Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

There are some things to note about the 25-year-old in this #NairaLife: she’s the breadwinner and was in about ₦2m debt. Three months ago she got a big break and her life changed — possibly forever.

What’s your oldest memory of money?

I was in primary school and living with my grandparents because my mum was in university. My parents would visit every two weeks and they’d give me between ₦300 and ₦500. This was in the early 2000s, so it meant a lot to me.

What could the money do for you?

I could ball a lot in school. I loved to spend the money on myself and my friends. I’m not sure if I was trying to show off or if I just liked to buy things for people. However, gifting got a little tiring when I was about 10 because books started to interest me. From that time, I started to spend more on books.

By 2005, I was in JSS 1 and my mum was done with the university so I returned to my parents’.

Ah, sweet.

Things were good. We weren’t rich-rich, but we were very comfortable. My dad sold cars and business wasn’t bad. He travelled to Germany a lot and even took me on some of the trips.

My mum was a stay at home mum. It didn’t matter because what my father made was enough for the family. It’s funny because at the time I didn’t even think we were comfortable, even though everyone thought we were.

Why didn’t you think you were comfortable?

I was very sheltered. I suspect that I may have taken everything — including the trips — for granted because my parents didn’t have conversations about money with me. But in 2008, I realised how comfortable we were.

What happened?

My dad died.

I’m sorry about that.

Thank you. It was challenging because my parents had four kids after me. Now, my mum had to worry about all five of us and she didn’t have a job.

Oof.

The good thing was that we have good extended family members on both sides. After we buried my dad, one of my aunts living in Ghana spoke with my mum and offered her two options: she could allow me to live with them in Ghana until after I finished university or I could remain in Nigeria and they would sponsor my education until university.

When my mum spoke to me about it, I decided to go live with my aunt and her family. I figured that my mum would still have to bear some of the cost of raising me if I stayed in Nigeria but if I lived with my aunt, my mum wouldn’t have to worry about me.

That’s how I moved in with my aunt at 14.

What happened in Ghana?

I was in a boarding school and my monthly allowance was GH₵100 until I finished.

When I got into university in 2013, my aunt and her husband were going through a tough time financially, so it was a bit of a struggle raising me with their five kids.

Regardless, they committed to seeing me through university but my allowance was reduced to about GH₵20 per month.

The four years in university were a little tough, but I survived and graduated in May 2017. I was broke as hell though.

Whew. What happened next?

I picked up my first job. Although, I should add that I did a couple of odd jobs here and there in uni to raise extra money for myself.

