“Money slow to enter, money quick to go.”

Those are M.I.’s opening lines from that 2008 song. It’s also how I describe my relationship with money. The same questions, every month; “Why am I getting debited because I crossed the road?” “Why do I get debit alerts because I inhaled too deeply?” “Is this money truly mine if it leaves me so quickly?”

I don’t know who, but someone said;

“To find a leak in a tyre, take the whole tyre, soak it in soapy water. Bubbles will reveal the leaks.” If this quote made any sense; yeah, I said it because I’ve seen a Vulcaniser do that. If it doesn’t, then I don’t know who said it. So, In June 2018, I decided to track every kobo I spent. I followed every trail; from transport money to food money, to even that ₦50 I spent buying Vicks on July 28 at a neighbourhood supermarket because they had no change.

I went all the way in, and what did I learn?

The method is as important as the experience itself.

I use Spendee. It has a mobile and web app that’s always open on my browser. This means I have a tendency to record my spending at the speed of a tweet. I document my spending manually, and although it gets exhausting tracking down the last ₦52.50, it’s quite revealing.

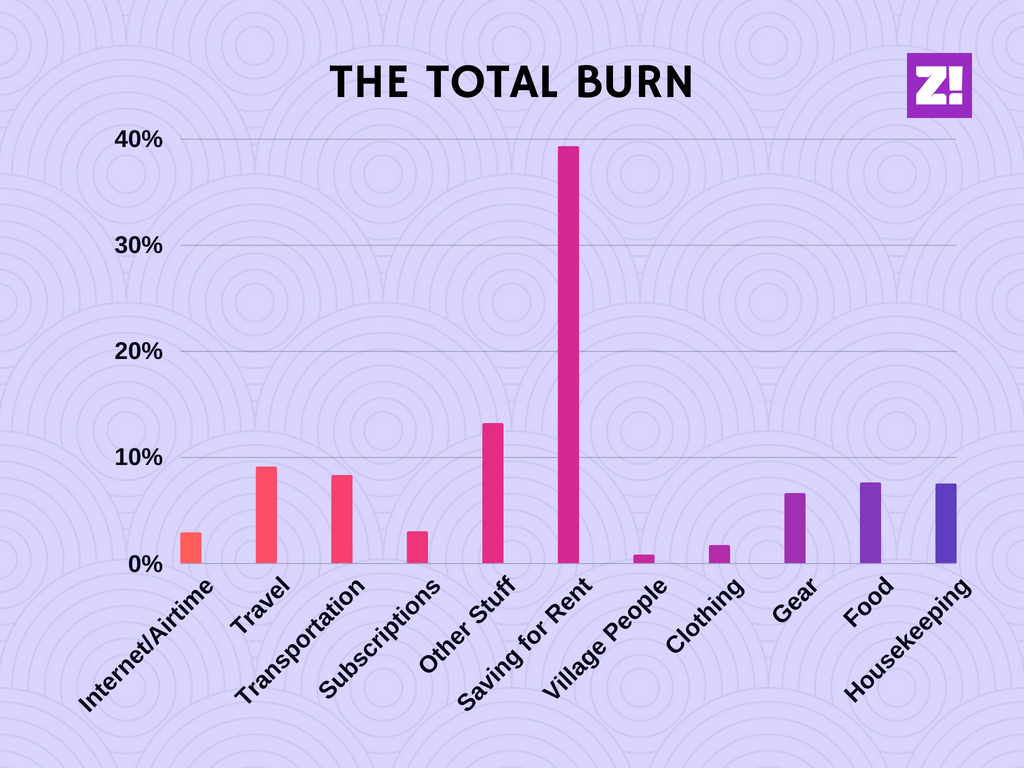

Like writing a diary; a journal of your financial life. You write the good days. You write the days you were reckless and admit your foolishness. You write about how it cost you more with a cab because you were too lazy to walk to the bus stop. I filed them into categories; like Food, Transport, Subscriptions, and even Bank Charges.

I had bad days where I’d forget and drop out of my routine, but I had the hack for that too. I just go to my Google Maps, check my timelines. If I know where I go, I almost always have an idea what I spent.

