Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

What’s your oldest memory of money?

One day – I think I was seven – my mum just came into the room with a black plastic bag. There was money inside ₦2.5 million. She just –

Wait, what?

Yes. She just said, “keep this money, this is for your dad’s next car.” I don’t know why they didn’t put it in the bank, or maybe it was from a bank.

This is what it was like as a child; my mum just bringing money and telling me to keep the cash. She’s a trader, so she actually used to give me small sums at the beginning.

Did you ever ask her why they always gave you that type of money?

Nope. I think it’s because I was very introverted as a child. My older sister was always going out every time she got the chance. So I guess that was why she always chose to give me money to keep.

Wild.

You know the funny thing is that my dad – I wish he could do a #NairaLife episode – there were times he was reckless with money, he just got better as he got older. He served in the military as a senior officer, and the thing about the military is that besides your salary, where you get posted to, determines the kind of money you’ll make.

So for example, when my dad got posted to the South-south, I knew we had money, like mad money.

Oil money.

Exactly. In the military, you get moved around a lot. They can keep you in Warri in Delta today and take you to Mongonu in Borno tomorrow. So when they post soldiers to dry places, they manage. When they move them to places with money, they make the most of it, allowances and all that.

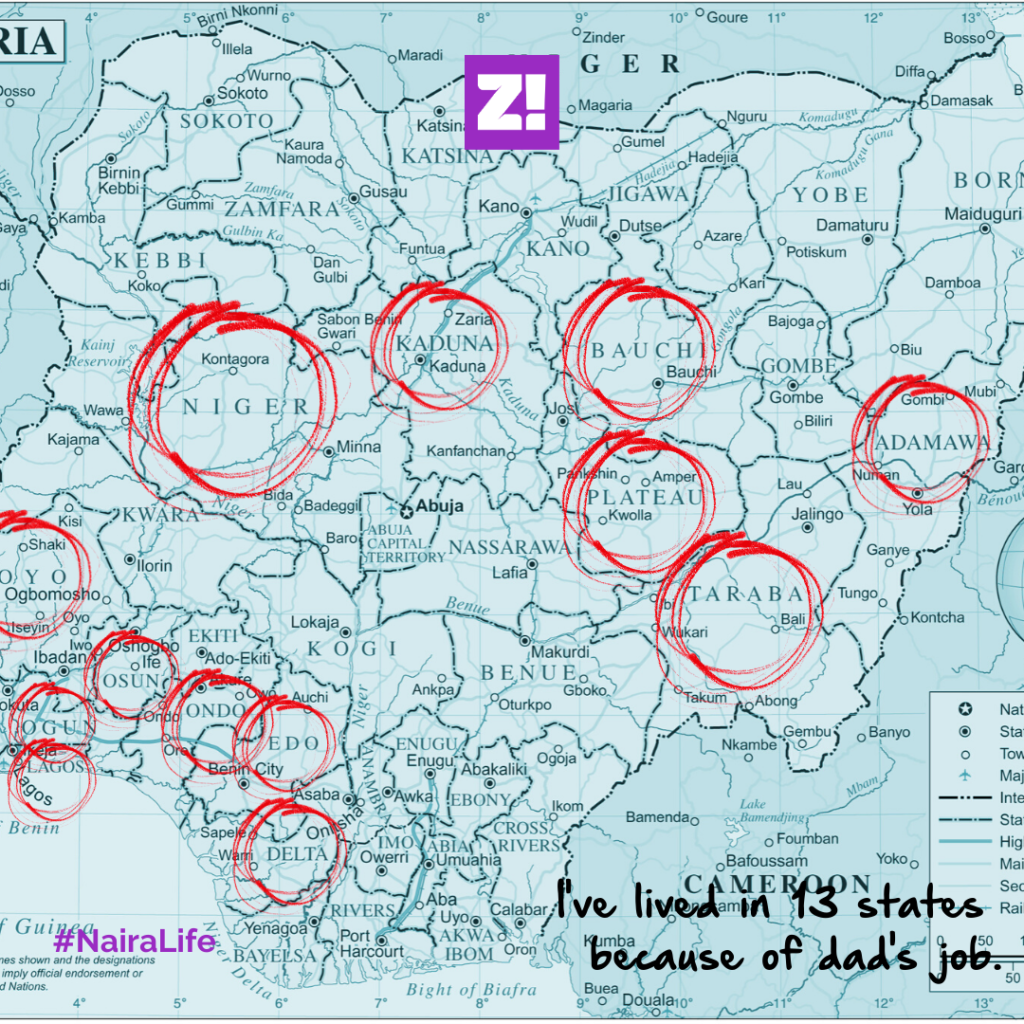

I was entering secondary school at the time, in 2007. The downside to my dad’s job is that we had to move around a lot. That meant that my education became slow by a few years. I’ve lived in 13 states.

Wow.

When I was in secondary school, my pocket money was ₦30, and I remember that money was fine even after I realised that my classmates were bringing up to ₦150 to school. But most of the time, my friends and I always shared our break money anyway.

Then I entered University and my allowance became ₦25k/month. This was 2014. There were people with ₦50k and I used to think wow that’s a lot of money. But the real money was blocking money.

What is blocking?

The money lecturers demand from students. Look, in my University, it was so mainstream that there was literally no other way to pass some courses without blocking. Some lecturers even had fixed prices. For instance, a course where every student took in 100-level, a lecturer demanded everyone pay up to ₦5k – we were over 500. Whole ass courses had price lists.

The highest I ever paid for blocking was ₦10k – I had to pay at some point.

What pushed you?

