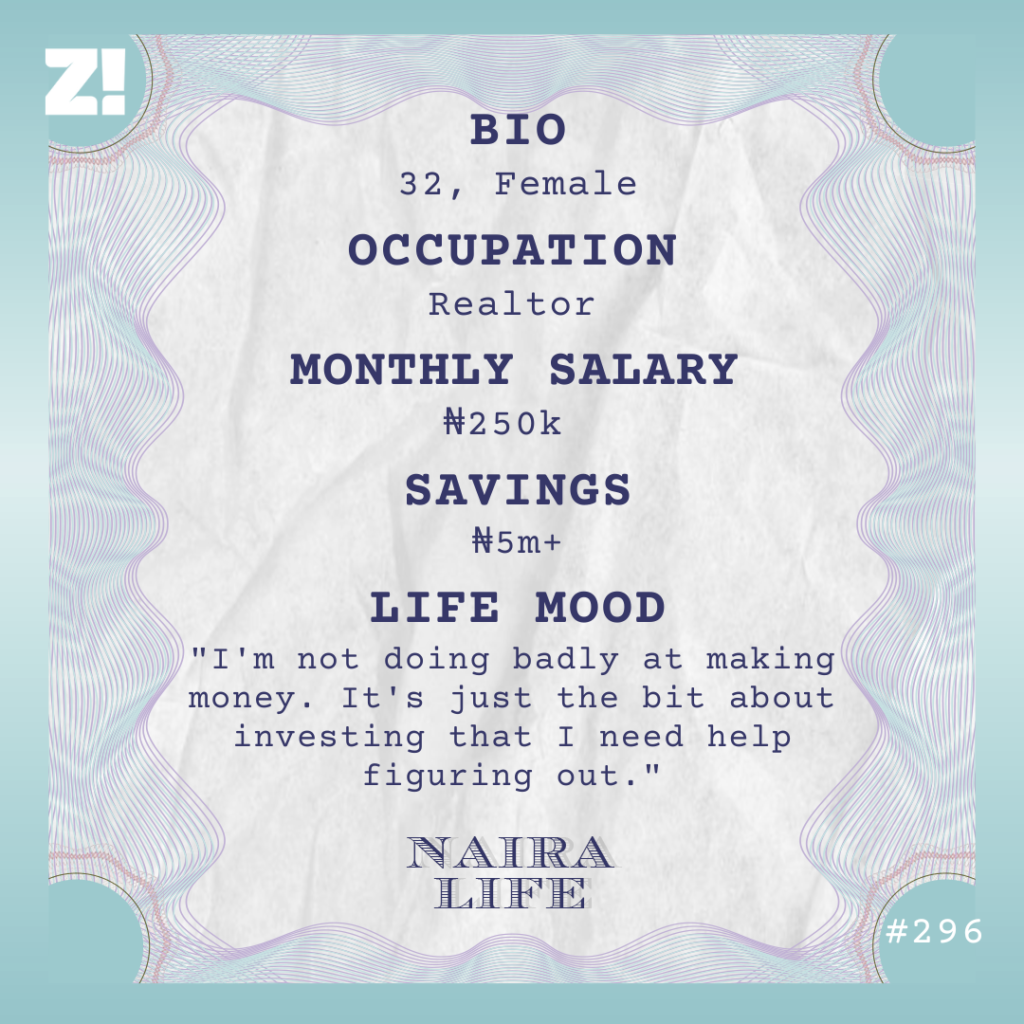

Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Let’s talk about your earliest memory of money

At 14, I got my first job at a movie rental, earning ₦500/week. It wasn’t an actual job, to be honest. I was in SS 3, preparing for my JAMB exams, and usually finished early from school.

My mum decided it was best I waited in the rental shop until she returned home from work. I started helping the shop owner attend to customers, and she paid me for my help. The pay wasn’t regular, and I spent it on suya whenever it came. I also bought airtime for my mum a few times.