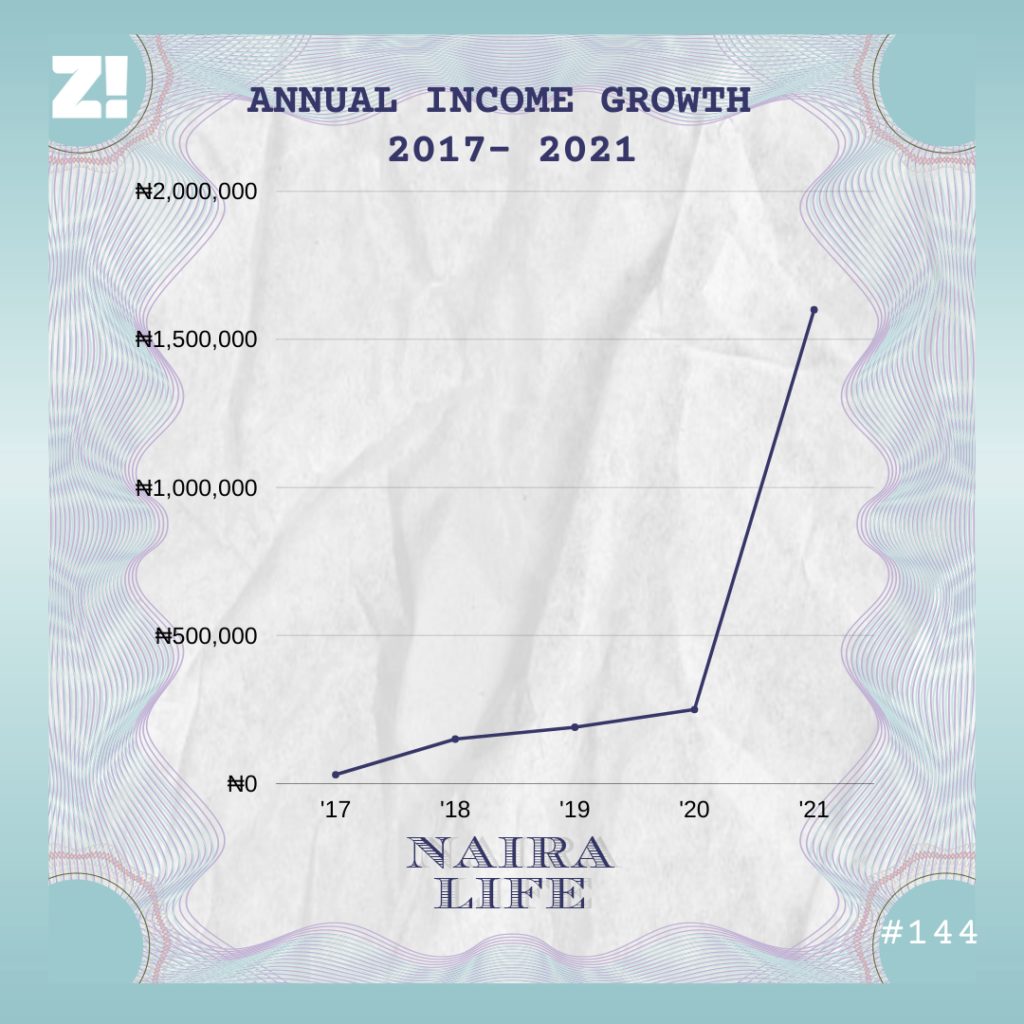

I returned to Nigeria in October and registered for NYSC immediately. I was posted to work at a university in Ogun State. I studied Human Resources in school, so I worked in their HR department and my salary was ₦10k. The federal government was also paying me ₦19800, so that brought my monthly earnings to ₦29800.

How were you moving money?

I lived in a 3-bedroom apartment with three other girls, and the total rent was ₦200k. One of my family members was paying my cut of the rent. My housemates and I also split household expenses amongst ourselves. However, I was the closest thing to a breadwinner my family had and I tried to send ₦10k home to my mum and my siblings. I also tried to save ₦5k every month but at the end of my service year, I had only ₦10k in savings.

How?

It was because of my money management skills. I was still an impulsive buyer and dipped a lot into my savings to buy things I didn’t need. Thankfully, I had started applying for jobs months before the end of my service year and got an offer two weeks after NYSC ended.

Tell me about it.

I got into the graduate trainee program at one of the Big Four consulting firms and my salary was ₦150k. This was 2018.

That’s a significant income jump.

It was. Moving from ₦29k to ₦150k in the space of a year was huge. I splurged on a lot of things that caught my eye in the first two months. I relaxed after that and started thinking about saving when I wanted an expensive new phone. I realised that I would be broke for months if I splurged on it at once. A better alternative would be to save the money for as long as it is required. I also had four siblings to worry about. I started to save ₦20k per month for the phone and another ₦10k in an emergency fund. About ₦40k went to my family. I lived on what remained. But it was hardly ever enough and I always ended up dipping into my emergency savings. I was pretty much living from paycheck to paycheck.

Omo. How long did you spend at the job?

Close to three years. I left in 2021.

How did your salary evolve during your time there?

I got my first promotion in October 2019 and my salary increased to ₦190k. My standard of living rose with it and I started spending more on some of the things I used to think of as luxuries. I ditched buses for Uber and hopped from one restaurant to another. Also, I increased my monthly support for my family from ₦40k to ₦50k. But there were other sacrifices I had to make for my family. Remember that money I was saving up for a phone in 2018? Towards the end of 2019, I had about ₦180k but my brother needed money because he was leaving for school, so I gave the money to him. I eventually opted for a lower-end phone.

You were something close to a breadwinner for your family too. What was it like navigating that?

For the longest time, I thought it wasn’t fair that I was working but didn’t have much to show for it because I had to think about my family first. But I’d also hate myself if we had to depend on members of our extended family before we could meet the most basic needs. That said, I learned to prioritise myself too and spend as much money on my most pressing needs as soon as I got my salary. The way I saw it, if I left the money in my account, I would end up spending it on something my mum or siblings needed.

Fair enough. When did you get the next raise at work?

October 2020. My salary went up to about ₦250k. However, I was already deep in debt.

Oh? Could you talk more about it?

In 2019, I took a ₦650k bank loan because our house rent was due. A few months later, my sister was about to resume university and because I wanted to send her off with something, I took another ₦200k loan from the bank. Later in 2020, my mum needed help restocking her shop but I didn’t have enough money. As a result, I applied for a ₦500k loan at the bank and got it.

