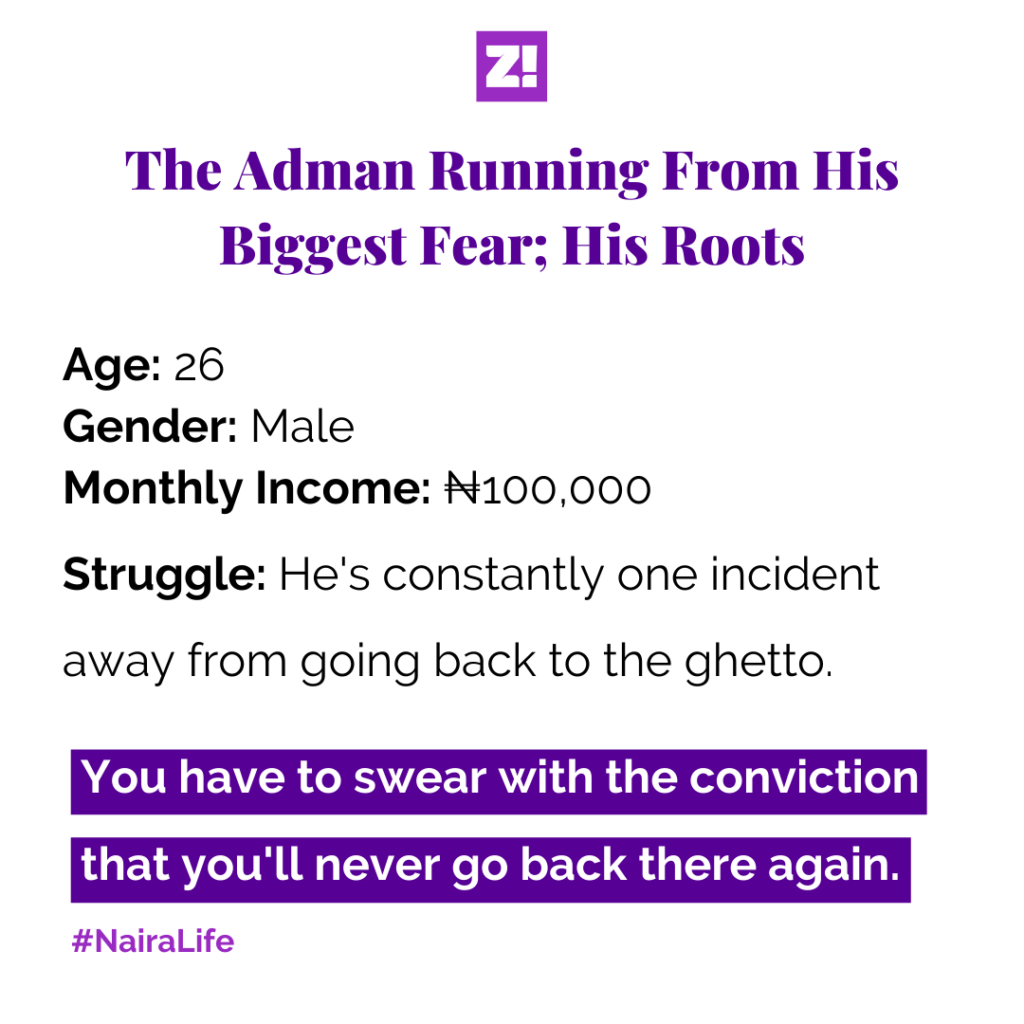

What’s your biggest fear? Snakes? Death? His biggest fear is not a person or people, it’s a system, a culture.

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your oldest memory of money?