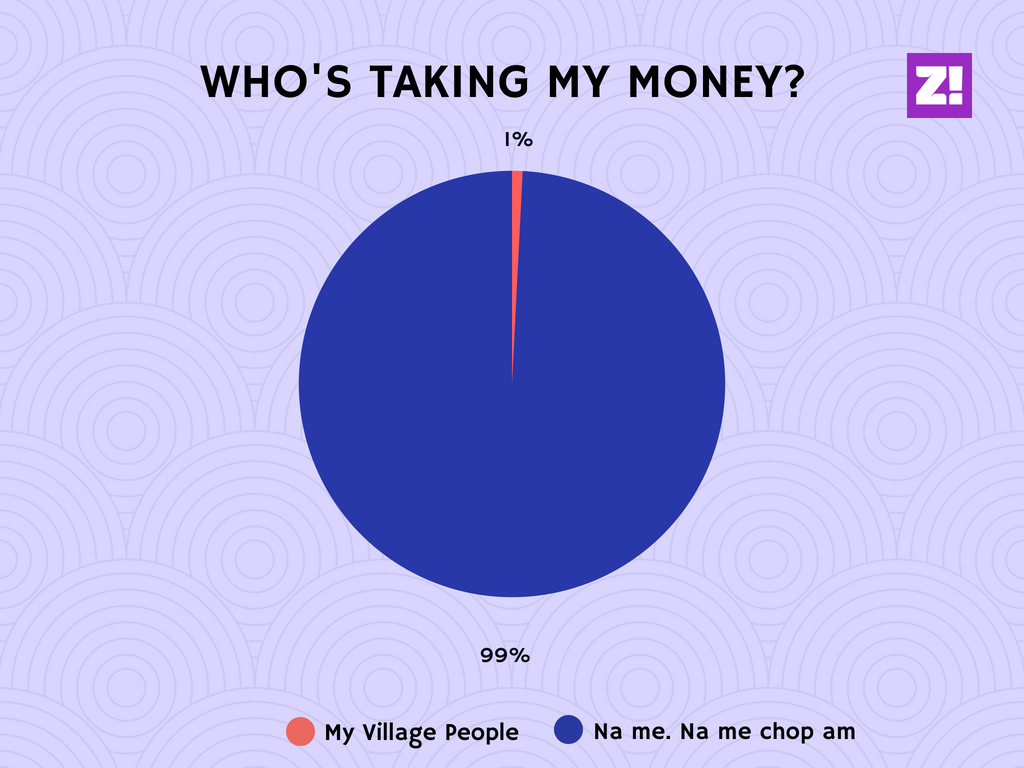

My Village People are not the enemy.

When you step out of your house and your money just disappears, it’s not your uncle in the village taking your money. Dude, it’s you. It’s you who’ll buy expensive food outside when there’s rice at home.

As much as I’d have liked to track every kobo I spent in this period, I couldn’t account for a tiny part. What I couldn’t track, I dedicated it to my Village People, because someone who isn’t me must be blamed. But even In three months, what I couldn’t account for was negligible.

Maybe your uncle and aunty in the village aren’t so horrible after all.