What was the financial situation at home like?

We were comfortable. My sperm-donor father decided he didn’t want the responsibility and left when I was about a year old, so it was just me and my mum for a long time. My mum worked at a multinational, and she drove me to school every day before she went to work. We also lived in an estate, so yeah, I’d say we were pretty comfortable.

My mum remarried shortly after I entered the university in 2007. I remember a friend asking why I wasn’t angry that my mum was “replacing” my father. How do you replace someone who was never there?

Plus, my bonus dad is a good man. He has been in the picture since I was in secondary school as my mum’s “friend”. They came clean about their relationship after I entered uni. I think that was their way of making sure I was grown enough to adjust. I honestly didn’t mind. It also didn’t hurt that my bonus dad started spoiling me with money.

Define spoiled

He started giving me a ₦25k monthly allowance even though he knew my mum already sent ₦10k/month. He worked in transportation and started doing cute things like bringing me clothes and fashion accessories whenever he returned from his regular travels.

My bonus dad even told me to always call him first for whatever I needed. I used to joke that he didn’t need to buy my love because I already accepted him.

That’s so sweet. Aside from the allowance, did you have any other income source in uni?

I had a stint selling earrings in the 200 level. I actually started the business by accident. I was wearing one of the earrings my dad bought me when a coursemate said she liked it.

I showed her the other pieces; she picked one and paid me ₦1k. The next day, someone else expressed interest in my earrings. That’s when it clicked that I could sell them. So, I told my dad to buy me a few more pieces, and I started selling.

I’m not sure how much profit I made since my dad refused to let me pay, but I sold each piece for between ₦1k and ₦1500. I did that for two months and stopped when I had to leave the university.

Why did you leave?

I started hearing talk about how the uni wasn’t accredited. It was a fairly new private university that had about three sets of graduated students. Those students kept complaining that they were stuck and couldn’t go for NYSC because of the accreditation issue.

My parents thought it was too risky for me to stay, hoping the issue would be resolved before I graduated, so I left in 2009. By the time I left, I’d secured another admission to a college of health to study community health extension work, so I just changed schools.

What do community health extension workers do in Nigeria?

So, they also call them “CHEW”. They’re the health workers you see wearing ash-colour uniforms in primary health centres. CHEWs typically work in semi-rural communities with limited access to health care.

I was studying nursing at the uni I left, and when I had to leave, a friend of my mum recommended the CHEW course. I felt like both courses were one and the same, so I didn’t object. I was happy as long as I went to school like my friends.

It doesn’t sound like you were thrilled about the course

I didn’t know what I wanted to do, actually. I didn’t even choose nursing. My mum wanted me to study medicine, but a lecturer at the university suggested nursing to increase my chances of getting admission since medicine was competitive. It’s not like anyone forced the course on me. I didn’t have strong opinions about any other course, so I just agreed.

I did end up liking CHEW. However, I didn’t have time to consider business opportunities because the course required me to go on unpaid work experience placements in health centres. But my parents still gave me the ₦35k monthly allowance, so I was never broke.

I assume that means ₦35k was enough to give you a good life

It was. I lived alone in an apartment that my parents paid for, and I didn’t like cooking, so I constantly bought food. ₦35k was enough to feed me for a whole month, take me to and fro school and still have a little extra to buy perfumes and look good.

However, the allowance stopped after I finished school in 2012, and I suddenly knew what broke meant. I mean, I lived with my parents, and they fed me. But a young woman needs to have money in her account, you know?

Right. So, what did you do?

I started job-hunting. I found one at a private hospital, but at ₦30k/month, the salary was ridiculous. To make matters worse, I was practically working as both a CHEW and nurse. I worked nights, assisted in surgery and lab work, and attended to patients. It was exhausting.

I worked at the hospital for about two years and survived only by taking additional locum (or temporary) gigs here and there. The gigs were shift-based, so I took them when I was off duty at my hospital job. I usually did at least one locum gig monthly during those two years, which usually brought an extra ₦20k – ₦30k.