It was this very corrupt man. Also, when I was in 100-level, there was this course I was so sure I was going to pass – two in fact – I got F’s. It ruined my GPA. I cried so much. That’s one ₦5k I’ll never forget.

Did anyone try to report them or something?

Hahaha, no. We knew blocking is a tale as old as time. Lecturers are lords. Everyone feared that even the person they’ll report to is probably a partner in crime. HODs demanded money too.

Every semester, my dad would call and be like, “how many courses did you take, how much do you need for blocking?”

Incredible.

Anyway, when he gave me money, I chopped it. I actually wanted to save, but while I was in Uni, I was never really good at saving.

My friends too couldn’t save. The only thing we saved for was when we were trying to buy something, like a phone. But you can’t just be saving for nothing. Unless you’re probably paying your way through school and you’re saving for school fees.

After I left school, my dad started giving me ₦10k a month – internet and toiletries. This was early 2017, so I started job hunting. Even with that, there was a small twist. People would invite me for interviews, and I wasn’t attending.

Why?

Distance. My house was really far from where most of these interviews were supposed to happen – I live on the outskirts of Lagos. Also, I think I was just scared I wasn’t going to get picked. But I eventually got a job – a remote writing gig.

Oh, nice!

Three weeks in, I got sick – I have some health issues, we’ll get to it. I had to quit, and that hurt a lot. My boss at the time mentioned that she was going to pay me the full salary.

I was home sleeping a few days later, and I got the alert.

How much?

₦80k. I looked at it and started crying. My first salary. So while I was like “Thank you Jesus” for my first salary, I started to worry about where the next one would come from.

What happened next?

A few weeks after that, all my fellow unemployed friends started getting busy, and that’s when I was like “ah I can’t carry last” and started applying for jobs again.

Hahaha.

I applied for an internship, and the feedback I received was that they were going to hire me because of the quality of my CV. I’d had one since 300-level. I think I was the only person in my class who had one since Uni. My ex-boyfriend was the one that made me create one at the time.

What role?

Customer support. It was actually supposed to be a 3-month internship, but in less than a month, they converted me to full-time staff. Apparently, they were so impressed.

I felt like a hot cake. Thing is, every time I understand my role, the dedication that follows is always wild. They started me with ₦70k and got moved to Marketing. And slowly, more responsibilities were added. Then it climbed to ₦120k after a few months. Then ₦150k. Meanwhile, I started my NYSC a few months into this job.