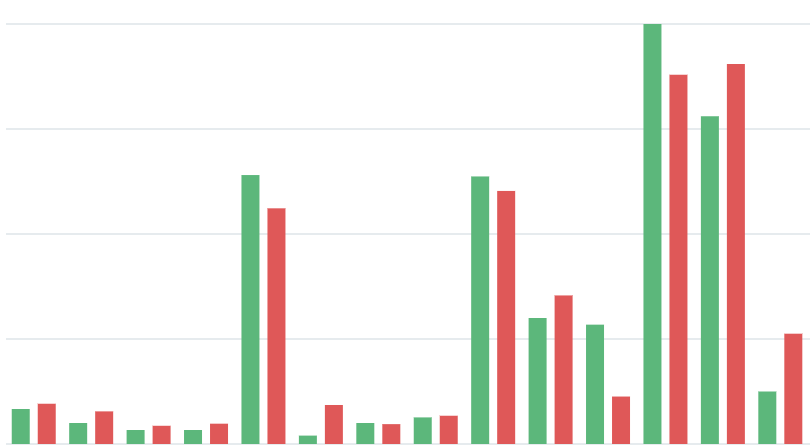

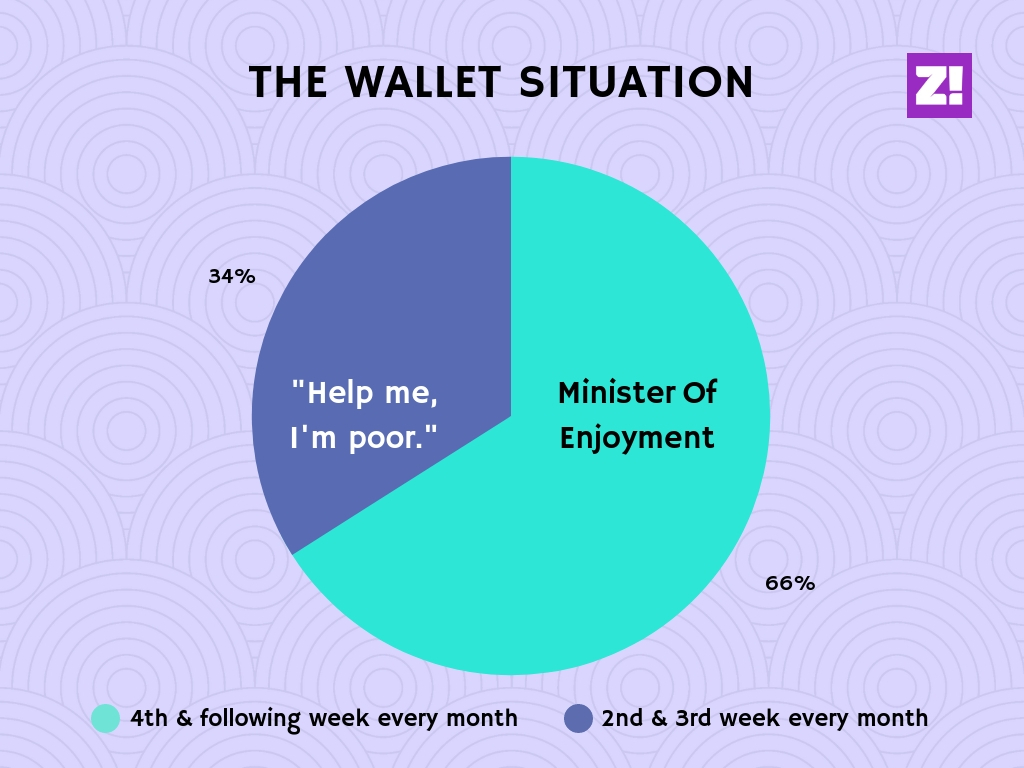

For two weeks, I’m a Don. The Don.

25th of every month is Christmas day and Eid, combined. That’s when salaries get paid; in the 4th week. That salary week and the following week, my voice is deeper, because when you have money, you have bass. The 2nd and 3rd week are for asking why all the bad things in the world are happening to me.

It’s also the time I promised to do better again next month. Then alert enters the next week. Then my brain falls inside the toilet. Rinse and repeat.