There were also random money tips from patients — nothing big, but substantial enough that I hardly touched my salary for transport costs. I still lived at home, so I only spent money on transport, food at work and the occasional snack for my siblings.

I’m not sure if I can accurately say I was balling on that salary because I didn’t even have time to ball. But I became a super saver. In some months, I saved as much as ₦30k. Work was stressful, but at least I was getting the hang of my finances.

Why did you only work at the hospital for two years, though?

I was pursuing government work for job security and better pay. My mum’s friend found me a plug who claimed he had the right connections to get me the job. So, I quit the hospital on impulse, thinking the government job was sure. I think the matron annoyed me that day, and I was just like, “To hell with your job madam.”

Two weeks after quitting, my “sure plug” disappointed me. This was in 2015.

Yikes. So you were effectively jobless

I had about ₦400k in my savings, but I knew the money wouldn’t last if I didn’t get another job. I’d also hoped the government job would give me an excuse to leave home and rent an apartment.

I was in a relationship with my boyfriend (now husband), and it was difficult to do relationship things while still living with my parents. If I wasn’t at work, I had to explain why I was going out and I didn’t like it. But since the job didn’t come through, I just had to double my hustle.

Locum jobs came to the rescue again, and I did that for a while. I still found full-time opportunities at hospitals, but I didn’t think they were worth it. All the jobs I saw offered between ₦40k and ₦60k, and it didn’t make sense to me. I preferred to do only a few shifts a month and get ₦20k than stress myself working full-time. I managed till 2016 when I decided to pursue a career selling real estate.

How did real estate enter the picture?

My boyfriend was a video editor who often worked with a real estate company. He was always talking about how there was money in the industry. He told me all about how the company paid affiliate marketers 10% of whatever they helped to sell and tried to encourage me to try it as a side hustle.

At first, I didn’t consider it because I didn’t see myself as the person who had the courage to convince people to buy things, not to talk of expensive real estate.

But by 2016, I was already tired of my work as a CHEW. Career and income growth opportunities were limited, except I worked in the government or returned to school to upgrade to nursing or public health.

So, I decided to give the real estate thing a try.

How did it go?

The company gave me access to pictures and videos of the landed property and buildings available on sale. I could also visit the sites to take pictures by myself. Once I got a client, I’d direct them to pay, and the company would give me my cut.

It seemed straightforward enough, but the hard part was selling. I designed my WhatsApp status and Facebook page with different pictures and videos of properties, but nobody came to buy.

I didn’t make any sales in the first eight months. By then, I’d pretty much stopped taking locum jobs because I was always going from one site to another. My mum didn’t understand why I left a reputable job to sell houses, but my dad was supportive and always helped me with transport fare.

Tell me about that first sale

It was a ₦3m plot of land. The buyer came from Facebook, and I remember being wary that someone I didn’t know was willing to trust me with millions.

I should note that I’d grown from only posting pictures of properties. To build credibility, I’d also started posting short articles about real estate: pieces about documents to look out for when buying land, regulatory bodies for buildings, etc. I thought it made me seem more professional and knowledgeable about what I was selling.

Anyway, the man bought the land, and I got my ₦300k commission. I was so excited. It’d taken me about a year to save ₦300k, and I made it just like that. It fueled my resolve. I was like, “This real estate? We’ll make this money there.”

Energy!

I worked for that company for about two years and earned an average of ₦700k/year.

One thing about real estate is that it’s a lot easier to sell after you’ve made your first few sales. This is because the people you sell to likely have friends in the same income bracket, and they can easily refer those friends to a trusted person (which is you).

In 2019, the company offered me a role as a real estate consultant. My job basically involved handling social media marketing, planning property showings, and offering investment advice. I took the role because it came with a sure ₦150k salary, and I’d still get my 10% commission for every sale I facilitated.