Within a year.

Yes. Also, the best part about all of this is that, because of the distance, they secured accommodation close to the office. Complete with power and all that. All I had to pay for there was my own food.

But, I still had to leave.

Why?

It got toxic for me. In fact, I was willing to leave without landing another job. I saved a lot – the only thing I was spending money on was cabs to go on dates. By October 2019 when I was leaving, I’d already saved ₦700k.

How did you pull this off?

I didn’t touch my NYSC allowance. I won’t have done it without my savings app though, it forced me to be disciplined. Every time I tried saving on my own, it didn’t go well. Out of my salary, I set out to spend ₦30k every month.

Now that I think about it, it feels unhealthy to earn ₦180k every month and then spend only ₦30k every month. I feel like I starved myself of some things I could have enjoyed.

But looking at my savings, I felt more comfortable. Anyway, I started applying, and I got lucky again.

Another offer?

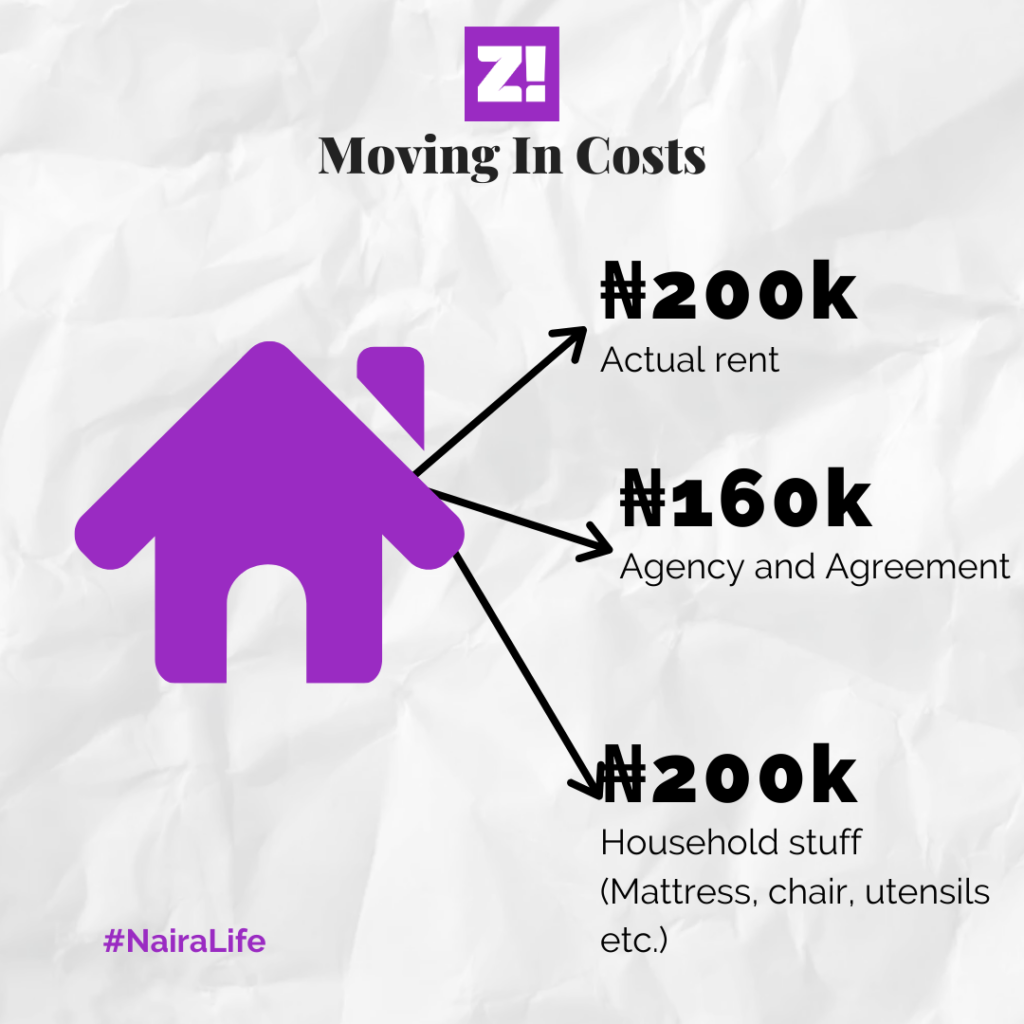

Yes. 5 days after I quit. I’d been applying before I quit though, but that meant I had to move out asap. That also meant getting a place near my new office. That meant budgeting ₦650k on making a one-room apartment liveable. I didn’t have any bed or furniture.

By the time I was done, I had only 90k left. This was when adulting started properly for me.

How much does your new job pay?

₦200k. It’s about a ₦20k raise from my last job. Also, the NYSC allowance had now stopped, so it’s not like I’m earning significantly more money.

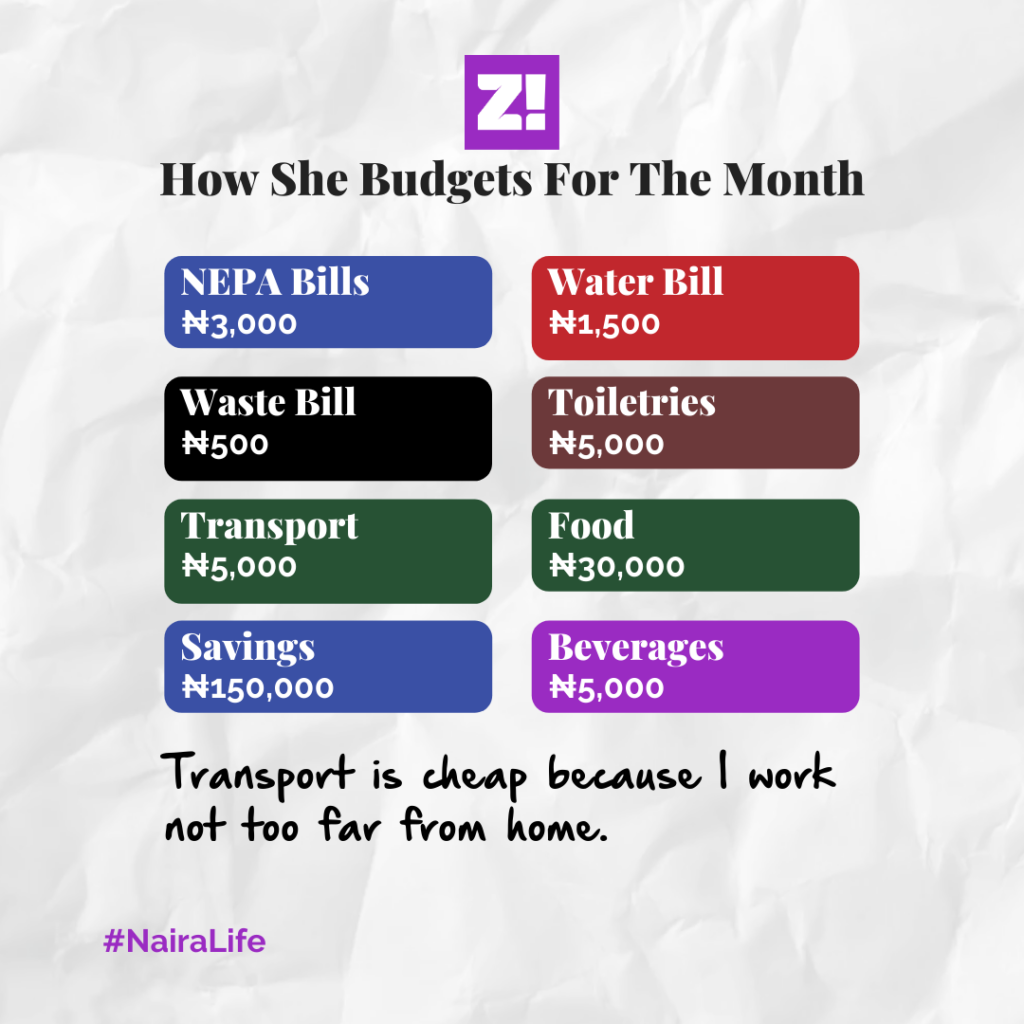

After settling in, I started budgeting ₦50k a month for personal spending. That extra ₦20k is mostly for bills.