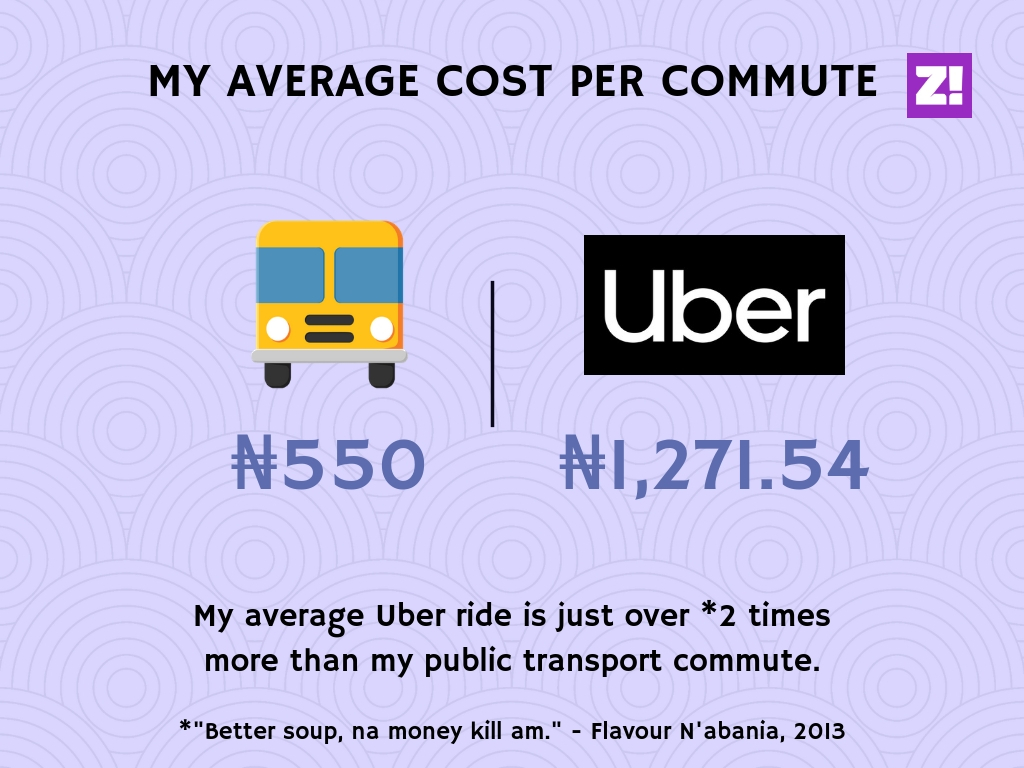

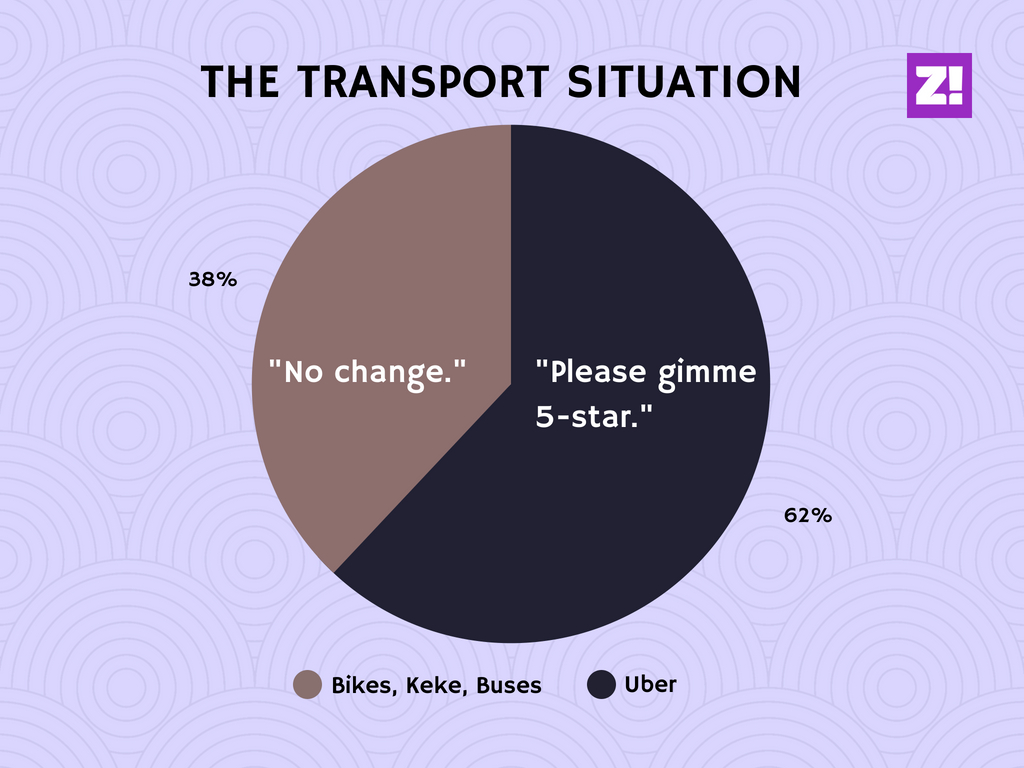

Uber money and transport money are not the same thing.

I’ll more often than not be found hopping from Okada to Danfo, to Keke. But the money I spent on Uber alone? It was more than all my non-Uber movement, combined.

Everyone has expenses like this. Take food for example; what you’d normally spend on food will most likely be less than what you’ll spend fine dining. If you’re a restaurant hopper, you should consider splitting your regular food expenses from your restaurant’s. If something in a category of your expenses becomes too big, you should give it some autonomy and create a category for it.

In time, the little things become big.

I tried to be more conscious about my big bills and tended to overlook the small. Those ‘tiny bills’ made up about 11% of all my expenses. So that quick snack, or that extra ₦500 might not mean much, but it pulls its own weight in the long run. The question is, if I don’t buy this thing will I die?

Tracking and discipline aren’t the same thing.

Because I could track everything, it still didn’t mean I was disciplined with my spending. What I was doing by tracking was cleaning up after I’d broken the china, not holding it with more caution. But it’s a start. It’s a great start.

“Do you know who you are? What is your name? What is your worth?”

I’m asking M.I. again to ask you; do you really know who you are if you don’t understand your finances?

I know I don’t spend as much on food as I thought; 8%. That slice will get thinner if I recite “There’s Rice At Home” 100 times every day.

I wanted to save an outrageous 50% of my salary so I can meet rent, but I failed. I’m still going to meet rent anyway. I also know why I failed, and looking back at it, I know what I could have done differently.

Truth is, the only reason I can ‘look back at it’ is because I kept records. Period.

It’s also why it’s crystal clear what needs to be done now. Budgeting.

Don’t overthink it. Find an app or a spreadsheet. Start from where you are, with what you have. You’ll do well. Don’t worry about everything that’s happened before today.

Let the first record be what you have now.

The only thing I miss from my pre-tracking days is finding money in my pockets. I don’t get to find money like that anymore, because I know where all my money is right now.