You were at least ₦1.3m in debt and your salary was ₦250k. How were you paying back?

First, a chunk of my salary was going into loan repayments and this brought my take-home down to about ₦190k – ₦200k every month. Then I did something I probably shouldn’t have done: I stopped paying them off. Immediately after I got my salary, I cleared all the money in my account and transferred it into another bank account. Not the best move because the interest kept piling up.

My quality of life took a hit because I knew the debt was still there. I had also lost interest in my job in June 2020 but I couldn’t quit because I didn’t have a lot of options. But I started learning about frontend development. For some reason, I thought my next money move would be to transition into tech.

I was floating through 2020. In November, I went on a work trip and was there for close to a month. When I returned in December, I found out that I had Covid.

Damn. That’s rough.

It was. But it gave me a much-needed break from work and I dedicated the time I spent in quarantine to my software engineering courses. Nothing much happened until February 2021 when I had Covid again.

Ah.

It came back in full force and my body forgot how to work. I was bedridden for more than a month. Unfortunately, my HMO didn’t cover costs for my treatment, so I had to dip into the small savings I had. It wasn’t enough. As a last resort, I took another loan from the bank. ₦200k this time.

Whew.

It was so crazy. I was sick and still had to worry about money. When I recovered fully in March, I realised that I wasn’t earning enough, and I would probably need to take loans every time I needed money. The only thing on my mind was how to increase my income.

Was there a plan?

First, I needed to quit my job and find a tech role. I had an interest in it already, but my job was standing in the way of me learning the things I needed to make a full transition. I started to apply for HR roles in Nigerian tech companies and got interviews with a few, nothing came out of it.

Then I started attending online conferences, hoping to network my way into the ecosystem. In May, I attended a random conference where I met a white lady. We kept in touch after that. During one of our conversations, I mentioned that I was looking for a role in the industry. It turned out that her company — a freelance platform — had an open role and she promised to refer me.

I see where this is going.

Haha. In June, I got an email from her people. They were looking for a talent specialist and wanted to know if I was still interested. Of course, I was. I wrote a couple of tests and sent them in. One week later, I got another email from them.

It was an offer letter. I almost let out a scream when I saw how much they were offering.

I’m listening.

$3k, and that’s just the basic pay. There are also profit and performance bonuses.

Wow. That’s something.

I knew my life was about to do a full 180. I thought about what this meant for me and my family, and all the things I could now afford to buy.

In the same vein, I feared that they would rescind the offer, so I was scared to resign from where I was working.

LMAO. That didn’t happen, did it?

Haha, no. I started the job in July.

Congratulations. How did it feel when the first salary landed in your account?

Funny story. I was at the send forth party my former workplace organised for me when I got my first salary. If I had any doubts about my decision to leave the place, the credit alert erased all of it. I just started grinning at everyone.

Haha.

One of the first things I did was to get a group of my friends’ gift cards, and each one cost $80. They were always there for me. It felt nice to do something for them for a change.

Then I sat down and drew a plan to pay off my loans, which had accumulated to about ₦2m because I had defaulted on payments. I cleared everything in less than three months and am now completely debt-free.