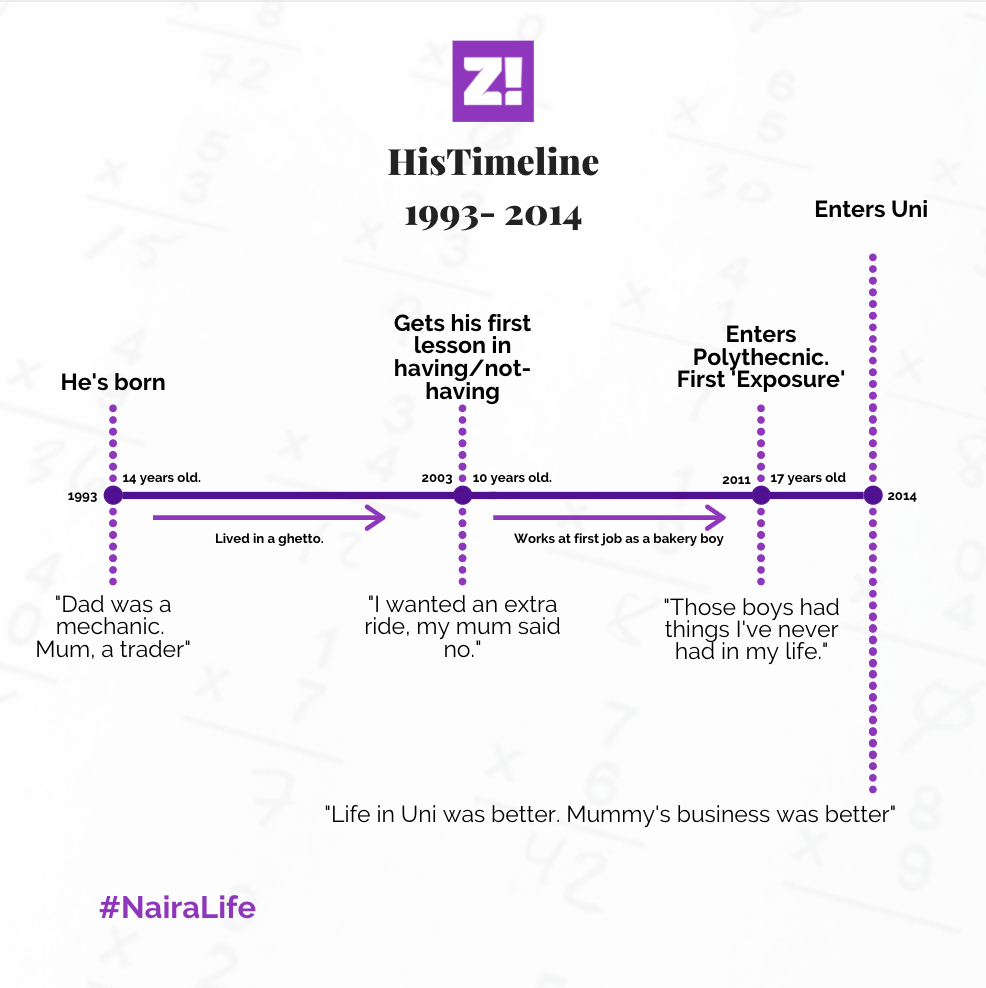

My mummy took me and my brother to this park, which was close to where we lived. After riding one of their motors, I wanted to go again and my mummy said no, let’s go home. When we got out of the place, she opened her purse to pay the okada man, I think I saw three ₦50 notes inside. I was about 10 or so.

Man.

When I think of it, following my parents to their work once in a while influenced my purpose in life. I remember following my mummy to where she sold stuff on the Island. I wished we would never go back home again.

This is a lot. What’s the first thing someone ever paid you for?

Not cash payment, but in 2007 I helped my father retrieve his MTN line all by myself, I set it up with an internet-enabled Nokia 3510 phone and went to a cafe to complete the rest. 24 hours later the thing worked. My father was so proud of me that he gave my mummy money to buy me chinos pants. I was 14 or so at that time. I spent those periods helping people set up proxies that would enable them to browse free on their Nokia and China phones.

How about your first job?

I was working as one of those bakery boys carrying hot bread trays up and down all day. Then I put money together and bought three textbooks: English, Government, Economics. I schemed for the remainder of the year on how I was going to pass JAMB without Maths — I’m super awful at it. This was 2010.

Tell me what led you to the bakery.

I’d just finished failing JAMB in 2010 and I was becoming useless at home. No factory at Apapa would take me because I looked too small, unlike the others. One of my uncles took me to this bakery, and the owner hired me. I earned ₦10k per month.

I travelled out of Lagos for post-UTME in 2011, met some students who seemed to have swag and loved music. One of them was saying he ran a blog and needed someone to write.

I said, “ah ahn, I can write it for you na.”

I’d never written anything serious at that point, but I felt, if they could do it, I could too. Also, the barrier for entry was very low. I remember writing it on a piece of paper, then typing it using a Nokia C1.

From that point, everything I knew how to do came from the fact that I thought ah ahn, if this guy can do it, I can do it too na.