I made good money in 2019. I was still saving most of my income but began keeping half of my savings in dollars on a Fintech app. A friend in finance suggested that because I was just piling money up and didn’t know what to do with it. At least, with dollars, my money wouldn’t reduce in value.

By the end of 2019, I had close to $3k and another ₦2m in my savings. Then I got married.

Did marriage come with some financial responsibility?

Yes. I think marriage was my first introduction to adulthood. Before the wedding, my husband and I agreed he’d handle the big bills like rent and utility bills while I’d assist with feeding. I feel like I played myself because feeding isn’t a small bill at all.

While I lived with my parents, I didn’t have any business with the food bill. I dropped the random ₦10k to support, but I didn’t know just how much food cost.

Imagine my shock after I got married and realised I was spending ₦20k weekly to cook for only two people.

Then, the pandemic happened, and my husband couldn’t get as many videography gigs because there were no events. I had to take on more bills at home. Property sales also reduced, and my bosses slashed my salary to ₦75k for about six months since nothing was coming in. We had to rely on my savings for almost all of 2020.

Thankfully, things picked back up in 2021, and we’ve mostly gone back to my husband handling the major bills.

What’s your monthly income like these days?

I still work with the real estate company on ₦250k/month, but most of my income comes from my commissions and realtor dealings on the side.

I started my own mini realtor business in 2022 to have direct access to sellers and not have to share commissions with real estate companies. I can negotiate 15% – 20% with the original seller as my commission.

Of course, sales don’t happen monthly, and it can take several months to make a huge sale. It has even gotten worse between 2023 and now. Before, I could be sure of at least ₦3m – ₦5m/year, but I’ve not made ₦1m this year.

Why do you think that is?

The economy. People aren’t buying as much these days. You’ll see one generic duplex and hear that the price is ₦150m. It’s usually people with dodgy income sources who can afford those types of houses, and they also expect you to shake body.

What does “shake body” mean in this context?

Sexual demands. This doesn’t happen all the time, but in this line of work, I’ve seen men who see a woman selling real estate and expect she’s ready to do anything to convince you to buy. I don’t know if some people do it, but I’m not chasing commissions that seriously.

I guess it’s just one of the job hazards. The economy is my major concern, and it doesn’t look like things will get better. I’m still sticking around to make enough money to build an investment portfolio and safety nets for whenever I have children.

What kind of investment options are you considering?

That’s been one of my major financial headaches, actually. It’s easy for me to pile up money, but I get scared of the prospect of investing my money somewhere and losing it.

I still save in dollars, but I’m looking for options that will actually grow my money. I have $1k in Bamboo stocks and ₦1m in mutual funds, but I want to overcome my fear and diversify my portfolio. My savings—both in naira and dollars—are about ₦4m currently.

I notice you didn’t mention real estate investments

I can’t say this outside, but I don’t really believe in investing in real estate. It’s wild because that’s literally what I sell, but I don’t think I want to go that route, especially in Lagos. It’s not worth it.

Please tell me more

It’s just really problematic. If you decide to buy land, you have to accept the possibility of the government or one random person contending with you for it. You can choose to buy in an estate, but those are often overpriced with plenty of hidden charges. To get a decently priced piece of land in Lagos, you have to enter the bush.

If you decide to just leave the land and buy a house outright, that also comes with some risk. I’ve worked with these guys; some just build with substandard materials. Plus, I don’t like how new buildings all have tiny windows and high roofs. I prefer to build based on my specifications. But that also comes with the challenge of the ridiculously high cost of building materials.

Even if I close my eyes now and buy land, who knows how much cement and paint will cost when I’m ready to build? Let me not say never sha. If I see free money, I can buy land in my village. But this Lagos? I don’t want to.