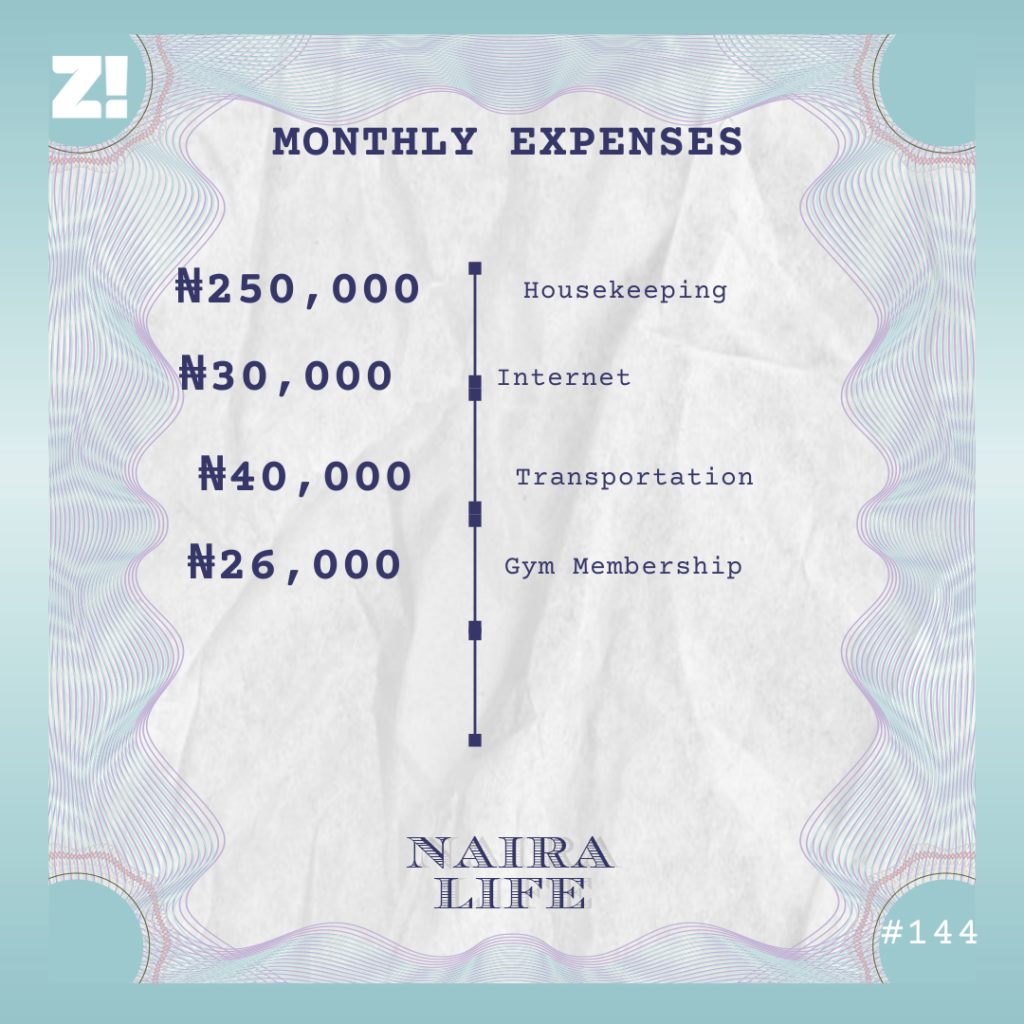

Love that for you. So what’s eating your money these days?

Sweet. What do your savings and investments look like at the moment though?

Core savings — $750

Crypto investment — $500

Stocks — $250

I’d have put more money aside but we recently moved apartments because of some issues with the old landlord. The new apartment cost ₦1.3m.

Also, the initial excitement of getting a huge increase in income is phasing out. I’ve bought most of the things I couldn’t get this time last year, so I’m beginning to think about how to be more intentional about how I spend my money.

It feels like I’ve just started my financial journey, to be honest. And I’m hoping to have a better relationship with money going forward.

Great. How have all of your experiences shaped your perspective about money?

I’ve realised that spending money makes me happy, and that’s not a bad thing. The only thing on my mind now is to figure out how to consistently make more. The more I can manage to do that, the more I can increase my standards of living. I’m excited about my next level of income and the kind of life it will get me.

What do you imagine will get you there?

I currently work where I can focus on my job and have enough time I could dedicate to my software engineering courses. The plan is to upskill and fully transition into a tech role. It’s already happening actually.

I’m listening.

I’m currently in talks with the engineering team in the company I work at about the possibility of interning with them. We’re still ironing out the details, but it’s a paid role. It’s a win-win: I get to work on software engineering projects and learn on the job while also earning from it. I’ll start the new role this month.

Rooting for you. Is there something you want right now but can’t afford though?

Travelling to Dubai and the Maldives are high up on my list. But I don’t have the money for that now. If I save a few months, I might be able to do that, so fingers crossed.

Fingers crossed. What was the last thing you bought that improved the quality of your life?

My MacBook. It cost about ₦570k, but my company refunded the money. It was stressful to code on my old Dell laptop, but the new Mac has made it more fun.

What part of your finances do you think you could be better at?

Impulsive buying decisions. I bought a new phone in September, which isn’t a bad thing. But I didn’t plan for it. I saw the phone online a day after I got my salary and I placed an order for it even though it cost $500.

I also need to think more about investing. My mood used to be “What’s the point? What if I die soon?” Now it’s “ What if I live long and end up being broke because I didn’t plan well when I was younger?”

That said, I think the mindset shift is a reflection of my current earnings. I’m earning a lot more money now and have enough left to play with after settling my basic expenses.

I hear you there. On a scale of 1-10, financial happiness?

7. I’m in a good place right now and I know that I will be in a position to earn more soon. It’s amazing how much one job can change your life.