think about school fees, a house, vacations and those other miscellaneous items and I know this isn’t rich. It’s the middle class without the responsibilities.

I’ve never given this much detail about my finances to anyone ever.

I appreciate this a lot.

Random, but one of the things that have been super helpful along the way is that I pay zero black tax. We share bills for electricity and utilities, but I have zero obligation to any family member to send them money. No one needs it. I’m very insulated from the extended family because they all abandoned us when things went bad.

Looking at where you are in your career, how much do you feel like you should be earning?

Hmmm, that’s tough to answer. Up until last year, I was very convinced that I was being significantly underpaid. When I changed jobs, I believe the pay became representative of my experience level.

Everyone knows that the problem with earning in naira is that the value of your earnings are constantly being eroded. I’d say right now I should be earning about $130k per annum.

A segue, what’s something you want but can’t afford?

A big house in a particular beach estate that costs about 250-300 million.. To be honest, I’m a very content person. I only want a house because I’ve come to identify a family house as security. When stuff wasn’t going great, that was the one thing we had.

A bit further afield may be a really nice house abroad. Maybe you can give me a few ideas because the only things that have come to mind are luxury cars, planes and property. Is there anything else that’s very expensive that people spend money on?

Omo, I don’t know o. What’s the last thing you paid for that required serious planning?

…

…

Nothing I can think of. The most expensive thing I paid for recently was a MacBook. I just decided to get it. The only reason I may not be able to afford stuff immediately is that I’ve invested the money I’d have used to buy it. But my salary more than covers any wants or needs. Okay, maybe the car I bought in 2014.

When was the last time you felt really broke?

Really broke? fourth year in the university. Things were still very tough, I hadn’t had money in what felt like weeks. I remember my older brother showing up and pressing ₦5k into my hand, I cried. He was just as broke as me, probably broker, but there he was giving me what was almost certainly all the money he had.

What’s your biggest financial regret?

Not investing in dollars earlier.

Do you ever think back to one moment that might have changed everything and given you a completely different life?

Yup. I think if my dad had stuck around things would have turned out significantly worse. He was a terrible role model and just generally bad vibes.

On a scale of 1-10, how would you rate your financial happiness?

I’d say 8. Money itself doesn’t make me happy. Being able to do stuff for the people I love with that money does. Right now, that’s well within my reach.

Do you ever think about retirement?

Nope. I’m too young. My career is super young. I’m not even 30! Although I’m planning towards it financially. The retirement age in my head is 45 sha. But if I’m a general manager, there’s no way I’m retiring.

How old are you?

28.