These boys talked about things I didn’t know at the time, but I lapped up everything. From Voltron to Lion King, anything these boys talked about, I’d rush to Google and Wikipedia to go read about them.

Interesting.

The longer I stayed with these guys, the further I moved away from the boys I grew up with. It was also access to these guys that made me realise that I had to do well in my polytechnic so I could get into university like them.

These new set of people I was meeting, they had things I didn’t have; relatives abroad, a university education. Their parents were professors, doctors, pilots and all those shiny professions.

What did your parents do for a living?

My father was a mechanic. My mummy shuffled between selling herbs in Ajegunle and rich people fruits and vegetables in Ikoyi.

Uhm, rich people fruits?

Grapes, aubergine, cauliflower, cabbage, eggplant, avocado, berries, Irish potato, lettuce, soursop, all those things. Every time my mummy gave neighbours, they vomitted some of them.

My siblings couldn’t eat some of those at some point.

Anyway, when I got into uni in 2014, my financial life got better. The market was shaping up for my mummy and from the money she was earning, she was sending me some in the university. Every 2 weeks, my mummy was sending me ₦15k to ₦20k. But I never balled with all that money.

Also, I now had somebody abroad too. And this person, he sent me dollars once or twice in a semester. And some badass polos and quality sneakers too. So, I was in a good place in the university.

I focused on saving things. Even down to food. By the end of the semester when most people didn’t have food again, my food was still there. When I finished uni in 2017, Ambode came and demolished my mummy’s shop. So, finances crashed.

Woah.

They’d rebuild and Ambode will come and scatter it again. Repeat. But this didn’t affect me much and it also didn’t stress my mummy. I kind of had savings to get by on.

They still run the shop now inside someone’s closet there, but people don’t know they’re there, so sales are awful. My mummy right now, she’s taking some of these basic A-B-C classes. When she’s able to read and write, I have plans to get her to run her own business. And it gives me joy that she’s pushing herself and taking those classes.

How was your dad doing?

Bad. He’s been convalescing from a stroke since 2010. It happened early on a Monday morning. Before that day, he was supposed to go to the General Hospital, but everybody was on strike. Three appointments missed because of a strike. Then stroke.

He ended up in a private hospital where my mummy dug into the money she was saving for my university to save her husband.

That stroke collected the Vanagon – he drove a danfo after his day shift as a mechanic. He actually bought it after he sold the Subaru.

He woke up one day and said, “this Subaru that I’m driving, it can’t send these children to school finish o,” so he sold it.

It’s one of the reasons I got health insurance for myself last year, and when I start to earn better money, I’ll get a more comprehensive package.

Man. Tell me about post-Uni.

I finished Uni in 2017, and after NYSC one year later, it took me about 3 months to get a paying job. That’s because I wanted to work in the advertising industry. So I made a list of all the agencies in Lagos – over 50. I selected my top 30 and sent cover letters to them. No one answered. So, I looked elsewhere. I even looked at Ghana.

After three months, I decided to work anywhere else to sustain myself, then I’ll keep searching for advertising opportunities. Mid 2019, I finally got a job at an ad agency – ₦100k a month.

About two months after, my mummy told me the house we were living had been sold.

Ehn?

My grand-uncle owned it, so we didn’t pay rent there. Everybody else living in it too was living rent-free — they were always owing rent.

My father moved to another house, still owned by my uncle. And my mummy looked at me one night and said, you’re never following us to that house. So I gathered money and moved when the new owner of the house showed up to claim his thing.

“You’re never following us to that house.”

Yes. She was going to hustle and get me going, but I was already preparing to leave too. I just didn’t expect that I’d need to make the decision quick-quick like that.

I’m curious about what it was like when you joined your team.

Their first impression was that I was soft, cute boy – they always said it. But things got really uneasy when they start talking about Uber and Taxify like that. I only ever budget for danfo. And when I spend slightly higher than the danfo budget, I try to even things up and I do that very well. I’m good at it.

Also, because I wear confam, they usually don’t even think of me first as the guy from the back-back.

The only thing that usually opens my nyansh is when they start to talk about these fancy restaurants and their French-named cuisines, I usually don’t have the range, so I just keep quiet.

Most times, I feel like people even forget whenever I talk about where I started from. Because before you know it, they’d start talking about how I didn’t suffer.