Again, I still feel like I’m limiting myself.

Current expenses

I actually try to keep a budget.

I had this weird addiction to these loan apps. I’d just borrow because I could, and I borrowed and borrowed at some point while my score grew and grew. I think I borrowed up to ₦300k, and that’s wild when you think about the fact that my first loan was ₦2k.

How much did you have to pay back in interest?

Up to ₦70k. Also, I had this embarrassing moment. They texted my boss to tell him that “they were trying to reach me because they had unfinished business with me.”

A mess.

Interestingly, my loans were for petty things, like when I need money on a Tuesday and money is coming on Friday, I won’t wait till Friday, I’ll just take the loan on Tuesday.

I think this changed when I started saving in 2019. But I’m at a point where I’m able to loan people money. You can say I went from taking loans to becoming a loan shark myself. Anyway, my goal for this year is to save 1 million. And then buy whatever the best Samsung phone is at the time.

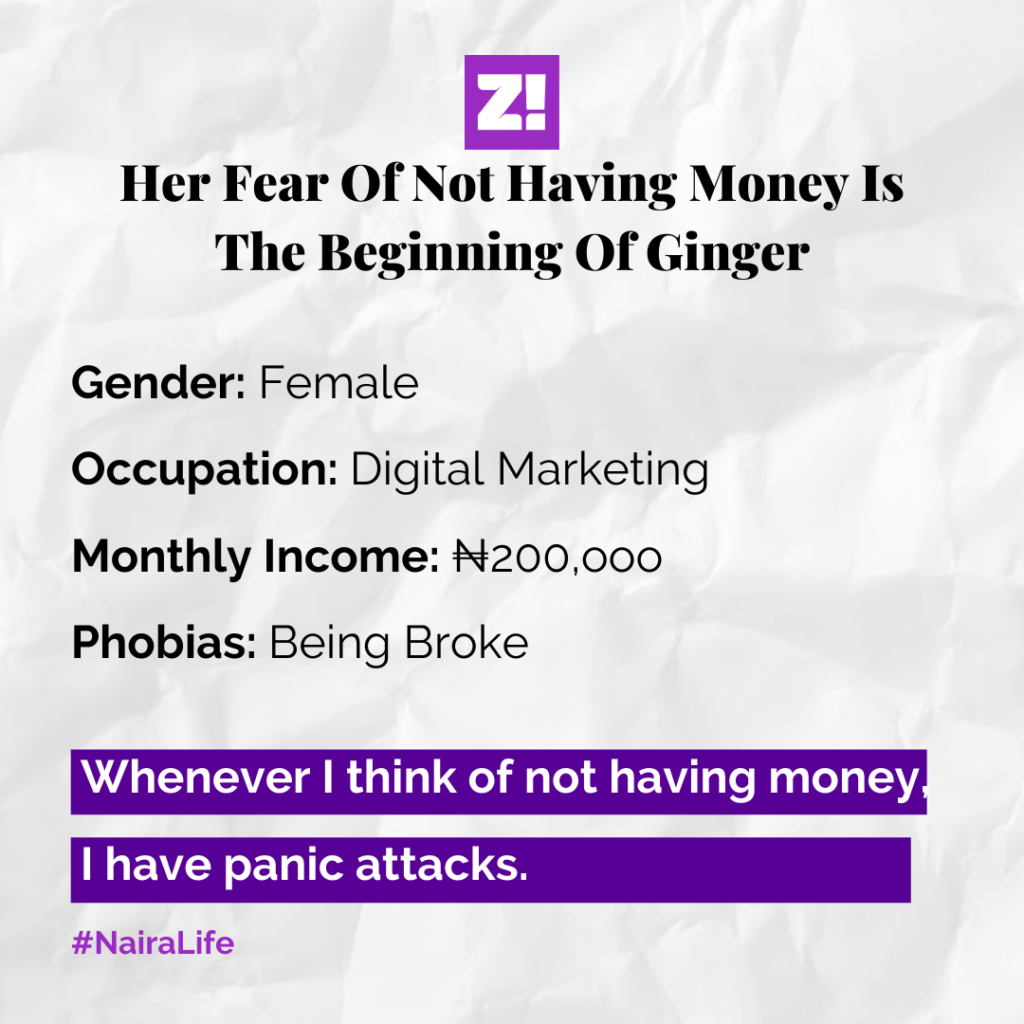

What’s your obsession with that ₦1 million figure?

Every time I think about being poor, I have panic attacks. I just don’t ever want to be stranded. Before you say I have my parents, I feel mostly independent of them now. Also, I worry about my health issues. I worry that a time will come when I’ll have a medical emergency, and I want to have cash.

Now’s a good time to talk about your health, right?

Let’s start with Angina Pectoris. This alone has affected a lot of my life choices. I can’t stay in cold places or lift heavy things.

I have a few other conditions, like a really bad stomach ulcer, even though I’ve treated it a lot. Then those mentally draining periods where you’re just immensely sad. I realised that every time I had money, I got better. Also, when those moments come, I just start spending money anyhow. Talking about spending, see what I blew in like two weeks of January 2020.

I’m listening.

I spent ₦120k and I dunno what I spent it on.

I also have – this is so embarrassing –

It’s okay.

It’s a rectal condition. That means there are all kinds of heavy food I can’t eat because it just makes my rectum hurt a lot.

You have a consistent health struggle, do you have any insurance?