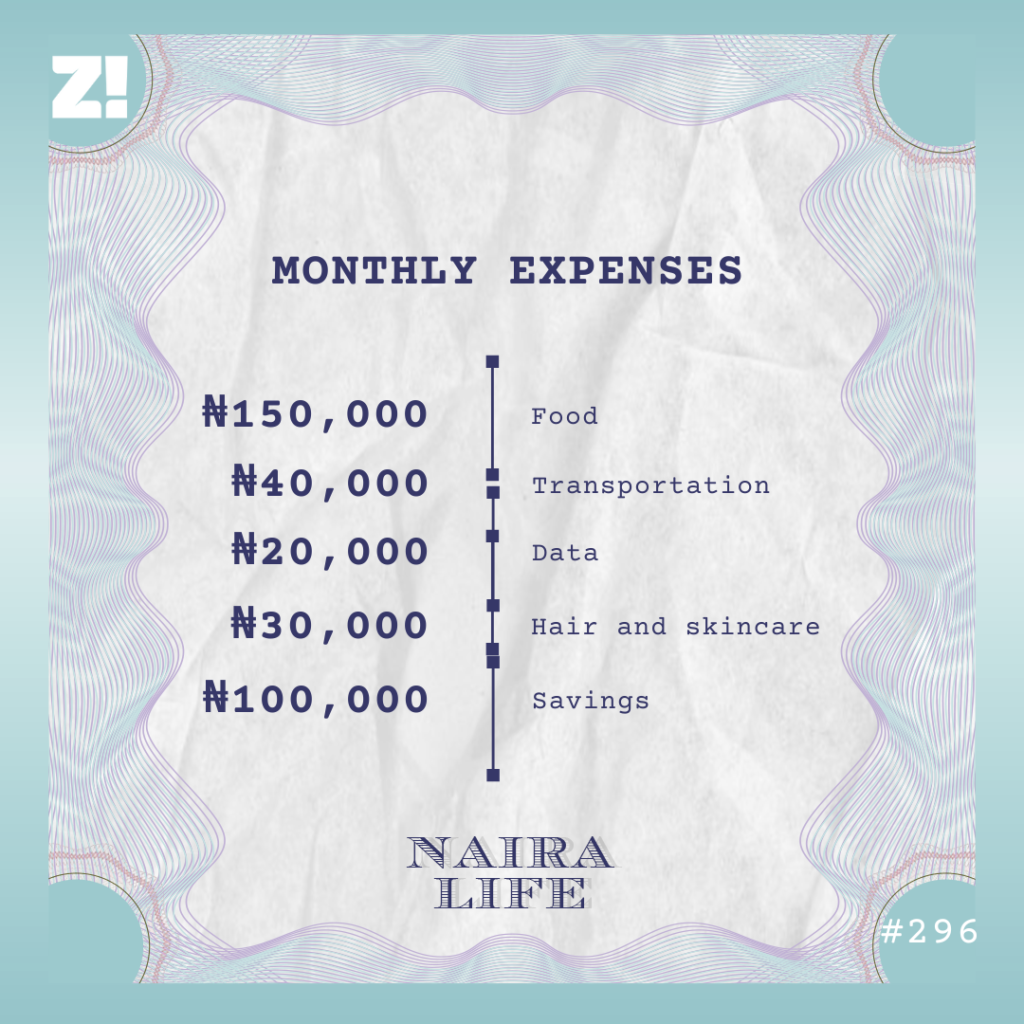

Fair. Let’s break down your typical monthly expenses

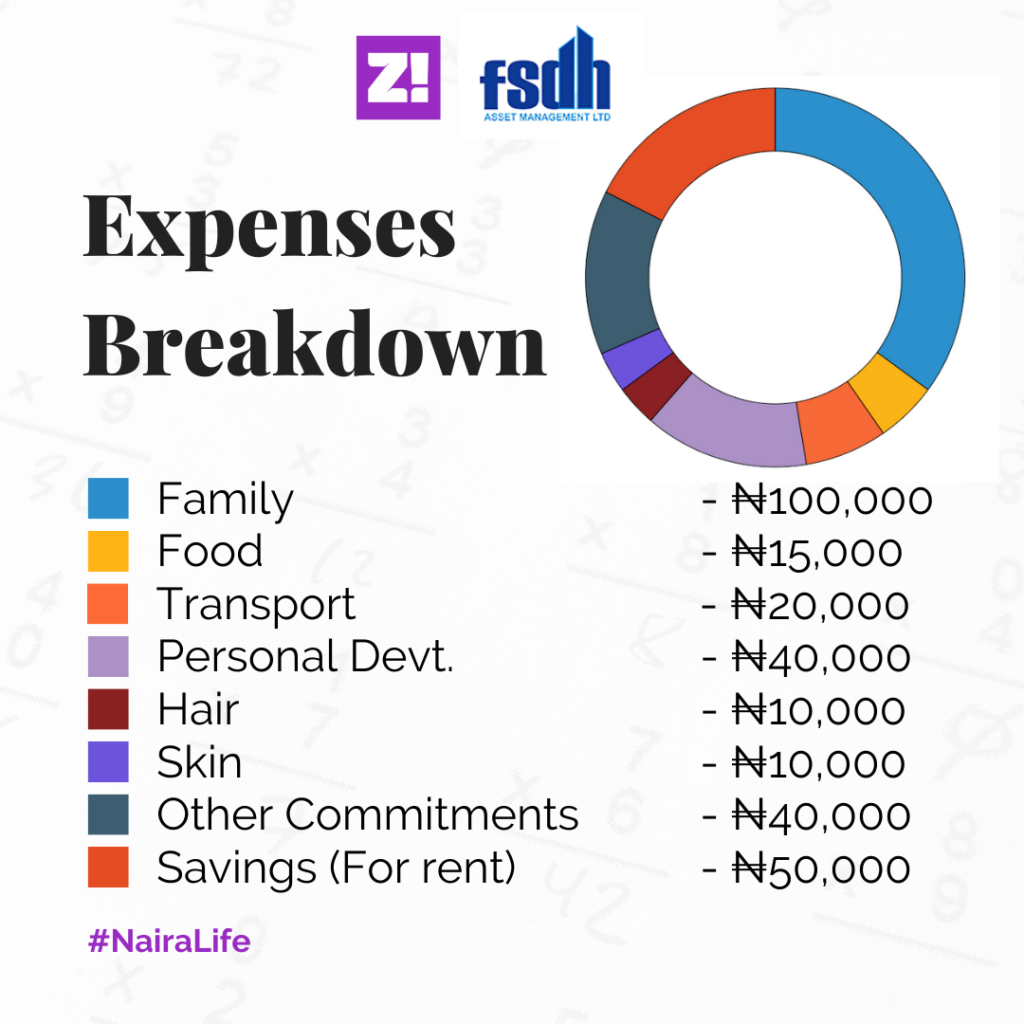

I complained to my husband early this year about the rising cost of food, so he now gives me a ₦100k monthly allowance to support the food bill. It goes like this:

How would you describe your relationship with money?

I think I’m still figuring things out. I hope to soon get to a point where I’m not just gathering money because I like seeing a heavy balance in my account but that my money is actually working for me. If I can hack investments and start earning passive income, I’ll be able to take a step back from real estate.

What would you be doing if you took a break from real estate?

Maybe I’ll try my hand at being a stay-at-home wife. Who am I kidding? I’ll probably die of boredom and return to selling land within a week.

Haha. What’s one thing you want but can’t afford?

A car. We have a 2007 Toyota Corolla, but my husband often uses it for his events, and I end up taking cabs to property showings. We can’t afford to maintain two cars right now — I’m even scared of checking how much a Tokunbo car costs now — but it will definitely make my life easier.

How would you rate your financial happiness on a scale of 1-10?

7. I’m not doing badly at making money. It’s just the bit about investing that I need help figuring out.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.

[ad]