And when I look at it in pari passu with my university years and some other moments, I feel like they’re right. My mummy didn’t make me suffer, even though I was a ghetto child. I had it better than most people I grew up with.

What’s interesting, people in the ghetto don’t believe I’m like them and I came from there.

On the other hand, when I hangout where those rich boys are and their expensive perfumes fill my nose, I feel a bit comfortable, but I know deep down that my father doesn’t have money and I don’t have a trust fund.

I felt that.

I also hated that my barber in Ajegunle and other people spoke English with me whenever I speak Pidgin or Yoruba.

How do your old neighbours perceive people who ‘made it out’?

Lucky. And they tell people leaving that “they’ll miss the convivial and the bubbly ghetto air”. But I think they say that because they have no idea what it’s like to live better without going to shit outside.

There are certain expectations that come with making it out. You have to lift others out too and in most cases, these others, they don’t want to be lifted out.

This happened to my cousin. He’s carrying everybody in his family, but this everybody, they don’t want to come out. They just want to be able to say we supported him until he got there.

This is an interesting perspective.

See, people never ever leave the ghetto. They’ll always find a way to drag you back. To leave and to never return, you have to swear with the conviction that you’ll never go back there again.

Because if you don’t, one day you’ll miss it and go back to rent a 3-bed apartment or to live in your uncle’s house rent-free and the people will start to feed off you until you become poor again.

Let’s come back to now. How has your income grown since you started at that job?

Definitely not the kind I want. I started from ₦100k in February 2019. Then I took a pay cut for a job in advertising to ₦50k — I needed to do it. However, it was easy for me because I was only spending ₦30k from my last salary. The adjustment wasn’t as scathing. By July, I was back on ₦100k, but I was no longer excited about the money. I still want more.

Do you have older siblings?

No. I am the first – I have three other siblings. One is trying to get into uni. The last one is still in secondary school. The second one is hustling – trying all kinds of things here and there. I don’t know what he’s chasing currently, we’re not so close.

How’s coronavirus affecting you?

It’s costing me unnecessary money. For example, I’ve been spending money on table water since because the water finishes faster now. Whereas before you just drink water at the office and you’re okay, you won’t even have to touch your own bottles at home.

I also have to spend extra money on food now that I can’t eat lunch at the office. But to tone that down, I’ve been doing fruits and Mai Shayi because those ones help my spendings even out.

Coronavirus walks up to a Mai Shayii, how do you think this story ends?

I’ll go home – no face touching and all that – bath with soap. Then I’ll sit inside and hope for the best.

So basically, you can’t afford to live 100% isolation.

Yes, but I reduce how much I go out. I can’t afford to stock up on all those things that’d make me sit inside for long – no fridge or microwave. Right now, I only go out at night, when foot traffic is really low. And I also try to avoid supermarkets, because that’s where people who are returning usually shop.

Mai Shayi is low risk, he’s less likely to have made close contact with someone that’s just returning from the UK, compared to the cashier or security at a supermarket.

I either die of hunger or catch Coronavirus and be treated for free by the government.

I wish I could stay inside all through, but na condition make crayfish bend.

Just so we’re clear, it’s still risky. But I hear you.

Free Advice: Beat your fear of coronavirus with facts. In 5 minutes. Click here.

What’s a purchase you made recently that significantly improved the quality of your life?

My house rent – a room with a toilet and no kitchen + the bed. It cost 400k, the rent alone. For the first time ever, I am living and waking up without having to worry whether there’d be water to bath or whether there’d be light. I got a room in a house with an inverter/generator.

I know right now that I have a disposable income problem. And to fix that, I must seek another job elsewhere. However, I’m not willing to jettison my growth in advertising for that money yet.

Still, my first mission is to secure my financial base; I’m putting some money down every time to, first of all, have the capital for proper investment. I’ve made little progress with that.

What’s a financial regret you have?

2014/2017. The fact that I let my money, over ₦70k stay in the hands of FirstBank without getting ₦1 in interest is vexing me. These days I prefer to pay for knowledge because all the times that I paid, I saw the reward.

Let’s rate your financial happiness, on a scale of 1-10

3. I’m always one silly incident from going back. I have managed to build a little cushion, but that cushion, I’ve now transformed it into savings for my abroad masters — which will eventually also become a cushion for me forever. The better the degree the more likely I am to earn more and that also means the more likely I am to be far far far away from where I’m coming from.

Godspeed man.

Thanks, bro.