So first of all, I’d like to say that I believe it wouldn’t have gotten bad if my parents had taken it seriously when I was little. Whenever I complained of chest pain, I used to get the “don’t worry, it will go” talk. I think they thought it was a cold

So it continued till I was of googlable age. I saw every single one of the symptoms I’d been having for years. It feels like mild heart attacks. It normally lasts for less than a minute, but this one time, it was longer.

I ended up at the hospital, spent three days there, and the bill was ₦150k.

Woah.

That was when I got my first diagnosis, over 10 years after I first complained. What my dad didn’t realise is that this wasn’t a one-off payment. First, he had to borrow the ₦150k from three people – ₦50k each.

One week later, I had the attack again. My dad flipped.

Eish.

“What else do you want from me?!”

I understand that he was frustrated, but I know now that I don’t want to have to depend on that. So, how have I adjusted? Better lifestyle choices. The episodes went from twice a month to like to maybe once in two months. The pain is shorter too.

I also try to have as much cash as I can.

Do you know anything about insurance?

I have some hesitation about insurance, and I really dunno why.

Random, but I have googled how to become a vampire an unhealthy amount of times. I’m scared of growing old or dying. Sometimes, I wonder if there are real vampires on the dark web that I can hire.

Ehn?

Hahaha, I’m serious.

What’s something you want now, but can’t afford?

I want a house. When I first hit ₦700k in 2019, I was googling where I could find houses to buy for ₦700k. I hate paying rent.

What do you think about investment?

I think I’m not there yet. I want to have millions so that the returns can be significant. I invested in one these apps, and they told me that I’ll get ₦24k on ₦100k after 9 months. One full pregnancy, and only 24k? No, thank you.

My dad, for example, invests in Agric and gets massive returns after like 3 months. He invested ₦2.2 million and got ₦250k – over 11%. So, I want to grow my capital before I start thinking consciously about investment.

How will you rate your happiness levels on a scale of 1-10?

5. Look, I think whenever I should be happy, I start worrying that it will disappear. So saying 5 means that if I’m being honest, it should probably be a 9.